January 2025

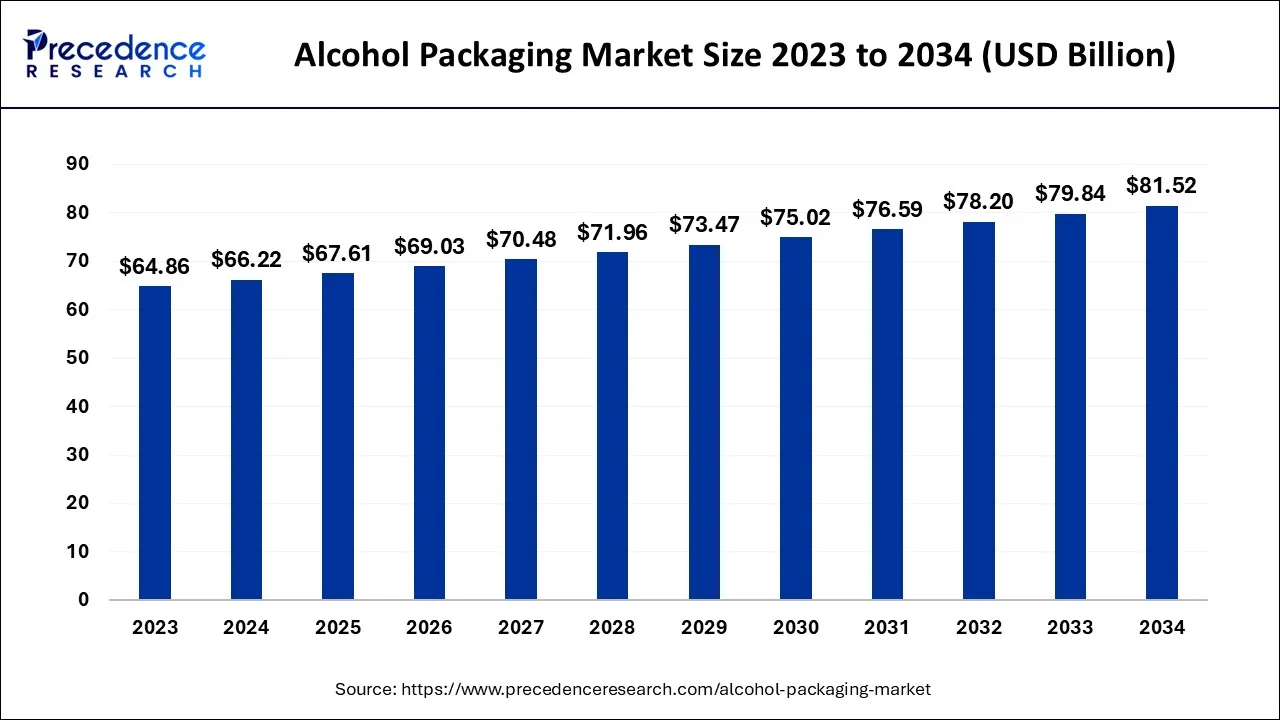

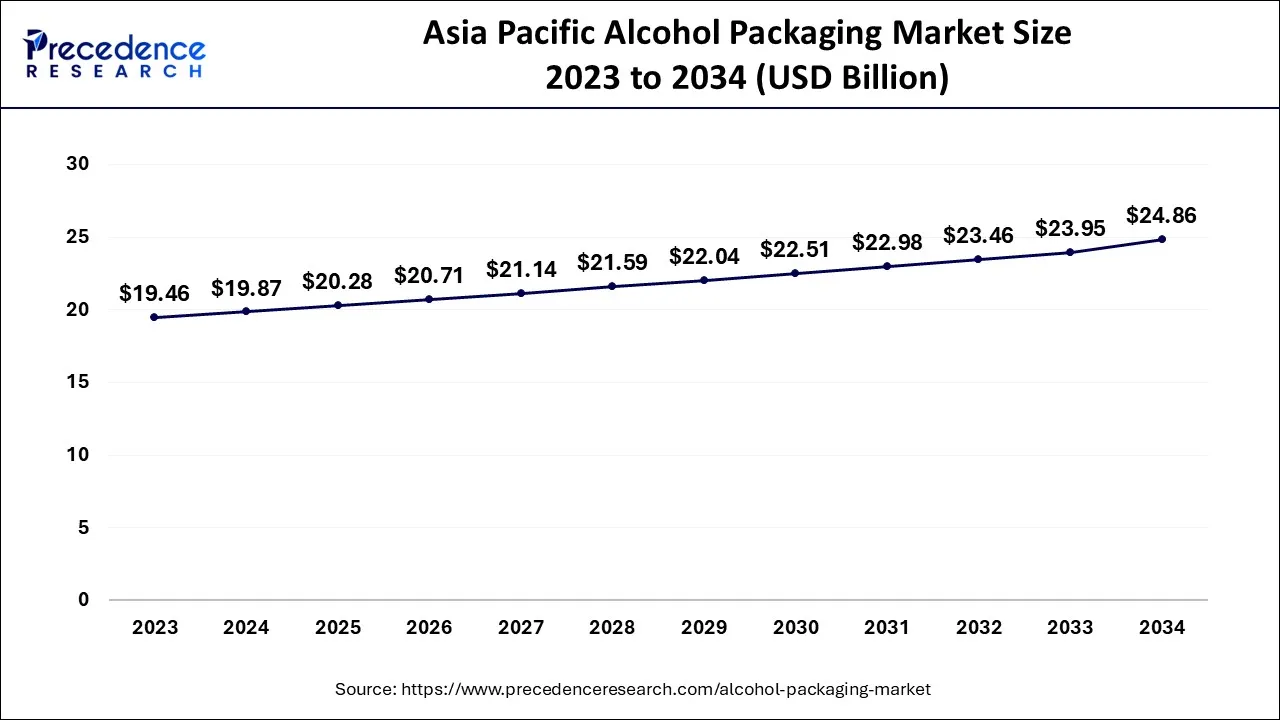

The global alcohol packaging market size accounted for USD 66.22 billion in 2024, grew to USD 67.61 billion in 2025, and is expected to be worth around USD 81.52 billion by 2034, poised to grow at a CAGR of 2.1% between 2024 and 2034. The Asia Pacific alcohol packaging market size is predicted to increase from USD 19.87 billion in 2024 and is estimated to grow at the fastest CAGR of 2.27% during the forecast year.

The global alcohol packaging market size is expected to be valued at USD 66.22 billion in 2024 and is anticipated to reach around USD 81.52 billion by 2034, expanding at a CAGR of 2.1% over the forecast period 2024 to 2034.

The Asia Pacific alcohol packaging market size is exhibited at USD 19.87 billion in 2024 and is projected to bealcohol packaging market worth around USD 24.86 billion by 2034, growing at a CAGR of 2.27% from 2024 to 2034.

The increasing preference for beer and craft beer among the younger and elderly population, the North American region is anticipated to hold a sizable share over the forecast period. To rapidly speed up their operations and meet the growing demand for alcoholic beverages, market participants are additionally making more investments and growth initiatives.

For instance, Crown Holdings, one of the top packaging solutions providers, recently announced plans to expand their beverage can manufacturing facility in Bowling Green, Kentucky, USA, to meet the region's growing demand for craft beer and beverage cans in February 2020. The facility in Kentucky Transpark will have a total floor area of 327,000 square feet, and it is anticipated that operations will start in the second quarter of 2021.

Additionally, it is anticipated that the Asia Pacific region's market share will increase significantly throughout the forecast period. This is due to the fact that there are more and more market participants offering improved and cutting-edge solutions to support the beverage packaging industry in nations like Australia and India, among others. This results from the younger and elderly populations in these countries' growing inclination toward various alcoholic beverages.

Alcohol packaging uses primary and secondary packaging to package various types of alcohol. The increase in alcohol consumption has raised the demand for alcohol packaging. Similar to how population growth has increased capital income, so has the amount of alcohol consumed globally.

The requirement for alcohol packaging from end-use industries like the alcohol industry is what is fueling the market's expansion globally. In addition, the entry of fresh local competitors into this market and creative packaging that enhances product appeal are anticipated to fuel market expansion internationally.

Major alcohol-producing companies use ceramic glass bottles, bag-in-box, whiskey pouches, bag-in-tube, and other eye-catching packaging formats. The market is significantly impacted by shifting consumer preferences. Vendors in the worldwide alcohol packaging market have tapped into the needs and want of the wealthiest customers. These companies also invest in packaging technologies, which are a dependable part of the global market dynamics.

The use of alcohol packaging will increase as trends in drinking alcohol change in the future. Numerous well-known vendors have recently entered the global alcohol packaging market.

