March 2025

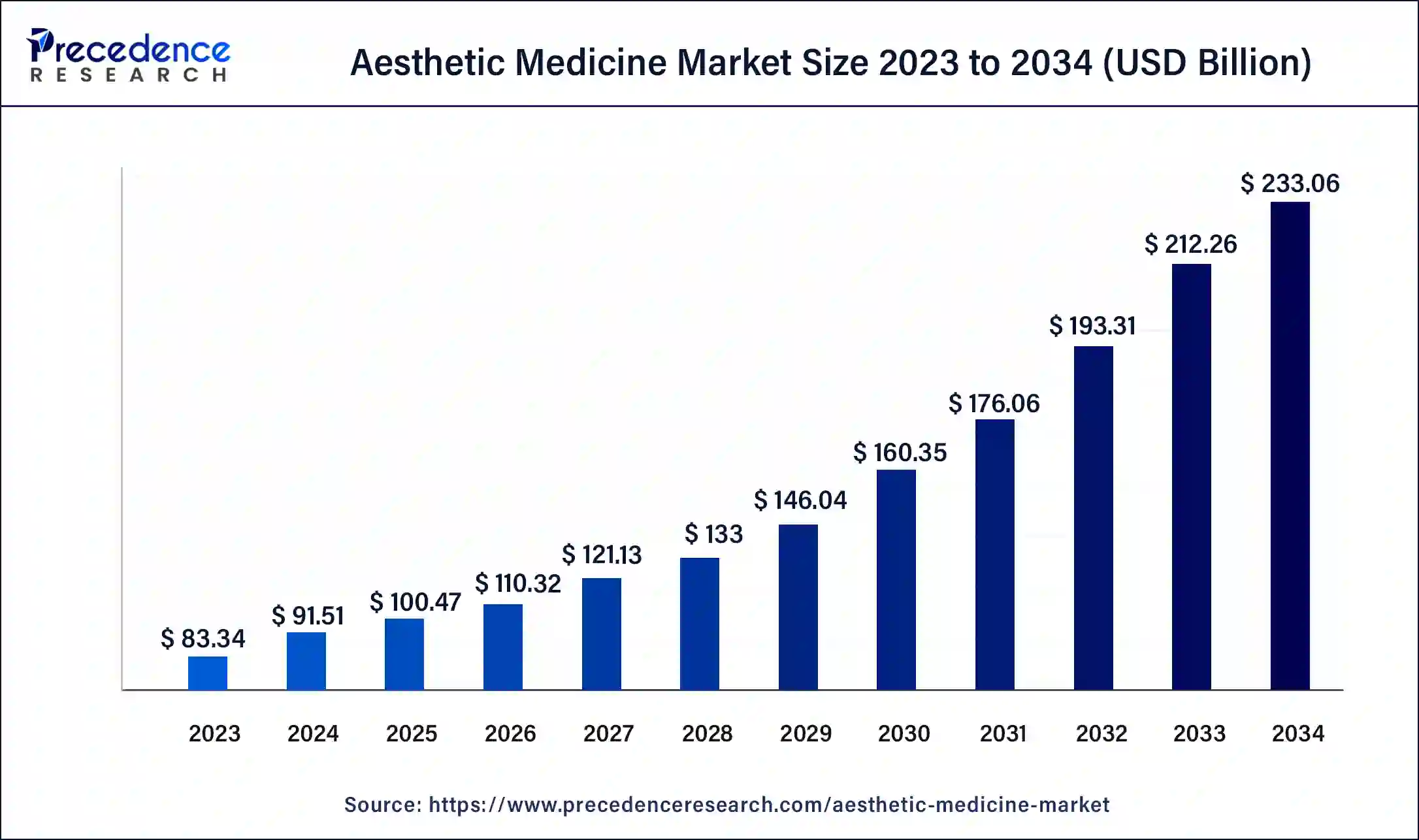

The global aesthetic medicine market size was USD 83.34 billion in 2023, calculated at USD 91.51 billion in 2024 and is expected to reach around USD 233.06 billion by 2034, expanding at a CAGR of 9.8% from 2024 to 2034.

The global aesthetic medicine market size accounted for USD 91.51 billion in 2024 and is expected to reach around USD 233.06 billion by 2034, expanding at a CAGR of 9.8% from 2024 to 2034. The North America aesthetic medicine market size reached USD 30 billion in 2023.

