October 2024

3D Printers Market (By Component: Hardware, Software, Services; By Printer Type: Industrial 3D Printer, Desktop 3D Printer; By Technology; By Software; By Application; By Vertical; By Material) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

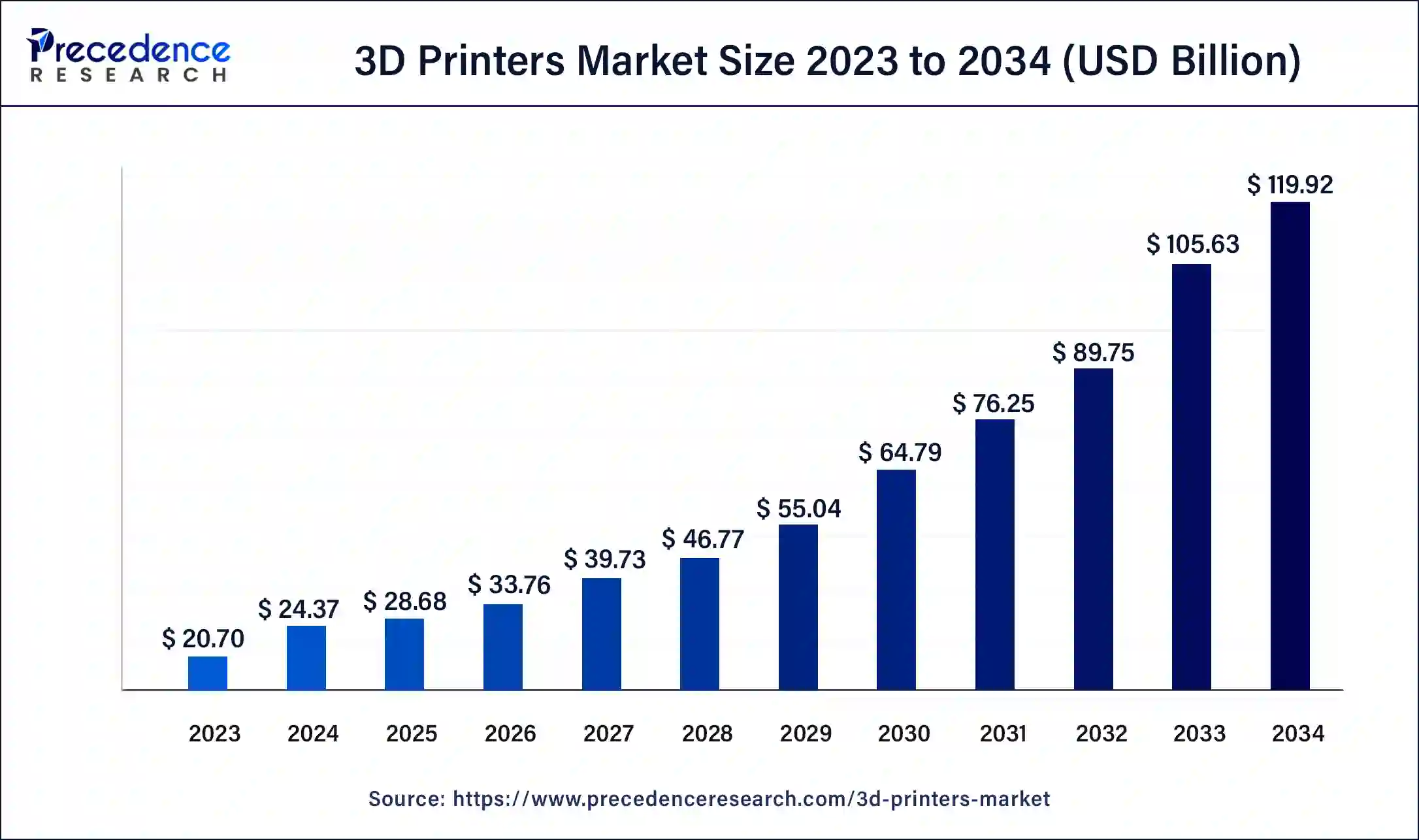

The global 3D printers market size was USD 20.70 billion in 2023, accounted for USD 24.37 billion in 2024, and is expected to reach around USD 119.92 billion by 2034, expanding at a CAGR of 17.3% from 2024 to 2034. The North America 3D printers market size reached USD 6.62 billion in 2023.

