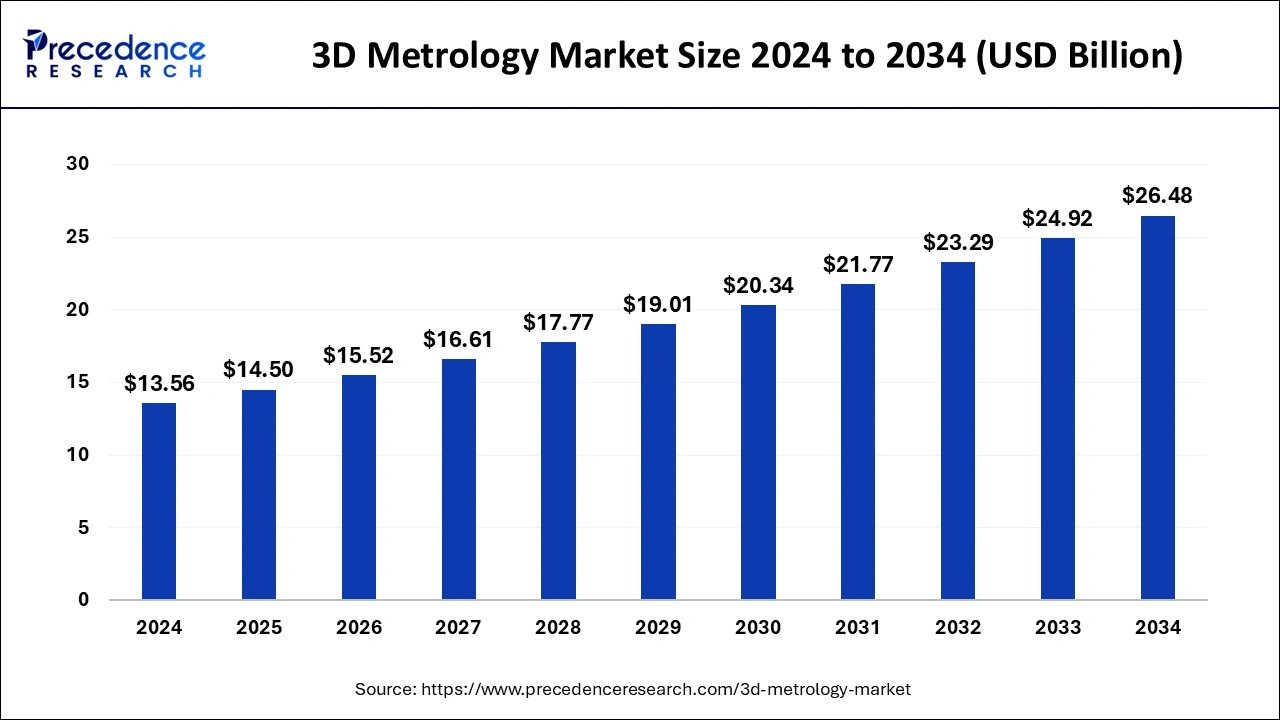

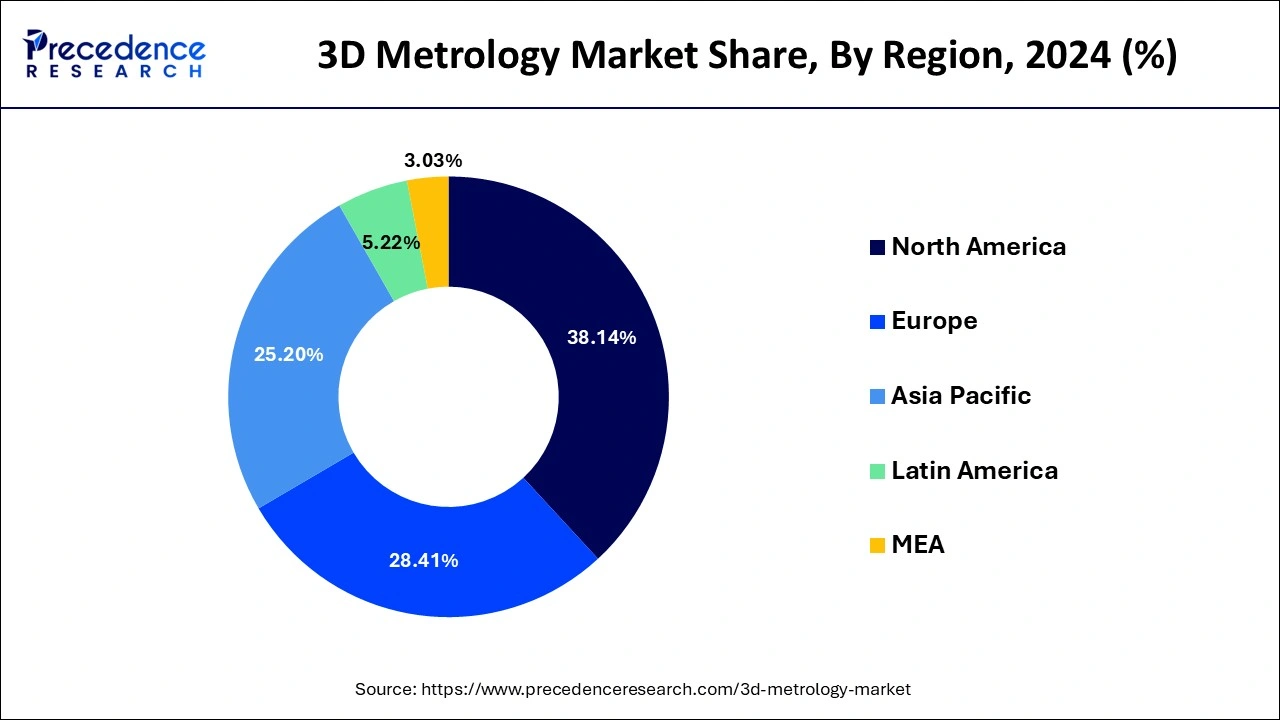

The global 3D metrology market size is calculated at USD 14.5 billion in 2025 and is forecasted to reach around USD 26.48 billion by 2034, accelerating at a CAGR of 6.92% from 2025 to 2034. The North America 3D metrology market size surpassed USD 5.17 billion in 2024 and is expanding at a CAGR of 6.93% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global 3D metrology market size was estimated at USD 13.56 billion in 2024 and is anticipated to reach around USD 26.48 billion by 2034, expanding at a CAGR of 6.92% from 2025 to 2034. The increased demand for 3D metrology in various industries like automotive, aerospace, electronics, and healthcare is driving the growth of the 3D metrology market. Technological advancements, including improved laser and structured light scanning, are fueling the adoption rate of the 3D metrology technology. The increased utilization of 3D metrology in engineering and design is projected to boost the market growth in the forecast period.

The integration of artificial intelligence (AI) with 3D metrology has become a significant transformative technology. AI helps to improve the accuracy as well as data processing capabilities of the 3D metrology. Automated inspection enables the reduction of labor requirements; AI further provides accurate interpretations with fast data analytic capabilities. The increased adoption of 3D metrology in various industries and sectors has raised the requirement of more efficient, accurate, precise, and automated 3D metrology technology, where AI is helping to capture such needs.

AI integration with 3D metrology ensures a high level of safety and performance and is determinant to developing high-quality outputs. The rising need for scalable, cost-effective, high-efficiency, faster, and accurate 3D metrology is being developed thanks to the AI.

