What is the Transportation Services Market Size?

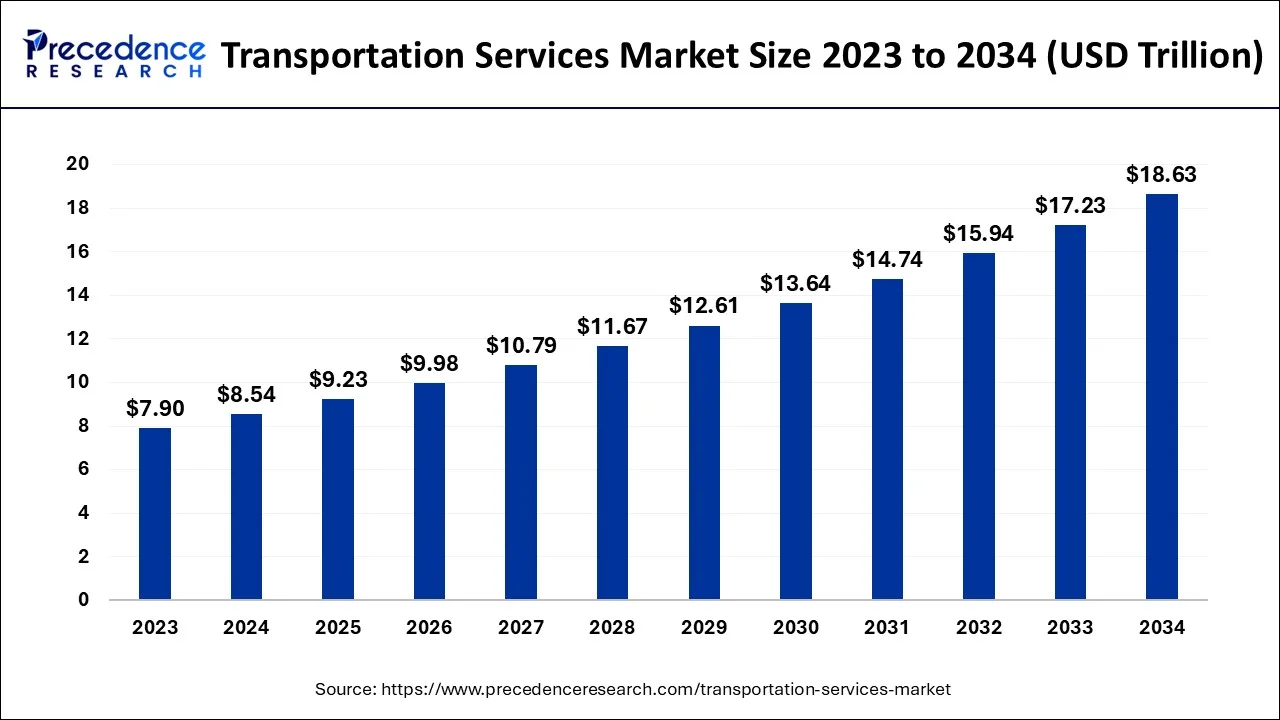

The global transportation services market size is exhibited at USD 9.23 trillion in 2025 and is predicted to increase from USD 9.98 trillion in 2026 to approximately USD 19.96 trillion by 2035, growing at a CAGR of 8.02% from 2026 to 2035.

Strategic Overview of the Global Transportation Services Industry

The market for transportation services includes companies (organizations, sole proprietors, and partnerships) that move people and products from one place to another in exchange for a fee or payment. The transportation services industry includes businesses that offer services to transfer people, commodities, and materials via pipelines, rails, and roads.

To minimize expenses and reduce carbon emissions, businesses are actively pursuing electric bus power. Solar buses are powered by electric batteries, occasionally recharged by solar panels mounted on the bus's top. This extends the life of lithium batteries and enhances the vehicle's fuel efficiency. Additionally, the system features parts that require less maintenance, saving businesses money. BYD Company, Kiira Motors, Heilongjiang QiqiarLonghua New Energy Automobile Co., Ltd., Yutong, Bauer's Intelligent Transportation, and Volvo buses are some of the major manufacturers of electric buses.

