What is the Gasoline Direct Injection Device Market Size?

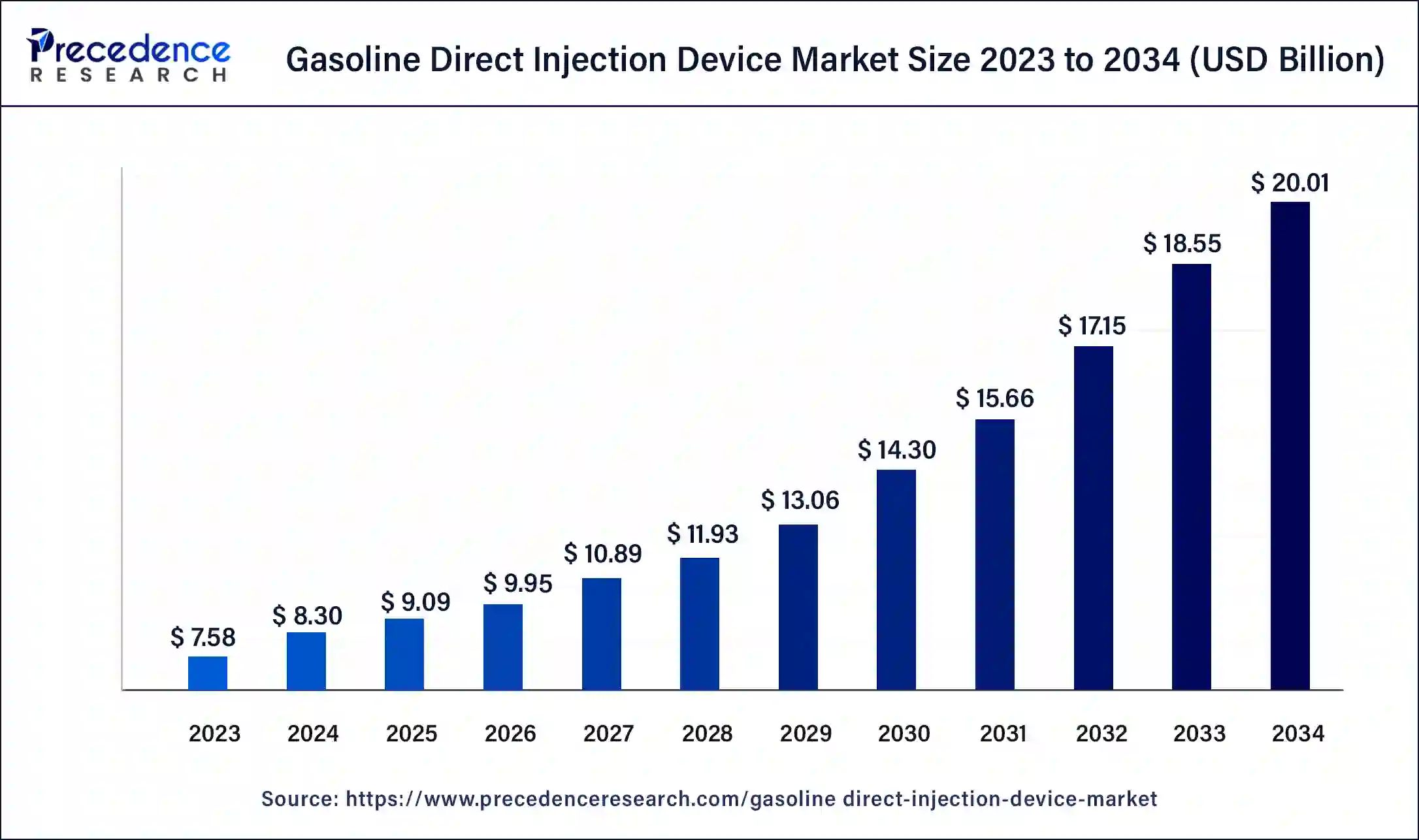

The global gasoline direct injection device market size is calculated at USD 9.09 billion in 2025 and is predicted to increase from USD 9.95 billion in 2026 to approximately USD 21.43 billion by 2035, expanding at a CAGR of 8.95% from 2026 to 2035.

