Aerial Work Platforms Market (By Platform Working Height: Below 10 meters, 10-20 Meters, 20-30 Meters, Above 30 Meters; End-User: Construction, Maintenance and Cleaning, Logistics and Transportation, Manufacturing, Aerospace and Defense, Others; Propulsion Type: Internal Combustion Engine (ICE), Electric Powered; Types: Boom Lift, Scissor Lift, Atrium Lift) - Global Market Size, Trends Analysis, Segment Forecasts, Regional Outlook 2024 - 2033

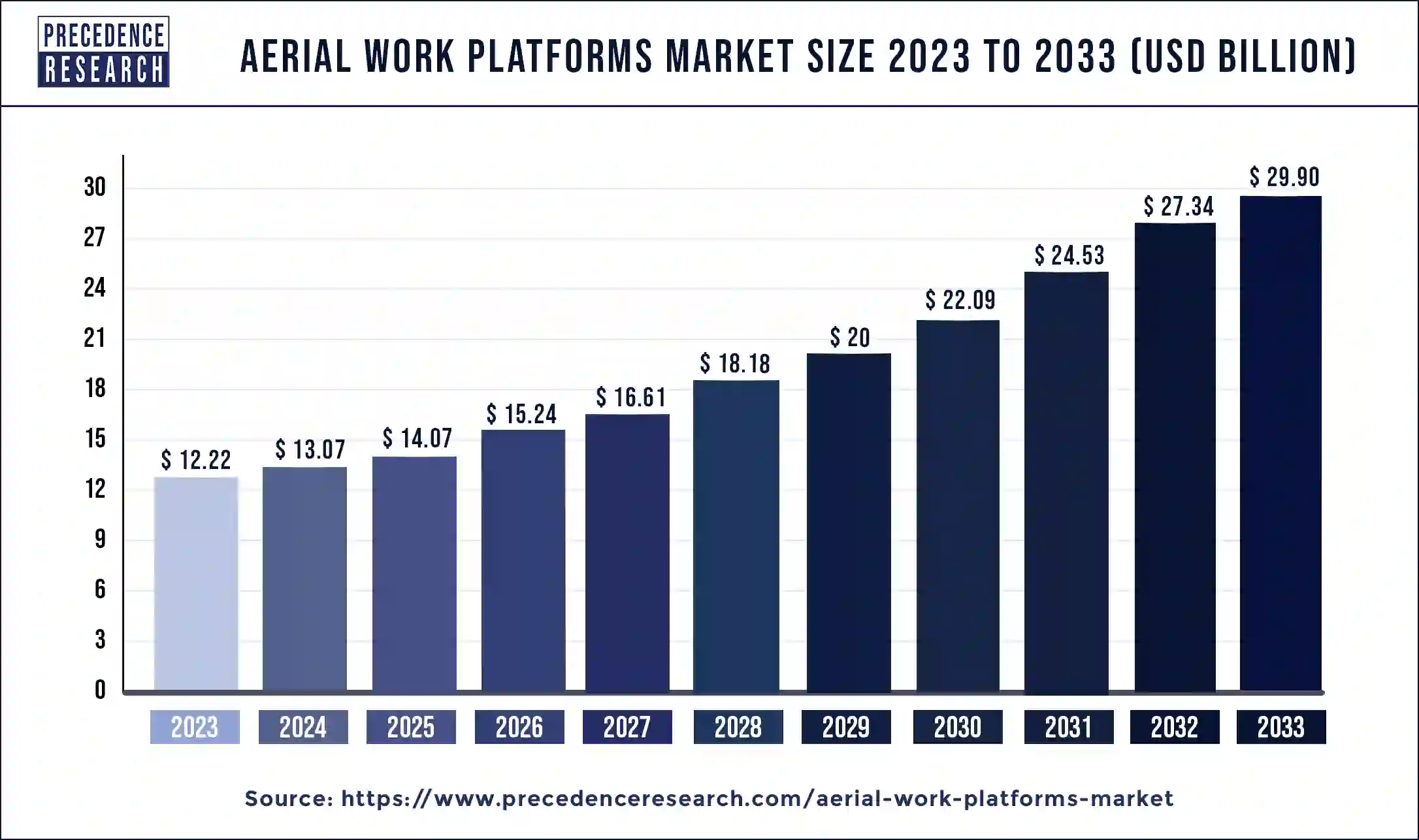

The global aerial work platforms market size was estimated at USD 12.22 billion in 2023 and it is expected to be worth around USD 29.90 billion by 2033 with a compound annual growth rate (CAGR) of 9.3% in the forecast period 2024 to 2033.

