November 2023

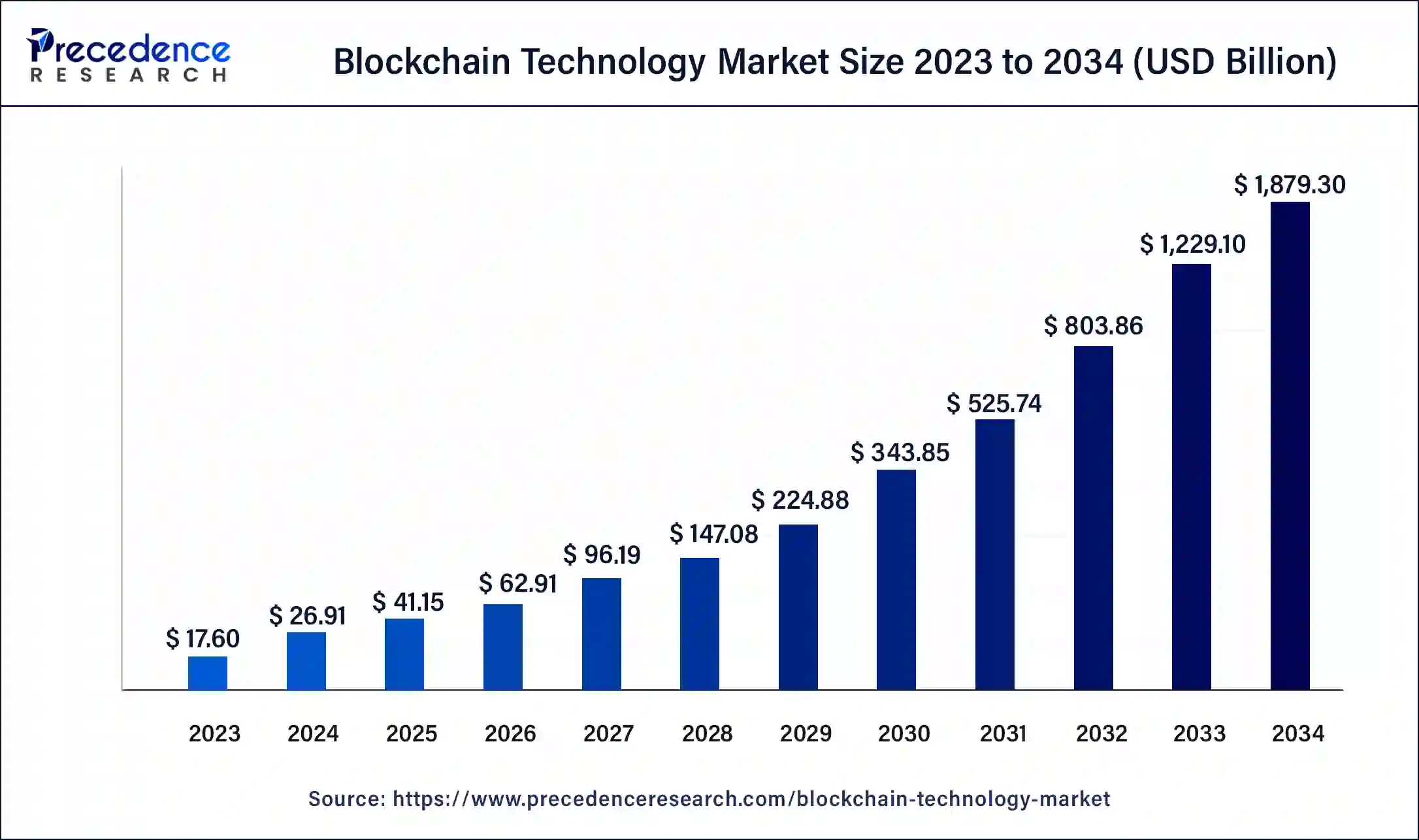

The global blockchain technology market size was USD 17.60 billion in 2023, calculated at USD 26.91 billion in 2024 and is expected to reach around USD 1,879.30 billion by 2034, expanding at a CAGR of 52.9% from 2024 to 2034.

