February 2025

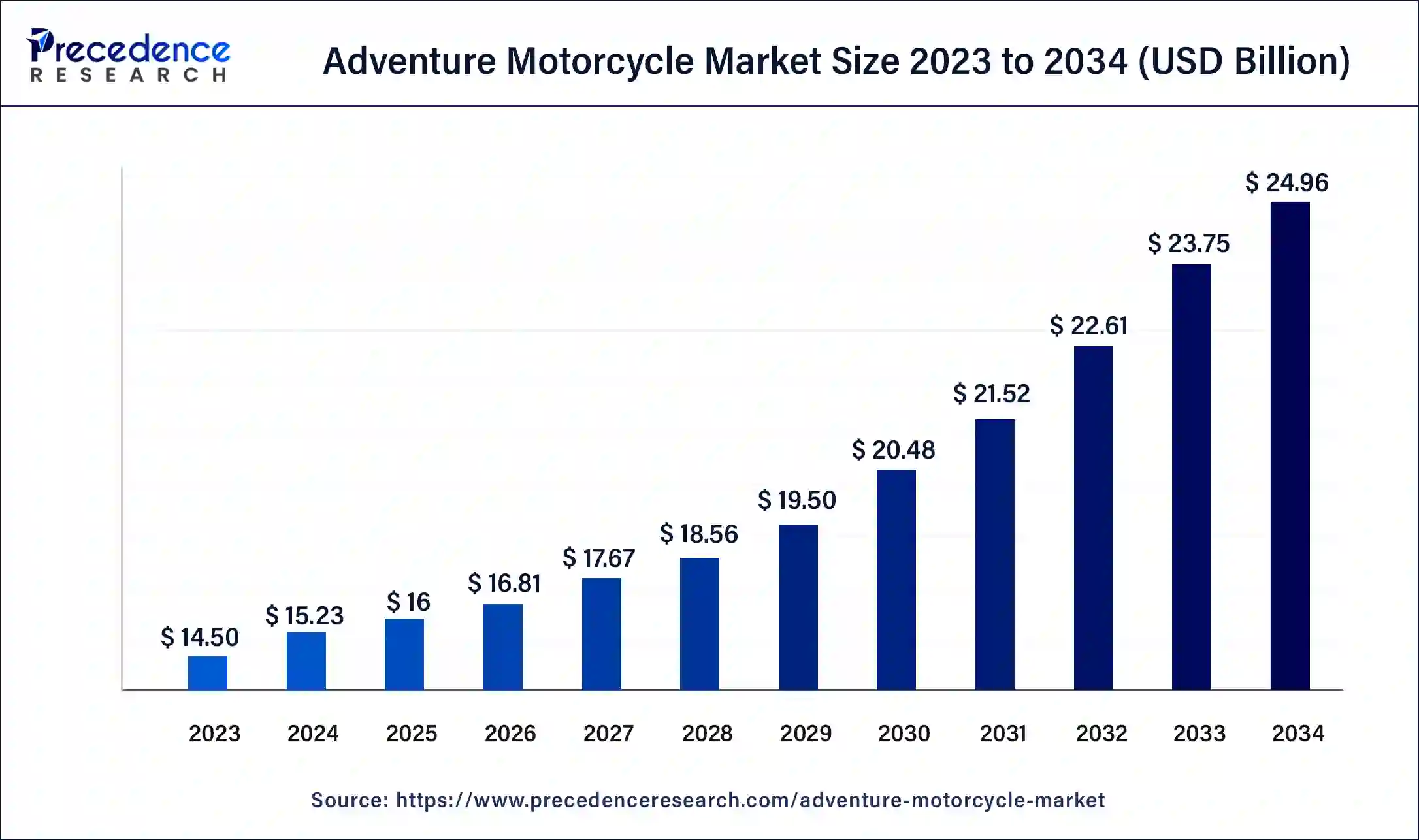

The global adventure motorcycle market size was USD 14.50 billion in 2023, calculated at USD 15.23 billion in 2024 and is expected to be worth around USD 24.96 billion by 2034. The market is slated to expand at 5.06% CAGR from 2024 to 2034.

