September 2024

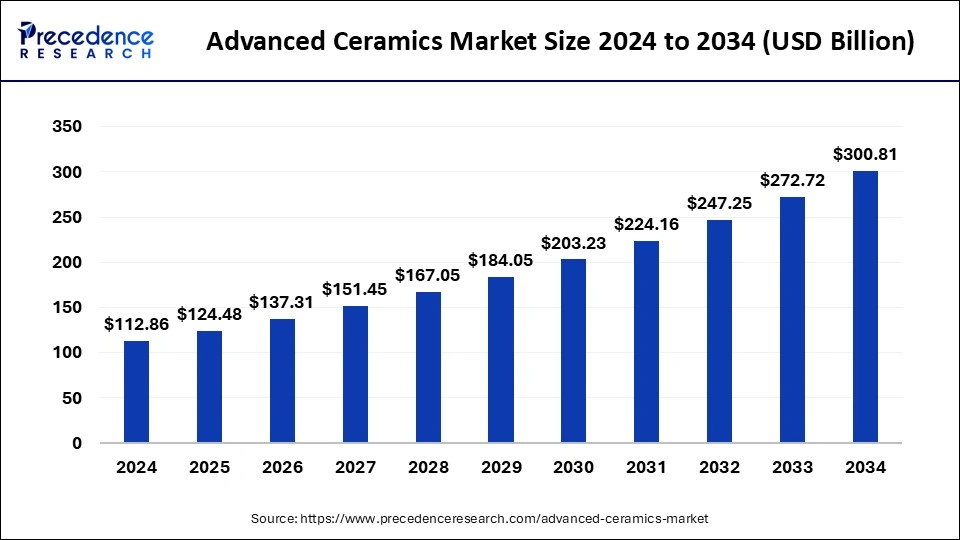

The global advanced ceramics market size is calculated at USD 124.48 billion in 2025 and is forecasted to reach around USD 300.81 billion by 2034, accelerating at a CAGR of 10.38% from 2025 to 2034. The North America market size surpassed USD 42.89 billion in 2024 and is expanding at a CAGR of 10.50% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global advanced ceramics market size was estimated at USD 112.86 billion in 2024 and is predicted to increase from USD 124.48 billion in 2025 to approximately USD 300.81 billion by 2034, expanding at a CAGR of 10.30% from 2025 to 2034.

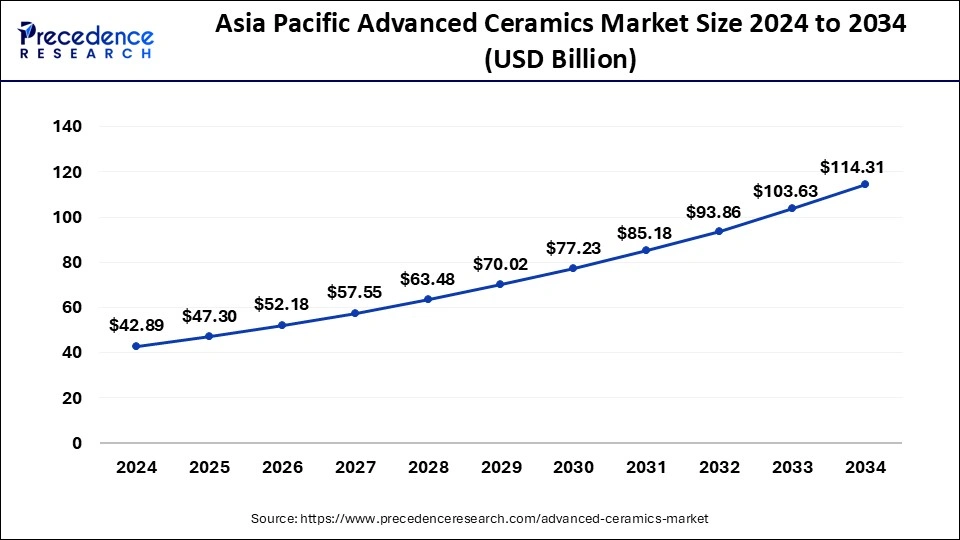

The Asia Pacific advanced ceramics market size was estimated at USD 42.89 billion in 2024 and is predicted to be worth around USD 114.31 billion by 2034, at a CAGR of 10.5% from 2024 to 2034.

