June 2024

DNA Repair Drugs Market (By Drug Type: PARP Inhibitors, ATM Kinase Inhibitors, ATR Inhibitors, DNA-PK Inhibitors, BER Inhibitors, NER Inhibitors, Mismatch Repair (MMR) Inhibitors, Homologous Recombination (HR) Inhibitors, Non-Homologous End Joining (NHEJ) Inhibitors; By Application Type: Cancer Therapy, Genetic Disorders, Neurodegenerative Diseases, Immune Deficiencies, and Others; By Distribution Channel) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2033

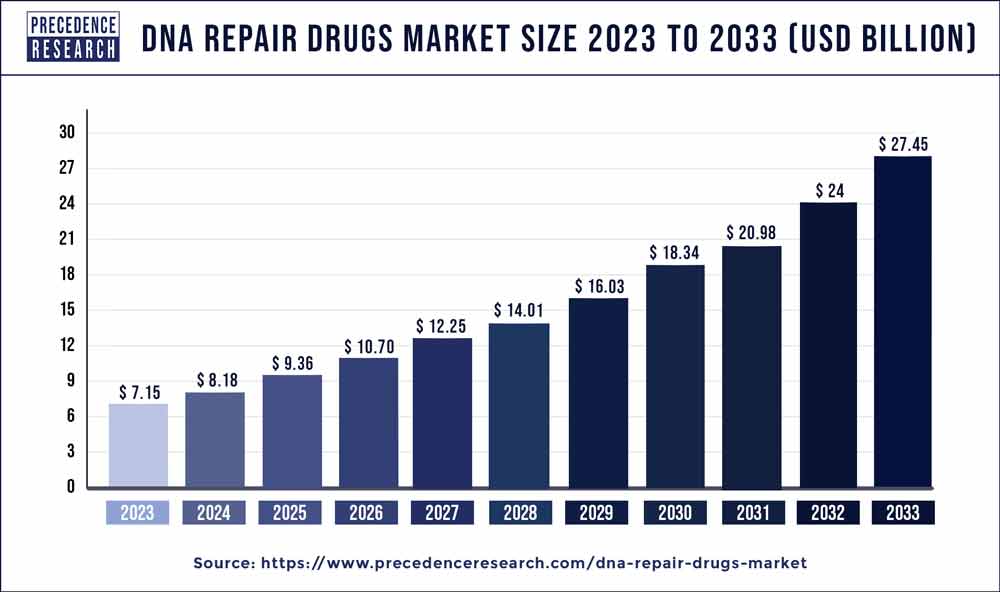

The global DNA repair drugs market size was valued at USD 7.15 billion in 2023 and is estimated to hit around USD 27.45 billion by 2033 with a CAGR of 14.40% from 2024 to 2033.

Advancements in precision medicine DNA repair drug development, tailored treatment to individual genetic profiles, increased understanding of DNA repair deficiencies, and regulatory support are some factors that encourage the growth of the market.

DNA Repair Drugs Market Overview

DNA repair drugs are a class of pharmaceuticals designed to address abnormalities or deficiencies in the DNA repair mechanisms of cells. DNA repair processes are crucial for maintaining genomic stability, as they correct damage caused by various endogenous and exogenous factors, including radiation, chemicals, and metabolic byproducts. When these repair mechanisms fail, it can lead to the accumulation of mutations and genomic instability, which are associated with cancer and other genetic disorders.

Therapeutics produced by the DNA repair drugs market function by either enhancing the activity of DNA repair enzymes or inhibiting pathways that promote DNA damage. For instance, some drugs target specific repair pathways, such as base excision repair (BER), nucleotide excision repair (NER), or homologous recombination (HR). By modulating these pathways, DNA repair drugs aim to restore the cell's ability to accurately repair DNA damage, thereby preventing or treating diseases associated with genomic instability.

In clinical practice, the DNA repair drugs market finds application primarily in cancer therapy. Tumors with defective DNA repair pathways, such as those with mutations in the BRCA genes, are particularly sensitive to certain DNA repair inhibitors. By exploiting these vulnerabilities, DNA repair drugs can selectively target cancer cells while sparing normal cells, offering a promising approach to personalized cancer treatment. Additionally, ongoing research aims to expand the use of DNA repair drugs beyond cancer therapy, potentially addressing a broader range of genetic diseases characterized by impaired DNA repair mechanisms.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 14.40% |

| Global Market Size in 2023 | USD 7.15 Billion |

| Global Market Size by 2033 | USD 27.45 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Drug Type, By Application Type, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers

Increasing incidence of cancer

The rising prevalence of cancer worldwide is a significant driver for the DNA repair drugs market. As cancer incidence continues to escalate due to factors such as aging populations, lifestyle changes, and environmental exposures, there is a growing demand for innovative treatments targeting specific molecular pathways involved in DNA repair. DNA repair drugs offer promising therapeutic options, especially for cancers with defects in DNA repair mechanisms, such as those caused by BRCA mutations.

Advancements in precision medicine

The emergence of precision medicine and personalized cancer therapy has fueled the demand for the DNA repair drugs market. With advancements in genomic sequencing technologies, healthcare providers can identify specific genetic alterations in individual patients' tumors, including mutations affecting DNA repair pathways. This molecular profiling enables the selection of targeted therapies, including DNA repair inhibitors, tailored to the unique genomic characteristics of each patient's cancer. As precision medicine becomes more integrated into clinical practice, the demand for DNA repair drugs is expected to continue growing.

Restraints

Regulatory challenges

One significant restraint in the DNA repair drugs market is the stringent regulatory requirements governing the development and approval of pharmaceuticals. Regulatory hurdles may arise from the need to demonstrate clinical benefit in specific patient populations, such as those with rare genetic disorders or treatment-resistant cancers. Meeting these regulatory requirements poses challenges for drug developers, potentially delaying market entry and limiting the availability of DNA repair drugs for patients in need.