Increasing demand in the alcohol packaging market is greatly influenced by the appeal of the brand being purchased. This component has been a significant factor in driving sales in the global alcohol packaging sector. The total amount of money entering the global alcohol packaging market has increased with the introduction of new alcoholic beverages like beer and guinea.

Additionally, emerging nations are consuming more alcohol, and the growing purchasing power of the general public has allowed them to experiment with new alcoholic flavors. These factors all support the growth of the global alcohol packaging market. Additionally, there is little disagreement among businesses regarding alcohol consumption.

| Report Coverage | Details |

| Market Size in 2024 | USD 66.22 Billion |

| Market Size by 2034 | USD 81.52 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 2.1% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Material, By Packaging Type and By End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising consumption

Major alcohol producers use ceramic glass jars, whiskey pouches, bag-in-box packaging, bag-in-tube packaging, and other appealing packaging designs. The industry under consideration is significantly impacted by changing consumer preferences. Suppliers in the global alcohol packaging market have tapped into the needs and desires of the wealthiest customers. These companies also invest in packaging systems, which have grown to play a significant role in the organization of the world market.

Over the next ten years, as drinking habits change, alcohol packaging will be used more frequently. The global market for alcohol packaging has recently welcomed several well-known suppliers. For the leading sector providers, this growth and advancement dynamic is essential. The appeal of the purchased brands is essential to increasing interest in the global alcohol packaging market. This element has been a significant sales motivator for alcohol-based products in the global packaging industry. The adoption of novel alcoholic beverages like beer and wine has increased the overall revenue of the global alcohol packaging market. Alcohol consumption is also growing in emerging markets, and the general populace's expanding purchasing power has allowed them to experiment with new alcohol tastes. The market for alcohol packaging is expanding globally due to all of these factors.

Harmful packaging waste

The environmental harm that packaging waste causes and the strict regulations on the materials used in rigid liquor packaging are the factors limiting the growth and development of the global alcohol packaging industry. Additionally, fluctuating raw material prices may impede growth.

New packaging trends

New packaging trends in the alcoholic beverage industry appear as packaging processes continue to advance. These ideas increase brand recall and purchase intent or divert customers' attention from a compelling message.

While being environmentally friendly is a common theme for all categories, each category has its distinctive shifts, such as using pop-top cans, beer and cider bottles, wine, and saki bottles, custom boxes, gift sets, etc.

Alcohol packaging bottles that cannot be damaged or broken during transport are made using plastic bottles and flexible bags in boxes instead of glass bottles. Additionally, they are lighter than glass bottles, portable, and recyclable. So that numerous companies can advertise the benefits of their products and packaging. Their product packaging can offer greater convenience, food protection, and consumer communication easily.

Alcohol packaging design is crucial for a specific product and brand. Then, all alcohol packaging must be water as well as alcohol resistant and must not change the flavor or alcohol content of the product. Bag-in-box beverage packages were introduced to increase convenience while reducing the weight of the package and preventing breakage and damage to glass bottles during packaging.

The primary packaging type dominates the market. Growlers, liquid bricks, cartons, pouches, bottles, cans, and bags in boxes are just some of the packaging options available for the primary market. Alcohol packaging aims to safeguard, maintain, and inform the consumer.

The package that comes into direct contact with the product is the primary packaging, also called the customer's unit. The consumer or end user is typically the target consumer for this kind of packaging. Items are not only made more straightforward for customers to handle but also more appealing and can be used to communicate with customers by giving them written product details.

The beer market will dominate the global market for alcoholic beverages. One of the oldest and most popular alcoholic beverages is beer; after coffee and tea, it is the third most popular beverage. Beer is a popular party beverage among millennials, and it is a crucial component of the feast, promoting social group cohesion.

Beer is healthier than any other alcoholic beverage and rich in proteins, vitamins B, and antioxidants. Beers range in alcohol content from less than 3% to 40% by volume, depending on the brand and formula. Beer consumption lowers the possibility of developing kidney stones.

Other advantages of beer include its high silicon content, which strengthens bones, and its soluble fiber, which lowers bad cholesterol. The main factors propelling the global beer industry include the rising number of breweries and the expanding demand for beer globally. The industry has seen an increase in the sale of low-alcohol beers due to growing demand from health-conscious consumers.

Segments Covered in the Report

By Material

By Packaging Type

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

March 2025