April 2025

Adhesives and Sealants Market By Product (PVA, Epoxy, Acrylic, Styrenic block, PU, EVA, Others) By Technology (Solvent based, Water based, Hot melt, and Reactive, Others) By Application (Packaging, Pressure Sensitive, Furniture, Construction, Footwear, Automotive, Others) Sealants Market Product (PU, Silicone, Acrylic, PVA, Others) By Application (Automotive, Construction, Assembly, Packaging, Consumers, Others) - Global Market Size, Share, Trends Analysis, Regional Outlook and Forecast 2024 - 2034

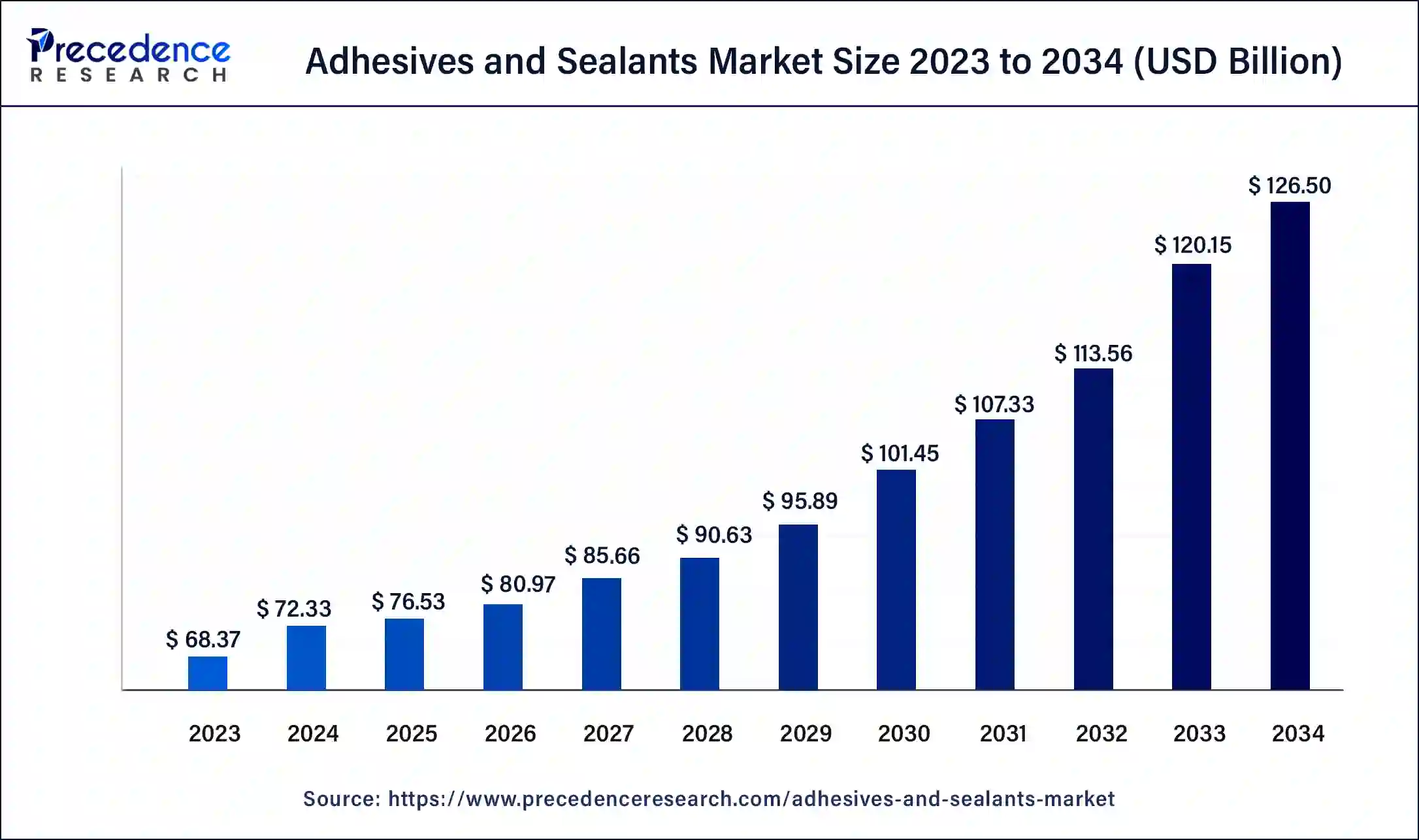

The global adhesives and sealants market size was USD 68.37 billion in 2023, accounted for USD 72.33 billion in 2024, and is expected to reach around USD 126.50 billion by 2034, expanding at a CAGR of 5.7% from 2024 to 2034.

