July 2024

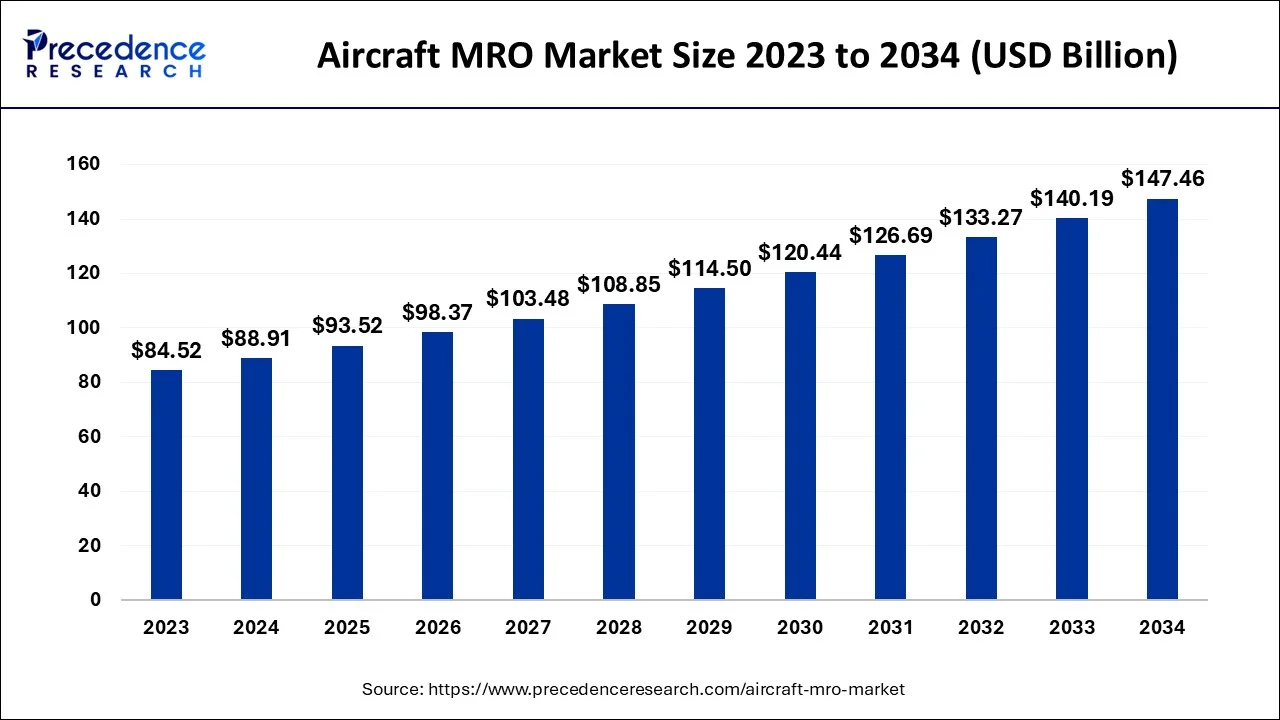

The global aircraft MRO market size accounted for USD 88.91 billion in 2024, grew to USD 88.91 billion in 2025 and is projected to surpass around USD 147.46 billion by 2034, representing a healthy CAGR of 5.19% between 2024 and 2034.

The global aircraft MRO market size is estimated at USD 88.91 billion in 2024 and is anticipated to reach around USD 147.46 billion by 2034 expanding at a CAGR of 5.19% from 2024 to 2034.

