December 2024

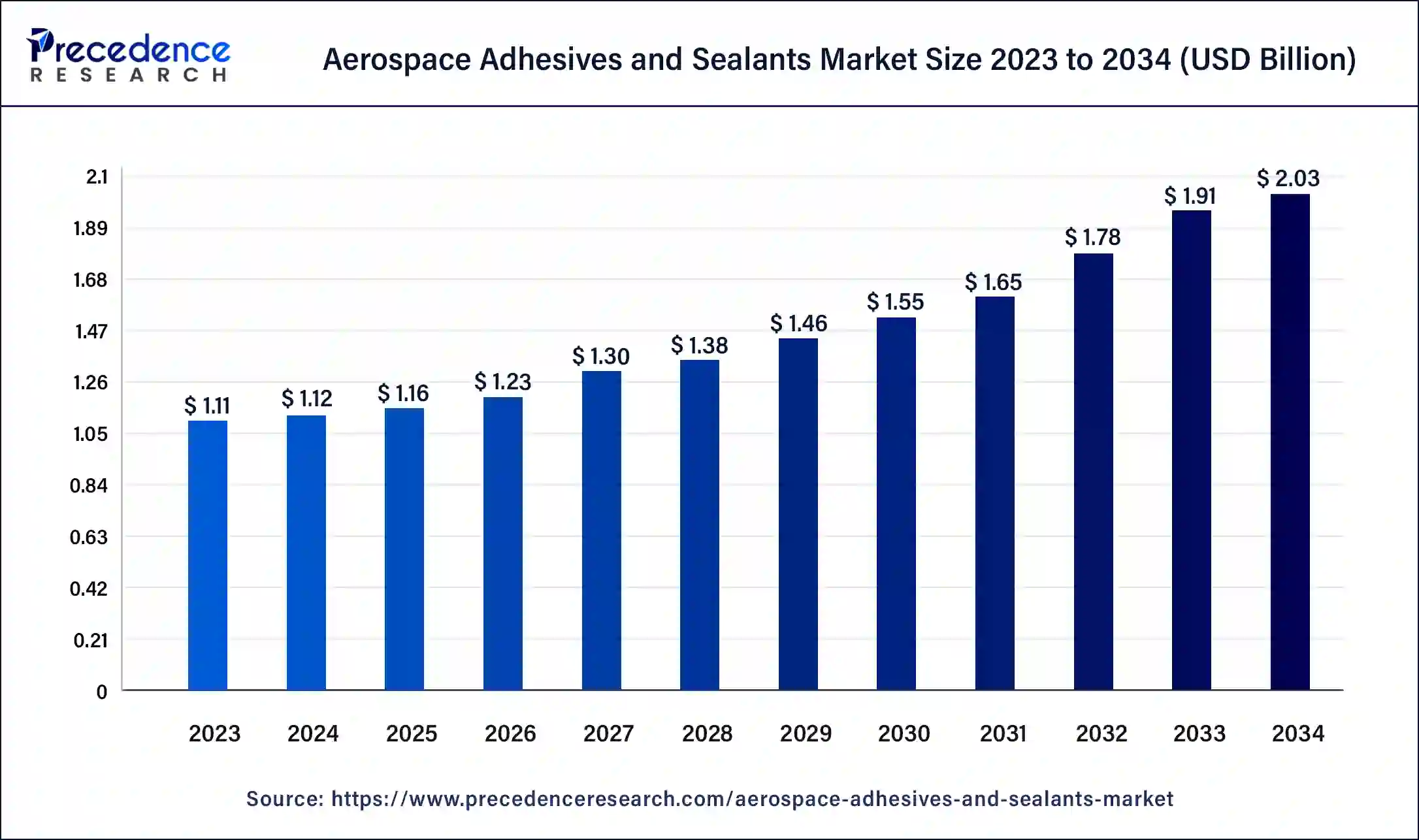

The global aerospace adhesives and sealants market size was USD 1.11 billion in 2023, estimated at USD 1.12 billion in 2024 and is anticipated to reach around USD 2.03 billion by 2034, expanding at a CAGR of 6.03% from 2024 to 2034.

