February 2024

Electric Vehicle Charging Station Market Size, Share and Growth Analysis (By Charging Station Type: AC Charging, DC Charging, and Wireless Charging; By Power Output: <11KW, 11KW-50KW, and >50KW; By Supplier Type: OE Charging Station and Private Charging Station; By End User: Private Type and Public Type) - Global Industry Analysis, Trends, Regional Outlook, Forecast 2023 - 2032

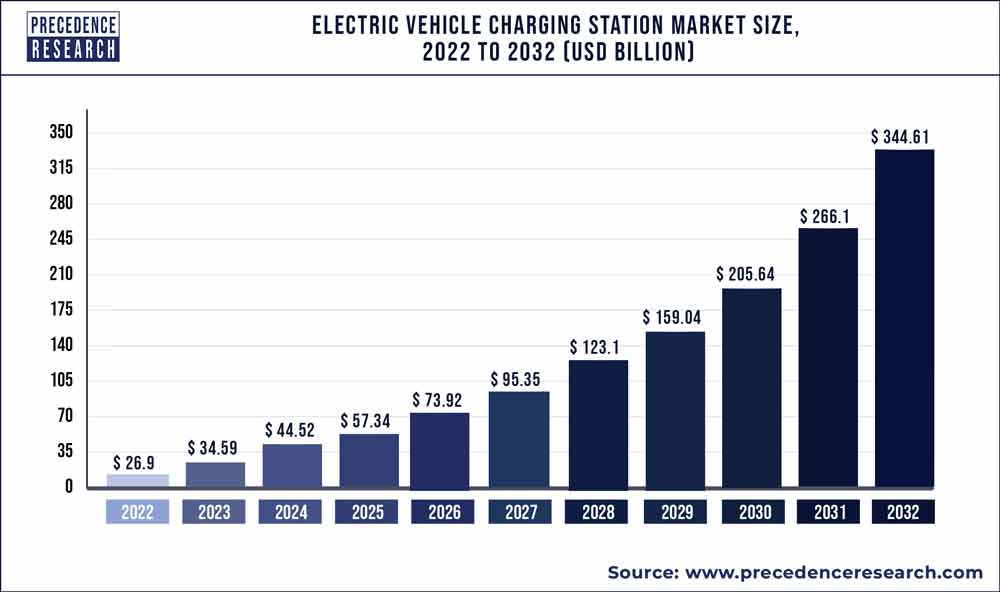

The global electric vehicle charging station market size is calculated at USD 44.52 billion in 2024 and it is projected to hit around USD 344.61 billion by 2032 with a remarkable CAGR of 29.1% from 2023 to 2032. The EV charging station market is highly attractive and opportunistic market. The growth trend of EV charging stations is directly proportional to the electric vehicle (EV) adoption rate across the globe. As per the stats, Norway leads the world in percentage of EVs sold per year out of total vehicles sale with 49.1% followed by Iceland with 19.1%, Sweden with 8%, Netherlands with 6.7%, Finland with 4.7%, and China with 4.4%. Furthermore, according to stats revealed for U.S., total EVs registered across U.S. in the year 2020 were 1,019,260 with California, Florida, and Texas leading in the number of EV registrations. This was mainly attributed to the attractive government policies for reducing the rate of emission from vehicles.

The rise in carbon emissions and other hazardous pollutants from transportation has necessitated the adoption of electric vehicles. As a result, there is a growing demand for electric vehicle charging infrastructure in business and residential settings. Increased cooperation among automobile manufacturers for charging infrastructure, as well as a subscription model, are also projected to boost market expansion.When opposed to residential areas, commercial spaces have a far higher market penetration of electric vehicle charging equipment. With the increased usage of electric vehicles, the number of commercial charging stations is expected to rise. Efforts to improve charging infrastructure in commercial areas would be critical in increasing the use of electric vehicles, as overnight charging at residential complexes or individual residences would not be adequate for long-distance travel.

The major factors driving the market’s growth are government initiatives to encourage the adoption of electric vehicles and associated infrastructure, rising demand for electric vehicles fast charging infrastructure, and increased deployment of electric vehicles by shared mobility operators. The market players can benefit from increased research and development in vehicle-to-grid technology and rising acceptance of electric mobility in emerging nations.

Rising demand for electric vehicles is one of the prime factors for the aggressive growth of EV charging station market. The growth is further propelled by the government funding to the Original Equipment Manufacturers (OEM) for the deployment of charging stations. For instance, in December 2016, ChargePoint Inc. was awarded USD 4 million by California Energy Commission (CEC) for completing the West Coast Electric Highway that connects Baja California to British Columbia with electric vehicle charging stations.