Gasoline Direct Injection Device Market Key Takeaways

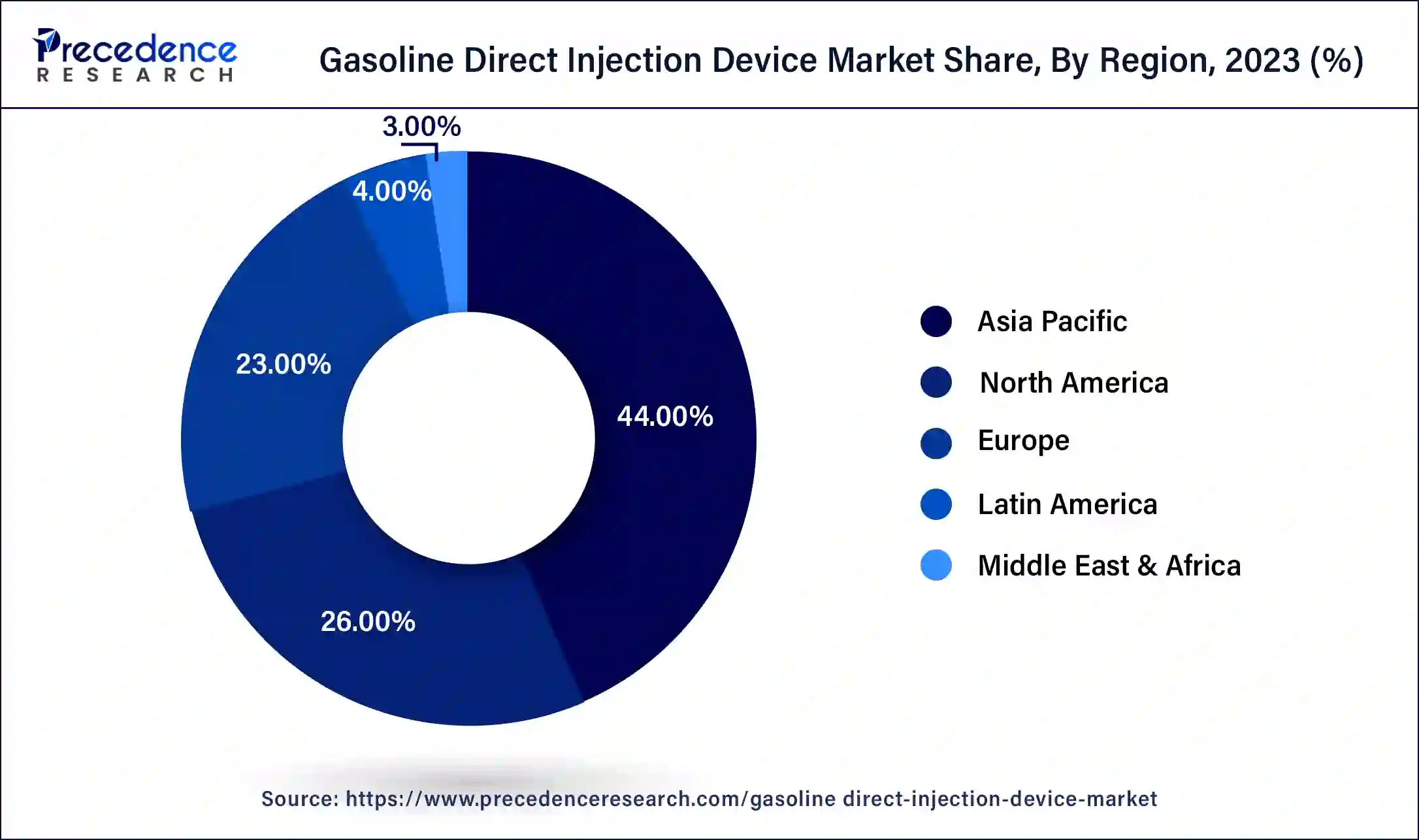

- Asia Pacific led the global market with the highest market share in 2025.

