What is the Automotive Fasteners Market Size?

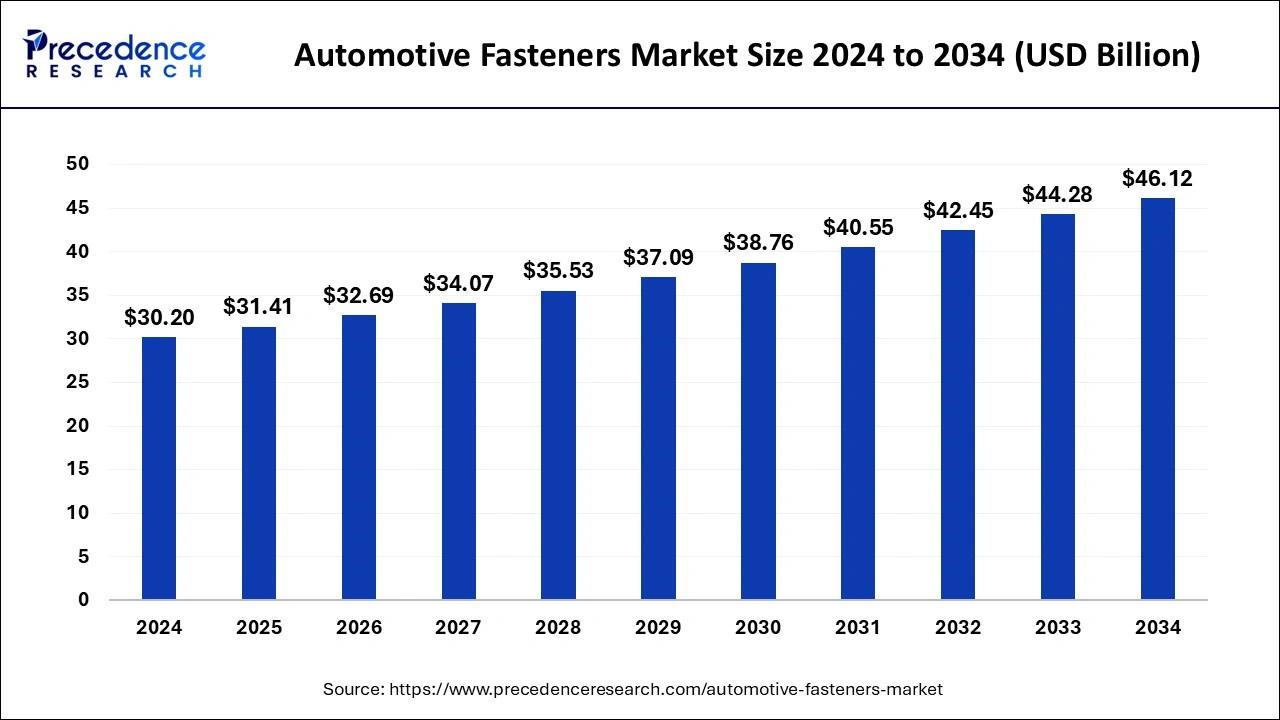

The global automotive fasteners market size is calculated at USD 31.41 billion in 2025 and is predicted to increase from USD 32.69 billion in 2026 to approximately USD 47.95 billion by 2035, expanding at a CAGR of 4.32% from 2026 to 2035

