July 2024

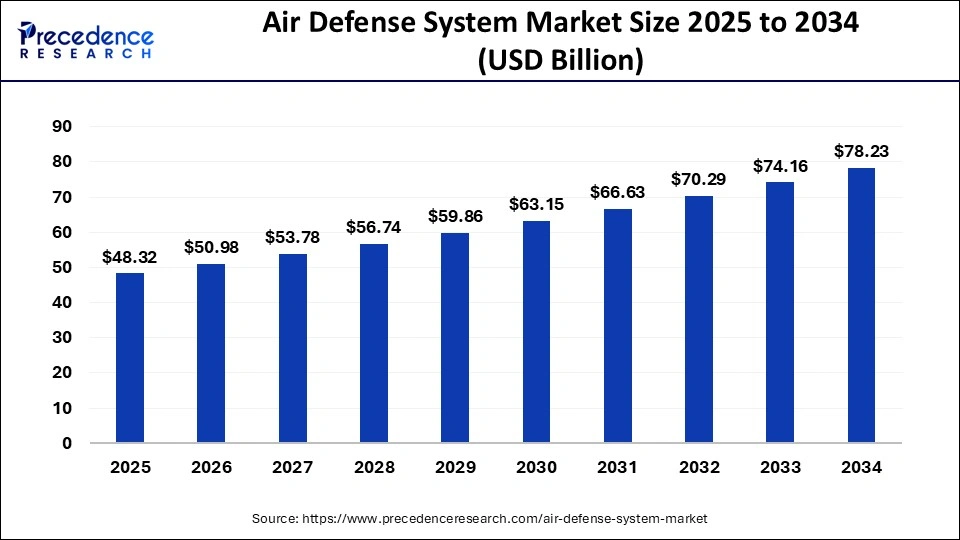

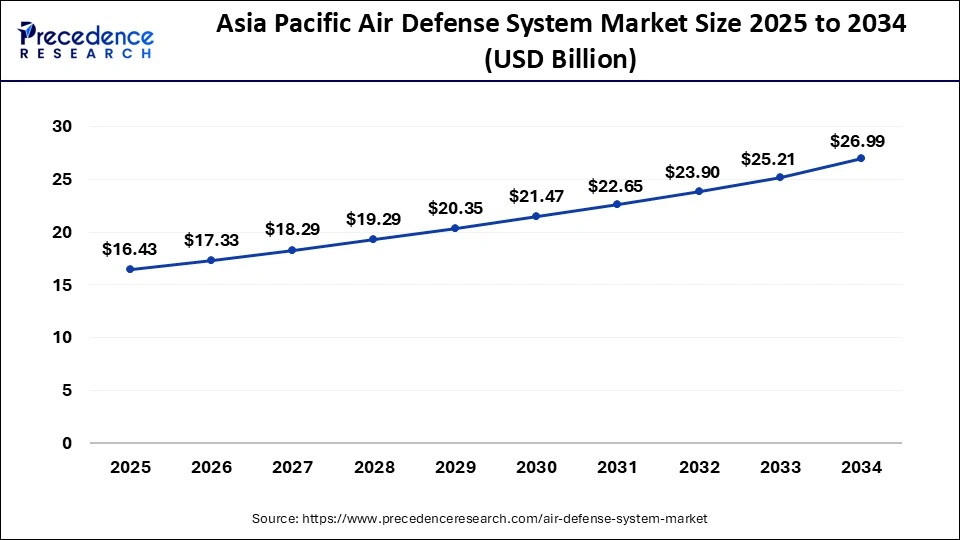

The global air defense system market size accounted for USD 45.80 billion in 2024, grew to USD 48.32 billion in 2025 and is expected to be worth around USD 78.23 billion by 2034, registering a CAGR of 5.5% between 2024 and 2034. The Asia Pacific air defense system market size is calculated at USD 15.57 billion in 2024 and is estimated to grow at a CAGR of 5.65% during the forecast period.

The global air defense system market size is calculated at USD 45.80 billion in 2024 and is projected to surpass around USD 78.23 billion by 2034, growing at a CAGR of 5.5% from 2024 to 2034.

The Asia Pacific air defense system market size was estimated at USD 15.57 billion in 2024 and is predicted to be worth around USD 26.99 billion by 2034, at a CAGR of 5.65% from 2024 to 2034.