The global aerospace adhesives and sealants market size accounted for USD 1.12 billion in 2024 and is predicted to reach around USD 2.03 billion by 2034, growing at a CAGR of 6.03% from 2024 to 2034.

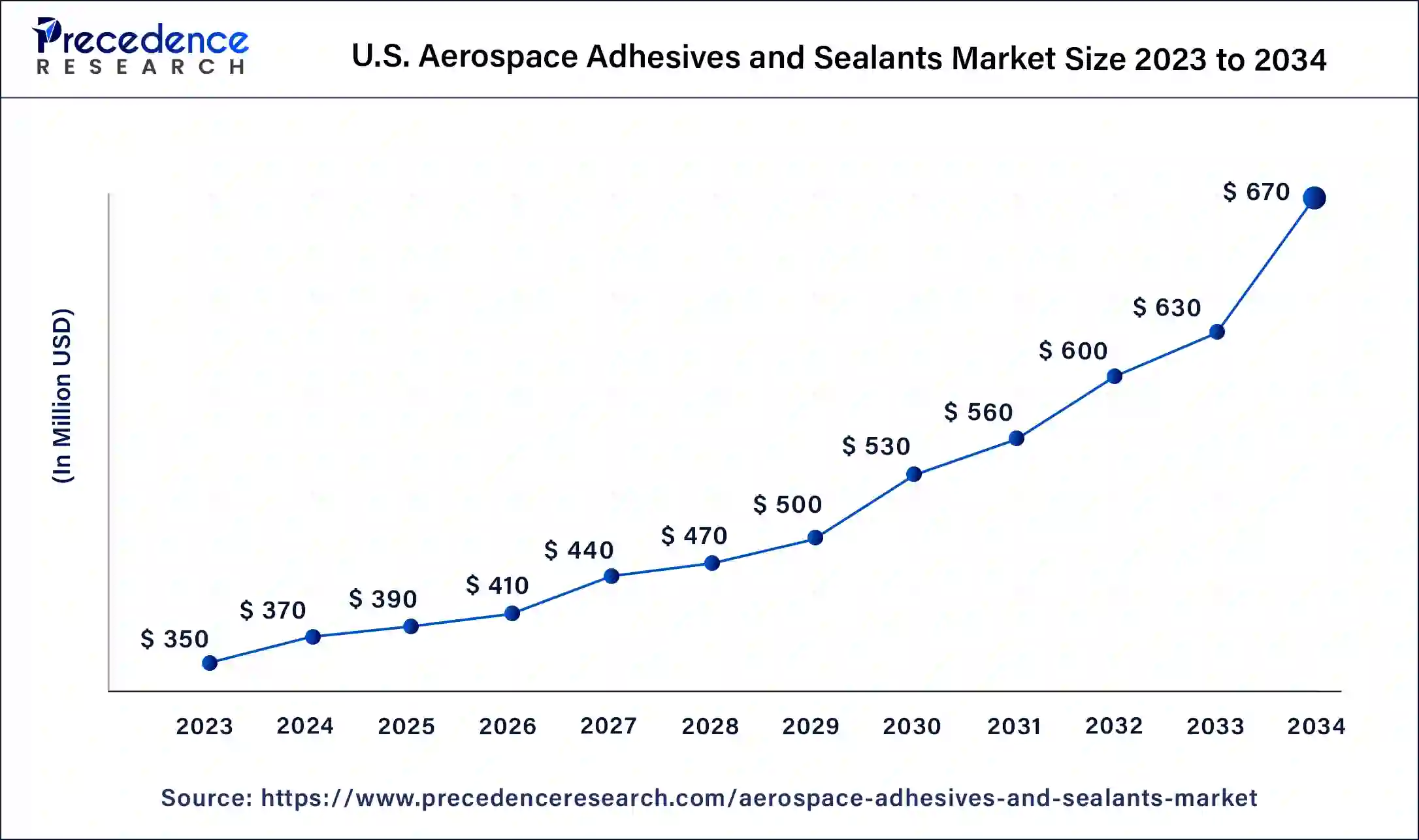

The U.S. aerospace adhesives and sealants market size was valued at USD 350 million in 2023 and is expected to be worth around USD 670 million by 2034, at a CAGR of 54.20% from 2024 to 2034.

