January 2025

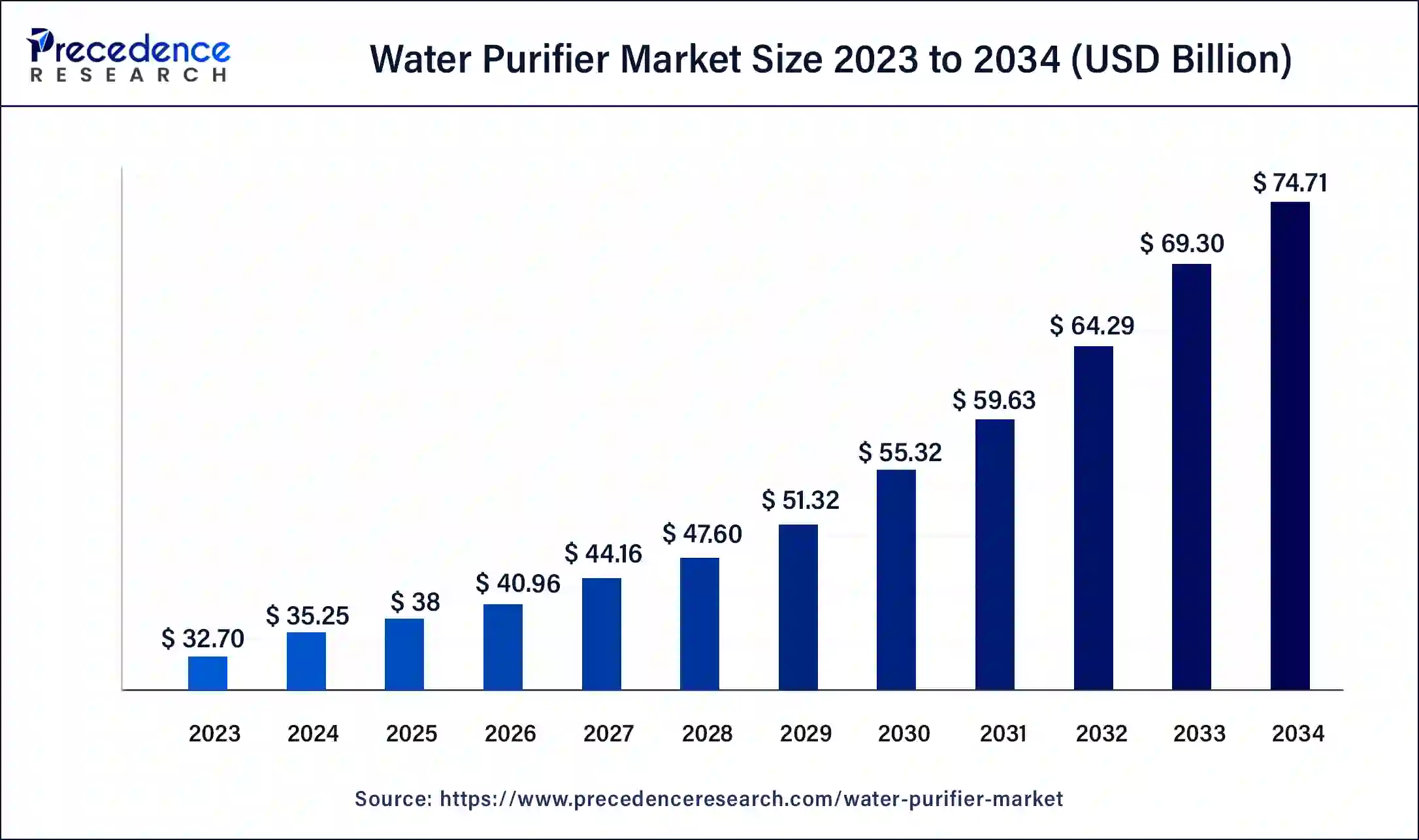

The global water purifier market size was calculated at USD 38 billion in 2025 and is projected to surpass around USD 74.71 billion by 2034, expanding at a CAGR of 7.8% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global water purifier market size was estimated at USD 35.25 billion in 2024 and is predicted to increase from USD 38 billion in 2025 to approximately USD 74.71 billion by 2034, expanding at a CAGR of 7.8% from 2025 to 2034.

