October 2024

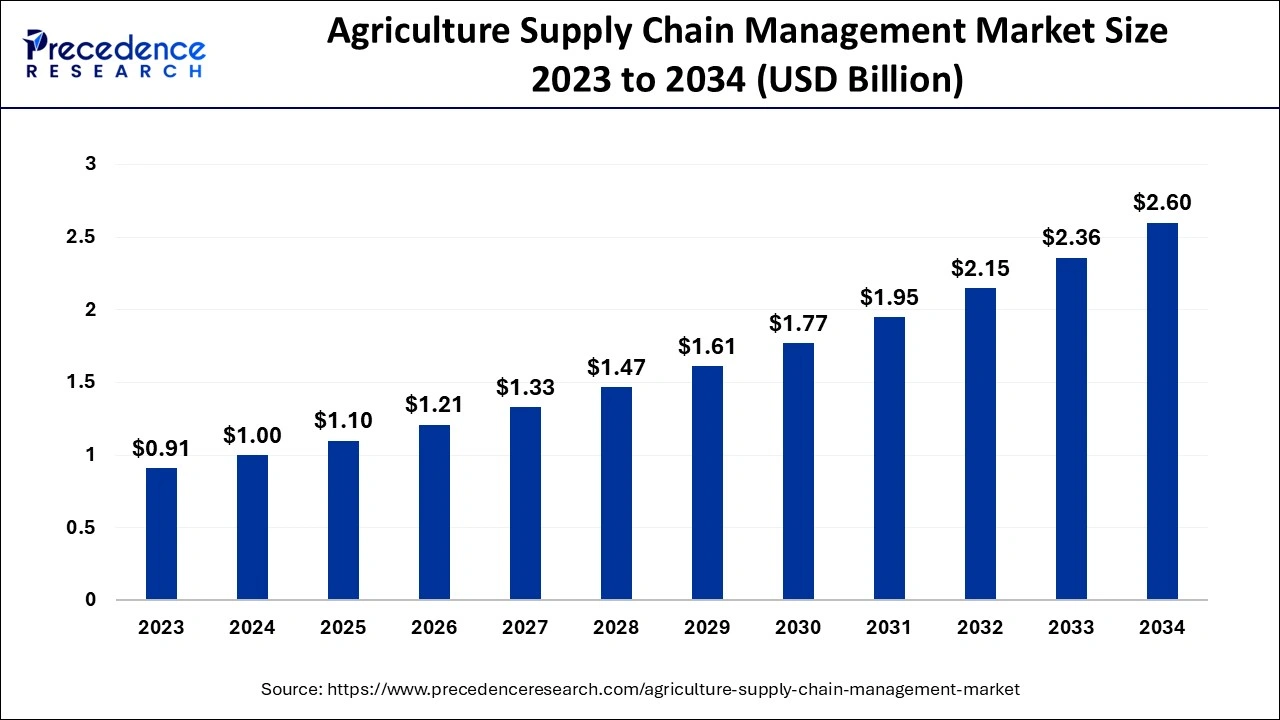

The global agriculture supply chain management market size accounted for USD 1 billion in 2024, grew to USD 1.1 billion in 2025 and is projected to surpass around USD 2.6 billion by 2034, representing a healthy CAGR of 10% between 2024 and 2034.

The global agriculture supply chain management market size is estimated at USD 1 billion in 2024 and is anticipated to reach around USD 2.6 billion by 2034, expanding at a CAGR of 10% between 2024 and 2034.

Increased production efficiency, timely distribution, cost-effective transportation, and differentiation of products are driving the growth of the agriculture supply chain management industry. Additionally, the increasing demand for better supply chain visibility is a vital growth factor for market development. Increasing demand for agricultural products has boosted the market size significantly.

The agriculture supply chain management industry mainly manages the execution of services and goods by including various processes which help transform raw materials into final products. A symbiotic relationship must exist between multiple companies across the agriculture supply chain management value chain to deliver high-quality products from farms to direct customers.

Maintaining the product price, quality, and quantity forms the main components of the delivery process. Various companies and industries work together to ensure successful delivery by preserving the integrity of perishable products. A coordinated business-to-business (B2B) interaction between different vendors satisfies potential consumers. Production, if managed promptly, helps fulfill the delivery commitments made to the consumers.

| Report Coverage | Details |

| Market Size in 2023 | USD 1 Billion |

| Market Size by 2034 | USD 2.6 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 10% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Component, By Solution, By Deployment Model, By End-User, Agriculture |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Based on components, the hardware segment has emerged as the highest contributor due to the increasing demand accounting for approximately 70% of the total agriculture supply chain management market share. This segment is expected to perform well during the forecast period due to the increasing demand for advanced technology and hardware.

Key market players and leading producers demand various advanced components to increase the supply capacity. The increasing demand for advanced technology and equipment has dramatically boosted this segment's size.

The various features that have been offered by advanced hardware have been successful in attracting potential consumers and hence contributing to the size of the market considerably. However, faster growth is expected in the services segment over the next few years due to the rapid shift to supply chain management systems and software.

Based on the solution, the manufacturing execution system segment emerged as one of the fastest-growing segments in 2023 due to the increasing demand for advanced agricultural equipment and the rising need for agricultural products among people. Transportation is the primary requirement for fulfilling the demand and supply chain and providing consumers with the necessary goods. The management of transportation facilities helps manufacturers to complete the delivery within a given time frame.

The warehouse management system has also emerged as one of the leading segments because of the increasing need for storage spaces for the various agricultural products which need to be protected from external environmental effects. Managing warehouses require proper coordination and rotation as the goods tend to perish over time.

Based on the deployment model, the on-premise segment is expected to show tremendous growth, accounting for approximately three-fifths of the total global agricultural supply change management market share by 2030. On-premise provides services to clients in real-time at their sites, which will help bolster the segment's growth. The major contributing factors to the growth include organizing critical data and analyzing it for the consumer with the help of emails and calls.

The tools included in the on-premises model can collect and display the data during the procedure. The form is expected to utilize its information technology infrastructure with the help of chatbots. The increasing demand for cloud-based management solutions has been attributed to the growth of this segment during the forecast period.

Based on the end-user, the large enterprise segment has emerged as the leading market segment due to the availability of disposable income, allowing advanced services and solutions to be implemented. The large enterprise segment is expected to contribute significantly to the market growth due to expanding companies' operations due to the growing consumer demand.

Faster growth is expected in the medium and small-sized business segments during the forecast period. A rapid shift has been observed toward consumer satisfaction, boosting the adoption of agricultural supply chain management systems and equipment that help obtain deep insights by processing real-time data.

Based on geography, Asia Pacific will likely emerge as the largest market during the forecast period. Its extensive global contribution to the agricultural supply chain management market has contributed to its leading position. The strong growth of the Asia Pacific economy is driven by the development of various new businesses and enterprises investing heavily in agriculture. Productivity is expected to increase rapidly due to the increasing demand for modern technology and equipment.

The increasing demand for agricultural products worldwide is contributing to the growth of the agricultural supply chain management market. The regions of Latin America, Middle East, and Africa have also contributed significantly to developing the agriculture supply chain management market.

Segments Covered in the Report

By Component

By Solution

By Deployment Model

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

August 2024

December 2023

December 2024