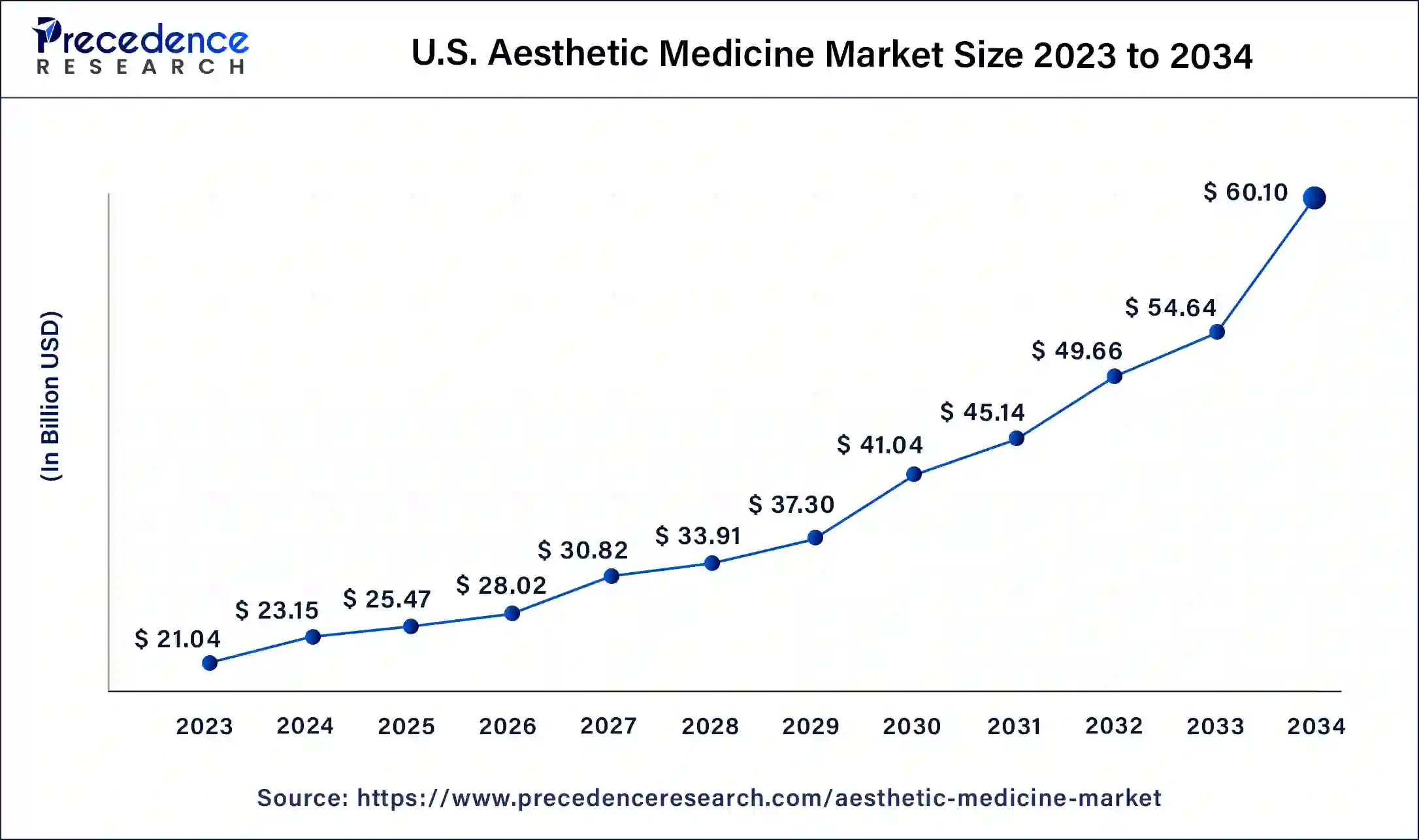

The U.S. aesthetic medicine market size was estimated at USD 21.04 billion in 2023 and is predicted to be worth around USD 60.10 billion by 2034, at a CAGR of 10% from 2024 to 2034.

