December 2024

3D Printed Drugs Market (By Technology: Inkjet Printing, Fused Deposition Modeling, Stereolithography, Zip Dose Technology; By Application: Orthopedics, Neurology, Dental, Others; By End-use: Hospitals & Clinics, Research Laboratories, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

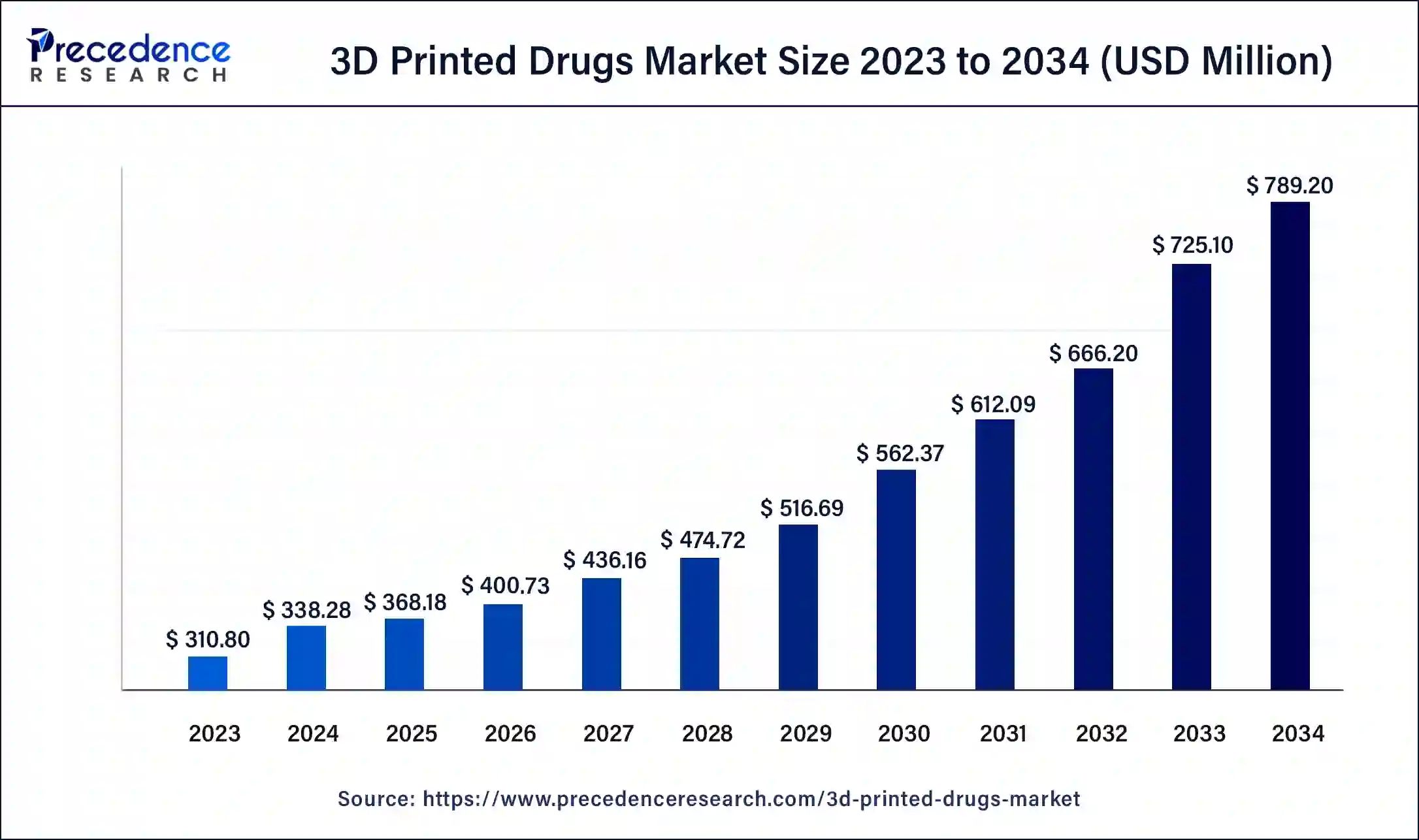

The global 3D printed drugs market size was USD 310.80 million in 2023, calculated at USD 338.28 million in 2024 and is expected to reach around USD 789.20 million by 2034, expanding at a CAGR of 8.84% from 2024 to 2034. The North America 3D printed drugs market size reached USD 118.10 million in 2023. The benefits of 3D printed drugs include helping to get novel medicines to patients rapidly. 3D printing is beneficial for patients with rarer conditions, for making bespoke pills with precise dosages, and for delivering personalized medicines to patients’ needs. These factors help to the growth of the market.

