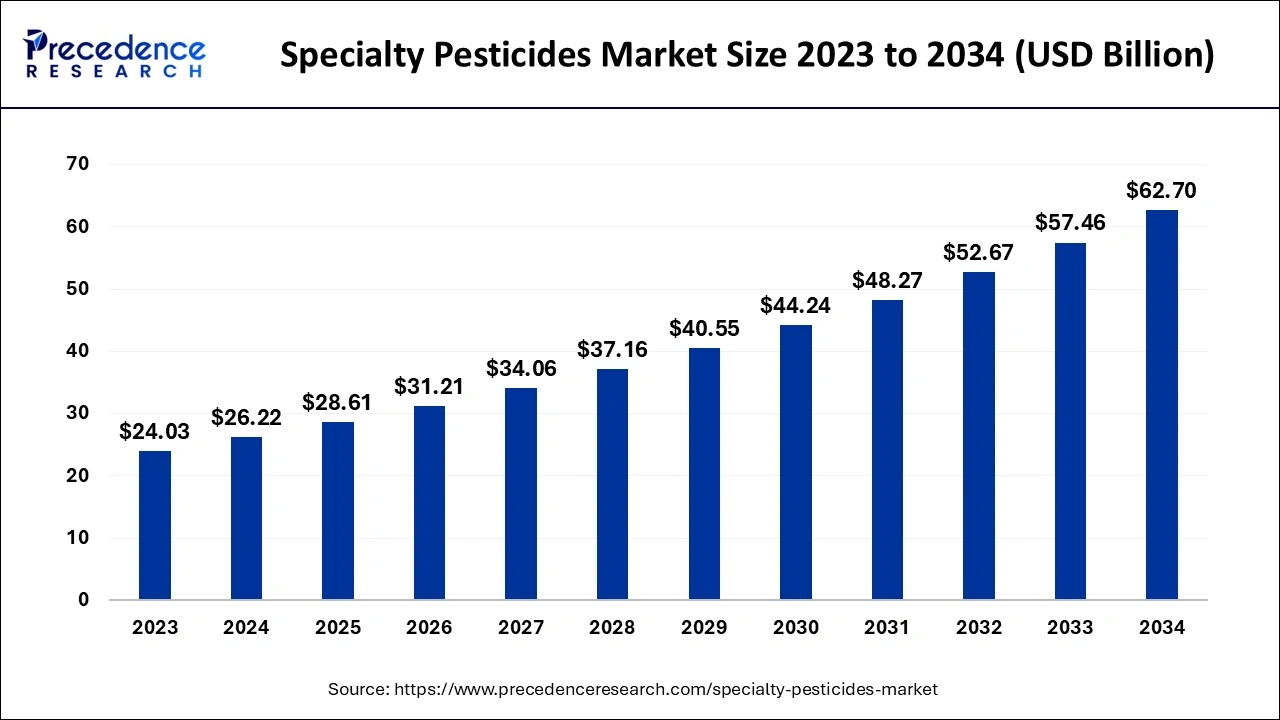

What is the Specialty Pesticides Market Size?

The global specialty pesticides market size is calculated at USD 28.61 billion in 2025 and is predicted to increase from USD 31.21 billion in 2026 to approximately USD 67.64 billion by 2035, expanding at a CAGR of 8.99% from 2026 to 2035.

Speciality Pesticides Market Key Takeaways

- Asia Pacific dominated the global specialty pesticides market in 2025.

- North America is anticipated to register the fastest growth in the market during the forecast period of 2026 to 2035.

- By product, the herbicides segment dominated the global market in 2025.

- By product, the insecticides segment is expected to grow at the fastest rate in the market during the forecast period of 2026 to 2035.

- By formulation, the liquid segment led the global market in 2025.

- By formulation, the powder segment is expected to grow rapidly in the market during the forecast period of 2026 to 2035.

- By application, the crop protection segment registered its dominance over the market in 2024.

- By application, the non-crop protection segment is expected to witness the fastest growth in the market during the forecast period.

Market Overview

Pesticides are chemical substances used to kill, repel, and control plants and animals that are pests. Specialty pesticides focus on a specific category, including products applicable beyond traditional agricultural practices like public health settings that could control fungal diseases, especially in urban areas. They also play a crucial role in managing pets like rodents, weeds, insects, and fungi, where agricultural applications cannot be used. The specialty pesticides market is witnessing significant growth due to the rising demand for specialty pests in public health settings. The increasing prevalence of diseases caused by insects is leading to a greater adoption of pests in these settings.