The global adventure motorcycle market size is worth around USD 15.23 billion in 2024 and is anticipated to reach around USD 24.96 billion by 2034, growing at a CAGR of 5.06% over the forecast period 2024 to 2034. Increasing disposable income, growing interest in adventure tourism, technological advancements, and expanding urban infrastructure are the key factors driving the adventure motorcycle market growth.

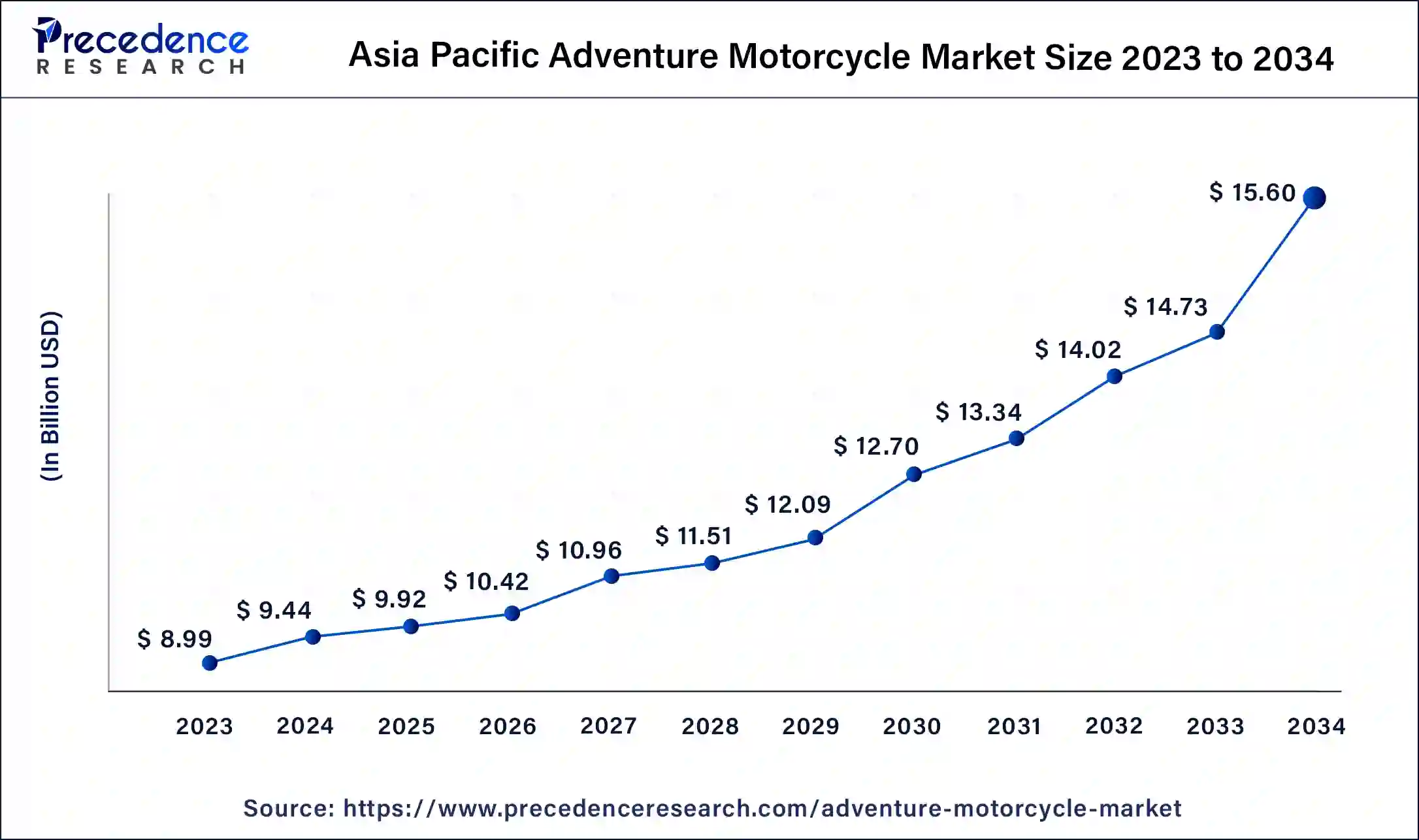

The Asia Pacific adventure motorcycle market size was exhibited at USD 8.99 billion in 2023 and is projected to be worth around USD 15.60 billion by 2034, poised to grow at a CAGR of 5.13% from 2024 to 2034.