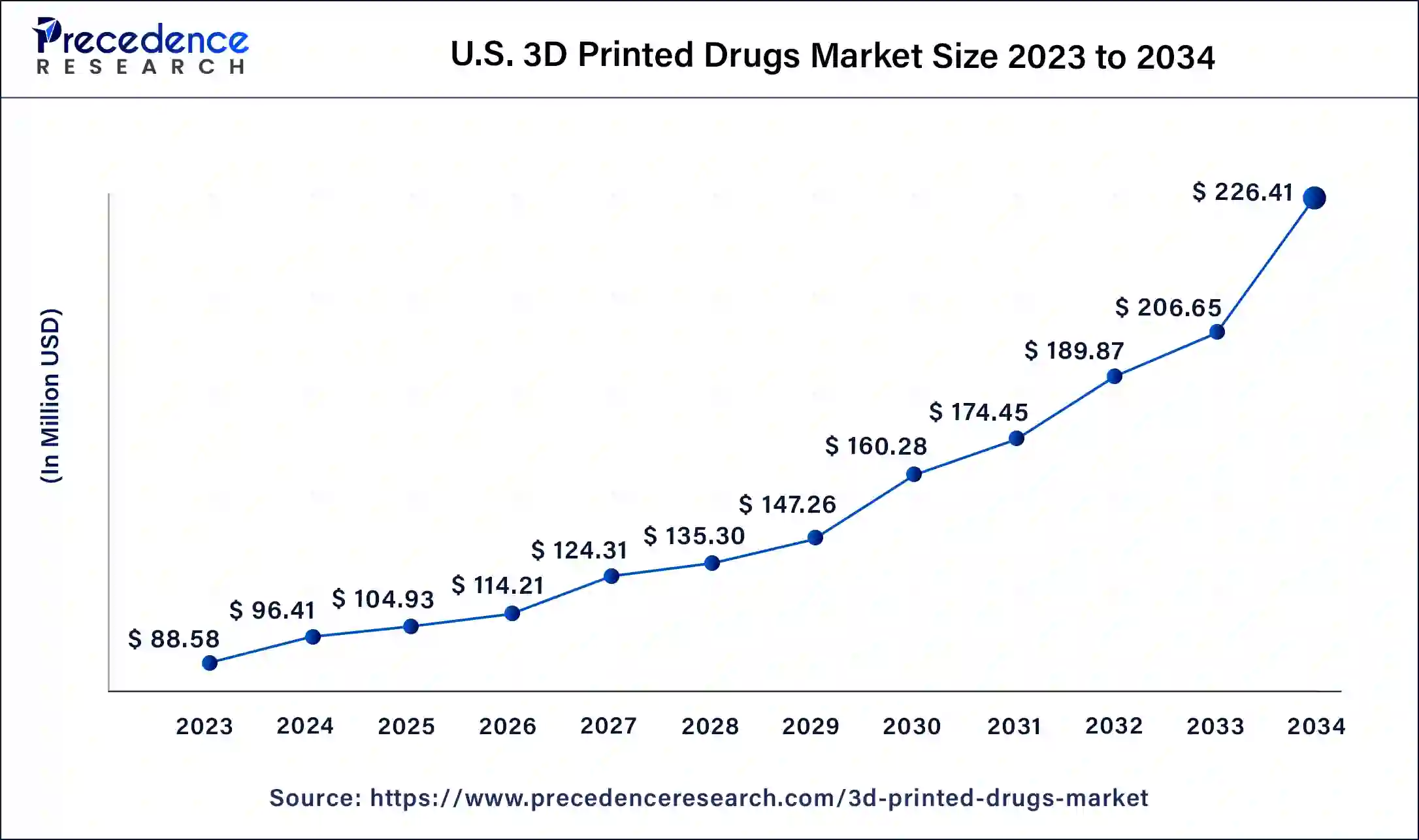

U.S. 3D Printed Drugs Market Size and Growth 2024 to 2034

The U.S. 3D printed drugs market size was exhibited at USD 88.58 million in 2023 and is projected to be worth around USD 226.41 million by 2034, poised to grow at a CAGR of 8.90% from 2024 to 2034.