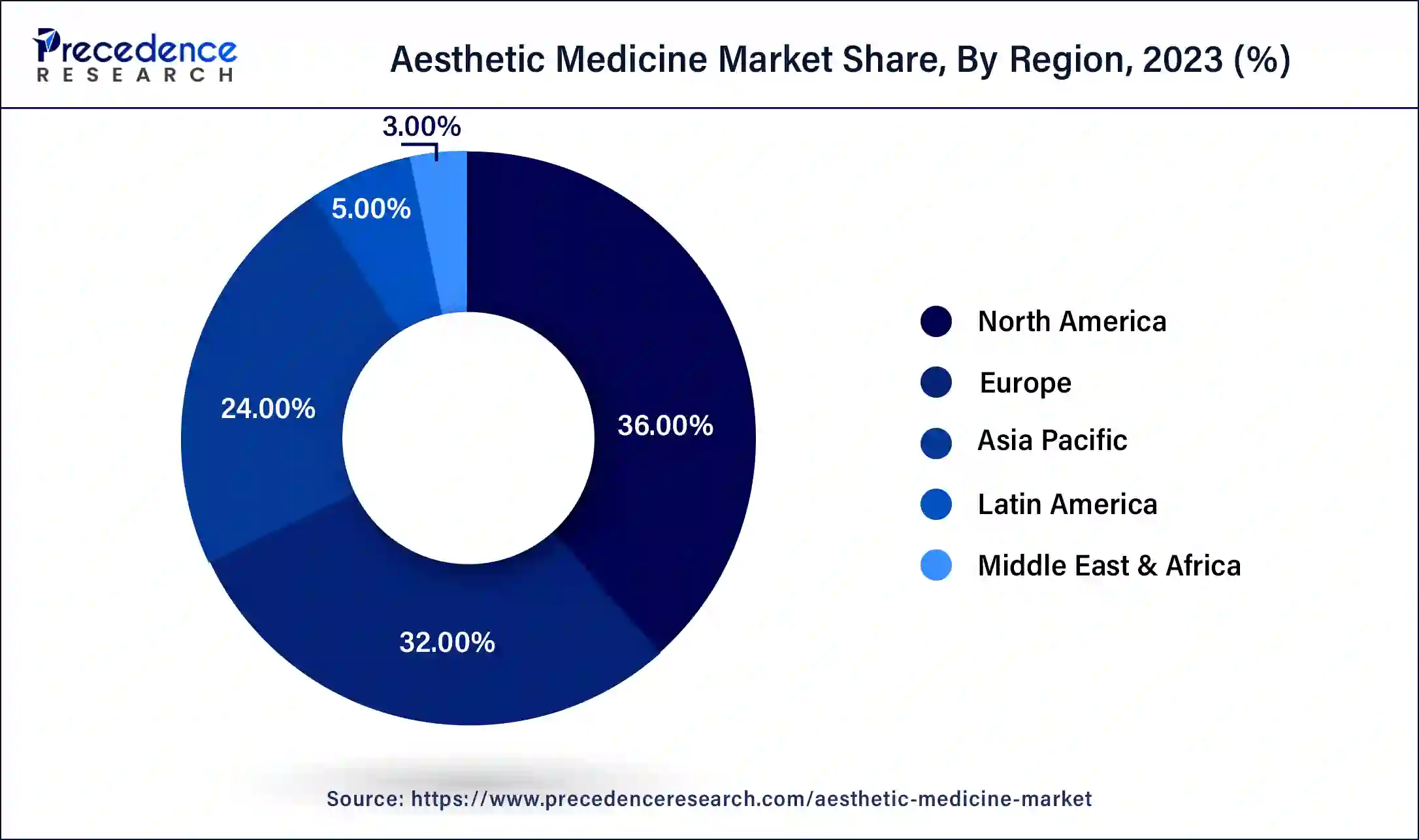

North America was the dominating aesthetic medicine market with around 36% of the global aesthetic medicine market share in 2023. The presence of strong and well-established healthcare and medical infrastructure, rising adoption of robots and digital technologies in the surgical procedures, increased awareness regarding the availability of advanced aesthetic treatments and medicines, higher healthcare expenditure, rapidly aging population, and presence of favorable government policies are some of the most prominent factors that has boosted the growth of the aesthetic medicine market in North America.