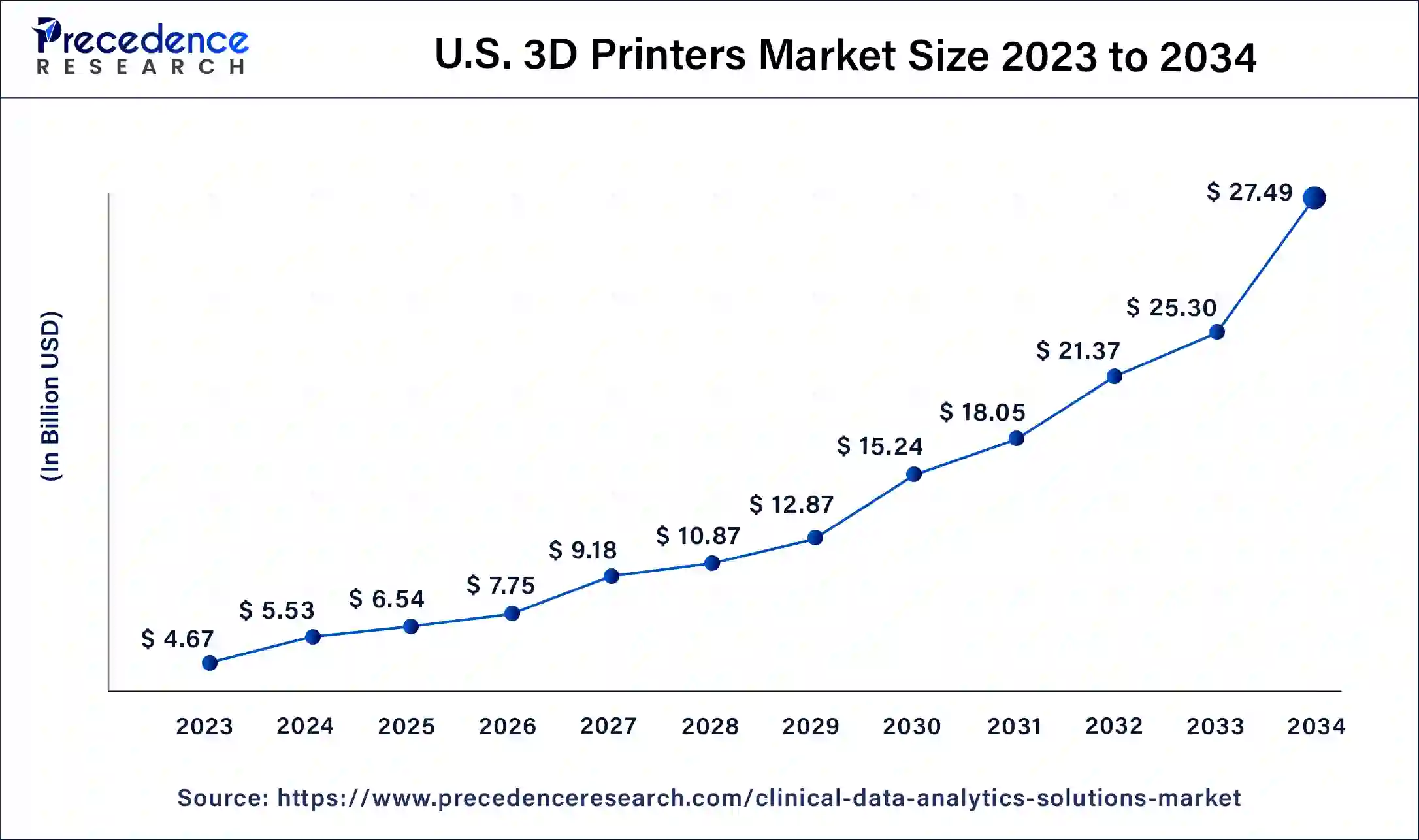

The U.S. 3D printers market size was estimated at USD 4.67 billion in 2023 and is predicted to be worth around USD 27.49 billion by 2034, at a CAGR of 17.4% from 2024 to 2034.

