February 2025

Agricultural Biologicals Market (By Crop-type: Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Others; By Product: Biopesticides, Biostimulants, Biofertilizers, Others (Macro-organisms); By Application: Foliar Sprays, Soil Treatment, Seed Treatment, Post-harvest; By End-User: Biological Product Manufacturer, Government Agencies) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

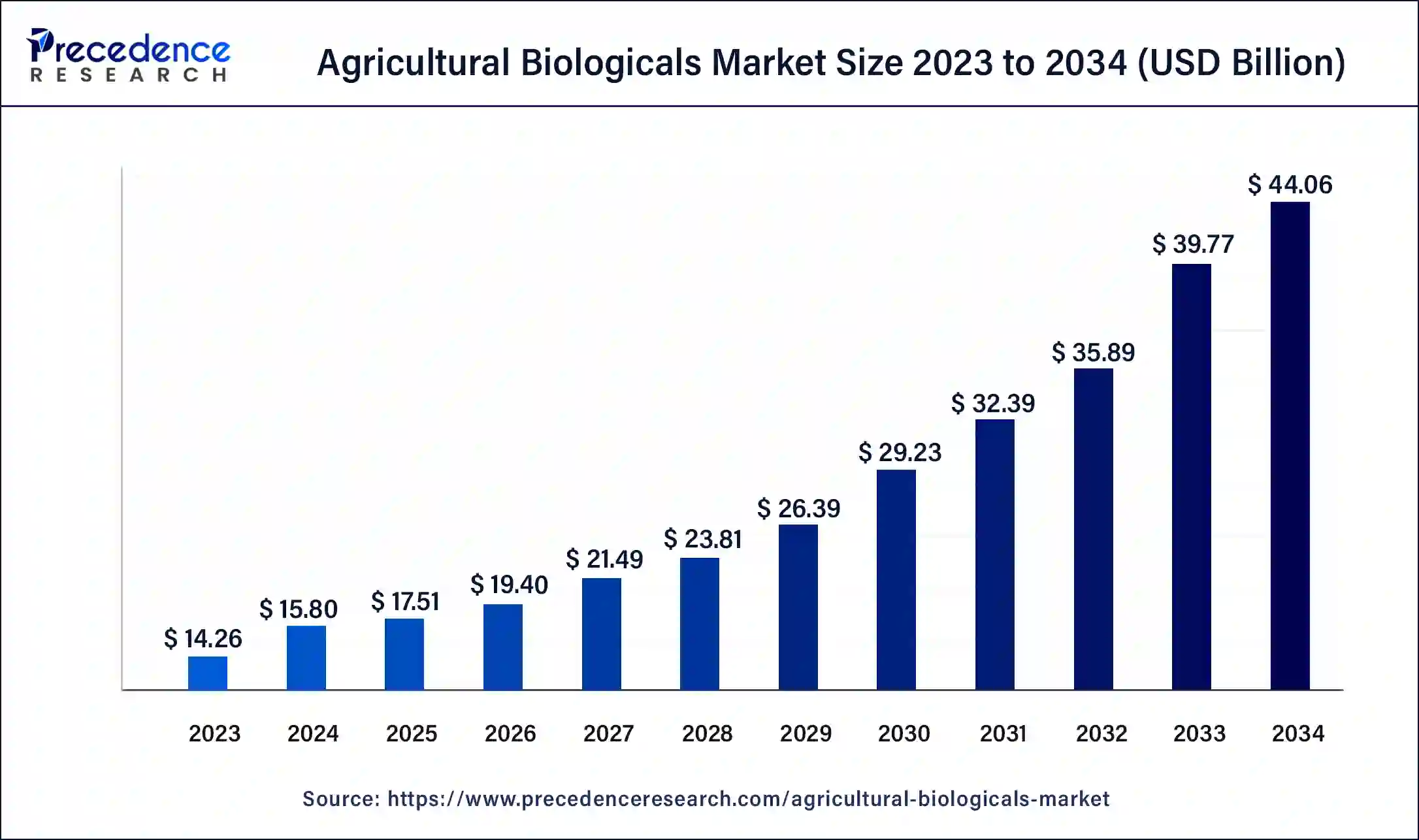

The global agricultural biologicals market size was USD 14.26 billion in 2023, accounted for USD 15.80 billion in 2024, and is expected to reach around USD 44.06 billion by 2034, expanding at a CAGR of 10.8% from 2024 to 2034. The North America agricultural biologicals market size reached USD 5.13 billion in 2023. The rising demand for sustainable and organic alternatives to chemical-based pesticides in farm production drives the growth of the market.

