January 2025

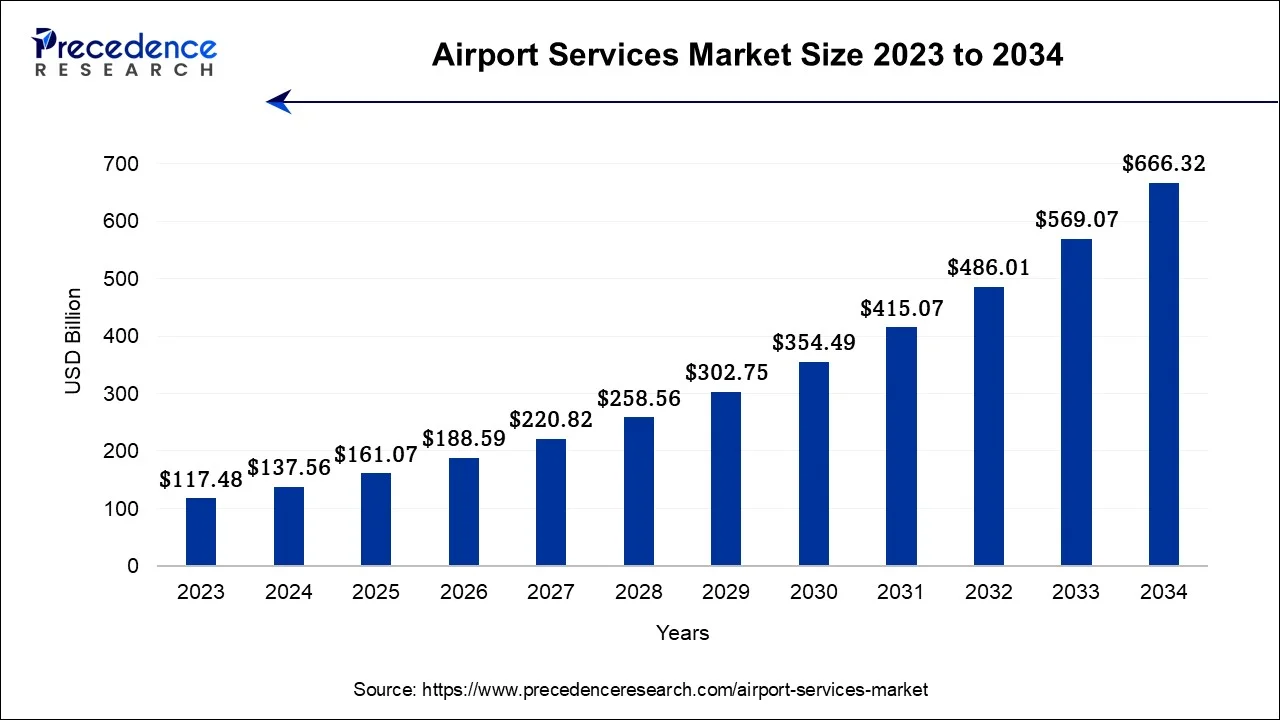

The global airport services market size accounted for USD 137.56 billion in 2024, grew to USD 161.07 billion in 2025 and is projected to surpass around USD 666.32 billion by 2034, representing a healthy CAGR of 17.09% between 2024 and 2034. The North America airport services market size is calculated at USD 52.27 billion in 2024 and is expected to grow at a fastest CAGR of 17.24% during the forecast year.

The global airport services market size is estimated USD 137.56 billion in 2024 and is anticipated to reach around USD 666.32 billion by 2034, representing a notworthy CAGR of 17.09% between 2024 and 2034.

