February 2024

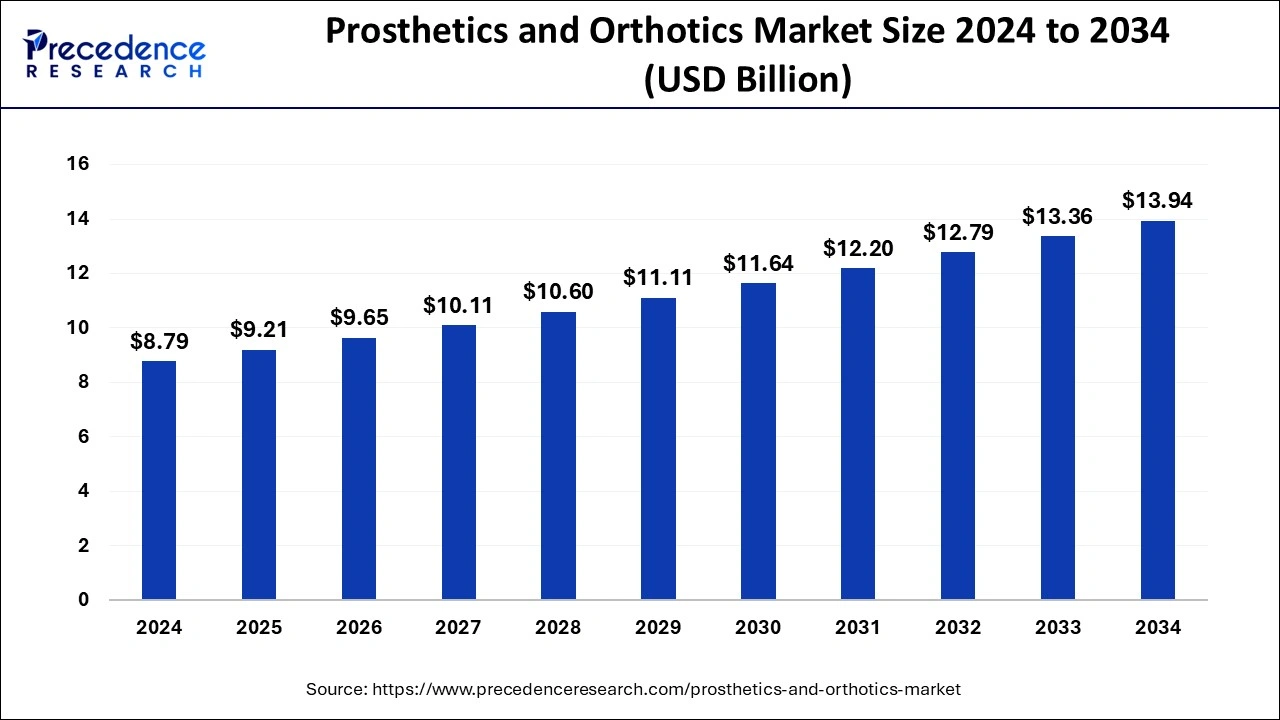

The global prosthetics and orthotics market size was USD 8.38 billion in 2023, estimated at USD 8.79 billion in 2024 and is anticipated to reach around USD 13.94 billion by 2034, expanding at a CAGR of 4.72% from 2024 to 2034.

The global prosthetics and orthotics market size accounted for USD 8.79 billion in 2024 and is predicted to reach around USD 13.94 billion by 2034, growing at a CAGR of 4.72% from 2024 to 2034.

