September 2024

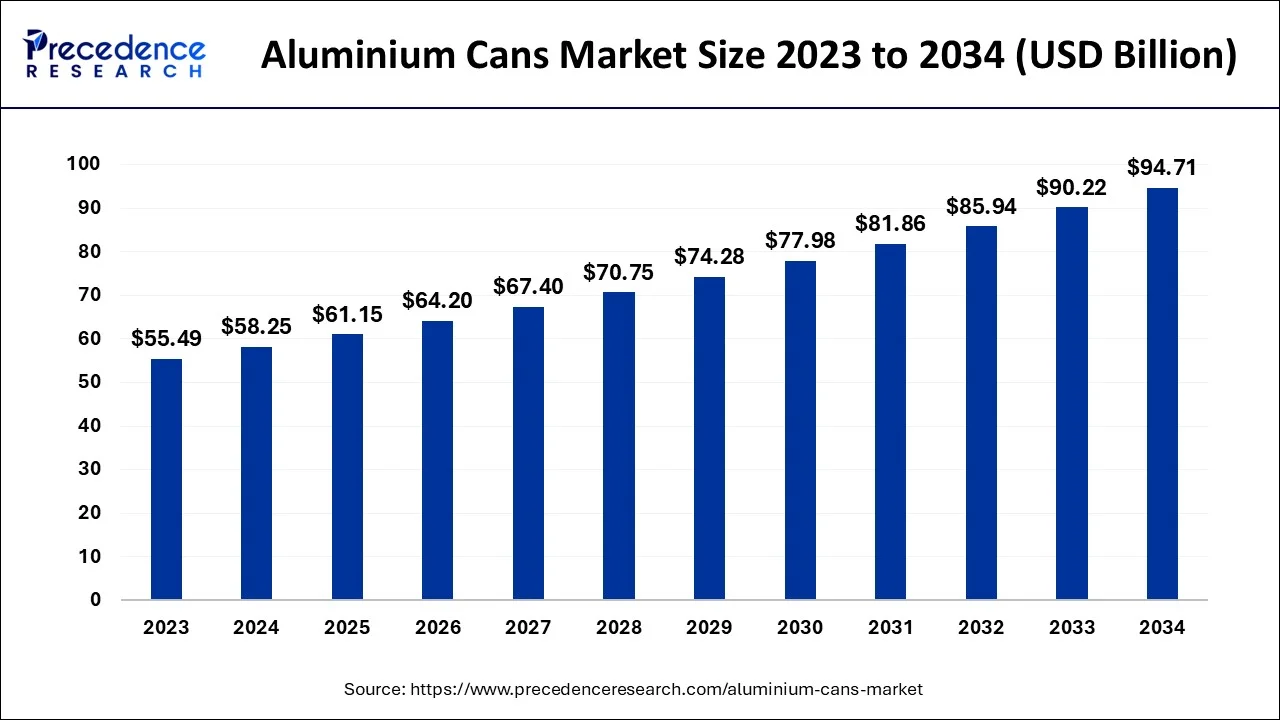

The global aluminium cans market size accounted for USD 58.25 billion in 2024, grew to USD 61.15 billion in 2025 and is predicted to surpass around USD 94.71 billion by 2034, representing a healthy CAGR of 4.98% between 2024 and 2034. The North America aluminium cans market size is calculated at USD 22.72 billion in 2024 and is expected to grow at a fastest CAGR of 5.10% during the forecast year.

The global aluminium cans market size is estimated at USD 58.25 billion in 2024 and is anticipated to reach around USD 94.71 billion by 2034, expanding at a CAGR of 4.98% from 2024 to 2034.

