List of Contents

Action Camera Market Size and Forecast 2025 to 2034

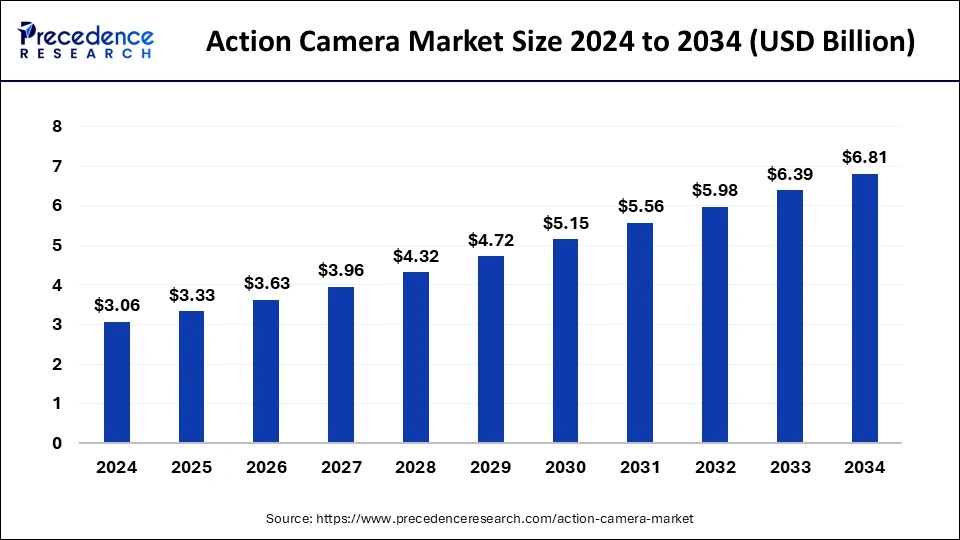

The global action camera market size was calculated at USD 3.06 billion in 2024 and is predicted to increase from USD 3.33 billion in 2025 to approximately USD 6.81 billion by 2034, expanding at a CAGR of 8.28% from 2025 to 2034.

Action Camera Market Key Takeaways

- The global action camera market was valued at USD 3.06 billion in 2024.

- It is projected to reach USD 6.81 billion by 2034.

- The market is expected to grow at a CAGR of 8.28% from 2025 to 2034.

- North America has held the highest revenue share of 30.84% in 2024.

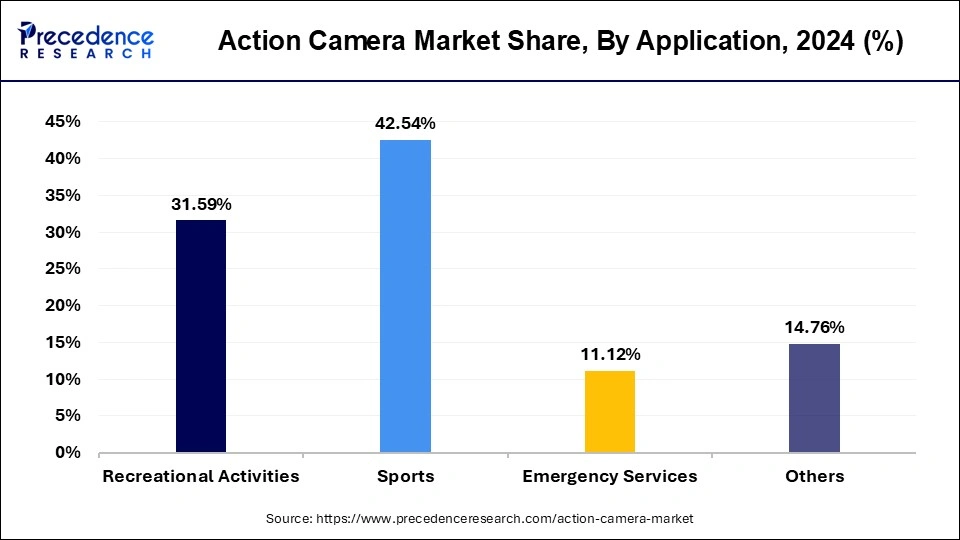

- By Application, the sports segment captured the largest market share of 42.54% in 2024.

