July 2024

Polyurethane Market (By Product: Rigid Foam, Flexible Foam, Coatings, Adhesives & Sealants, Elastomers, Others; By Raw Material: Polyol, MDI, TDI, Others; By Application: Furniture & Interiors, Construction, Electronics & Appliances, Automotive, Footwear, Packaging, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2023-2032

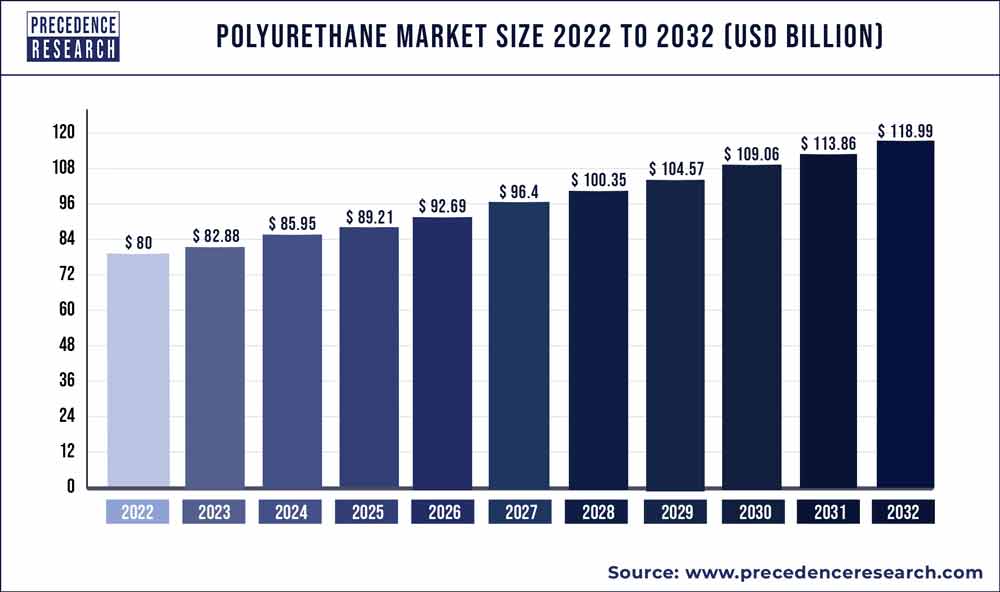

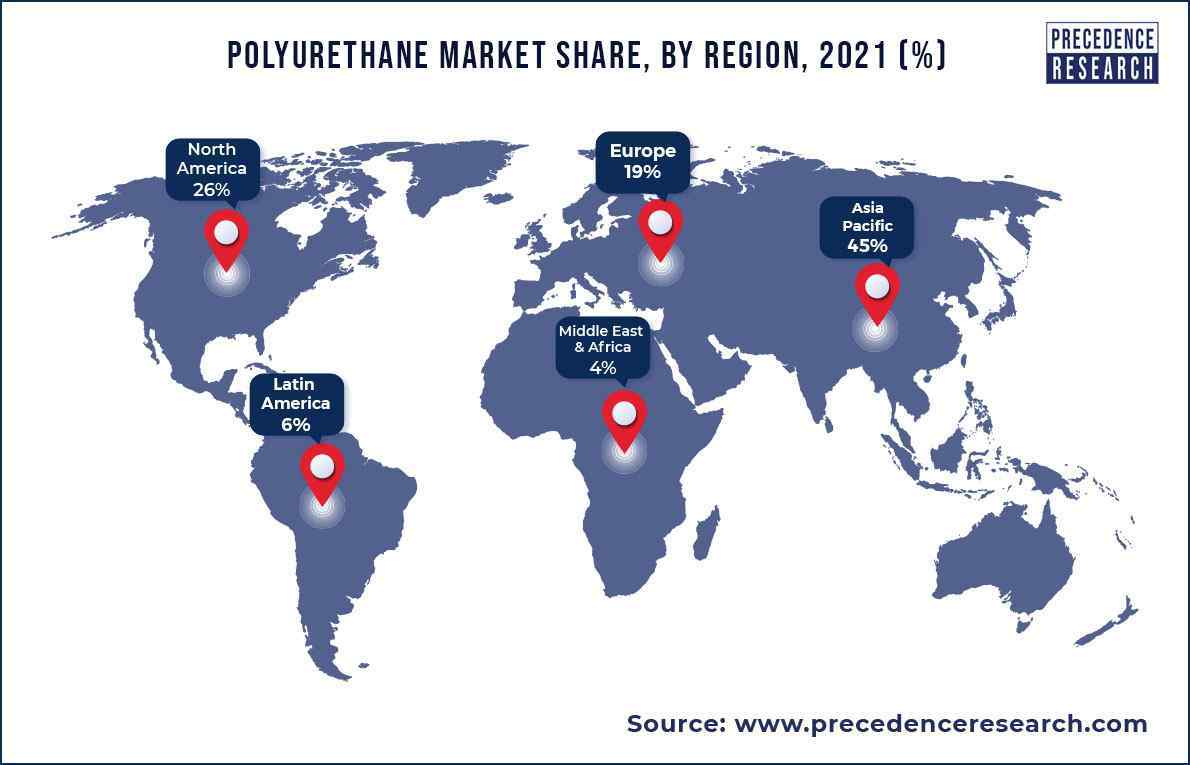

The global polyurethane market size was estimated at USD 80 billion in 2022 and is projected to surpass around USD 118.99 billion by 2032 and will be growing at a CAGR of 4.10% during the forecast period 2023 to 2032. Asia Pacific polyurethane market was accounted at USD 27.9 billion in 2022.

Key Takeaways:

Growth Factors

The polyurethane chemistry is such that, it allows to be fashioned into unusual shapes without compromising the quality with the same time it enhances industrial and consumer commodities by adding value of comfort and convenience. Polyurethanes are created by perfectly balanced chemical reaction. Polyols with the diisocyanate or polymeric isocyanate are the ingredients that are used in these reactions with proper amounts of additives and catalysts. To meet the specific requirements in various industries, variety of industry solutions are manufactured based on vast range of polyols. Polyurethane products are being used in vast range of consumer goods for day-to-day life use. For instance, polyurethane is used in, rigid foam for casing in walls and roofs, flexible foam in upholstered furniture, TPU in medical devices and footwear. It is also used on floors and automotive interiors, in coatings, sealants, adhesives. Polyurethane has high requirements in construction industry at large scale.

This growing need is for majorly in building insulation. Considering the all global pandemic situation now construction industry is at sustainable growth and it is prudently established that Polyurethane market is further expected to rise in projection period. Sustainability considering the building construction is vast field and it embodies many steps that must be incorporated in primary construction processes since it their potential environmental brunt is very considerable. Due to these reasons green buildings are certainly making their way stronger in the construction industry. Awareness about climate changes and government initiatives are encouraging to increase investments in smart energy-efficient commercial as well as residential buildings. These buildings provide financial opportunities as well as they are also in accordance with federal and environmental regulatory requirements, providing a significant solution to ever growing consumer sustainability demands. Increased building material effectiveness has resulted in a greater requirement for proficient insulating material to control Ventilation, Heating and Air Conditioning and offset the amount of energy wasted owing to inadequate insulation. Polyurethane foam is then used as exceptionally efficient insulation materials, resulting in significant energy savings.