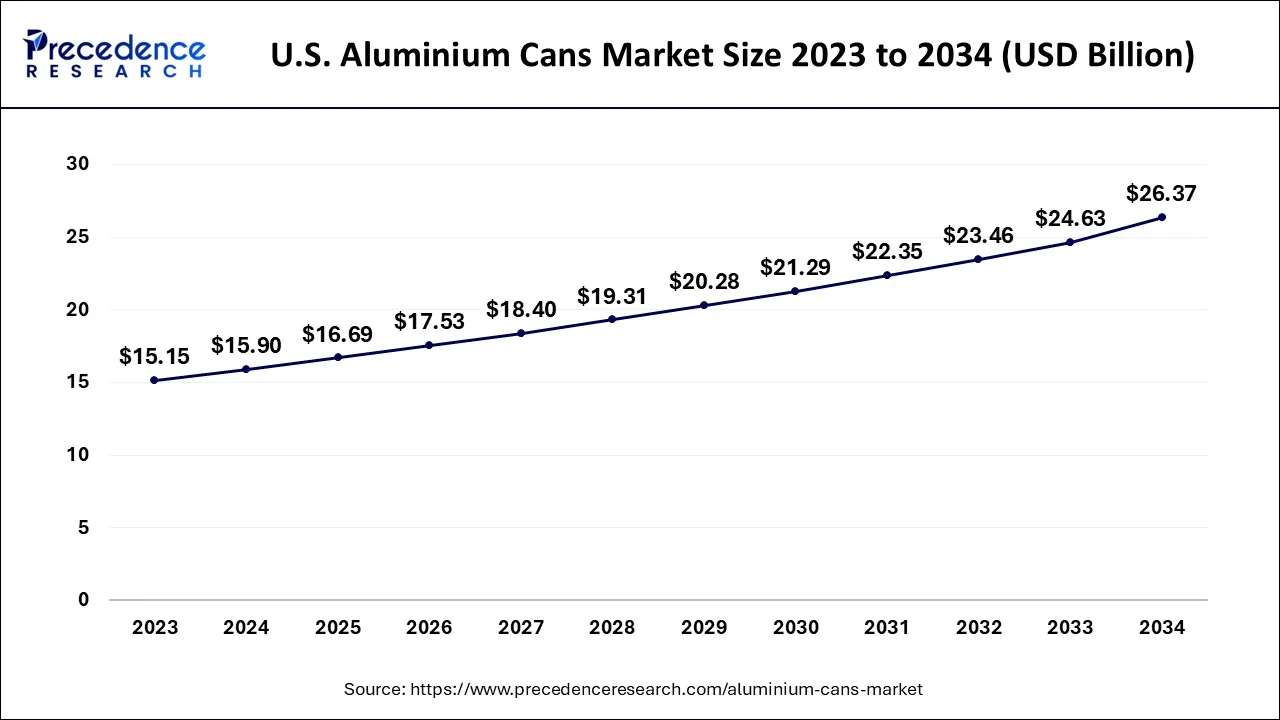

The U.S. aluminium cans market size is evaluated at USD 15.90 billion in 2024 and is predicted to be worth around USD 26.37 billion by 2034, rising at a CAGR of 5.17% from 2024 to 2034.