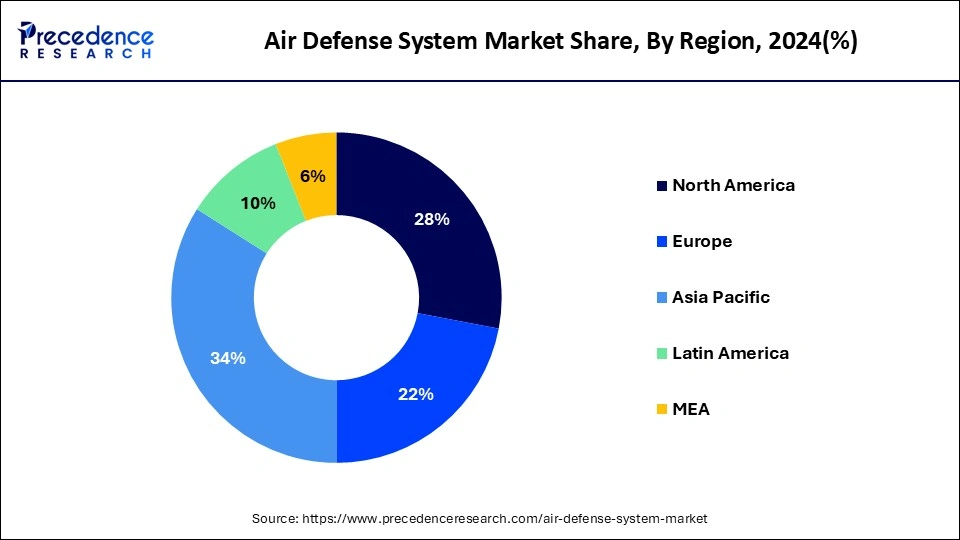

Asia Pacific is the largest and the fastest-growing market in the global air defense system market in 2023. The rising defense budgets of countries like China, India, South Korea, Pakistan, Indonesia, and Vietnam are the major drivers of the Asia Pacific air defense system market. The rising territorial disputes in the south Asia and South China Sea regions has significantly fostered the demand for the air defense system market across the region. The most prominent defense exporters like Russia, US, and Israel are witnessing a huge growth potential in the Asia Pacific region. The advanced technologies adopted by the major air defense system manufacturers are attracting the various emerging nations in Asia Pacific region to purchase those systems. China has border disputes with almost all of its neighbors, which is significantly driving the demand for the air defense systems among the neighbors of China. The rising investments in the development of advanced and untraceable missiles are boosting the expenditure towards the adoption of air defense systems.

Europe is also expected to be the fastest-growing market during the forecast period. The ongoing war between Russia and Ukraine has resulted in a rapid spike in the demand for the air defense systems among the neighbor peers of Russia like Sweden, Finland, and Poland. The Nordic states in Europe considers Russia as a potential threat are deploying advanced air defense systems to protect their territories from Russian invasion.

The rising defense expenditure in various developed and emerging countries for developing various missile and air defense systems, rising geopolitical instabilities, and changing nature of warfare are the prominent factors that are expected to boost the growth of the global air defense system market during the forecast period. The nature of the air warfare has changed with the introduction of more untraceable, agile, and lethal weapons that are autonomous in nature. Every country is trying to safeguard their territories against the potential adversaries. The increased importance of missiles and aircrafts in the modern-day warfare has significantly attracted huge investments towards the development and deployment of advanced air defense systems along the borders of countries. The huge government expenditures in the research and development of new and advanced air defense systems has led to the growth of the global air defense system market. The rapid spike in the military budgets owing to the geopolitical tensions has led to the growth of the air defense system market across the globe.

The various market players and their huge investments in the development of advanced air defense systems is expected to foster the market growth. For instance, in October 2022, Lockheed Martin invested in the development and manufacturing of hypersonic systems to be used against the emerging threats from the neighboring peer adversaries. The introduction of latest software and digital technologies is expected to enhance the performances of the air defense systems and ensure the safety of the aerial territories. The various manufacturers are increasingly adopting the various technologies such as high power lasers, mobile air defense integrated systems, multi-location radars, and missile warning systems that is expected to boost the demand for the latest air defense systems across the globe.

| Report Coverage | Details |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.5% |

| Market Size in 2024 | USD 45.80 Billion |

| Market Size by 2034 | USD 78.23 Billion |

| Largest Market | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Platform, By Range, By Type, and By Component |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

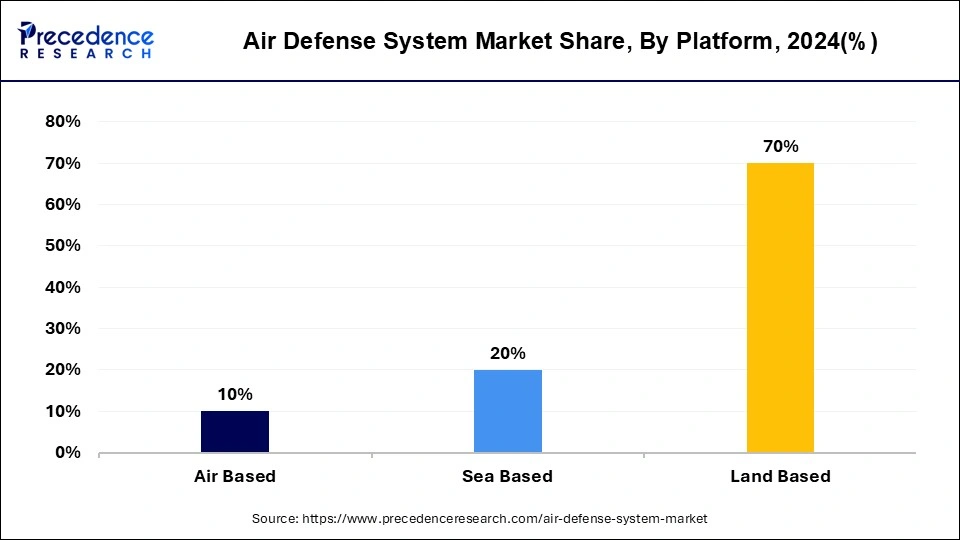

Based on the platform, the land segment dominated the global air defense system market in 2023. It accounted for a market share of around 70% in 2023. The demand for the land based air defense systems is higher owing to the rising need for protecting ground stations and personnel from any incoming aerial threats. Various developed nations are engaged in manufacturing technologically advanced air defense systems. For instance Russia’s S-400 anti-craft weapon system is known to be among the most advanced air defense systems that are currently in operation. The nations like India and Turkey are the recent buyers of the S-400 systems. US is also procuring land based midcourse defense systems. Therefore, the rising demand for the land based air defense systems across the major markets has led to the growth of this segment.

The sea segment accounted for the second largest market share in 2023. This is attributed to the increased demand for the sea based air defense systems to protect the naval ships from any missile or other aerial adversaries. The navy of any country plays a crucial role in attacking as well as defending from the enemy. Hence, to protect that huge naval ships and naval bases, the demand for the sea based air defense systems is high across the major nations with naval forces.

Depending on the range, the medium range air defense (MRAD) system segment dominated the global air defense system market in 2023. The growing number of conflicts among countries such as China-Taiwan, China-India, China-Japan, Russia-Ukraine, and Israel-Middle East nations are the significant factor that are driving the demand for the MRAD systems. The rising conflicts to gain territorial ownership among the neighboring nations have boosted the adoption of the MRAD systems in almost all the major regions across the globe.

The growing importance to locate the aerial threats is stimulating the demand for the long range air defense (LRAD) system across the globe. The growing need to protect the territories, the major nations is deploying LRAD systems to counter and dismantle any incoming adversaries before it reaches the target. This factor is stimulating the growth of this segment significantly. Moreover, the LRAD systems are used as a tool to show-off the technological advancement and power to the other nations as a part of the defense strategy.

Based on type, the missile defense system led the global market in terms of revenue in the year 2023 and expected to retain its dominant position during the forthcoming years. The prime factors attributed to the escalating growth of the segment include high demand for missile defense across military applications along with increased usage of missile during any war. In addition to this, increased investment from the government of Iran, Russia, China, the U.S., North Korea, India, and France are likely to prosper the market growth for air defense

On the other hand, anti-aircraft system predicted to register prominent growth over the forecast period owing to increasing emphasis of the governments of various nations towards strengthening their aircraft defense system. As of 2020, Russia, the U.S., France, and Israel have the best anti-aircraft system of the world. For instance, S-400 defense system of Russia is the third-generation surface to air anti-aircraft system that is used for fight with dense and multi target air strikes in various altitude ranging from ultra-low to high. The Russian Land Defense Forces are currently having the best class anti-aircraft systems and are also investing significantly in order to upgrade the quality of their defense systems. These initiatives taken by the government of various nations are likely to propel the anti-aircraft defense system during the upcoming years.

Weapon system held significant market revenue in the year 2023 in the global air defense system market. Prime factor supporting the prominent growth of the segment includes increasing emphasis of today’s warfare on missile improvement and modernization. Presently, almost every country is investing towards upgrading the quality of their missiles in order to make their defense system stronger and more compatible with other nations. For instance, in April 2022, the government of U.S. has proposed to invest around US$ 900 million in order to procure a new missile defense system from Guam. The initiative taken by the government of the U.S. was to address the rising threat of missiles from China. Similarly, other nations are also investing prominently in upgrading their missile technology along with their launching pads in respect to strengthen their defense system and technologies.

The various developmental strategies adopted by the government of various nations and various market players such as agreements, partnerships, new product launches, and joint ventures are expected to significantly influence the growth of the global air defense system market in a positive way. The market players are constantly engaged in research and developmental activities to gain a competitive edge and gain market share.

Segments Covered in the Report

By Platform

By Range

By Type

By Component

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

September 2024

October 2024

May 2024