The complex mechanisms involved in DNA repair and the potential for off-target effects necessitate rigorous preclinical and clinical evaluations to ensure safety and efficacy. Regulatory agencies such as the FDA and EMA impose stringent standards for clinical trial design, data collection, and drug approval, which can prolong the time and increase the cost of bringing DNA repair drugs to market.

Opportunities

Targeted combination therapies exploiting synthetic lethality

One highly anticipated opportunity in the DNA repair drugs market is the development of targeted combination therapies exploiting synthetic lethality. Synthetic lethality occurs when the simultaneous disruption of two specific genes or pathways leads to cell death, while disruption of either gene alone is tolerated. Exploiting synthetic lethality offers a promising approach for selectively targeting cancer cells with defects in DNA repair pathways, such as those with BRCA mutations.

By combining DNA repair inhibitors with other targeted agents or immunotherapies, researchers aim to enhance treatment efficacy and overcome resistance mechanisms, potentially leading to improved outcomes for patients with various types of cancer.

Gene editing technologies for precision DNA repair

Another eagerly awaited opportunity lies in the advancement of gene editing technologies for precision DNA repair. Techniques such as CRISPR-Cas9 offer unprecedented capabilities for precisely modifying DNA sequences, including repairing disease-causing mutations and restoring normal function to damaged genes. By harnessing these technologies, researchers envision the development of novel therapies for genetic disorders characterized by impaired DNA repair mechanisms.

In the DNA repair drugs market, gene editing holds promise for enhancing the effectiveness of these drugs by enabling targeted modifications to specific genomic loci, thereby optimizing treatment outcomes while minimizing off-target effects. As gene editing tools continue to evolve and become more accessible, they represent a transformative opportunity for advancing the field of DNA repair and personalized medicine.

The PARP inhibitors segment held the largest share of the DNA repair drugs market in 2023. Recent advancements in DNA repair drugs have focused on PARP and ATM kinase inhibitors. PARP has been a revolutionary presence in the industries of chronic illnesses such as cancer and Alzheimer's due to its regulatory function in several pathways. PARP inhibitors, such as olaparib and niraparib, have gained prominence in cancer therapy, particularly for treating BRCA-mutated tumors by exploiting synthetic lethality.

The ATM kinase segment is expected to witness the fastest growth during the forecast period. ATM kinase inhibitors, like AZD0156 and M3541, are being investigated for their potential to enhance the efficacy of radiotherapy and chemotherapy by targeting the ATM-mediated DNA damage response pathway. These drugs hold promise for improving treatment outcomes and overcoming resistance mechanisms in various cancers, representing a significant advancement in precision medicine approaches for DNA repair-targeted therapies.

The most recent and notable segments in the DNA repair drugs market are cancer therapy and genetic disorders segments. The cancer therapy segment held the dominating share of the market in 2023. Here, DNA repair drugs target specific pathways involved in repairing DNA damage, particularly in tumors with defective repair mechanisms, such as those caused by BRCA mutations. These drugs offer promising options for personalized cancer treatment and are continuously being explored in clinical trials for various cancer types.

Besides the cancer therapy segment, the genetic disorders segment is observed to witness a significant rate of expansion during the forecast period. In genetic disorders, DNA repair drugs aim to address underlying defects in DNA repair pathways associated with conditions such as neurodegenerative diseases, immune deficiencies, and rare genetic syndromes, offering potential therapeutic interventions for patients with these challenging conditions.

The hospital pharmacies segment held a significant share of the in 2023. These facilities play a crucial role in dispensing DNA repair drugs to patients undergoing cancer treatment or genetic disorders requiring specialized care. These pharmacies are equipped to handle complex medication regimens and provide comprehensive support services, ensuring timely access to DNA repair therapies within the hospital setting.

The specialty clinics segment is projected to experience substantial growth in the coming years. Specialty clinics dedicated to oncology or genetic medicine offer specialized expertise in managing patients with DNA repair deficiencies, facilitating the delivery of personalized treatment strategies and targeted therapies tailored to individual genetic profiles.

In 2023, North America, particularly the United States, stands out as the most dominant region in the DNA repair drugs market. This prominence is primarily attributed to several factors, including robust healthcare infrastructure, extensive research and development activities, and a high prevalence of cancer and genetic disorders necessitating DNA repair interventions. The United States boasts advanced healthcare facilities and a well-established pharmaceutical industry, facilitating the development, production, and distribution of DNA repair drugs. Moreover, the country is home to numerous renowned research institutions and biotechnology companies actively engaged in pioneering advancements in DNA repair therapeutics.

Canada, another critical market within North America, also contributes to the region's dominance in the DNA repair drugs market. With a strong emphasis on healthcare innovation and a supportive regulatory environment, Canada serves as a vital hub for clinical trials and collaborative research endeavors focused on DNA repair mechanisms and targeted therapies. Mexico further bolsters North America's position in the DNA repair drugs market, benefiting from increasing investments in healthcare infrastructure and expanding access to advanced medical treatments.

Asia Pacific region, particularly in countries such as China, Japan, India, and Australia, is emerging as a significant presence in the DNA repair drugs market. Rapidly growing economies, rising healthcare expenditures, and a large patient population afflicted with cancer and genetic diseases drive the demand for innovative DNA repair therapies in this region. As these countries continue to invest in healthcare infrastructure and research capabilities, they present lucrative opportunities for market expansion and collaboration in the field of DNA repair drugs.

Segment Covered in the Report

By Drug Type

By Application Type

By Distribution Channel

By Geography

For questions or customization requests, please reach out to us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

June 2024

November 2024

January 2023

March 2024