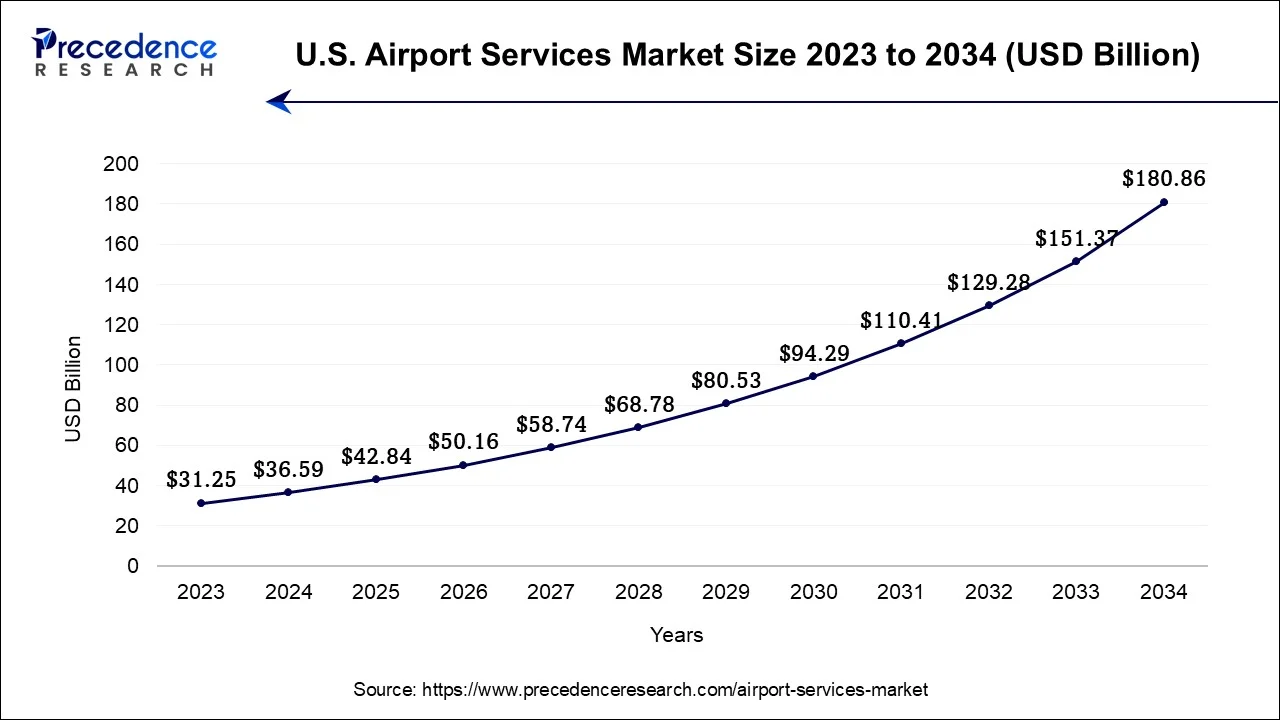

The U.S. airport services market size accounted for USD 36.59 billion in 2024 and is expected to be worth around USD 180.86 billion by 2034, growing at a CAGR of 17.32% between 2024 and 2034.