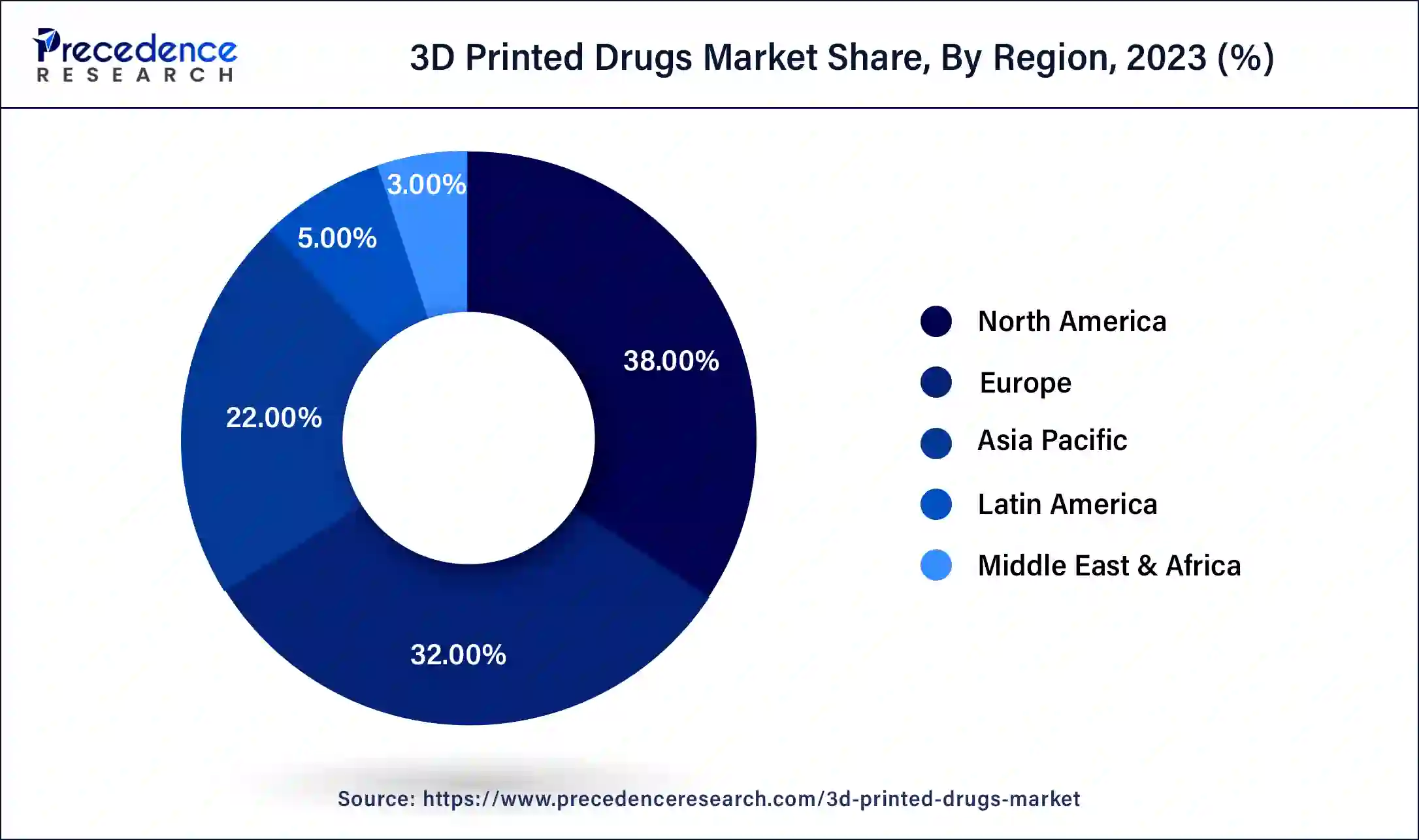

North America dominated the 3D printed drugs market in 2023. Expanding use of technological developments, increasing investment in R&D, the presence of outstanding domestic healthcare infrastructure, and the rising prevalence of chronic diseases helped grow the market in the North American region.

Asia Pacific is estimated to be the fastest-growing during the forecast period of 2024-2033. The integration of technological developments in 3D printed drug technologies in China and Japan contributes to the growth of the market in the Asia Pacific region. The development of clinical frameworks, research & development, and healthcare infrastructure of emerging economies like Australia and India contribute to the growth of the market in the Asia Pacific region.

The 3D printed drugs market refers to 3D printed drugs are the prescriptions created using the 3D printing process to give individuals effective and safe tailored medications. 3D printing drugs offer benefits as compared to traditional preparation technologies. It provides the adjustment of the drug combination and doses, flexibility in the design of complex 3D structures, enabling precise control of drug release to meet a high range of clinical needs, transforming the way we use, design, and manufacture drugs, driving breakthrough in drug manufacturing technology, a significant reduction in drug preparation development time, creativity and a high degree of flexibility to personalize pharmaceuticals, rapid prototyping, and manufacturing. These factors help to the growth of the market.

| Report Coverage | Details |

| Market Size by 2034 | USD 789.20 Million |

| Market Size in 2023 | USD 310.80 Million |

| Market Size in 2024 | USD 338.28 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.84% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for immediate soluble drugs