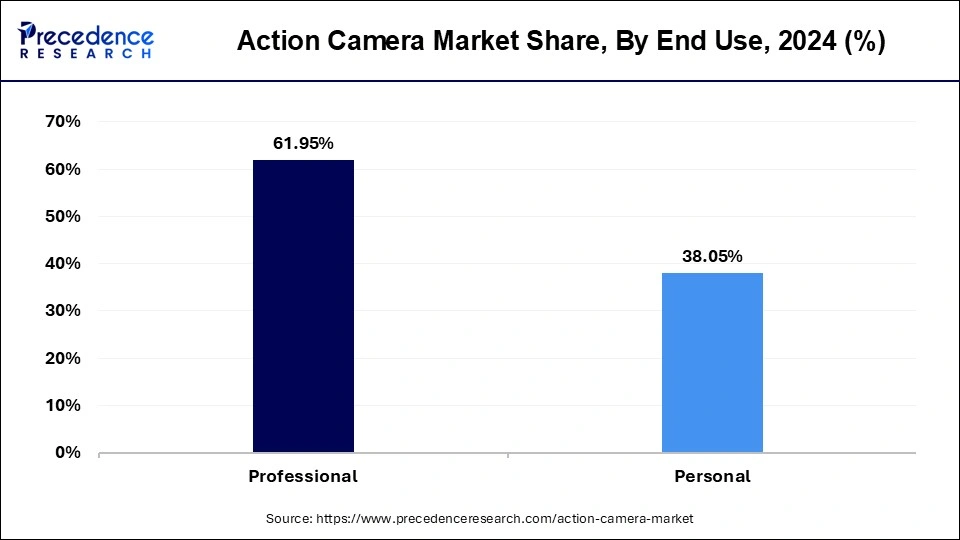

- By End Use, the global professional has held the highest revenue share of 61.95% in 2024.

AI integration in the Action Camera Market

Artificial Intelligence is transforming the action camera industry by massively upgrading the functionality, usability, and content creation ability. The action cameras are increasingly having AI-based functionality like object detection, scene recognition, and real-time video stabilization to improve the performance. Also, the voice control and gesture recognition enabled by AI ensure that the cameras are more convenient to control and use, especially in situations that are hands-free or extreme, where conventional means of controlling the cameras would be unlikely.