Key Takeaway

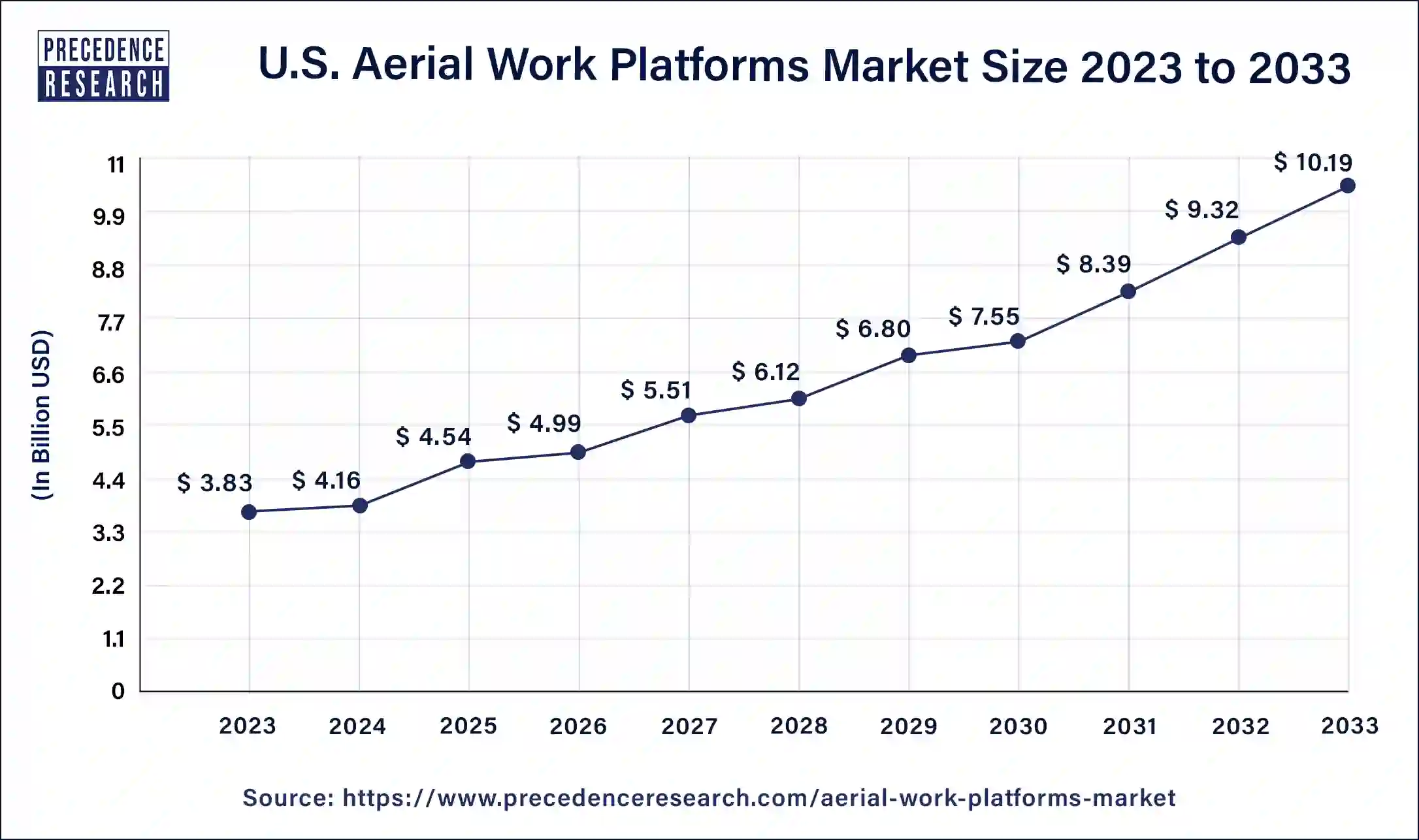

The U.S. aerial work platforms market size was valued at USD 3.83 billion in 2023 and is anticipated to reach around USD 10.19 billion by 2033, poised to grow at a CAGR of 10.28% from 2024 to 2033.

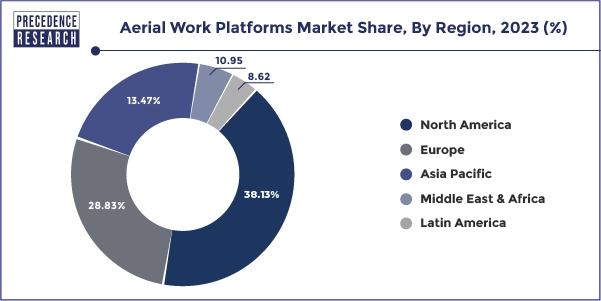

North America dominated the market with the maximum market share of 38.13% in 2023. North America, particularly the United States and Canada, has a highly developed economy with significant investments in infrastructure, construction, manufacturing, and other industries that require aerial work platforms. The robustness of these sectors drives demand for aerial work platforms. North America has stringent safety regulations and standards governing construction and workplace safety. Compliance with these regulations often necessitates the use of aerial work platforms to ensure safe working conditions at height, further driving market demand.

Asia Pacific is observed to witness expansion at fastest CAGR during the forecast period. Asia Pacific is experiencing rapid urbanization, with growing investments in infrastructure projects such as construction, maintenance, and renovation of buildings, bridges, and roads. Aerial work platforms are essential equipment for accessing elevated work areas in these construction and infrastructure projects, driving demand in the region. Asia Pacific is witnessing significant growth in construction activities across residential, commercial, and industrial sectors. Aerial work platforms are indispensable tools for construction tasks such as painting, welding, glazing, and façade maintenance, supporting the expansion of the market in the region.

Governments in Asia Pacific are investing heavily in infrastructure development, including transportation networks, airports, and ports. Aerial work platforms are essential for maintenance and repair activities in these infrastructure projects, further fueling market growth.

Government authorities of several regions have imposed stringent worker safety norms expected to surge the adoption of advanced lifting technologies across the globe. Further, rising investments in construction and infrastructure sectors by the private and government authorities again propels the market growth. Government authorities across various regions are significantly investing for the development of public transportation infrastructure that includes airports, railway stations, and residential buildings. Mobile elevating work platforms (MEWPs) are prominently used at construction sites to lift tools, workers, and other light materials at an elevated height safely and efficiently.

The accessibility of aerial work platforms (AWP) rental services provides an impetus to the growth in market size. Companies renting AWP offer a wide range of equipment from various equipment manufacturers to augment their product portfolio that provides a positive market outlook. Moreover, the advent of electrification in the global construction industry prominently supports the industry growth of aerial work platform market. Electric AWPs notably aid in reducing the carbon footprint as well as offer noiseless performance compared to diesel-powered equipment anticipated to boost the demand for AWP in the coming years.

