February 2025

Agricultural Chelates Market (By Type: EDTA, DTPA, EDDHA, IDHA, Others; By Crop Type: Cereal & Grains, Fruit & Vegetables, Oilseeds & Pulses, Others; By Mode of Application: Foliar Spray, Soil Treatment, Fertigation, Seed Treatment, Others; By End-use: Agriculture, Horticulture, Floriculture, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2033

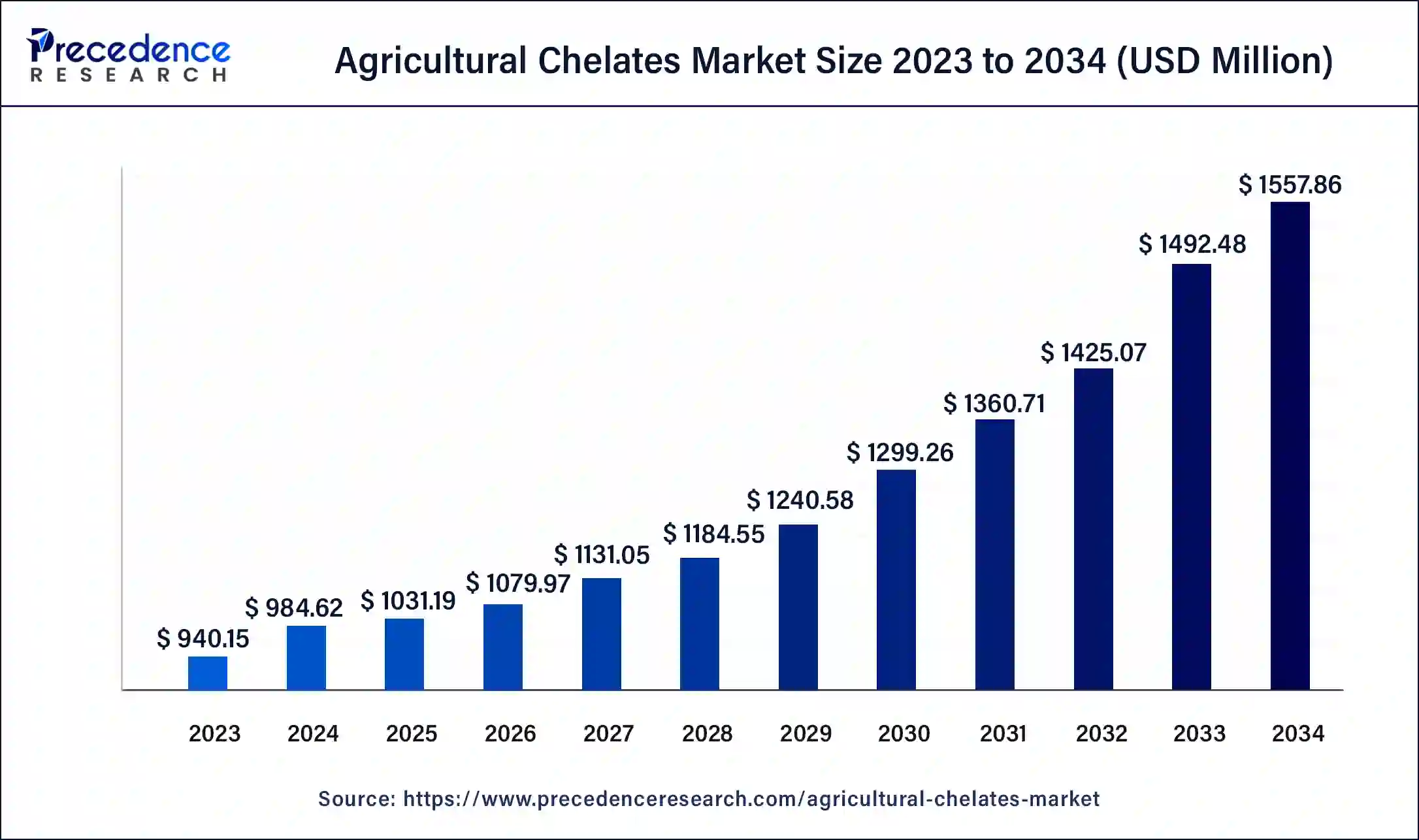

The global agricultural chelates market size was USD 940.15 million in 2023, calculated at USD 984.62 million in 2024, and is expected to reach around USD 1557.86 million by 2034, expanding at a CAGR of 4.69% from 2024 to 2034. The agricultural chelates market is driven by the growing need for high-value crops.

