July 2024

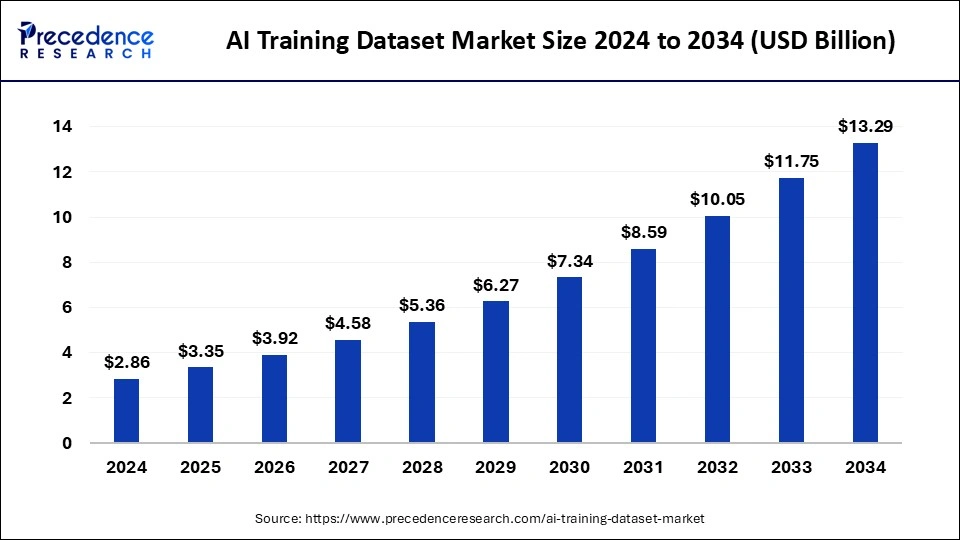

The global AI training dataset market size is calculated at USD 3.35 billion in 2025 and is forecasted to reach around USD 13.29 billion by 2034, accelerating at a CAGR of 16.55% from 2025 to 2034. The North America market size surpassed USD 1.15 billion in 2024 and is expanding at a CAGR of 16.57% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global AI training dataset market size accounted for USD 2.86 billion in 2024 and is predicted to increase from USD 3.35 billion in 2025 to approximately USD 13.29 billion by 2034, expanding at a CAGR of 16.55% from 2025 to 2034.

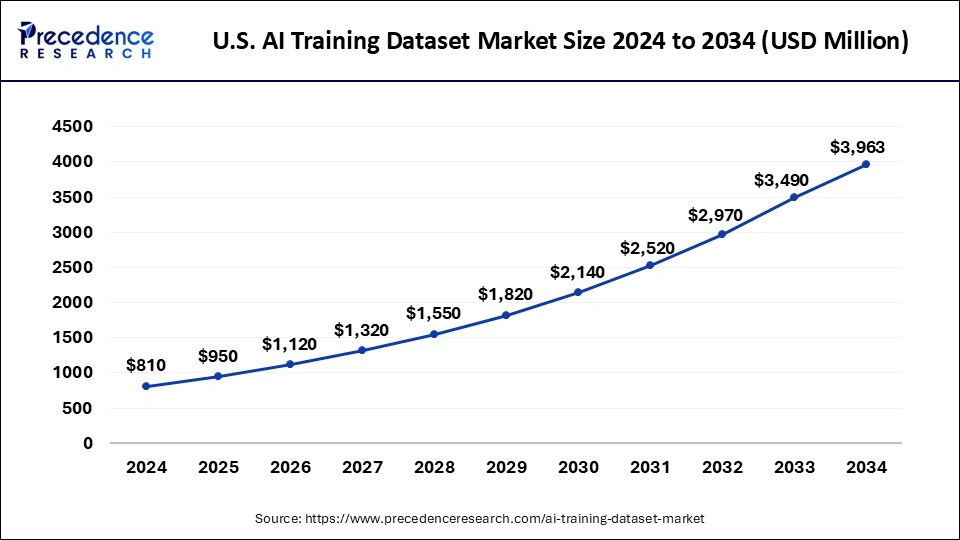

The U.S. AI training dataset market size was exhibited at USD 810 million in 2024 and is projected to be worth around USD 3,963 million by 2034, growing at a CAGR of 17.20% from 2025 to 2034.

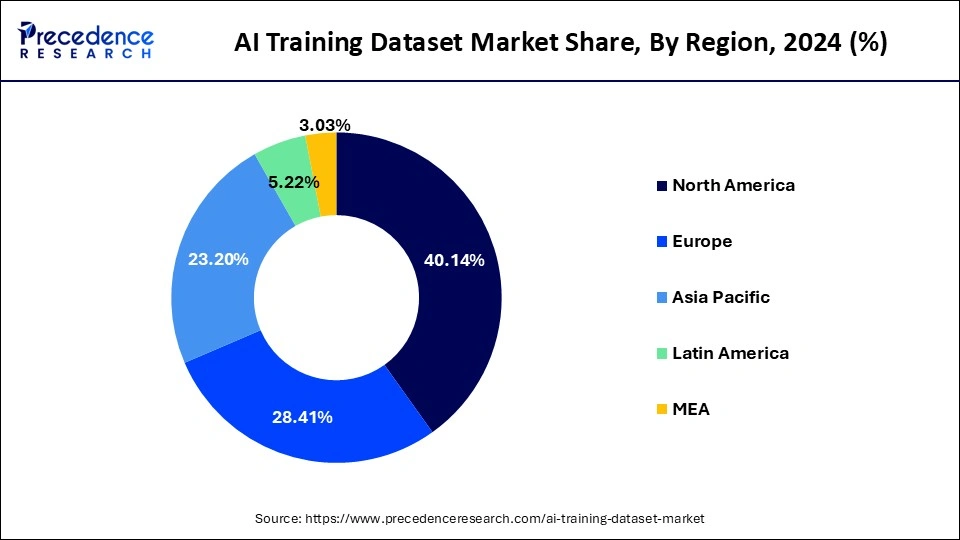

Regionally, the global AI training datasets market is divided into North America, Asia Pacific, the Middle East, Europe, Latin America, and Africa. Around 40.14% of the world market for AI Training Datasets was estimated to be accounted for by North America in 2024. To accelerate the acceptance of artificial intelligence technology in emerging North American areas, market vendors are focusing on launching new datasets.

For example, Waymo LLC, a subsidiary of Google LLC, published a special dataset for automated vehicles in September 2020. This dataset or data was gathered using camera sensors and LiDAR in various driving scenarios, including those involving cyclists, signs, pedestrians, and other road users.

The use of artificial intelligence technology is expanding. The need for technology is growing as organizations move toward automation. Technological advances have seen unprecedented advancements in marketing, logistics, transportation, healthcare, and many other industries. The acceptance of the technology has been fuelled by the advantages of integrating it into various organizational operations that outweigh the costs.

The demand for training datasets is increasing exponentially due to the quick uptake of artificial intelligence technology. Numerous businesses are expanding their market share by producing multiple datasets operating across various scenarios to train the machine learning algorithm, making the technology more adaptable and precise with its predictions.

These elements have a significant impact on market expansion. Leading industry players like Google, Apple Inc., Microsoft, and Amazon have been concentrating on creating different artificial intelligence training datasets. For example, Amazon introduced a new dataset of rational conversation in September 2021 to support open-domain conversation research.

A training dataset, also known as an artificial baseline, is needed by artificial intelligence programs to instruct models or machine learning algorithms on making informed decisions. Big data is becoming increasingly dependent on AI because it makes it possible to extract complex, high-level abstract concepts through a hierarchical learning process, which calls for data analysis and extraction. The method of the machine entirely depends on the dataset that is provided. Consequently, offering top-notch datasets for training becomes crucial.

This excellent dataset enhances AI performance. Additionally, it helps shorten the time spent gathering data and increases prediction precision. As a result, market vendors are concentrating on acquiring businesses that can help them improve the quality of their data.

The expansion of the market is being fuelled by elements like the creation of new, high-quality datasets that will hasten the advancement of AI technology and produce accurate results. For example, the technology company IBM Corporation confirmed the release of a new dataset in January 2019 that contains 1 million images of faces.

This dataset was made available to developers so they could use it to train various face recognition systems powered by artificial intelligence. They will be able to improve face identification accuracy with the help of this dataset. For example, IBM introduced a new data set called CodeNet in May 2021, which contains 14 million sample sets and is intended to be used to create machine learning models that can assist programmers.

| Report Coverage | Details |

| Market Size in 2025 | USD 3.35 Billion |

| Market Size in 2024 | USD 2.86 Billion |

| Market Size by 2034 | USD 13.29 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 16.55% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type and Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The market for AI training datasets is anticipated to expand overall as demand for AI applications rises. To succeed in this competitive environment, businesses that operate in this market must understand the changing market dynamics and find ways to set themselves apart.

Overall, these limitations may hinder the development and use of AI training datasets, so businesses involved in this market need to be aware of these issues and devise solutions to overcome them.

The market for AI training datasets is anticipated to expand overall in the upcoming years as the demand for AI applications rises. This will present a number of opportunities for businesses that can offer top-notch training data services.

The Text, Audio and Image/Video types are the worldwide AI training dataset market divisions. With a 30.80% market share in 2023, the text segment surpassed the market's expectations for AI training datasets. Text datasets are widely used in the IT industry for various automation processes, including speech recognition, caption generation, and text classification.

Because of the extensive range of audio datasets available, the audio segment is expected to serve a good market share. Examples include the Multimodal Emotion Lines Datasets, speech and music datasets, speech commands, environmental audio datasets, and many others.

The worldwide AI training dataset market is classified into Automotive, Healthcare, IT, Government, and other segments based on Vertical. The IT segment dominated the industry with a market share of approximately 34% in 2023. Additionally, AI in healthcare opens up several opportunities for therapies like virtual assistants, wellness and lifestyle management, wearable technology, and diagnostics.

Additionally, voice-activated symptom checkers and improved organizational workflow are two areas where AI is used. A substantial training dataset is required for these applications to produce accurate results. Datasets will grow; as a result, resulting in a high CAGR during the forecast period.

By Type

By Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

July 2024

August 2024

August 2024