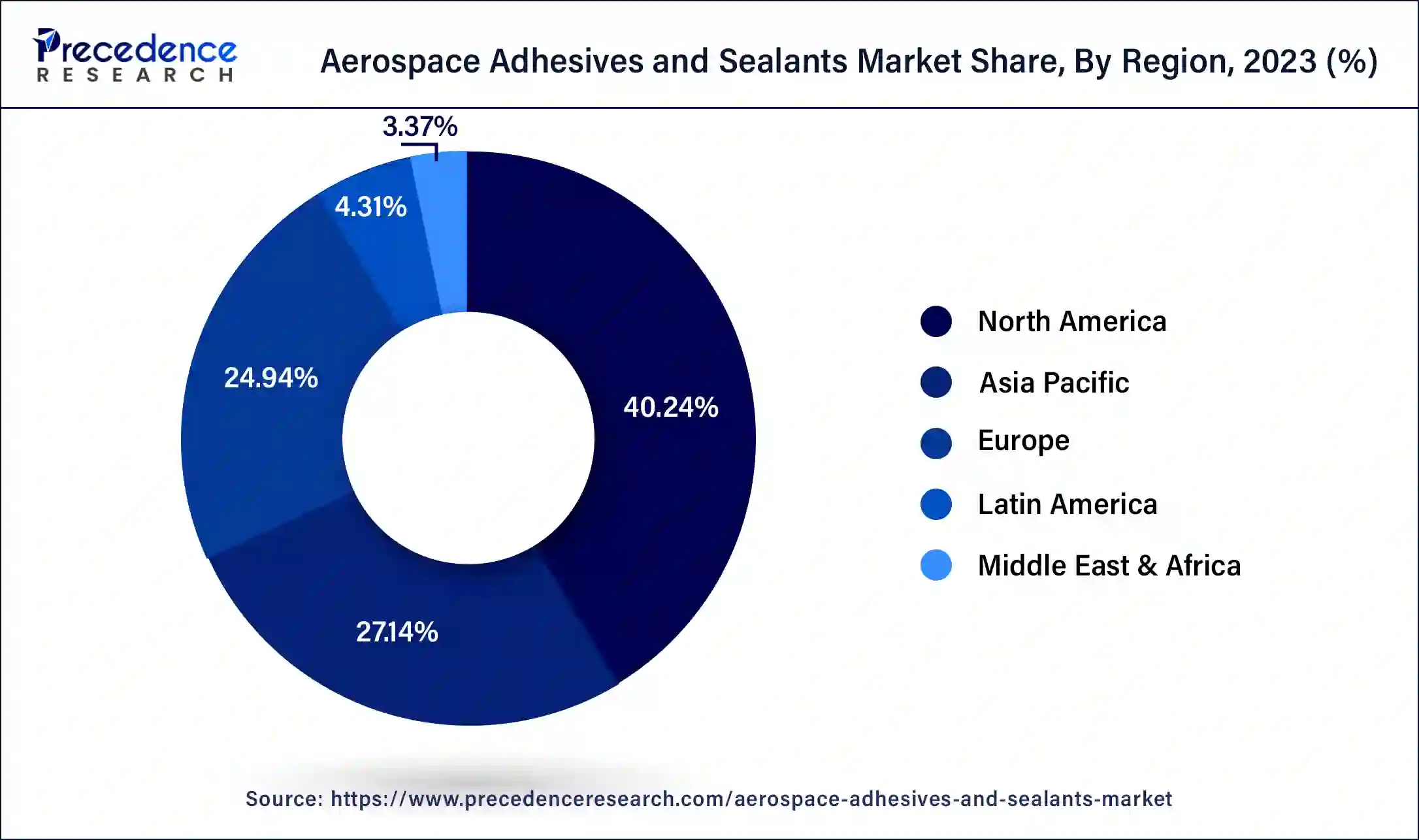

North America led the global market with a volume share of over 40.24% in the year 2023. This is mainly because of the increased focus of the U.S. government to strengthen its military force. Hence, increased spending on the defense sector is likely to offer immense opportunities for the contractors along with their supply chains over a longer period.

However, the Asia Pacific exhibits a significant growth rate during the upcoming period, in terms of revenue. The key factors driving the growth of the region are a rapid boost in air passenger traffic coupled with the demand for new aircraft. China is likely to be the major revenue contributor in the Asia Pacific region which drives the growth of the region and accounts for a demand for more than 8,000 new aircraft over the upcoming 20 years.

The global aerospace adhesives and sealants market deals with the production and distribution of specialized adhesives and sealants in the aerospace industry. These specialized materials are important in aircraft manufacturing and maintenance. They provide bonding and protection to crucial aircraft components and also prevent corrosion. The increasing demand for fuel-efficient and lightweight aircraft and the growing emphasis on safety and reliability in the aerospace industry are expected to boost the market significantly.

Significant growth of passengers in aviation industry predicted to be a key factor that propels the demand for sealants and adhesives products. Adhesives and sealants are used in wide range of applications in aerospace industry. Interior applications in airplane include retaining compounds, hydraulic thread systems, and thread-lockers. However, exterior application of adhesives and sealants in an aircraft includes wing spars, door moldings, and panels.

The adhesives and sealants demand is witnessing a surge with the increasing usage of composite materials. Applications for example primary and secondary assemblies in aircraft anticipated to offer alluring growth opportunities for the market vendors. Further, need for customization according to the manufacturer’s requirement is the other most promising area in the aerospace adhesives and sealants market. The manufacturers of adhesives and sealants are able to modify the properties of materials that include viscosity, toughness, shorter cure time, and longer work time in line to the requirements in aerospace application.