What is the Role of AI in the Specialty Pesticides Market?

The emergence of technologies like artificial intelligence and ML has been playing a crucial role in improving the specialty pesticides market's reach in the agricultural industry. Specialty pesticide-producing companies are adopting technologies like sensors that would track and identify pest movement patterns in real time. This helps reduce the time required for production and allows for the focus on innovations. The application of drones and robots in the specialty pesticide market is increasing as they help enhance the overall process without any human intervention. Additionally, the increasing demand for sustainable pesticides has been contributing to the demand for specialty pesticides.

A Switzerland-based company named Syngenta AG partnered with Insilico Medicine to apply deep-learning AI tools that help in producing sustainable weedkillers.

- In September 2024, the government of India announced an investment of 6,000 crore Indian rupees in smart farming. The investment aims to adopt the use of AI, drones, and data analytics that might help 60,000 farmers over five years.

Specialty Pesticides Market Growth Factors

- Technological advancements, such as the adoption of smart pest management systems, are one of the major factors driving the growth of the specialty pesticides market.

- The rising need for speciality pests in turf management like parks, golf courses etc, stands out as a major market growth factor.

- The rising demand for pest-free environments plays a crucial role in market growth.

- The rising collaborations and partnerships between speciality pest providers are increasing the demand for speciality pests which stands out as a market growth factor.

- The rising shift towards sustainable agriculture is driving the adoption of eco-friendly agricultural practices that boost market growth.

Market Outlook

- Industry Growth Overview: The specialty pesticides market is experiencing robust growth, driven by rising demand for crop protection, the wider adoption of high-efficiency formulations, and expanding horticulture and organic farming practices. Moreover, tighter regulations on traditional chemical pesticides are likely to contribute to market growth.

- Global Expansion: The market is growing worldwide, driven by agricultural modernization, a focus on high-value crops, and demand for environmentally sustainable pest control solutions. The adoption of precision agriculture, advances in biotechnology, and the wider availability of customized crop-specific pesticide formulations are further accelerating market penetration across developed and developing economies.

- Major Investors: Major investors in the market include venture capital firms, agricultural technology funds, and multinational agrochemical corporations focusing on sustainable crop protection. Investments target biopesticides, precision farming solutions, and innovative pest-management technologies, with strong participation from institutions supporting climate-resilient agriculture, improved farm productivity, and eco-friendly pest-control product portfolios.

- Startup Ecosystem: The market's startup ecosystem is expanding, with new companies developing biopesticides, microbial solutions, pheromone-based pest control, and nanoformulations. Startups are attracting funding through agritech accelerators, sustainability-focused investors, and collaborations with research institutions to deliver eco-friendly, high-efficiency pest management technologies tailored for organic and high-value crop farming.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 67.64 Billion |

| Market Size in 2025 | USD 28.61 Billion |

| Market Size in 2026 | USD 31.21 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.99% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Formulation, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rapid urbanization

Rapid urbanization has led to many pest-related concerns in the cities due to the widespread of mosquitoes, which might lead to diseases like dengue, malaria, and others. These factors have led to the deployment of the specialty pesticides market services beyond non-agricultural practices. Additionally, urbanization has led to many congested living or commercial spaces, which has led to the need for these solutions. Urban agricultural practices are also adopting heavy usage of specialty pesticides.

High demand for pesticide-resistant crops

The food demand has increased rapidly due to the rising population, especially in the urban areas. This has resulted in many initiatives from organizations and governments that are focusing on developing more reliable production of crops that would protect public health.

Restraint

Complex approval processes

Several concerns related to the use of chemical pesticides have led to complex approval rates in the specialty pesticides market. The regulatory bodies have started to focus deeply while approving pests that could harm public health, which delays the introduction of new products in the market.

Opportunities

Rising preference for sustainable solutions

Changing consumer preferences towards the adoption of sustainable farming practices has increased the demand for the specialty pesticides market. Adoption of this sustainable solution is also expected to lead to the growth of innovative products that help in tackling consumer demand. Many governments are promoting sustainable farming practices that help maintain public health as well as the environment.

Increasing educational programs

Many governments are focusing on farmer training, especially in the rural areas of the developing countries which might help the farmers to learn new technologies in the agricultural industry. Many educational institutes are also introducing agricultural courses and programs that help increase awareness regarding agricultural practices.

