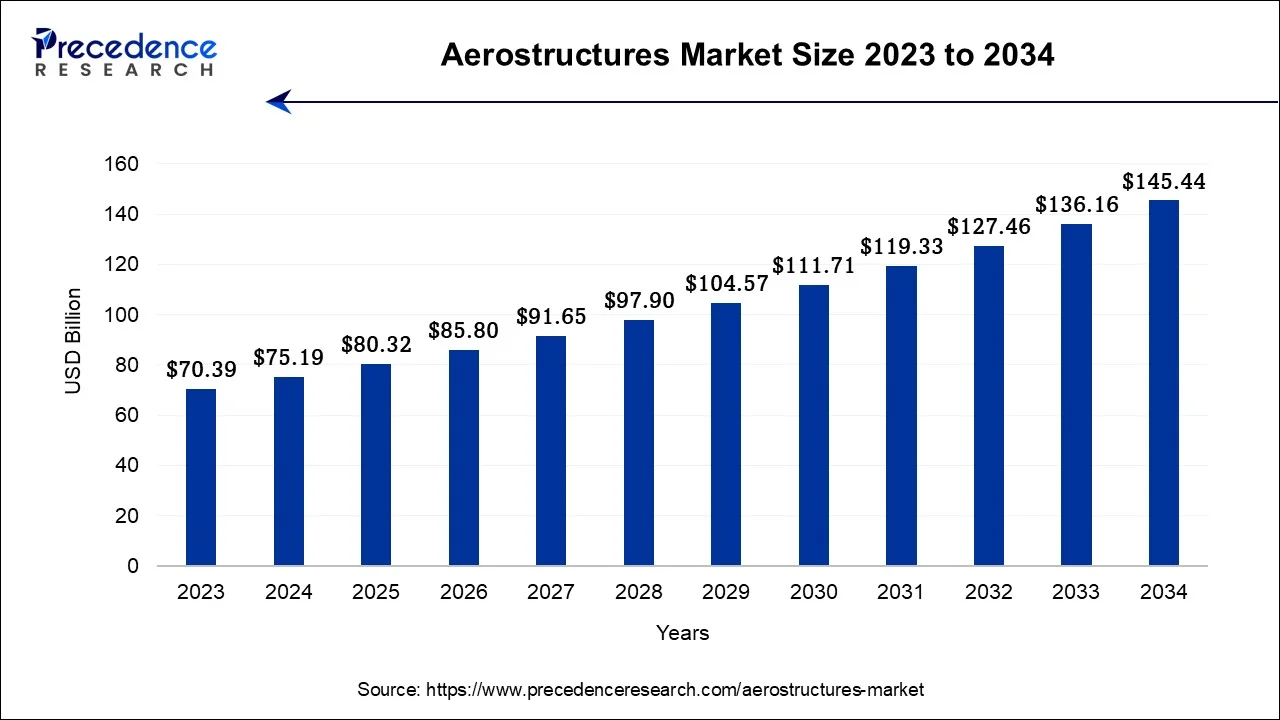

The global aerostructures market size is predicted to increase from USD 75.19 billion in 2024, grew to USD 80.32 billion in 2025 and is anticipated to reach around USD 145.44 billion by 2034, poised to grow at a CAGR of 6.82% between 2024 and 2034. The North America aerostructures market size is calculated at USD 33.84 billion in 2024 and is estimated to grow at a fastest CAGR of 6.93% during the forecast year.

The global aerostructures market size accounted for USD 75.19 billion in 2024 and is predicted to be worth around USD 145.44 billion by 2034, poised to grow at a CAGR of 6.82% between 2024 and 2034.