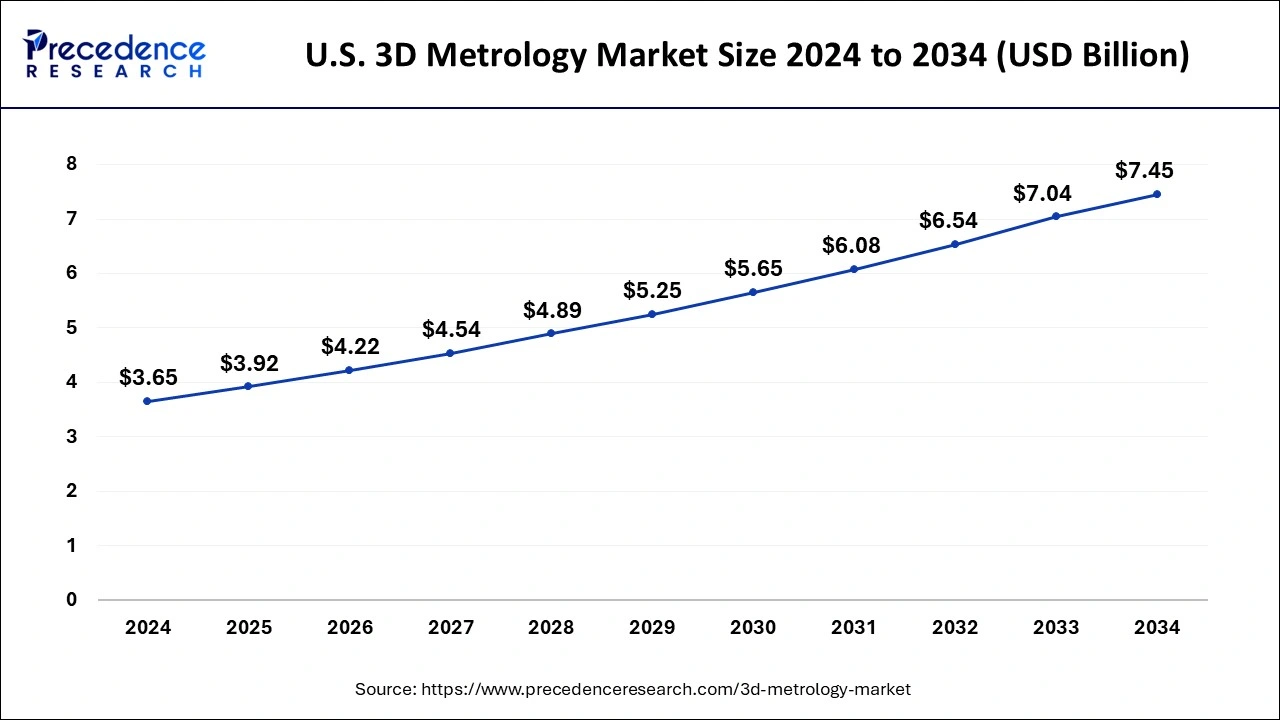

3D metrology market size was valued at USD 3.65 billion in 2024 and is predicted to surpass around USD 7.45 billion by 2034, rising at a CAGR of 7.40% from 2025 to 2034.

The largest revenue sponsor in the global 3D metrology market was North America. The popularity of 3-Dimensional metrology devices has increased due to the involvement of numerous automobile manufacturers in this area, including General Motors AND Ford Motors, as well as research facilities and sizable semiconductor companies.

The U.S.'s significant aerospace and pharmaceutical equipment industries also contribute to the region's growth. Many manufacturers of powertrains and bodies-in-white could replace traditional measurement facilities.

The United States is leading the regional market due to several factors, including increased semiconductor industry, government and regulatory initiatives and investments in research & developments and healthcare expenditure, increased adoption of aerospace and defense, and a rapidly growing automotive industry. The presence of key manufacturing companies and advancing infrastructures are contributing to the country's market growth.

China is leading the regional market due to rapidly growing adoption of the advanced technologies in all sectors in the country. China is a hot spot for engineering worldwide. The 3D metrology software market is predicted to expand as production methods become more accurate and challenging. China currently houses several manufacturing services of international and national companies. With government focus and support of technology advancements and investments in key companies, the country is projected to continuously dominate the 3D metrology market.

The primary factor driving the expansion of the 3D metrology market is the increasing acceptance of 3D metrology devices by various industries, automotive, aerospace, including heavy machinery, engineering and construction, power and energy. Additionally, industry 4.0 implementation and increased R&D spending by producers of metrology equipment are anticipated to impact market growth.

In the market for 3D metrology, the emergence of the services segment is significantly influenced by the adoption of industry 4.0. The goal of Industry 4.0 is to digitize physical assets and integrate them into digital ecosystems that include different value chain participants. Significant advancements in portable metrology tools and software-driven automated processes have fueled the market's expansion.

The requirement for industries to adopt 3D metrology solutions is anticipated to be driven by the expanding demand for expensive goods brought on by increasing disposable income in rapidly growing countries and economies with a low GDP.

Additionally, many industries are concentrating on high-quality products produced through accurate measurement using cutting-edge 3D metrology methods and tooling. High-precision measurement solutions are beneficial for almost all industrial applications.

The metrology system also helps to cut costs associated with product development and the overall time needed for product launches. To perform 3D digital measurement and investigation processes, 3D CAD data is used. As a result, it is anticipated that the rising demand for quality inspection will contribute to the market's expansion during the forecast period.

Research and development in 3D metrology have made significant strides over time, and the market's expansion depends heavily on technological development and research. Recent years have seen many engine technology improvements due to consumer preferences for safety, rigid government regulations, and scientific advancements. The major players in the 3D metrology market are attempting to expand engine design R&D to improve engine performance, emission reduction, and combustion efficiency.

On the other hand, the trend for specialized metrology solutions prevents the expansion of universal systems' application bases from including various functional aspects. As a result, the end-user is forced to pick from multiple service providers to display a single chain of production processes. However, it might increase the additional expenses and compel customers to buy their metrology products, contributing to the market's total demand.

| Report Coverage | Details |

| Market Size in 2025 | USD 14.5 Billion |

| Market Size by 2034 | USD 26.48 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.92% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Component, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing adoption of 3D modelling and analysis techniques across a variety of industries

Several industries, including defence and aerospace, heavy equipment, medical, automotive, electronics, and energy & power, use 3D modelling. The data points used to create a 3D model from a 3D object are gathered by coordinate measuring machines (CMMs) or scanners equipped with sophisticated data tools and models.

