October 2024

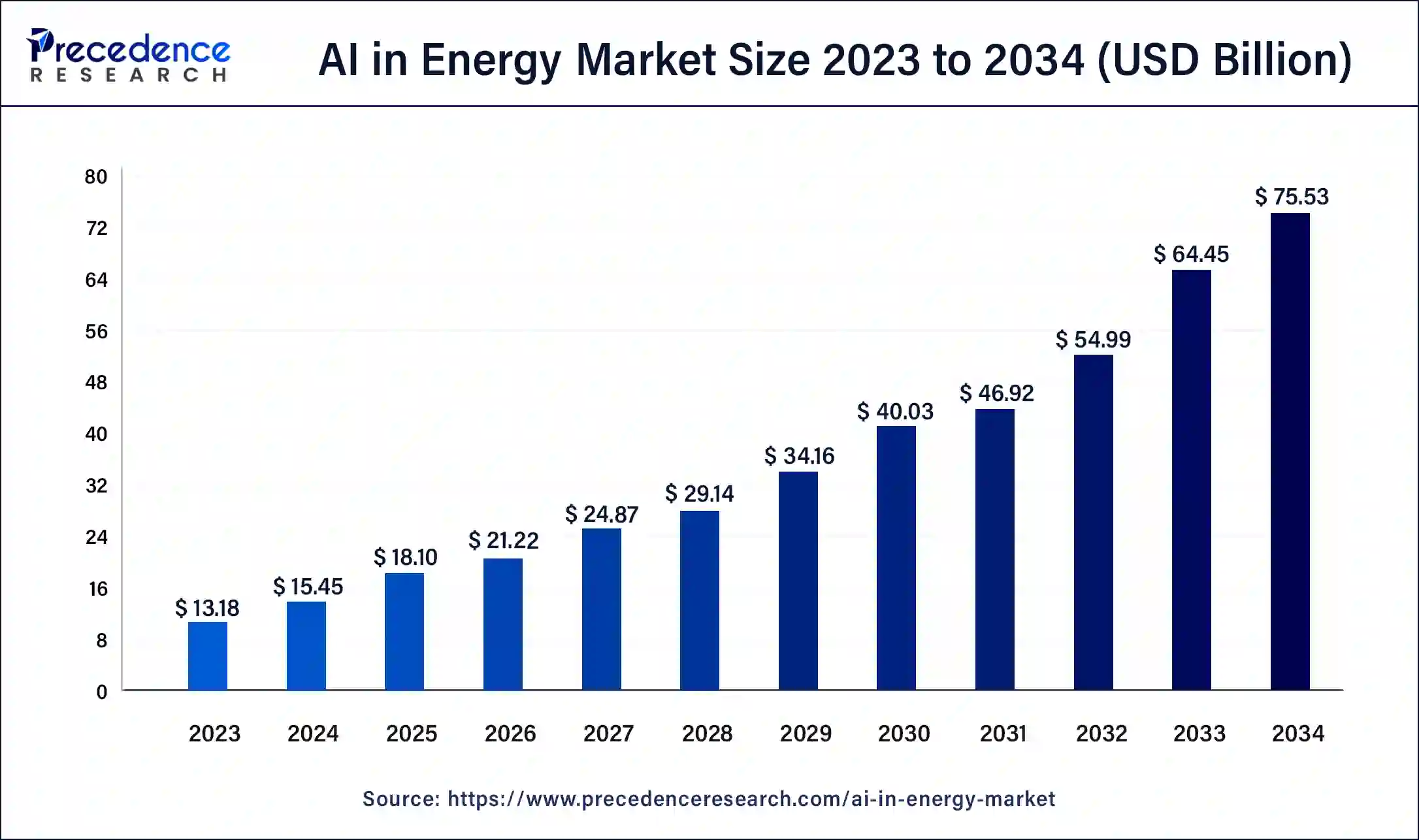

The global AI in energy market size was USD 13.18 billion in 2023, calculated at USD 15.45 billion in 2024 and is expected to be worth around USD 75.53 billion by 2034. The market is slated to expand at 17.20% CAGR from 2024 to 2034.