The rising prevalence of skin disorders among the population, presence of skilled cosmetic surgeons along with the rising adoption of cosmetic procedures in North America is significantly fostering the growth of the market. According to the American Society of Plastic Surgeons, the breast augmentation procedures increased by 48% from 2000 to 2018 while the Botox injections increased by around 845% in the same period. Therefore the rising demand for breast augmentation and Botox injections have significant contributions in the growth of the North America aesthetic medicine market. Moreover, the presence of top market players and various strategies adopted by them and the active participation of the government authorities on the aesthetic medicine product approvals is positively impacting the market growth in this region.

Asia Pacific aesthetic medicine market is expected to grow at the highest CAGR of 10.8% during the forecast period. The rising adoption of technologically advanced products, rising focus towards aesthetic appearance, and rising demand in developing countries like India, China, and South Korea is boosting the growth of the market in this region. South Korea is recognized as the hub of cosmetic surgeries. Furthermore, the significantly rising geriatric population in the region is expected to propel the growth of the market.

According to the United Nations, around 80% of the global geriatric people are expected to live in the low and middle income countries by 2050. Moreover around 93% of the road accident cases are observed in low and middle-income countries which are another major reason behind the rising demand for aesthetic medicine. The rising awareness regarding the aesthetic treatments and aesthetic medicines among the population in Asia Pacific is expected to drive the growth of the market in the forthcoming future.

The growing demand for the aesthetic treatments among the global population coupled with the rising technological advancements and innovations in the aesthetic treatment devices is expected to significantly drive the growth of the global aesthetic medicine market during the forecast period. For instance, the introduction of non-invasive body contouring system, which uses the fat freezing technology is expected to offer growth opportunities to the market players. The rapidly aging population across the globe is expected to have a significant and positive impact on the growth of the global aesthetic medicine market. The rising urge to look fit and young is fueling the demand for aesthetic treatments.

According to the United Nations, the global geriatric population is estimated to reach at around 1.5 billion 2050. This will provide a rapid impetus to the aesthetic medicine market. Various aesthetic procedures such as nose reshaping, Botox injections, and liposuction are gaining a rapid traction in the developing market like India and South Korea. As per the International Society of Aesthetic Plastic Surgery, India was among the top five nations performing non-surgical procedures at a global level. These factors are encouraging the increased production of the aesthetic medicines across the globe.

Moreover, the rising awareness among the population regarding the availability of various advanced and non-invasive aesthetic treatment procedures and improving access to the advanced healthcare and medical facilities is playing a crucial role in the growth of the market. The rising investments in the research and development and various collaborative strategies adopted by the companies are bolstering the growth of the aesthetic medicine market across the globe. Moreover, the aesthetic medicines are used for treating the scars, wrinkles, moles, skin discoloration, excess fat, and skin laxity. The rising incidences of road accidents, sports injuries, and burns are expected to boost the demand for the aesthetic medicines.

| Report Coverage | Details |

| Market Size in 2023 | USD 83.34 Billion |

| Market Size in 2023 | USD 91.51 Billion |

| Market Size by 2034 | USD 233.06 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 9.8% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Procedure, Product, Application, End-User, Gender, Route of Administration, and Region |

| Regions Covered | North America,Asia Pacific, Europe, Latin America, Middle East and Africa |