Additionally, prominent rise in the investment particularly for R&D activity and new product development is also the major factor that estimated to fuel the product demand over longer term. The market participants in the global aerospace adhesives and sealants market are largely focused towards enhancing the reliability of lightning protection technology, bonded composite structures, and new multifunctional surfacing. Hence, the aforementioned factors are likely to impart high growth for the adhesives and sealants in aerospace industry during the forthcoming years.

| Report Coverage | Details |

| Market Size by 2034 | USD 2.03 Billion |

| Market Size in 2023 | USD 1.1 Billion |

| Market Size in 2024 | USD 1.12 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.03% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Technology, Sealants Resin, Adhesive Resin, Aircraft, and User Type, Regions |

| Regions Covered | Covered North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Expnasion of the Aerospace Industry

The aerospace industry is expanding rapidly due to the increasing air traffic, expanding airline fleets, and rising investments in aircraft design technology. This significant growth of the aerospace industry impacts the demand for aerospace adhesives and sealants, which are essential for bonding and sealing components in aircraft construction and maintenance. These specialized materials are important for ensuring the longevity of aircraft components by preventing corrosion.

Drawbacks Related to Adhesives & Sealants

The relative weakness of adhesives when bonding large objects with small bonding surface area is one of the major challenges that limit the widespread adoption of adhesives and sealants in the aerospace industry. This limits their utility in certain applications where stronger mechanical fasteners, such as bolts or rivets, might still be preferred. Many polymer-based adhesives have some limitations when exposed to high temperatures, which can affect their stability. Only specific silicon-based adhesives demonstrate significant heat resistance, which makes them the exception rather than the rule. The separation of bonded materials during testing or repair can be difficult, which also adds extra complexity to maintenance and repairs in the aerospace sector.