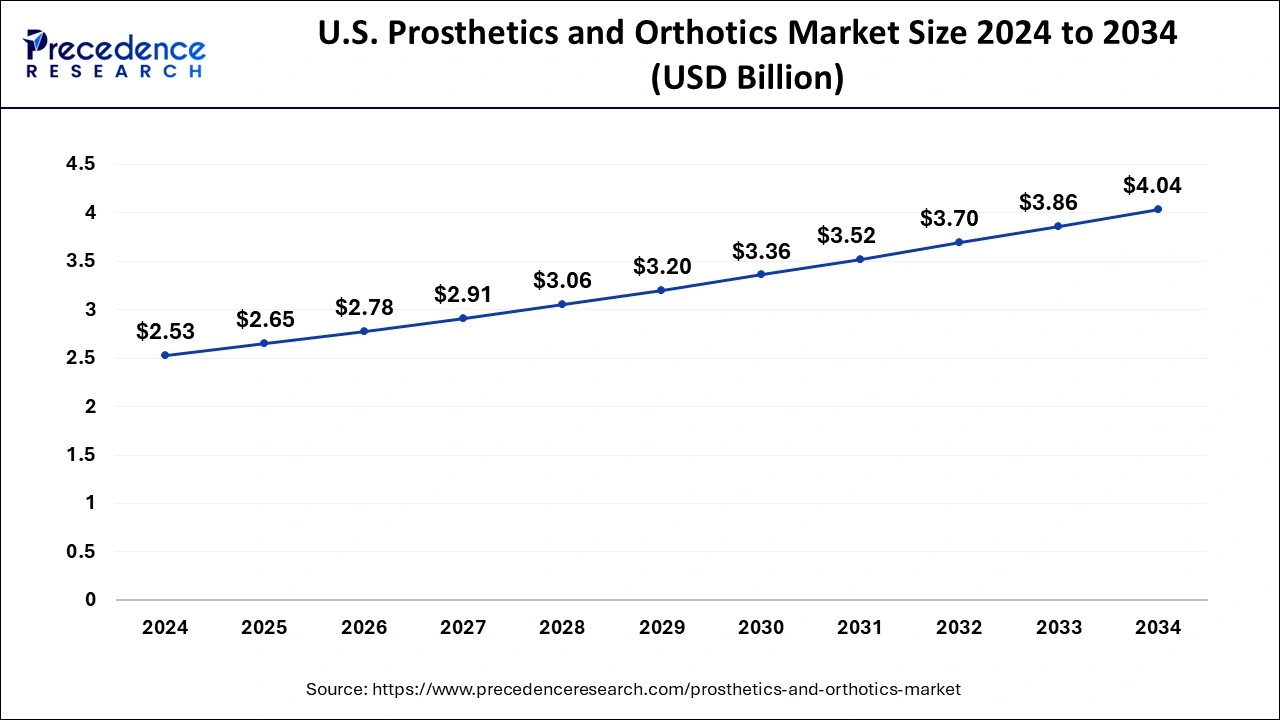

The U.S. prosthetics and orthotics market size was valued at USD 2.41billion in 2023 and is estimated to reach around USD 4.04 billion by 2034, growing at a CAGR of 5% from 2024 to 2034.