The increasing demand for immediate soluble drugs helps to the growth of the market. In the development phase, poor solubility may lead to inadequate exposure in toxicity and efficacy studies. Immediate soluble drug benefits include better availability, reduced dosage level requirements, and better adsorption in the gastrointestinal tract. These factors help the growth of the 3D printed drugs market.

High use of 3D printed technology for cancer drug manufacturing

The high use of 3D printed technology for cancer drug manufacturing is due to its benefits. As with many new technologies, 3D printing is highly applied in the field of healthcare, including cancer treatment. Revolutionizing and speeding up the complete drug development and discovery process, 3D printing may transform basic oncology discoveries for clinical use quickly and with its fast-prototyping nature. These factors help the growth of the 3D printed drugs market.

Limitations of materials linked with 3D-printed drug manufacturing

The potential for the 3D printed drug technology to progress the pharmaceutical industry. However, there are some limitations of materials or complications impacting applications linked with 3D printed drug manufacturing, which include the regulatory landscape, optimizing the product's mechanical properties, the development of printing instrumentation and software, and the requirements for excipients. These factors can restrict the growth of the 3D printed drugs market.

Continuous technological developments in 3D-printed drug technologies

The continuous technological developments in 3D-printed drug manufacturing technologies help the market grow. Different types of 3D-printed drug technologies are used for medicine production, like bioprinting, stereolithography, and hot melt extrusion. 3D-printed drug technology has the potential to manufacture dosage forms that may be customized based on individual needs.