- By Component, the fuel injectors segment is likely to have a significant increase throughout the forecast period.

- By Application, the passenger cars segment registered the maximum market share in 2025.

- By Application, the commercial vehicle segment is expected to grow at a remarkable CAGR during the forecast period.

Market Overview

The gasoline direct injection device market is gradually evolving, driven by demand for fuel-efficient vehicles, stringent emission regulations, and advancements in automotive engine technologies. A GDI system enables a more exact fuel delivery directly to the combustion chamber, which enhances engine performance, fuel economy, and power output while reducing overall emissions. To comply with the standard rules without sacrificing the vehicle's performance, GDI devices are on the list of the suppliers' requirements that automakers must meet.

Gasoline Direct Injection Device Market Growth Factors

Increasing motorized mobility along with rising consumer preferences for fuel efficient vehicles expected to escalate the Gasoline Direct Injection (GDI) device market size over the forecast period. Increasing demand for regulating pollution levels related to greenhouse gases coupled with improving the air quality are the key factors propelling the adoption of vehicles incorporated with the advanced fuel injection systems.

Improved engine performance together with high thermal efficiency that significantly assists in reducing the fuel emissions prominently supports the growth of the GDI industry. Rising inclination of manufacturers towards vehicle efficiency and engine downsizing anticipated to augment the market share. In addition, multiple financing firms for passenger vehicles together with increasing individual spending projected to considerably boost the adoption of GDI devices.

Market Outlook

- Market Overview: The gasoline direct injection device market is growing due to rising demand for fuel-efficient vehicles, stringent emission regulations, and continuous advancements in automotive engine technologies. Increasing adoption of lightweight and high-performance engines is further fueling market expansion.

- Major Investors: Major investors in the market include automotive OEMs, engine component manufacturers, and tier-1 suppliers, who fund R&D and production of advanced injection technologies. Their investments drive innovation, improve fuel efficiency, and help automakers meet regulatory emission standards.

- Global Expansion: The market is expanding globally with high adoption in Europe, North America, and Asia Pacific due to strict emission norms and growing automotive production. Emerging regions, such as Latin America and the Middle East, offer opportunities through increasing vehicle demand, modernization of engines, and adoption of fuel-efficient technologies.

Market Scope

| Report Highlights | Details |

| Market Size in 2035 | USD 21.43 Billion |

| Market Size in 2025 | USD 9.09 Billion |

| Market Size by 2026 | USD 9.95 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 8.95% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Component Insights

Fuel injectors anticipated to witness prominent growth over the analysis period owing to need for precise control over fuel injection to ensure complete combustion of fuel. In addition, need for effective controlling of air-fuel mixture along with exhaust emissions in the gasoline engine predicted to escalate the growth of the segment over the forecast timeline. Further, the fuel injector assists in monitoring the fuel regulator that helps in maintaining the fuel pressure of delivery pipe at a constant level.

On the other side, the Electronic Control Unit (ECU) segment projected to witness significant growth in the Gasoline Direct Injection (GDI) device market due to the flexible multiple input and output channels that enhances the signal transfer within the vehicle system components. High control along with mapping the status of automotive components as well as vehicle performance on the basis of selected system inputs expected to flourish the growth of the segment.

Companies involved in the manufacturing of automotive ECU are significantly engaged in new product launch that improves the reliability and functions to cater the rising customer demand. For instance, in September 2018, Delphi Technologies introduced generation 7 electronic controllers used particularly in commercial vehicles that include trucks, buses, and off-highway vehicles. The new product enables extreme flexibility provided with multiple applications that supports the user requirements.

Application Insights

Passenger cars leads the gasoline direct injection device market in terms of revenue because of rising inclination of consumers towards luxury & premium cars especially in developed countries coupled with implementation of direct injection systems in those vehicles. Escalating demand for passenger cars together with the introduction to stringent emission norms for such vehicles expected to further impel the penetration of passenger cars over the analysis period. Consistent developments in the passenger vehicles owing to implementation of new functions for comfort and vehicle safety anticipated to propel the growth of the segment in the coming years.