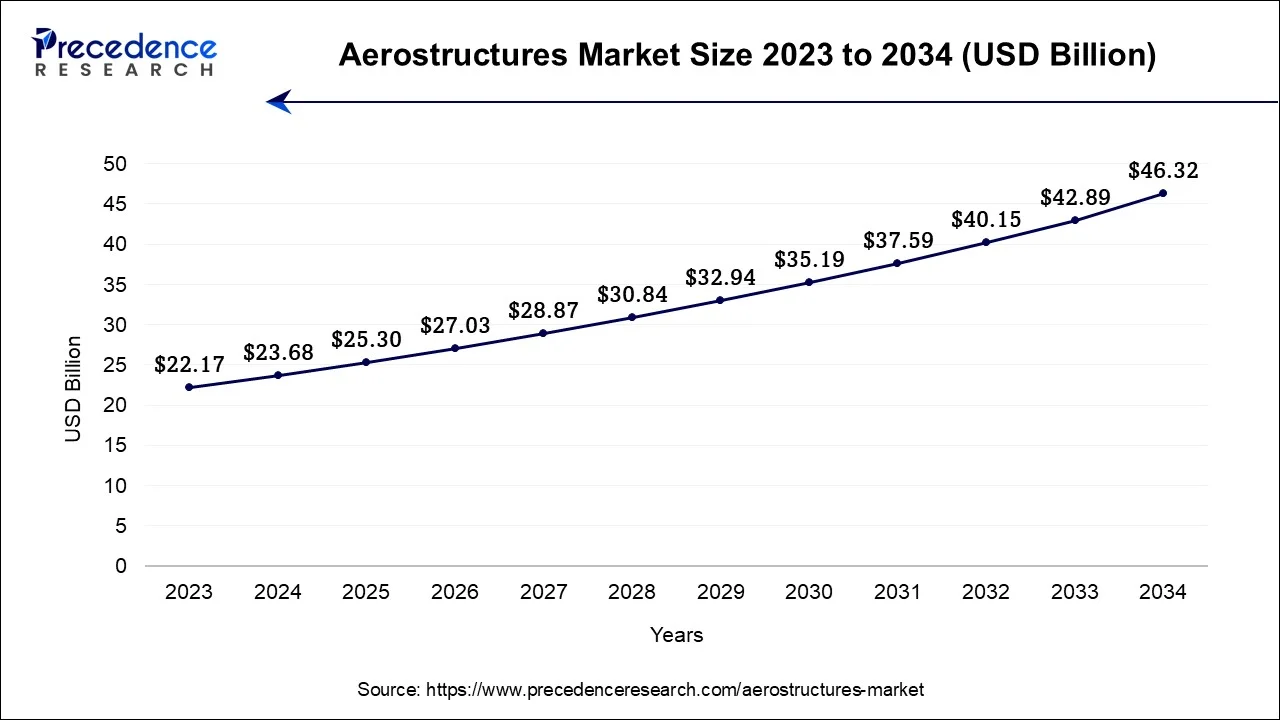

The U.S. aerostructures market size is estimated at USD 23.68 billion in 2024 and is expected to expand around USD 46.32 billion by 2034, growing at a CAGR of 6.94% from 2024 and 2034.

