February 2025

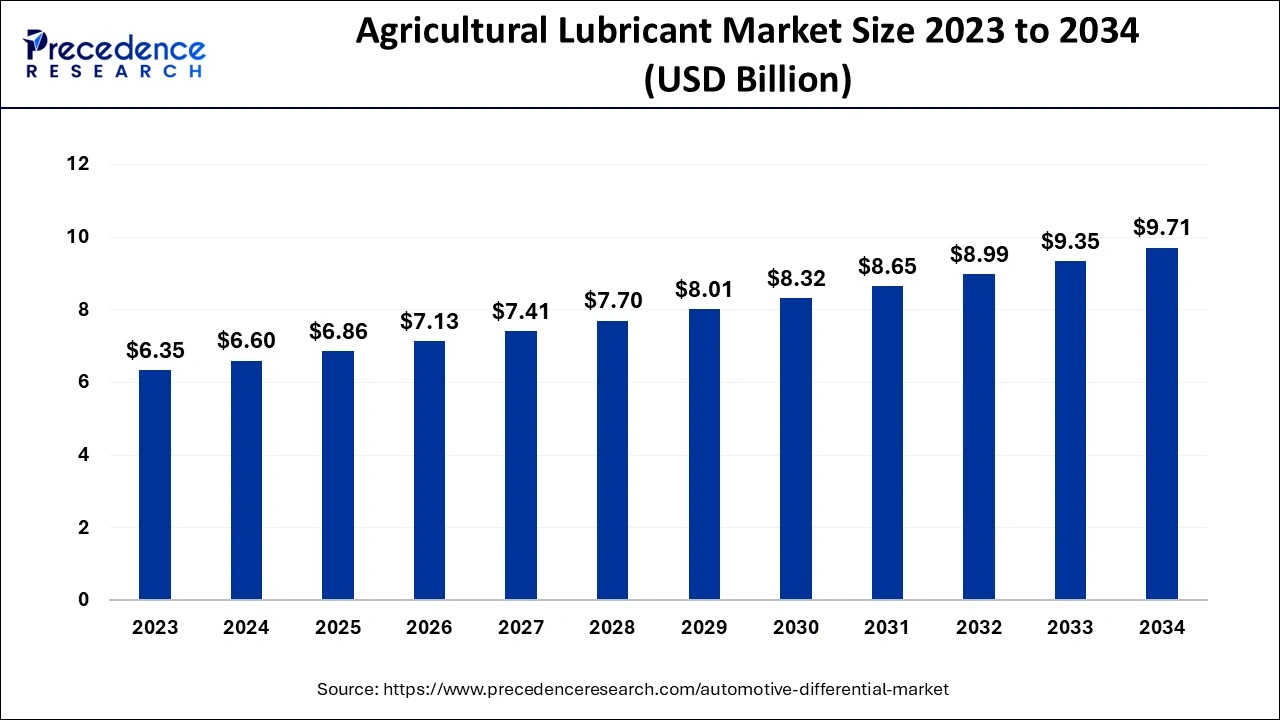

The global agricultural lubricant market size accounted for USD 6.60 billion in 2024, grew to USD 6.86 billion in 2025 and is expected to be worth around USD 9.71 billion by 2034, registering a CAGR of 3.94% between 2024 and 2034.

The global agricultural lubricant market size is calculated at USD 6.60 billion in 2024 and is predicted to reach around USD 9.71 billion by 2034, expanding at a CAGR of 3.94% from 2024 to 2034. The agricultural lubricant market is growing because of frequently rising levels of mechanization and constant innovation in farming equipment technology.

As global forces such as increasing costs, scarcity of labor, and the effect of climate change increase, farmers are adopting innovative technologies like artificial intelligence, robotics, and Internet of Things (IoT) T to keep production and gains per acre high. The use of AI and automation technology is widely affecting the lubricants market in agriculture and farming. Advanced techniques of real-time datasets driven by AI/ML have allowed farmers to track the condition of machinery and lubricants to improve overall utilization. There’s better control of lubricants; this has made the systems cut on wastage and even reduce costs, making the operations efficient. These developments are not only revolutionizing lubricant handling but also positively impacting this market by promoting innovation and enhancing equipment’s reliability in agriculture.

The agricultural lubricants are used for machinery engine oil. Lubricants on which performance, longevity, and the safety of deployment rely are developed to address issues such as high-temperature usage, longer periods between servicing, and greater power densities to support more effective equipment. They also protect the machinery against end damage to the engine part. Agricultural lubricants have become important for the agricultural machinery industry through the improvement of farm equipment. Better performance lubricants are needed, which can also increase efficiency and reduce wastage.

| Report Coverage | Details |

| Market Size by 2034 | USD 9.71 Billion |

| Market Size in 2024 | USD 6.60 Billion |

| Market Size in 2025 | USD 6.86 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 3.94% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, Category Type, Sales Channel, Farm Equipment, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Rising Automation in Farming Practices

As the use of machinery and equipment in agricultural operations to improve diagnosis, decision making or performing, reducing the labor of agricultural work and improving the timeliness and possibly precision agriculture, this market is expected to grow because of growing automation in farming practices as well as the increase in food production and new farmlands. This will create massive demand for engine oil in the agricultural lubricant market around the globe since it extends the life of the equipment.

Price fluctuations

The fluctuations in raw material prices are one of the biggest restraints for the global agricultural lubricant market. Lubricants are manufactured from a variety of raw materials, which include the base stock, additives, and special chemicals. These materials are very sensitive to changes in affected prices and, hence, can greatly affect the costs of producing Lubricants. As natural disasters, logistic problems, or a pandemic can result in a shortage of raw materials, their prices rise.

Rising demand for eco-friendly agricultural lubricants

The importance of sustainability progresses the demand for bio-based lubricants. The increasing concern accelerates the growth of the bio-based lubricant market for the consumer, especially regarding the positive impact on the environment. Bio-based lubricants are chemically synthesized organic products developed from renewable resources, including vegetable oil, animal fats, natural esters, and special adjuvants. Further, the higher price of petrochemicals and the global diminishing of crude oil reserves also boost the bio-based lubricant market. The growing focus on economic development and enhancing sustainability to minimize carbon emissions, as well as the emerging automotive, mining, and industrial businesses, are fueling market growth in the global bio-based lubricants sector. The government's regulatory policies toward ‘green’ and ‘environmentally friendly’ products are also pushing the industry for such products.

The engine oil segment accounted for the biggest agricultural lubricant market share in 2023. Automobile engines, or motor oil, are commonly used to reduce friction in internal combustion engines. In addition, to prevent the engines from corrosion, keep them cool during use. In the agricultural sector, engine oils are used in tractors, harvesters, and forage equipment to reduce the maintenance period, wear and corrosion protection, improve the reliability of the engine, and improve fuel consumption. The major uses of engine oils are to lubricate and safeguard the engine against the effects of high temperature and pressure.

The UTTO segment is expected to witness significant growth in the agricultural lubricant market during the forecast period. Universal Tractor Transmission Oil (UTTO) is a category of agricultural oil used in the transmissions, hydraulics, and wet brakes of agricultural equipment. UTTO oils are among the most important products currently used in modern agriculture throughout the world. Such oils are used for the first assembly of agricultural and industrial machinery and vehicles in the tractors' design. UTTO is a universal reducing and increasing friction and cleaning, keeping the seals of mechanisms and hydraulic systems.

The aftermarket segment dominated the agricultural lubricant market in 2023 due to the continuous requirement for lubricants for the replacement and maintenance of agricultural equipment. Modern farming equipment is characterized by specialization and high cost. The operators are more concerned with keeping their machines for long periods before replacement. The increasing demand for better quality lubricating oils enhances the efficiency of engines, hydraulics, and many others. Further, the aging of agricultural machines and threats of frequent downtime have also propelled the sales of lubricants in the aftermarket. This segment relies on repeat purchases because the end consumer recognizes the need to use the appropriate lubricant on agricultural machinery.

The bio-based lubricant segment dominated the agricultural lubricant market in 2023. Bio-lubricants are non-hazardous to human health; they are carbon neutral, renewable, and environmentally friendly, thus increasing the demand for them. Increased usage of agriculture lubricants for higher products, including biodegradable products with high flash points, constant viscosity, and low emission levels. The availability of crude oil resources worldwide and the growing costs of crude oil have helped to create a higher need for bio-based products. Other drivers, including the need to carry out research and development, technology advancement, increasing awareness of the environment, and government policies, will influence the bio-based lubricant market.

Asia Pacific led the agricultural lubricant market in 2023. Regions such as China and India are expected to enhance their capability to produce agricultural lubricants to lessen import dependence on oils. The region is the largest producer of various crops like rice, cotton, potato, etc. The size of agricultural production in the country and the need for agricultural machinery in the future will remain high. This will stimulate the demand for agricultural lubricants so that it becomes the leading market segment. India is one of the world’s most agriculture-based economies.

North America is anticipated to grow notably in the agricultural lubricant market during the forecast period. This growth is attributed to the change that has occurred in the agriculture sector through the use of high-performance machinery that needs specialized oil to enable efficiency and durability. Also, the growing concerns for sustainability and environment-conscious products in the region are promoting the evolution of lubricants with less detrimental effects on the environment due to demanding legislation. The changing agricultural trend, especially in North American countries such as the U.S. and Canada, is augmenting the use of agricultural machinery such as tractors and sprinklers, hence driving the sales of lubricants.

By Product Type

By Category Type

By Sales Channel

By Farm Equipment

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

August 2023

July 2024

July 2024