Additionally, Polyurethane products and solutions requirements in the United States is major factor that pushing the market forward. These growing product demands are from the several industries such as automotive, packaging sectors and construction as well. This will drive market for polyurethane further. The construction sector was worst hit by the pandemic in last two years in the U.S. But the conditions at normalcy again and the construction sector is at boom. It is rapidly developing as a result of advanced commercial real estate market fundamentals and enlarged state and federal financing for institutional infrastructure and public infrastructure. Moreover, currently undertaken working construction projects, like the construction of the LaGuardia Airport, San Francisco Civic Centers campus, Second Avenue Subway Construction Project and O’Hare Airport Construction Project are likely to drive the product demand in construction applications in foreseeable future. Furthermore, in addition to these major projects, government of United States announced investments of USD 2 trillion in March 2020. These investments are allocated for roads, government offices, hospital buildings and other infrastructure. This is further expected to propel market growth for Polyurethane in the country.

Report Scope of the Polyurethane Market

| Report Coverage | Details |

| Market Size by 2032 | USD 118.99 Billion |

| Growth Rate from 2023 to 2032 |

CAGR of 4.10% |

| Asia Pacific Market Share in 2022 | 46% |

| Rigid Foam Product Segment Market Share in 2022 | 33% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Product, Raw Material, Application, Geography |

| Companies Mentioned | Dow Inc., BASF SE, Covestro AG, Huntsman International LLC, Eastman Chemical Company, Mitsui & Co. Plastics Ltd, Mitsubishi Chemical Corporation, Recticel NV/SA, Woodbridge, DIC Corporation, RTP Company |

Product Insights

Rigid foam product segment accounted largest market share in 2022. Rigid Polyurethane foams are basically closed-cell plastics with high-performance. They are utilized in end-use industries at large, such as industrial insulations & appliances, packaging and transportation. These foams have characteristic, as they are structurally stable, which makes it easier for manufacturers to devise thermally insulating products. Also, rigid foams hold sound insulation qualities, thermal resistance and they possess mechanically higher strength. These structure based qualities of material makes them highly suitable in extreme weather and harsh environments.

Flexible foam segment is expected to grow at steady pace over the forecast period. In 2022, North American market was dominated by this segment with huge market share of 32%. Flexible polyurethane foam is primarily used as cushioning for a many of consumer and commercial products, such as automotive interiors, bedding, furniture and carpet underlay.