The expansion of the transportation services market is supported by the steady economic growth anticipated in many developing and developed nations. According to forecasts from the International Monetary Fund (IMF), global GDP growth will be 3.3% in 2020 and 3.4% in 2021. It is also likely that recovering commodity prices, which experienced a considerable decrease in the recent past, will support market expansion. Additionally, consistent growth is likely in developed economies over the predicted period. Additionally, emerging markets will likely grow faster during the projected period than developed markets. Investments in end-user markets will likely rise due to stable economic expansion, propelling the market throughout the forecast period.

In the United States, the market for transportation services will likely reach US$1.7 trillion by 2020. The second-largest economy in the world, China, is anticipated to grow at a 6.2% CAGR from 2020 to 2027 to achieve a projected market value of US$1.6 trillion. Canada and Japan are two geographic markets that are more notable, with growth rates of 1% and 2.6%, respectively, predicted for the years 2020–2027. Germany will likely grow in Europe at a CAGR of roughly 1.7%. By 2027, the market in Asia-Pacific will likely reach US$1.1 trillion, led by nations like India, Australia, and South Korea.

The United States, Canada, Japan, China, and Europe will propel the segment's predicted 3.2% CAGR in the worldwide truck transportation market. By the end of the analysis period, these regional markets will account for a market size of US$1.1 trillion in 2020 and will likely grow to US$1.3 trillion. China will continue to have one of these regional marketplaces with the strongest growth rates. Latin America will grow at a 4% CAGR for the analysis.

Artificial Intelligence: The Next Growth Catalyst in Transportation Services

AI is fundamentally reshaping the transportation services industry by optimizing efficiency, enhancing safety, and enabling new autonomous solutions. Through AI-driven logistics platforms, companies can achieve real-time route optimization and load balancing, significantly reducing fuel consumption, empty miles, and overall operational costs. Predictive analytics, powered by machine learning, enables predictive maintenance of fleets, minimizing costly downtime and improving asset utilization.

Furthermore, AI is crucial in the development and deployment of autonomous vehicles, from self-driving trucks in long-haul logistics to autonomous taxis in urban mobility, promising radical shifts in labor models and service delivery.

Market Outlook

- Market Growth Overview: The transportation services market is expected to grow significantly between 2025 and 2034, driven by a boom in e-commerce, adoption of AI, IoT sensors, telematics, and cloud-based transportation management systems, and infrastructure investment.

- Sustainability Trends: Sustainability trends involve alternative fuels and low-carbon logistics, regulatory compliance and green initiatives, and autonomous and integrated mobility.

- Major Investors: Major investors in the market include DHL Group, FedEx & USP, Amazon Logistics, Daimler Truck AG & Volvo Group, and NVIDIA Corp.

- Startup Economy: The startup economy is focused on disrupting traditional logistics with technology-first solutions in autonomy, sustainability, and digitalization.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 9.23 Trillion |

| Market Size in 2026 | USD 9.98 Trillion |

| Market Size by 2035 | USD 19.96 Trillion |

| Growth Rate from 2026 to 2035 | CAGR of 8.02% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Purpose, By Destination, and By Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Market Driver

Rising penetration towards enhancing the capacity of transportation modes and infrastructure is one of the major factors contributing to the growth of the industry. Moreover, increasing improvement in using advanced and better technology is also propelling market growth. Transportation companies are offering various services to the open market that further beholds the enhance the market development. Surging demand for transportation from various industries such as institution and economy is also helping the market to grow.

Market Opportunity

Stable economic growth in various developing and developed countries is expected to create lucrative opportunities in the transportation services sector. Rising investment in end user market along with emerging key players is also expected to boost the industry share. Companies are making continuous efforts to switch towards the electric transportation in order to reduce the carbon emission will expand the market revenue.

Market Restraints

The massive destruction caused due to the outburst of corona virus pandemic is likely to restrain the growth of the market. Restrictions imposed on the free movement of goods and people along with lockdown in various countries to reduce the transmission of deadly virus have declined the market growth. The virus was initially identified in china spread to the various part of the world. However, the market is expected to re-gain its growth during the coming year.

Segment Insights

Type Insights

The market for transportation services includes public buses, electric buses, subways, taxis, auto rickshaws, ferries and other public transport vehicles. People and goods are moved between locations using waterways in "water transport."

Region Insights

Due to an increase in the manufacture and sales of passenger vehicles in China, South Korea, and India, the Asia Pacific region will likely account for a sizable portion of the global market for public transportation services.

Strong economies are present in Asia, including China, India, Japan, and South Korea. The demand for cargo transportation, material handling, and public transportation is growing due to the expansion of the e-commerce sector and the presence of a well-established supply chain network serving various industries, including shipbuilding, automotive, consumer goods manufacturing, and heavy machinery manufacturing. As a result, the area's market for public transportation services is anticipated to grow.

