What is the Additive Manufacturing Market Size?

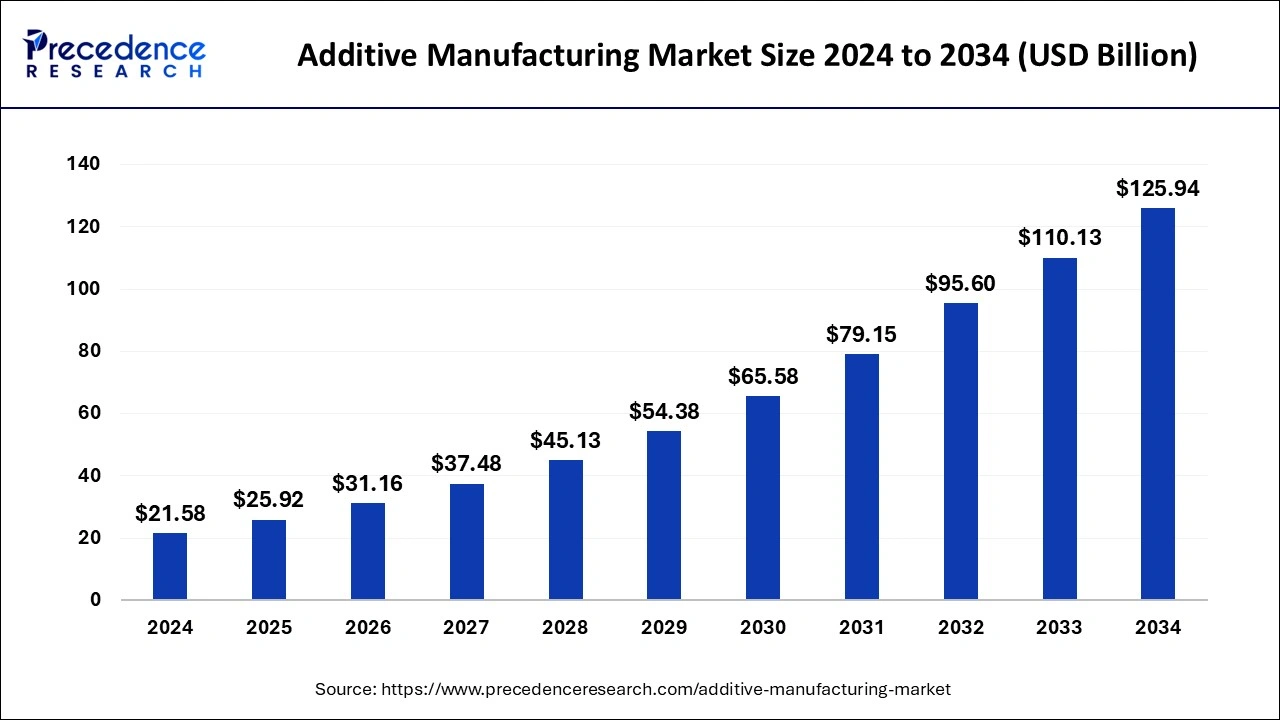

The global additive manufacturing market size is valued at USD 25.92 billion in 2025 and is predicted to increase from USD 31.16 billion in 2026 to approximately USD 125.94 billion by 2034, expanding at a CAGR of 19.29% from 2025 to 2034.