The zip dose segment dominated the 3D printed drugs market in 2023. The zip dose technology is a drug formulation platform for the rapid disintegration of prescribed medicines. The benefits of zip dose technology include zip dose medicines are solid and easy to consume, which makes them convenient for patients. Zip dose technology ensures precise dosing even at high dose loads up to 1000 mg. These medicines maintain rapid disintegration properties, which is key for patient compliance. Zip dose technology provides a high range of taste masking options, which helps to improve patient experience.

Caregivers and patients benefit from a convenient way to administer or take medicine, and providers may prescribe zip-dose formulations for patients who have difficulty consuming large tablets. This zip-dose drug technology is beneficial and easy to use for patients who suffer from dysphagia. Rising requirements among pediatric and geriatric patients for rapidly soluble drugs that disperse rapidly in the mouth help the growth of the segment. These factors help the growth of the zip dose technology segment and contribute to the growth of the market.

The inkjet printing segment is anticipated to be the fastest-growing during the forecast period. In 3D printing technology, inkjet printing plays an important role. The benefits of inkjet printing technology include multi-material inkjet 3D printing. Tablets may be customized to release drugs at a controlled rate fixed by the tablet’s design. This allows personalized pills to deliver timed doses and allows for more effective and precise treatment options for patients.

The unique interior structure of the tablet enables precise control over the drug release rate. Researchers have developed a new method of ink formulation based on molecules sensitive to ultraviolet light. These factors help the growth of the inkjet printing technology segment and contribute to the growth of the 3D printed drugs market.

The neurology segment dominated the 3D printed drugs market in 2023. 3D-printed drugs play an important role in patients who suffer from neurological diseases. 3D printed technology assists in graceful neurological planning, which leads to better outcomes for patients. 3D printing allows for personalized drug formulations. A polypill is made of many medications in a single pill and may be customized for individual patient needs for neurological diseases. 3D-printed drugs of nasal casts help the development of nose-to-brain drug delivery, potentially improving treatment for neurological diseases. 3D-printed drugs can also used to regenerate nerves, offering hope for patients who suffer from nerve damage, and it offers practical benefits to patients who suffer from neurological disorders. These factors help the growth of the neurology segment and contribute to the growth of the 3D printed drugs market.

The orthopedics segment is expected to grow lucratively during the forecast period. In the last decades, the use of 3D printed drugs has gained increasing attention in the orthopedic field, and in modern societies, increasingly prevalent diseases like bone loss and cartilage injuries help the growth of the market. 3D printed drugs, customized implants, and prosthetics are readily available for patient-specific therapies, cartilage or osteochondral tissue regeneration, and enabling bone. The 3D printing technology leads to a faster fabrication of tissue with increased functionality, resolution, and complexity, which can replicate tissue function more accurately. These factors help the growth of the orthopedics segment and contribute to the growth of the 3D printed drugs market.