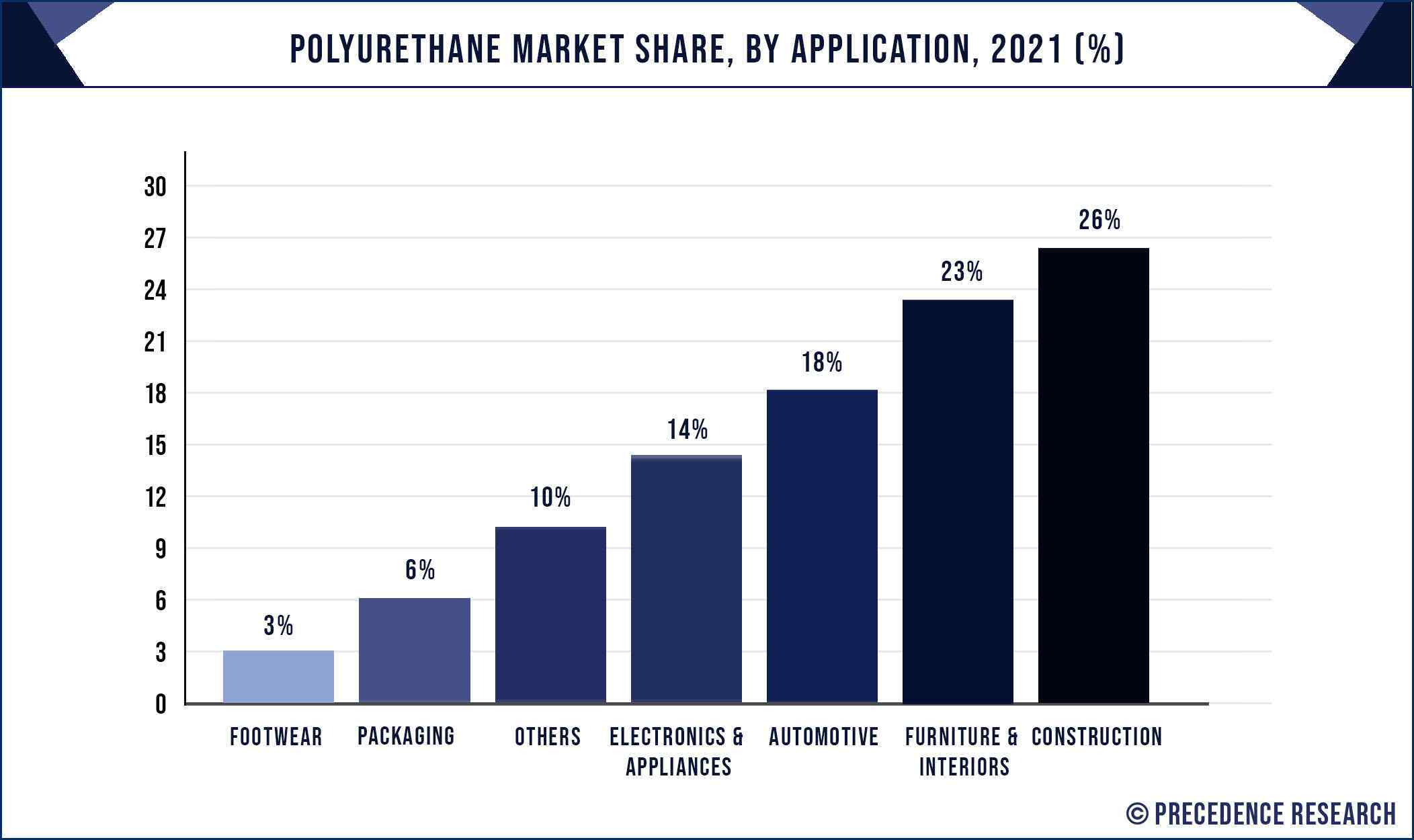

Application Insights

In 2022, the construction segment accounted largest market share of total global market. The heavy need for polyurethane in the construction sector is anticipated to cast significant growth over the projection period. Polyurethane possesses various chemical characteristics including bacterial & pest resistance, greater thermal insulation, chemical inertness and lightness. Rapid urbanization with government initiatives and industrialization throughout the globe are probable to fuel the further growth of the global construction industry. While in emerging economies, such as India and China are more focused on grater investments in these sectors. These governments are providing major budget allocations to improve their infrastructure. These development activities on large scale are expected to increase the product demand.

Automotive industry is anticipated to grow at remarkable CAGR trough the projection time frame. Polyurethane has a vast range of sustainable applications in the automotive industry. Using the Polyurethane has its own benefits such as, safety, comfort, lightness together with the design freedom. Polyurethane foam products help automobile designers and manufacturers to design the vehicle seating at their choice. By using polyurethane seating can be easily assembled, disassembled, and recycled. Polyurethane has the enhanced performance specifications with a vast range of firmness without quality compromise and added weight.

Regional Insights

Asia Pacific was the major leading regional market for polyurethane in year 2022. Largely the Asia pacific market is propelled by the significant growth of the large end-use industries, Such as construction, automotive, furniture & interior, electronics & appliances and packaging.

Another reason for market’s expansion is low cost skilled labour is at disposal of the industry. As mentioned before India and China are pouring their resources to build and develop infrastructure to put world’s top auto manufacturers in their country. For example, Tesla is in negotiations with Government of India to put manufacturing plant in the country. These activities in the market are certainly to provide productive growth opportunities to polyurethane manufacturers.

Key Market Players

Segments Covered in the Report

(Note*: We offer report based on sub segments as well. Kindly, let us know if you are interested)

By Product

By Raw Material

By Application

By Geography

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

April 2023

May 2024

May 2024