Additive Manufacturing MarketKey Takeaways

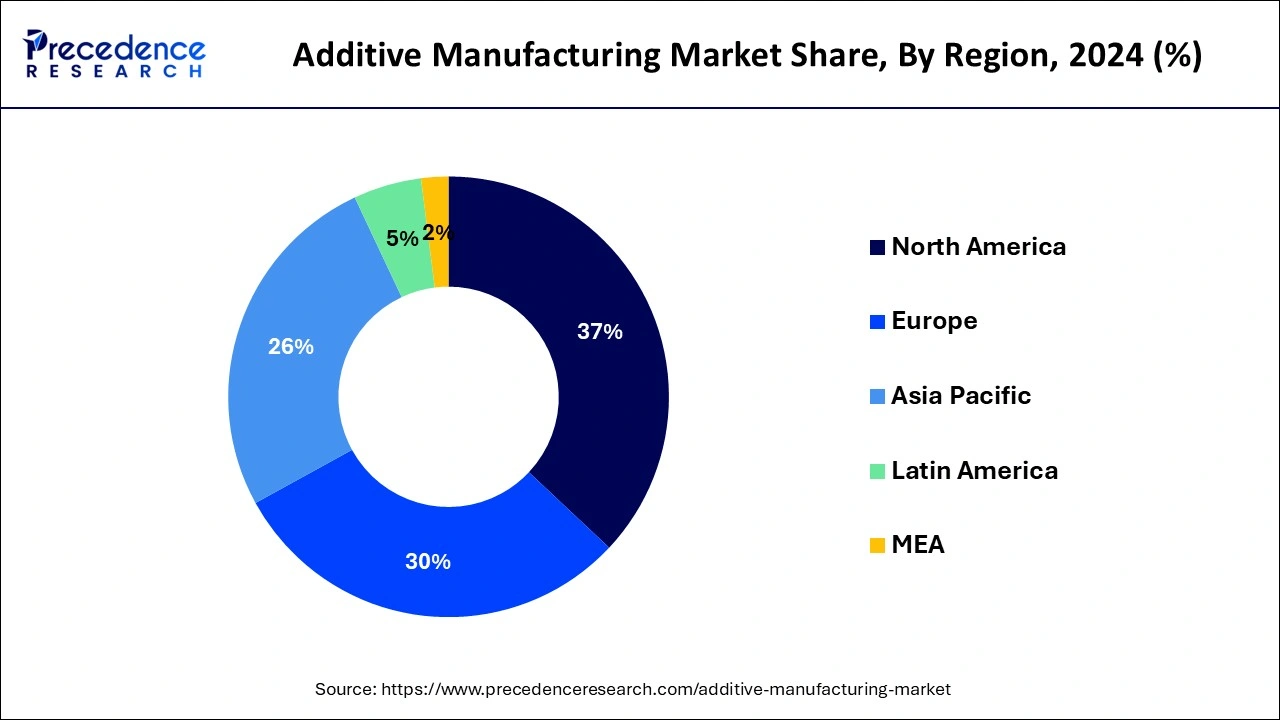

- North America led the market and contributed more than 37% in 2024.

- Asia Pacific is expected to witness the highest CAGR throughout the forecast period.

- By Component, the hardware segment captured the largest market share of 61% in 2024.

- By Component, the software segment is expected to expand at the fastest CAGR of growth during the forecast period.

- By Printer Type, the industrial 3D printer segment registered more than 65% of revenue share in 2024.

- By Printer Type, the desktop 3D printer segment is expected to grow at a significant CAGR during the forecast period.

- By Technology, the stereolithography segment led the global market in 2024.

- By Software, the design software segment has led the market in 2024 with the biggest market share of 32%.

- By Application, the prototyping segment led the market with the highest market share of 57% in 2024.

- By Vertical, the automotive segment had the biggest market share of 22% in 2024.

- By Material, the metal segment dominated the market in 2024 and the segment is expected to sustain the position throughout the forecast period.

What are the Significant Advances in Additive Manufacturing?

Additive manufacturing is the industrial production process used by several industry verticals such as automotive, aerospace, defense, consumer electronic products, etc. Additive manufacturing revolves around the creation of an object by generating one layer at a time. Additive manufacturing typically refers to 3D printing. The emergence of 3D printing with technological advancements has highlighted the importance of additive manufacturing processes. Additive manufacturing is basically made to scale the model of the final product at a robust pace without spending on the cost of creating a prototype and a typical setup process. This saves up the overall cost of the manufacturing process by promoting speedy manufacturing for end-user industries.

Additive manufacturing is used for making a prototype of an object by creating a design. The design is basically made by using applications such as computer aided designs, software or just by scanning an object that has to be printed. Additive manufacturing can be used by any kind of materials such as metals, polymers, ceramic, foams, gels, and also biometrics.

Additive Manufacturing Market Growth Factors

- Attraction of investments and funding into 3D printing companies and startups spurs innovation which is observed to offer a growth factor for the market's expansion.

- Moreover, industries such as defense and aerospace are using 3D printing for lightweight components and complex parts, reducing fuel consumption and improving efficiency. The expansion of end-users in the market is observed to promote the market's growth.

- The healthcare sector is embracing 3D printing for patient-specific implants, prosthetics, and pharmaceuticals, driving market growth. The ability to quickly prototype and manufacture small batches of products at a lower cost is attractive to various industries, including automotive and aerospace.