However, the market will experience a decline in 2020 as a result of supply chain disruptions affecting several industries as a result of manufacturing and production facility closures and a scarcity of raw materials brought on by the global coronavirus pandemic. The coronavirus outbreak has affected the market for public transportation services. In 2021, it was projected that the market would improve due to higher component and vehicle production volumes. In turn, this will likely present substantial potential for market participants in the public transportation service supply chain during the projected period.

U.S. Transportation Services Market Trends

The U.S. market, the boom in e-commerce has fundamentally altered the market, driving significant demand for fast, reliable last-mile delivery and creating pressure on warehousing and fulfillment operations. Rapidly adopting technologies to enhance efficiency and safety, the sustainability and electrification push for sustainability is increasing, driven by both consumer demand and regulations.

China Transportation Services Market Trends

China's market is experiencing robust growth driven by massive e-commerce growth and extensive, government-led infrastructure modernization. The industry is rapidly adopting AI and automation in areas like dynamic routing and automated sorting, with cloud platforms capturing a significant market share. Strong emphasis is placed on electrification and low-carbon logistics, supported by a dense network of charging stations.

How did Europe gain a notable share in the Transportation Services Market?

Europe's extensive intermodal infrastructure facilitates seamless cross-border logistics across the Schengen area. The dominance of road freight for flexible delivery and the rapid growth of the e-commerce sector. Stringent EU sustainability regulations accelerate the adoption of green transport solutions, while technological integration of AI and IoT enhances efficiency.

Germany Transportation Services Market Trends

Germany's market is primarily reliant on road freight and driven by Industry 4.0 digitalization initiatives, leveraging AI and IoT to boost efficiency. The market is also heavily influenced by stringent EU sustainability regulations, which accelerate the push toward electrification and green logistics solutions.

Value Chain Analysis of the Transportation Services Market

- Infrastructure Management and Operations:

This foundational stage involves the management and maintenance of essential transport infrastructure, including roads, railways, ports, airports, and logistics hubs.

Key Players: DP World, China COSCO Shipping Corporation - Vehicle Manufacturing and Technology Provision:

This stage focuses on producing the physical assets (trucks, trains, ships, aircraft, delivery drones) and the underlying technology (AI software, IoT sensors, telematics, EV components) that power modern transportation services.

Key Players: Daimler Truck AG, Volvo Group, Tesla, and NVIDIA - Logistics Planning and Service Integration:

This stage involves the planning, optimization, and integration of various transport modes to create end-to-end logistics solutions for clients.

Key Players: Third-Party Logistics (3PL) providers and freight forwarders like DHL Group, DSV, Kuehne + Nagel, Samsara, and Oracle - Transportation Operations and Delivery:

This core stage is where the physical movement of goods and people actually occurs, involving fleet management, last-mile delivery, and passenger transport services.

Key Players: Amazon Logistics and Waymo - Aftermarket Services and Maintenance:

The final stage involves the ongoing maintenance, repair, and support services necessary to keep transportation assets operational and safe.

Key Players: JOST World

Key Companies and Competitive Intelligence

The strength of the global economy, which influences commodity trade, manufacturing output, consumer and corporate spending, and leisure and business travel activity, has a significant impact on the transportation services industry. Since many expenditures are fixed, effective operations and favorable fuel and labor prices affect a company's profitability. Large businesses benefit from economies of scale in buying and have the capacity to offer a wider range of services. By providing services to local or regional markets, small businesses can compete.

Due to the presence of leading producers, the market for public transportation services worldwide is extremely consolidated. Several significant participants in the market for public transportation services include:

- Chicago Transit Authority (CTA): As the operator of the second-largest public transportation system in the U.S., the CTA contributes by providing essential bus and rail services for the Chicago metropolitan area, facilitating daily mobility for millions of residents and commuters.

- Bay Area Rapid Transit (BART): BART operates the rapid transit system serving the San Francisco Bay Area, contributing by connecting major cities and reducing road congestion through efficient, electrified rail transportation services.

- Cosmatis: This company develops software solutions for public transport, focusing on optimizing network planning, scheduling, and resource management to enhance the efficiency of transportation service providers.

- Consat: Consat specializes in public transport IT solutions, providing systems for real-time passenger information, fleet management, and vehicle tracking that improve the overall rider experience and operational control.