The Asia Pacific water purifier market size was estimated at USD 14.10 billion in 2024 and is predicted to be worth around USD 29.88 billion by 2034, at a CAGR of 8% from 2025 to 2034.

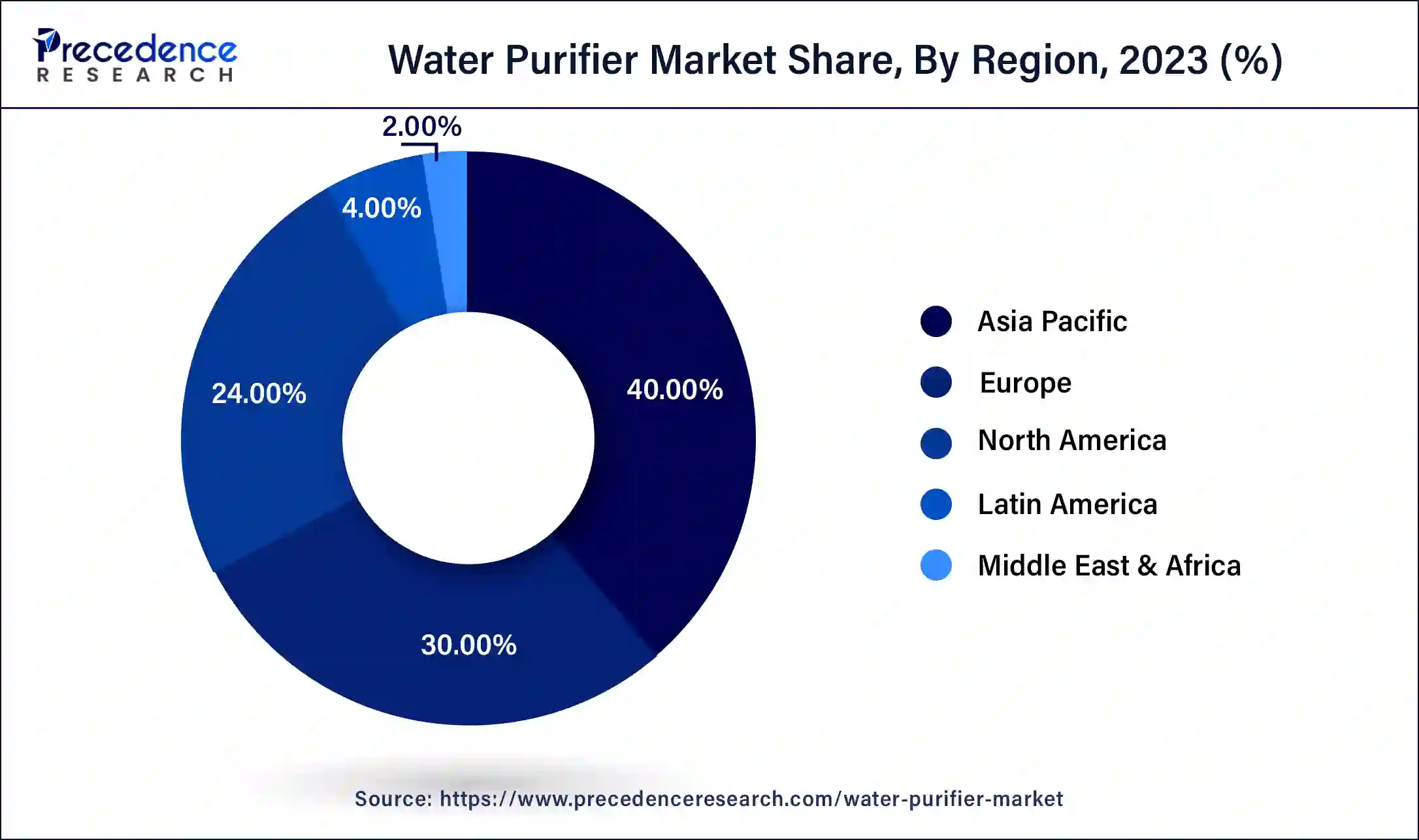

Asia Pacific accounts for the majority of global water purifier sales. The region’s rapid urbanization, heightened awareness about health, and government initiatives that improve access to clean water have all driven sales in the region. Several Asian countries, including India and China, have seen an increase in demand for water purifiers because of concerns over evidently contaminated water supply and their respective focus on safe drinking water. Companies like Eureka Forbes and Kent RO Systems in India are catering to this increasing water purifier market, driven by awareness and government programs aimed at reducing waterborne diseases.

Based on region the report provides market data for North America, Europe, Asia-Pacific, Latin America and the Middle East, and Africa. The market for water purifiers in Asia Pacific, which generated is expected to expand significantly at a compound annual growth rate of more than 8% during the forecast period. In 2024, Asia Pacific accounted for the largest market share in the water purifiers market. With a larger number of market participants and substantial research and development expenditure, product demand would increase in this area. There is a large customer base for companies such as Eureka Forbes, which is helping to develop the sector.

The North American market is growing at the fastest rate, typically due to concerns about the aging infrastructure surrounding the water supply, as well as rising health awareness among consumers. The Flint water emergency, as well as raised awareness of contaminants in water like lead and microplastics, have shown the urgency of addressing the broader concerns about public health and increased the demand for systems that treat or filter drinking water. Major players in the United States, including Brita, Culligan, and Aquasana, are monitoring developments in the filtration market while meeting the consumer demand for reliable and accessible water purifiers.

Water purifiers make drinking water safe by removing harmful viruses, bacteria, and other pollutants. The removal of cryptosporidium and giardia reduces the chances of gastrointestinal disease by more than 30%. It also removes its metabolites and chlorine lowering the risk of bladder cancer and rectal. In addition, drinking water that is pure helps to keep your body's optimum energy level, improves skin health, loses weight and strengthens its overall immune system. After purification, water flavour and taste become more valuable. As a result, using safe and clean water while cooking helps to preserve the flavour of the dish. Water filters used by household remove minerals, which may reduce the overall quality of the water. Purification at the entry point of water extends the life of the piping and significantly reduces maintenance costs.