Additive Manufacturing Market Outlook:

- Global Expansion: Increasing demand for faster prototyping, personalised products, and advancements in multi-material printing are assisting the comprehensive progression.

- Major Investors: In April 2025, Fabheads, the Indian company, secured a Series A funding round of $10 million from investors, including Accel.

- Startup Ecosystem: Metafold 3D, a Canadian startup that offers design for additive manufacturing (DfAM) software and a cloud-based API.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 19.29% |

| Market Size in 2025 | USD 25.92 Billion |

| Market Size in 2026 | USD 31.16 Billion |

| Market Size by 2034 | USD 125.94 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Component, By Printer Type, By Technology, By Software, By Application, By Vertical, and By Material |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Environmental benefits offered by additive manufacturing

Businesses looking to increase manufacturing sustainability have an advantage owing to additive manufacturing's favorable environmental effects. Compared to conventional production, additive manufacturing offers a number of advantageous environmental advantages. The two most notable ones are energy and waste minimization. Comparatively, additive manufacturing technologies are more effective and dramatically lessen the environmental impact of waste products than traditional manufacturing procedures.

As additive manufacturing only uses what is necessary to make a product, it has a higher material efficiency. Compared to conventional production, additive manufacturing offers a number of advantageous environmental advantages. The two most notable ones are energy and waste minimization. Therefore, as manufacturers start focusing on the development by considering sustainability, the market is expected to be accelerated while offering environmental benefits.

Restraint

Limited availability of material for additive manufacturing

With the expanding industrial process and technology, there is increasing demand for materials that are used in the additive manufacturing process. However, the process of selection of material is limited and this impacts the manufacturing process of the industry which is restraining the growth of the additive manufacturing market. As compared to the conventional method of manufacturing, additive manufacturing is newer to the industry. Thus, limitations in supply chain and logistics can also harm the expansion of the market by acting as a major restraint for the market.

Opportunity

Emergence of power bed fusion

For printing one-off parts including machine parts, jigs, and fixtures, powder bed fusion is generally employed for low-volume functional parts across industries. The mechanical qualities of components made by powder bed fusion 3D printing are comparable to those of casting and machining. Power bed fusion also supports a variety of materials and allows for the concurrent development of several pieces. The three power bed fusion techniques that are used most frequently are selective laser sintering (SLS), electron beam melting, and selective laser melting.

The field has made improvements in powder purity and size dispersion. Enhanced powder qualities will increase the use cases for PBF, even though hardware advancements greatly speed up its uses. Additionally, in order to make PBF more accessible, entrepreneurs are creating low-cost 3D printing materials. Thus, the emergence of power bed fusion technique is observed to offer lucrative opportunities for the market.

Component Insights

The hardware segment has dominated the market with the highest market share of 61% in 2024. An increase in rapid prototyping and expanding manufacturing sectors drives the growth of the hardware segment in the additive manufacturing market. The overall development and advancements in hardware platforms for additive manufacturing supplement the growth of the segment.

The software segment is expected to significantly grow during the forecast period. There are several software programs used in additive manufacturing such as computer-aided design software used for the 3D model modification of the object to be printed. 3D object scanner software is used for capturing the shape or dimension of the object and converting it into digital models. Build preparation software works in the optimization of orientation, design, support structure, and slicing up the 3D models for the printing process. Simulation software is used to analyze and predict the performance, behavior, and quality of the printed object. The post-processing software is used for the planning and execution of final steps such as policing, painting, and CNC machining of the printed object.

Printer Type Insights

The industrial 3D printer segment dominated the market with the highest market share of 66% in 2024. The dominance of the segment is attributed to the rising adoption of industrial 3D printers as compared to CNC milling and injection molding. 3-D printers are specifically used for the detailing part of the full-size model and make it for the perfect prototype and the production of the high-quality part. The cost of the industrial varies according to the planning of production and or the prototype. There are several types of industrial 3D printer processes like fused deposition modeling, resin 3D printing, selective laser sintering, and material jetting metal 3D printing.

- In August 2023, a major industry player in the 3D printing technology Coolsiga announced the launch of FinderOne 136, it is a cutting-edge innovation in high-speed LCD 3D printer that help to revolutionize the world of additive manufacturing, the product is made for the moving forward for the boundaries of innovation. The printer is the combination of unprecedented speed, unrivaled convenience, and unmatched precision.