Market Highlights

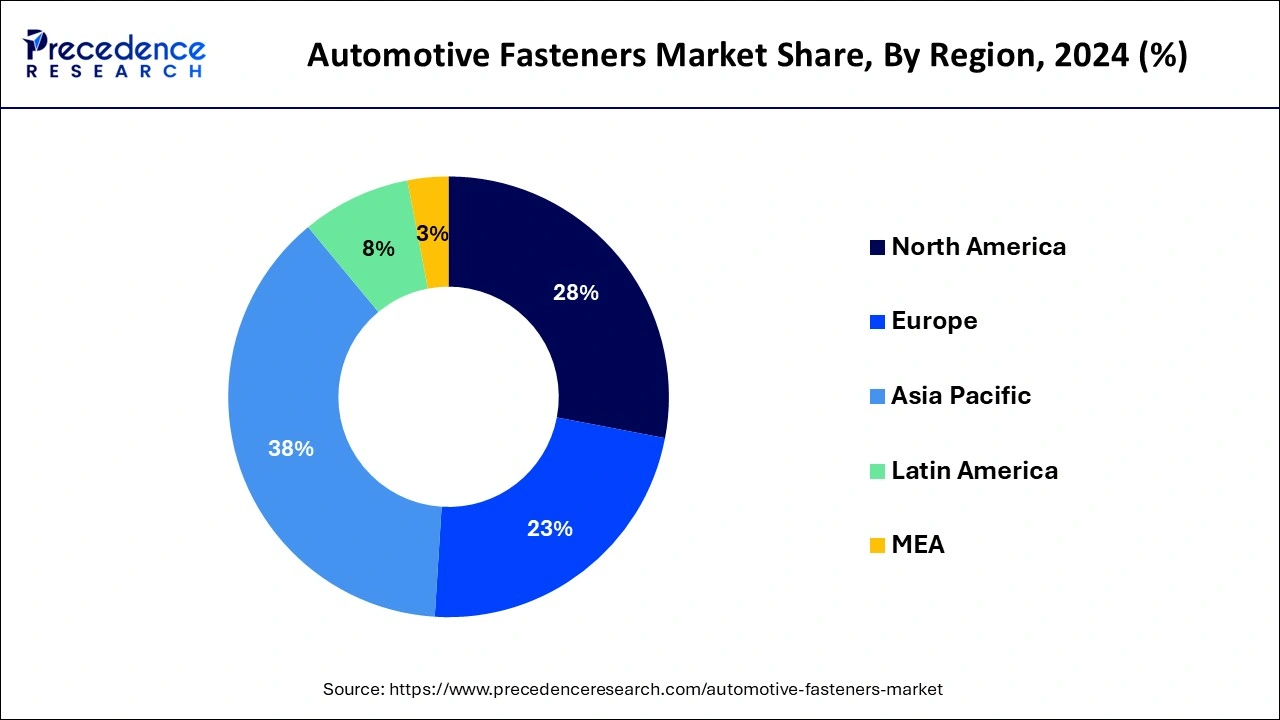

- Asia Pacific dominated the global market with the largest market share of 38% in 2025.

- North America is projected to expand at the fastest CAGR during the forecast period.