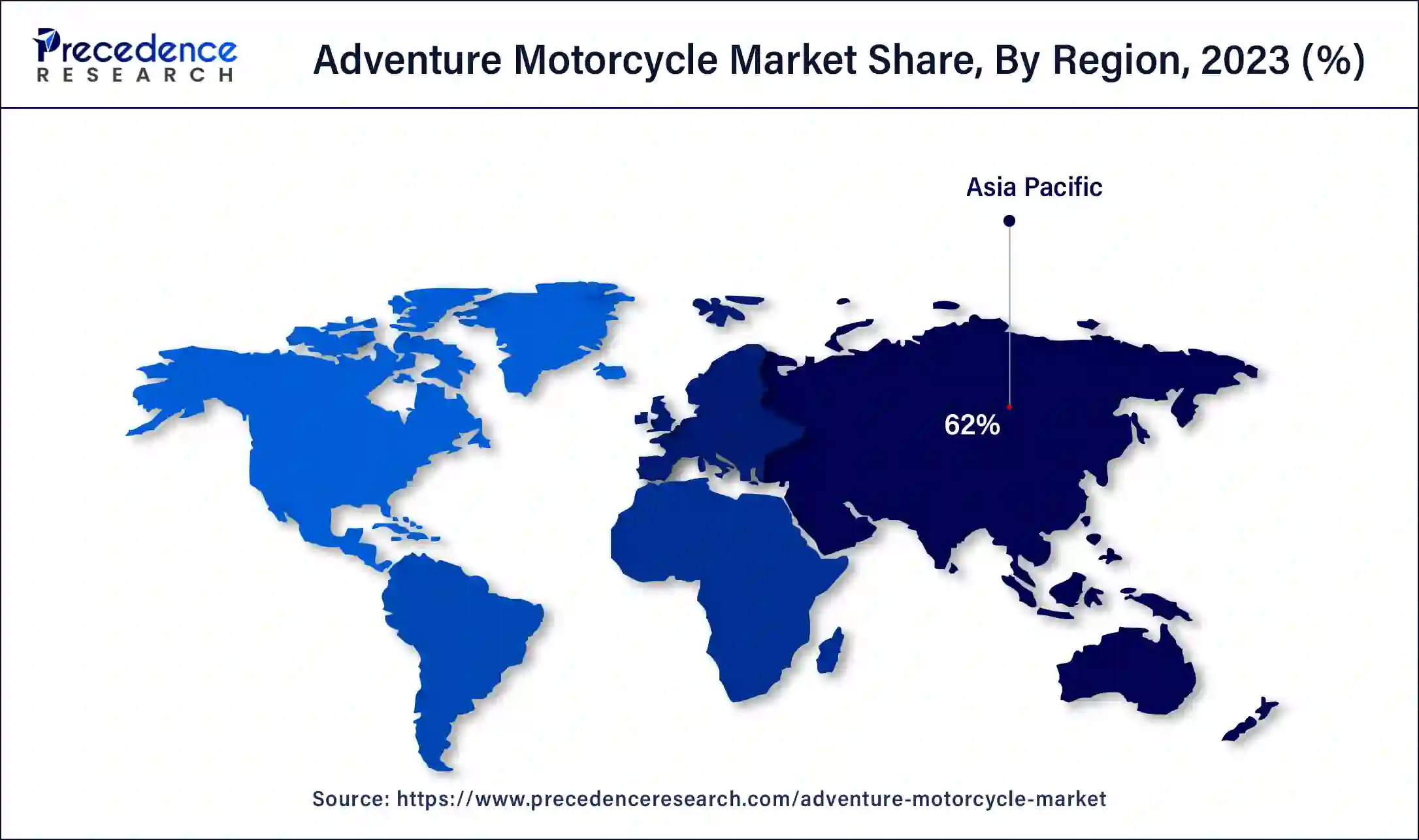

Asia Pacific dominated the adventure motorcycle market in 2023. The rising economic development along with increasing customer’s interest in adventure activities. The increasing industrialization and economic growth in economies such as China, India, and South Korea. Additionally, including rising population, growing income, increasing interest in adventure activities, and the presence of major manufacturers drive demand for adventure motorcycles.