Besides this, unavailability of skilled workers for operating the equipment challenges the industry growth. Numerous AWP manufacturers operating in the industry provide operator training courses to address the challenge. Moreover, the high cost of MEWPs anticipated to hamper the market growth over the forecast timeline.

| Report Highlights | Details |

| Growth Rate from 2023 to 2032 | CAGR of 9.3% |

| Global Market Size in 2023 | USD 12.22 Billion |

| Global Market Size by 2033 | USD 29.90 Billion |

| U.S. Market Size in 2023 | USD 3.83 Billion |

| U.S. Market Size by 2032 | USD 10.19 Billion |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, Product, Application, Region |

| Companies Mentioned | CTE, Aichi Corporation, Haulotte Group, Dinolift OY, Hunan Runshare Heavy Industry Company, Ltd., Zhejiang Dingli Machinery Co, Ltd., Holland Lift International bv, JLG Industries, Hunan Sinoboom Heavy Industry Co. Ltd. |

Market Drivers

Increasing Constructional And Infrastructural Activities

Rising improvement in urban and rural infrastructure, coupled with government initiatives to provide the technological facilities such as electrical utilities and telecommunication network to the rapidly increasing population in the various countries including China, India, Brazil, Bangladesh, Indonesia, the U.S., and others are expected to propel the growth of end-use industries such as construction, electric & telecommunication, retail, and others. This, in turn, is anticipated to increase the demand for aerial work platforms as a large number of end-use industries across the globe use aerial lifts for new and daily maintenance work.

A large number of boom and scissor lifts are used at airports for the placement and storage of luggage and cleaning and maintenance work of aircraft. Articulated electrical boom lifts are used on a large scale for work on the interior of the airport premises to reach the overhead of an aircraft for cleaning, maintenance, and inspection work. Their trend is like to continue in the coming years with rise in the number of flyers and construction of new airports which, in turn, is expected to lead to the requirement for different types of lifts, thus propelling the growth of the overall aerial work platform market.

Increasing Number Of Retail And Warehouse Units

An attempt to provide uninterrupted supply of products and equipment requires storage and warehouse units, especially by e-commerce and logistics companies. Keeping and storing the required products reduces the shortage of materials and helps in maintaining the inventory up to date. Rising e-commerce platforms are the major drivers fueling the growth of warehouse units across the globe. Promised shipping standards by various e-commerce giants require near-by storage and warehouse units that employ a large number of scissor, vertical, and boom lifts for product handling and transportation from one place to another. These aerial platforms promote easy material handling and lookup in bulk orders and help retain a company’s delivery promises.

Fully automated warehouses are gaining popularity in various developed countries. These warehouses are equipped with several aerial lifts and platforms that need minimum human intervention. They require the deployment of a large number of single scissor lifts, double scissor lifts, and other lifting tables for product and pellets placement. Massive funding and investment in the construction of warehouse buildings by various e-commerce and logistics companies across the globe are expected to significantly contribute to overall market growth. For instance, Walmart and eBay spend heavily on logistics and warehousing to compete with Amazon in terms of fulfilling product delivery to consumers. Moreover, Amazon India established 10 new warehouses in the country in 2020, which is likely to increase the demand for different types of lifts in these warehouses, thereby adding to the overall growth prospects of the aerial work platform market.

Market Restraint

Lack Of Skilled Labor

The demand for various mechanical and electrical equipment for aerial lifts production has witnessed an upward trend in recent years. Manufacturers are forced to offer technically advanced machines or lifts such as hybrid and electricity-driven machines to conserve fuel. However, the penetration of such advanced and technologically enhanced aerial platforms has not been widespread owing to the lack of skilled labor.

Several companies such as Wiese USA, MEC Aerial Work Platforms, JLG Industries, and various other market players conduct training and certification courses to ensure the proper use of different types of aerial platforms. This becomes a major challenge which hampers the growth of the market. Untrained worker or operator increases the safety concern in the working area which may lead to an unexpected incident. Moreover, ANSI A92 has strict regulations and standards in place for the use and operations of aerial work platforms as training and maintenance contribute to the safe and efficient operation of aerial lifts.

Market Challenges

High Dependency On Raw-Material Suppliers And Vendors

Environmental Health and Safety Impact

Changes In Import/Export Regulatory Regimes

High Competition

The construction segment held the largest market share of 45.53% in 2023. Construction projects often involve working at elevated heights, such as during building construction, roofing, or façade installation. Aerial work platforms provide safe and efficient access to elevated work areas, allowing workers to perform tasks at various heights with ease. Aerial work platforms come in various types, including boom lifts, scissor lifts, and vertical mast lifts, each suited to different construction tasks and site conditions. Their versatility and adaptability make them indispensable equipment for construction companies seeking efficient solutions for accessing heights in diverse construction environments.

