February 2025

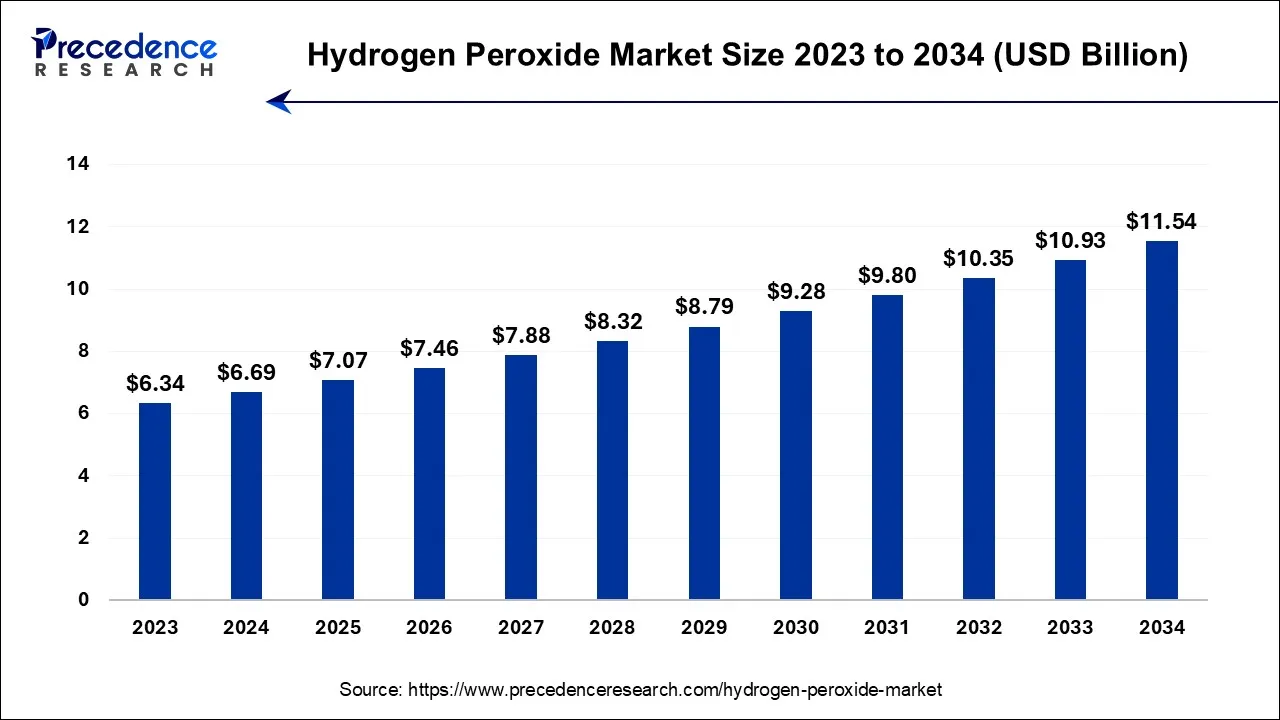

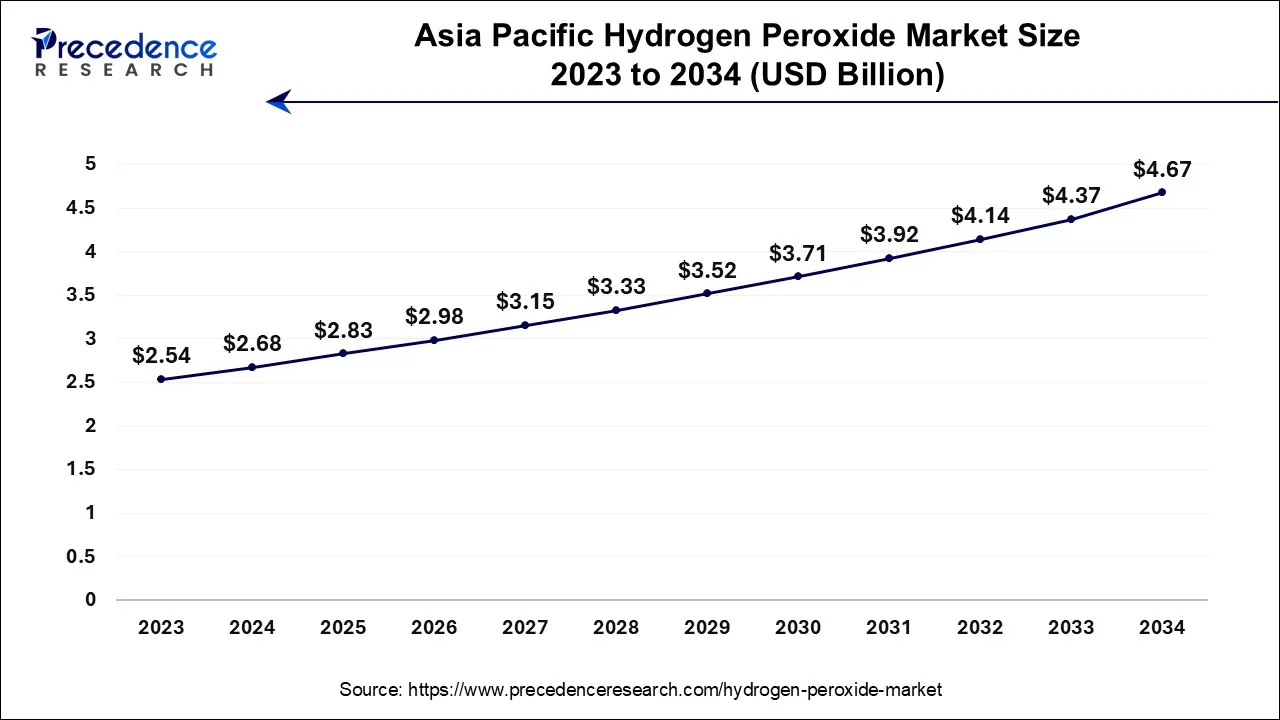

The global hydrogen peroxide market size is calculated at USD 7.07 billion in 2025, and is predicted to hit around USD 11.54 billion by 2034, poised to grow at a CAGR of 5.6% between 2024 and 2034. The Asia Pacific hydrogen peroxide market size accounted for USD 4.83 billion in 2024 and is anticipated to grow at the fastest CAGR of 5.25% during the forecast year. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global hydrogen peroxide market size is expected to be valued at USD 6.69 billion in 2024 and is anticipated to reach around USD 7.07 billion by 2025, to approximately at USD 11.54 billion by 2034, expanding at a CAGR of 5.6% over the forecast period from 2024 to 2034.

The Asia Pacific hydrogen peroxide market size is accounted for USD 2.83 billion in 2025 and is projected to be worth around USD 4.67 billion by 2034, poised to grow at a CAGR of 5.71% from 2024 to 2034.