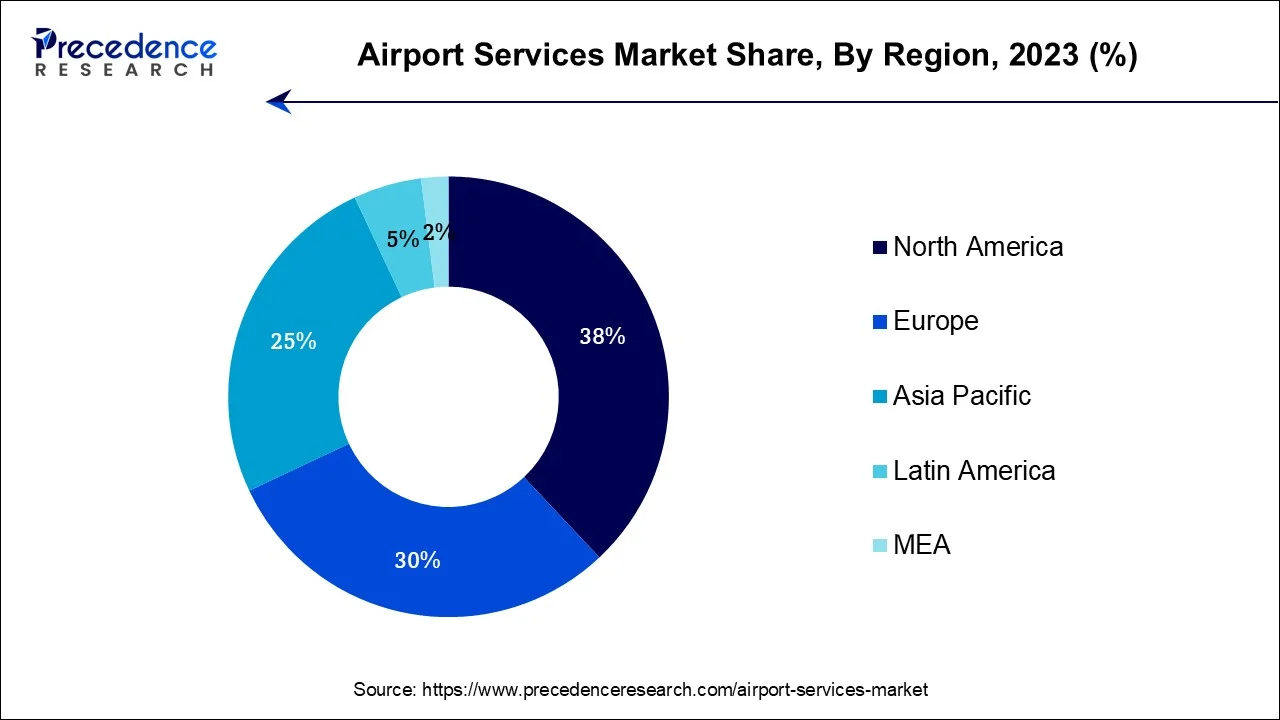

North America has held largest revenue share in 2023. The region's growth is primarily due to its technological innovation, security emphasis, and commitment to sustainability. Moreover, North America is home to one of the busiest and most prominent airport hubs in the world, including Hartsfield-Jackson Atlanta International Airport, Los Angeles International Airport, John F. Kennedy International Airport and others. These major hubs require considerable services for ground operations, passenger handling, and cargo logistics. As the region's aviation industry continues to evolve, this market remains a critical component in facilitating efficient air travel and supporting economic growth in North America.

Asia-Pacific is estimated to observe the fastest expansion in the airport services market. Asia-Pacific is experiencing substantial growth in air travel demand, driven by various factors such as rising disposable incomes, rapid urbanization, and an increasing middle class. This has helps in increasing passenger traffic at airports across the region. China and India are one of the emerging economies in the region where rapid urbanization and economic development are driving the construction of new airports and expansion of existing ones.

The European airport services market is expected to witness significant growth due to the European airports are at the forefront of adopting advanced technologies, including biometric authentication, automated baggage handling, and smart airport solutions. These technologies enhance passenger experience and operational efficiency. It plays a crucial role in connecting Europe to the global aviation network and supporting economic growth in the region.

The airport services market refers to the broad range of goods and services offered to travelers, airlines, and other stakeholders within and around an airport facility. This market encompasses various services and facilities that contribute to the efficient and comfortable operation of airports and the convenience of passengers. It include services provided directly to airlines, such as ground handling services, aircraft maintenance and repair, catering, and fueling. Ground handling services involve activities like baggage handling, aircraft towing, and passenger boarding. These services are designed to enhance the travel experience for passengers.

| Report Coverage | Details |

| Market Size in 2024 | USD 137.56 Billion |

| Market Size by 2034 | USD 666.32 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 17.09% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 To 2034 |

| Segments Covered | By Airport Type, By Application, and By Infrastructure Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rise in global air travel demand

The expansion of the global middle class, rapid urbanization, and improving economic conditions are fostering an environment where air travel is becoming increasingly accessible and affordable to a broader population. As more people aspire to explore new destinations, pursue business opportunities, or connect with friends and family across borders, airports witness a steady influx of travelers. Furthermore, airports are experiencing higher passenger volumes, necessitating a broader array of services to ensure the efficient handling of these travelers. Check-in counters, baggage handling, security screenings, customs and immigration procedures, and passenger lounges are all pivotal components of the airport experience that must scale up to meet this escalating demand.

Moreover, this demand generates a cascade effect, prompting investments in airport infrastructure expansion and modernization projects. Airports worldwide are compelled to upgrade terminals, runways, taxiways, and parking facilities to accommodate larger aircraft and increased passenger traffic. For instance, in August 2023, HOK collaborated with the Port of Seattle and AECOM, for the modernization of Seattle-Tacoma International (SEA) Airport’s S Concourse. The project includes a considerable upgrade to existing structures and building systems, and repurposing space to comply with the latest building codes. Airlines rely heavily on these services to deliver a seamless and comfortable experience to their passengers. Thus, the rising global air travel demand is not merely an indicator of increasing mobility but also a powerful driver for the airport services market.