Data from 3D metrology is essential for the manufacturing industry because it can be used to evaluate the performance and quality of products. A manufacturing company shares this data with its purchasing, designing, and other specific business units to guarantee the accuracy of manufactured goods.

Visualizing measurements taken into account during a production process is another application of 3D metrology. To describe a company's product for highly precise inspection, a lot of 3D data is needed. Due to improvements in measuring devices, verification software, and data-collection sensing technologies, CMM is regarded as a practical and affordable procedure for this purpose. Currently, CMMs and 3D scanners are used together.

Dimensional metrology solutions for quick, high-precision results are frequently used with white-light scanners, 3D laser scanners, and laser trackers. With the aid of these technologies, data collection has become quick and simple, enabling extremely accurate inspection. The aerospace, automotive, and heavy machinery companies mainly use small laser tracking systems with large-volume measurement abilities to obtain exact measurements.

The high cost of establishing 3D metrology facilities.

A significant financial investment for SMEs is required to set up a 3D metrology facility, which involves measuring equipment, installation, and maintenance costs. To help integrate metrology into their product development and manufacturing processes, companies usually prefer to set up their 3D metrology services or work with outside parties.

To set up an entire 3D metrology department, businesses have difficulty achieving the targeted return on investment, and it is also a laborious and challenging task. Additional expenses include hiring meteorologists, maintaining, upgrading, hiring, standardizing, and offering regular training for metrology equipment and software.

The requirement for 3D metrology facilities is expanding.

Due to the high expense of establishing a 3D metrology facility and the scarcity of 3D metrology specialists, there has been an increase in the need for 3D metrology facilities. Metrology suppliers have more expertise with equipment and measurement techniques than in-house technicians. By contracting with a professional for 3D metrology facilities, data collection is guaranteed to be highly accurate, reliable, and impartial.

For the highest data reliability and repeatability level, 3D metrology equipment manufacturers instruct their engineers on the most recent tools and software for regularly maintaining, measuring, and calibrating the devices.

A 3D metrology supplier can set up portable CMMs at the production facility according to the measurements required for the product and company. Manufacturers can save money and time by utilizing on-site facilities now that 3D metrology equipment suppliers have begun to offer them.

One of the main factors influencing the requirements for 3D metrology in multiple companies is technological advancement. Industries are concentrating on providing devices with advanced technologies and modular architecture in response to emerging application fields, rising innovations, and advanced technology.

These improvements increase the cost of 3D metrology software and hardware. Companies like communications, automotive, aerospace and defence, and industrial electronics frequently rent or lease measurement equipment services to lower operational expenses.

Customers with limited resources or short-term needs should use these services. Additionally, renting or leasing the testing equipment eliminates related expenses like measurement and repair costs and gives renting service providers the flexibility to end a service contract when necessary.

The global market for 3D metrology is divided into segments for video measuring devices, optical scanners and digitizers, coordinate measuring devices, and 3D automated optical inspection systems. The coordinate measuring machine is anticipated to represent a sizable portion of the 3D metrology market by 2033. The main driver of the segment's expansion is its measurement benefits, including high accuracy and precision.

Hardware, Software, and services comprise the three segments of the global 3D metrology market. The hardware market is expected to grow at an accelerating rate throughout the projected period because of its ability to fit into sectors such as defence, construction, aerospace, architecture, electronics, medical, and heavy machinery to sustain the quality of the products.

Reverse engineering, quality control & inspection, virtual simulation, and other segments make up the global 3D metrology market. The quality assurance and application segment are anticipated to grow significantly throughout the forecast period due to the use of 3D metrology for quality control and examination in the aerospace, automotive, and military industries.

The automotive sector generated the most revenue in 2023 due to the numerous advantages this technology offers in automobile production processes. The market is being driven worldwide by the choice of numerous automakers to use coordinate measuring machines for quality assurance and inspection in the factory. The manufacturing sector is expanding along the same lines as the automotive sector, and it is anticipated that the defence and aerospace sector will have the highest CAG during the projected period.

Additionally, the revenue from CMM unit sales in the defence & aerospace and automotive industries is very high because of the regular use of scanner devices and optical digitizers, which will lead to profitable market opportunities.

But during the anticipated period, the electronics, architecture, and construction components showed only modest growth.

By Product

By Component

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client