Water is used extensively in manufacturing and processing industries. Water shortages have a great impact on such businesses. As a result, the need for water purification systems in industries is exacerbated by the demand for recycled water. There is an increasing demand for modern technology-enabled water treatment cleaners to combat water pollution caused by untreated water discharged by processing businesses. The expansion of food and beverage production facilities is expected to drive the water purifier market revenue over the forecast period.

Rising disposable income in emerging markets drives the growth of the water purifier market. As customers' incomes increase, their purchasing power increases and this results in a higher standard of living. In addition, the demand for water filtration systems in developing countries is rising due to improved municipal availability of safe drinking water and an increased number of wastewater recycling plants. Some emerging economies, such as Brazil and China, have seen an increase in disposable income as a result of population skill development and an increase in employment in service-oriented industries. This increased the demand for water purification systems in these industries and aided in the development of the water purifier.

The global population's increased concern for health and well-being has resulted in the adoption of hygiene practices. This is an important factor that contributes significantly to the global market's growth. Furthermore, widespread availability of healthcare services, changes in economic and social systems, and improved diagnostics have improved consumer health across multiple regions. As a result, increased health consciousness and an increase in the incidence of waterborne diseases fuel demand for water purification systems.

| Report Coverage | Details |

| Market Size by 2034 | USD 74.71 Billion |

| Market Size in 2025 | USD 38 Billion |

| Market Size in 2024 | USD 35.25 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7.8% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, End-User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rise in the awareness about purified water

As a result of increased awareness of the impurities in the water supply and increased investment in innovative marketing campaigns by water purifier companies, people are becoming more aware of the benefits of water purifiers. The growing demand for water treatment solutions is being driven by the introduction of digital advertising, increased sales at local shops in emerging regions, and a constant availability of water purification products sold via retailers' services.