North America is anticipated to grow at the fastest rate in the adventure motorcycle market during the forecast period. Owed to the growing concern for outdoor activity as well as adventure tourism, rising disposable income. Added to this is the availability of a wide variety of terrains and the relatively developed infrastructure in the region that enhances the sales of adventure motorcycles specifically among users that require versatile and high-performing bikes for off-road activities or adventure riding. Moreover, the riding tourism culture expanded, along with increased technological development in motorcycles.

Adventure motorcycles referred to as ADV bikes are larger displacement multi-cylinder motorcycles designed for on and off-road travel and come with relative comfort to the rider to travel long distances. Adventure motorcycle riding is more centered on the ability to move freely and have the ability to move about the motorcycle, and stay safe while off-road riding. Most of the adventure motorcycles can handle graded dirt and gravel very well. ADV riders commonly enjoy long-distance adventures and often camp out or stay in remote areas.

How can AI impact the adventure motorcycle market

Implementing AI in the adventure motorcycle industry is expanding and revolutionizing the adventure motorcycle market. AI Motorcycles can also possess an essential component called advanced driver assistance systems (ADAS). These systems use sensors and machine learning algorithms to understand the environment, detect potential hazards, and warn the rider or take corrective action automatically. Artificial intelligence enables motorcycles to be safer and smarter at the same time.

| Report Coverage | Details |

| Market Size by 2034 | USD 24.96 Billion |

| Market Size in 2023 | USD 14.50 Billion |

| Market Size in 2024 | USD 15.23 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.06% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing interest in adventure tourism

The increasing interest in adventure tourism is expected to drive the adventure motorcycle market. The rising interest in adventure tourism and off-roading has led to a need for motorcycles that can handle long-range and off-roading. There is a rise in adventurous travel and tours in the less explored regions. A motorcycle tour is also a form of adventure tourism wherein tourists take motorcycles to travel around the beautiful countryside, cities, or standard tourist attractions. Such motorcycle tours can be arranged at different places such as country roads, hills, along the seashores, or within the city. As the industry continues to innovate, adventure bikes are expected to remain at the forefront, meeting the demands of an ever-growing and diverse community of riders.

Increasing disposable income in emerging economies

The higher disposable incomes in urban areas in developed countries and emerging economies, the more people can afford the cycle. This has resulted in the growth of the adventure motorcycle market due to factors such as an increase in customer’s disposable income and an increase in the trend of outdoor activities. With this increase in the standard of living, consumers are inclined to undertake adventure activities, thus fueling the growth of the market. Furthermore, there is an increasing trend of outdoor and sporting activities and events.