On the other hand, the maintenance and cleaning segment is observed to witness the fastest rate of expansion during the forecast period. As urbanization and infrastructure development continue to expand globally, there is a growing need for regular maintenance and cleaning of buildings, including high-rise structures, commercial complexes, and industrial facilities. Aerial work platforms provide efficient and safe access for maintenance personnel to perform tasks such as window cleaning, facade inspection, painting, and repair work.

There is a growing emphasis on sustainability and environmental responsibility in the maintenance and cleaning industry. Aerial work platforms powered by electric or hybrid propulsion systems offer eco-friendly alternatives to traditional diesel-powered equipment, reducing emissions and environmental impact during operation.

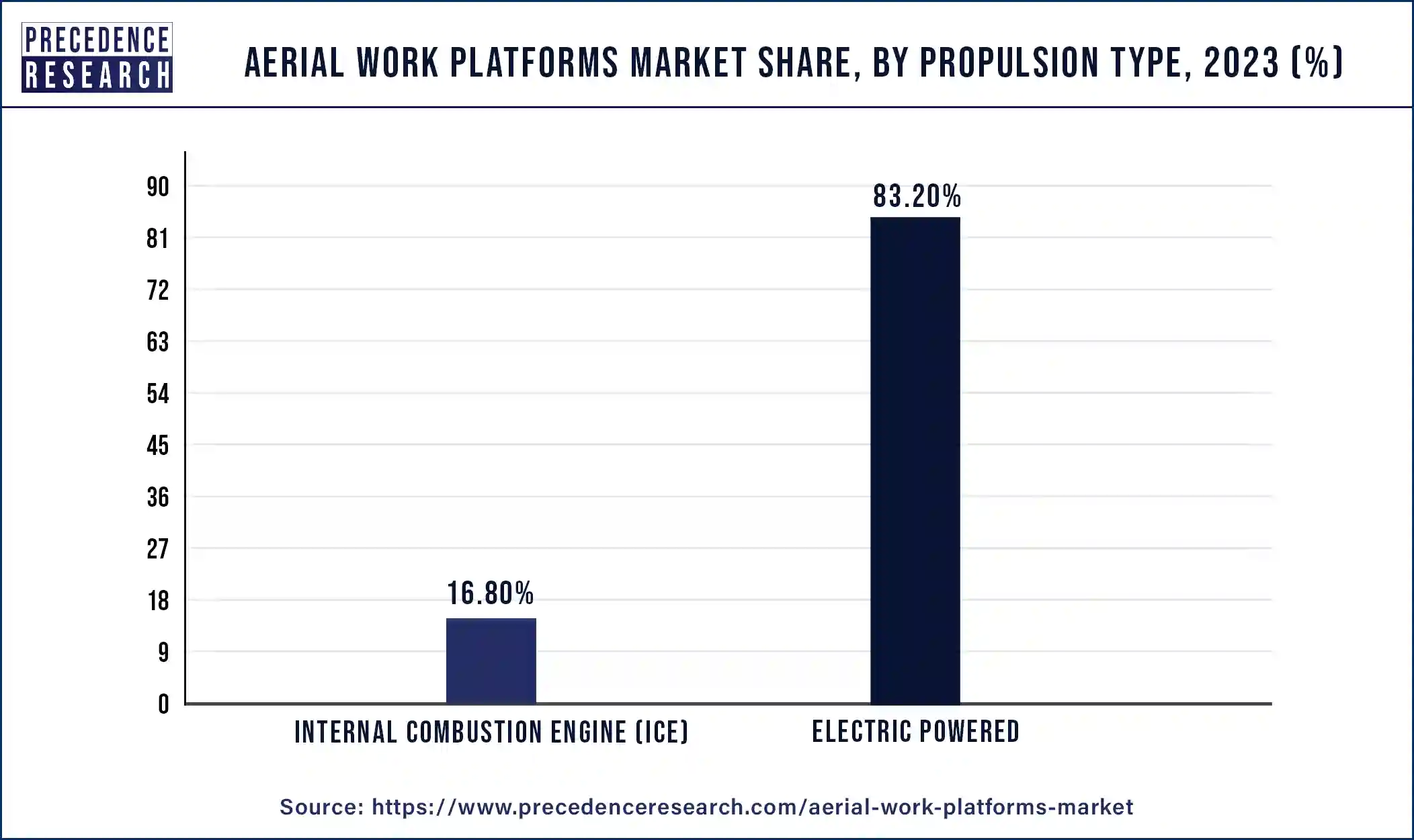

The internal combustion engine segment led the market with the highest market share of 83.20% in 2023. Internal combustion engines offer high power output and performance capabilities, making them well-suited for heavy-duty applications such as lifting and maneuvering aerial work platforms. Their robust performance allows for efficient operation in various work environments, including construction sites, industrial facilities, and outdoor settings.

Aerial work platforms powered by internal combustion engines can operate at higher altitudes and have a longer working radius than those powered by electricity. Accessing elevated work areas, where accuracy and dexterity are crucial, including utility poles, building facades and rooflines, requires an extended reach.

The electric powered segment is expected to grow at the fastest rate during the forecast period. An increasing number of individuals prefer electric-powered equipment over conventional diesel-powered options due to rising environmental awareness and the need to minimise carbon emissions. Because they emit fewer pollutants and greenhouse gases, electric aerial work platforms are a more environmentally responsible option.

In the long run, electric aerial work platforms are less expensive than their diesel-powered equivalents. Electric vehicles have reduced running and maintenance costs due to less frequent refuelling, fewer mechanical components, and less wear and tear, even though their initial purchase price may be higher.

Aerial Work Platform Market Value (US$ Mn), 2020-2023

| Propulsion Type | 2020 | 2021 | 2022 | 2023 |

