February 2025

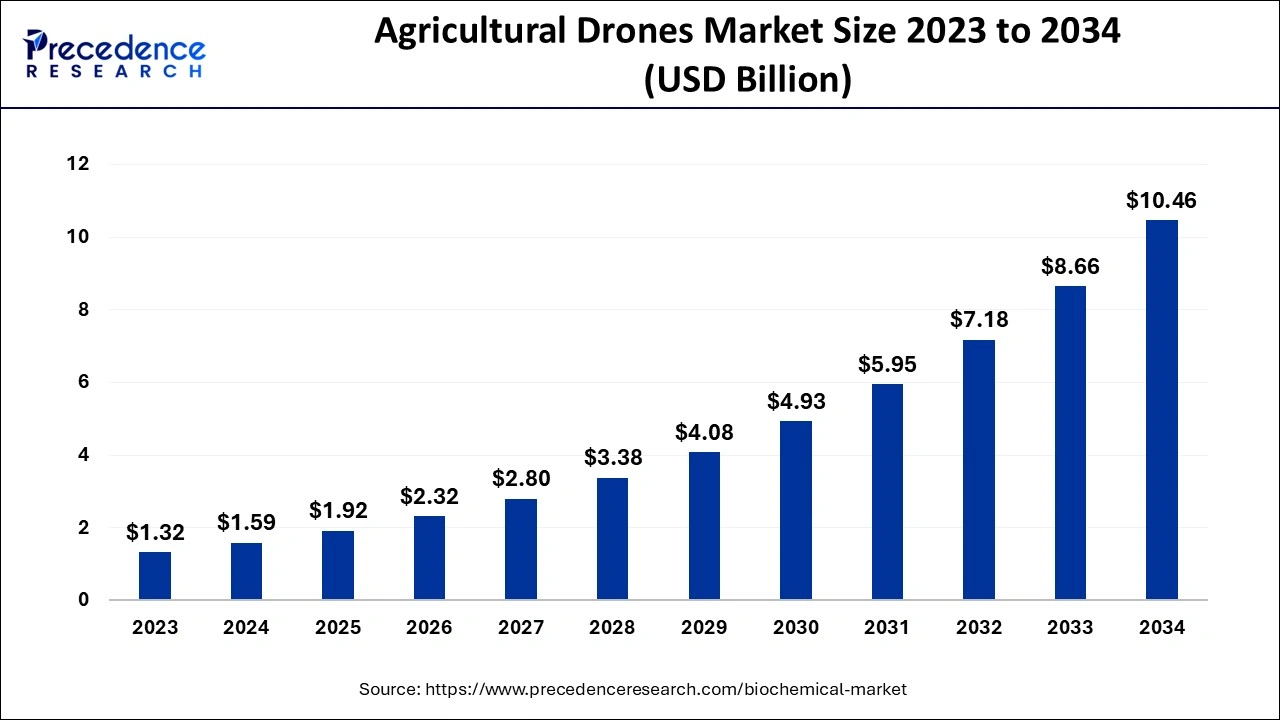

The global agricultural drone market size is estimated at USD 1.59 billion in 2024, grew to USD 1.92 billion in 2025 and is predicted to surpass around USD 10.46 billion by 2034, expanding at a CAGR of 20.70% between 2024 and 2034. The North America agricultural drone market size accounted for USD 560 million in 2024 and is anticipated to grow at a fastest CAGR of 20.90% during the forecast year.

The global agricultural drone market size accounted for USD 1.59 billion in 2024 and is anticipated to reach around USD 10.46 billion by 2034, expanding at a CAGR of 20.70% between 2024 and 2034.

An agricultural drone also known as an Unmanned aerial vehicle (UAVs) used in agriculture can aid with crop monitoring, crop production, and other aspects of optimizing agricultural operations. Drones are being used in precision agriculture for a variety of tasks, including the application of pesticides, planting, and the examination of agricultural fields and soil.

Given that it must provide for the world's steadily growing population, agriculture is seen as the most promising sector of the economy. The lack of skilled agricultural laborers or farmers, a lack of fertilizers, extreme weather conditions and their ineffective use, illnesses, infections, allergies, and other health issues brought on by the use of chemicals such as pesticides, insecticides, fungicides, or animal/insect stings have all been issues that the agricultural industry has faced. However, the agriculture sector is focused on developing nowadays by using more sophisticated and technologically advanced machinery. The agricultural drone is an autonomous flying cart with the ability to monitor crop development and increase crop yield. Smart sensors and digital imaging capabilities included in the cutting-edge equipment let farmers monitor their fields from a higher vantage point and avoid complications like fungal and insect infestations, irrigation problems, soil changes, and other challenges. Due to the development of sophisticated software solutions for data analytics and field service, favorable government policies and incentives to promote the agricultural sectors, and rising consumer awareness of the advantages of agricultural drones, the market for agricultural drones is anticipated to grow at a significant CAGR over the forecast period.

There are several prospects for drone applications due to an increase in agricultural and farming automation. Additionally, exemptions granted by U.S. federal authorities in the agricultural industry offer a profitable potential for the expansion of the market for agriculture drones.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.59 Billion |

| Market Size by 2034 | USD 10.46 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 20.7% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered |

|

| Regions Covered |

|

The use of small drones in agriculture is growing

The creation of drone usage restrictions in response to data privacy issues

The growing use of sustainable farming methods to promote the use of agriculture drones

According to the component, the hardware segment is anticipated to have the greatest market share for farm drones in 2023. The expansion of this market is being driven by an increasing requirement for replacement, upgrade, and modification in drone hardware components to extend drone lifespan and performance as well as to gain a competitive advantage.

The firms' increasing focus on modifying and creating drone structures to make them operate in any harsh climatic circumstances is also contributing to the expansion of this market. However, due to developing software technology and the rising software need for improved data analysis in precision agriculture, the software sector is anticipated to grow at the quickest CAGR throughout the projected period.

According to projections, the crop spray segment of the worldwide agriculture drone market would develop at the quickest rate in 2022. In drone farming, crop spray drones used for irrigation, fertilizer, and pesticide treatments enable more effective usage in rice paddies, small fields, and other waterlogged systems, as well as steep slopes or difficult-to-access locations. Precision agriculture may incorporate such systems since drones can be fitted with ultrasonic echoes, GPS, and lasers to maintain their height over the crop. These improvements to crop spraying drones will propel the growth of the sub-segment in the coming years.

Crop monitoring drones provide higher resolution data of agricultural conditions than traditional satellite methods fast detection of stressed areas, disease infestations, and real plant counts. In fields up to 50 ha, drones are said to be able to administer fertilizers and pesticides up to 5 times quicker than conventional equipment, and by concentrating only on areas that require treatment, as determined by crop monitoring, up to 60% of materials may be saved. The autonomous drones segment of the worldwide agriculture drone market would develop at the quickest rate and approach $ 2,243.9 million by 2028, up from $512.9 million in 2020. Drones with superior ground control systems that use automatic supervisory procedures to reduce the number of operators needed to manage the fleet are referred to as autonomous agriculture drones. Many agricultural applications, including data-collection missions and drone mapping, are now carried out automatically. The sub-segment is also expected to have impressive growth in the next years because of advancements in autonomous technology like automated seeders and autonomous pollination drones that can operate and assess crop health without the need for humans.

The airborne portion of the drone and the pilot operating it from a ground control station, as well as the sensors mounted on the UAV, and the software that can be used to analyze the data gathered by the sensor, are all included in manually operated drones. Farmers are demanding more manually piloted drones with several sensors to provide a more precise and varied crop management system. The sub-development segments are anticipated to be aided by the relaxation of governmental limitations on the use of drones and assistance for drone startups throughout the world.

Furthermore, it is predicted that throughout the course of the forecast period, the rotary wing sub-segment would have the fastest growth. Rotary drones are the most common variety since they are the easiest to control for direction and elevation. These drones provide the best balance of control, lift, maneuverability, and price. A common example of a multi-propeller drone is the DJI Matrice 200 series, which is sold by DJI Technology Co., Ltd. The DJI Matrice 210 RTK offers a payload of up to 2KG as well as a range of up to 7KM, which is more than enough for the majority of surveying applications in the agriculture sector. With revenues of $387.5 million in 2020 and $1,613 million throughout the forecast period, the fixed-wing drone sub-segment is expected to have a sizeable market share in the worldwide market, increasing at a CAGR of 19.0%. The benefit of fixed-wing aircraft is their capacity to cover large distances on a single battery. Due to their more efficient engines, most commercial versions can fly for an hour or more and cover an area of about 400 hectares, making them perfect for inspecting oil pipelines or electrical pylons.

Over the course of the projection period, the market for drones used in agriculture in Asia-Pacific is anticipated to rise significantly. To accelerate the deployment of agriculture drones, countries in the area are consistently boosting their R&D expenditures. Additionally, the expansion of venture finance provided to UAV makers in the area has aided in the growth of the sector. Many businesses in the area are creating affordable, effective UAVs for a wider range of agricultural uses.

The global market for agricultural drones is dominated by the North American continent. The growing trend of using UAVs for anything from mowing to plowing to increase production is anticipated to have an impact on the industry's expansion. Farmers have begun using UAVs in their operations as a result of rising interest in precision agriculture for crop scouting and field mapping.

By Component

By Application

By Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

July 2024

July 2024

January 2025