July 2024

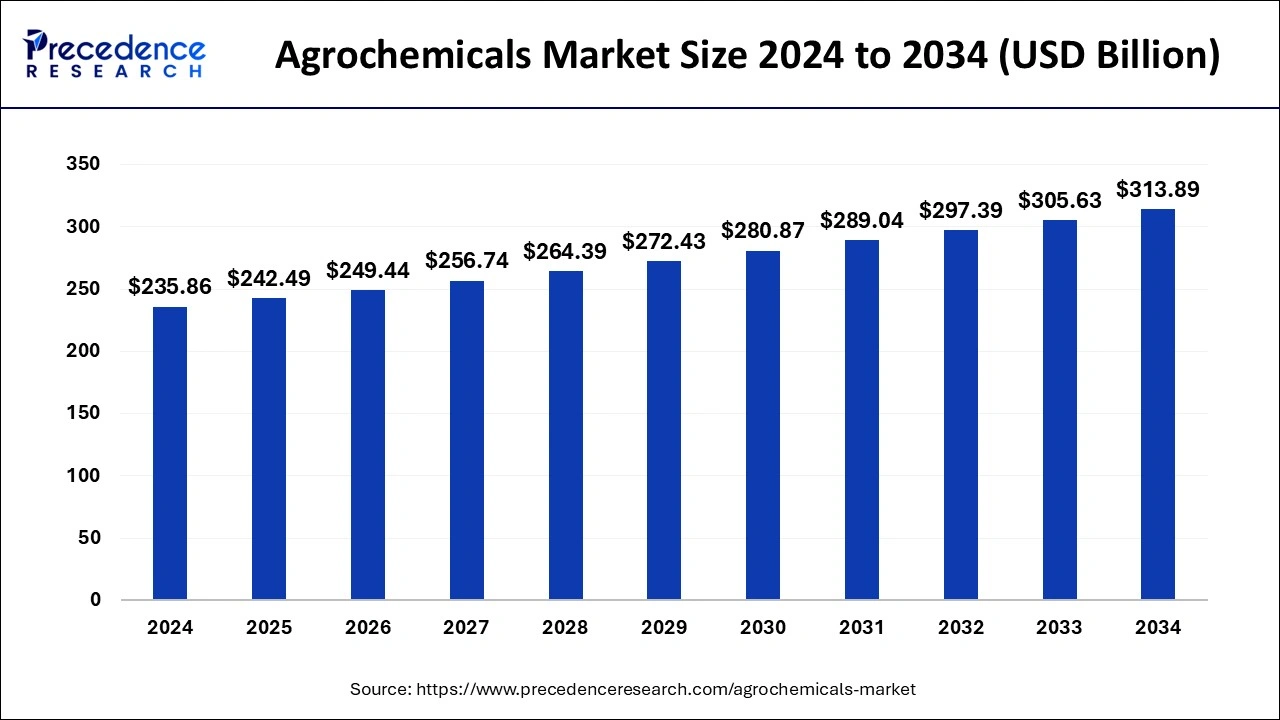

The global agrochemicals market size is accounted at USD 242.49 billion in 2025 and is forecasted to hit around USD 313.89 billion by 2034, representing a CAGR of 2.90% from 2025 to 2034. The Asia Pacific market size was estimated at USD 70.76 billion in 2024 and is expanding at a CAGR of 3.07% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global agrochemicals market size was calculated at USD 235.86 billion in 2024 and is predicted to reach around USD 313.89 billion by 2034, expanding at a CAGR of 2.90% from 2025 to 2034.

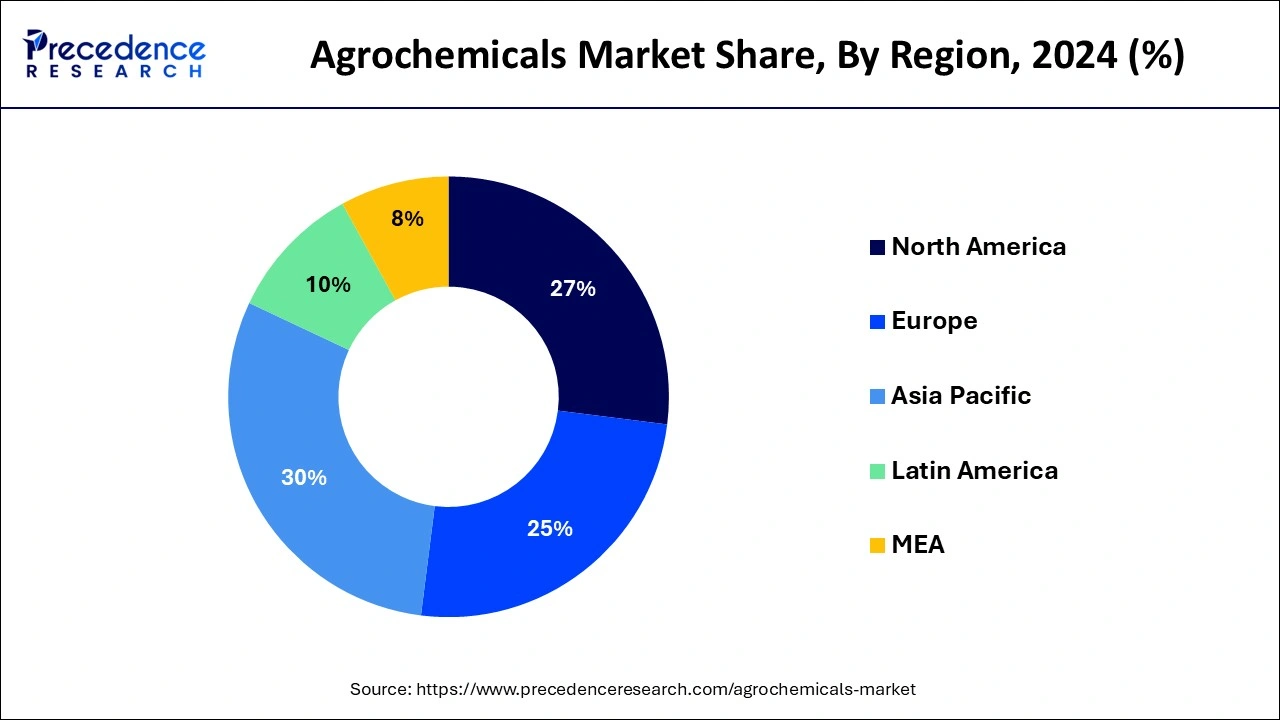

The Asia Pacific agrochemicals market size was exhibited at USD 70.76 billion in 2024 and is projected to be worth around USD 95.74 billion by 2034, growing at a CAGR of 3.07% from 2025 to 2034.

Asia-Pacific region hit the largest revenue share of around 29.18% in 2024. The Asia-Pacific region is an important market for agrochemicals because it is the world’s largest and most populous area.

North America will hit a notable revenue share in 2024. The region’s overall agricultural land is declining as a result of rising population and fast urbanization and industrialization. As a result, farmers turn to agrochemicals to boost productivity and quality.

Agrochemicals are chemical or biological compositions that are created to increase the quality and productivity of crops. The insecticides and fertilizers are the two types of agrochemicals. The pesticides protect crops by controlling, killing, and repelling pests and weeds that can harm them. The fertilizers improve crop quality by providing essential nutrients to the crop and soil, on the other hand pesticides protect crops by controlling, killing, and repelling weeds and pests that can harm them. Due to the current global population situation, increasing agricultural output on existing agricultural land is critical to feeding the world’s population. As a result, agrochemicals play a very vital role in the agricultural business, supporting farmers in improving both the quality and quantity of their crops.

Agrochemicals are highly used in agricultural activities. It helps to enhance productivity of agriculture business. That’s the reason; agrochemicals have become one of the key components in agriculture. The constant research and development activities are being carried out for producing high quality of agrochemicals in the market. The consumption of food is highly dependable on agriculture. As a result, government agencies pay more attention towards agriculture business. Thus, all these above-mentioned factors are driving the growth of the global agrochemicals market during the forecast period.

The expanding global population combined with rising propensity, is causing a shift in purchasing habits. Not only must supply be increased to satisfy demand, but also the nutritional demands of an increasingly affluent population must be satisfied. The wastage results from diminishing agricultural land and crop losses owing to pest infestations, posing a serious threat to food and nutritional security. The agrochemicals sector is a vital agriculture support sector that helps farmers produces more quantity. These elements are assisting the agrochemicals market’s expansion.

| Report Coverage | Details |

| Market Size in 2025 | USD 242.49 Billion |

| Market Size by 2034 | USD 313.89 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 2.90% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The high population and associated growth in food consumption, soil pollution, arable land, and increased consumer knowledge of the advantages of the agrochemicals industry. On the other hand, the potential danger of synthetic pesticides like atrazine herbicide could stymie the industry growth. When agrochemicals are used in larger concentrations, they pollute surface water and have a negative impact on the ecosystem. As a result, the manufacturing of bio-based fertilizers and pesticides has opened up a lot of new market prospects for key market players for agrochemicals.

The food consumption has increased globally as a result of high population growth, driving up demand for agricultural products. This has resulted in a rise in the usage of agricultural chemicals to improve crop productivity and agricultural development. As a result, the usage of agrochemicals such as pesticides and fertilizers has become a need in order to fulfill rising food demand. This, in turn, is increasing global demand for new agricultural technologies and developments. The agrochemicals are essential for improving crop quality and output.

The growing population necessitated increased crop output. Apart from that, water and land scarcity forces people to employ fertilizers and pesticides to assist them grow many crops in specific spaces, which drives the agrochemicals market growth during the forecast period. The increasing use of agrochemicals in developing countries boosts the expansion of the agrochemicals market. The agriculture’s new technologies may boost growth of the market. Farmers must employ such agrochemicals like pesticides and fertilizers in farming to boost land production and maintain soil quality as a result of the rising effect of urbanization.

Increasing environmental risks from pesticides and fertilizers could limit the agrochemicals market’s growth. The chemical fertilizer utilization is being hampered by rising demand for organic food products and increased use of biofertilizers, which is restraining market development.

In 2024, the fertilizers segment dominated the agrochemicals market with highest revenue share. Fertilizers are commonly utilized to boost crop output in a short amount of time. The growing global food demand around the world is putting additional strain on agricultural land, hence farmers are using more fertilizers to boost the productivity and yield of various crops.

The crop protection chemicals segment, on the other hand, is predicted to develop at the quickest rate in the future years. The fungicides, insecticides, herbicides, and other pesticides such as rodenticides and bactericides are examples of crop protection chemicals. In the agriculture industry, herbicides are widely used as pesticides.

The cereals and grains segment accounted largest revenue share in 2024. Cereals and grains are the most widely consumed crops, especially in Asian countries. Furthermore, this segment covers a large portion of the world’s agricultural land. The use of fertilizers in the production of cereals and grains has almost become mandatory.

The fruits and vegetables segment is the fastest-growing segment of the agrochemicals market in 2024. This is attributed to the surge in demand for fresh vegetables and fruits around the world as people become more health conscious.

The major agrochemicals market players conduct substantial research and development to develop agrochemicals with greater requirements. These compounds are subjected to lot of restrictions, including chemical registration, codes of practice, product laboratory evaluations, environmental health impact assessments, and limitations on storage, use, and transportation.

Segments Covered in the Report

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024