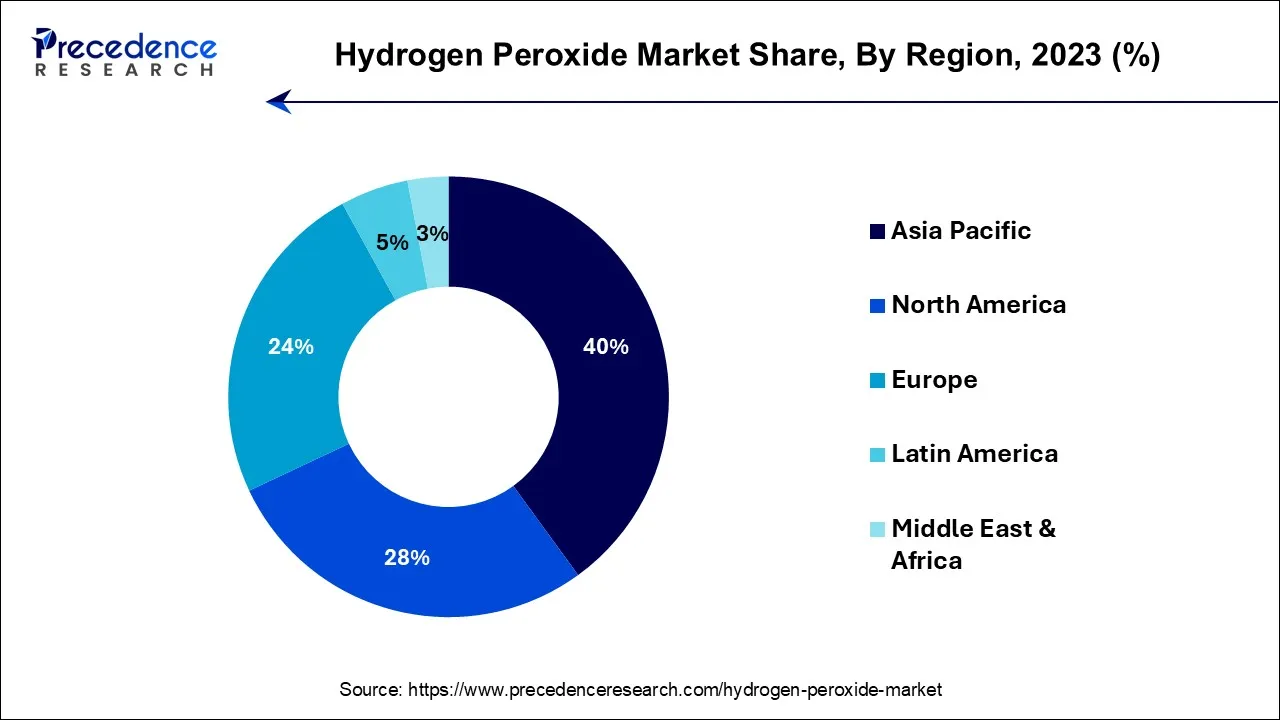

In 2024, the Asia Pacific region dominated the market and generated 40% of global revenue. This is explained by the growing influence of the medical, personal care, and chemical formulating businesses in the area. Due to cheaper land prices, the availability of trained labour, and an improved trade balance, China, Thailand, India, South Korea, and Japan have emerged as important centres for multinationals operating in various sectors to develop their business practises in the nation.

Due to the long-term prevalence of water-borne illnesses in the region, North America is seen as being at the forefront of the wastewater treatment sector. Every day, the U.S. purifies more than 34 billion gallons of contaminated water to make it safe for locals to drink. One of the main requirements in the nation is the removal of phosphorus and nitrogen from water sources, along with the oxidation of wastewater. This has ultimately resulted in a significant use of hydrogen peroxide throughout the nation's industries.

Hydrogen peroxide usage in the area is rising as a result of the expanding demand for various personal care products in the European market. Its oxidising and antibacterial qualities are the main reasons for the product's rising demand in this application. In nations including the United Kingdom, France, Italy, Germany, and Spain, cosmetics and personal care items like skincare creams and lotions have seen tremendous growth. This is primarily attributable to the increased market penetration of cosmetic manufacturers in these nations.

U.S.

The U.S. hydrogen peroxide market has experienced substantial growth. This growth is driven by increasing demand in various industries such as pulp and paper, textiles, and chemicals. Hydrogen peroxide's applications in environmental sectors, such as wastewater treatment and pollution control, further contribute to market expansion. The trends in recent times indicate a shift toward a more extensive application of hydrogen peroxide across various industries, driven by regulatory factors and consumer preferences focused on safety and sustainability. Furthermore, the food processing industry is increasingly incorporating hydrogen peroxide for food preservation and safety, highlighting its versatility.

In January 2024, the U.S. Food and Drug Administration announced that it regards vaporized hydrogen peroxide VHP to be an accepted practice of sterilization for medical devices, considering VHP’s extensive history of safety and effectiveness. The FDA has revised the final guidance, Submission and Review of Sterility Information in Premarket Notification (510(k)) Submissions for Devices Labeled as Sterile, to list VHP as an exemplar of an Established Category A method of sterilization.