Rising Popularity of UAVs

The increasing adoption of unmanned aerial vehicles (UAVs), commonly known as drones, is one of the emerging trends that presents a significant growth opportunity for the aerospace adhesives and sealants market. UAVs are being deployed in various sectors, including delivery services, military operations, farming or agriculture, search and rescue, and surveillance. As the demand for UAVs increases, so does the need for specialized adhesives and sealants tailored to drone manufacturing and maintenance requirements.

UAVs often require lightweight and high-strength adhesives to maximize efficiency. In contrast, military drones and search-and-rescue drones require adhesives that can withstand extreme conditions, such as high temperatures, humidity, and exposure to chemicals. These drones also demand weather-resistant and heat-resistant adhesives to ensure durability and reliability in the field.

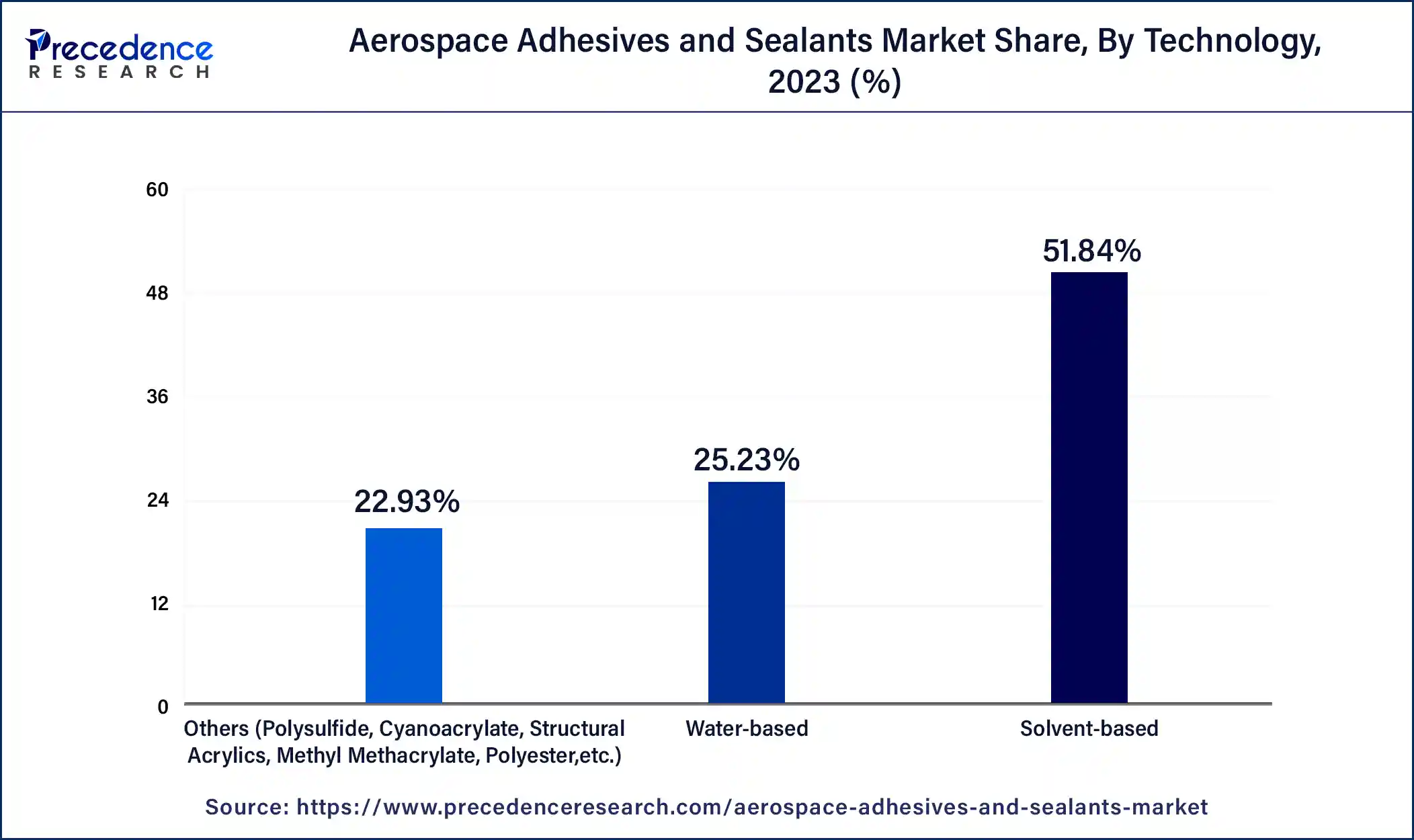

The solvents segment led the aerospace adhesives and sealants market with the largest share in 51.84% in 2023. Solvents help improve the bonding characteristics of adhesives and sealants by enabling better adhesion to various substrates like aluminum, composites, and titanium, all of which are widely used in aerospace components. Solvent-based adhesives are often used in place of mechanical fasteners to reduce the overall weight of the aircraft, contributing to improved fuel efficiency and performance. Aerospace companies are focusing on greener alternatives by using solvent-based adhesives and sealants that reduce environmental impact without sacrificing performance.

The silicone segment is anticipated to expand at a rapid pace in the coming years. This is due to its ability to provide adhesion to various substrates, such as plastics, metals, and composites. Silicone-based sealants provide excellent temperature resistance. Thus, they are suitable for applications where components are exposed to high temperatures. Furthermore, these sealants prevent leaks and cracks, thus enhancing the longevity of aerospace components.

The MRO segment is expected to lead the market throughout the forecast period. The MRO segment encompasses maintenance, repair, and overhaul of aircraft. The segment growth is attributed to the rising maintenance and repair activities of aircraft. Aerospace adhesives and sealants are heavily used during the repair and maintenance of aircraft to protect surfaces from environmental factors, thus ensuring safety of the aircraft.