U.S. Action Camera Market Size and Growth 2025 to 2034

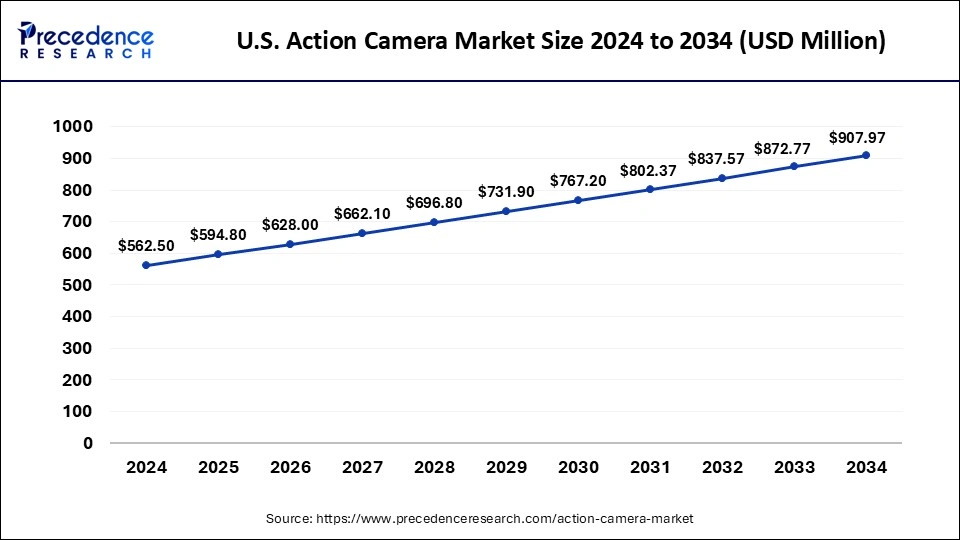

The U.S. action camera market size was evaluated at USD 562.50 million in 2024 and is projected to be worth around USD 907.97 million by 2034, growing at a CAGR of 4.81% from 2025 to 2034.

Based on region, North America dominated the global action camera market in 2024. This is attributable to the increased disposable income and increased popularity of recreational and adventurous activities such as sky diving, bungee jumping, and scuba diving among the youth. The desire to capture videos and pictures and posting them on social media is significantly boosting the demand for the action camera in the region.

On the other hand, Europe is estimated to be the most opportunistic market owing to the rising popularity and growth of the sports tourism and adventure tourism. Moreover, significant product launches in the European market by the various market players is positively influencing the market growth in the region.

North America

U.S. Action Camera Market Trends

The U.S. action camera market accounted for a dominant revenue share of the regional market in 2024, with more people being interested in adventure sports and the increased awareness about the advantages of action cameras. Competition in the market is also increased by the existence of known brands like GoPro and other upcoming competitors, and this has resulted in a low cost and variety of products in the market. Moreover, the new technological features and functionality, including the presence of waterproofing, 4K recording, and wireless connectivity, are useful in professional and end-user applications.

Europe Action Camera Market Trends

Europe is estimated to grow at the fastest CAGR during the forecast period due to the growing desire of consumers for adventure activities and the robust presence of renowned companies like GoPro, Sony, and DJI. The countries of Europe, such as Spain and Portugal, provide popular surfing locations with areas like Galicia, Peniche, and Nazare that receive surfing tourists and fans all around the world. Availability of intuitive technology like 4K and ultra HD video recordings enables the consumer to take beautiful pictures.

The market in Germany is supported by the tech-savvy and environmentally friendly population, who are highly involved in outdoor activities like cycling, hiking, skiing, and water-related activities that are greatly assisted by the use of rugged and high-quality cameras. In addition to leisure activities, action cameras are becoming commonly used in industrial areas such as manufacturing and engineering spheres in terms of safety tracking and training. Applications in motorsports, in-car recording, and insurance-related (e.g., dashcams) are also motor-related services contributing to the demand generated by the automotive industry.

Asia Pacific Action Camera Market Trends

The Asia Pacific action camera market is expected to account for a substantial market share in 2024 because of the growth of living standards and the growth of disposable incomes of the economies of the region. These developments have contributed to the increase in travel and tourism activities, which enhances the demand for special gadgets such as action cameras. Places like Thailand, Indonesia, and Japan are well-known places to have fun through diving, trekking, and skiing, thus provoking consumers to document their exciting moments and post them on social media.

China is also set to become one of the greatest markets due to the domestic tourism growing and the number of outdoor activities like hiking, skiing, and water sports growing. The popularity of available social media such as Douyin and Xiaohongshu, demand has increase, since many young people are fond of posting their way of life as well as their activities on social media. The intense pace of technological development experienced by China has brought into the market many more competitors that increase the level of competition and innovation.

- In October 2024, Insta360, a Shenzhen-based camera manufacturer, launched an addition to its Ace series of action cameras, the Insta360 Ace Pro 2 camera. This is a product co-developed with Leica and can record up to 4K60fps and 8K30fps Active HDR video at a frame rate of higher video with the help of a 1/1.3-inch 8K sensor and Leica SUMMARIT lens with a field of view of 157 degrees.