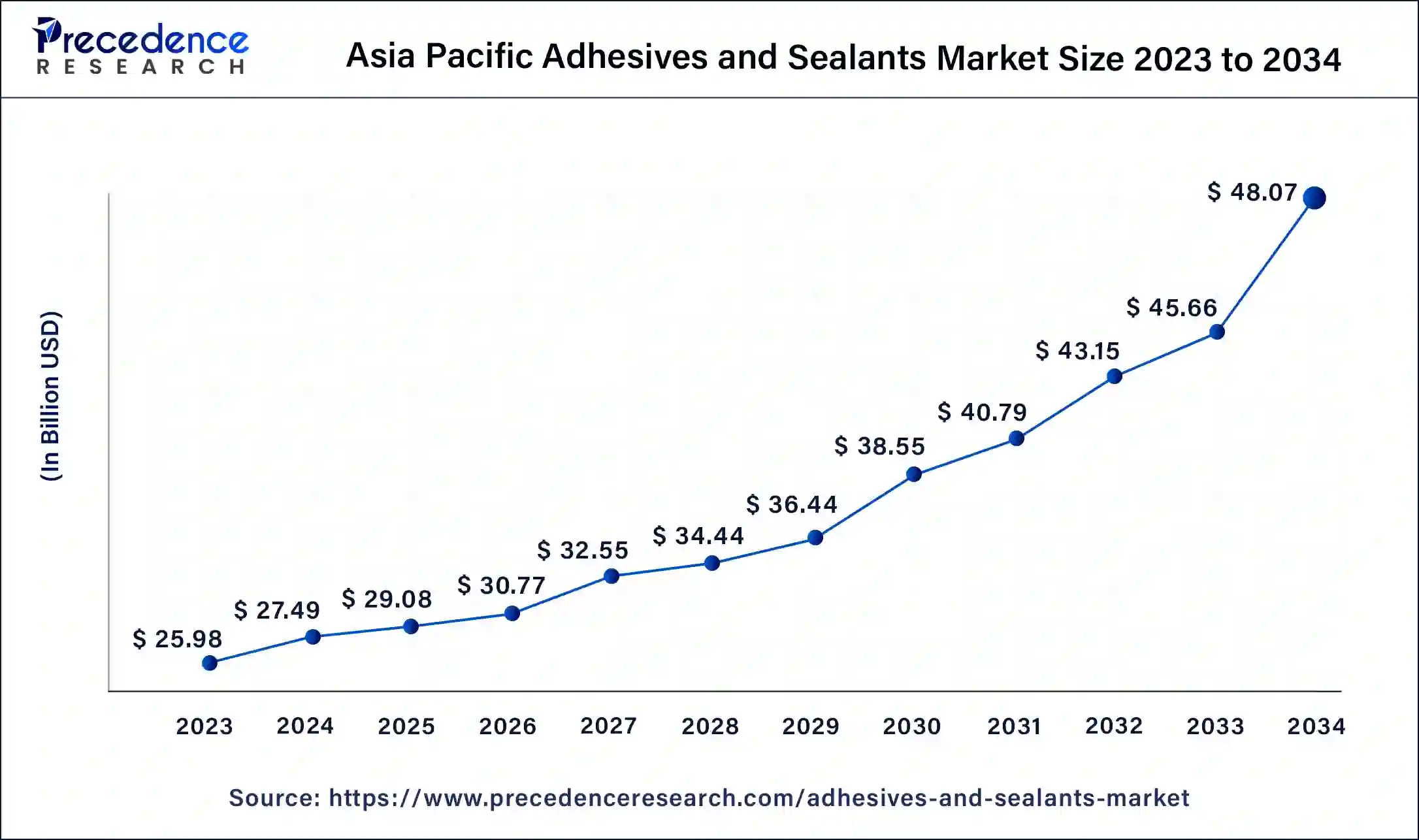

The Asia Pacific adhesives and sealants market size was estimated at USD 25.98 billion in 2023 and is predicted to be worth around USD 48.07 billion by 2034, at a CAGR of 5.9% from 2024 to 2034.