Epoxy led the adhesive resins segment in the global aerospace adhesive & sealants market in the year 2023. Epoxy-based products are prominently used in sandwich panels, composite ribs, large wingskins, and other carbon composite substrates. It also offers higher coefficient of thermal expansion, higher compressive strength, as well as low elongation to fracture. The above-mentioned properties and its applications are likely to prosper the growth of the market in the coming years.

In terms of volume, polyurethane expected to be the most lucrative segment in adhesive resins during the forecast timeframe between 2024 and 2034. Bonding different substrates using adhesives expected to enhance the efficiency during aerospace manufacturing process. Joining or bonding permits assembly of separate materials along with the capability to bear higher loads. It also supports in uniform distribution of stresses and strains across joints.

The commercial aircraft segment dominated the global aerospace adhesives and sealants market in 2023. The prominent growth of the segment is mainly due to rising passenger demand along with indirect demand for new commercial aircraft. For instance, Airbus and Boing have a collective order of around 9,000 for the new commercial aircrafts. Further, the passenger traffic has risen by 2.4 times from 2000 to 2019. As per the latest study published by Airbus, the passenger traffic is likely to double during the next 15 years.

Apart from the passenger traffic, aerospace companies are largely focusing on improving fuel efficiency with a purpose to meet the stringent environmental regulations. According to the study conducted by Airbus, from 2008 to 2018, average improvement in the fuel efficiency was greater than 2.0% per year. In order to meet such fuel efficiency norms, companies operating in the aviation industry are likely to replace their old aircrafts with the modern ones that are light-weight and fuel-efficient.

Furthermore, surge in demand for new and advanced military aircraft that include patrol, transports, and fighters projected to impel the growth of the aerospace adhesives and sealants market. Increase in defense spending particularly in the leading countries such as the U.S., India, and China is the other most promising factor responsible drive the aerospace adhesives and sealants market.

Segments Covered in the Report

By Technology

By Sealants Resin

By Adhesive Resin

By Aircraft

By User Type

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

April 2025

April 2025

August 2024