The global AI in energy market size is worth around USD 15.45 billion in 2024 and is anticipated to reach around USD 75.53 billion by 2034, growing at a solid CAGR of 17.20% over the forecast period 2024 to 2034. The rising adoption of AI by energy companies, utilities, and grid operators is the key factor driving the AI in energy market growth over the forecast period.

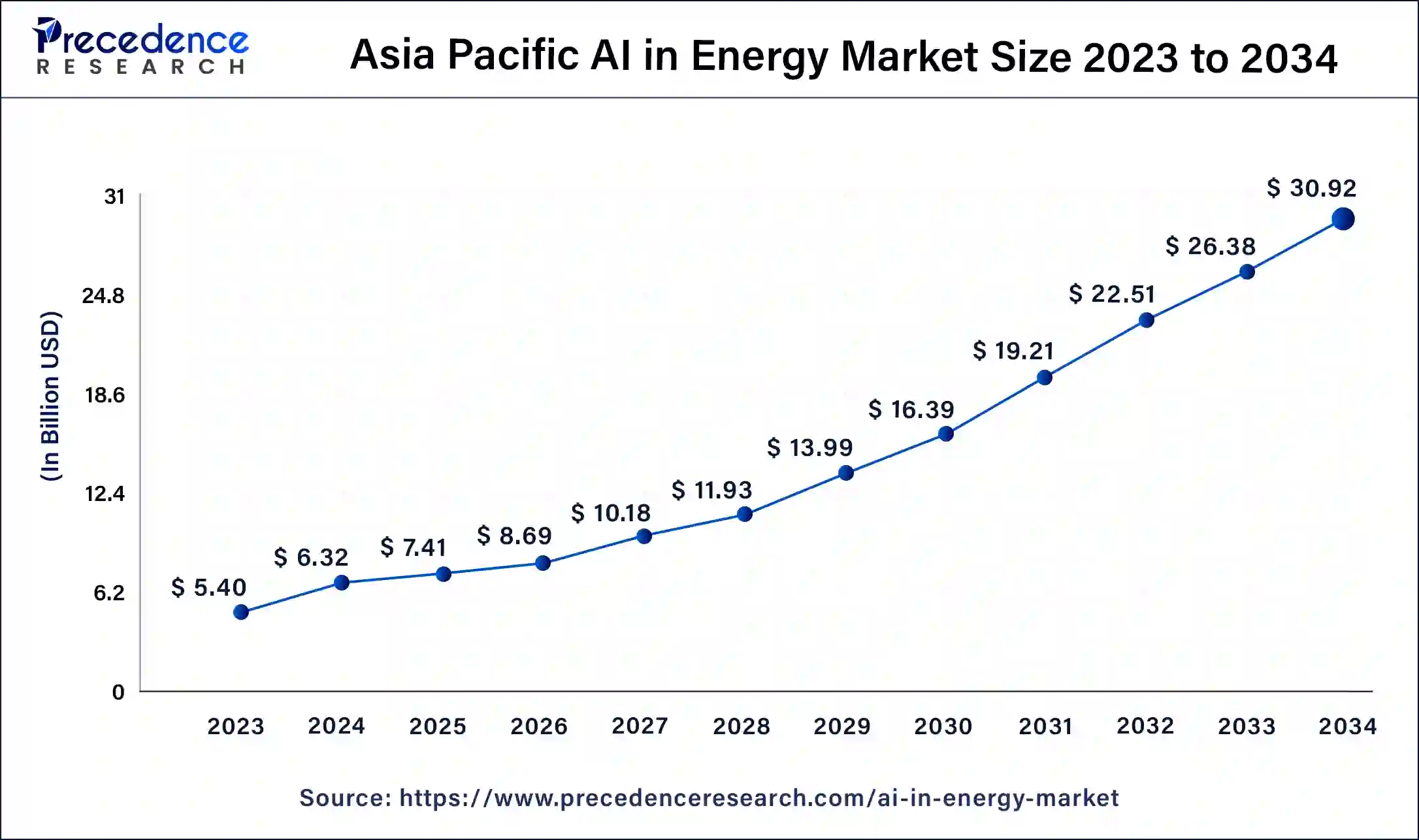

The Asia Pacific AI in energy market size was exhibited at USD 5.40 billion in 2023 and is projected to be worth around USD 30.92 billion by 2034, poised to grow at a CAGR of 17.40% from 2024 to 2034.

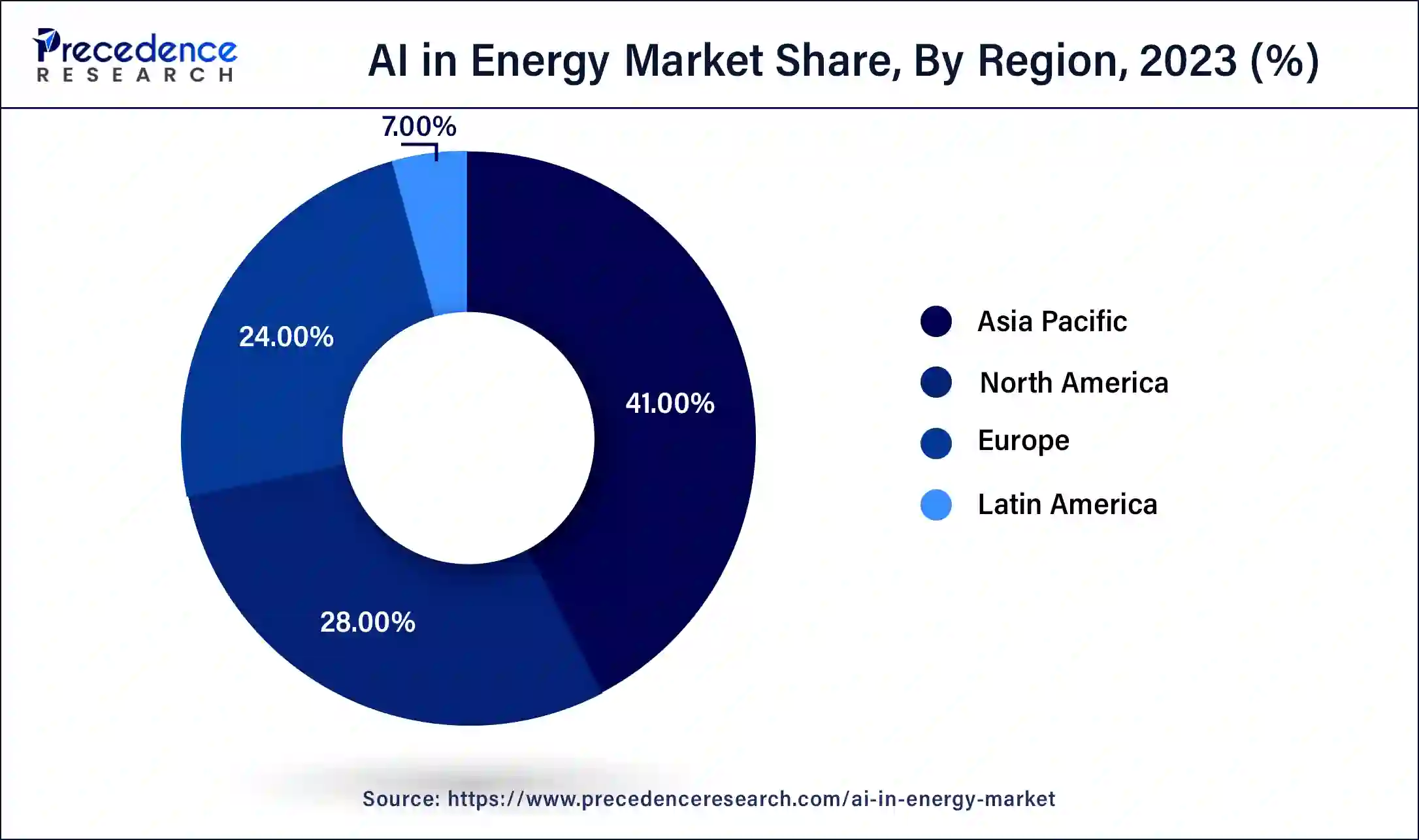

Asia Pacific dominated the AI in energy market in 2023. This is due to nations like China, India, Japan, and South Korea are likely to offer lucrative opportunities for AI vendors in the region. Moreover, initiatives aimed at reducing carbon footprints and improving energy efficiency have received significant support which can drive market growth in the region further.

North America is expected to show the fastest growth in the market over the projected period. The dominance of the region can be attributed to the increasing adoption of advanced technologies coupled with the robust digital infrastructure in the region. North America, especially the United States, held the leading position in the market. Furthermore, the region’s commitment to overcoming climate change and converting to more sustainable energy sources has fueled the adoption of AI technologies.

Artificial intelligence (AI) is playing a crucial role in the energy sector by changing the way energy is created, distributed, and consumed. The utilization of AI technologies in the energy sector is called AI in energy. This has the potential to improve sustainability and efficiency gains, enhancing decision-making processes that can create significant changes in the AI in energy market, which can be seen in their uses like energy distribution systems and smart automated grids.

Global AI Adoption by Region

| Country | AI Deployment Rate | AI Exploration Rate |

| China | 50% | 36% |

| India | 59% | 27% |

| Canada | 37% | 48% |

| Italy | 36% | 38% |

| Singapore | 53% | 41% |

| United Arab Emirates | 58% | 32% |

| Report Coverage | Details |

| Market Size by 2034 | USD 75.53 Billion |

| Market Size in 2024 | USD 15.45 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 17.20% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Application, End-user, Deplyoment, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising demand for renewable energy integration

The growing worldwide emphasis on sustainability, as well as the decrease in carbon emissions, is a significant factor driving the AI in energy market. Renewable energy sources like solar and wind are becoming increasingly important in the energy mix. Moreover, AI's ability to forecast energy supply from renewables using historical data and weather conditions enables more effective management of supply and demand. This capability of AI also enhances grid stability and the generation of renewable energy.

Technological complexities

The complexity of integrating AI systems into current energy infrastructure coupled with the high initial investment needed for implementing AI technologies can hamper the AI in energy market growth significantly. Moreover, the complexity of retrofitting legacy systems with AI abilities creates technical anomalies that can constrain the adoption rate of the market.

Developments in IoT and big data analytics

The ongoing developments in big data analytics and IoT (Internet of Things) create lucrative opportunities for the AI in energy market. The expansion of smart sensor technology generates extensive datasets that, after analyzing with AI, can uncover key insights to fuel efficiency. Furthermore, the combination of technologies enables more dynamic and nuanced control of energy systems, opening new doors for innovation in operational efficiency and energy management.

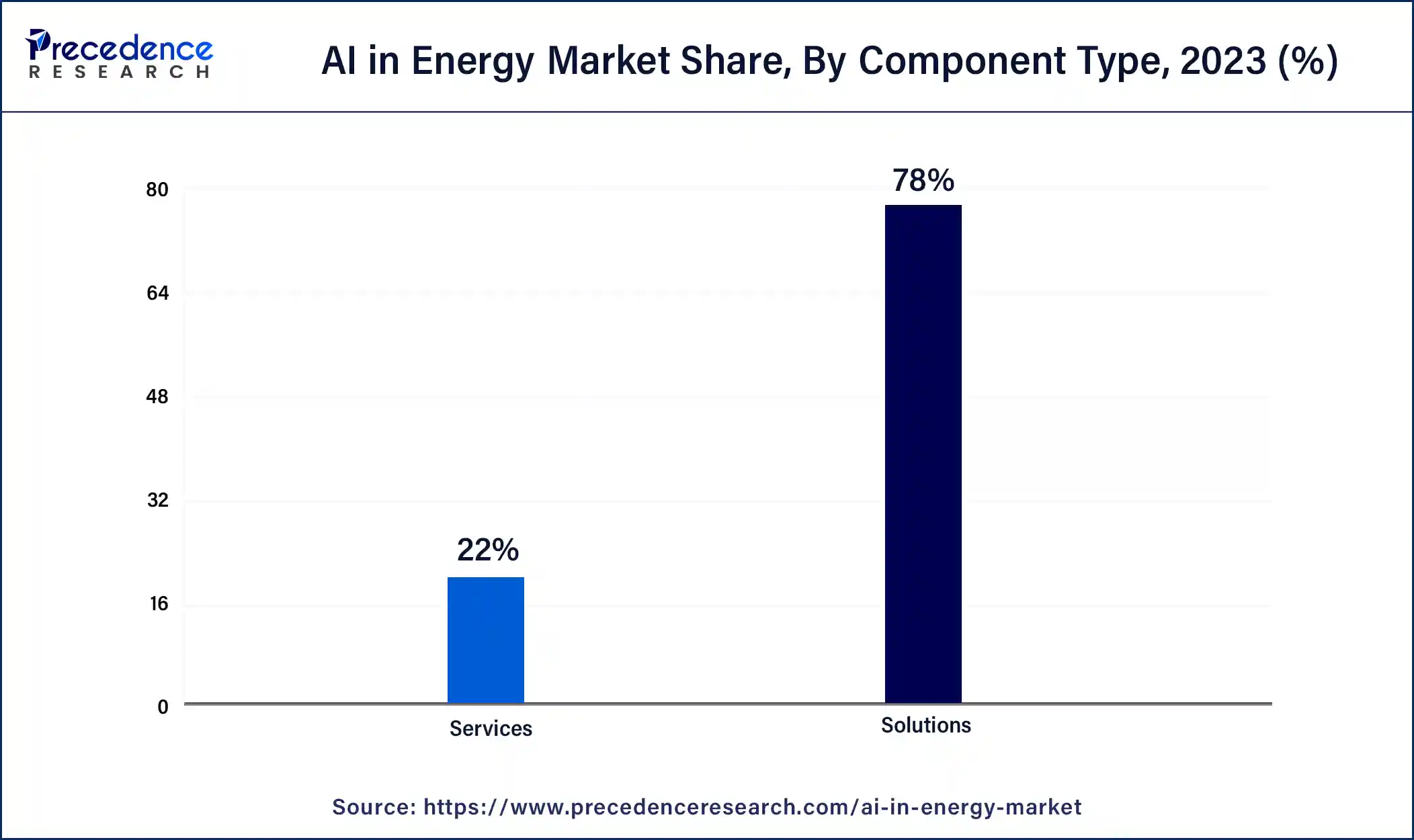

The solutions segment dominated the AI in energy market in 2023. The dominance of the segment can be attributed to the increasing need for integrated solutions that use artificial intelligence to improve energy efficiency and optimize power generation. Additionally, solutions in the AI energy field cover machine learning models, advanced analytics, and IoT integration, which stimulate predictive maintenance and renewables management.

The service segment is expected to grow at a lucrative rate in the AI in energy market over the forecast period. This is because AI services support the integration of AI solutions into core processes and business functions. Furthermore, AI can help companies to get more out of their marketing expenditure. Utilizing data services can also address operational efficiencies and energy security.

The cloud segment led the AI in energy market in 2023. The growth of the segment can be linked to the increasing flexibility, scalability, and cheapness of cloud services, which are important attributes for energy companies that are navigating the difficulties of digital transformation. Also, the cloud deployment model provides energy firms the agility to install AI solutions rapidly across numerous operations without the requirement for substantial upfront investment in IT infrastructure.

The on-premise segment is expected to witness significant growth in the AI in energy market during the projected period. The on-premise segment in the AI energy market offers unparalleled customization and one-size-fits-all cloud services solutions. However, AI on-premises provides scalability to fulfill future energy demands and regulatory requirements efficiently.

The safety & security segment dominated the AI in energy market. This dominance is driven by increasing emphasis on protecting the confidentiality and integrity of data utilized in AI models and systems by market players. Furthermore, AI systems can break down complex data into easily framed insights which can help organisations to make critical decisions for the benefit of the company.

The demand forecasting segment is expected to grow rapidly in the AI in energy market during the studied period. The growth of the segment can be credited to the rising need for accurate and efficient energy management tactics within the evolving energy sector. Additionally, there is a growing global shift towards renewable energy methods amidst changing supply and demand.

The utility segment held the largest share of the AI in energy market in 2023. This is due to utilities playing an important role in combining AI technologies to enhance reliability, efficiency, and sustainability in energy systems. Moreover, the Utilities segment dominates the market because of the rising pressures of climate change coupled with the increasing need for renewable energy sources. AI helps utilities overcome these challenges by optimizing energy flow and offering data-driven insights.

Segments Covered in the Report

By Component Type

By Application

By End-user

By Deployment

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

January 2025

January 2025

January 2025