Additionally, increasing popularity of Mobility as a Service (MaaS) also expected to flourish the market growth. Further, the growth of the EV charging station is fuelled by the significant emphasis on the subscription-based charging models. As per the model, many utilities such as Vattenfall AB, Duke Energy Corporation, and New York Power Authority have signed a partnership agreement with the OEMs to provide the subscription-based services to their customers. For instance, in April 2019, Duke Energy Corp. signed a partnership agreement with ChargePoint Inc. for offering subscription-based services to its EV drivers in the U.S. state of North Carolina.However, various costs associated to the EV charging infrastructure that includes maintenance cost, installation cost, and operational cost are impacting negatively on the market growth.

The governments all around the globe have shifted their focus from other activities to medical and health care facilities due to COVID-19 pandemic. During the outbreak, strict lockdown rules were imposed in all countries. These restrictions hampered the work process of every industry. People were forced to stay at home and maintain social distancing norms and prevent the coronavirus from spreading, affecting the availability of the labor. However, as all countries lifted the lockdown restrictions, the ongoing projects resume, and the electric vehicle charging stations market is likely to rise significantly.

Electric Vehicle Charging Stations Market Data and Statistics:

Drivers

Growing adoption of vehicle-to-grid electric vehicle charging station

Increasing Sustainability

Development in the EV Infrastructure

Restraints

Stringent government regulations

Lack of Vehicle-grid Interoperability

Opportunities

Surge in sales of electric vehicles

Increasing demand for clean transportation

Challenges

High cost of chargers

| Report Highlights | Details |

| Market Size in 2023 | USD 34.59 Billion |

| Market Size by 2032 | USD 344.61 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 29.1% |

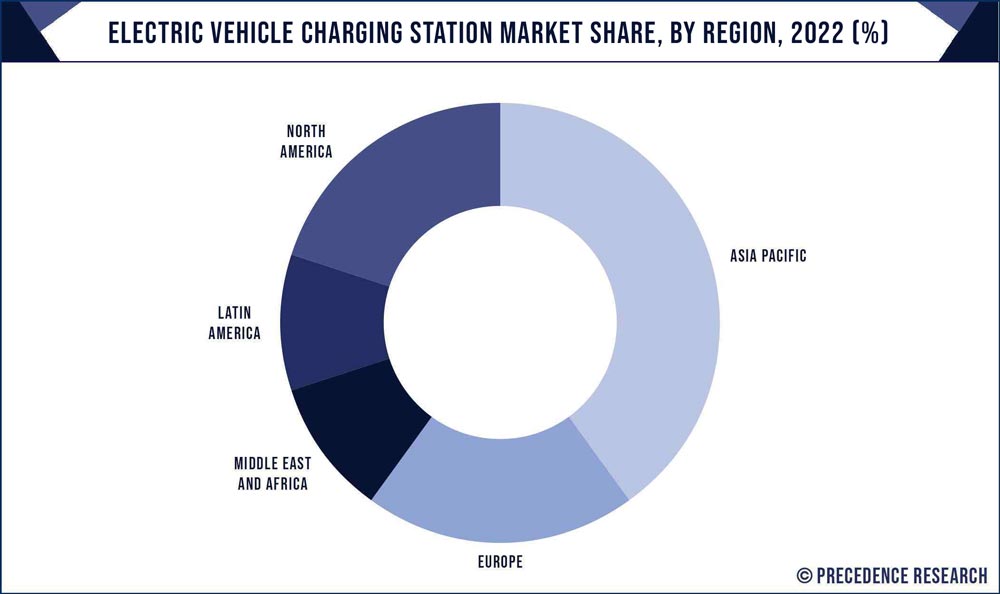

| Largest Market | Asia Pacific |

| Fastest Growing Market | Europe and North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Charging Station Type, Power Output, Supplier Type, End User, Geography |

| Companies Mentioned | ABB Ltd., ChargePoint, Inc., EVgo Services LLC., Allego, Scheinder Electric, Blink Charging Co., Wi Tricity Corporation, Toshiba Corporation, AeroViroment, Inc., Mojo Mobility, Inc., General Electric, Robert Bosch GmbH |

Chargers at Level 3 are intended for industrial use. An EV can be charged 16–32 times faster at a level 3 charging station than at a level 2 one. Level 3 charging station capacity is being increased by researchers. In the future, fueling a conventional vehicle will take longer than charging an EV at a level 3 charging station. The third level of charging has the maximum output of all the levels and charges significantly more quickly than the first two. This level, which also offers DC Fast Charging, needs a special cable to handle higher electrical loads. Additionally, they are typically managed by outside businesses, according to NeoCharge.