Europe

In March 2025, Nouryon, a worldwide leader in specialty chemicals, introduced Eka® HP Puroxide™, a novel low-carbon hydrogen peroxide product. As the foremost Nordic company to provide this solution, Nouryon offered mining, pulp and paper, and water treatment companies a sustainable option to lower Scope 3 greenhouse gas emissions.

Evonik is one of the global forerunners in specialty chemicals. The industry is operational in more than 100 nations around the globe and created sales of € 15.3 billion and an operating profit of € 1.66 billion in 2023. Evonik is way beyond chemistry to formulate inventive, profitable, and sustainable solutions for consumers. Evonik is now providing carbon-neutral hydrogen peroxide to consumers in Europe.

Hydrogen peroxide is one of the essential ingredients used in the creation of such disinfectants and sanitizing products. A typical disinfectant, for instance, typically contains 3% to 4% hydrogen peroxide, 0.5% to 1% peroxyacetic acid, a small amount of isopropyl alcohol, chlorine dioxide, and other ingredients. The material is also expected to continue to be in high demand throughout the industry for a considerable amount of time due to its great abilities to give resistance against viruses, bacteria, and a variety of other microbes, according to the Center for Biocide Chemistries.

Growing healthcare industry demand for the product as a result of its antiseptic qualities is anticipated to continue to be a major driver of market expansion. The substance is widely sought-after in the healthcare industry as an antiseptic, which is usually used to skin wounds and bruises to prevent infections. Due to its capacity to reduce mouth irritation, mucus, and other oral infections, it is also frequently used as a mouth rinse. The material primarily releases oxygen, which causes foaming on the bruised and cut skin and ultimately results in the efficient elimination of dead skin while protecting the area from infection.

Furthermore, because hydrogen peroxide is widely used in the creation of disinfection goods in light of the current COVID-19 epidemic, its demand has increased dramatically globally. Disinfecting both public and private areas is crucial, say a number of international government directives, to lessen the effects of the coronavirus spread. Commercial buildings, bus stops, airports, and train stations must be sterilised for more than 60 minutes inside restricted perimeters. Similar household cleaning guidelines have also been published by a number of countries, which has resulted in a notable increase in the market for sanitizer and disinfection solutions.