On the other hand, the desktop 3D printer segment is expected to grow at a significant rate during the forecast period. The growth of the segment is attributed to the rising use of desktop 3D printing for small-scale purposes. The use of desktop 3D printing in small-scale business to increase the operational level of the business and the use of desktop 3D printing in educational institutes, schools, and university for research and technical training purposes driving the growth of the segment. The desktop 3D printers are convenient and small in size and can be made 3D objects on a desk. There are several types of material which are used in desktop 3D printers like filament or resin.

Technology Insights

The stereolithography segment dominated the market in 2024. Stereolithography is considered to be the very first technology in conventional printing technologies. The stereolithography makes operational work easier. The technology which is used for converting liquid plastic into a solid object by the SLA machine works with the liquid plastics in which some of the it hardened to form a solid object. There are four main parts of the SLA machine, tank which is used to fill a liquid plastic, a penetrated platform which is lowered into the tank, ultraviolet, lesser, and the platform which are further controlled by the computer. Stereolithography is considered as one of the ideal technologies for creating a prototype due to its higher accuracy, durability and cost-effective manufacturing.

Software Insights

The design software segment dominated the market with the highest market share of 32% in 2024and the segment is expected to generate a significant revenue throughout the forecast period. The growth of the segment is attributed to the rising adoption of design software by industries such as consumer electronic products, automotive, healthcare, and aerospace. There are several software designs that are used in the additive manufacturing process. The design software is considered as the filling gap or the bridge between the printed object and the hardware. Software designs printed software, scanning software, and inspection software are a few major types of design software, widely used in the additive manufacturing process. Among all, the utilization of scanning software is being highlighted in the market due to the rising trends for scanning and storing documents.

Application Insights

The prototyping segment dominated the market with the largest market share of 57% in 2024. The growth of the segment is attributed to the extensive use of the prototype process in industries like automotive aerospace and defense for the designing and development of the components, parts, and complex system. Prototyping is used for higher accuracy in the final product. Prototyping in additive manufacturing speeds up the process of product development and accelerates the overall production process for the end-user industry. There are several advantages of prototyping in additive manufacturing such as rapid prototyping that speeds up the development cycle, prototyping is used purely for modeling, and all types of prototypes are faster and cost-effective. Prototyping is a cost variable according to the technology, design, and materials. Prototyping a new design can identify the mistakes and flaws in the main object which can save time, and money, and make an error-free object.

A major key player in low-volume production services and the rapid prototyping services “Proteck” announced the launch of its latest rapid quoting platform for additive manufacturing (3D printing) services. The technology is developed for giving the respond to consumer demand rapidly and streamlining the process in production and prototyping.

Vertical Insights

The automotive segment dominated the market in 2024, the segment is expected to sustain the position throughout the forecast period. The growth of the segment is attributed to the maximum use of overall additive manufacturing process in the automotive industry. The automotive industry almost occupies $550 million worth of 3D printing materials in 2021. There are several steps which are beneficial in the incorporation of the additive in manufacturing strategies. These are some of the key strategies used by the automotive industry for better productivity such as speeding up prototyping, simplifying the supply chain, light-weighting and supporting customization. In addition, the development of electric vehicles in the automotive industry that requires comparatively light-weight automotive parts is observed to promote the segment's growth.

Material Insights

The metal segment dominated the market with the biggest market share of 52% in 2024 and the segment is expected to sustain the position during the forecast period. The growth of the metal material segment is attributed to the substantial use of metal material in an additive manufacturing process in major industries such as automotive, consumer electronics, etc. Metal additive manufacturing is also known as the metal 3D printing. In metal additive manufacturing, it uses heat sources like electrons or lesser beams for heating of meal to wire or powder form so it can transform to the object. There are several ranges of applications in which metal additive manufacturing is used, which includes the production of models and prototypes. The availability of metal materials with offered sustainability promotes the segment's growth.

- In September 2023, TCT Asia 2023 a China-based major additive manufacturing event, Farsoon teases the launch of a 16-laser metal powder bed fusion 3D printer. With the assessment of the Chinese largest trend in the additive manufacturing market, it also shows the details of the flight technology and gives hints for the upcoming innovations in Farsoon.