For instance, Level 3 charging stations are effectively Tesla Superchargers. Like other third-party stations, they provide direct current quick charging. The primary distinction is that these stations only work with automobiles bearing the Tesla brand. Other EVs currently cannot use Superchargers.

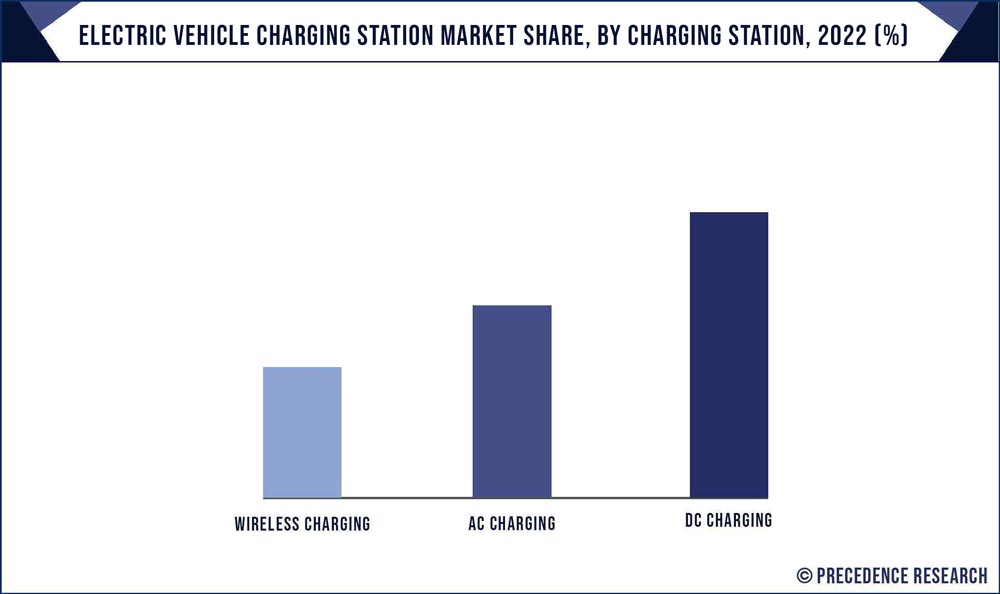

DC charging station led the global electric vehicle charging station market with largest revenue share in the year 2022. This is mainly attributed to fast charging capacity and attractive pricing of DC charging stations. The DC charging station directly charges the battery by converting the power before it enters the car's converter. The DC charging station charges the battery directly as it converts the electricity prior to entering in the cars converter. Additionally, rapid increase in the adoption of technologies, such as Near-field Communication (NFC) and Radio Frequency Identification (RFID), in charging stations installed on highways also flourishes the DC charging market growth.

Many top companies are investing in the development of wireless charging systems for electric vehicles because wireless charging has the potential to grow significantly for the players in the market for electric vehicle charging stations. For instance, the Korean automaker Hyundai introduced the first wirelessly charging EVs with the Genesis GV60. This was swiftly followed by the Chinese automaker FAW, which teamed up with real estate giant Wanda Group to develop 60 autonomous parking garages with, among other features, car charging stations for 60 different types of vehicles. China was the first country to implement wireless charging, and it is anticipated that this trend will spread.

Additionally, wireless charging allows autonomous charging and offers electric vehicle drivers a whole new experience. For those who supply vehicle-to-grid (V2G) services, wireless charging opens up new economic opportunities.

Governments all around the globe are encouraging the production of automobiles in response to increasing concerns about the environmental impact of conventional cars. zero-emission cars, or electric vehicles, are becoming more well-liked as a more eco-friendly mode of public transit across the globe. To encourage the use of EVs, numerous national authorities provide financial incentives, such as refunds and tax exemptions, lower parking/toll charges for EVs, free charging, and subsidies. Thus, the battery-electric vehicle industry is rapidly growing. Electric cars require much less maintenance than internal combustion engines since they have fewer moving parts.

Electric cars require less upkeep than regular gasoline or diesel vehicles. As a result, the annual cost of operating an electric car is relatively low. Road tax and registration for electric vehicles are less expensive than those for gasoline or diesel vehicles. These elements are fueling battery-electric vehicle growth on a global scale.

The AC charging specification created by renowned connection maker Mennekes was highly received by EV users and is widely utilized in Taiwan, Europe, Australia, Southeast Asia, and Australia. The lack of a pin on the object distinguishes Type 2 from other types. Customers can choose SINBON's 20A, 32A, and so on.