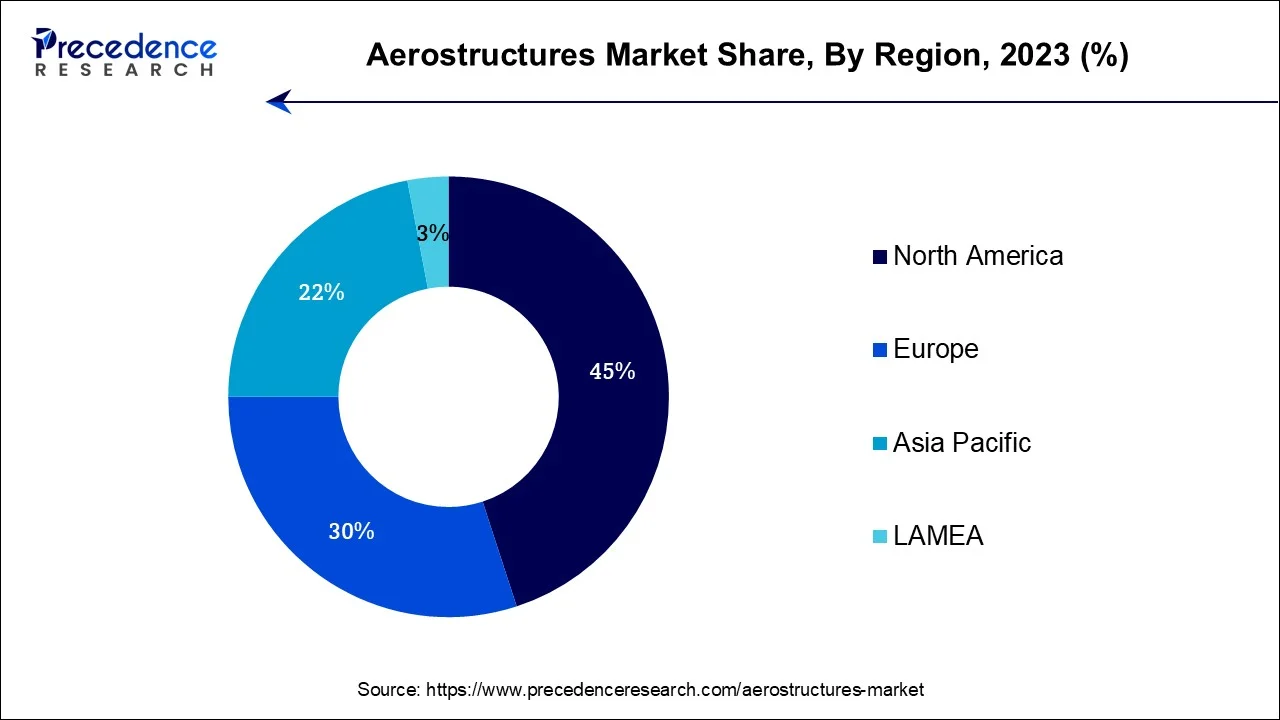

North America has held largest revenue share in 2023. North America, known for its prominent role in aerospace manufacturing and innovation, holds a key position in shaping the future of aviation and space exploration. Within this region, there is a diverse market that encompasses various companies involved in aerostructure manufacturing and supply, contributing to both commercial and defense aviation sectors. Major players such as Boeing and Airbus have substantial production facilities and operations based in North America, which drive the demand for aerostructure components. In addition to the thriving aerospace industry, North America also hosts renowned organizations like SpaceX and NASA actively engaged in spacecraft development, further fueling the need for specialized aerostructures.

North America's dedication to technological progress and commitment to preserving the environment have spurred remarkable advancements in materials, manufacturing processes, and aircraft design. The aerospace industry within this region stands out as a pioneer in developing incredibly fuel-efficient aircraft and eco-friendly aerostructures.

The Asia-Pacific aerostructures market is rapidly gaining prominence in the global aerospace industry. This growth can be attributed to the region's robust economic progress, surging air travel demand, and its focus on aerospace manufacturing and innovation. As the middle-class population expands and disposable incomes rise, the demand for air travel in Asia-Pacific has skyrocketed, making it one of the fastest-growing aviation markets worldwide. Consequently, there is a substantial need for fuel-efficient aircraft, which has led to an increased demand for aerostructures. Notably, countries like China have made significant investments in aerospace infrastructure by establishing manufacturing facilities and research centers. These efforts have further propelled the aerostructures market in the region. Additionally, Asia-Pacific has also witnessed notable developments with regard to indigenous commercial and military aircraft programs. This advancement has fostered collaboration between international aerospace players while driving up demand for aerostructure components.

| Report Coverage | Details |

| Market Size in 2024 | USD 75.19 Billion |

| Market Size by 2034 | USD 145.44 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.82% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Components, Platform, Material, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rise in global air travel demand

The demand for global air travel has been intricately linked to transformative changes in the transportation of people and goods worldwide. Urbanization, growing middleclass populations, and rising disposable incomes have collectively fueled an unprecedented surge in air travel. Today's passengers are in search of efficient, comfortable, and environmentally friendly modes of transportation. As a result, airlines continuously update their fleets with state-of-the-art aircraft that are fuel efficient. This drive towards modernization heavily relies on aerostructures as the foundation for enhancing aircraft design and performance.

In response to the rising demand, aircraft manufacturers are ramping up production and developing new models. This surge in activity creates a significant market for aerostructure manufacturers. Advanced aerostructures are essential components in constructing aircraft that not only prioritize fuel efficiency but also provide improved passenger comfort and safety. These structures play a vital role in optimizing aerodynamics, reducing weight, and enhancing structural integrity all crucial factors for ensuring the economic viability of airlines in an increasingly competitive market.

Moreover, the development of long-range, wide-body planes specifically designed to connect far-flung corners of the world is directly correlated with the rise in global air travel demand. These aircraft heavily rely on groundb¬reaking aerostructures that are capable of enduring the strains posed by extended flights while ensuring optimal fuel efficiency. Airlines are making substantial investments in these cutting-edge aircraft to cater to passengers' desire for uninterrupted, long-distance travel experiences. At the forefront of this engineering marvel, aerostructure manufacturers diligently deliver lightweight yet durable components essential for such remarkable accomplis¬hments.

High cost of procuring and maintaining aerostructure components

The aerostructures market is facing a significant hurdle in its growth. This obstacle arises from the substantial costs associated with procuring and maintaining aerostructure components. The aerospace industry's demanding standards for quality and safety necessitate the utili¬zation of advanced materials, cutting-edge manufacturing techniques, and stringent quality control processes. Consequently, these factors contribute to escalated expenses. Moreover, aircraft manufacturers and airlines often bear the brunt of a large initial investment for research and development, material sourcing, and specialized manufacturing facilities. These expenses are passed onto them due to the complex nature of the industry.

Furthermore, the maintenance and repair of aerostructures throughout an aircraft's lifespan incur significant costs due to specialized maintenance demands, highly skilled technicians, expensive equipment, and a comprehensive inventory of spare parts. These costs can be a substantial portion of operational expenses for airlines, making the high cost of aerostructure components a restraining factor for the growth of the aerostructures market.

Growth in usage of UAVs

Unmanned Aerial Vehicles (UAVs) have gained significant popularity in various fields, including surveillance, agriculture, delivery services, infrastructure inspection, and military reconnaissance. With the increasing demand for UAVs, there arises a need for specialized aerostructures that can withstand the unique challenges of unmanned flight. This opens up a niche market for aerostructure manufacturers to develop lightweight, durable components optimized for unmanned platforms. For instance, high-altitude, long-endurance UAVs used in surveillance and communication relay tasks require aerostructures capable of enduring extreme environmental conditions while maintaining stability during extended flights.