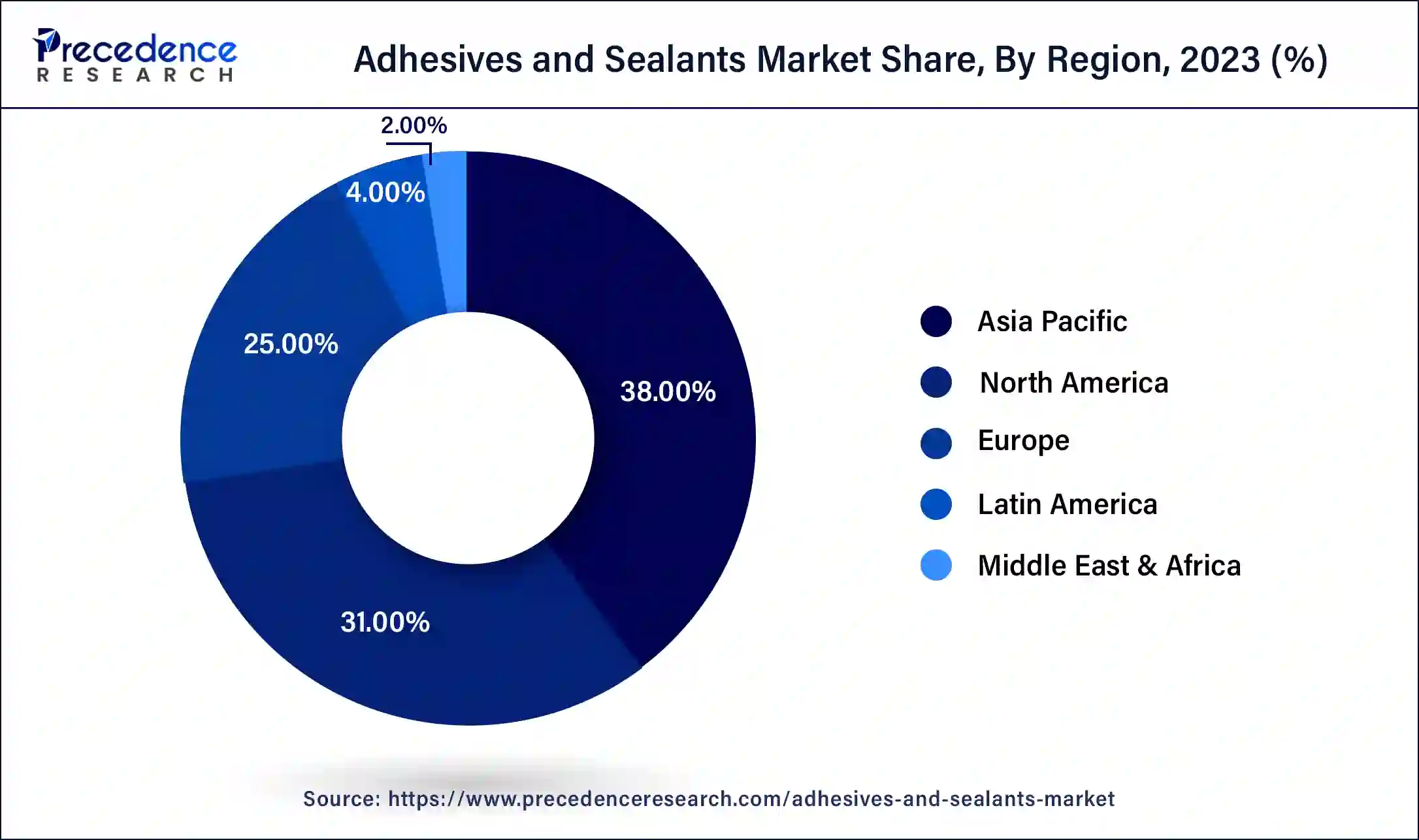

Based on region, the Asia Pacific adhesives market anticipated to register the highest growth over the forthcoming years. Rapid industrialization, rise in manufacturing output, and strong GDP growth projected to boost the growth of the region. Besides this, supportive government policies predicted to propel the demand of adhesives in construction industry that in turn expected to support the product penetration in the region.