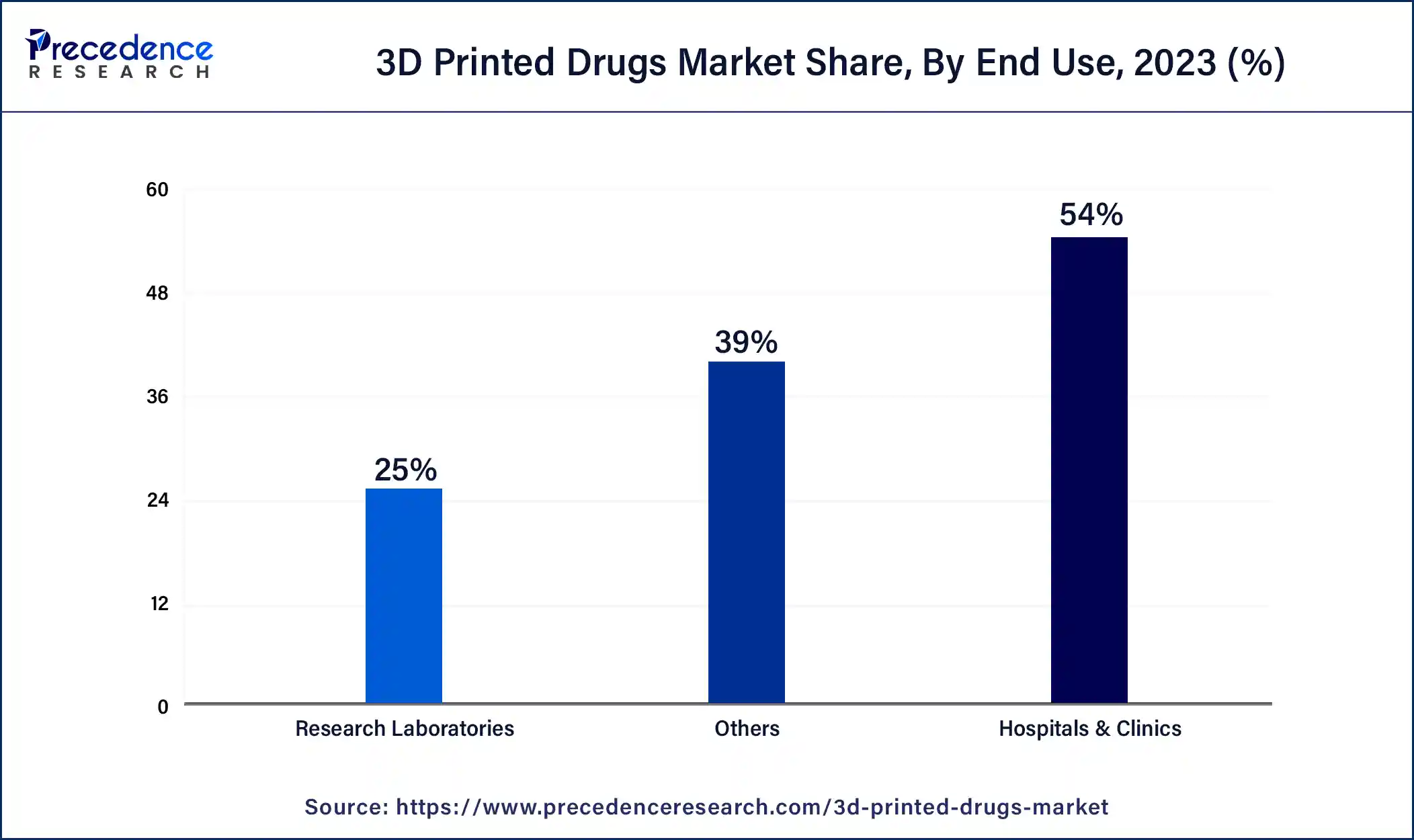

The hospitals & clinics segment dominated the 3D printed drugs market in 2023. 3D printed technologies play an important role in hospitals and clinics. The use of 3D printing in hospitals is not only for rapid prototyping but also for developing end-use products like educational, clinical, and diagnostics tools. The requirements and benefits for implementing clinical 3D printing services in hospitals include the consideration of implementation, for example, use cases, 3D printing drugs management, and technology.

3D printing drugs can be used in the hospital environment in many clinical and technological areas applications, including hospital support services like future use cases, research & development, non-standard clinical cases like oral prosthesis with trismus, mandibular model for pre-bending fixation plate, research & development, and standard clinical cases like anatomical models, surgical guides, radiotherapy boluses, brachytherapy applicators. These factors help to the growth of the hospitals & clinics segment and contribute to the growth of the market.

The research laboratories segment is estimated to be the fastest-growing during the forecast period. 3D-printed drug technology, also called rapid prototyping or additive manufacturing, allows the fabrication of personalized drug delivery that uses complex geometries and different materials with several release profiles by eliminating high initial costs and can help conduct scientific research. These factors help the growth of the research laboratories segment and contribute to the growth of the 3D printed drugs market.

Segments Covered in the Report

By Technology

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

November 2024

November 2024

January 2025