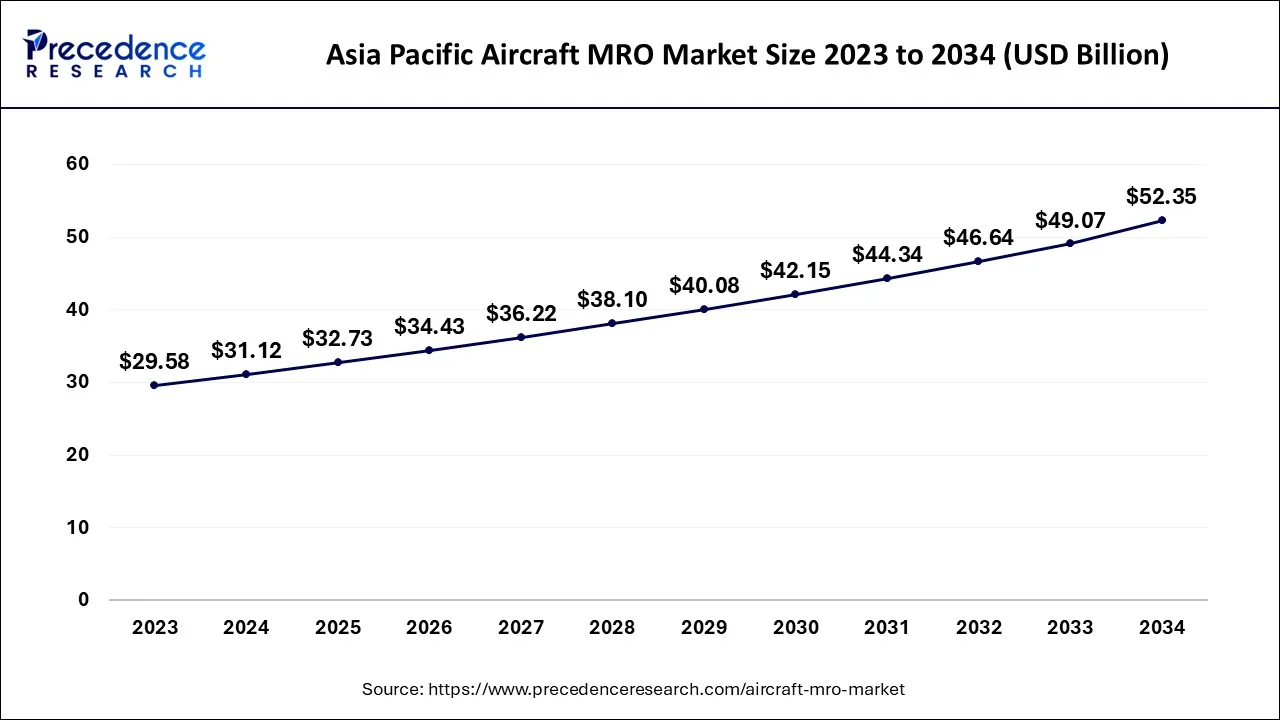

The Asia pacific aircraft MRO market size acccounted for USD 31.12 billion in 2024 and is expected to be worth around USD 52.35 billion by 2034 growing at a CAGR of 5.33% from 2024 to 2034.