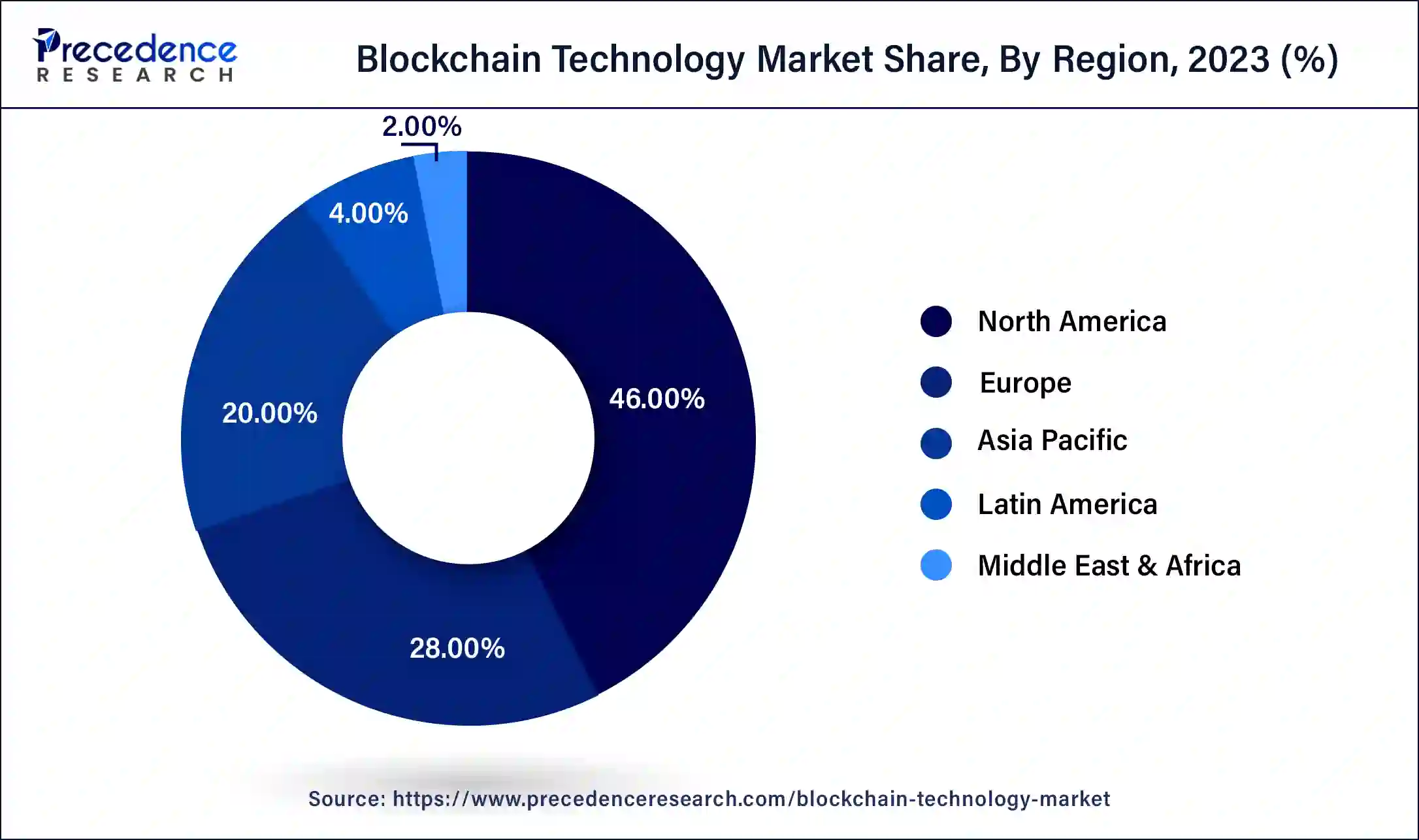

The global blockchain technology market size accounted for USD 26.91 billion in 2024 and is expected to reach around USD 1,879.30 billion by 2034, expanding at a CAGR of 52.9% from 2024 to 2034. The North America blockchain technology market size reached USD 8.1 billion in 2023.