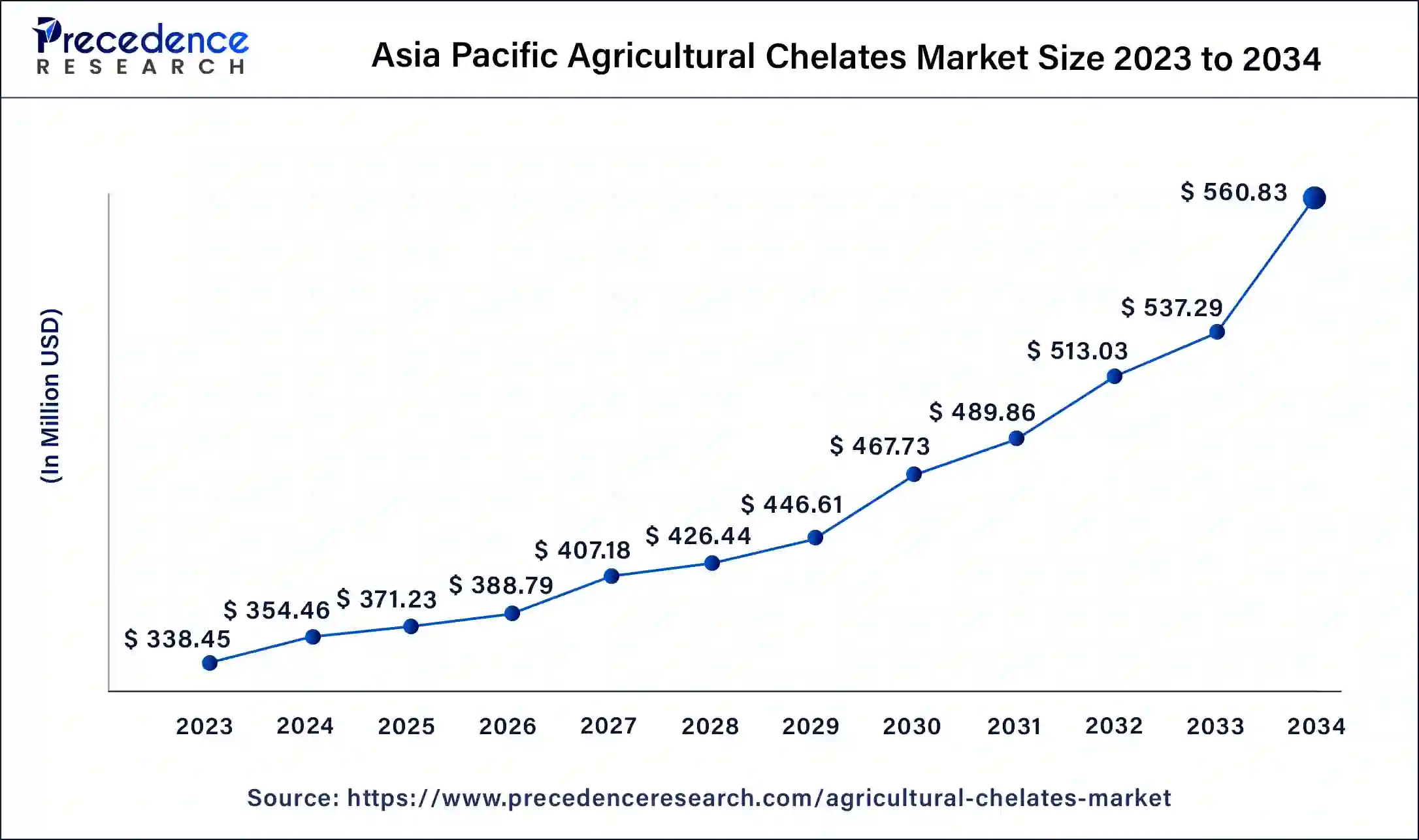

The Asia Pacific agricultural chelates market size was estimated at USD 338.45 million in 2023 and is projected to surpass around USD 560.83 million by 2034 at a CAGR of 5% from 2024 to 2034.

