What is Animation Market size?

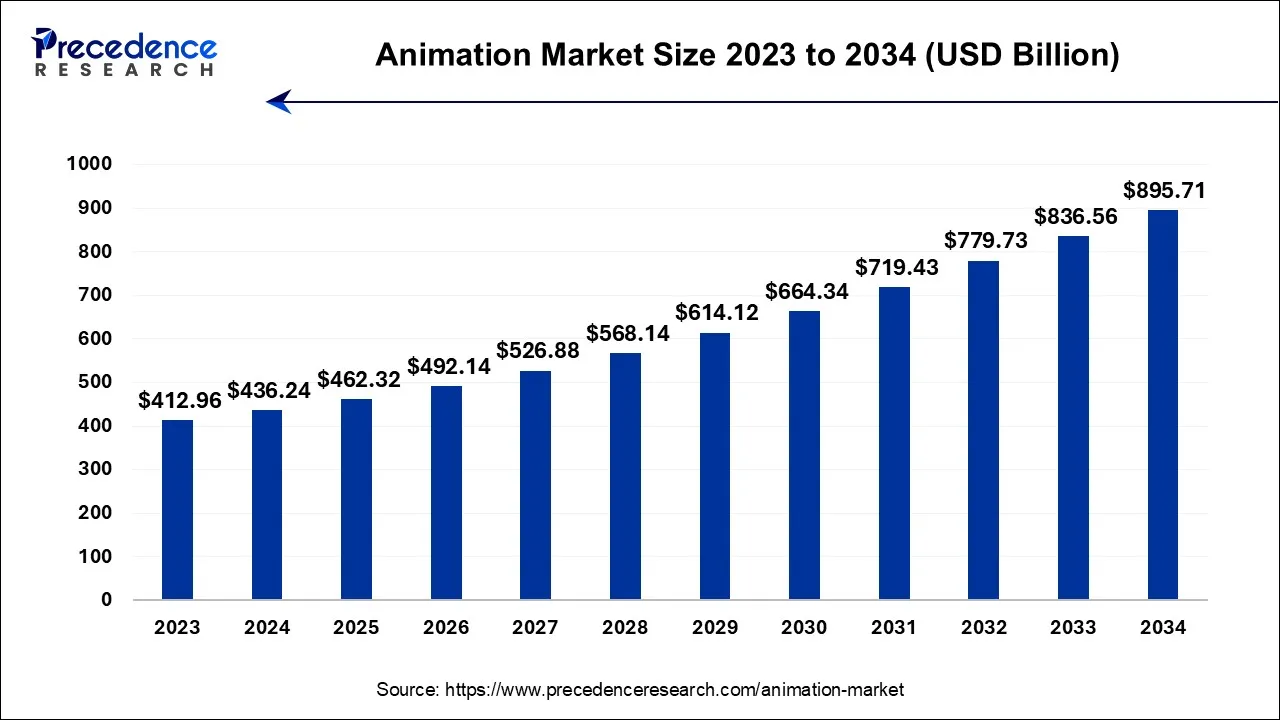

The animation market size is estimated at USD 462.32 billion in 2025 and is projected to increase from USD 492.14 billion in 2026 to approximately USD 953.31 billion by 2035, growing at a CAGR of 7.52% from 2026 to 2035.