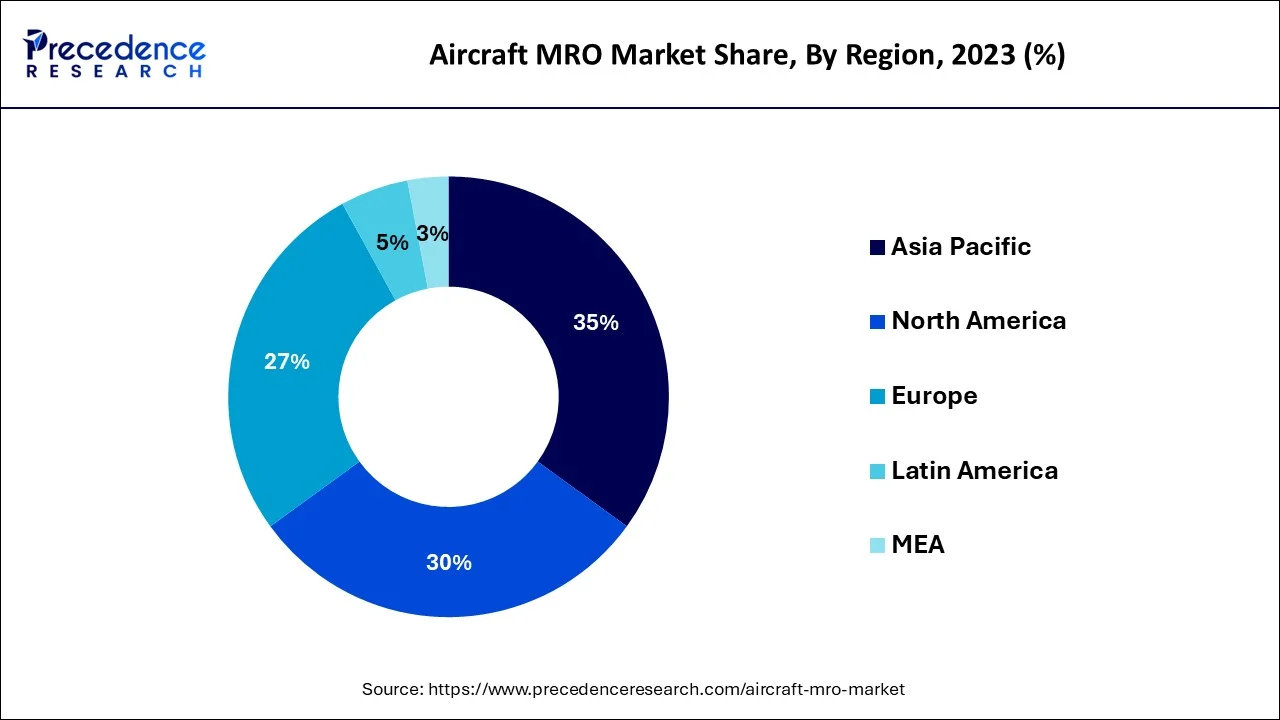

Asia Pacific dominated the market in 2023, the region is anticipated to hold the leading share of the market throughout the forecast period. In recent years, Asia Pacific has witnessed a significant boost in the aviation sector, the rise in the aviation sector with the adoption of air services for logistics and transportation is observed to boost the demand for MRO services. Airlines in the region are expanding with advancements in the aviation industry and associated services, this factor is expected to fuel the market’s expansion at a significant rate. Moreover, improving infrastructure, regulatory support for aircraft maintenance and operation as well as potential in developing countries are few other factors that supplement the growth of the market in Asia Pacific.

North America is anticipated to grow at the most significant rate during the forecast period. The growth of the segment is driven by factors such as well-developed aviation industry and the commercial scope for the aircraft industry in the region. The potential in the region to attract international players of the market also promotes the growth of the market. Moreover, the region carries a standardized regulatory framework for the safety and operation of aircraft, this factor highlights the requirement for MRO services for aircraft. All these factors collectively support the market’s growth.

The Aircraft MRO (Maintenance, Repair, and Overhaul) market is a significant segment of the aviation industry that focuses on the maintenance, repair, and overhaul of aircraft and their components. It plays a critical role in ensuring the safety, reliability, and airworthiness of aircraft throughout their operational lifespan. Aircraft MRO involves routine maintenance activities to keep aircraft in optimal condition. This includes tasks like regular inspections, servicing of engines and systems, and replacing worn-out or damaged parts to ensure that aircraft meet safety and performance standards. When aircraft experience mechanical or structural issues, they require repairs to restore them to full functionality. Aircraft MRO facilities are equipped to identify and fix problems such as damaged airframes, avionics, landing gear, and more.

| Report Coverage | Details |

| Market Size in 2024 | USD 88.91 Billion |

| Market Size by 2034 | USD 147.46 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.19% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 To 2034 |

| Segments Covered | Service Type, Organization Type, Aircraft Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising requirements of air travel

The aircraft MRO market is primarily driven by the rising demand for air transport, both for people and freight. Air travel becomes increasingly accessible and inexpensive for a wider segment of the population as economies grow and disposable incomes increase. Also, emerging countries are rapidly urbanizing and becoming more connected, which is driving up demand for air travel. Airlines grow their fleets and run more flights as they work to satisfy this rising demand. The need for maintenance, repair, and overhaul services is consequently increased by the increase in the number of operating aircraft. MRO companies are essential for maintaining the safety and airworthiness of these growing fleets.

Airlines are required to adhere to stringent regulatory criteria set by aviation authorities in order to continue operating. To ensure that aircraft are airworthy, these requirements frequently require routine inspections, maintenance checks, and repairs. Airlines may comply with these standards with the help of MRO services, which also guarantee that their aircraft are maintained in top condition and are safe to fly. The demand for air travel is rising, which also increases aircraft use and necessitates more frequent maintenance cycles. MRO services are needed by airlines to perform routine inspections, deal with wear and tear, and resolve any problems that might emerge while in use. Service providers assist to the overall safety, performance, and availability of aircraft in the rapidly changing aviation sector by offering dependable and effective MRO solutions.