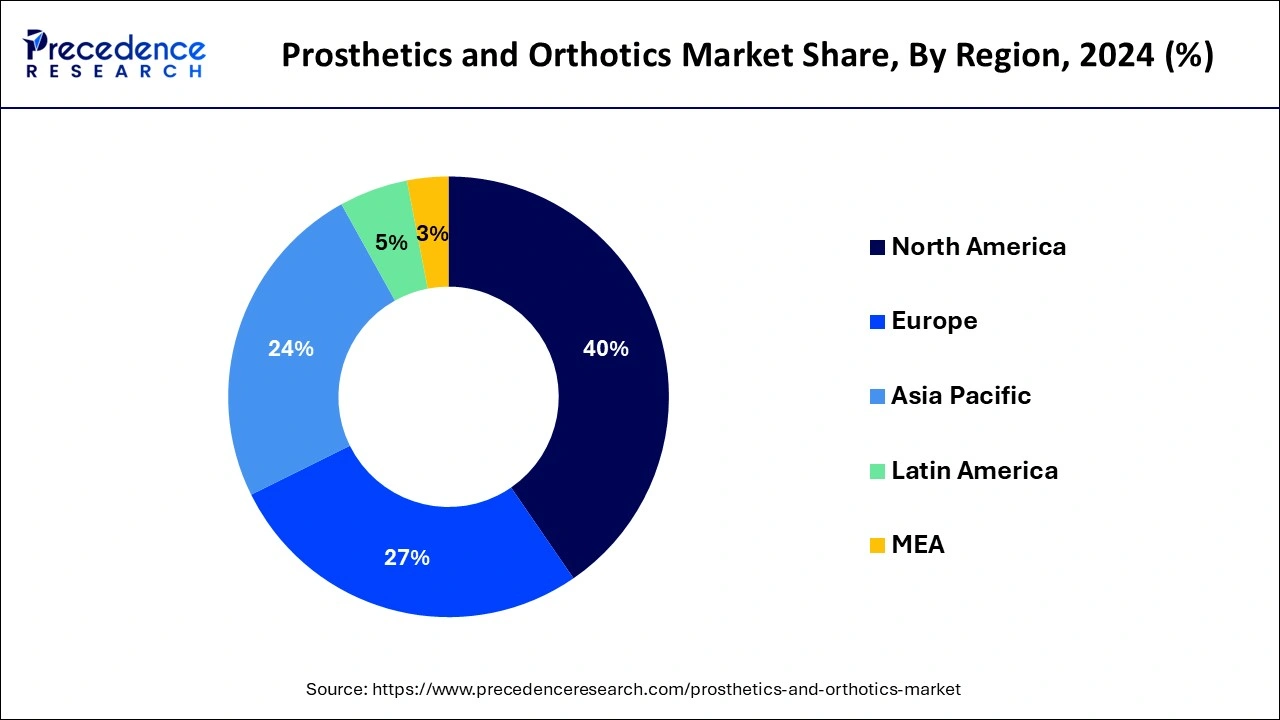

The global prosthetics and orthotics market is categorized into four key regions, comprising North America, Europe, Asia-Pacific, and the Rest of the World (RoW). North America accounted market share of around 38% in 2022. The demand within the market for prosthetics and orthotics in the North America region has been intensifying at an unprecedented rate, majorly owing to the presence of established providers of prosthetics in the U.S. Furthermore, a growing amount of sports damages are consolidation the growth of the market in the North American region. Also, the proficiency and skill of medical experts and doctors in the region have encouraged people from other regions to go there for prosthetic treatments. However, it is expected that the prosthetics and orthotics market in Europe and APAC will pick up pace during years to come.

The availability of well-established healthcare infrastructure, increased R&D investments by firms, and attractive reimbursement regulations in the region all contribute to this rise. Furthermore, the market is predicted to rise due to the rising frequency of osteosarcoma and the increasing rates of sports injuries.

Asia Pacific is anticipated to hold a substantial share in the market owing to the ample pervasiveness of osteoporosis in the region. A surge in the incidence of road accidents, rising cases of diabetes-related amputations and supportive government activities are driving the regional market. The region is driven by an escalation in the number of road accidents, a growing number of diabetes-associated amputations, and supportive government initiatives. According to the report by the Asian Diabetes Prevention Initiative, 60% of the diabetic population presently lives in Asia, and by 2030, it is expected that both India and China will have about half a million people with diabetes. The above-mentioned factors are anticipated to boost the regional market over the projection timeframe.

The prosthetics and orthotics sector is at the uttermost age of artificial limbs along with brain- monitored prosthetics accessible. The demand within the worldwide prosthetics and orthotics market has been increasing on account of large-scale investments made towards the event of effective and versatile artificial limbs and aids. The frightening rise in the frequency of road accidents is also a leading factor in pouring limb amputation procedures around the globe. Moreover, the curiosity of sports and a variety of strenuous accomplishments have also augmented the risk of wounds and fractures that may leaden during disabilities. This has successively generated remarkable demand within the worldwide prosthetics and orthotics market while giving lucrative opportunities to market stakeholders and vendors. The amount of annual road accidents has also been on an upswing over the past decade, and this has also led to an active rate of growth for the worldwide prosthetics and orthotics market.

On the other hand, the low-income status of a large population, particularly in the developing economies, has taken a large chunk of consumer base away from the market. In addition, the demand within the global prosthetics and orthotics market is also hampered by the increasing cases of duplication in this industry.

In addition, the present apprehension for proliferation of coronavirus is predicted to have a negative influence on the prosthetics and orthotics market for a short time. The most common apprehension for the governments of all COVID-19 hit countries is the piercing need to screen for and test huge numbers of patients for possible COVID-19 infection. Major factors projected to exert an impact on the healthcare sector include supply chain disruptions across the globe, reduced healthcare spending, and delay in approval and launch of new medical equipment.

The use of prosthetic limbs to restore normal movement to people who have lost limbs is known as prosthesis. Orthotics, on the other hand, is the study and creation of orthoses with the goal of providing precision and accuracy to artificial parts. The combination of two professions has the potential to provide significant patient rehabilitation.

The usage of orthopedic prosthetic devices is becoming more common as the frequency of amputations rises. This has increased demand for globalorthopedic prostheses, propelling market expansion. The orthopedic prosthetics industry is growing due to technological developments and advancements in the development of prosthetic devices. Lower limb amputation procedures are being driven by an increase in the prevalence of sports injuries, road accidents, and disability rates. As a result, the market is expanding.