Market Highlights

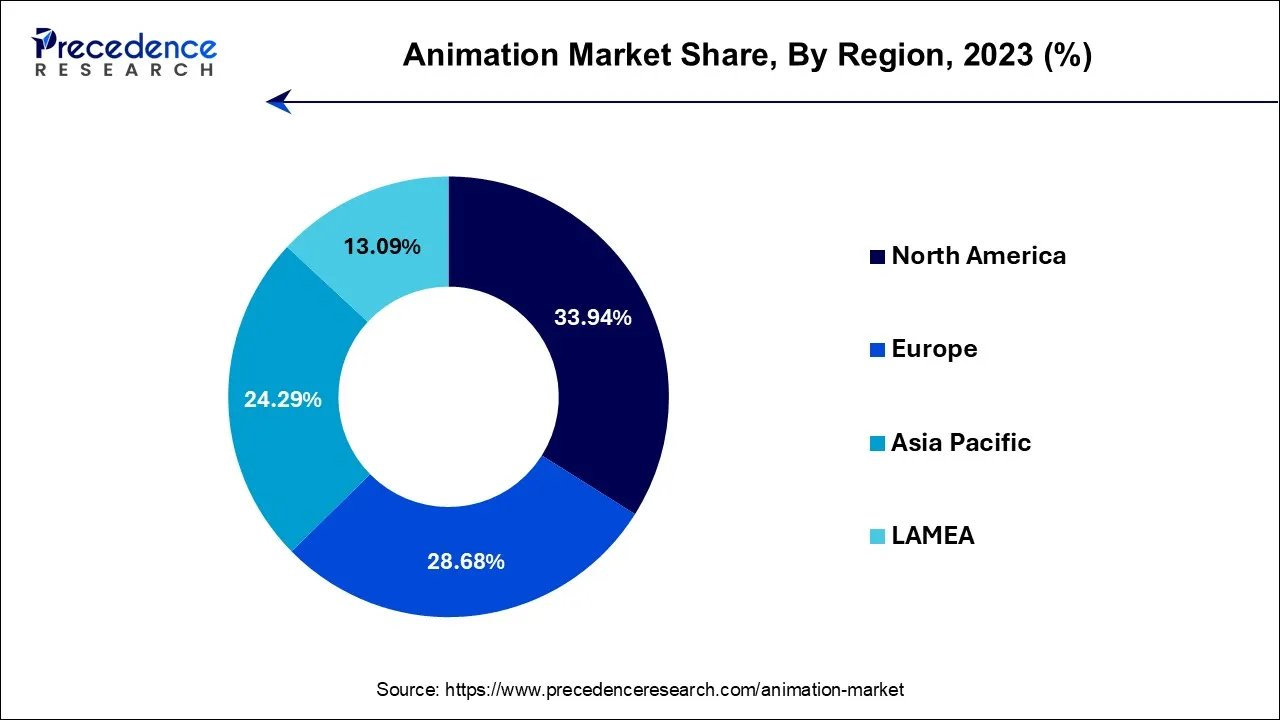

- North America led the global market with the highest market share of 33.97% in 2025.

- By product type, the 3D animation segment accounted for the biggest market share of 44.16% in 2025.