( Source- https://www.cined.com )

Market Overview

Action cameras are small, tough cameras that have a wide-angle lens that can record high-quality videos and photos, sometimes 4K. These are cameras with CMOS (complementary metal oxide semiconductor) image sensor, which allows them to be able to shoot modes such as time-lapse and burst, giving visuals that are sharp and a clear view. Action cameras are mounted on different surfaces or used as wearable devices so that they can capture immersive shots of what someone does.

The action camera market will experience massive growth, and much of that can be attributed to the phenomenon in adventure sports and outdoor recreation. As the industry of travel and tourism continues to thrive on the global scene, more adventure lovers want to grab a good and sturdy camera that will take them through the rugged/harsh weather settings of snow, rain, and even dust. These cameras have rough construction, as well as well-developed sensor technology that allows the cameras to work even in extreme climatic conditions and maintain video and image quality, which makes their application even more widespread.

Action Camera Market Growth Factors

The rising popularity of social media platforms and various short video platforms has significantly influenced the revenues of the action camera market in a positive manner. The rising penetration of internet, rising consumption of video content, availability of cheap data, increased adoption of smartphones, and rising penetration of internet has significantly contributed towards the growth of the global action camera market and is expected to grow at an exponential rate during the forecast period. The rising participation of youth in the creation of video content in order to gain popularity on social media platforms such as Instagram, Facebook, YouTube, and Tik-Tok is a major driver of the global action camera market. The growing number of social media influencers and content creators and desire to gain popularity on social media amongst the youth population is a crucial factor accountable for the increased demand for the action camera market. Moreover, the social media is also overseen as a career. Platforms such as Instagram and YouTube pays the content creators based on their views per video. Therefore, all these factors are benefiting the action camera market positively.

The rising professional activities is boosting the action camera demand. The introduction of latest technologies like VR and AR in the action camera is further boosting the sales. Moreover, the use of miniature sensors and other parts in action camera resulted in its portability, convenience, and compact size that drives the growth of the market. The introduction of Wi-Fi and Bluetooth connectivity and ability to shoot videos and photos in 4K clarity have fostered the demand for the action camera. The rising tourism activities have also boosted the sales of action camera as people now a days tends to capture photos and videos of the destinations.

The rising importance of social media marketing is another significant factor propelling the market growth indirectly. The popular brands such as Zomato, Snapchat, and Google uses social media platforms as an important medium of advertisement. Moreover, certain brands partners with the various social media influencers and content creators for the endorsement of their products. Therefore, rising investments of various companies for advertising their products and brands on different social media platforms is indirectly boosting the participation of the population in social media platforms, which in turn boosting the growth of the action camera market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.33 Billion |

| Market Size by 2034 | USD 6.81 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.28% |

| Largest Market | North America |

| Fastest Growing Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | End Use, Application, Resolution, Distribution Channel, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing use of social media platforms

Photography and video streaming are becoming an everyday routine with billions of active users on Facebook, Instagram, Twitter, Snapchat, TikTok, YouTube, and WeChat accounts. They give brands plenty of information that they use to comprehend customer interests and patterns to define product development. Social media is being exploited by professional photographers, filmmakers, and influencers who demonstrate their work within seconds to a worldwide audience.

Divers, surfers, skiers, cyclists, motor drivers, parachute jumpers, and other so-called adventure enthusiasts are among the people with action cameras who live-stream or share exclusive action-camera footage of their exploits. This has resulted in an imminent increase in the admiration of action cameras: consumers who own them can make high-quality, immersive records to satisfy social media followers.

Increasing Popularity of Adventure Sports

The major growth driver of the action camera market is the increasing popularity of adventure sports like skiing, surfing, mountain biking, and the rest of outdoor activities. The nature of these sports requires long-term, lightweight, and high-performance cameras to take pictures despite the extreme weather in immersive detail. Also, the content creation and vlogging business is reaching new heights, and hence many people are using high-end cameras to create entertainment videos, and therefore heavy demand in the market.