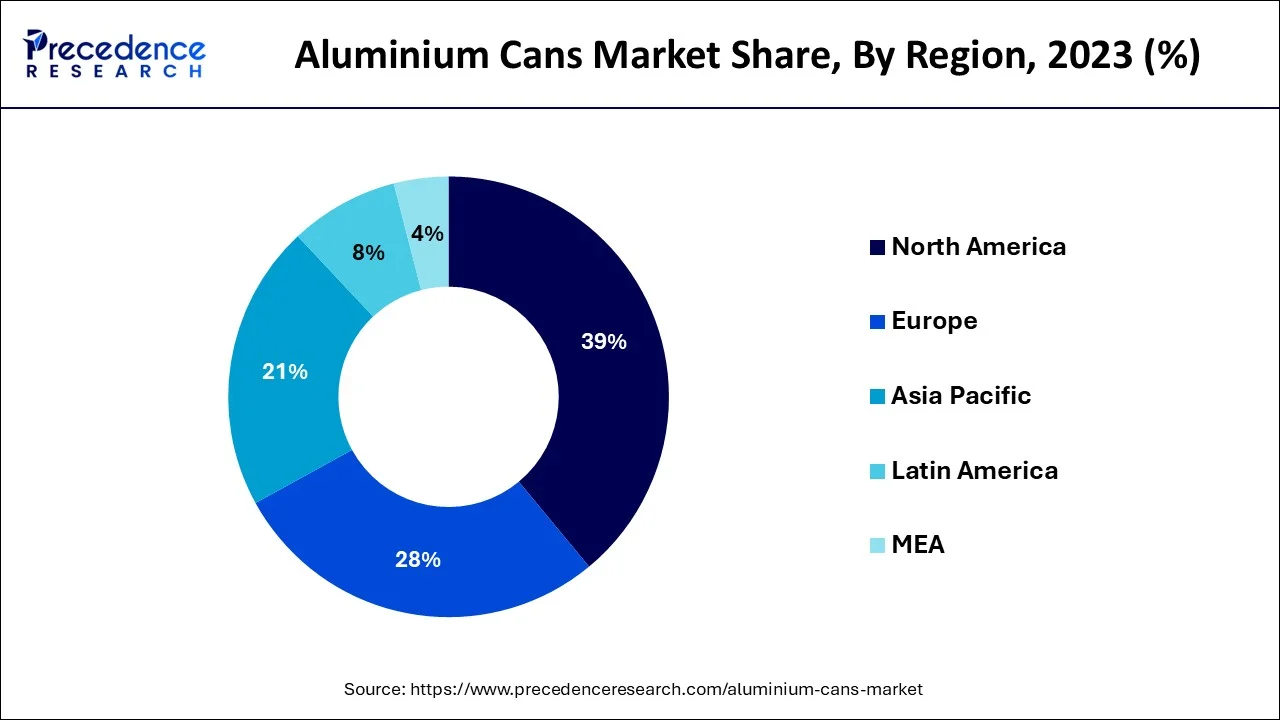

On the basis of geography, North American region accounted 39% market share in 2023. As the demand for processed and packaged foods in this nation has increased the demand for aluminium cans is also expected to grow. The sales of the aluminium cans are also expected to grow in the European region especially in Germany due to its increased use of aluminium cans in the food and beverages industry as well as the chemical industries.

Chemical industry in Germany is growing at a great pace and they shall provide maximum opportunities for the growth of the market in the coming years. Apart from Germany United Kingdom is also expected to have a good amount of market share in the coming years. The demand for canned food has increased in the recent years which has generated a good amount of revenue, and the increase in the consumption of canned food will lead to an increased consumption of aluminium cans. The beverages industry also makes use of aluminium cans in its packaging which will help in the growth of the market in the coming years. Countries like Japan are constantly focusing on recycling the products used in packaging due to which the plastic and glass packaging options will not be used on a large scale in the food and beverages industry.

Aluminium cans are also known as the tin cans. The increased consumption of different types of beverages is expected to be one of the major reasons that will help in the growth of the market during the forecast period. Aluminium cans are offered in different types of capacities and due to which the market is expected to grow well in the coming years.

Aluminium cans are also used for the packaging of food and it is expected to gain more popularity in the coming years. Through the introduction of the aluminium cans that are BPA free which happens to be a packaging that is chemical free the demand for these aluminium cans is expected to grow in the coming years and provide major opportunities for the growth of the market during the forecast period. The demand for different types of canned foods is expected to grow especially in the developed nations across the world due to the introduction of the chemical free option.

In the recent years in most of the developing as well as the developed regions the demand for convenient and sustainable packaging for different types of beverages has increased. In order to have packaging solutions that are convenient the demand for aluminium cans has increased. Due to the sustainability policies adopted by various nations across the world the demand for metal packaging has increased and it will continue to grow in the coming years. Recycling of metals is extremely easy and it is environment friendly. These materials can be recycled many times and the recycling process does not hamper the quality of the product and this is expected to be a major factor that will be instrumental in the growth of the market in the coming years. Compared to all other packaging options the demand for aluminium cans is expected to grow as it happens to be an economic option for the packaging of different types of products used in personal care and for different types of foods as well as beverages. Aluminium cans are used on a large scale in the food and beverages industry and it will continue to dominate the market as compared to any other metal packaging available in the market as they are extremely cost effective. Most of the aluminium hence used widely in the food and packaging industry contains about 70% of the recycled form which is the highest as compared to any other type of containers.

| Report Coverage | Details |

| Market Size in 2024 | USD 58.25 Billion |

| Market Size by 2034 | USD 94.71 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.98% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Type, Capacity, End User and Geography |

On the basis of the product, the 2-piece Segment is expected to dominate the market with a 53% revenue share in 2023. This segment is expected to grow well in the coming years as this type of packaging is used in many different industries. These cans are extremely convenient to use and provide easy opening. They are light in weight due to which they are used in the beverages industry.

The demand for packaged food and beverages that are convenient to carry around has created more demand for aluminium cans of this type in the recent years and it will continue to grow in the coming years.

On the basis of the end user, the beverages segment is expected to have the largest market share in the coming years period this segment has dominated the market in the past with the higher share in terms of revenue. Increased use of aluminium cans in different types of beverages will provide opportunities for the growth of the market. The use of the aluminium cans is also expected to grow in the food industry. Aluminium cans help in improving the shelf life of the products and it also acts as the best barrier for all the contaminants. All of these factors will drive the market growth in the coming years.

On the basis of capacity, the 201-450ml segment is expected to have the largest market share in the coming years period it is expected to grow with the highest compound annual growth rate which is expected to be 4.1% in the coming years. This is the most affordable option in the market do to which the segment is expected to grow. About 35% of the total of the aluminium cans used in the market out of the capacity 201-450ml. The 1000 ml capacity segment is also expected to grow well in the coming years due to its increased use in the food industry.

By Product

By Type

By Capacity

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

February 2025

March 2025

January 2025