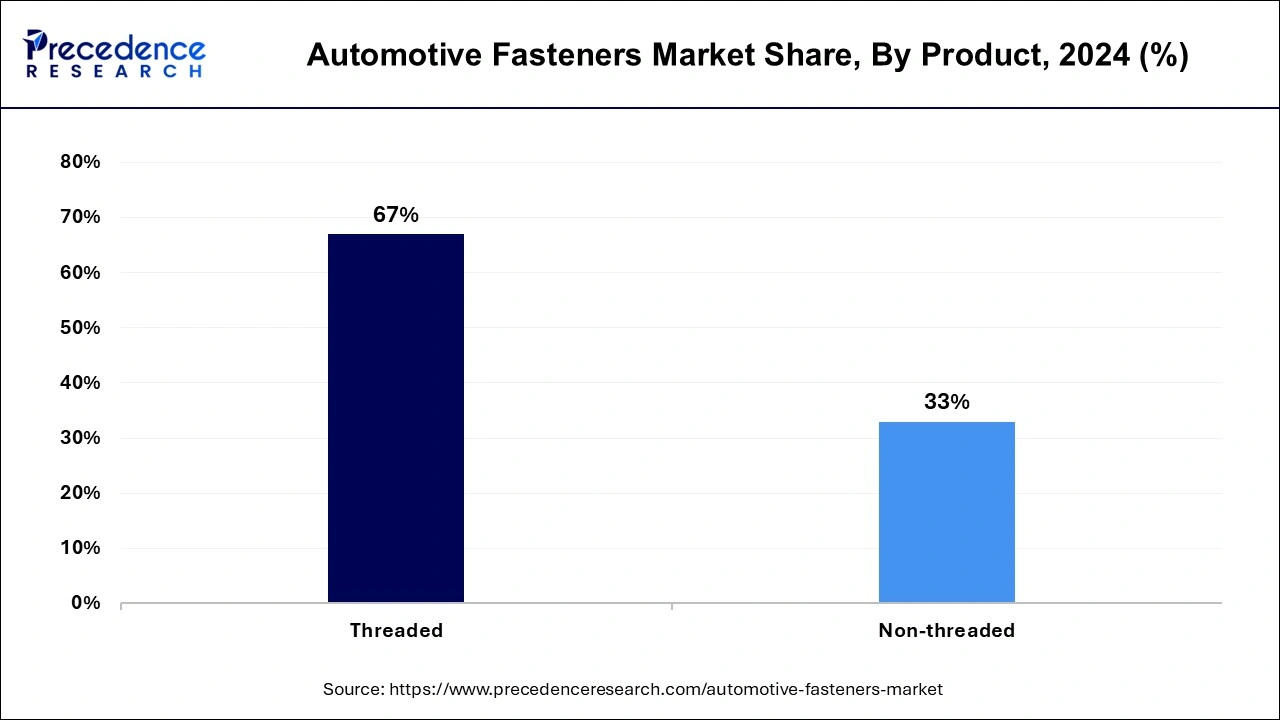

- By product, the threaded segment contributed the highest market share of 67% in 2025.

- By product, the non-threaded segment is expected to grow at a significant CAGR from 2026 to 2035

- By material, the plastic segment captured the biggest market share in 2025.

- By material, the stainless-steel segments is estimated to be the fastest-growing segment during the forecast period.

- By characteristics, the removable fasteners segment has held the largest market share in 2025.

- By characteristics, The semi-permanent fasteners segment is predicted to grow with CAGR during the forecast period.

Fastest Sneak Peek into the Automotive Fasteners Potential

The automotive fasteners market is expected to rise as a result of factors such as increased vehicle production, more usage of electronics in vehicles, and a shift towards lighter vehicles. Furthermore, the key market players are moving away from standard fasteners and toward customized fasteners, which fuel the growth of the automotive fasteners market.

The thriving vehicle industry as well as the critical relevance of fasteners in automobiles is important factors boosting the growth of the automotive fasteners market. Another factor driving the expansion of the automotive fasteners market is technological advancements and developments in fastener durability and quality. The easily changeable nature of automotive fasteners makes it convenient for end users to acquire fasteners for their automobiles, boosting the automotive fasteners market growth. The alternatives to automotive fasteners like as clutching and assembling parts, on the other hand, may slow the growth of the automotive fasteners market.

The mechanical innovations as well as improvements in the quality of fasteners are expected to raise market demand. Furthermore, the growing demand for lighter automobiles and their stability is driving a preference for automotive fasteners over welding, resulting in the growth of the global automotive fasteners market over the forecast period.

How AI Recharged the Existing Growth of the Automotive Fasteners?

Artificial Intelligenceintegration in automotive fasteners industry can help in transforming manufacturing processes by automating production lines, in predictive maintenance, real-time monitoring, quality control and assurance, for product designing, customization, supply chain optimization and for testing real-world applications thereby enhancing the accuracy, reliability and efficacy with reduced costs contributing to the overall consumer and vehicle safety.

Market Outlook

- Industry Growth Overview: The automotive fasteners market is expanding due to rising vehicle production and increasing demand for lightweight, high-strength components. The market growth is also fueled by innovations in materials, coatings, and fastening technologies across passenger cars, commercial vehicles, and electric vehicles.

- Sustainability Trend: Sustainability trend is reshaping the market by boosting the demand for eco-friendly coatings and recyclable alloys. Manufacturers are also focusing on using low-energy manufacturing processes and reducing material wastage. Regulatory push in Europe enhances the adoption of green surface treatments.

- Major Investors: Major investors in the market include large OEM suppliers, private equity firms, strategic industrial investors, and government-backed industrial funds, all of which provide capital for expansion, technology upgrades, and geographic diversification. Their investments help manufacturers scale production, adopt advanced materials and automation, meet regulatory standards, and strengthen global supply chains to serve growing demand in automotive segments.

Automotive Fasteners Market Growth Factors

- Advancements in manufacturing capabilities with streamlined workflows.

- Active involvement in research and development for producing superior quality fasteners.

- Increased sales and purchase of automotive vehicles especially, electric vehicles across the globe.

- Rising disposable incomes .

- Increased usage of technology in new generation of automobiles.

- Expansion of automotive fasteners manufacturing facilities to improve distribution supply.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 31.41 Billion |

| Market Size in 2026 | USD 32.69 Billion |

| Market Size by 2035 | USD 47.95 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.32% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, Characteristics, Material, Electric Vehicle Type, Vehicle Type, Distribution, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Segment Insights

Product Insights

The threaded segment dominated the automotive fasteners market with revenue share of 67% in 2025. The bolts with a head on one end and a nut on the other end are known as threaded automotive fasteners. These fasteners are frequently put into a hole and attached with the help of nuts.