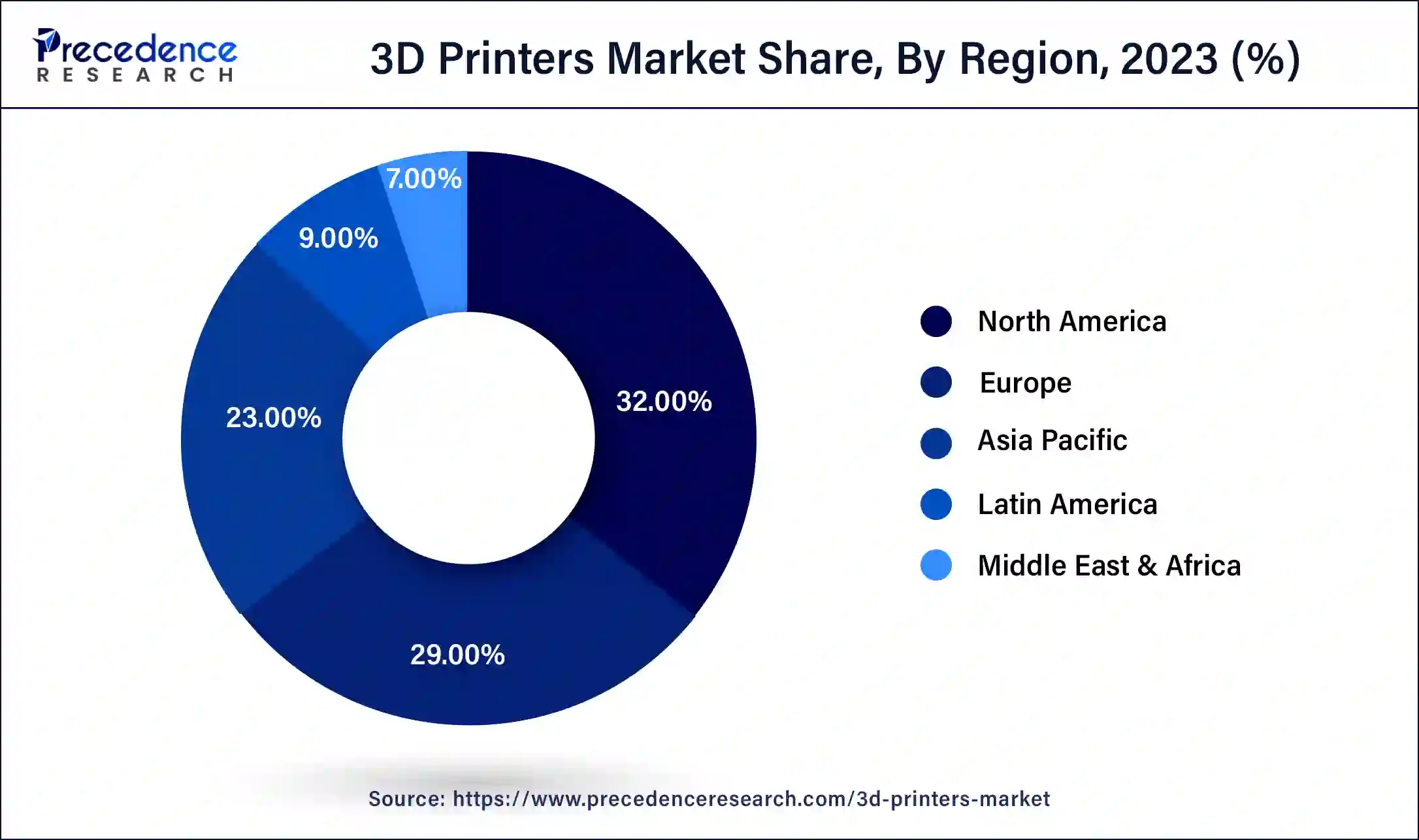

Geographically, North America dominates the global 3D printers market with the highest revenue share of around 32.14% in 2023. The North America is predicted to maintain growth owing to rapid technological innovation. Increasing numbers of 3D printing technology start-ups in the region are seen as another driving factor for market growth. Europe is considered the fastest-growing region in the global market.

The presence of companies with expertise in additive technology is a contributing factor to the market's growth. Asia Pacific is projected to show a significant change in the 3D printers market during the forecast period of 2024-2034. Developing additive industries and increasing investment in R&D for invention in 3D technology printers are considered to drive the global 3D printers market in the Asia Pacific.

The emerging economy in the countries like Brazil and Chile is projected to grow the revenue share for the 3D printers market in Latin America. The deployment of 3D printers in automotive and architectural activities is expected to increase during the forecast period in Latin America. The rapidly developing IT industry and availability of low-cost raw materials are boosting the growth of the market in the Middle East & Africa. These regions are anticipated to show a significant increase during the forecast period.

Market Overview

In recent years, three-dimensional (3D) printing technology has replaced the traditional manufacturing process. 3D printing is the process of creating an object. This advanced technological process allows the designing or creating of complex parts for machines, tools, clothing, and even body parts. 3D printers have helped industries/enterprises mold and sculpt parts with reduced effort, time and cost. 3D printers create the blueprint of objects in the form of data. 3D printers, after receiving the data make a 3D object by adding layers to layers to form a full structure.

3D printers provide revolutionary advantages to enterprises/industries. The benefits offered by 3D printers include flexible design, printing on demand, rapid prototyping, lightweight yet strong part for machinery, and reduced waste. Moreover, 3D printers are considered environmentally friendly as they reduce material wastage. 3D printers are being used in many fields.