With the development of contemporary and new care models that focus on aiding clients in identifying their treatment objectives and assessing how successfully those goals have been achieved, the prosthetics and orthotics market position will continue to change in the future. Despite knowing the anticipated outcomes, practitioners must employ high-level communication skills to foster discussions, aiding clients in setting their own treatment goals and informing decisions about prosthetics and orthotics therapies.

The growing prevalence of osteosarcoma in children and young adults is further propelling the market. The patients recovering from this surgery often require orthopedic devices and protheses as a part of their post-operative care, which is expected to drive the prosthetics and orthotics market in the coming years.

| Report Coverage | Details |

| Market Size in 2023 | USD 8.38 Billion |

| Market Size in 2024 | USD 8.79 Billion |

| Market Size by 2034 | USD 13.94 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.72% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Technology, End Users, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rise in demand for orthotic devices

The ageing population, which is more prone to osteoarthritis, osteoporosis, and body ailments, increased bone injury prevalence, and increased sport-related injuries are all driving the demand for orthotic devices. As people seek alternatives to surgical deformity repair and pain management, the use of orthotic devices will be used all around the world. Furthermore, the advancements in the prosthetics and orthotics market are making orthotic devices more affordable and accessible. Thus, the rise in demand for orthotic devices is boosting the growth of prosthetics and orthotics market during the forecast period.

Lack of consumer awareness

The people of underdeveloped and developing regions are quite unaware about the orthopedic prosthetic devices. These devices are used to reduce the pain of body. The people with orthopedic disorder can use the devices of orthopedic prosthetic. As a result, the lack of consumer awareness is restricting factor for the growth of prosthetics and orthotics market during the forecast period.

Rising geriatric population

One of the main causes boosting demand for prosthetics and orthotics is the growing senior population around the world. According to the United Nations, the global population of people aged 60 and more is predicted to grow to 2.1 billion to 2050. People over 60 are more prone to illnesses like osteoporosis and osteopenia, which increases the demand for orthopedic solutions. Thus, the rising geriatric population is creating growth opportunities for the prosthetics and orthotics market during the forecast period.

Higher cost of orthotic devices

One of the significant challenges impeding the growth of the prosthetics and orthotics market is the increased cost of customized orthotic devices. Despite the fact that the customized orthotic devices offer numerous advantages over pre-fabricated devices are extensively used due to their low cost and accessibility. Pre-fabricated devices on the market nowadays are highly advanced and come in variety of ranges and sizes to treat variety of diseases and ailments. As a result, the high cost of orthotic devices is biggest challenge for the growth of prosthetics and orthotics market during the forecast period.

Depending on the type, the global prosthetics and orthotics market is categorized into orthotics type and prosthetics type. The orthotics segment accounted largest revenue share of around 75% in 2023, due to an increase in the prevalence of sports injuries, osteoarthritis, and the penetration of orthopedic technologies.

Prosthetics type is sub-divided into modular components, liners, lower extremity, and upper extremity. Among these, the orthotics segment is predicted dominate the market with major. These are recommended for numerous reasons like avoiding, fixing, or accommodating foot deformities, aligning and supporting the ankle or foot. The expanding number of spine injuries and cumulative occurrences of osteoarthritis is further boosting the sales of orthotics. Furthermore, these solutions can be extremely potential at minimizing pain and addressing other postural or physical problems.

The prosthetics segment is anticipated to witness substantial growth during the projection period. Foremost companies manufacturing this product are Zimmer Biomet Holdings Inc., Ossur, and Blatchford Inc. An upsurge in disability rates across the world is projected to propel the segment growth in the coming years. For example, according to the report published by the Rehabilitation Research and Training Center on Disability Statistics and Demographics, in 2018, the percentage of people with disabilities in the United States increased from around 11.9% in 2010 to 12.9% in 2017, thereby leading to increasing demand for prosthetics in the country.

At present plentiful makers are striving hard to surpass its opponent by providing better-quality devices. In the prosthetics and orthotics market, the major foremost players are adopting numerous key strategies such as mergers & acquisitions, partnerships, agreements, collaborations, and new product development to gain a competitive advantage in the global market. Substantial companies competing in the prosthetics and orthotics marketplace are as follows:

Segments Covered in the Report

This research report estimates revenue growth at global, regional, and country levels and offers an analysis of present industry trends in every sub-segment from 2016 to 2027. This research study analyzes market thoroughly by classifying global prosthetics and orthotics market report on the basis of different parameters including type and region:

By Type

By Technology

By End Users

By Regional Outlook

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2024

April 2023

August 2024

June 2024