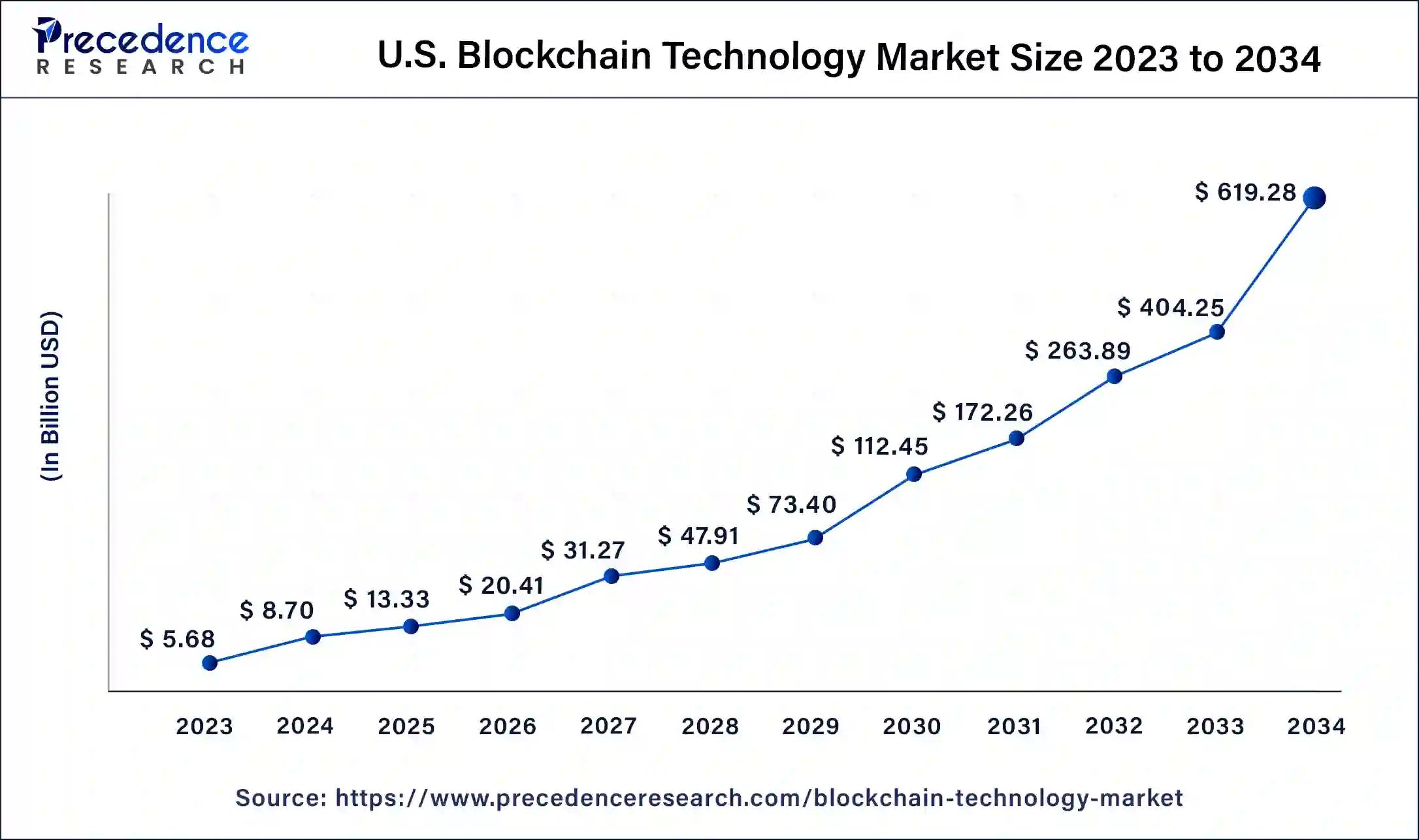

The U.S. blockchain technology market size was estimated at USD 5.68 billion in 2023 and is predicted to be worth around USD 619.28 billion by 2034, at a CAGR of 53.2% from 2024 to 2034.

On a geographical basis, the North American region has gained the largest market share due to the large number of startups in the region due to the growing demand for blockchain networks by large enterprises operating in the region. The presence of cutting-edge technological solutions in this region has greatly benefited the Blockchain technology market.

Market Overview

Shared Blockchain is an immutable, shared ledger that makes it easier to record transactions and manage assets inside a business network. Intangible assets (cars, money, houses, and land) can exist alongside tangible assets (patent, brand image, copyright, intellectual property).

Almost any valuable asset may be monitored and processed on the blockchain network, lowering risks and costs for all parties involved. Blockchain is suitable for supplying this information since it allows for immediate, shareable, and entirely transparent data to be kept on an immutable ledger that only authorized network users may access.

The growing demand for e-identity has driven the expansion of Blockchain technology. The platforms based on blockchain technology have diverse applications in countries with weak identification processes and in unregulated countries. At the national level, the adoption of market demand-based identity platforms of Blockchain technology has been carried out by many governments in order to promote secure transactions in the public and private sectors. Various governments have been using blockchain technology with their e-citizenship programs over the past few years. As a result, these countries have been able to develop identity-related procedures on their own and manage to reduce bureaucracy. Moreover, this technology has helped them to digitize all kinds of public transactions through a secure digital identity.