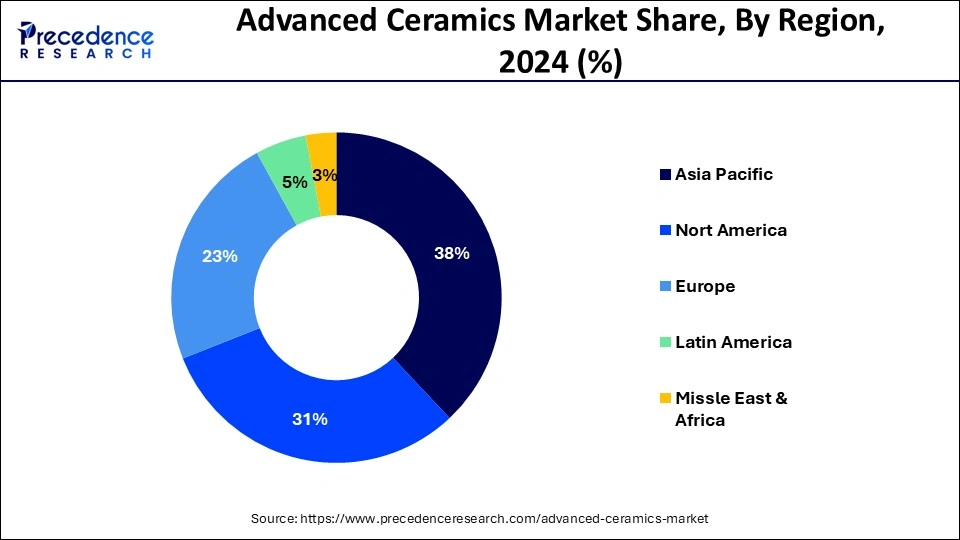

The Asia Pacific emerged as the largest advanced ceramic market accounting for a value share of around 38% in 2024. Further, the region is expected to retain its position during the forthcoming years because of prominent growth in the automotive and electrical &electronics industries, especially in India and China. The region has been a prominent contributor in the electronics industry owing to the excellent demand of consumer electronic devices, particularly in the emerging countries such as India, China, and Thailand.

North America expected to register significant growth in the industry in the wake of increasing healthcare awareness along with the rising electronics industry in the region. Although the electronics industry in North America is relatively matured, the product demand for various electronic devices set to escalate due to rising penetration of smart homes and smart offices in the region.

Increasing demand of advanced ceramics from various industries that include electronics, heavy machinery, cutting tools, automotive, energy, and defense is a key factor that impels the growth of the market. Further, the growth of the industry is largely dependent on the dynamics of the electronic devices & electrical equipment that accounted for more than 70.0% of the total product demand in the year 2018. Products that are made from advanced ceramics for example electrical conductive elastomers are increasingly used in lamps, wire insulation, cell phones, lighting, power distribution, and inter-connectors because of their superior dielectric properties as well as good thermal stability.

| Report Highlights | Details |

| Market Size in 2034 | USD 300.81 Billion |

| Market Size in 2025 | USD 124.48 Billion |

| Market Size by 2024 | USD 112.86 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 10.3% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Material, Application, End User, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

The monolithics segment was examined as the largest revenue contributor in the year 2024 and accounted for nearly 80% of value share in that year. Increasing product utilization in the electronics & electrical sector, especially in the developing countries of the Asia Pacific expected to fuel its demand over the forthcoming years. Some of the major types of product are silicon carbide zirconium, silicon nitride, and zirconium carbide. These materials possess favorable properties for industrial use such as wear, durability, reliability, and high-temperature resistance.

On the contrary, ceramic matrix composites estimated to be the fastest growing segment with a CAGR of around 11% over the analysis period. They are mostly preferred in applications such as mechanical, environment, chemical, aerospace, defense, and energy because of their superior properties that include high strength along with excellent heat &wear resistance. Further, the segment registers an extensive Research & Development (R&D) processes for the development of advanced products that acts as an effective alternative for the metal alloys in hot zone structures.

Based on material, alumina led the global advanced ceramics market in 2024, accounting for a value share of 35% that year. Alumina or aluminum oxide refers to an advanced engineering material that possesses excellent wear resistance property. Moreover, high-cost effectiveness of the material plays a significant role in its extensive application in numerous end-use industries.

Titanate segment projected to grow at a rapid pace over the upcoming years witnessing a CAGR of around 11.0%. Titanate or aluminum titanate has the most vibrant thermal shock resistance compared to other materials across the world. Hence, the components made using this material likely to withstand extremely high temperatures of around several hundred degrees. The U.S. is the most prominent region in this material segment and further its demand predicted to rise at a significant rate across the region. Besides this, the Asia Pacific also estimated to be a key region in this segment owing to its increasing demand from electrical and manufacturing sectors.

By application, electronic devices captured the largest value share in the advanced ceramics market in the year 2024 and accounted for nearly half of the global revenue that year. Increasing need for high-performance and cost-effective electronic gadgets, particularly in the Asia Pacific expected to fuel the growth of the segment over the analysis timeframe. Advanced ceramics are widely used in the electronic device for insulating, superconducting, semiconducting, magnetic, and piezoelectric applications.

Bioceramics are analyzed to show the fastest growth over the forecast timeframe. They are inert substances that possess tremendous strength and wear resistance. Henceforth, they are largely utilized in surgical implants for example dental and bone implants. Aluminum oxide and zirconia oxide are the commonly used materials in this segment.

By Product

By Material

By Application

By End-Use

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

December 2024

November 2023

November 2024