The demand for higher specification features such as 4K resolution and 360-degree recording facilitates continued innovation in the market. Manufacturers are coming up with projects that address consumer demand for higher image clarity and quality that immerse a viewer. On top of that, the growth of live broadcasting on social media platforms also promotes the usage of action cameras to stream adventure live.

Restraint

High Cost of Advanced Action Cameras

The expensive cost of the advanced action cameras is a huge limit to the market growth. These cameras are usually laden with high-end capabilities like 4K video recording, image stabilization, waterproofing, and rough and tough strength that add more to the costs of production, and consequently, the selling price.

Action cameras also have a low battery life, which makes it impossible to perform long activities such as hiking, skiing, or snowboarding, as these activities take longer than the usual battery life, making them stop in between recording sessions and leading to dissatisfaction by user dissatisfaction. There is also the environmental setting that may cause the camera to perform poorly due to extreme temperatures, rain, and dust, thus making it less reliable when subjected to extreme outdoor conditions.

Opportunity

Growth in Wearable Camera Models

There is a growing demand for hands-free and compact cameras that can be used by consumers to record experiences in adventure sports, travelling, as well as everyday life events in a smooth way. Wearable technologies are characterized by mobility and ease of use, which is appealing to athletes, outdoor lovers, and technology-savvy persons who require flexibility of movement without losing video quality.

Also, wireless and remote operation is increasingly common as well, allowing the user to use the controls via a smartphone application or using wearable devices to provide a more convenient experience and control over their actions when engaging in sports. Consumers are likely to use more of the action cameras as the manufacturers keep on producing a lightweight, durable, and technologically advanced wearable camera that have been known to drive growth and diversification in the action cameras market.

End Use Insights

Based on end use, the professional segment dominated the global action camera market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period.This is due to the rising adoption of photography and videography as a career opportunity among the young population. Hence, the professional segment is anticipated to register highest growth rate.

On the other hand, the personal segment is expected to be the fastest growing segment during the forecast period. This is attributed to the rising adoption of action camera among the population, rising tourism activities, rising disposable income, and rising participation in social media platforms. These factors has had significantly led to the growth of this segment.

Global Action Camera Market, By End Use, 2022-2024 (USD Million)

| By End Use | 2022 | 2023 | 2024 |

| Professional | 1,613.1 | 1,747.0 | 1,892.7 |

| Personal | 963.2 | 1,057.9 | 1,162.5 |

Application Insights

Based on application, the sports segment dominated the global action camera market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. This can be attributed to the rising sports tourism and rising number of sports enthusiasts who wants to capture the high quality pictures and videos of their sports and adventure activities such as biking, surfing, scuba diving, and skydiving.

On the other hand, the recreational activities segment is estimated to be the most opportunistic segment during the forecast period. This is attributed to the rising participation of young in various recreational activities such as dancing, swimming, hiking, and canoeing, the developed nations. The demand for the action camera for capturing good quality photos and videos during these recreational activities is fostering the action camera market growth.

Global Action Camera Market, By Application, 2022-2024 (USD Million)

| By Application | 2022 | 2023 | 2024 |

| Recreational Activities | 810.0 | 883.9 | 965.1 |

| Sports | 1,093.9 | 1,192.1 | 1,299.7 |

| Emergency Services | 287.6 | 312.4 | 339.6 |

| Others | 384.9 | 416.5 | 450.9 |

Resolution Insights

Based on resolution, the full HD segment dominated the global action camera market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. The full HD action camera is a compact and convenient camera that provides wide-angle lenses and helps the user to shoot desired quality of pictures and videos. This segment has gained immense popularity since its introduction in the market.

On the other hand, the ultra HD segment is expected to be the fastest-growing segment. The rising demand from the professionals is significantly augmenting the segment growth. The commercial use of actionable camera is growing due to the advanced features installed in the premium action cameras.