High cost of MRO services

The airplane MRO market is significantly constrained by the high cost of MRO services. Activities for maintaining and repairing aircraft need a workforce, specialized equipment, and the purchase of expensive spare parts and components. The kind and size of the aircraft, as well as the difficulty of the required maintenance chores, can all affect these expenses. Costs associated with MRO services can be particularly significant for bigger commercial aircraft.

To maintain the aircraft's safety and airworthiness, regular maintenance procedures such as inspections, repairs, and checks are required. For airlines and aircraft operators, the costs incurred by these efforts, however, can be a financial hardship, particularly in a market with intense competition and small profit margins. Additionally, the price of replacement parts and components may be high. The pricing and availability of these parts are under the Original Equipment Manufacturers' (OEMs) control, which has a big impact on the entire MRO expenses. This could lead to delayed maintenance activities, reduced frequency of inspections, or even the postponement of necessary repairs.

Outsourcing trend

Airlines and aircraft operators now choose to outsource their MRO activities to specialized service providers, making outsourcing a common practice in the aviation sector. For MRO businesses, this shift presents substantial prospects. For a variety of reasons, airlines and operators contract out MRO services doing so enables them to concentrate on their primary business functions, such as flight operations and passenger services, and hand off maintenance and repair work to knowledgeable MRO providers. Airlines can increase overall efficiency, save costs, and streamline operations by outsourcing. Access to specialist knowledge and resources is another benefit of outsourcing. MRO companies frequently employ a specialized staff of knowledgeable mechanics, engineers, and technicians with in-depth understanding of particular aircraft types or systems. The reliability and safety of aircraft are increased due to the high-quality maintenance and repairs ensured by this knowledge.

Also, outsourcing MRO services may reduce costs. MRO businesses can offer their customers cost-effective solutions by utilizing economies of scale, bulk purchasing power, and smart inventory management. Airlines can take advantage of the competitive pricing provided by MRO suppliers and avoid making the significant upfront expenditure necessary to create in-house maintenance facilities. Thus, the outsourcing trend in the aviation MRO market offers MRO suppliers chances to grow their clientele, provide a variety of services, and forge long-term relationships with airlines and operators.

The engine overhaul segment is expected to hold the largest share of the market during the forecast period. Multiple original equipment manufacturers are involved in the MRO services for engine haul. As the requirement for substantial repair, maintenance and overall exchange of engine part increases, the segment is expected to grow. Multiple OEMs have started offering total care contracts for engine overhaul MRO. This factor boosts the overall expansion of the segment. With the significant responsibility in the aircraft, the engine overhaul starts to wear and tear with the time. MRO services are required to set it back to its optimum performance.

The component segment is expected to grow at a significant rate during the forecast period. The increasing demand for spare parts for aircraft along with the rising number of air travels from multiple end-users and industries boost the growth of the component segment. Component in the aircraft require anti-corrosion coatings time-to-time to regenerate the reliability, especially on metal components.

The independent MRO segment is expected to dominate the market during the forecast period. Major aviation hubs offer independent MRO services. The ability of independent MROs to handle large volume of aircraft maintenance activities promotes the growth of the segment. The specialization offered by independent MRO is observed to provide high-quality services. The most prominent specialization of independent MROs is they offer maintenance and repair services for multiple types of aircraft. Moreover, the presence of skilled technicians and professionals at the independent MRO organization plays a crucial role in the segment’s expansion.

The narrow body segment lead the market in 2023, the segment is anticipated to generate significant revenue during the forecast period. The operational efficiency and environmental advantages offered by narrow-body aircraft promote the utilization of narrow-body type of aircraft by multiple end-users industries. The rising demand for narrow-body aircraft has increased the requirement for inspection and reapplication of aircraft components. This fuels the growth of the segment.

Segments Covered in the Report:

By Service Type

By Organization Type

By Aircraft Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

February 2024

July 2024