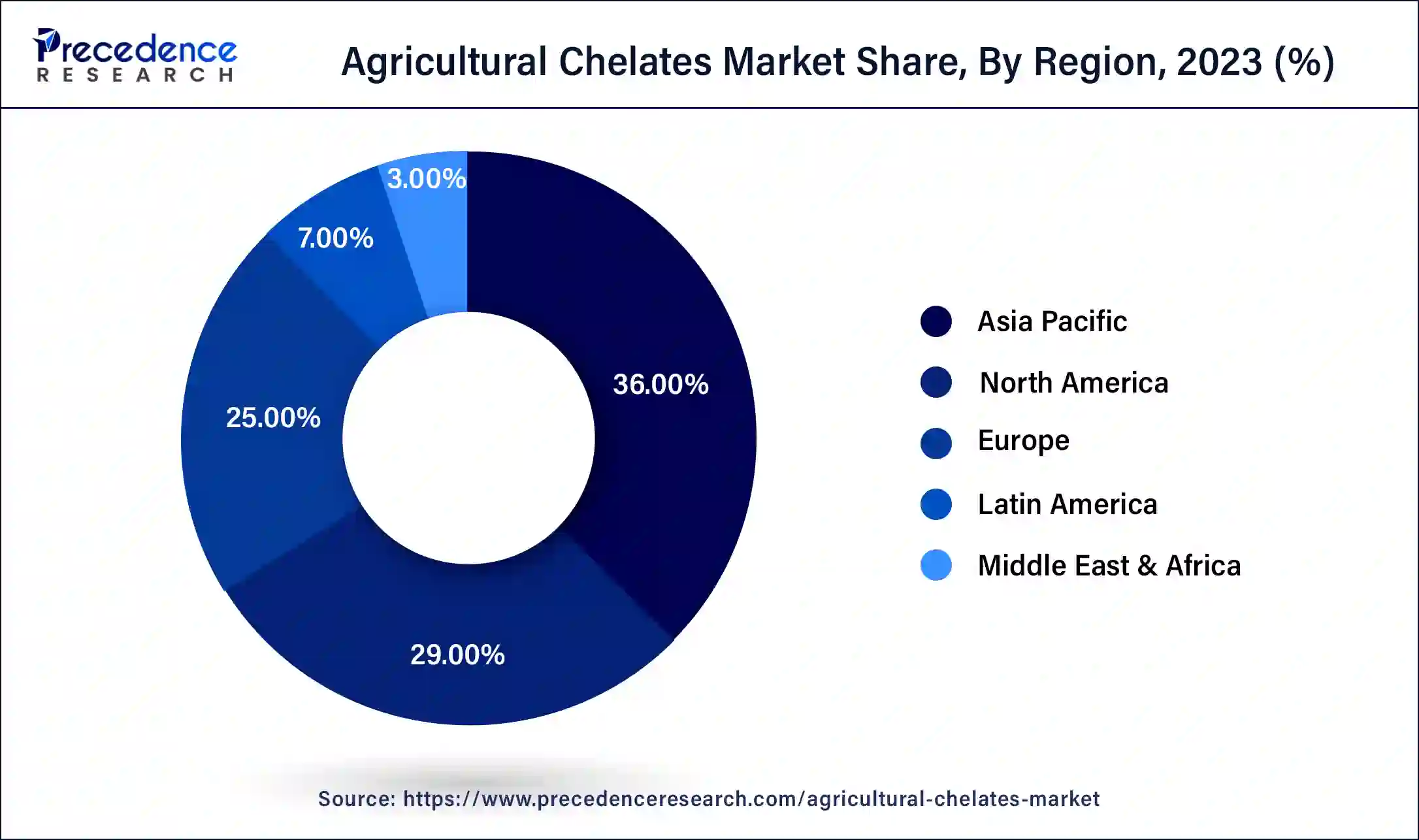

Asia-Pacific has its largest market share in 2023 in the agricultural chelates market. To supply the region's expanding population with food, agriculture has rapidly expanded in the area. Agricultural chelates are used more frequently due to this expansion to raise crop yields, improve nutrient uptake, and improve soil fertility. To increase production and sustainability, farmers in the Asia-Pacific region are progressively implementing sophisticated farming techniques. This covers integrated nutrient management systems, precision agriculture, and greenhouse farming. Agricultural chelates are essential to these methods because they minimize soil degradation, reduce nutrient losses, and guarantee that crops have the best possible nutrient availability.