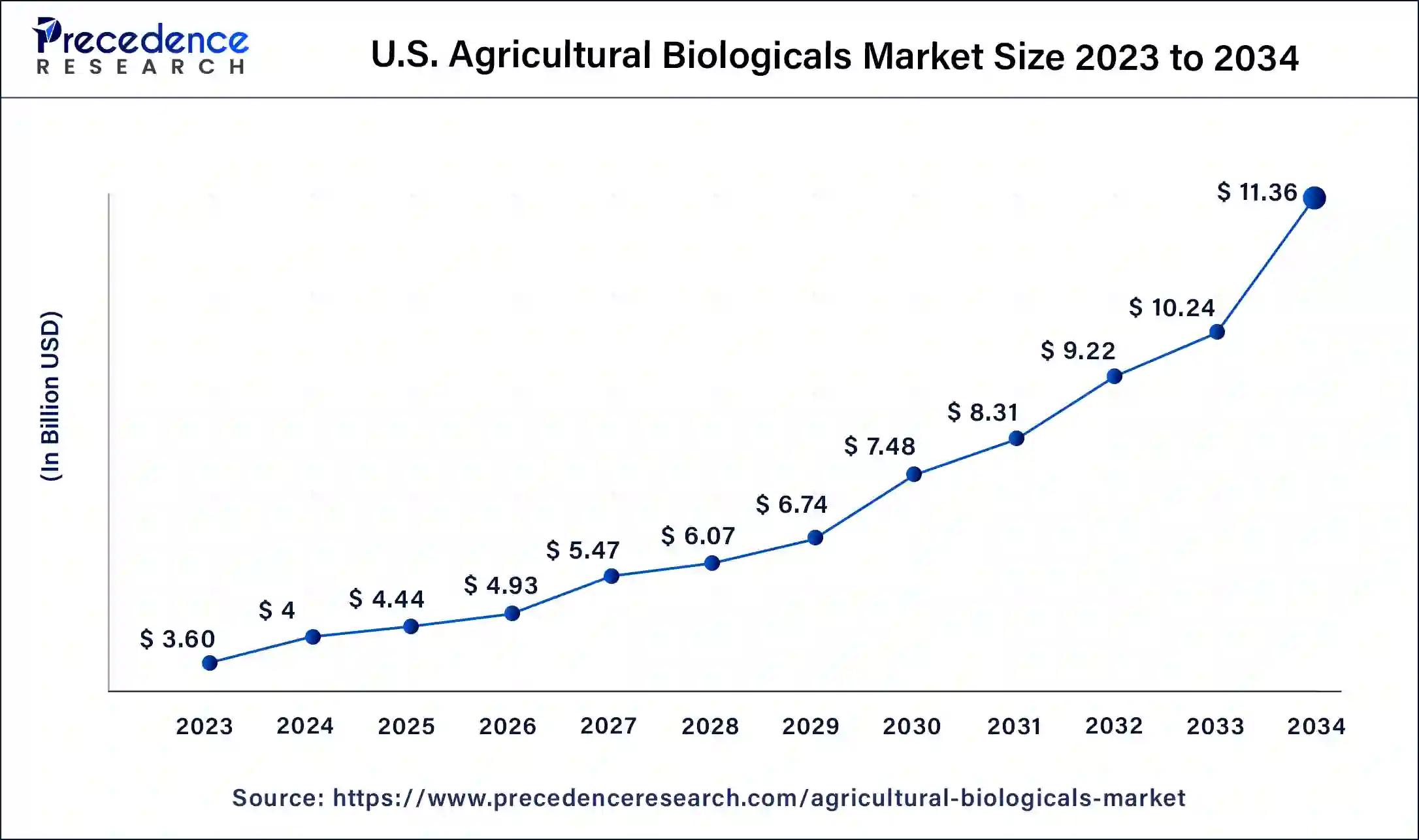

The U.S. agricultural biologicals market size was estimated at USD 3.60 billion in 2023 and is predicted to be worth around USD 11.36 billion by 2034, at a CAGR of 11% from 2024 to 2034.