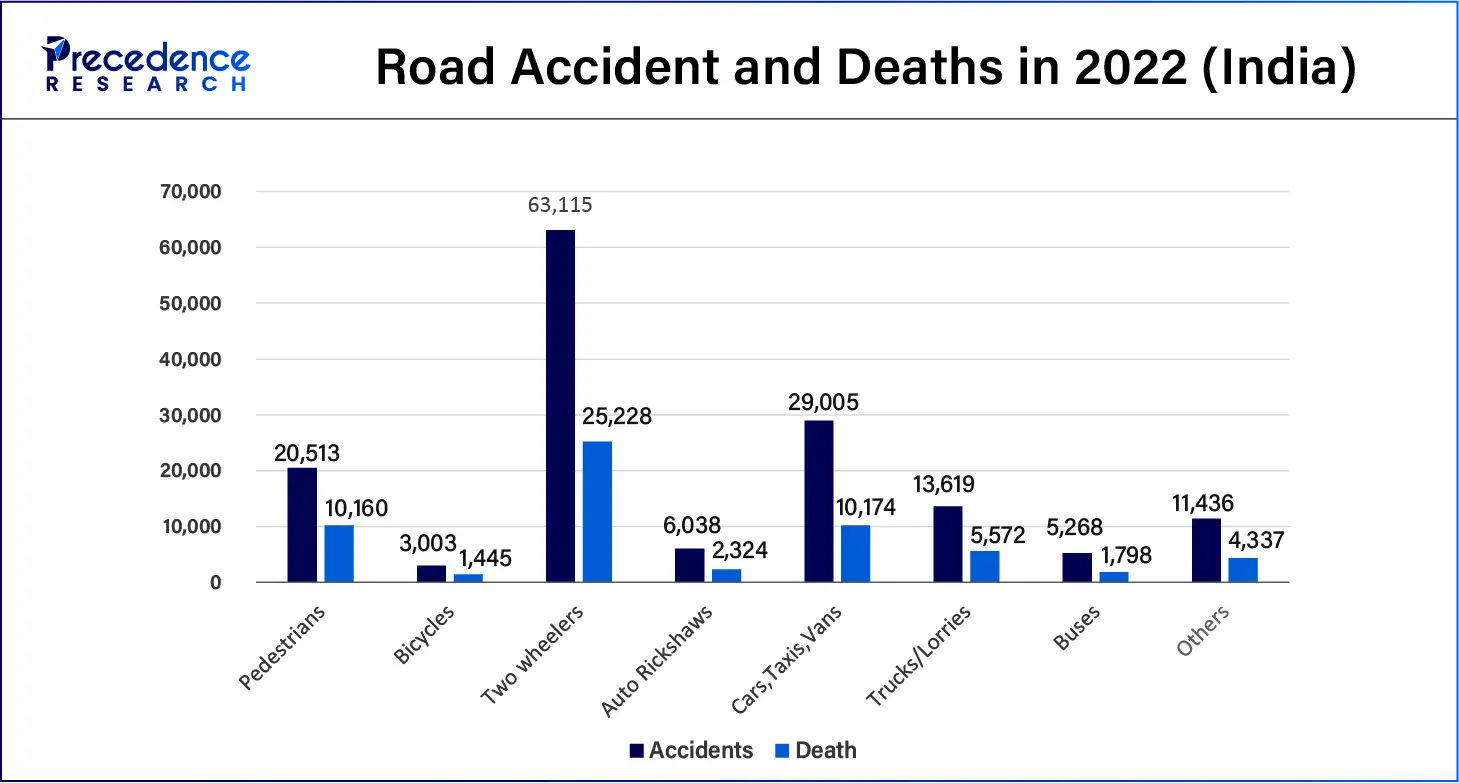

Increasing road accidents

Riding position is also significant in the high accident rates of the sports bikes and the super sports bikes. The maximum number of multiple motorcycle crashes is common with super-sport bikes. Designed for speed and performance, their riders are often more likely to engage in risky behaviors like speeding and aggressive driving. The most common types of motorcycles involved in accidents are sports bikes and super sports bikes. Such bikes mainly feature an aggressive posture that places the majority of the body weight on the wrists as well as shoulders.

Customizations

Making a motorcycle an interesting product for consumers is the high degree of diversification in the domain of customization. The advancement continues with opportunities in the adventure motorcycle market for customization and personalization for consumers. Bike owners are more demanding these days and are more interested in getting their own styles and designs, accessories that fit their personalities and requirements, and the best performance upgrade packages that suit their needs. To this, manufacturers are coming up with different color options, localized apparel, and improved performance modifications.

The 500CC - 1000CC segment accounted for the biggest share of the adventure motorcycle market in 2023, as most riders prefer these segments because they offer the best on-road and off-road travel. The increased adoption due to its popularity is that it is usable for daily traveling as well as has a variety of adventure features, making it capable of handling all ground; these properties are driving the demand for the 500CC- 1000CC segment.

The above 1000CC segment is predicted to grow at a significant rate in the adventure motorcycle market over the forecast period. The rising economic development globally and the rising demand due to its maximum performance, speed, and advanced technology. This segment is gaining further attention, especially due to sophisticated technology and more efficient handling systems. They are intended for professional racing and long-distance touring.

The off-road market segment dominated the global adventure motorcycle market in 2023. The term off-road refers to driving surfaces that are not conventionally paved. These may be of natural origin, including sand, gravel, a river, mud, or snow. Off-road machines are lightweight and more versatile than road-use motorcycles. Other characteristics include a very low height ratio and extremely long wheel travel, high stoke-endowed ground clearance, and higher gearing to provide more force in off-road conditions.

The street market segment is anticipated to grow at a solid CAGR in the adventure motorcycle market during the forecast period. A street motorcycle is also referred to as a road bike. A street bike is a motorcycle that can legally ride on a road or pavements together with other vehicles. Street bikes are intended for use on paved roadways. These models, which include adventure bikes or dual sport bikes, are mostly referred to as street bikes since they can be legally ridden on the road.

Segments Covered in the Report

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

February 2025