January 2025

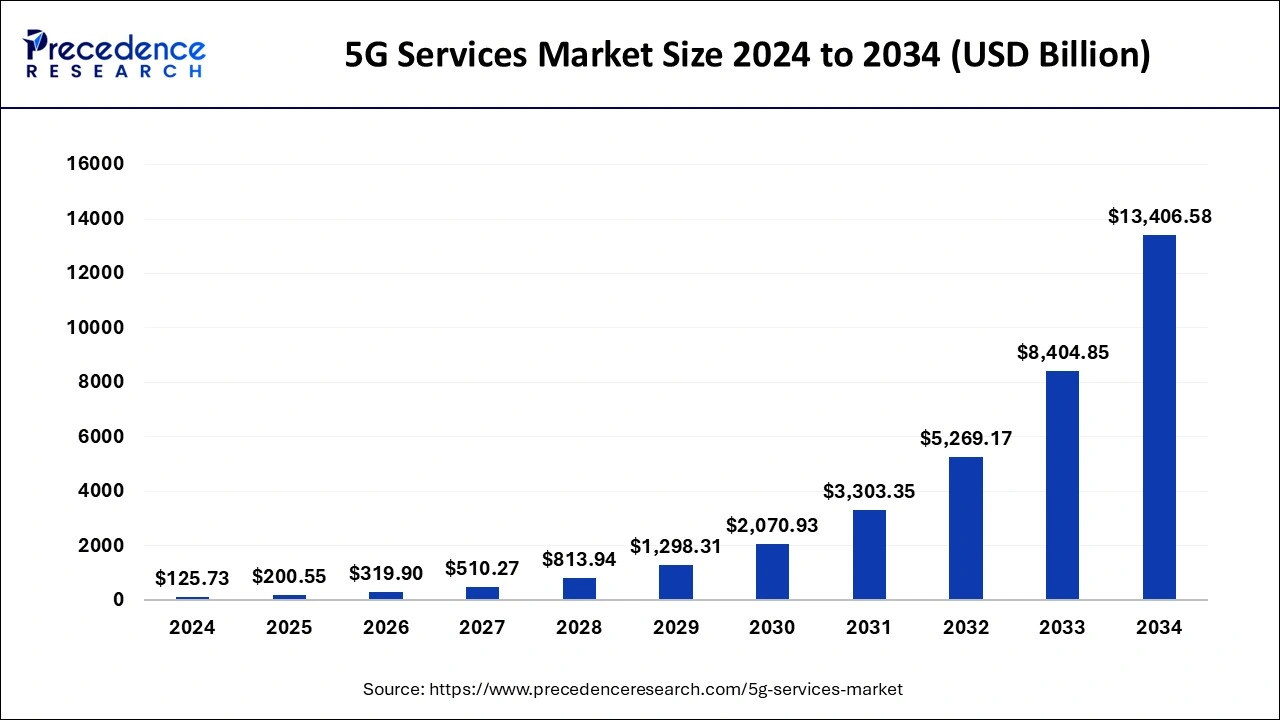

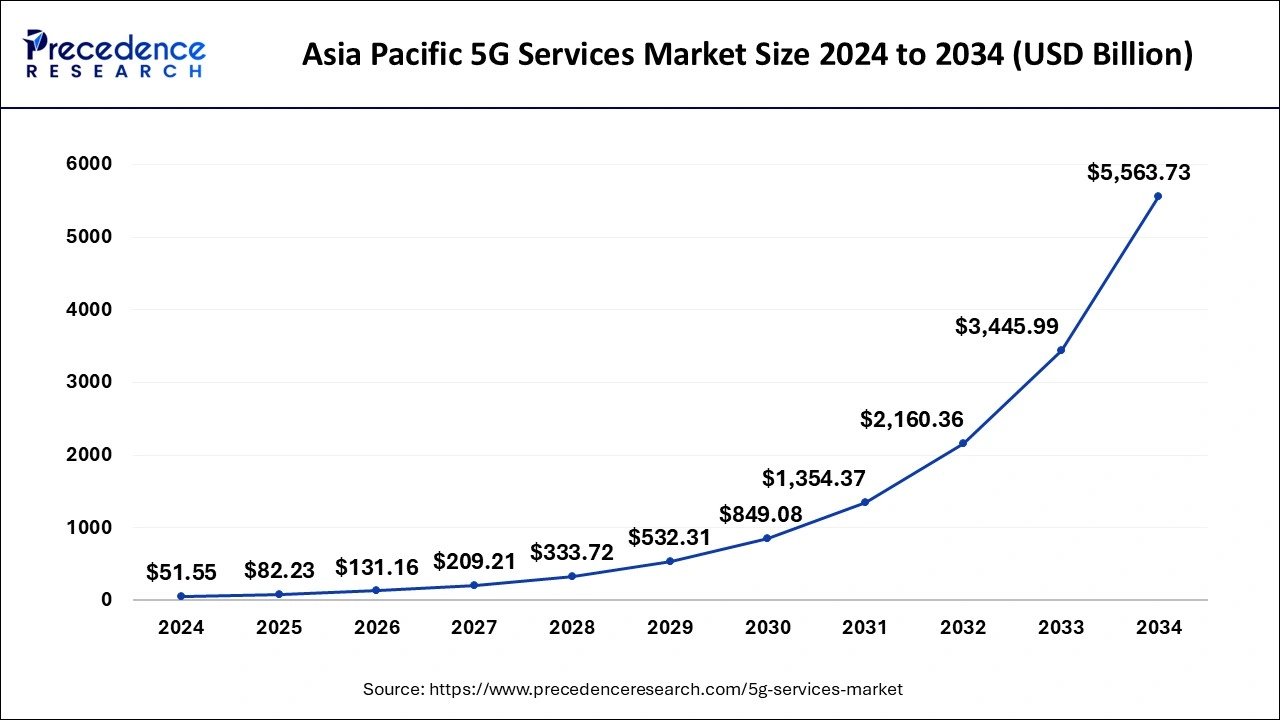

The global 5G services market size is calculated at USD 200.55 billion in 2025 and is forecasted to reach around USD 13406.58 billion by 2034, accelerating at a CAGR of 59.51% from 2025 to 2034. The Asia Pacific 5G services market size surpassed USD 82.23 billion in 2025 and is expanding at a CAGR of 59.70% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global 5G services market size was estimated at USD 125.73 billion in 2024 and is anticipated to reach around USD 13406.58 billion by 2034, expanding at a CAGR of 59.51% from 2025 to 2034.

The Asia Pacific 5G services market size was evaluated at USD 51.55 billion in 2024 and is predicted to be worth around USD 5563.73 billion by 2034, rising at a CAGR of 59.70% from 2025 to 2034.