Moreover, the Asia Pacific region is also a front-runner in the sealants market in 2023 with India, china, and Japan as the prime countries that contribute towards the revenue growth. The flourishing manufacturing sector anticipated to fuel the sealants demand from industrial machinery, automotive, and electrical &electronics industries. In the recent past, India and China have witnessed a spike in automotive production because of technology transfer to the sector from western markets. This has enhanced the manufacturing capabilities of the sector leading to boost the overall sales of automobiles in the region.

On the other hand, Europe considered as a significant market for adhesives because of a hub of large number of automobile manufacturers in the region. Adhesives have large application in the automotive industry that include friction, metal/composites bonding, glass, headlight assembly, exterior trims, interiors, body sealing, electrical motors & components, and noise vibration harshness. In terms of sealants, North America examined as the largest market with a revenue share of nearly 23%. This is attributed to the significant presence of end-use industries along with increased spending in the construction sector.

Increasing penetration of lightweight passenger vehicles together with lower emissions and higher fuel economy drives the sale of high-performance adhesives across the global automotive industry. These adhesives find numerous applications in both interior and exterior applications in the automotive industry. For instance, they can be used as a substitute of nuts & bolts in a vehicle that significantly reduces its weight and resulting in an improved fuel economy of vehicles. Consequently, traditional welding as well as other mechanical fastening methods predicted to be replaced by the enhanced adhesive materials with superior bonding capabilities.

The adhesives and sealants are prominently used for attaching drywall, tiling applications, bathroom flooring, ceiling applications, fixtures to walls, and molding applications in the construction sector. Thus, rapid growth in the construction industry particularly in the developing countries such as China and India projected to offer lucrative growth opportunities in the near future.

| Report Highlights | Details |

| Market Size in 2023 | USD 68.37 Billion |

| Market Size in 2024 | USD 72.33 Billion |

| Market Size by 2034 | USD 120.15 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.7% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product, and By Application |

Water-based technology led the market in the year 2023. In this technology, water is used as a diluting medium or carrier and allowed to set by evaporation or absorbed by the substrate. Furthermore, they reduce Volatile Organic Compound (VOC) emissions, increasing environmental awareness, and stringent government regulations are predicted to boost the growth of the segment in the forthcoming years.

In terms of revenue, hot melt technology expected to witness a growth rate of approximately 8% over the analysis period because of its excellent properties. They form rapid bond and therefore are implemented in highly automated manufacturing processes that include converting, assembly, bookbinding, packaging, and footwear.

Pressure-sensitive applications of adhesives captured a prominent value share in 2023. In this application, when pressure is applied to the adhesives, they form a bond with the adherent. Water or any other type of solvent is not required for this application. In addition, prominent demand for automotive interior trim assembly, safety labels for power equipment, pressure sensitive tapes, and sound or vibration damping films anticipated to propel the growth of the segment.

Moreover, the automotive adhesives market predicted to register the highest growth over the forecast period. Recent technological advancements in adhesive and sealants have helped to reduce the frequency of spot welding by almost 50% that has helped notably in reducing the overall weight of vehicles. In addition, stringent regulations in the U.S. for improved fuel efficiency have prompted leading manufacturers in the automotive industry to reduce the weight of automobiles thus prospering the demand of automotive adhesives and sealants. Further, an escalating growth of the automobile industry particularly in the BRIC nations expected to foster the growth of the segment over the analysis period.

Segments Covered in the Report

By Adhesives Product

By Adhesives Technology

By Adhesives Application

By Sealants Product

By Sealants Application

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

October 2024

January 2025

October 2024