Regional Insights

U.S. Additive Manufacturing Market and Growth 2025 to 2034

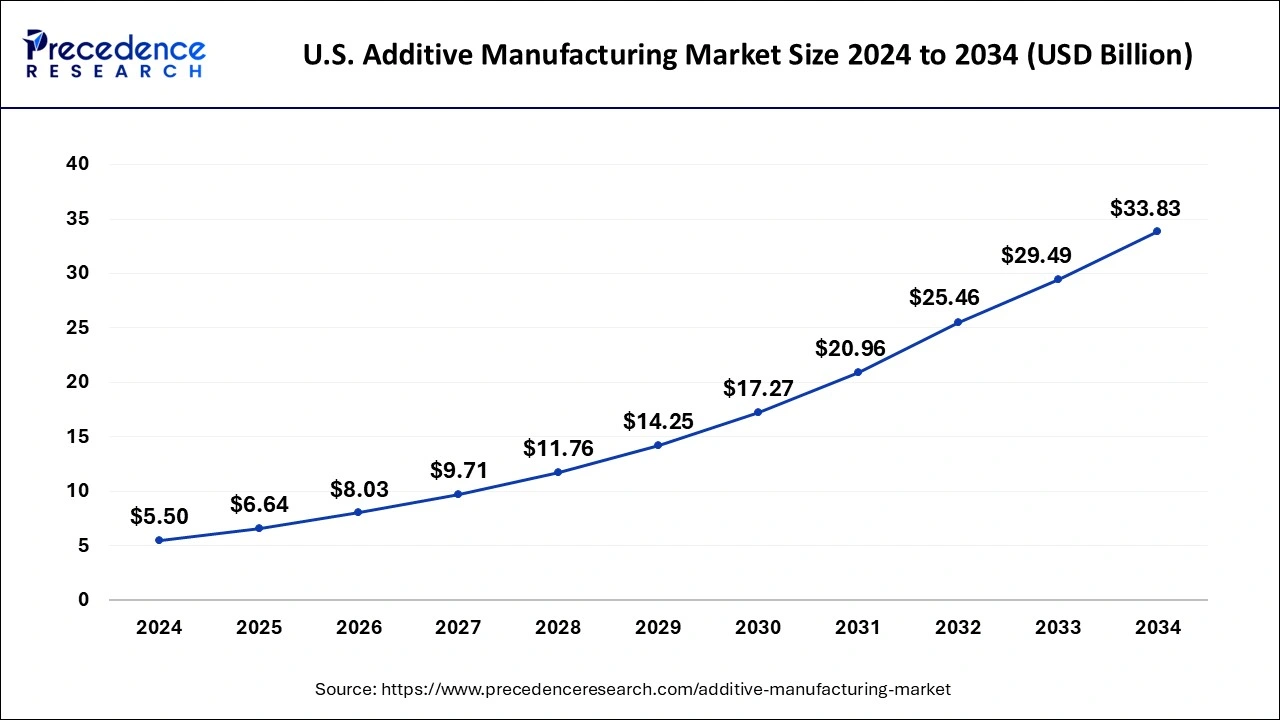

The U.S. additive manufacturing market size accounted for USD 6.64 billion in 2025 and is estimated to reach around USD 33.83 billion by 2034, growing at a CAGR of 19.92% from 2025 to 2034.

Why did North America hold a Major Share of the Market in 2024?

North America dominated the market with the largest market share of 37% in 2024. The region is expected to sustain its position throughout the forecast period. The growth of the market in the region is expected to increase due to the rising adoption of advanced technologies by the number of industries in the region. The expansion of manufacturing processes with product demand such as automotive, consumer goods, aerospace and defense and healthcare in North America is boosting the utilization of 3D printing in these industries, this element is expected to continue the dominance of the market in the region. Preferably, the United States and Canada with the presence of major economies and well-established manufacturing industries are observed to be the largest contributors to the market during the forecast period. Multiple manufacturing industries in the region are emphasizing sustainable manufacturing processes, this element will supplement the market's expansion in the upcoming years.

In Youngstown, Ohio, the EGCC's director of workforce Amelia Taggart stated that they are ready to serve as the Tradesman Series P3-44 core of new additive centers at Juggerbot 3D in Youngstown.

Supportive Governments for Sustainable Processes are Supporting the Asia Pacific

Asia Pacific is expected to witness a highest CAGR during the forecast period. The growth of the market in the region is attributed to the rapidly expanding industrialization and acceptance of technologies in multiple end-user industries, the rising urbanization is highly contributing to the growth of the additive manufacturing market in Asia Pacific. Multiple governments support sustainable manufacturing processes, which supplements the growth of the market in the region.