Major Applications of Hydrogen Peroxide:

| Uses | Application |

| Food/Aseptic Packaging | It is used to sterilize the internal aseptic areas of the manufacturing equipment with the surface of the packaging material that sustains contact with food. |

| Gardening | The all-purpose liquid can help with pest control, prevent infection on damaged trees, kill foliage fungus, combat root rot, as well as improve plant growth. |

| Remove Stains | The all-purpose liquid can be used for pest control, treatment of insect attacks on trees, treating foliage fungus, combating root rot, and encouraging plant growth. |

| Disinfectant | It is used in the practices of waste-water treatment to neutralize organic content. |

| Textile Industry | Hydrogen peroxide is a bleaching agent in natural and synthetic fiber treatments inclusive of wool, linen, cotton, silk, and rayon fiber. |

| Electronics Industry | The manufacturing process of semiconductors customs high-quality electronic-grade hydrogen peroxide as an oxidizing and cleaning agent. |

| Soil remediation | Technological processes also use Hydrogen Peroxide to decrease their negative environmental impact. Soil remediation, when polluted with hydro-carbons, is generally done using H2O2. |

Increasing need for disinfectants, increased demand from the healthcare sector, a rise in the number of paper & pulp producers, and an increase in the number of food processing facilities are some of the key drivers anticipated to propel the global hydrogen peroxide market. In addition to this, it is employed in the personal care, chemical synthesis, cosmetics, and wastewater treatment sectors.

| Report Coverage | Details |

| Market Size by 2034 | USD 11.54 Billion |

| Market Size in 2025 | USD 7.07 Billion |

| Market Size in 2024 | USD 6.69 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.6% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Function, Grade, Application, Sales Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Green hydrogen peroxide (Hâ‚‚Oâ‚‚) are chemical compound that is produced with no emission of carbon dioxide. This chemical is referred to as the green chemical that dissolves in water and oxygen and upon usage it decomposes into both water and oxygen. Carbon-neutral hydrogen peroxide is a more sustainable method for hydrogen peroxide manufacture which will lower the carbon footprint. The primary and most effective active component in hydrogen peroxide solution is natural in its occurrence and is biodegradable because it is easily blended with water and forms oxygen gas which makes it an environmentally friendly item.

With a share of 40.2% in terms of volume in 2023, the bleaching segment dominated the market. The substance has a wide range of uses as a bleaching agent in several sectors, including pulp & paper, medicine, and textiles. The product is extremely helpful in the medical field as a dental bleach, hair bleach, mouthwash, and for maintaining oral hygiene. The textile sector uses a bigger amount of the material as bleach, where it is frequently used to brighten clothing and remove stains from both synthetic and natural fabrics. It is employed in the production of fabrics as well since it helps improve the mechanical qualities of fibres.

Over the projection period, the disinfection segment is anticipated to see the fastest volume growth. This is explained by the product's great indulgence in manufacturing several cleaning agents and hygiene goods. The global viral epidemic increased demand for this function starting in the first quarter of 2020, which greatly increased production of several disinfection items such, glass cleaners for indoor and outdoor use, and hand sanitizers. These factors contributed to a rise in the use of hydrogen peroxide as a disinfectant around the world, and the trend is expected to continue for the foreseeable future.

With a volume share of 34.8% in 2024, the pulp and paper application category led the market. Similar to bleach, the substance is acknowledged as a chlorine-free element, making it a crucial component of the pulp and paper industry across the world. It is utilised properly to enhance the mechanical and chemical qualities of pulp and raise the quality and brightness of paper. As it lowers manufacturing costs, offers better quality, is simple to use, and is environmentally benign, it has created a rising demand in the business.

Over the projected period, the fastest CAGR in terms of volume growth is anticipated for the healthcare application category. This is attributable to the product's extensive demand as a result of the quick production of disinfection and sanitization solutions by several multinational corporations throughout the world. Due to rising public awareness of the significance of these healthcare necessities in daily life in the wake of the global pandemic, the demand for these items will see considerable rise globally over an extended period of time.

The worldwide market is divided into various hydrogen oxide concentrations based on grade and is offered in accordance with their uses. In general, personal care, home care, and speciality applications employ less than 35% of lower concentrations. Applications involving paper, textiles, chemicals, and wastewater treatment typically use higher concentrations of more than 35%. Rocket propellants employ pure grades or concentrations greater than 90–95 percent. The main element promoting the growth of this market is the high use of goods with more than 35% concentration to produce optimal outcomes.

By Function

By Grade

By Application

By Sales Channel

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

February 2025

February 2025

August 2024