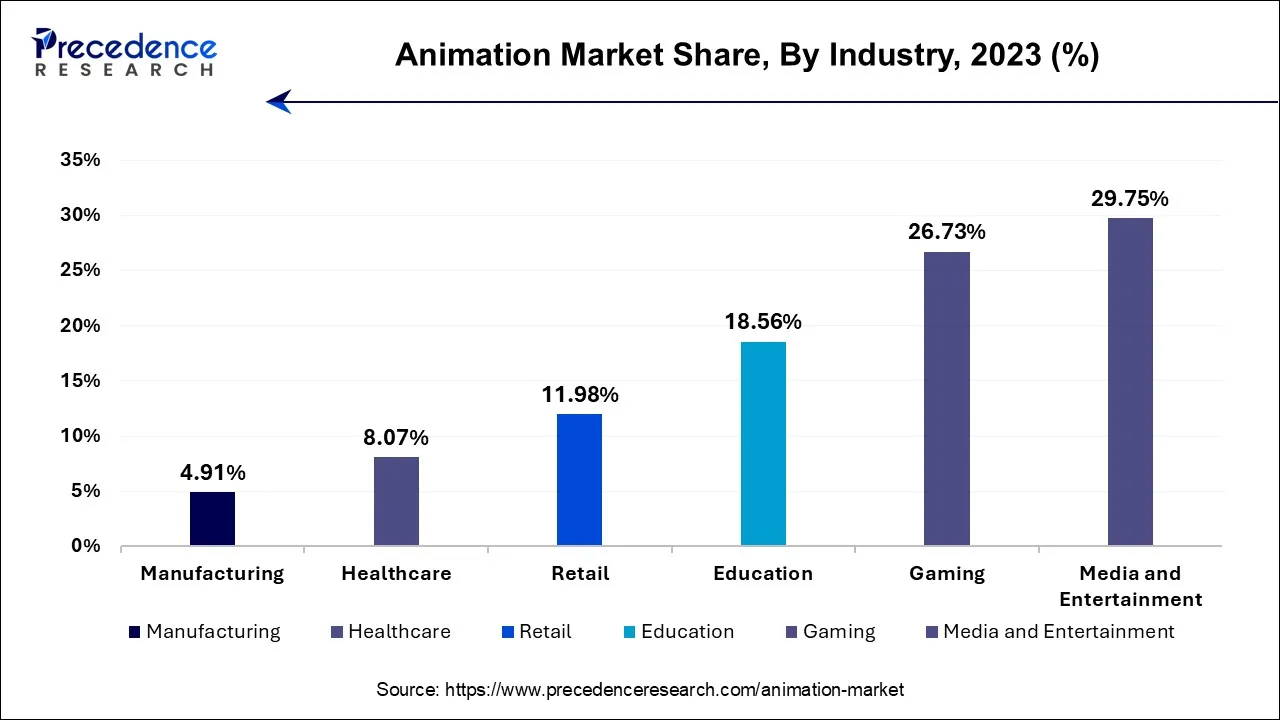

- By industry, the media and entertainment segment generated more than 29.75% of revenue share in 2025.

- By industry, the manufacturing segment is estimated to expand at the fastest CAGR between 2026 and 2035.

Market Overview

Technological advancements in the communications as well as technology sectors across the globe are major factors driving the growth of the target industry. The emergence of virtual reality and artificial intelligence technologies across the globe is expected to generate new opportunities for market players operating in the global market. Various existing XR (Extended Reality) technologies such as Virtual Reality and Artificial Intelligence Technologies are becoming more advanced in terms of creative use and application in the animation industry. Artificial intelligence will have a massive and profound effect on industrial growth and have a transformative effect on the animation industry which is offering potential opportunities for the key players in the market. The rising adoption of visual effects technology in movies is another factor that is expected to boost the growth of the target industry during the forecast years 2026 to 2035.

How AI is Transforming Animation: Innovation Driving Faster Creativity

Artificial intelligence is rapidly transforming the animation market by creating a more efficient way to produce animated content and giving creators tools that will allow for more creative ideas to come to fruition.

- For instance in March 2025, Invisible Universe's AI-enabled animation pipeline called “Invisible Studio” that includes the use of artificial intelligence from conception to completion and allows for the production of short-form animated content within hours versus weeks, as well as a significant cost reduction.

As a result, many content production studios, independent creators and major corporations are utilizing these new offerings to improve their production processes and break creative barriers. As a result, there has been an increase in productivity and creativity through the combination of traditional arts and the use of artificial intelligence in the animation industry.

Animation Market Growth Factors

- Advancements and developments across the communications and technology sectors

- Growing media and entertainment industry

- Increased internet penetration across different regions

What are the Trends Revolutionizing the Animation Market?

- AR in animation: Animated content is shown digitally in animated form. This helps to create new ways of telling stories of an interactive nature, and immersive experiences that aid in advertisements, education, marketing, and other areas where there is gaming engagement, etc.

- Eco-conscious animation: A type of animation where the rendering process is done in a way that conserves energy, reduces the use of hardware, and promotes digital workflows and collaboration to produce less waste.

- Cloud-based animation software: Software programs that provides the ability to work remotely, allowing for a very large number of jobs to be completed in one location. Additionally, it allows for the flexibility of having access to computer power, allowing for immediate upload and use of assets.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 436.24 Billion |

| Market Size in 2026 | USD 492.14 Billion |

| Market Size by 2035 | USD 953.31 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.52% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Industry, and Region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Segment Insights

Product Type Insights

3D Animation Product Type Segment Testified Leading Market Stake in the Year 2025?