| Internal Combustion Engine (ICE) | 1,806.9 | 1,878.6 | 1,957.4 | 2,055.4 |

| Electric Powered | 8,543.1 | 9,018.3 | 9,542.0 | 10,172.7 |

The boom lift segment has held revenue share of 38% in 2023. The segment is observed to sustain the position during the forecast period. Boom lifts are renowned for their impressive height and outreach capabilities, allowing workers to access elevated workspaces at considerable heights, often exceeding those of other types of aerial work platforms. This makes them ideal for tasks such as building maintenance, construction, window cleaning, and tree trimming, where extended reach is essential.

Manufacturers continue to innovate with the integration of advanced safety features into boom lifts, such as fall arrest systems, anti-tip mechanisms, overload sensors, and platform interlocks. These safety enhancements prioritize worker protection and compliance with stringent industry regulations, further contributing to the popularity of boom lifts.

On the other hand, the scissor lift segment is expected to witness the fastest expansion during the forecast period. Scissor lifts are highly versatile aerial work platforms that can be used across a wide range of industries and applications. From construction and maintenance tasks to warehousing and logistics operations, scissor lifts offer a flexible solution for accessing elevated work areas. The construction industry, in particular, is witnessing significant growth worldwide, driving demand for aerial work platforms such as scissor lifts. These platforms play a crucial role in construction projects for tasks such as installation, painting, electrical work, and maintenance, contributing to the segment's expansion.

The global aerial work platforms market participants are investing prominently on the research & development (R&D) activities to develop new products and enhance the safety of workers along with the lifting capacity of the AWP. Moreover, the industry players are also focusing on the development of electric AWPs and MEWPs. For instance, in July 2019, MEC Aerial Work Platform launched its new Micro 26 slab scissor lift. The new AWP features a 36-inch roll out extension deck with incremental lock positions that maximizes productivity and material usage.Besides this, market players also focus strictly towards inorganic growth strategies that include partnership, merger & acquisition, and collaboration.

Segments Covered in the Report

By End-User

By Propulsion Type

By Platform Working Height

By Type

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client