Besides this, the commercial vehicle segment projected to witness a steady growth due to the rising road transportation along with domestic trading activities across the world. Heavy and medium commercial vehicles that operate on diesel contribute significantly towards the vehicular emissions and thus necessitate the implementation of gasoline powered engines for curtailing the environmental impact. Commercial vehicles also require highly durability and long-lasting engines that boosts the installation of GDI devices for enhanced reliability. Further, rising research & development (R&D) activities along with integration of advanced technologies in GDI devices anticipated to positively influence the growth of the segment over the forecast timeframe.

Key Companies & Market Share Insights

The global GDI device industry seeks significant new product launch, development, and enhancement that turn the market into competitive. This approach from industry players helps them to increase their consumer base. For instance, in July 2019, Xtreme-DI introduced GDI high-flow fuel injectors that offer more than 45% of additional fuel flow compared to stock products. The aftermarket injectors deliver outstanding and consistent performance by offering compatible injection pressures as that of the OEM equipment.

Furthermore, the market players are majorly focused on establishing long term contract for supplying specific vehicle model along with designing customized solutions for commercial and passenger vehicles this in turn will strengthen their footprint in the global market.

Regional Insights

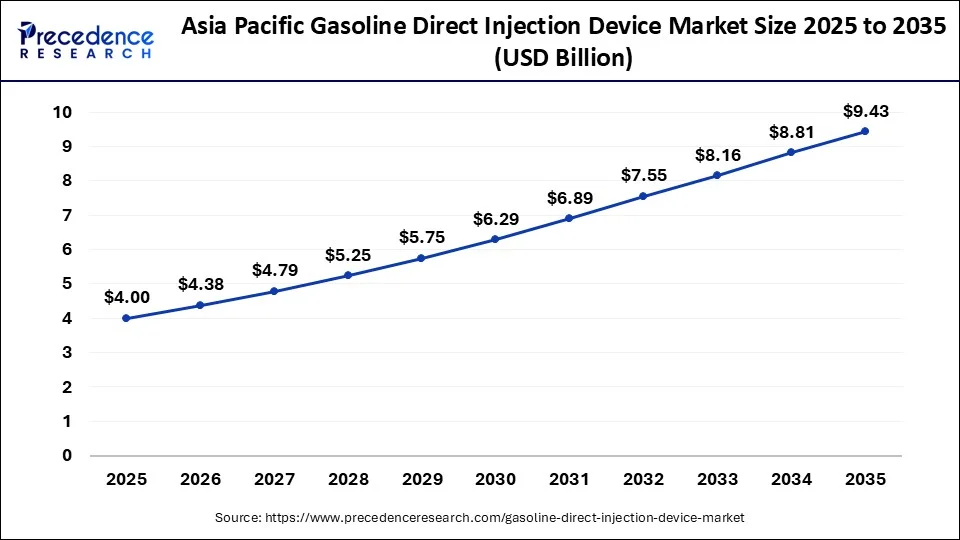

What is the Asia Pacific Gasoline Direct Injection (GDI) Device Market Size?

The Asia Pacific gasoline direct injection (GDI) device market size was valued at USD 4 billion in 2025 and is expected to reach USD 9.43 billion by 2035, growing at a CAGR of 8.95% from 2026 to 2035.

Asia Pacific led the global GDI device market due to the increased focus of automotive market players towards untapped opportunities in the region. Further, shifting consumer trends towards vehicles with superior fuel efficiency are anticipated to spur industry growth during the projected period. Government authorities are taking strict measures to control the carbon footprint including fuel economy standards and engine upgrades.

What Makes Europe the Fastest-Growing Region in the Market?

Europe region is expected to register the highest growth over the forthcoming years pertaining to the stringent norms for fuel efficiency and emission targets. OEMs are prominently adopting GDI systems to achieve compliance standards. The significant presence of automotive players including BMW AG, Daimler AG, and Audi AG in the region is projected to positively impact the growth of the GDI system over the analysis timeframe.

What Potentiates the Gasoline Direct Injection Device Market in the Middle East & Africa?