Due to the increasing demand for electric vehicles, there is a greater need for charging stations. As a result, new products are being created, and there is a wider variety of EV charger specifications available.

AC charging chargers need to arrive faster. An electric vehicle may be fully charged in roughly 3 minutes at its 22 kW maximum rating. The majority of European electric vehicles use the Type 2 connector, which is what the chargers often have.

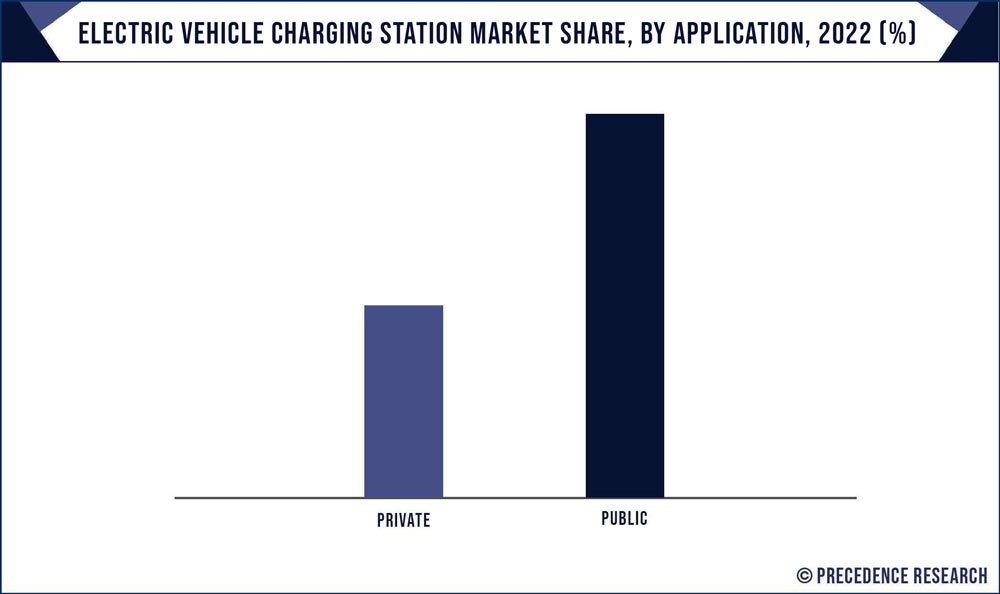

Public type charging stations held major revenue share in the year 2022 as they are more cost-effective to the manufacturers. In addition, they have sufficient parking space and are accessible to all public.

On the other hand, private type charging stations are basically workplace based or residential based station that are only accessible to the owners or limited public. As a result OEMs and different utilities are also focused towards building public charging station. Thus significant benefits offered by public type over private type fuels the market growth.

The future of the EV industry is mainly in public EV charging, which must be reliable and easily available for the EV sector to experience sustainable growth. Public EV charging is any station that enables members of the public to refuel their cars, whether it is used at specialized charging stations (like those found at current gas stations) or at establishments that provide public access, such as stores and apartment buildings. No limits apply to which drivers can use the public charging station.

The advantages of public EV charging are numerous. Tax subsidies and other financial incentives at the federal, state, and local levels support a large portion of the public charging infrastructure. Widespread use also entails public charging. While station utilization increases income, it is net-positive for sustainability. As a result of the higher utilization and revenue, owners may have more opportunities.

A dedicated circuit that can handle a heavier load than a typical home circuit connects the wall-mounted box to the electrical grid. A Mobilize power solution is accessible to everyone who wants to charge their car at home or to business owners who want to add electric vehicles to their fleet. Additionally, each owner of an electric vehicle residing in a shared apartment building has the right to have a charging station installed in their parking space in an increasing number of nations, including Spain, France, India, and Japan.

By using this cutting-edge technology, one may, for instance, charge an electric vehicle at night when there is less demand for electricity and then use that electricity to power their homes during the day (V2H) or help balance local or even national energy supply and demand (V2G). A more balanced power supply translates to cheaper costs and more dependable electricity for everyone.

A dependable and sophisticated commercial EV charging station is essential for your company or local government because many companies aim to convert their fleets to electric vehicles while also offering EV charging options for clients and tourists. Consider the software and service provider EV Connect for electric vehicle charging. The platform provides possibilities for charging electric vehicles at public, private, academic, and hospitality facilities. The platform develops and maintains the industry's most dependable and flexible cloud-based platform for controlling charging stations and the drivers who utilize them. The service provides charge station agnostic command and manages enterprise, driver communications and support, demand-response capability across several charging networks, energy systems integration via an open API, and more.