In addition, the growing capitalization of market-linked cryptocurrencies has promoted the risk of capital investments made by different countries. According to the size of the Blockchain technology market, cryptocurrency has marked innovation in different payment contexts. Furthermore, compared to other types of payment, these currencies offer lower transaction fees. Furthermore, because transaction fees are expensive, cryptocurrencies are attracting businesses and individuals to use cross-border payment methods. Also, due to the decentralized ownership of these cryptocurrencies, cross-border regulators cannot impose any kind of restrictions on these transactions. Therefore, low transaction fees and many other factors are beneficial to Blockchain technology market revenue as well as cryptocurrency capitalization, which motivates venture capitalists to invest in Blockchain technology market share.

| Report Coverage | Details |

| Market Size in 2023 | USD 17.60 Billion |

| Market Size in 2024 | USD 26.91 Billion |

| Market Size by 2034 | USD 1,879.30 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 52.9% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Component, Application, Enterprise, End-Use, and Region |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

Increase in venture capital

The major driving factor that is contributing to the ever-prospering growth rate of the Blockchain market include the increase in venture capital and investment in blockchain technology; widespread use of blockchain solutions in banking and cybersecurity; strong adoption of blockchain solutions for smart contracts, payments, and digital identities; and increased government initiatives.

Increasing number of market players in the market

Blockchain technology has seen a boom after the birth of Bitcoin and has been used by various financial institutions for transactions. The application of blockchain technology solutions has gained wide popularity in the past 2-3 years for various business applications, such as documents, exchanges, payments, smart contracts, and receipts. Many startups have entered this market and started developing blockchain technology solutions.

Increasing government investment in blockchain technology

The blockchain networks isbeen promoted by government authorities in many countries. This is mainly due to the benefits that this technology brings to different businesses, such as increased transparency and efficiency. In addition, government initiatives and partnerships with commercial organizations to incorporate blockchain networks to protect existing systems are driving demand for blockchain systems. The market is expected to continue to offer the most lucrative opportunities for revenue generation throughout the forecast period.

The private cloud segment is expected to witness significant growth during the forecast period. Private services include providing dedicated infrastructure and resources specifically for organizations. A private cloud allows businesses to reverse transactions at a cost-effective transaction rate.

This is the growth driver of the segment. In addition, increasing private cloud adoption by large, small, and medium enterprises is one of the key growth drivers for this segment.

The infrastructure and protocol segment leads the market and accounts for more than half of the global revenue share. The growing demand for blockchain standards and protocols, such as Hyperledger, open chain, and Ethereum is driving the growth of the segment. Users demand protocols because they allow sharing of information securely across crypto networks. As a result, the advantages brought by infrastructure and protocols contribute to the growth of the segment.

The middleware segment is expected to record the second-fastest growth during the forecast period. Middleware helps developers build apps more efficiently. Growing investment in the healthcare sector is expected to drive the growth of this segment. Middleware tools track performance metrics in the lab, which is also one of the growth drivers of the segment.

The payments segment leads the market and accounts for over 40% of global revenue. A Blockchain system improves the efficiency of the payment system, minimizes operating costs, and provides transparency. These benefits provided by blockchain technology are increasing its use in payment solutions thus driving the growth of the segment. In addition, blockchain reduces the need for middlemen in payment processing, which is also a key growth driver for the segment.

The digital identity segment is expected to grow at the fastest CAGR during the forecast period. Companies that provide digital identities are entering into partnerships with blockchain technology providers, which are driving the growth of the segment.

The large enterprise segment dominates the market in terms of global revenue share. Large enterprises operating in industries such as supply chains, financial services, insurance, and healthcare are increasingly working to digitize their services, which is creating the need for technology. Large companies, such as HSBC, Intesa Sanpaolo, BBVA, and Barclays are using blockchain technology to streamline their KYC and funding processes.

They have access to appropriate capital and various assets to apply new technologies introduced in the market. The Small and Medium Enterprises (SME) segment is expected to grow at the fastest CAGR during the forecast period. SMEs are finding it difficult to scale their tasks, such as funding, processing payments, and selecting the ancillary services needed for global expansion. Blockchain technology helps them to reduce problems in the area of subsidy and account exchange. In addition, safe and secure information exchange and smart contracts powered by blockchain technology help SMEs streamline supply chains. In addition, blockchain-based storage applications allow small businesses to securely and cost-effectively store data, further driving blockchain demand among small businesses.

Segments Covered in the Report

By Type

By Component

By Application

By Enterprise

By End-Use

By Geography

For questions or customization requests, please reach out to us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2023

November 2024

July 2024

April 2024