The military and defense sector heavily relies on UAVs for reconnaissance and combat missions. In these critical operations, rugged aerostructures play a vital role in ensuring mission success and aircraft safety. As defense budgets increase worldwide, the demand for aerostructure manufacturers to supply components for military UAVs grows significantly.

In the commercial sector, the delivery drone industry is undergoing rapid expansion. Giants like Amazon and UPS are actively exploring drone-powered delivery services. To navigate urban landscapes and transport goods securely, these delivery drones rely on sturdy and efficient aerostructures. Aerostructure manufacturers can seize this emerging market opportunity by supplying the essential components necessary for the growth of drone-based delivery systems.

According to the component, the fuselage sector has held the major revenue share of around 36% in 2023. The segment of the aerostructures market that deals with the fuselage holds immense significance in the construction of aircraft and spacecraft. Serving as the central body, it encompasses crucial components such as the cockpit, passenger or cargo compartments, and vital systems. The fuselage acts as a structural foundation, providing both aerodynamic shape and integrity to the vehicle. Designing and manufacturing these structures involve intricate processes, which demand unwavering attention to safety measures, weight reduction, and efficient aerodynamics. Companies specializing in fuselage components not only contribute significantly to advancements in the industry but also strive to achieve greater fuel efficiency, reduced environmental impact, and enhanced passenger comfort.

The fuselage segment is continually evolving with the introduction of composite materials, advanced alloys, and cutting-edge manufacturing techniques. These innovations contribute to the development of aircraft and spacecraft that are not only more efficient but also more sustainable. They represent the forefront of modern aviation and space exploration.

The alloy segment is anticipated to hold the largest market share the market in 2023. Alloys play a vital role in constructing aerostructures due to their exceptional properties. These include high strength, durability, corrosion resistance, and the ability to withstand extreme temperatures and pressures experienced during flight. Aerospace engineers and manufacturers utilize specialized alloys, often derived from combinations of metals such as aluminum, titanium, and nickel. They are employed in critical components like wings, fuselages, landing gear, and engine parts.

The alloys segment continually advances with metallurgical progress as experts strive to develop lighter yet heat-resistant and fuel-efficient materials. This pursuit aims to enhance aircraft and spacecraft performance. The aerospace industry increasingly prioritizes weight reduction, improved fuel economy, and safety standards. Within this context, the alloy segment stands at the forefront of innovation. Its role is to ensure that aerospace vehicles meet the rigorous demands of modern aviation and space exploration.

The fixed-wing aircraft segment is anticipated to hold the largest market share the market in 2023. Fixed-wing aircraft, from commercial airliners to military fighter jets and cargo planes, rely on specialized aerostructures. These aerostructure components, including wings, fuselages, tail sections, and landing gear, undergo meticulous design and manufacturing processes. Their purpose is to withstand the forces and stresses of flight for achieving aerodynamic stability, structural integrity, safety, and performance. Within this segment of aviation innovation thrives as a constant driving force.

The focus lies in the development of lightweight materials, advanced aerodynamic designs, and fuel-efficient technologies. Such advances aim to enhance aircraft performance while prioritizing environmental sustainability. As the demand for air travel continues to rise globally with special significance in emerging markets; fixed-wing aircraft remain an influential stakeholder shaping the future of aviation. This sentence highlights the role of aircraft development in addressing key challenges such as passenger capacity, carbon emissions, and global air transportation demands. The fixed-wing aircraft segment demonstrates the industry's commitment to advancing aviation technology and establishing new bench¬marks for safety, efficiency, and sustainability.

In 2023, the aftermarket sector had the highest market share on the basis of the end-user. Aftermarket services are crucial for aerostructures. They involve inspecting, repairing, and replacing components that have experienced wear and tear during operational use. This segment encompasses various activities, including routine inspections, structural repairs, corrosion prevention, and the replacement of worn or damaged parts. Meticulous attention to detail is required to ensure that aerostructure components like wings, landing gear, and fuselage sections meet safety standards and performance criteria.

The aftermarket end-use segment serves commercial and military aviation as well as the space industry. It plays a vital role in sustaining the operational fleets of aircraft and spacecraft. Airlines, military forces, and space agencies rely on Maintenance, Repair, and Overhaul (MRO) services. These services help to prolong the lifespan of their assets, optimize operational costs, and ensure mission safety. As the aerospace industry progresses, the aftermarket sector is projected to expand. This growth is driven by older aircraft remaining in service for extended periods and the increasing demand for specialized expertise in aerostructure maintenance and repair. Companies specializing in MRO are presented with lucrative opportunities.

Segments Covered in the Report:

By Components

By Platform

By Material

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client