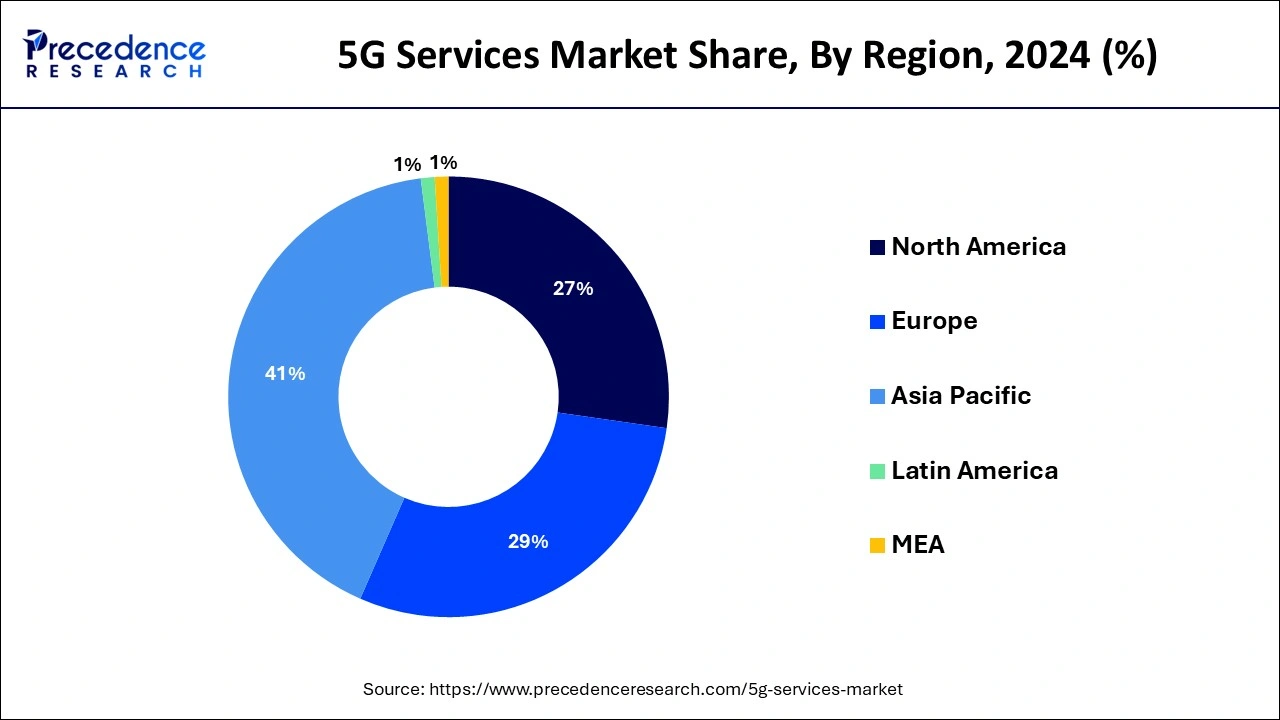

Asia-Pacific dominated the global 5G services market with the largest market share of 41% in 2024. China, Japan, and South Korea dominates the 5G services market in Asia-Pacific region. One of the significant factors driving the growth of Asia-Pacific 5G services market is the adoption of new and advanced technologies. The market players are adopting innovative technologies such as blockchain, edge computing, and 5G core technology for the development of 5G services market in the region. In addition, the expansion of information technology sector is also contributing towards the growth and development of 5G services market in Asia-Pacific region.