North America shows a significant growth in the agricultural chelates market during the forecast period. Fruits, vegetables, and high-value crops are among the horticultural and specialty crop production increasing in North America. These crops are grown in controlled conditions where fertilizer management is crucial and frequently have specialized nutritional requirements. The customized solutions agricultural chelates provide for these crops encourage growers concentrating on specialist markets to adopt them.

The agricultural chelates market refers to the industry that produces and distributes chelated micronutrients used in agricultural practices. Chelates are chemical compounds in which a metal ion is bonded to an organic molecule to form a ring-like structure, known as a chelate complex. These chelated micronutrients are essential for plant growth and supplement soil and foliar applications in agriculture.

The purpose of agricultural chelates is to improve plant nutrient availability and uptake. Chelation helps prevent nutrient deficiencies by improving the stability and solubility of micronutrients such as iron (Fe), manganese (Mn), zinc (Zn), copper (Cu), etc. These micronutrients play a vital role in various biochemical processes within plants, which include photosynthesis, enzyme activation, and overall plant growth and development.

| Report Coverage | Details |

| Global Market Size by 2034 | USD 1557.86 Million |

| Global Market Size in 2023 | USD 940.15 Million |

| Global Market Size in 2024 | USD 984.62 Million |

| Growth Rate from 2024 to 2034 | CAGR of 4.69% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Crop Type, Mode of Application, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing trends of precision agriculture

Using GPS, drones, and sensors, precision agriculture allows farmers to assess field variations in soil nutrients, moisture levels, and other characteristics. Farmers can apply site-specific nutrient management strategies by accurately identifying these variances. Agricultural chelates are critical in minimizing waste, guaranteeing proper plant nutrition, and providing targeted nutrients to certain field areas. It uses digital platforms and data analytics to make well-informed judgments regarding crop management.

Farmers may improve their agronomic practices by gathering and evaluating data on plant nutrition, weather patterns, soil health, and yield variability. Farm productivity is increased using agricultural chelates and data-driven insights to treat specific nutrient deficits found by soil testing or remote sensing.

Rising awareness about micronutrient deficiencies

Significant technical developments in the agricultural sector have included data analytics, remote sensing, and precision agriculture. Due to this technology, farmers can now precisely monitor crop health, soil conditions, and nutrient levels. To meet crop-specific requirements, there is a greater emphasis on targeted nutrient management and micronutrient-enriched fertilizers.

Limited adoption in traditional practices

Erosion, inadequate irrigation techniques, and the overuse of chemical fertilizers are the main causes of soil degradation in many parts of the world. The soil's unbalanced pH values may, therefore, lower plant nutrition availability. Agricultural chelates are designed to bind or chelate with micronutrients so that plants may more easily access and utilize them, even in less-than-ideal pH soils. This ability is essential for preserving soil fertility and productivity in deteriorated or acidic soils.

Technological advancements in agriculture

The market for agricultural chelates has undergone even more radical change with the advent of nanotechnology. The term "nano-chelates" refers to nano-sized chelated micronutrient particles with superior stability, nutrient release characteristics, and surface area. These nano-chelates ensure better crop utilization and nutrient absorption by penetrating plant cells more effectively. Manufacturers of agricultural chelates are progressively integrating their products with agronomy software and digital farming platforms.

Through this interface, farmers may monitor crop response in real-time, track application rates, and receive individualized suggestions for nutrient management. These platforms use machine learning algorithms and data analytics to optimize chelate consumption for optimal agricultural advantages.