The non-threaded segment is fastest growing segment of the automotive fasteners market in 2025. The non-threaded fasteners lack internal threading to hold it together with other parts. The different ways for securing mechanical components are demonstrated by these fasteners.

Material Insights

The plastic segment dominated the automotive fasteners market in 2025. The plastic fasteners are utilized in applications that need consideration of thermal, optical, environmental, and electrical qualities during the manufacturing process.The stainless-steel segment, on the other hand, is predicted to develop at the quickest rate in the future years. Depending on the use in the automotive sector, stainless-steel is the most commonly used material for automotive fasteners.

Characteristics Insights

The removable fasteners segment dominated the automotive fasteners market in 2025. The removable automotive fasteners are used to link two parts, but they may be easily detached without causing damage to the fasteners or the part.The semi-permanent fasteners segment is fastest growing segment of the automotive fasteners market in 2025. The semi-permanent automotive fasteners are meant to attach two parts; however, when the parts are disconnected, the fasteners or the part are frequently damaged.

Regional Insights

Asia Pacific Automotive Fasteners Market Size and Growth 2026 to 2035

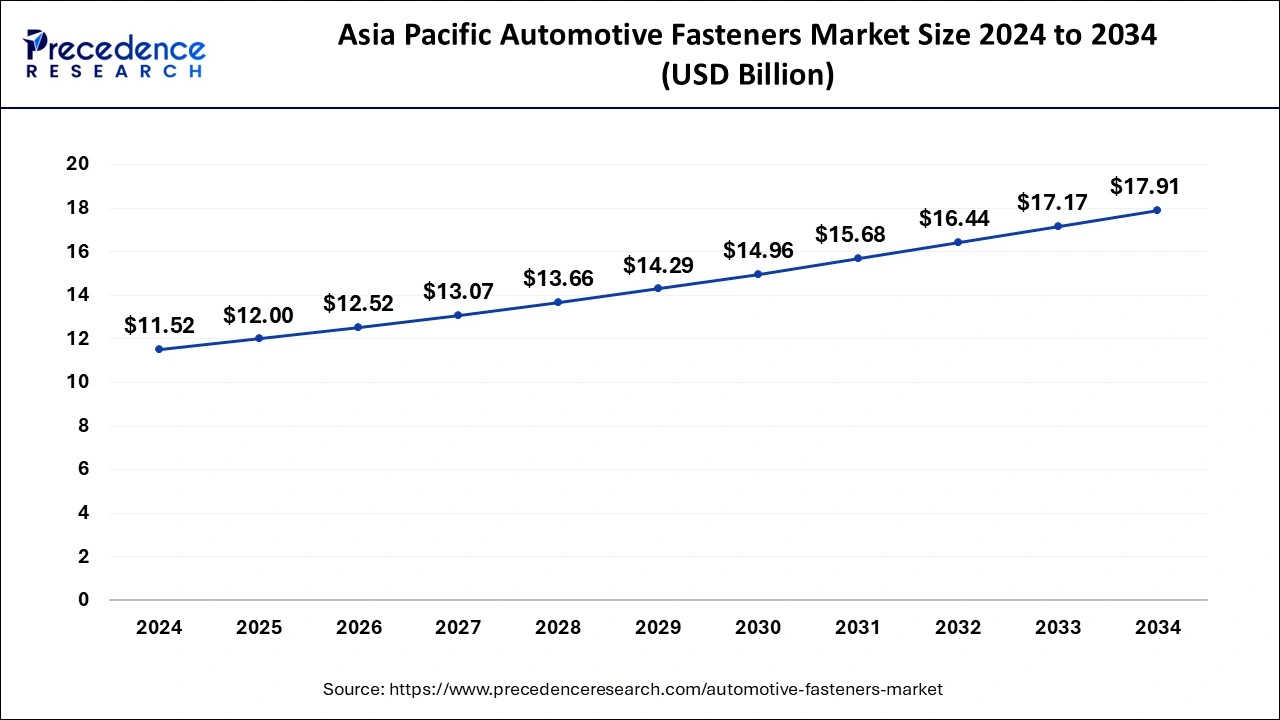

The Asia Pacific automotive fasteners market size is exhibited at USD 12.00 billion in 2025 and is projected to be worth around USD 18.64 billion by 2035, growing at a CAGR of 4.5% from 2026 to 2035

Asia-Pacific dominated the automotive fasteners market in 2025. The need for vehicles that are safer and more fuel efficient is driving the growth of the automotive fasteners market in the region. In addition, the government regulatory framework for light weight automobiles has resulted in technological developments in the region.