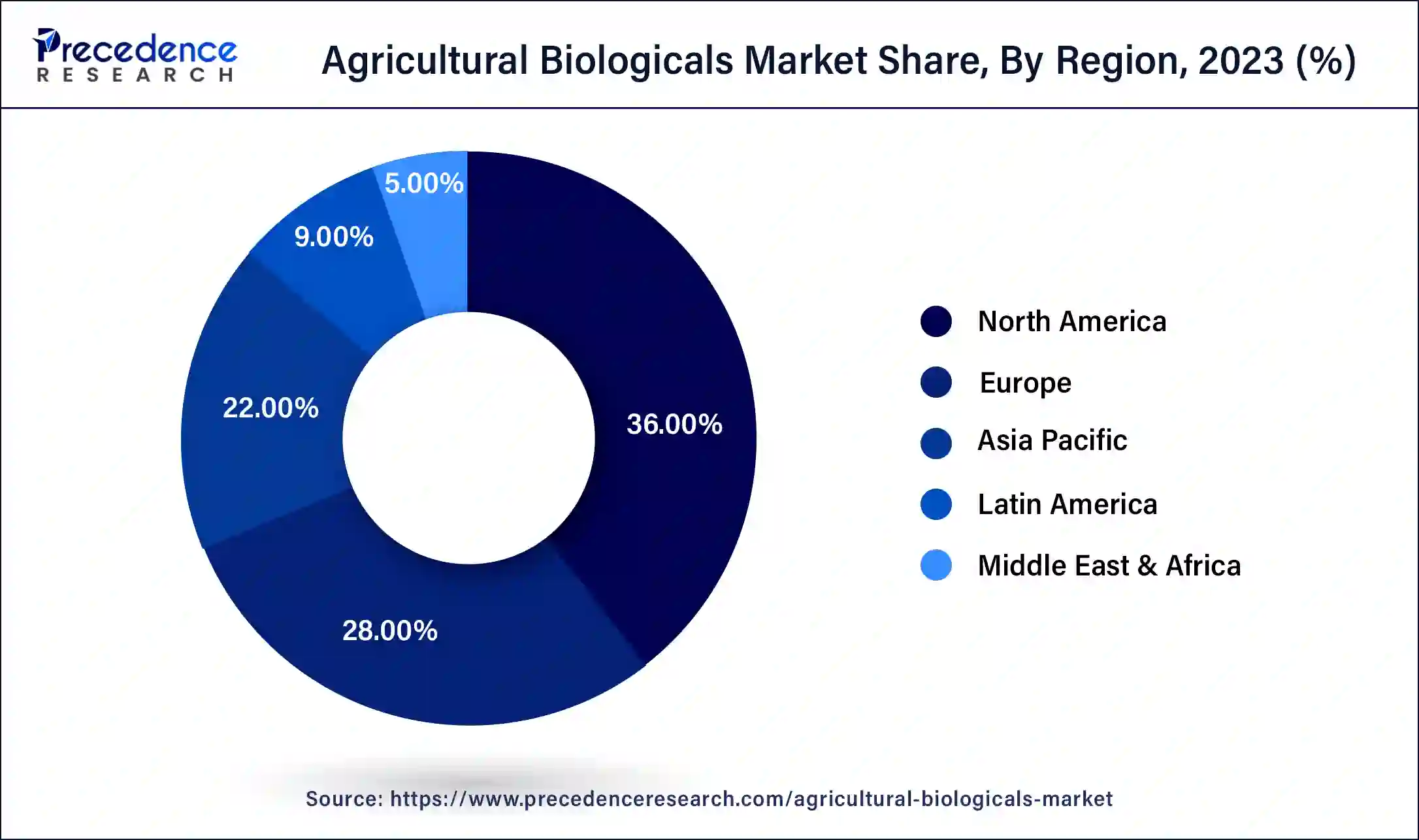

North America led the agricultural biologicals market with the largest share in 2023. The growth of the market in the region is attributed to the rising awareness about the organic product consumption and the rising development and innovations in the agriculture industry are driving the growth of the market. The rising investments on the natural or organic food and materials for the development of the organic market and the reducing the environmental issues that caused by the harmful chemical-based products are driving the growth of the agricultural biological market in the region.

Asia Pacific is expected to witness the fastest growth in the agricultural biological market during the forecast period. The growth of the region is attributed to the well-established agriculture industry and the rising population that anticipated the demand for the high-quality food grain that drives the growth of the market. The rising awareness about the environmental issues causing by the chemical-based pesticides are driving the demand for the sustainable product that driving the growth of the market. Additionally, the rising investments in the agriculture and the regularities associated with the agriculture and pollution are positively influencing the growth of the agricultural biological market in the region.

As awareness of environmental issues such as soil degradation, water pollution, and biodiversity loss grows, there is an increasing emphasis on sustainable agriculture practices in the region. Agricultural biologicals offer eco-friendly alternatives to conventional chemical inputs, reducing environmental impact and promoting long-term soil health. Consumers, governments, and businesses are increasingly prioritizing sustainability, driving the demand for biological products in the region while promising a sustained growth to the agricultural biological market.

The agricultural biologicals market offers a set of products that are made by naturally found plant extract, microorganisms, organic matter, and beneficial insects. The agricultural biologicals are divided into three major categories or type as per the use in farming or agriculture biostimulants, biopesticides, and biofertilizers.

In which biostimulants are used for the enhancing productivity of plants, biopesticides are used for the protection of the plants from the pests, and biofertilizers are used for the plant fertilization or nutrition. The rising awareness about the chemical-based pesticides and their harmful impact on the environment and human health, along with the rising demand for the sustainable alternatives to the chemical-based pesticides are driving the growth of the agricultural biologicals market across the globe.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 10.8% |

| Global Market Size in 2023 | USD 14.26 Billion |

| Global Market Size in 2024 | USD 15.80 Billion |

| Global Market Size by 2034 | USD 44.06 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Crop-type, By Product, By Application, and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The rising awareness about the improved health in the population and the increasing inclination towards the organic farm food for the better health and chemical free food are driving the growth of the agricultural biologicals market. The rising awareness about the synthetic chemical-based pesticides which are affecting the quality of the crops and leave negative impact on the human health and environment by the excessive use also promotes the utilization of biologicals in the agricultural sector.

The use of excessive chemical pesticides is also responsible for the air pollution and it highly impacting the consumer’s health. The various regional countries are reducing the use of the agrochemical the farming and adopted the alternative like agricultural biological products in the production farms for the organic farming which drives the growth of the agricultural biological market.

Agricultural biological pesticides are higher in cost as compared to chemical-based pesticides due to the lesser competition, higher cost of the production and limited scalability that limiting the use of the product and restraints the growth of the agricultural biological market. The cost-effectiveness of agricultural biologicals can vary depending on the scale of production. Large-scale farms may find it more challenging to adopt biological products due to higher upfront costs and logistical challenges. Conversely, smaller-scale or niche farmers may find it easier to integrate biologicals into their operations, especially if they can command premium prices for sustainably produced crops.

The rising demand for the sustainable pesticides and the shifting government regularities for the adoption of the organic pesticides that are environmentally safer and safer to consume by the human offers a significant opportunity for the agricultural biological market. The chemical-based pesticides negatively impact the environment like it harms to the non-target organisms which are beneficial for the insects and wildlife and the source of the contaminated water.

Several governments have started implementing strict regulations on the excessive utilization and application of chemical-based pesticides in the farms in order to promote the application of eco-friendly and sustainable alternatives for the agricultural practices. As well as knowing the demand for the organic pesticides many market players are investing in the production and manufacturing of these products are also driving the growth of the market.

The biopesticides segment dominated the agricultural biological market with the highest share in the market in 2023. The growth of the segment is attributed to the higher consumption of biopesticides by the farm producers for safeguarding their crops from pests. The biopesticides include pathogenic, botanicals, microbial species such as bacteria, fungi, and viruses, and the natural competitors of pests, including nematodes and semiochemicals, parasitoids, and predators, for controlling the pests level. Biopesticides are one of the important tools for farmers because to reduce the pests on the crops without harming any environmental factors or creating pollution and it not harmful to human health either.

The rising demand for sustainable agricultural products, demand for organic food, and the restrictions on harmful pesticides are driving the growth of biopesticides in the agricultural biological market.

The biofertilizers segment is observed to grow at a notable rate during the forecast period in the agricultural biological market. There is increasing awareness among farmers and consumers about the negative environmental impacts of chemical fertilizers. Biofertilizers offer a sustainable alternative by harnessing natural processes to enhance soil fertility and crop productivity without causing harm to the environment. As sustainability becomes a key focus in agriculture, the demand for biofertilizers has been on the rise.

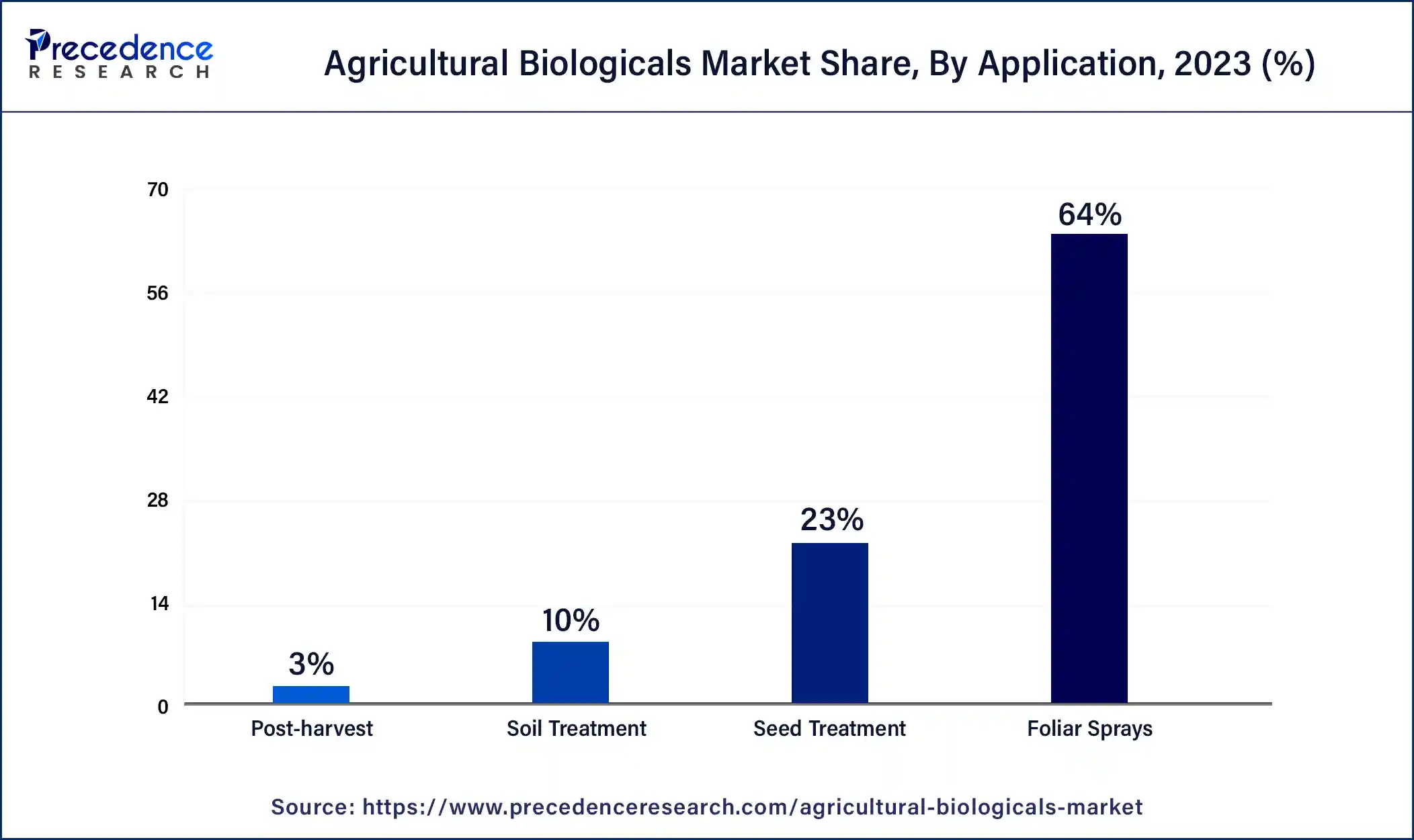

The foliar spray segment, in the agricultural biological market, held the largest share for the year 2023. The dominance of the segment is attributed to the rising adoption of foliar spray by the medium and large farming. Foliar sprays are applied liquid nutrition and mineral directly to the plants. It is beneficial for the plants due to provide the liquid to the plants in the form of mist directly to the foliage.

There are basic three types of the foliar sprays that are foliar feeding sprays, foliar sprays for pests, and foliar to fight diseases. The rising adoption of the foliar sprays due to its effectivity and provides the nutrients to the plants are driving the growth of the segment.

The biological product manufacturers segment held the largest share of the agricultural biological market in 2023. The rising adoption of the agricultural biologicals pesticides in the biological products manufacturer for the manufacturing of organic products that drives the growth of the segment. The demand for the organic products in the market due to its beneficial properties and the rising awareness about the chemical-based products that causes the health and environmental issues that drives the demand for the biological products. Additionally, the rising public and private investments in the development of the biological farming and production are further boosting the growth of the biological product manufacturers segment.

Segments Covered in the Report

By Crop-type

By Product

By Application

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

August 2023

July 2024

January 2025