The EDTA segment dominated the agricultural chelates market in 2023. When it comes to providing plants with vital micronutrients like iron (Fe), manganese (Mn), zinc (Zn), copper (Cu), and others, EDTA chelates are incredibly adaptable and efficient. These micronutrients are essential for several physiological functions, such as photosynthesis, the activation of enzymes, and the general growth and development of plants. EDTA chelate-containing agricultural formulations come in various forms, including granules, soluble powders, and liquid solutions. Farmers may easily apply EDTA chelates using various application techniques, including foliar spraying, soil soaking, and fertigation (application through irrigation systems), because of the formulation's adaptability.

The DTPA segment is observed to be the fastest growing agricultural chelates market during the forecast period. Five carboxylic acid groups make up DTPA's structure, making it a powerful chelating agent. DTPA forms stable complexes with metal ions, including Fe3+, Cu2+, Zn2+, and Mn2+, with high charge densities. By preventing precipitation and locking vital micronutrients into a state that plants can readily absorb, these chelates increase nutrient uptake efficiency. Farmers and other agricultural professionals are implementing micronutrient management techniques more frequently due to rising awareness of how micronutrient deficits impact crop productivity and quality. DTPA chelates provide a dependable option to treat deficiencies, improve plant health, and give plants access to micronutrients in a bioavailable form.