The 3D animation segment dominated the market during the forecast period. The growth of this segment is driven by the growing demand for animated content and the rising adoption of visual effects technology. There has been a rise in digital platforms, including streaming services, social media, and virtual advertising which has shown significant demand for high-quality animated content. This demand has been fulfilled by the 3D animators by their skills and ability to design visually extraordinary animations.

3D animation has become prevalent in various industries, such as film, television, video games, advertising, and architecture, among others. Therefore, 3D animators are in high demand as they play a crucial role in meeting the growing demand for animated content. Moreover, the advancement in technology has opened opportunities for 3D animators to create high-quality animations for a range of markets, including film, television, video games, and advertising.

Animation Market, By Product Type, 2022-2024 (USD Billion)

| By Product Type | 2022 | 2023 | 2024 |

| 2D Animation | 123.56 | 130.25 | 137.85 |

| 3D Animation | 172.82 | 182.37 | 193.26 |

| Stop Motion | 60.56 | 63.42 | 66.64 |

| Others | 35.60 | 36.92 | 38.49 |

IndustryInsights

Media and Entertainment Industry Segment Reported Foremost Market Stake in 2025

The media and entertainment industry segment is expected to account for the major share of the target market. Film, radio, television, and print make up the media and entertainment industry. TV shows, Movies, news, newspapers, radio shows, magazines, music, and books are included in these segments. As both the old and modern continue to coexist, the media & entertainment industry is in a transition process. Along with this the automotive segment is anticipated to grow at the important growth rate and will expand the market revenue.

Animation Market, By Industry, 2022-2024 (USD Billion)