Segment Insights

Product Insights

The herbicides segment dominated the global specialty pesticides market in 2025. Herbicides are chemical substances used to eliminate weeds in crop fields and forests. The dominance of the segment is attributed to the increasing number of sports fields, parks, and golf courses in urban settings, which has led to the rising need for herbicides to maintain the field. Urbanization has been a major contributor to the rising need for turf management. These pests have gained significant popularity, which has led to mass production that also helps reduce production costs. Many companies are investing heavily in the development of more efficient herbicides that might help in tackling weed-related issues.

- In September 2024, a research student from GB Pant University India developed a biofiber herbicide capsule that aims to restore land fertility in a shorter period.

The insecticides segment is expected to grow at the fastest rate in the specialty pesticides market during the forecast period of 2026 to 2035. Insecticides refer to the chemicals used to control or kill insects that are a threat to human health or the environment. The growth of the segment is attributed to the rising prevalence of diseases like malaria, dengue, Zika, and other viruses caused by insect bites. Multiple factors like ecosystem disruption are major causes that lead to the spread of these insects. This has increased the focus on adopting solutions for controlling these insects that cause harm to humans. Health organizations and governments are investing heavily in adopting solutions.

- In September 2024, Pyrone Systems Inc. completed EPA submission of its plant-based insecticide, Pyronz™, marking a milestone in eco-friendly pest control.

Formulation Insights

The liquid segment led the global specialty pesticides market in 2025. Liquid-based specialty pesticides are formed by dissolving the ingredient into oil or water, which can be used as a sprayer in particular areas. The dominance of the region is attributed to the wider use of these sprayers in crop protection, which is easy to apply in the fields. These liquid pesticides are also gaining popularity in turf management due to their effectiveness, which helps with easy absorption in the designated area. Farmers use liquid pests in multiple agricultural practices, which makes them applicable to the whole agricultural sector. Rising technologies are focusing on adopting automated robots and drone-based spraying systems, which could help increase their effectiveness and save time.

The powder segment is expected to grow rapidly in the specialty pesticides market during the forecast period of 2026 to 2035. Powder pesticides, also referred to as dust pesticides, can be directly applicable to plants or surfaces. Powdered-based pesticides are gaining notable popularity due to their effectiveness, especially in turf management. These pests are considered to be more effective against diseases, which has led to increasing demand in urban areas.

Application Insights

The crop protection segment registered its dominance over the specialty pesticides market in 2025. The segment refers to the use of specialty pesticide products like herbicides, insecticides, and others that are used to protect crops from various threats like weeds and insects. The dominance of the segment is attributed to the massive agricultural practices all over the world. The agricultural industry has been a major contributor to the specialty pesticides market. Many governments are focusing on implementing policies that help farmers to adopt new technologies in their agricultural practices. They are focusing on adopting pest control management to avoid potential threats to the human population and the environment.

The non-crop protection segment is expected to witness the fastest growth in the specialty pesticides market during the forecast period. Non-crop protection refers to the use of pesticides apart from traditional agriculture. The specialty pesticides market is growing efficiently due to the rising demand for pests in public areas, homes, and other commercial areas that require pests to avoid potential health threats to the people or the property. Governments and private companies are focusing on investing in these services that would help them maintain a clean environment. Additionally, the adoption of non-crop pesticides is expected to drive due to the growth in the tourism sector.

Regional Insights

What Factors Support Asia Pacific's Dominance in the Market?