Immersive Navy Applications: U.S. Market Analysis

A substantial growth of the U.S. market has been leveraged by the adoption of additive manufacturing solutions in the Navy, which has importance in on-demand parts production to prevent supply chain concerns at sea and in remote locations. Alongside, the Navy has also purchased systems that alter standard metal bar stock into AM-grade powder for expeditionary use.

Robust Materials & Processes: Japanese Market Trend

The additive manufacturing market is prominently experiencing the highest expansion, with efforts being put into materials, like magnesium alloy printing. Mitsubishi Electric, partnered with the Japan Aerospace Exploration Agency (JAXA), established the industry's first high-precision technology for 3D printing magnesium alloys using the directed energy deposition (DED) method.

A Surge in Research & Development Approaches is Fostering Europe

A notable growth of the market in Europe is driven by the ongoing R&D efforts, including the EU investment in the "In-Shape" project, which emphasised optimizing metal powder bed fusion processes to be seven times faster, 50% cheaper, and more energy-efficient. However, the Fraunhofer Research Institute in Germany developed new processes for the rapid production of large-scale metal and ceramic components and integrated AI for process monitoring and defect detection.

Widespread Applications in the Aerospace Sector: UK Market Trend

The UK market has been bolstering extensive additive manufacturing in aerospace, such as Cranfield University and BAE Systems, were collaborated to 3D print a 1.2-meter titanium wing spar in just 37 hours using Wire and Arc Additive Manufacturing (WAAM), presenting the possibility to evolve large, durable parts for significant applications.

Key Players Offerings:

- Stratasys, Ltd.- A major company offers a variety of D printing technologies and materials for the entire product lifecycle, from prototyping to production.

- Materialise NV- It primarily explores different software solutions for build preparation and workflow management, like Magics & CO-AM Platform.

- EnvisionTec, Inc.- A leader explored the specialised 3D Bioplotter for biomedical applications, and the Viridis 3D printer for developing sand molds and cores for foundries.

- 3D Systems, Inc.- This usually provides numerous 3D printers (SLA, SLS, DMP, etc.), a broad portfolio of materials (plastics, metals, composites, etc.), and advanced software.

- GE Additive- It facilitated Direct Metal laser Melting (DMLM) and Electron Beam Melting.

Additive Manufacturing Market Companies

- Stratasys, Ltd.

- Materialise NV

- EnvisionTec, Inc.

- 3D Systems, Inc.

- GE Additive

- Autodesk Inc.

- Made In Space

- Canon Inc.

- Voxeljet AG

Recent Developments

- In September 2023, Redwire launched the first 3D bioprinted human knee meniscus in orbit. The launched product is made on the International Space Station (ISS) 3D Biofabrication Facility (BFF). Redwire has developed 20 research facilities for the International Space Station (ISS) and of the 20, 10 are already operating on the station.

- In September 2023, a major worldwide supplier and manufacturer of piezoelectric, and it subordinated of FUJIFILM Corporation “FUJIFILM Dimatix, Inc” had successfully launched FUJIFILM Dimatix STARFIRE SG1024 L3F, the launch is for the consumer expectation of increased performance printheads used for the additive manufacturing including metal binder jetting and sand casting.

- In September 2023, a major Germany digital manufacturing company “Replique” which works on making a simple and sustainable industrial process supports an HP's leading industry Multi Jet Fusion technology has launched the personalized 3D printed wheelchair.

Segments Covered in the Report

By Component

- Hardware

- Software

- Services

By Printer Type

- Desktop 3D Printer

- Industrial 3D Printer

By Technology

- Stereolithography

- Fuse Deposition Modeling

- Selective Laser Sintering

- Direct Metal Laser Sintering

- Polyjet Printing

- Inkjet Printing

- Electron Beam Melting

- Laser Metal Deposition

- Digital Light Processing

- Laminated Object Manufacturing

- Others

By Software

- Design Software

- Inspection Software

- Printer Software

- Scanning Software

By Application

- Prototyping

- Tooling

- Functional Parts

By Vertical

- Industrial Additive Manufacturing

- Automotive

- Aerospace & Defense

- Healthcare

- Consumer Electronics

- Power & Energy

- Others

- Desktop Additive Manufacturing

- Educational Purpose

- Fashion & Jewelry

- Objects

- Dental

- Food

- Others

By Material

- Polymer

- Metal

- Ceramic

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344