| By Industry | 2022 | 2023 | 2024 |

| Media and Entertainment | 116.48 | 122.86 | 130.13 |

| Education | 72.78 | 76.63 | 81.02 |

| Retail | 47.18 | 49.48 | 52.10 |

| Healthcare | 31.83 | 33.34 | 35.06 |

| Manufacturing | 19.08 | 20.28 | 21.64 |

| Gaming | 105.19 | 110.37 | 116.29 |

Regional Insights

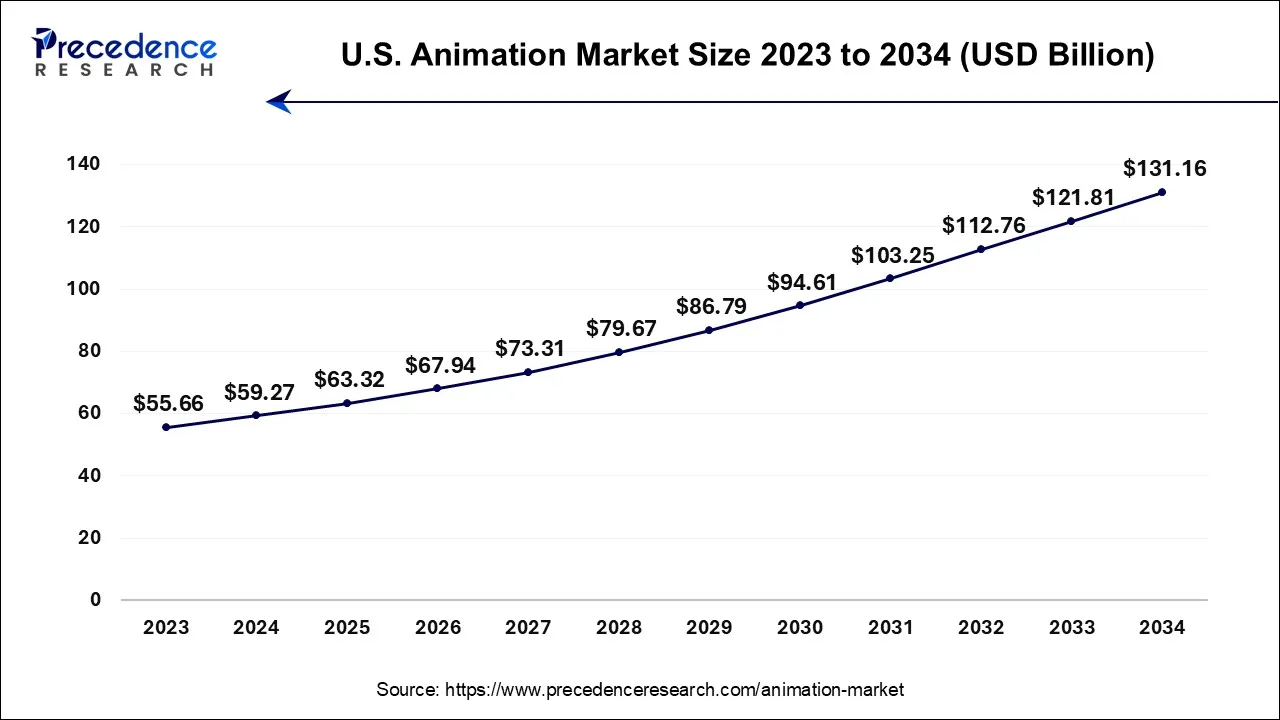

What is the U.S. Animation Market Size and Growth?

The U.S. animation market size is valued at USD 63.32 billion in 2025 and is expected to grow from USD 67.94 billion in 2026 to nearly USD 140.31 billion by 2035, expanding at a strong CAGR of 8.28% from 2026 to 2035.

U.S. Animation Market Trends:

The United States continues to be the leading country in the animation industry due to the strength of its creative ecosystem, cutting-edge technology for digital production, and many well-known intellectual properties. Major animation companies are constantly implementing AI-enhanced workflows, virtual production and real-time rendering methods to expedite animation production. Animated content is in demand for feature films, television series on streaming services, television commercials and advertisements, video games and virtual reality experiences.

North America is Likely to be the Largest Market for Animation

The study report contracts with the business predictions of animation products around are as counting Europe, Latin America, Asia-Pacific, North America, Middle East and Africa. Animation market is occupied by North America due to augmented intake of the animation in various end use applications, coupled with presence of major companies in the North America and business plans that are executed by the chief players in the nations.

Asia PacificAnimation Market Trends

Asia Pacific is probable to list the remarkable CAGR, on account of growing in the demand for the animation in evolving economies owing to increased preferences form automotive industry. Likewise, utmost of the companies functioning in the market are advancing heavily in order to get the modest edge in the animation market in Asia Pacific. Further, the Latin America as well as Middle East and Africa regions will likely to register moderate growth in the coming.

China Animation Market Trends:

China's animation market will be impacted by strong domestic demand; cultural initiatives backed by the government and the rapid development of digital platforms. Local animation studios are increasingly combining traditional Chinese storytelling techniques with advanced 3D computer graphics and artificial intelligence-assisted animation. Animation content that is produced with export opportunities in mind is also becoming popular with other Asian territories and with the growth of global OTT platforms.

Europe Animation Market Trends

Europe is a vibrant center for animation, with key spots in France, the United Kingdom, and Germany. France stands out due to its rich history of animated cinema and esteemed educational establishments such as Gobelins. The European market consists of co-productions, in which they combine their resources to collaborate on specific projects.

- For instance, the EU had developed a strategy to allocate over €4 million over three years in November 2024 for creating a comprehensive report on the nation's animation sector - challenges this industry encounters, evaluating the conditions, and strategizing its growth. The study will provide insights for policymakers and stakeholders to enhance the competitiveness of the EU animation sector on the global stage. This area also features lovely festivals like Annecy that foster creativity and global acknowledgment. Digital distribution truly extends further and broader across Europe.