3D printing technology has revolutionized the healthcare, automotive, and aerospace industries. 3D printers are filled with unique 3d printing materials such as rubber, plastic, or even metal to create real-world models/objects. 3D printers have changed the manufacturing process's speed, functionality, and efficiency while promising production quality.

| Report Coverage | Details |

| Market Size in 2023 | USD 20.70 Billion |

| Market Size in 2024 | USD 24.37 Billion |

| Market Size by 2034 | USD 119.92 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 17.7% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Component, By Component, By Technology, By Software, By Application, By Vertical and By Material |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The deployment of artificial intelligence in 3D printing technology is considered a major driving factor for the growth of the global 3D printers market. 3D printing technology has gained popularity in recent years as it offers rapid and flexible design with reduced efforts. Such factors that benefit large-scale industries are driving the growth of the market. The expansion of the application of 3D printing technology in the healthcare sector during complex replacement surgeries is considered a driver for the market's growth.

Rising government investment in the research and development of 3D printing technology is boosting the growth of the overall 3D printers market. The technological advancements in 3D printers with more ease and flexible application will fuel the development of the market during the forecast period.

However, the high cost associated with 3D printers that are not affordable for small and medium-sized enterprises is seen as a significant restraint for the growth of the 3D printers market. Along with this, several loopholes in the prototyping process in 3D printing, such as poor documentation and too many variations according to the client's requirements, are likely to hamper the market growth.

The lack of technical knowledge and skilled professionals required to manage 3D printers is considered a restraint for the global 3D printers market growth. Moreover, a lack of awareness about additive technology in underdeveloped countries is hindering market development.

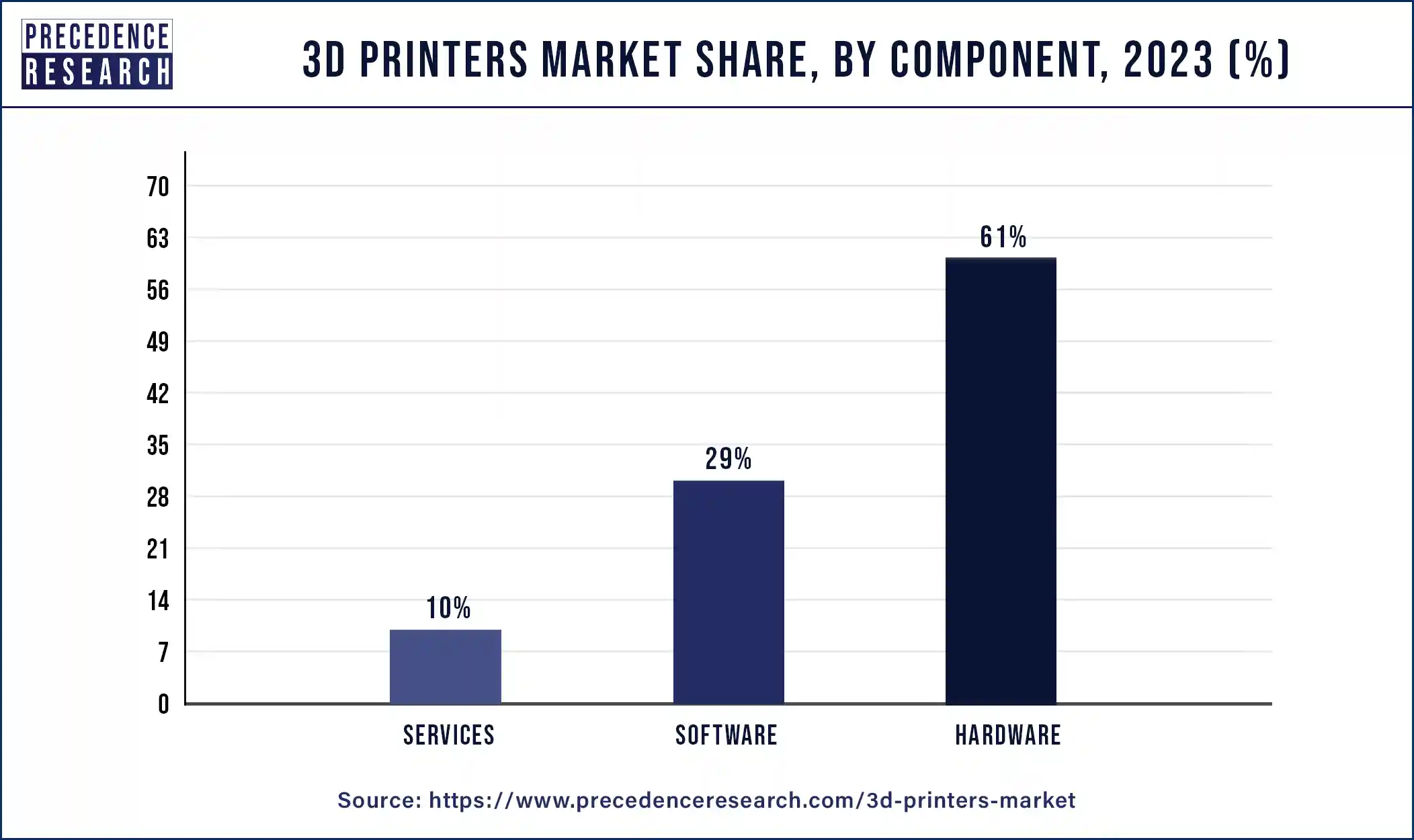

The 3D printers market is segmented based on components: hardware, software, and services. The hardware segment dominates the market and generated more than 61% of the revenue share in 2023, owing to rapid industrialization and urbanization.

Advanced manufacturing processes and increased penetration in consumer electronics are other factors that boost the growth of the hardware segment in the 3D printers market.

The industrial 3D printers segment holds the largest revenue share of around 71% in 2023. The rapid adoption of 3D printing technology by heavy industries such as automotive, aerospace and defense, electronics, and healthcare has boosted the demand for technologically advanced 3D printers, which makes industrial 3D printers the dominating segment.

Industrial 3D printers help design consumer, automotive and industrial tools and final parts. Industrial 3D printers have capabilities of mass production and offer high performance. Increasing demand from the healthcare, aerospace & defense, and automotive industries is boosting the growth of the industrial 3D printers segment.

On the other hand, the desktop 3d printers segment is showing steady growth. Desktop 3D printers are being deployed by educational centers such as institutions, schools, and universities for training purposes. Usually, desktop printers are used for limited purposes by small enterprises. Several small enterprises are adopting desktop 3D printers to manufacture/design projects.

The size of a desktop 3D printer is small and can be fitted near a computer or laptop, which is convenient for small-scale industries and educational institutions. Thus, the demand for desktop 3D printers is projected to grow during the forecast period.

Based on technology, the stereolithography segment accounts for the highest revenue share in 2023. Stereolithography is a process used for industrial purposes to create concept models, and Stereolithography is considered the most conventional process of printing. The rapid adoption of Stereolithography is attributed to the easy operational methods for this printing process.

Moreover, the fuse deposition modeling segment is expected to account for the highest revenue share during the forecast period. Industries in prototyping and production applications use the fuse deposition modeling process. The fuse deposition modeling process in 3D printing boosts the prototyping speed. The rapid adoption of various 3D printing processes across the globe is considered a significant driver for the segment's growth.

Based on software, the design software segment accounted for the highest revenue share of around 31% in 2023 and the segment is projected to continue dominating the market during the forecast period. Design software is widely used to construct the designs of objects, and design software is mainly used in aerospace & defense, automotive, and engineering sectors.

Furthermore, the demand for scanning software has increased in recent years. The scanning software allows the storage of scanned images, which is predicted to boost the revenue share of the scanning software segment.

Based on application, the prototyping segment acquires the highest revenue share of around 56% in 2023. Prototyping offers flexible designing, allows easy detection of errors and easy functioning. These factors have led many industries and verticals to adopt the prototyping process in 3D printing.

Industries that require complex designing of components or parts, such as engineering, automotive, aerospace & defense, have started adopting prototyping to design parts. The functional parts segment is considered the fastest-growing segment in the market, with increasing demand for designing available parts with accuracy and precise sizes.

Based on vertical, the 3D printers market is segmented into automotive, aerospace & defense, healthcare, consumer electronics industrial, power & energy, education, fashion & jewelry, food, object, dental & others. The automotive segment dominates the global 3d printers market owing to the rapid adoption of additive technology for designing purposes in the industry. The Aerospace& defense sector has started deploying 3D printing technology to create complex designs.

The healthcare segment is seen as the fastest-growing segment in the global 3D printers market. The capabilities of the 3D printing process in replacement surgeries have forced the healthcare industry to adopt 3D printing technology. The food, education, fashion, and jewelry segments are anticipated to boost during the forecast period owing to the rapid adoption of desktop 3d printers.

The metal material segment accounts for the largest revenue share of around 51% in 2023. Metals allow suitable manufacturing processes due to high flexibility and strength. The segment is expected to maintain growth during the forecast period. The polymer segment accounted for the second-largest revenue share in the market. However, the ceramic material segment is new in the global 3d printers market.

Recent Developments

Segments Covered in the Report

By Component

By Printer Type

By Technology

By Software

By Application

By Vertical

By Material

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

June 2025