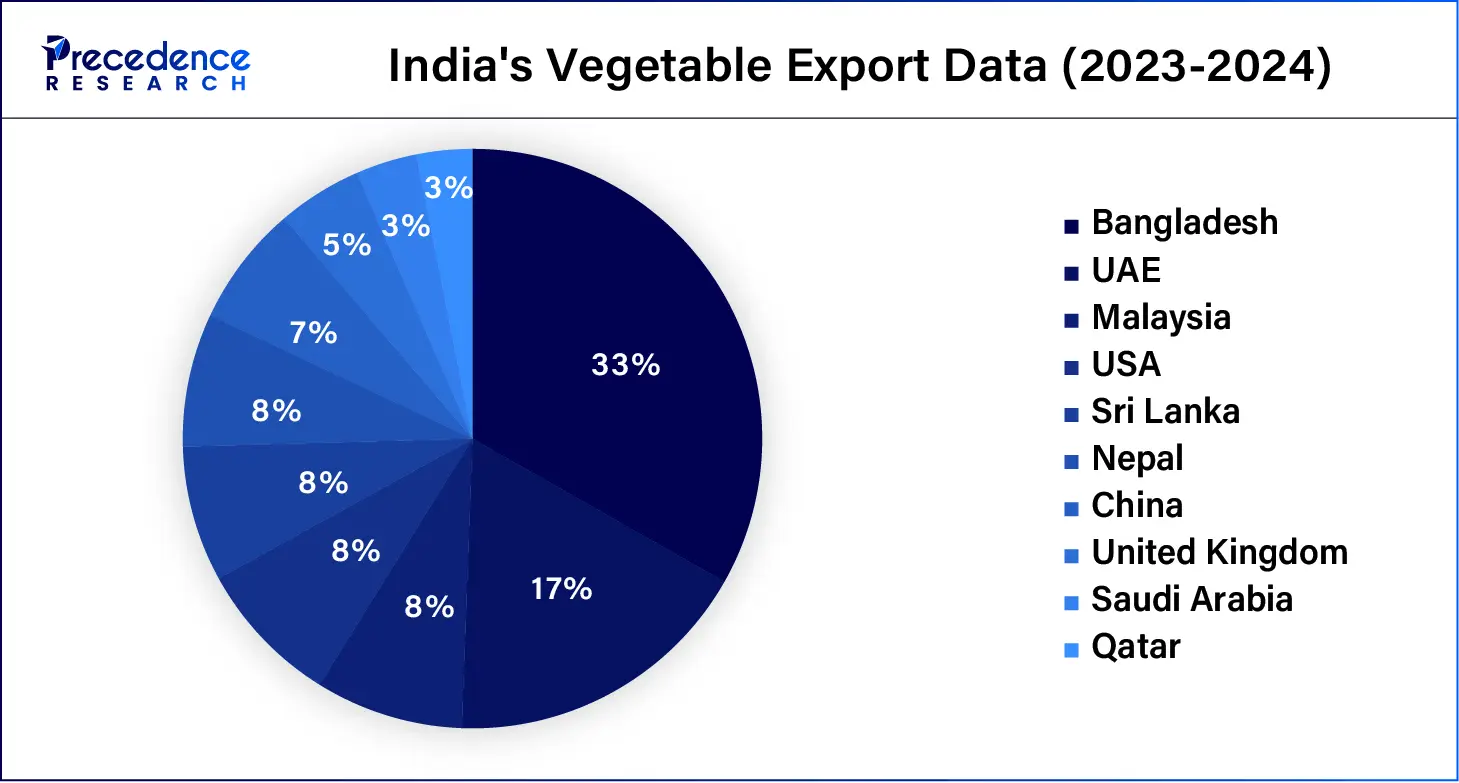

Asia Pacific dominated the global specialty pesticides market in 2025. The dominance of the region is attributed to the massive agricultural practices in countries like India, China, and Japan. The region stands out with two of the most populated countries, India and China, which are witnessing rapid food demand that leads to more agricultural production. These factors have attracted investments from governments that focus on the adoption of technologies that help increase the use of pesticides to avoid human and environmental threats.

- In September 2024, India's agricultural solution provider Coromandel International Limited inaugurated a Hi-Tech Polyhouse at its Telangana R&D facility, advancing precision agriculture research and new product development.

- In May 2024, the Pakistan-China Joint Lab for Artificial Intelligence and Smart Agriculture was inaugurated at the University of Agriculture Faisalabad to boost farming productivity through advanced technology.

What Makes North America the Fastest-Growing Region in the Market?

North America is anticipated to register the fastest growth in the specialty pesticides market during the forecast period of 2026 to 2035. The growth of the region is attributed to the rising advanced technology in countries like the United States and Canada, which are focusing on improving their agricultural sector. The specialty pesticides market is witnessing significant demand due to the adoption of non-crop pests in multiple settings in the region.

The U.S. uses pesticides to control pests in food production, with the EPA ensuring their safe use under the Food Quality Protection Act (FQPA), focusing on children's safety. It has adopted smart pest control technologies to protect public health from mosquitoes.

How Big is the Success of Europe in the Market?

Europe is growing at a notable rate in the specialty pesticides market due to stringent environmental regulations that encourage the adoption of sustainable alternatives to chemical or synthetic pesticides. Rising adoption of biopesticides and strong support for organic and precision farming are also driving the market. Germany is a major player in the market. The market in the country is growing due to rising demand for safer, crop-specific formulations, continuous investment in agricultural R&D, and collaboration between agrochemical companies and research organizations.