- Digigroup: Digigroup offers integrated IT systems for the transportation sector, contributing expertise in areas like data management, fare collection systems, and operational software that streamlines public transit operations.

- Cubic Transportation Systems: Cubic is a major provider of integrated travel payment and information solutions, contributing through innovative fare collection systems (like the OMNY system in NYC) and real-time passenger information displays that enable seamless travel.

- GMV: GMV contributes to the market through its intelligent transportation systems (ITS), offering solutions for fleet management, control centers, and data analytics that help optimize public and private transportation services.

- GIRO: GIRO specializes in planning, scheduling, and operations management software for public transit and postal services, contributing optimization tools that help transportation entities manage complex logistics efficiently.

- GrupoEtra: GrupoEtra provides technological solutions for smart cities and transport, focusing on advanced traffic management systems, public transport information, and energy efficiency solutions for sustainable urban mobility.

- Goal Systems: Goal Systems offers optimization software solutions for the transportation industry, using AI and algorithms to maximize efficiency in scheduling crews and vehicles for railway, bus, and airline operators.

- Indra: Indra is a global technology and consulting company that contributes with comprehensive transport solutions, including advanced traffic control, intelligent mobility systems, and ticketing services for smarter infrastructure management.

- Guangzhou Metro: As a major rapid transit system operator, Guangzhou Metro contributes to the urban transportation services in China by providing high-volume, high-efficiency rail transport for millions of passengers daily.

- IVU Traffic Technologies: IVU provides IT systems for planning, operating, and optimizing logistics and passenger transport services globally, helping transit authorities manage schedules, vehicles, and personnel effectively.

- INIT: INIT is a leading supplier of integrated planning, dispatching, telematics, and fare collection systems for public transit authorities worldwide, enabling comprehensive management of the entire operational workflow.

- Madrid Metro: Madrid Metro operates one of Europe's largest metro systems, contributing essential urban mobility services and setting standards for efficient and reliable subway operations within a major capital city.

- Link Technologies: Link Technologies offers integrated software and hardware solutions for transportation, focusing on data collection, processing, and management systems that aid in planning and optimizing public transit routes and services.

- Metropolitan Transportation Authority (MTA): The MTA is the largest public transit authority in North America, contributing vital services to the New York City region through its subway, bus, and commuter rail systems.

- Massachusetts Bay Transportation Authority (MBTA): The MBTA provides comprehensive public transportation services (subway, bus, commuter rail, ferry) for the Greater Boston area, connecting communities and supporting regional economic activity.

- MTR Corporation: As the primary operator of Hong Kong's railway network, MTR contributes highly efficient and integrated public transport services and is a global consultant for rail operations and property development models.

- Seoul Metro: Seoul Metro operates the vast subway system in Seoul, South Korea, contributing essential urban mobility services and leveraging advanced technology for operational efficiency and passenger safety.

- Prodata Mobility Systems: Prodata specializes in smart ticketing and automated fare collection systems for the public transport market, helping agencies streamline revenue collection and improve the passenger experience.

- The Washington Metropolitan Area Transit Authority (WMATA): WMATA operates the Metrorail and Metrobus systems in the D.C. metropolitan area, providing critical transportation links for residents, commuters, and visitors.

- The San Diego Metropolitan Transit System (MTS): MTS provides public transportation services (trolley and bus) for the San Diego metropolitan area, focusing on improving regional connectivity and providing sustainable mobility options.

- Transport For London (TfL): TfL manages most of London's public transport network, from the Underground to buses and roads, contributing innovative approaches to urban mobility, fare collection (Oyster card), and smart city integration.

Recent Developments in the Transportation Services Industry

- In December 2024, the PTV Group incorporated AI-driven employee estimations into its Model2Go software, enabling cities to generate faster and more precise transportation simulations to ease congestion and lower emissions. PTV Model2Go is designed and trained as an AI tool that tackles this challenge, offering a faster, more scalable, and accurate estimation of employee data for transport models.

Segments Covered in the Report:

By Purpose

- Commuter Travel

- Tourism and Leisure Travel

- Business Travel

- Cargo and Freight Travel

- Shipping and Delivery Travel

By Destination

- Domestic

- International

By Type

- Public Buses

- Electric Buses

- Subways

- Taxis

- Auto Rickshaws

- Ferries

- Other Public Transport Vehicles

ByGeography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content