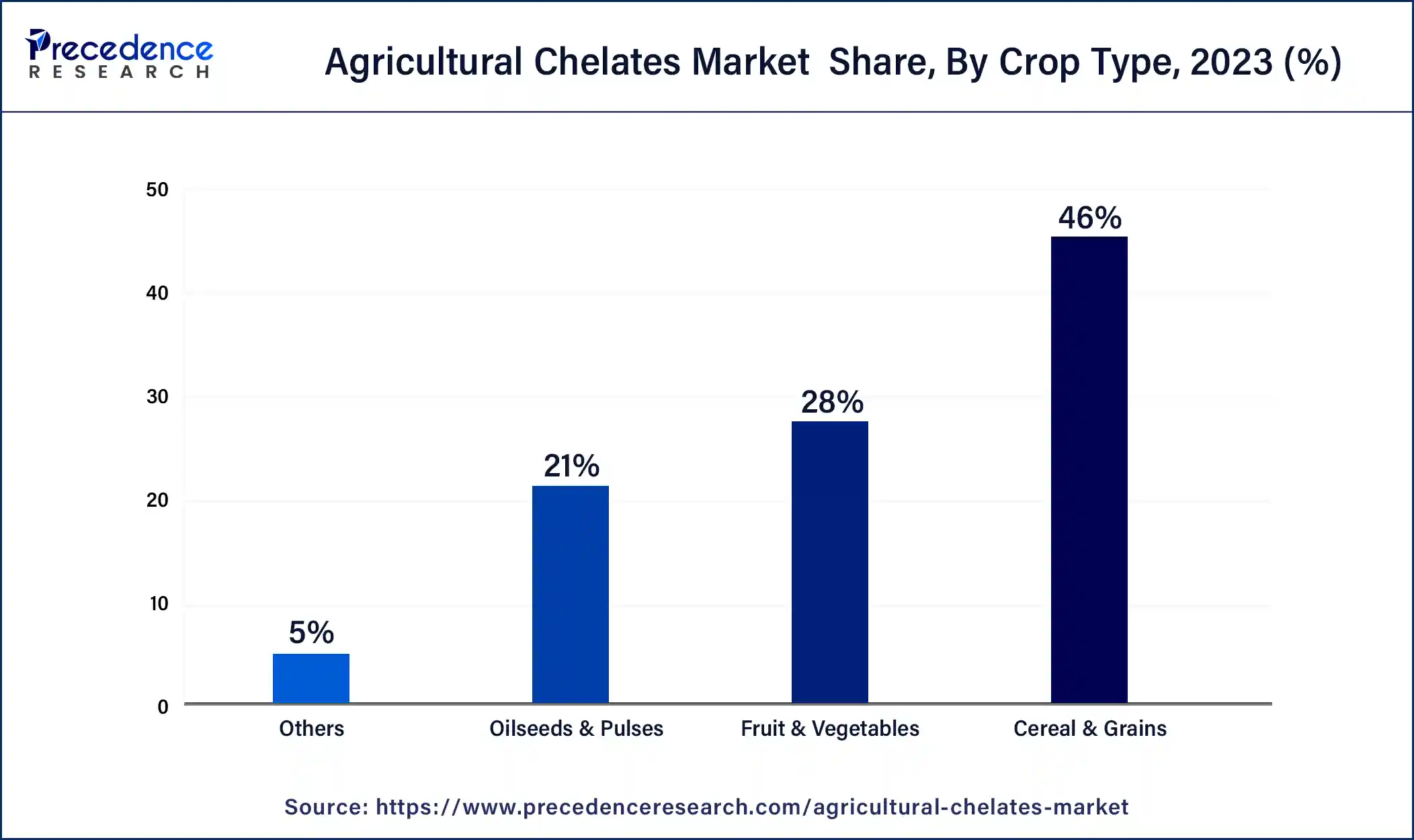

The cereal & grains segment dominated the agricultural chelates market in 2023. Grain and cereal crops require a lot of nutrients during different growth phases. These crops need a balanced supply of micronutrients for optimal growth and productivity, including zinc, iron, manganese, and copper. Chelated micronutrients ensure that these crops obtain the critical elements required for maximum growth and yield since they are more efficient and available to plants than traditional forms. Environmental impact reduction and sustainable techniques are becoming increasingly important in modern agriculture.

The benefits of chelated micronutrients include less runoff and leaching, which improves plant nutrient uptake and lessens environmental pollution. The use of chelates is further encouraged by regulatory support for sustainable farming techniques, particularly in ecologically vulnerable areas where traditional fertilizers may provide hazards.

The fruit & vegetables segment is the fastest growing segment in the agricultural chelates market during the forecast period. Consumers seek premium, nutrient-rich fruits and vegetables as they become more health-conscious. The demand for products that have improved nutritional content, and their attractive appearance has surged due to this trend. By facilitating improved absorption of vital elements, including iron, zinc, manganese, and copper, agricultural chelates contribute to the increased nutrient content of fruits and vegetables. Sustainable farming practices are becoming increasingly popular as people become more conscious of the negative impacts of chemical fertilizers and the sustainability of the environment.

Agricultural chelates provide a more environmentally responsible method of managing nutrients than conventional fertilizers. They help farmers achieve maximum crop yields while minimizing environmental impact by reducing nutrient leaching and runoff.

The oilseeds & pulses segment is observed to show a significant growth in the agricultural chelates market during the forecast period.

Compared to conventional fertilizers, agricultural chelates provide a more effective and environmentally friendly method of delivering plant micronutrients. The chelation technique minimizes waste and its negative effects on the environment by extending the time that nutrients are available to plants. Regardless of the pH or other properties of the soil, oilseeds and pulses are frequently cultivated in various agroclimatic situations, and the application of chelated micronutrients helps maximize nutrient availability. Because of their adaptability, chelates are desirable for farmers growing these crops.

The soil treatment segment dominated the agricultural chelates market in 2023. The pH of the soil is a significant factor in the nutrient's plants can get. Certain micronutrients, such as iron and zinc, are less accessible to plants in alkaline soils, which can result in shortages and poor crop production. By preserving these micronutrients in a soluble and bioavailable state even in high pH soils, chelates aid in overcoming this restriction. Chelates can also enhance the cation exchange capacity, soil structure, and water retention of the soil, improving the conditions for plant roots' growth and the uptake of nutrients.

The agriculture segment dominated the agricultural chelates market in 2023. Farmers and growers use agricultural chelates to increase farm output and maximize production. Chelates help to improve plant health, resistance to pests and diseases, and tolerance to environmental challenges like salt and drought by ensuring that plants obtain the proper balance of nutrients. All these elements work together to create higher yields and higher-quality products necessary to meet the world's food needs.

Various crops, including cereals, fruits, vegetables, legumes, and ornamentals, are grown with agricultural chelates. Since their products can be used in a wide range of crop needs and farming systems worldwide, their broad application increases the market reach of chelate makers and suppliers.

Segments Covered in the Report

By Type

By Crop Type

By Mode of Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

August 2023

July 2024

January 2025