How Crucial is the Role of Latin America in the Specialty Pesticides Market?

Latin America is expected to grow at a lucrative rate in the market due to the rapid expansion of commercial agriculture, strong demand for high-value export crops, and increasing pest resistance that requires advanced crop protection solutions. Rising adoption of biopesticides, government support for sustainable farming practices, and greater focus on productivity improvement in soybean, sugarcane, and fruit cultivation further strengthen regional market growth. Brazil leads the market in the region due to the rising focus on food safety and quality.

How Big is the Opportunity for the Market in the Middle East & Africa?

The Middle East & Africa offer significant opportunities for the specialty pesticides market due to rising demand for improved crop productivity, the increasing adoption of modern irrigation and farming systems, and the rising cultivation of fruits, vegetables, and high-value export crops. The opportunity is significant as governments promote sustainable agriculture, farmers shift toward eco-friendly pest control, and agritech companies introduce advanced formulations to address climate-driven pest pressure and soil challenges across the region.

The UAE leads the market in the Middle East and Africa due to a strong focus on advanced agriculture, widespread use of protected farming and hydroponics, and high demand for crop-specific, eco-friendly pest control solutions. Government support for food security initiatives, collaborations with global agrochemical firms, and quick adoption of precision farming technologies further strengthen the UAE's position as a regional leader.

Value Chain Analysis

- Feedstock Procurement

Feedstock Procurement: Raw materials, including active biological and chemical ingredients, are sourced from certified agricultural, chemical, and biotechnology suppliers to ensure purity and consistency.

Key Players: BASF SE, Croda International, Cargill. - Chemical Synthesis and Processing

Chemical Synthesis and Processing: Active compounds are formulated into crop-specific pesticide products through controlled synthesis, blending, and microencapsulation to achieve targeted pest protection and environmental safety.

Key Players: Bayer AG, Syngenta, FMC Corporation. - Regulatory Compliance and Safety Monitoring

Regulatory Compliance and Safety Monitoring: Finished products undergo multi-stage safety assessments, toxicology evaluations, environmental impact validation, and compliance with regional agricultural standards before commercialization.

Key Players: European Food Safety Authority (EFSA), U.S. Environmental Protection Agency (EPA), Food and Agriculture Organization (FAO).

Top Companies in the Specialty Pesticides Market & Their Offerings

- Syngenta Crop Protection AG:Offers a broad portfolio of specialty insecticides, herbicides, and fungicides, including innovative bio-based and precision-formulation products aimed at sustainable crop protection and resistance management.

- Bayer CropScience:Supplies advanced crop-protection solutions including herbicides, fungicides, insecticides, seed treatments and hybrid seeds, along with integrated pest- and crop-management tools for high-value and cereal crops.

- BASF SE:Delivers a comprehensive set of specialty pesticides — fungicides, insecticides, herbicides, and seed-treatments — and invests heavily in green chemistry and bio-based formulations.

- Corteva Agriscience:Offers modern specialty pesticide solutions, combining herbicides, insecticides, and fungicides with seed genetics and agronomic support, targeting both commodity and high-value crops.

- FMC Corporation:Produces niche specialty pesticide formulations and agrochemicals, including insecticides and herbicides tailored for varied climatic zones and crops requiring targeted pest control.

- Nufarm Limited:Focuses on off-patent and generic specialty pesticides — supplying herbicides, insecticides, and fungicides to a wide range of crops globally, often with cost-effective and locally adapted solutions.

- Sumitomo Chemical Company:Provides a variety of specialty pesticide products, including insecticides, herbicides, and seed treatments, often leveraging chemical innovation to address pest-resistance and evolving agronomic challenges.

Recent Developments

- In June 2024, Best Agrolife announced the launch of its patented insecticide 'Nemagen,' targeting lepidopteran pests with a market goal of 500 crore Indian rupees.

- In June 2024, MOA Technology announced a collaboration with Nufarm to develop an innovative herbicide solution to tackle weed-related issues.

- In June 2024, FMC, an agricultural sciences company, obtained registration in India for Isoflex active and Ambriva herbicide, offering effective control against Phalaris minor in wheat cultivation.

Segments Covered in the Report

By Product

- Herbicides

- Insecticides

- Fungicides

- Others

By Formulation

- Liquid

- Granular

- Powder

By Application

- Crop Protection

- Non-Crop Protection

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting