March 2025

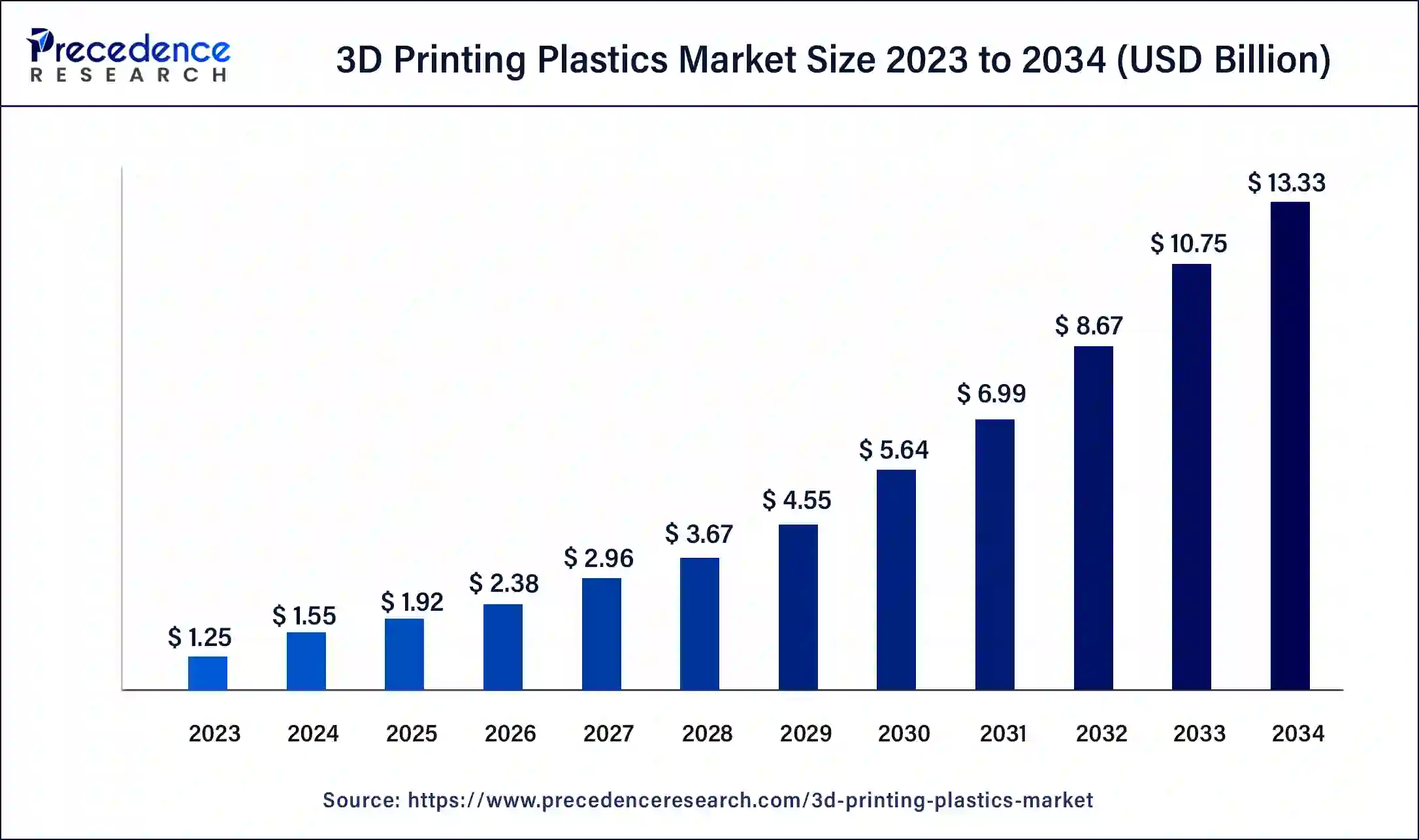

The global 3D printing plastics market size was USD 1.25 billion in 2023, calculated at USD 1.55 billion in 2024 and is expected to be worth around USD 13.33 billion by 2034. The market is slated to expand at 24.01% CAGR from 2024 to 2034.

The global 3D printing plastics market size is worth around USD 1.55 billion in 2024 and is anticipated to reach around USD 13.33 billion by 2034, growing at a CAGR of 24.01% over the forecast period 2024 to 2034. The North America mobile device management market size reached USD 510 million in 2023. Several factors, such as technology improvement, cost reduction, rapid prototyping, design flexibility, and sustainable development in various sectors, fuel the growth of the 3D printing plastics market.

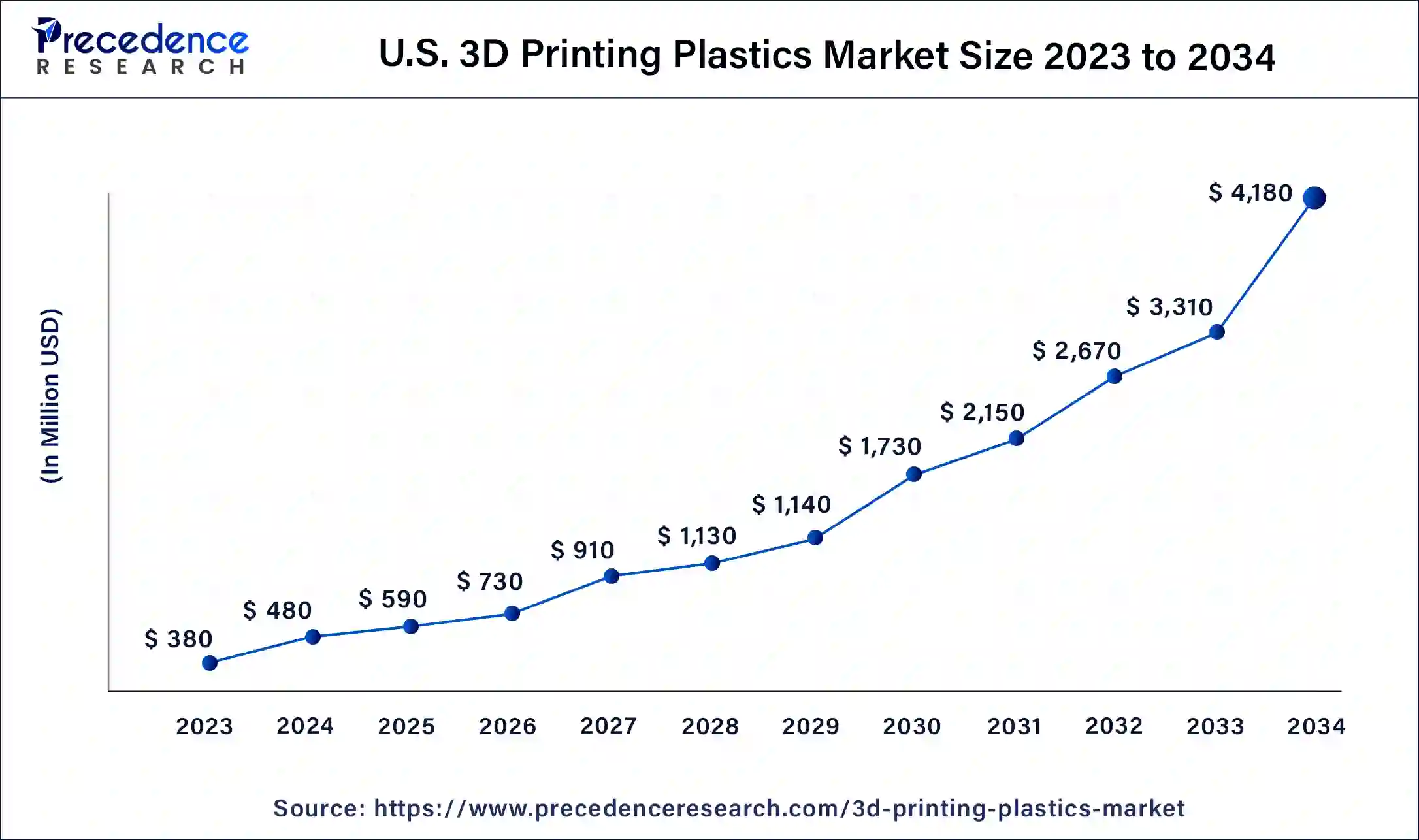

The global U.S. 3D printing plastics market size is worth around USD 380 million in 2024 and is anticipated to reach around USD 4,180 million by 2034, growing at a CAGR of 24.35% over the forecast period 2024 to 2034.

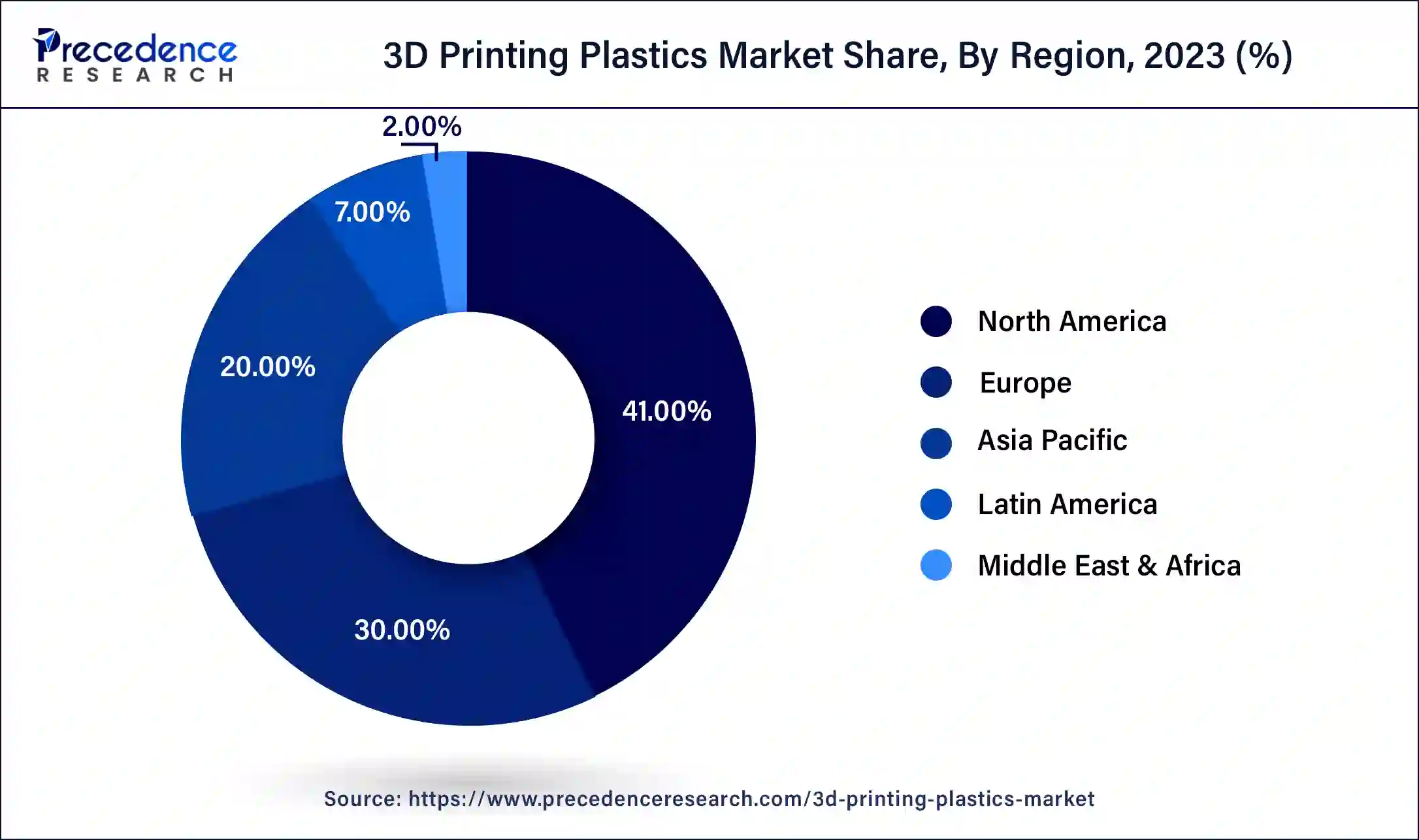

North America led the global 3D printing plastics market in 2023. 3D printing technology is experiencing wide adoption in the manufacturing industry, especially within the automotive, aerospace, healthcare, and defense industries. An increase in governmental initiatives in the United States towards the expansion of 3D printing and funding of research and development acts as the driver of this technology in North America. Furthermore, there is a sequence of new product developments in North America that are aimed at harnessing the opportunities available through 3D printing and also performing mergers and acquisitions.

Asia Pacific is anticipated to grow notably in the 3D printing plastics market during the forecast period. The Asia Pacific market is growing due to increasing manufacturing sectors in the region and technological improvements. The prominent leaders in adopting 3D printing are China, India, and Japan. Decreased material costs, increased efficiency in the manufacturing process, and flexibility in terms of innovation are some of the drivers that 3D printing plastics are good for the automotive, aerospace, and healthcare industries.

3D printing or additive manufacturing is a process of making three-dimensional objects from a digital file. Plastic is the most common raw material for 3D printing. The benefit of using plastic is that it is a highly diverse material for 3D-printed products like toys, household fixtures, desk utensils, and vases. The properties of plastic, such as strength, smoothness, and flexibility, have also played a critical role in increasing the applications of plastic in 3D printing. It also makes the material a relatively cheaper raw material to be used for 3D printing for both businesses and customers.

Types of 3D printing technology

| Ink-jet Printing | It uses inkjet technology to selectively deposit liquid photopolymer materials layer-by-layer, which are cured with UV light. |

| Fused Deposition Modelling (FDM) | A plastic filament or metal wire is unwound from a coil and supplies material to an extrusion nozzle, which can turn on and off. |

| Stereolithography (SLA) | A laser is used to selectively cure a tank of liquid photopolymer resin layer by layer. |

| Selective Laser Sintering (SLS) | A high-power laser is used to fuse small particles of plastic, metal, ceramic, or glass powders into a mass representing the desired 3D shape. |

| Electronic Beam Melting (EBM) | Uses an electron beam in a vacuum environment to melt and fuse metallic powder particles layer by layer. |

| Laminated Object Manufacturing (LOM) | Layers of adhesive-coated paper, plastic, or metal laminates are successively glued together and cut to shape with a knife or laser cutter. |

| Digital Light Processing (DLP) | Similar to stereolithography but with a digital light processing chip controlling the light source, enabling faster build times. |

How is AI Changing the 3D Printing Plastics Market?

The AI-enhanced 3D printing plastics market is expected to expand at a strong pace due to its ability to integrate with artificial intelligence, which offers 3D printers greater control and accuracy. AI is transforming 3D printing by automating design processes and optimizing manufacturing operations. This includes utilizing AI to immediately generate proposals for certain designs in CAD software application sets, enhancing the speed and reducing the need for extensive engineering experience. Sophisticated AI is now built into many 3D printers to detect and respond to errors that occur in the printing process.

| Report Coverage | Details |

| Market Size by 2034 | USD 13.33 Billion |

| Market Size in 2023 | USD 1.25 Billion |

| Market Size in 2024 | USD 1.55 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 24.01% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Form, End-use and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing usage in automotive industries

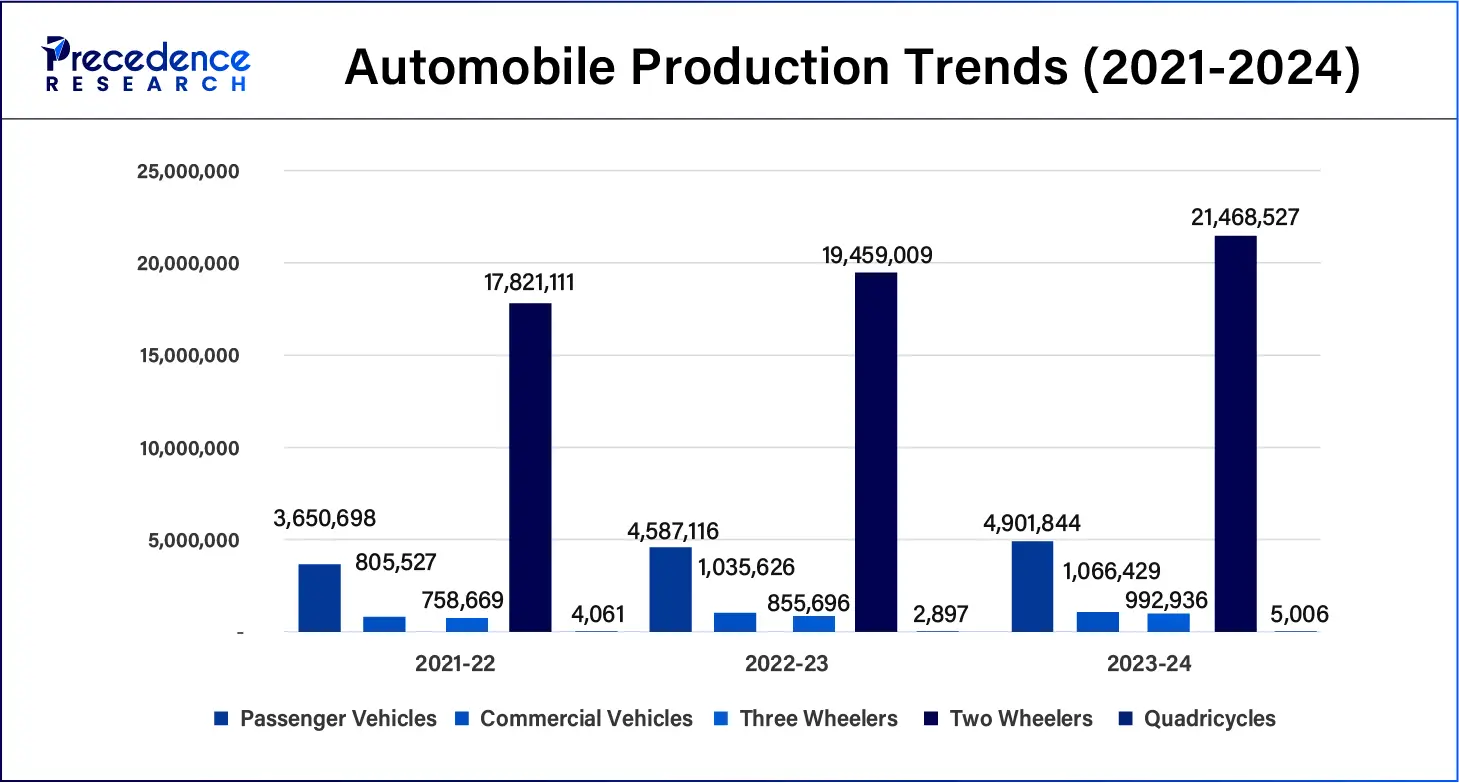

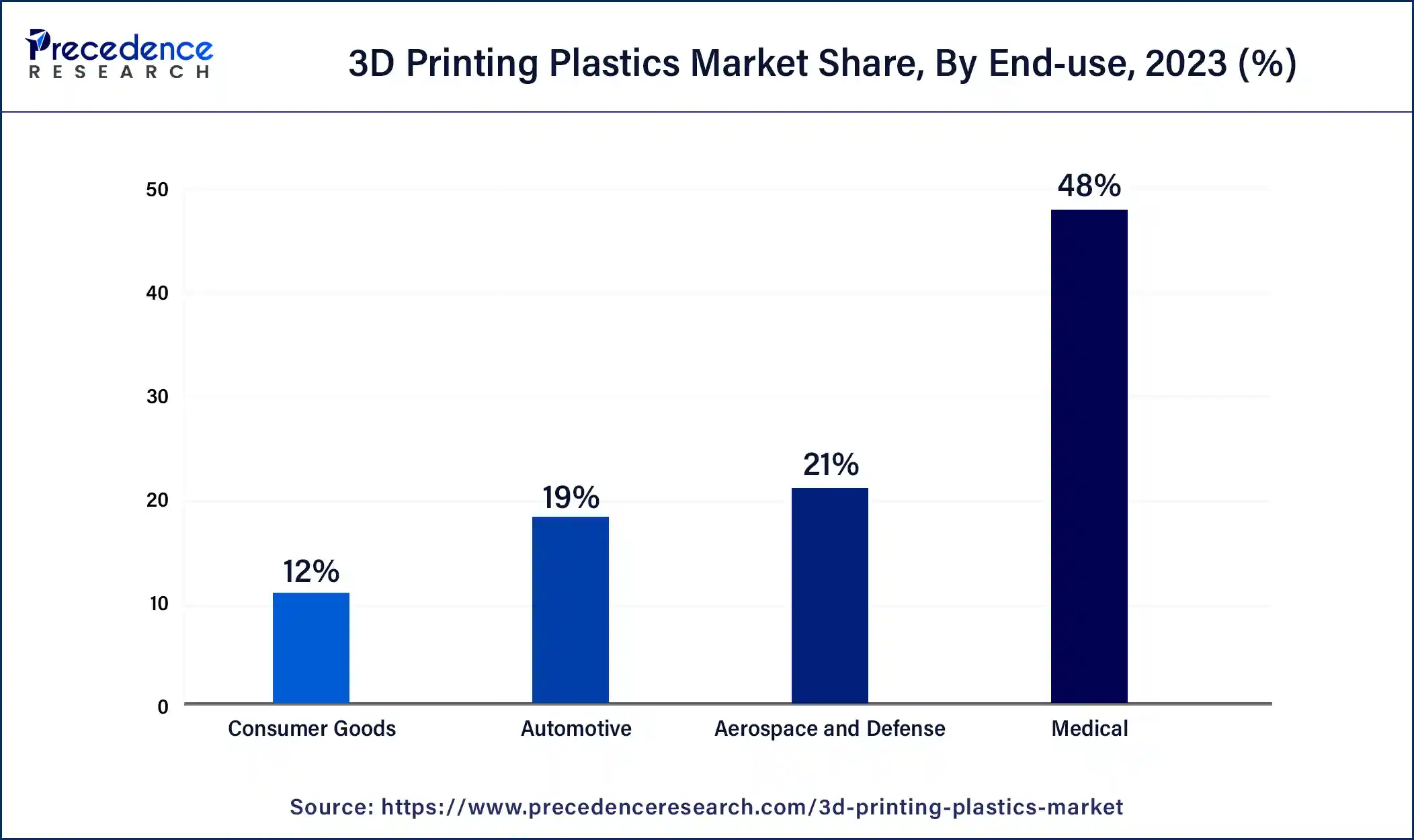

The 3D printing plastics market has led to significant advancements in the automotive industry. This includes fast prototyping, widespread production of final car parts, and even the possibility of 3D manufacturing the entire car. The ability to create physical models of parts designed in a very short time has made 3D printing indispensable in the automotive industry. The automotive industry has been a leader in exploring the use of 3D printing technology in manufacturing.

Rising adoption in various sectors

The trends that have been encouraging the growth of the 3D printing plastics market, especially in different industries, including within the consumer goods value chain, 3D printing presents a great opportunity for the invention of speedy and individualized goods and models, thus improving design freedom and quick market entrance. The medical devices industry has benefited from the use of technology in the production of patient-specific implants and prosthetic and surgical tools that enhance the quality of life of patients, as well as offering unique medical solutions. 3D printing is useful in the industrial sector since it is capable of creating specific tools and parts that will cut inventory in addition to closing the production time gap. All these sectors appreciate 3D printing for its efficiency, cost-saving, and innovation.

Non-standardized practices in 3D printing

The lack of elaborate laws regulating the use of the 3D printing plastics market products opens up a sort of ambiguity and challenges as to whether uniformity and safety measures can be achieved in the process. These challenges include the qualification of new materials and processes, which continues to be a major challenge. It is also important to note that the standardization and the ability to produce similar results across a range of applications are often unpredictable, which hampers wider acceptance of 3D printing technologies.

Increasing demand for bio-based grades of material

Biodegradable thermoplastics are plastic products that are based on renewable resources. Biomass used for developing bioplastics is currently derived from starch constituents or cellulose. Bio-derived bioplastics, on the other hand, allow for a significant reduction in carbon footprint at the resource extraction stage. Such natural sources include starch, chitin, protein, and cellulose. PLA is cheaper and less expensive; obtaining high-quality prints with PLA material is also possible. This is typical in most extrusion-based 3D printers because it is possible to print at a lower temperature without the use of a heated bed. Biodegradable bioplastics offer disposal channels that decrease the volume of plastic waste that is disposed of in the environment.

The photopolymers segment accounted for the biggest share of the 3D printing plastics market in 2023. Photopolymers are materials that can be processed in 3D printing and can be used to create objects that possess improved characteristics. There are many areas of use for photopolymers as well as for 3D printing technologies. These polymers have been used in different printing methods ranging from ink-jet to relatively new jetted 3D printing. It is in demand in the printing business as it provides better results.

The polyamide/nylon segment is expected to witness significant growth in the 3D printing plastics market during the forecast period. The polyamide is used in 3D printing in different types of forms. Polyamide has to be applied in powder form and is used in SLS (Selective Laser Sintering). Nylon is a very useful and versatile material. Its flexibility and strength make it ideal for automotive applications, such as the manufacture of friction and deformation-resistant parts. This material produces durable and flexible plastic parts. Nylon has a range of usages, from prosthetics to cases and enclosures.

The filament segment held the largest share of the 3D printing plastics market in 2023. The filament-based 3D printing material has several advantages, such as being easy to use and cost-effective. However, the filament is extruded from the nozzle, which shapes it into a filament.

The ink segment is expected to grow at the fastest rate in the 3D printing plastics market over the forecast period. Materials serve as the ‘ink’ in this paradigm of 3D printing ink solution formula and procedure through which these three-dimensional physical structures are constructed in layers. Possibilities for using 3D print materials are countless, and the technology has found its use in aerospace, automotive, medical, fashion, construction, and consumer sectors. The applications of 3D printing materials are vast and diverse, spanning across industries such as aerospace, automotive, healthcare, fashion, construction, and consumer goods.

The medical segment dominated the 3D printing plastics market in 2023. 3D Printing creates high-speed and low-cost prototypes of medical devices. This technology can enable a perfect replica of a specific geometry/ feature of a particular patient’s body. They are implant, instrumentation, and external prostheses devices used for dental implant procedures. In addition to prototyping, 3D printing for medical applications involves application in the manufacture of parts and casings for end-use medical products. Other 3D-printed products that have been produced in the medical field include inhalers, injectors, needle holders, surgical tool trays, splints, and testing equipment. The technology also advanced conventional manufacturing by manufacturing accurate models, patterns, cast, and dies for use in different molding and casting machinery for mass production.

The aerospace & defense segment is anticipated to grow significantly in the 3D printing plastics market during the forecast period. 3D printing is suitable for prototyping and use in the aerospace and aviation industries. The aerospace industry was one of the first industries to embrace 3D printing and is still a major contributor to the technology’s evolution. It was also relevant to acknowledge that the use of 3D printing technology for aerospace and defense sectors is revolutionary. The advantages include increased design opportunities, reduction of weight, increased efficiency, and savings in terms of financial resources.

Segments Covered in the Report

By Type

By Form

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

March 2025

December 2024

November 2024