Asia Pacific is expected to maintain its dominance in the coming years, fueled by booming vehicle production, increasing domestic consumption, and rapid industrialization. The region's cost-competitive manufacturing ecosystem has made it a global hub for fastener exports. Growing EV adoption in China, South Korea, and Japan is driving changes in fastener specifications toward high-precision and battery-compatible components. Emerging markets like India and Thailand are also witnessing demand as their automotive production capacities expand.

India is a major contributor to the market in Asia Pacific because it has a fast growing automobile manufacturing sector, including passenger vehicles, commercial vehicles, and two /three wheelers. At the same time, many global auto parts suppliers and OEMs source components from India due to its competitive labor and manufacturing costs, which makes India a key hub for the production of automotive fasteners in the region.

What Made North America the Fastest-Growing Region in the Automotive Fasteners Market?

North America is expected to develop at the fastest rate during the forecast period. As the number of vehicles on the road grows, so does the need for replacement parts. Moreover, the presence of major automotive and automobile manufacturers in this region as well as the availability of advanced technology allows automotive fasteners to thrive in this region.

North America remains a mature and innovation-driven hub for automotive fasteners, supported by high vehicle production and advanced manufacturing facilities. The growth of EV assembly lines is increasing the demand for lightweight and corrosion-resistant fasteners. OEMs and Tier-1 suppliers are working more closely with material scientists to develop fasteners suitable for aluminum, composites, and battery systems. Automation in manufacturing is increasing the need for precision-engineered fastening components.

The U.S. leads with high adoption of custom-engineered fasteners for SUVs, EVs, and commercial vehicles. Canada is experiencing steady growth supported by its automotive clusters and focus on high-performance, cold-resistant fasteners. Mexico continues to grow as a manufacturing hub, attracting fastener production due to favorable labor costs and proximity to OEMs. Cross-border supply chain integration across all three countries strengthens the region's fastener ecosystem.

What Potentiates the Growth of the Market in the Middle East & Africa?

In the Middle East & Africa, the automotive fasteners market is gradually growing as governments promote automotive diversification and industrial development. Increasing aftermarket activity is driving demand for replacement fasteners across passenger and commercial vehicle fleets. Lightweight and corrosion-resistant fasteners are increasingly needed in Europe due to the region's high-temperature and sand-prone environments. Investments in regional assembly plants are strengthening local fastener supply chains.

The UAE is increasingly becoming a logistics and re-export hub for automotive fasteners due to its strategic location. Saudi Arabia's industrial programs are driving up demand for high-performance fasteners in locally assembled vehicles. South Africa leads in automotive component manufacturing, supporting fastener production for both export and local markets. Egypt is experiencing growing investment in assembly operations, boosting demand for both standard and specialty fasteners.

How is the Opportunistic Rise of Europe in the Automotive Fasteners Market?

Europe is experiencing an opportunistic rise in the market, driven by stringent quality requirements and robust engineering expertise. The high adoption of electric and hybrid vehicles is boosting the demand for fasteners used in battery housings, thermal systems, and lightweight vehicle structures. Sustainability directives are pushing manufacturers toward recyclable coatings and energy-efficient production methods. OEMs rely heavily on precision fasteners to meet elevated durability and safety standards.

Germany leads the European market with high-end fastener technology, supporting OEMs like BMW, Mercedes, and Volkswagen. France is leveraging its strong automotive heritage to demand advanced fasteners suitable for EV platforms. Italy's automotive suppliers are increasingly using composite-compatible fasteners for luxury and performance vehicles. The UK is investing in engineering innovations, boosting demand for lightweight, high-strength fastening systems.

What are Latin America's Advancements in the Automotive Fasteners?

The major regional advancements are reaching heights of success due to the manufacturing power of hubs Mexico and Brazil. The technological shift has empowered and peaked the demand for lightweight materials to accelerate fuel's performance. Regarding the featherweight materials, the manufacturers are transforming their steel fasteners' old approach to powerful alternatives made from alloys, plastics, and aluminum.

The advancement is lighting up the EV integration, digitalization, and customization area, specifically for numerous vehicle designs. Whatever the advancements be the advanced threaded components remain the ruling factor to maintain structural integrity during the crucial vehicle operations.