Asia Pacific dominated the global electric vehicle charging station market in 2022 and is expected to be the most lucrative region during the forecast period. This is majorly attributed to the increasing investments by the government of China, South Korea, Japan, and other Asian countries for installation of charging infrastructures. For instance, in April 2020, China announced its plan to invest USD 1.43 billion in 2020 to maintain its leadership in EV adoption race. Similarly, Singapore, India, Korea, and Japan are also investing in the electric vehicle charging infrastructure to promote its adoption in their region.

The market for EV charging station in Asia-Pacific region is being driven by growing government initiatives. As of the end of July, members of the Alliance claimed that around 566,000 public charging stations had been erected and were operational across the country, according to figures released by the China electric charging infrastructure promotion in August 2020. Furthermore, by 2050, the Japanese government plans to convert all new cars sold in the country to electric or hybrid vehicles. By 2050, the government wants to reduce carbon dioxide emissions and other greenhouse gas emissions by around 80% per car. Thus, market growth in region is expected in the near future.

Europe and North America witness moderate growth in the global electric vehicle charging station market. This is mainly due to the government’s ambition in Europe & North America to curb the carbon emission and increase the adoption rate of electric vehicles. Nearly, 76% of total charging stations in Europe are just concentrated in four countries that are Germany, France, UK, and the Netherlands. In June 2019, Volkswagen Group announced its plan to install 36,000 electric vehicle charging points in various parts of Europe by 2025. Similarly in June 2018, three major states of U.S. that include New York, New Jersey, and California announced to spend USD 1.3 billion in the deployment of EV charging infrastructure to boost their EV adoption.

The U.S. is dominating the electric vehicle charging station market in the North America region. Electric vehicle use is fast expanding throughout North America. The U.S. is the third-largest market for electric vehicles, according to the International Council on Clean Transportation, with around 320,000 new electric vehicle sales in 2019. According to the International Energy Agency, about 1.8 million electric automobiles were recorded in the U.S. as of 2020, which is more than three times the number registered in 2016. The total number of electric vehicles registered in the U.S. increased from under 300,000 in 2016 to over 1.1 million in 2020. California began establishing charging station networks to help with the broad adoption of electric vehicles. As of 2021, there are more than 42,000 publicly accessible charging stations in the U.S.

For instance, electric car owners in the UK can take advantage of the EVHS (Electric Vehicle Homecharge Scheme) OLEV (Office for Low Emission Vehicles) subsidy, which, starting on April 1, 2020, pays up to USD 384.9 off the price of buying and inaugurating a residence charging point. Government incentives are also available to companies in the UK. The WCS (Workplace Charging Scheme), a voucher-based program created to assist with the up-front costs of purchasing and installing wall chargers, allows you to declare up to USD 10,999.5 for 40 chargers.

Additionally, according to bp pulse, the first charging station for medium- and heavy-duty electric trucks would open in Europe. There are now six public charging stations with ultra-fast 300kw charge ports over a 600km section of the Rhine-Alpine route in Germany. The freight roads, one of the busy roads in Europe, the corridor links the Mediterranean port of Genoa in Italy with the Netherlands and the North Sea ports in Belgium via a 1,300 km long network of motorways.

Additionally, the assistance in France takes the form of a tax credit: up to a deduction of 300 euros, equal to 75% of the cost incurred and detailed on the invoice, including installation charges. This assistance is a component of the ADVENIR project, which aims to install EV charging stations across France.

The global electric vehicle charging station market is highly competitive owing to rapid changing consumer preference and continuous technological development. Nearly every market player has their prime focus towards developing fast and ultra-fast charging stations. In 2015, ChargePoint Inc., Volkswagen Group, and BMW AG announced their plan to install 100 DC fast chargers on the West and East coasts of U.S. Some players also prefer merger & acquisition strategy for consolidating their market share. In 2018, BP Plc announced the acquisition of ChargemasterPlc, one of the leading suppliers of EV chargers and in UK. After the acquisition, ChargemasterPlc was rebranded as BP Charge master. Some of the prominent players in the electric vehicle charging station market include:

Segments Covered in the Report

This research report estimates revenue growth at global, regional, and country levels and offers an analysis of present industry trends in every sub-segment from 2020 to 2032. This research study analyzes market thoroughly by classifying global electric vehicle charging station market report on the basis of different parameters including charging station type, power output, supplier type, end user, and region:

By Level of Charging

By Charging Station Type

By Power Output

By Supplier Type

By Vehicle Type

By Installation Type

By Connector Type

By Application

By Mounting Type

By Charging Service

By End User

By Geography

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2024

September 2024

September 2024

September 2024