Regulatory compliance

Regulatory compliance serves as a potential restraint on the demand for the airport services market, primarily due to the stringent and ever-evolving nature of aviation regulations. These regulations encompass various facets, including safety, security, environmental standards, and customs procedures. While essential for the safety and security of air travel, they can impose significant challenges and costs on airports and service providers. Compliance with safety regulations is non-negotiable in the aviation industry. Airports must invest in advanced infrastructure, equipment, and personnel training to meet the highest safety standards. This can be financially burdensome and requires constant vigilance and adaptation to remain compliant with evolving safety protocols.

Security regulations are equally demanding, particularly in the current global security climate. Stringent passenger and baggage screening, access control, and surveillance systems are necessary to mitigate security risks. However, these measures can lead to longer passenger wait times and necessitate substantial investments in security infrastructure. Environmental regulations are increasingly influential in shaping the industry. Airports are under pressure to reduce their environmental footprint, requiring investments in energy-efficient technologies, emissions reduction measures, and sustainable practices. While environmentally responsible, these initiatives can impose significant upfront costs. Thus, while necessary for the safety and security of air travel, regulatory compliance can strain airport resources, affect operational efficiency, and potentially increase costs, which may, in turn, restrain the demand for airport services.

Rise in smart airports

Smart airports represent a transformative paradigm shift in the aviation industry and offer significant opportunities for the airport services market. These technologically advanced airports provide digital solutions, automation, and data-driven intelligence to improve operational efficiency, passenger experience, and sustainability. Smart airports use real-time data analytics and Internet of Things sensors to monitor baggage handling, aircraft movements, passenger flow, security and others. The data-driven approach allows airports to streamline processes, reduce bottlenecks, and improve resource allocation, leading to cost savings and enhanced service quality. For instance, in July 2022, Denmark’s Copenhagen Airport launched AIRHART, an airport management ecosystem. It is a unique platform and solution that links and combines more than 100 systems using a unified, up-to-the-date platform. AIRHART is developed by smarter airports.

Digital innovations such as biometric identification, mobile apps, and self-service kiosks to offer travelers a seamless and personalized journey. These innovations not only reduce passenger stress but also create opportunities for value-added services like targeted retail promotions and location-based services. Security and safety are paramount in aviation, and smart airports leverage advanced technologies like facial recognition, AI-based threat detection, and automated security checks to enhance security while expediting passenger screening. This combination of improved security and efficiency is attractive to both travelers and airlines. Thus, smart airports are not just a futuristic concept; they represent a tangible opportunity for the Airport Services market.

Impact of COVID-19:

The most immediate and severe impact of the COVID-19 pandemic was the dramatic reduction in passenger numbers as lockdowns, travel restrictions, and quarantine measures were implemented worldwide. Airports experienced a steep decline in both domestic and international travel, resulting in a severe drop in demand for airport services. With significantly reduced revenues from landing fees, parking, concessions, and other sources, many airports faced financial challenges. Some even struggled to cover their operational costs, leading to job cuts and reduced services. However, pandemic accelerated the adoption of digital technologies, such as contactless payment systems, biometric identification, and mobile applications, to minimize physical interactions and enhance the passenger experience. For instance, in March 2023, Sharjah Airport announced that it introduced biometric system that will allow passengers to use facial recognition and give travelers a paperless experience.

According to the airport type, the domestic airports has held highest revenue share in 2023. Domestic airports play a vital role in connecting cities, regions, and remote areas within a country. They contribute to improved accessibility and economic development in these areas. Travelers at domestic airports do not need to undergo customs and immigration checks, making the boarding and disembarking processes relatively faster and more straightforward compared to international travel.

The international Airports is anticipated to expand at a significantly CAGR during the projected period because it offer a wide range of services to cater to the needs of travelers crossing international borders. These services include immigration and passport control, customs clearance, currency exchange, visa services, and international lounges. Also, international airports serve as major gateways connecting one country to the rest of the world.