Brazil's Automotive Fasteners Market Trends

Brazil's major trends in this market are its electrifying driven solutions, intelligent custom fastening, modern corrosion resistance, and featherweight plastic fasteners. The rising volume of EV production is the reason for the rising demand for smart fasteners for electronic mechatronics and battery modules. Brazil is a salty place due to its coastal areas.

Also addressing the region's humidity, the manufacturers transitioned their interest by using stainless steel and zinc-nickel alloy. The trend unifies with Industry 4.0, involving fasteners with monitoring sensors and torque-sensing bolts. The custom-designed solutions are managing the crucial road vibrancy and issues.

Government's Contribution in Automotive Fasteners Industry:

India's Production Linked Incentive (PLI) scheme received thumbs up from the Union Cabinet. This scheme was brought into consideration to accelerate the manufacturing of Advanced Automotive Technology (AAT) products. The EV promotion and FAME scheme were another hit in the automotive fasteners industry.

The government regulations to reduce emissions footprint, elevated plastic fasteners demand to follow the featherweight and hassle-free trend, which is essential for the industry's growth. North America's government's compulsory Corporate Average Fuel Economy (CAFÉ) standards fuel the volume of lightweight materials.

Value Chain Analysis

- Raw Material Supply

This stage involves sourcing metals such as steel, aluminum, and specialty alloys that form the base for automotive fasteners.

Key Players: ArcelorMittal, Tata Steel, POSCO, and China Baowu Steel. - Manufacturing / Production

Fasteners are produced using processes such as cold forming, forging, machining, threading, and heat treatment to meet precise specifications.

Key Players: ITW, Stanley Black & Decker, Nedschroef, Sundram Fasteners, and Bharat Forge. - Coating and Surface Treatment

Fasteners undergo surface treatments such as plating, coating, and anti-corrosion finishing to enhance performance and longevity.

Key Players: Henkel, Chemetall, and PPG Industries. - Distribution and Logistics

This stage ensures the timely delivery of fasteners to OEMs, Tier-1 suppliers, and aftermarket channels, maintaining supply chain efficiency.

Key Players: DHL Supply Chain, FedEx, and DB Schenker.

Automotive Fasteners Market Companies

- Bulten AB

- KAMAX

- Sundram Fasteners

- Stanley Black & Decker

- Shanghai Prime Machinery Company

- SFS Group

- Lisi Group

- The Philips Screw Company

- KOVA Fasteners Private Limited

- Westfield Fasteners Limited

Latest Announcements

- In May 2024, AMK Products Inc., a leading distributor of wholesale and bulk automotive fasteners proudly celebrated its 34th anniversary. Max Kotlowski, Founder of AMK Products said that, “When I started AMK Products 34 years ago, I had a simple goal: to provide the automotive restoration niche with the best fasteners and components available. Today, I am proud to see how far we have come and the impact we have made in the industry. Our success is a testament to the hard work, unrelenting focus on quality and dedication of our entire team.

Recent Developments

- In December 2024, Nedschroef, a company owned by Shanghai Electric declared the commencement of construction of its second automotive fastener factory situated in Tarragona, Spain. This facility will enhance Nedschroef's capacity for providing advanced fastening solutions across Europe.

- In May 2024, Auto Fasteners Ltd., a global supplier of fasteners and metal engineered components based in UK signed a 10 years lease for taking a 15,000 square feet space at a new industrial scheme which will act as a warehouse, assembly, quality inspection and office space for the company thereby supporting its expansion.

Segments Covered in the Report

By Product

- Threaded

- Nuts Screws

- Rivets

- Studs

- Non-threaded

- Snap Rings

- Clip

By Application

- Engine

- Chassis

- Transmission

- Steering

- Front/rear Axle

- Interior Trim

- Wire Harnessing

- Others

By Characteristics

- Removable Fasteners

- Permanent Fasteners

- Semi-permanent Fasteners

By Material

- Stainless Steel

- Bronze

- Iron

- Nickel

- Aluminum

- Brass

- Plastic

By Electric Vehicle Type

- Battery Electric Vehicle (BEV)

- Hybrid Electric Vehicle (HEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

By Vehicle Type

- Passenger Car

- Hatchback

- Sedan

- Luxury

- Light Commercial Vehicle

- Heavy Commercial Vehicle

By Distribution

- Automotive OEM

- Aftermarket

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content