The market in the Middle East & Africa is being driven by rising vehicle sales, rapid urbanization, and stricter emission standards. GCC countries are actively promoting energy-efficient engines and phasing out traditional fuel-consuming systems to support market growth. Saudi Arabia leads the market, driven by extensive automotive manufacturing activity and rising passenger vehicle demand. Recent government initiatives focused on reducing fuel consumption and lowering air pollution have further supported the adoption of GDI devices in the country.

Saudi Arabia is leading the market by investing in local manufacturing capabilities and partnerships with automotive production companies. This move not only supports economic development but also fosters technological advancements within the region. Meanwhile, countries like Egypt and Morocco are beginning to explore GDI technology as part of their automotive evolution, capitalizing on increasing population and urbanization rates.

How is the Opportunistic Rise of Latin America in the Market?

Latin America is expected to experience an opportunistic rise in the gasoline direct injection device market, driven by rising automotive production, increasing demand for eco-friendly vehicles, and strengthening regulatory frameworks. OEMs expanding their factories in the region are adopting GDI technology, benefiting local manufacturers focused on efficient engines and helping them meet upcoming emission standards.

Brazil is the largest contributor to the Latin American gasoline direct injection (GDI) device market, driven by its extensive automotive manufacturing base, high vehicle production, and prevalent use of gasoline engines. Mexico follows closely, supported by strong automotive exports, investment inflows, and the presence of global OEMs introducing new vehicle models equipped with GDI systems.

The market in Latin America is also driven by increasing vehicle production and rising fuel efficiency standards. Countries like Brazil and Mexico are at the forefront, with a growing automotive industry that is embracing new technologies to enhance performance and reduce emissions. The demand for advanced fuel injection systems is being spurred by a burgeoning middle class seeking more efficient vehicles. Moreover, government initiatives aimed at promoting cleaner fuels and reducing pollution significantly influence the market landscape.

Countries such as Brazil, Argentina, and Chile are contributing to the market. These countries are investing in infrastructure and technology to support the adoption of advanced automotive solutions. The increasing availability of GDI-equipped vehicles is set to capture consumer interest across the region. Furthermore, with international automotive companies establishing a presence in Latin America, the market is likely to benefit from shared technology and innovation.

What Drives the Market within North America?

The gasoline direct injection device market in North America is driven by the region's strong automotive industry, increasing demand for fuel-efficient and high-performance vehicles, and stringent emission regulations. Growing adoption of turbocharged and downsized engines, which rely on GDI technology for improved power and reduced fuel consumption, further fuels market growth. Additionally, investments by OEMs and tier-1 suppliers in advanced engine technologies and emission-compliant solutions support the expansion of the GDI device market.

Value Chain Analysis

- Raw Material Sourcing

This stage involves sourcing raw materials like steel, aluminum, and alloys for injectors, high-pressure pumps, motors, fuel rails, and ECUs.

Key players: Bosch and Denso Continental. - Vehicle Assembly and Integration

This stage focuses on assembling several parts to deliver a smooth and seamless, highly pressurized fuel into the combustion chamber.

Key players: Delphi Automotive LLP

Gasoline Direct Injection Device Market Companies

- Delphi Automotive LLP

- Eaton Corporation

- DENSO Corporation

- Continental Corporation GmbH

- Robert Bosch GmbH

- Stanadyne LLC

- Keihin Corporation

- Hitachi Automotive Systems, Ltd.

- TI Automotive

- Magneti Marelli S.p.A

Segments Covered in the Report

This research study comprises complete assessment of the market by means of far-reaching qualitative and quantitative perceptions, and predictions regarding the market. This report delivers classification of marketplace into impending and niche sectors. Further, this research study calculates market size and its development drift at global, regional, and country from 2024 to 2034. This report contains market breakdown and its revenue estimation by classifying it based on component, application, and region:

By Component

- Fuel Injectors

- Electronic Control Units

- Sensors

- Fuel Pumps

By Application

- Passenger Cars (PC)

- Commercial Vehicles (CV)

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Get a Sample

Get a Sample

Table Of Content

Table Of Content