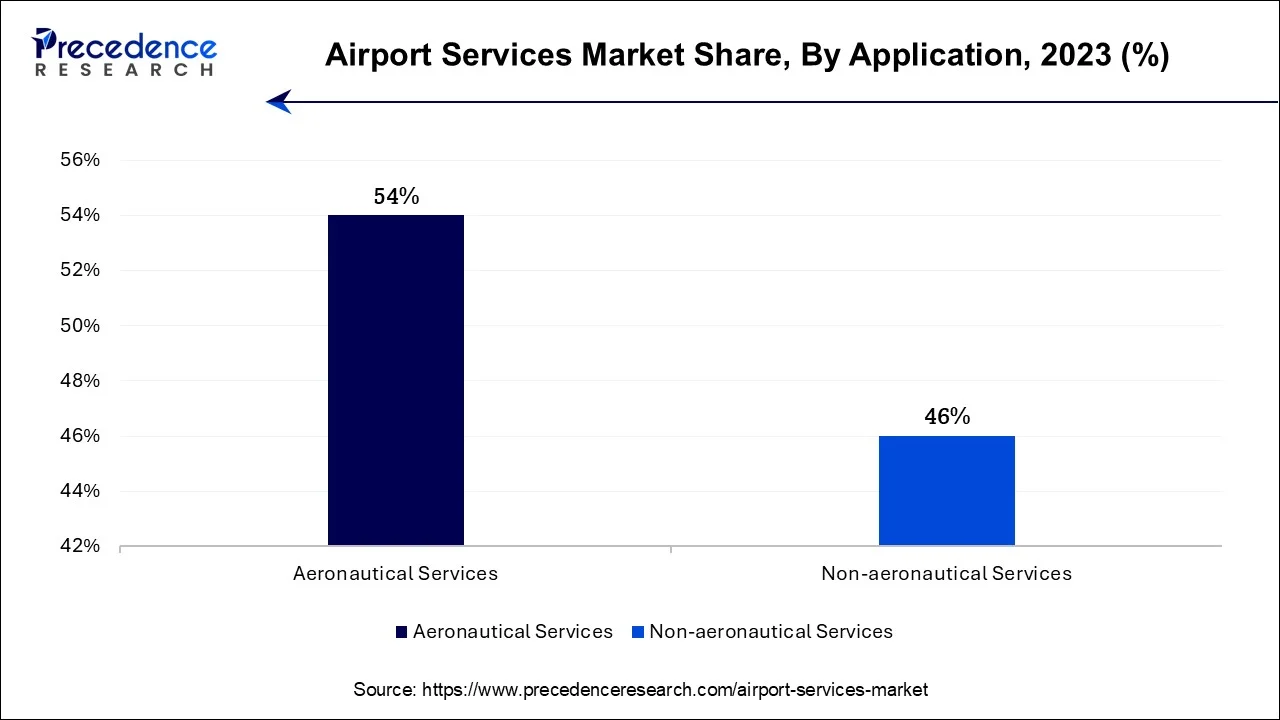

Based on the application, aeronautical services is anticipated to hold the largest market share in 2023. Aeronautical services are services directly related to the operation and safety of aircraft within the airport environment. They are critical for ensuring the smooth flow of air traffic and the safety of passengers and cargo. It also generates revenue for airports through landing fees, aircraft parking charges, and fuel sales.

On the other hand, the non-aeronautical services is projected to grow at the fastest rate over the projected period. Non-aeronautical services encompass a wide range of services and amenities that airports provide to enhance the passenger experience and generate additional revenue. These services are often directed at passengers and visitors within the airport terminal. It plays a crucial role in enhancing the passenger experience and generating revenue to sustain and develop airport facilities.

In 2023, the Greenfield airports had the highest market share on the basis of the infrastructure type. Greenfield airports are entirely new airport developments built from scratch on previously undeveloped land. These airports are typically initiated when there is a need for additional airport capacity in a region or when an entirely new airport is required to serve a specific area.

The Brownfield airport is anticipated to expand at the fastest rate over the projected period. Brownfield airports, on the other hand, are existing airports that undergo significant expansion, renovation, or redevelopment to meet the growing demand for air travel or to modernize infrastructure. Brownfield airports are numerous globally, as many established airports undergo regular upgrades and expansions to keep pace with evolving aviation demands. For instance, London Heathrow Airport and Los Angeles International Airport have undergone extensive brownfield development projects.

Segments Covered in the Report:

By Airport Type

By Application

By Infrastructure Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

November 2024

January 2025

August 2024