Global Action Camera Market, By Resolution, 2022-2024 (USD Million)

| By Resolution | 2022 | 2023 | 2024 |

| Full HD | 1,210.6 | 1,319.2 | 1,438.2 |

| Ultra HD | 925.7 | 1,011.5 | 1,105.7 |

| HD & SD | 440.0 | 474.2 | 511.4 |

Distribution Channel Insights

The brand outlets segment dominated the action camera market in 2023. Established brands in the action camera market often have strong visibility and recognition among consumers. Their dedicated brand outlets serve as hubs for showcasing the latest products, promoting brand identity, and engaging with customers directly. Brand outlets typically offer a wide range of action camera models, accessories, and related products, providing consumers with extensive choices and customization options. This comprehensive product availability enhances the appeal of brand outlets as one-stop destinations for all things related to action cameras.

On the other hand, the e-commerce segment is expected to expand at the fastest rate during the forecast period. E-commerce platforms provide a vast online marketplace accessible to consumers worldwide. Action camera manufacturers leverage these platforms to reach a global audience, enabling them to showcase their products to a larger customer base beyond traditional retail channels. Online shopping offers unparalleled convenience and flexibility, allowing consumers to browse, compare, and purchase action cameras from the comfort of their homes or on-the-go. E-commerce platforms provide 24/7 accessibility, enabling consumers to make purchases at their convenience without the constraints of store hours.

Global Action Camera Market, By Distribution Channel, 2022-2024 (USD Million)

| By Distribution Channel | 2022 | 2023 | 2024 |

| Brand Outlets | 871.9 | 942.8 | 1,019.4 |

| Supermarkets/Hypermarkets | 636.7 | 685.8 | 739.0 |

| E-Commerce | 573.9 | 642.4 | 719.4 |

| Speciality Stores | 493.8 | 533.9 | 577.4 |

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

In January 2020, Insta360 introduced One R Convertible Action Camera. It is a waterproof that can be used as a 360 degree capture device and can be also used as a standard action camera.

The various developmental strategies like new product launches with latest and innovative features fosters market growth and offers lucrative growth opportunities to the market players.

Recent Developments

- In September 2024, DJI announced its latest camera, the Osmo Action 5 Pro, which utilizes an innovative 1 /1.3-inch sensor type that has a 2.4 μm pixel size and a massive dynamic range of up to 13.5 stops. This means you can capture low-light and high-dynamic videos in 4K and 60fps. You can also use the SuperNight mode, which can provide clear footage in low-light situations by using AI-assisted noise-reduction algorithms.

- In September 2024, GoPro announced two cameras at launch: the advanced HERO13 Black with HB-Series Lenses, and a more basic 4k camera - the HERO. The HERO 13 has GPS built-in, a magnet latch mount, and four swappable HB-Series lens options with auto detection ensuring the ideal capture settings, an ultra-wide POV, macro with adjustable focus, and that's not an exhaustive list of features. In comparison, the HERO is extremely compact at under 100 grams and has 4K resolution and a very simple user interface.

- In November 2023, SJCAM launched the world's first dual-lens SJ20 action camera. It has an innovative night-specific lens that captures more than double the light than any of its predecessors. As more manufacturers launch similar products both regionally and globally, there is now organised competition driving prices down and broadening the user range.

Action Camera Market Companies

- Nikon Corporation

- GoPro

- Olympus Corporation

- Garmin Ltd.

- Rollei GmbH & Co. KG

- Sony Corporation

- SJCAM

- SZ DJI Technology Co.

- YI Technology

- Drift Innovation

Segments Covered in the Report

By End Use

- Professional

- Personal

By Application

- Recreational Activities

- Sports

- Emergency Services

- Others

By Resolution

- Full HD

- Ultra HD

- HD & SD

By Distribution Channel

- Brand Outlets

- Supermarkets/Hypermarkets

- E-Commerce

- Speciality Stores

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client