The awareness of water purity and its benefits for rural areas is being promoted through various public initiatives in developing countries such as India and China, where a strong government initiative to raise public awareness about waterborne diseases has been launched by means of different public campaigns. For example, with World Bank support, the government of India is delivering clean drinking water to villages all over the country. The water purification market is fueled by workshops and events, such as the Consumer Awareness Programme 'CAP' launched in 2007, aimed at raising consumer awareness on water quality issues. The programme shall also inform consumers on the importance of ensuring that water is delivered in a proper quality by periodically checking internal plumbing systems.

Increase in industrial activity

Water is used extensively in the manufacturing and processing industries. These industries are also the most vulnerable to a water crisis. As a result, the demand for water recycling is driving up the demand for water purification systems in these industries. The demand for advanced technology-enabled water treatment purifiers is rising in response to the problem of water pollution caused by untreated water discharged by processing industries. The expansion of manufacturing units in the food and beverage industry is expected to drive the water purifier market during the forecast period.

Heavy metal contamination in the water supply system has gradually increased over the last decades as industrial activity has increased. Because of their toxic effects on health, the presence of heavy metals in the environment is a serious concern. The majority of these metals, including chromium (Cr), mercury (Hg), manganese (Mn), nickel (Ni), cadmium (Cd), zinc (Zn), copper (Cu), and lead (Pb), are found in farm and industrial wastewater. Before discharging wastewater, the heavy metal content should be reduced.

Numerous advantages of using water filters

Water purifiers purify water to ensure safe drinking water by removing undesirable bacteria, viruses and impurities. Removing Giardia and cryptosporidium is a 33% decrease in the risk of becoming ill with GI disease. In addition, it has been shown to reduce the risk of urinary and rectal cancer by removing chlorine and its metabolites. In addition, drinking clean water is beneficial to your body's digestion, promotes optimum energy levels, helps skin health, prevents weight gain and strengthens the overall immunity system. Water purifiers purify water to ensure safe drinking water by removing undesirable bacteria, viruses and impurities. Removing Giardia and cryptosporidium is a 33% decrease in the risk of becoming ill with GI disease. In addition, it has been shown to reduce the risk of urinary and rectal cancer by removing chlorine and its metabolites. In addition, drinking clean water is beneficial to your body's digestion, promotes optimum energy levels, helps skin health, prevents weight gain and strengthens the overall immunity system.

The global Water Purifier market is divided into three product categories: activated carbon filters, UV water purifiers, and RO water purifiers. In 2023, the RO-based product sector led the water purifier market revenue globally, accounting for more than 38.00% of total revenue. The fact that it had a higher rate of decontamination compared to other products was the reason for this. The removal of dissolved solids, heavy metals and pesticides in addition to the bacteria is carried out by RO purifiers. Consumers are becoming more aware of the risks to their health caused by contaminated drinking water as a result of an increased number of cases of waterborne diseases.

In addition, the increasing penetration of low cost residential water purifiers, such as candle filters, by local manufacturers such as Rama AO in developing countries, as well as the appearance and innovation of innovative water purifiers by companies such as Kent and Smith, are expected to increase demand for residential water purifiers in the coming years.

Commercial and residential end-users are included in the global water purifier market segmentation. In 2023, the most popular application was residential, and this trend is expected to continue throughout the projection period. Residential buildings use far more water than commercial buildings for daily activities such as cooking, cleaning, bathing, and other activities. Furthermore, increased urbanization is expected to drive up demand for water purification products throughout the forecast period. Over 55% of the world's population now lives in cities. According to the United Nations' 2018 Revision of World Urbanization Prospects, that percentage is expected to rise to 68% by 2050.

By Product Type

By End-User

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

May 2025

March 2025