The animation market in the Asia-Pacific region has experienced significant growth lately. It revolves around creating motion visuals with a collection of static images. This type of animation is prominent in entertainment, advertising, gaming, and education. Countries such as China, Japan, India, South Korea, and Australia are at the forefront of producing and enjoying animated content. The Asia-Pacific animation industry is thriving due to increased demand for animated content, advancements in technology, and a growing audience. Featuring numerous excellent studios, skilled artists, and innovative thinkers, this sector is poised for continued growth in the years ahead.

With advancements in technology and an increasing global demand for varied content, the Middle East & Africa animation industry started to see a transition towards greater locally created productions, addressing regional preferences and cultural stories. Nations such as the United Arab Emirates, Egypt, and South Africa have become key players in the animation arena, bolstered by the creation of animation studios, festivals, and the growing access to cutting-edge technology.

Dubai, specifically, evolved into a significant center for animation, supported by projects like Dubai Media City and Dubai Studio City, which draw in global animation studios and provide opportunities for local talent. Additionally, Egypt, known for its extensive history in filmmaking, experienced a rise in animated film projects targeting both domestic and international audiences. The participation of global entities has been a key element in the growth of the Middle East & Africa animation market.

Germany Animation Market Trends

Germany's animation market is experiencing success because of its high-quality production standards, its strong culture of design and the increasing number of requests for animation services from various sectors, especially the advertising, gaming and industrial visualization sectors. Studios in Germany are creating detailed 3D animations, producing motion graphics and developing educational content. For these reasons, studios in Germany have access to a strong digital infrastructure, and as such are adopting AI-enabled tools and leveraging real-time rendering processes to increase efficiencies in creating animations.

Latin America Animation Market Trends

The animation market in Latin America is experiencing steady expansion, driven by rising digital content consumption, increased internet penetration, and the rapid adoption of streaming platforms. Growing demand for animated content across advertising, gaming, education, and entertainment is supporting market growth. Additionally, expanding creative talent pools, cost-competitive production capabilities, and increasing investment from global media companies are positioning the region as an emerging hub for animation production and services.

Middle East and Africa Animation Market Trends:

The animation market in the Middle East and Africa is witnessing gradual growth, supported by expanding media and entertainment industries and rising demand for localized animated content. Government initiatives promoting digital media, education, and creative industries are contributing to market development. Increasing smartphone usage, growing youth populations, and investments in animation for advertising, education, and gaming are further driving adoption across the region.

Animation Market Companies

- SideFX

- Adobe

- Broadcast2World, Inc

- Smith Micro Software, Inc.

- Animation Sharks

- IdeaRocket

- Triggerfish Studios

- EIAS3D

- NewTek, Inc

- BRAFTON

- Corel Corporation

- Autodesk Inc.

- Videocaddy

- Maxon Computer

- WinBizSolutionsIndia

Recent Developments

- In May 2025, Sony Pictures Animation and Sony Pictures Imageworks collaborated with the educational platform Yellowbrick to launch “This Is Animation,” a brand-new, freely accessible online course aimed at introducing learners of all ages to the craft and business of animated filmmaking.

- In June 2025, seasoned professionals from the UK animation sector, Andrew Pearce and Paula Bird, established Zaratan, a production company in Glasgow focused on creating animation for adult viewers. The co-founders were former long-serving executives at Axis Studios, known for producing shows like Eyes of Wakanda, Love Death & Robots, and Secret Level.

- In January 2025, industry experts Lynn Chadwick and Steve Cooke revealed the establishment of That Animation Company, a fresh production studio located in Halifax, Nova Scotia. The new initiative merges years of experience in the animation sector with an emphasis on proactive approaches, customer contentment, and top-notch animated material. That Animation Company seeks to meet the changing demands of clients in various industries, such as television, streaming, education, sports, marketing, and others.

Segments Covered in the Report

By Product Type

- 2D Animation

- Software

- hardware

- Services

- 3D Animation

- Software

- hardware

- Services

- Stop Motion

- Software

- hardware

- Services

- Other

- Software

- hardware

- Services

By Industry

- Direct

- Education

- Media and Entertainment

- Aerospace and Defense

- Manufacturing

- Automotive

- Healthcare

- Others

By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting