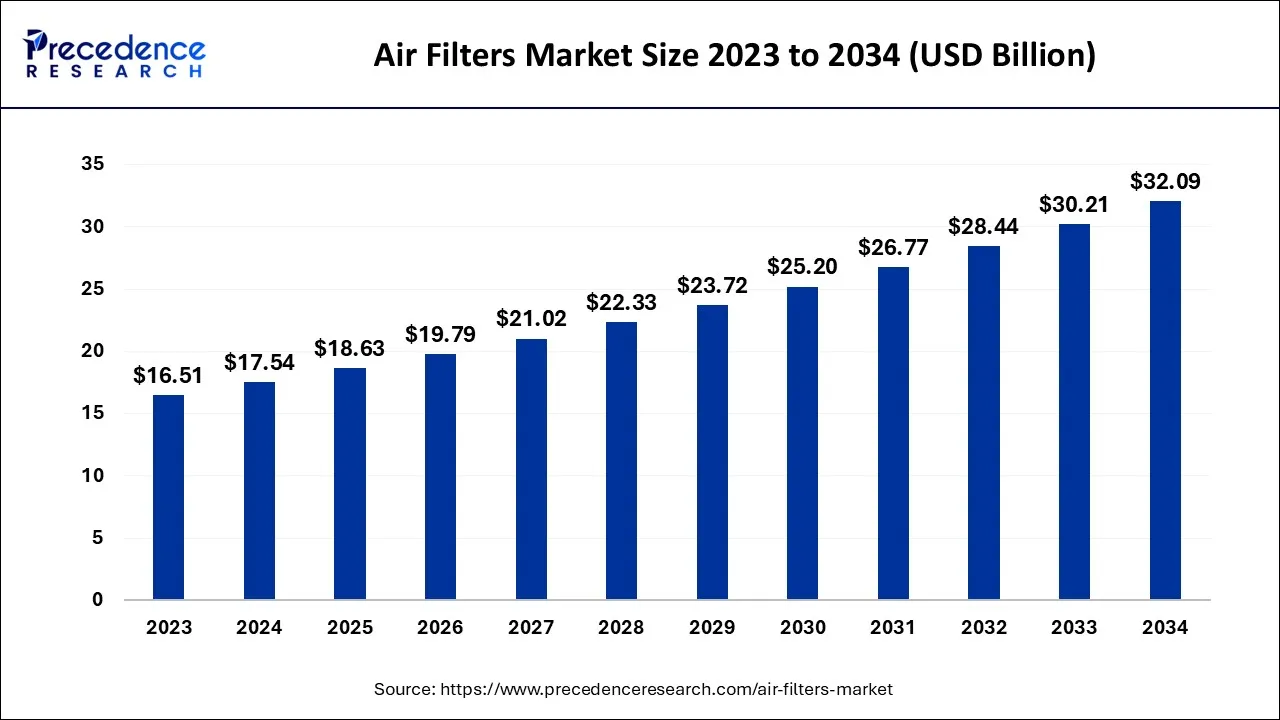

The global air filters market size accounted for USD 17.54 billion in 2024, grew to USD 18.63 billion in 2025, and is expected to be worth around USD 32.09 billion by 2034, poised to grow at a CAGR of 6.23% between 2024 and 2034.

The global air filters market size is expected to be valued at USD 17.54 billion in 2024 and is anticipated to reach around USD 32.09 billion by 2034, expanding at a CAGR of 6.23% over the forecast period from 2024 to 2034.

Market Overview

The air filters are a critical component of the HVAC system used in internal combustion engines to remove minute particulates. They are an essential component of air-moving devices like fan coils, terminal units, and air handlers. They clean the dirt that causes fan wheel imbalances and coil blockages. The principle is to protect people's health by keeping the ventilation system clean and ensuring a high level of hygiene (IAQ).

Furthermore, the increasing number of passenger cars on the roads, particularly in developing economies, the increased focus on environmental sustainability goals globally, the growth and expansion of the automotive industry, particularly in developing economies, and stringent government norms and regulations regarding pollution emission rate control parameters are the major factors driving the growth of the air filters market. Increasing airborne infections and rising pollution levels in urban areas are expected to propel the market.

Furthermore, rising health consciousness, as well as an improving standard of living and rising disposable income, are predicted to drive market expansion. Consumer health awareness is growing as the prevalence of airborne infectious diseases and viral infections rises. Furthermore, the emergence of several life-threatening epidemics such as Swine flu and Avian influenza has fueled the global air filter market growth over the last few decades.

However, over the forecast period, technical limitations related to air quality monitoring products are anticipated to impede market growth. Most portable and standalone air purifiers can only monitor air quality in a very small area and cannot collect data in three dimensions, which limits their acceptance to some extent.

The lockdown measures implemented by various governments in anticipation of the COVID-19 pandemic have increased sales of home products such as air purifiers, cleaning appliances, kitchen appliances, and water filtering equipment. Rising health consciousness has contributed to an increase in the global sales of air purifiers.

| Report Coverage | Details |

| Market Size in 2024 | USD 17.54 Billion |

| Market Size by 2034 | USD 32.09 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.23% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increase in demand across the automotive industry to brighten the market prospect:

The demand for filter installation in all cars has increased significantly with the development of the automotive sector, which has an impact on that demand. The air filter's purpose is to keep dust, grime, and other environmental toxins out of the engine. The air filter develops dusty and clogged over time and must be updated. In addition, it has high usage in the automotive sector due to its advantages for aftermarket services. The main purpose of the filters is to clean internal combustion engines, increase efficiency, and protect car engine components from hazardous dust particles. An air filter is designed to strain the air that the engine consumes during a series of strokes.

High initial installation and maintenance cost is causing hindrance to the market:

Filtration systems are becoming more popular as people become more concerned about the quality of their indoor air. However, one of the serious challenges hindering the market growth is the high maintenance cost of these filters. Filters are often highly expensive to replace, costing between $40 and $60, because they need to be changed and serviced every four to six months. Furthermore, many commercial and industrial end users choose low-cost filter equipment, which impedes the working environment in HVAC applications.

On the basis of type, air filters are segmented cartridge filters, Dust collectors, HEPA filters, baghouse filters, and others (Mist filters). HEPA filters are expected to grow at an exponential rate over the forecast period due to rapid growth in the industrial, residential, and commercial sectors. It has the power to attract atoms using its implanted cutting-edge diffusion processes.

HEPA filters that remove airborne particles with an efficiency greater than 99.94% have the potential to gain traction in healthcare, automotive, commercial and residential buildings, and other applications.

Due to their capacity to control air quality, dust collectors dominate the market and account for more than 28% of revenue share in 2023. In addition to having a sizable air filter market share, MIS collectors, baghouse filters, and cartridge filters are also predicted to support market expansion.

On the basis of end users, the air filter market is divided into residential, commercial, and industrial, with the industrial sector accounting for the majority of the market. Demand in the industrial sector is expected to rise significantly due to increased demand in manufacturing sites. These filters are used in the industrial sector to protect sensitive manufacturing processes by reducing the risk of microbiological and molecular contamination. As these filters play a dynamic role in all vehicles, the automotive industry captured the largest market share among industrial segments.

Air quality is an important consideration in many industrial applications. These applications need good air quality to maintain product integrity, reduce pollution, and, ultimately, enhance product safety. This excellent air quality is achieved by adding air filtering devices into industrial operations. Industrial air cleaning is the removal of solid particles and molecular pollutants from industrial operations to enhance the air quality inside a system or an environment. Due to the rising need for air purification in commercial and industrial structures, the commercial and industrial sectors account for significant shares.

On the basis of geography, North America dominates the market owing to increasing pollution day by day and the high growth of the automotive industry in the region. Additionally, the American Government's increased use of preventive measures to address the problems created by air pollution from the manufacturing industry has increased demand for these filters.

The region in Asia-Pacific is anticipated to have the greatest CAGR because of the region's increasing industrialization and urbanization throughout China, India, and other nations. In China, India, and other nations, air pollution is being exacerbated by growing industrialization and urbanization. The government is implementing many steps to prevent air pollution. For instance, China introduced the largest air purifier in January 2018 and garnered favorable reviews from the nearby residential and business sectors.

Furthermore, because industrial expansion reaches its pinnacle in developing nations like China, India, Singapore, and Indonesia, the demand for air purifiers is anticipated to rise the demand, which is fueling the market expansion of the air filters market.

Indonesia plans to construct additional coal-fired power plants in Jakarta, which could exacerbate air pollution and lead to a rise in the use of air purifiers. Sales of Sharp's plasma cluster-equipped air purifier, which produces positive hydrogen ions and negative oxygen ions while inactivating some viruses, increased five-fold in Indonesia. Every month, Sharp sells close to 10,000 air purifiers using its plasma cluster technology. This is increasing the demand for proper-quality air filters.

The South Korean air filters market is rapidly developing, primarily owing to rising demand as consumers become more concerned about fine particles. A face mask with an integrated battery-powered air purifier was introduced by LG Electronics Co. Ltd. to provide filtered air both inside and outside.

By Type

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client