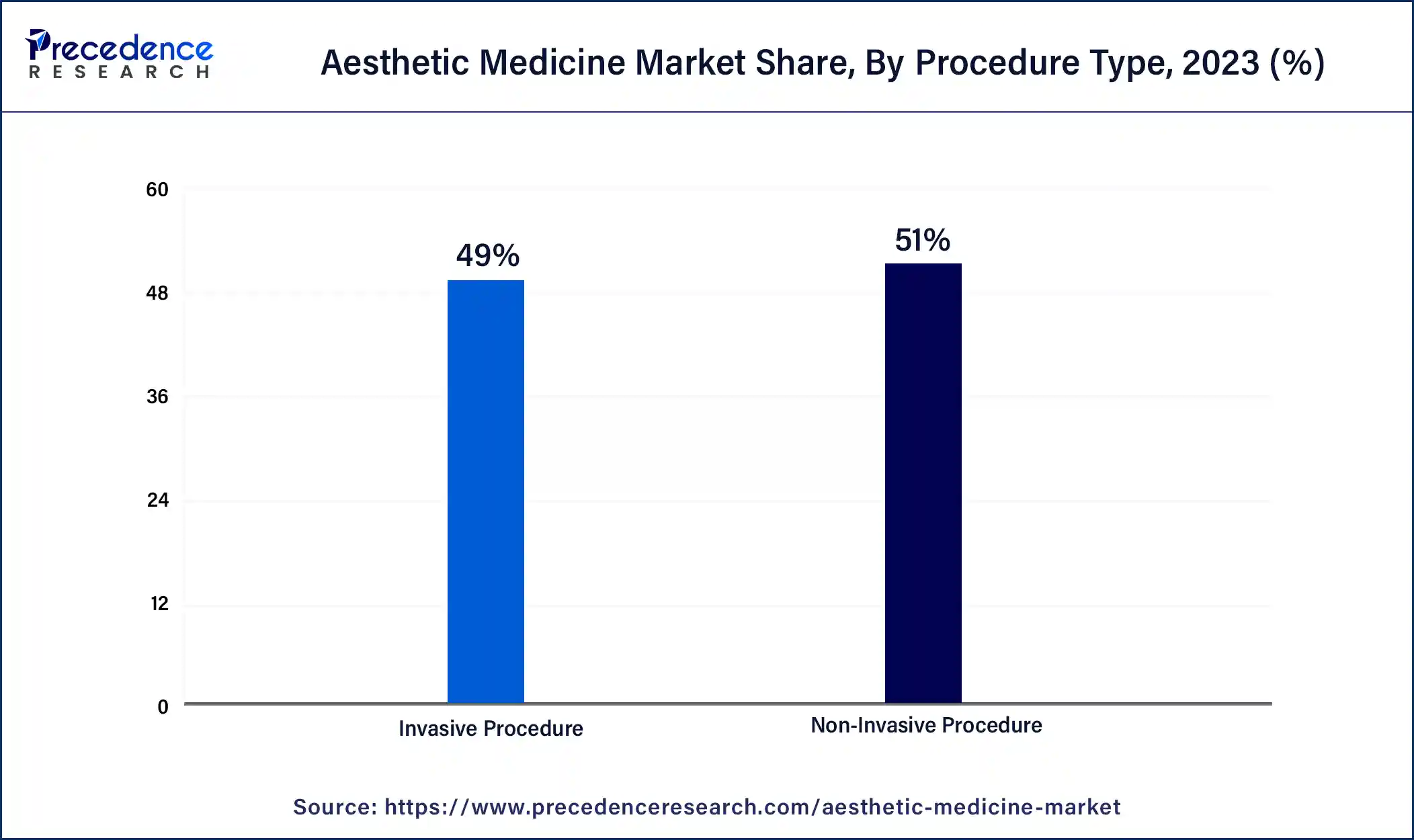

The non-invasive procedures were the dominating segment, capturing a market share of more than 51% in 2023. This segment is also estimated to be the fastest-growing segment during the forecast period. The non-invasive procedures have gained a rapid traction across the globe owing to its lesser pain, quick results, and less stays in hospitals or surgical centers. The increasing adoption of robotics and other digital devices in the non-invasive procedures is boosting its efficiency and effectiveness and is expected to gain a significant growth in the developing markets. The non-invasive procedure segment is further divided into Botox injections, microdermabrasion, soft tissue fillers, laser hair removal, chemical peel, and others. The Botox injection segment dominated the market in 2020. According to the American Society of Plastic Surgeons, the Botox injections became the leading non-invasive aesthetic procedure with around 4.4 million procedures performed in 2020. The significantly rising popularity of Botox injections across the globe has led to the dominance of this segment in the global aesthetic medicine market.

The invasive procedures segment is expected to grow at a substantial rate during the forecast period. The invasive segment is further segregated into liposuction, nose reshaping, breast augmentation, tummy tuck, eyelid surgery, and others. The rising demand for the liposuction and nose reshaping is expected to fuel the growth of the segment in the forthcoming years. The rising number of road accidents across the globe and various sports injuries that can injure nose is a major factor behind the growing demand for nose reshaping.

The key market players are constantly engaged in various developmental strategies like partnership, collaborations, new product launches, and acquisitions to strengthen their market position and gain market share.

Segments Covered in the Report

By Procedure Type

By Product Type

By Application

By End-User

By Gender

By Route of Administration

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

May 2025

June 2024

September 2024