North America is expected to develop at the fastest rate during the forecast period. The growing demand for 5G network is driving the growth of 5G services market in North America region. As per the Ericcson’s Mobility Report from June 2019, the region would have close to 270 million 5G subscriptions, representing for about 60% of all mobile subscriptions. This shows that the region has a lot of potential for 5G services. In addition, the market players operating in Canada are spending lot of money for the development of 5G services market. For example, Rogers paid $1.7 billion in April 2019 for 20-year licenses to 600MHz spectrum in Ontario and Atlantic Canada will allow its 5G network to strengthen every industry.

The growth of global 5G services market is being driven by the growing demand for high-speed connectivity and growing data traffic. The mobile or smartphone users expect new applications such as YouTube, Flickrs, or Snapchat experiences to develop as 5G development and subscriptions reach 13 billion by the end of 2019, as per the GSA and Ericsson Survey, 2018. In addition, the growing healthcare expenditure is also driving the growth and development of global 5G services market. The National Health Expenditure Accounts of the U.S., for example, predicts the total healthcare expenditure in the nation will exceed $6.2 trillion by 2030, with a CAGR of approximately 7% from 2022 to 2030.

The connection revolutions are predicted to grow at a 3 to 4 times quicker rate than the transition to the 5G environment. This is mainly due to the rapid development of networking virtualization as well as the rising number of applications that require a latent free connection. Due to these aforementioned elements, rapid acceptance and adoption of 5G services is expected, followed by a rapid deployment of 5G services by other emerging nations.

The growing reliance on machine-to-machine communication and the growing volume of mobile data traffic are driving the worldwide 5G services market. by boosting the quantity of data transmitted across a wireless system based on high frequency and superior antenna technology, 5G services offer a fully mobile environment. The 5G services market is also developing due to the surge in demand for broadband subscriptions and the rising requirement for high speed and comprehensive network coverage. In addition, the incorporation of 5G services with internet of things in daily activities has permitted high speed data communication in applications such as smart home energy management, resulting in a 5G services marketforecast.

As various regional telecom service providers funding in next generation infrastructure deployment, the worldwide market is tremendously competitive. This will assist businesses in building a large consumer base. Additionally, to strengthen their position in the worldwide 5G services market, these key market players are actively concentrating on acquisitions and mergers. Furthermore, major market participants are spending a lot of money to get the frequency they need. The market players would be able to strengthen their overall portfolios and grow their subscriber base across multiple nations if they had appropriate spectrum.

| Report Coverage | Details |

| Market Size by 2034 | USD 13406.58 Billion |

| Market Size in 2025 | USD 200.55 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 59.51% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Communication Type, Vertical, End Users, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The enhanced mobile broadband (eMBB) segment contributed the highest market share of 47% in 2024. The enhanced Mobile Broadband (eMBB) will be first commercial 5G services to introduce as a supplement to existing 4G internet services, but they will provide far more than just greater download speeds. The enhanced Mobile Broadband (eMBB) will be one of the first 5G services, primarily as an enhancement to existing 4G services. By 2023, Ericsson predicts that 1 billion 5G eMBB subscriptions will have been purchased worldwide, with North America and Asia likely to be the first to do so.

The massive machine-type communications (mMTC) segment is projected to grow at a notable CAGR during the forecast period. The massive Machine-Type Communications (mMTC) is a sort of communication between machines that takes place through wireless or wired networks with little or no human participation. It’s a subset of machine-to-machine communication. The massive Machine-Type Communications (mMTC) is a significant step in the transition from the Internet of Things to the Internet of Everything since it focuses on wireless communication and networking among huge numbers of machines.

The IT & telecom segment held the biggest market share of 26% in 2024. Due to considerable expenditures by major companies in the modern communication technologies, the IT & telecom segment is likely to maintain its dominance over the forecast period. The IT & telecom industry is expected to rise due to rising demand for greater data speeds for commercial and households applications.

The manufacturing segment is expanding at the fastest CAGR over the forecast period. The manufacturing industry is increasingly digitizing. As a result, manufacturing lines are continually being automated in order to improve overall productivity. As a result, flawless wireless communication between sensors, robots, and other devices put in manufacturing facilities has become necessary.

By Communication Type

By Vertical

By End Users

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2024

September 2024

January 2025