October 2023

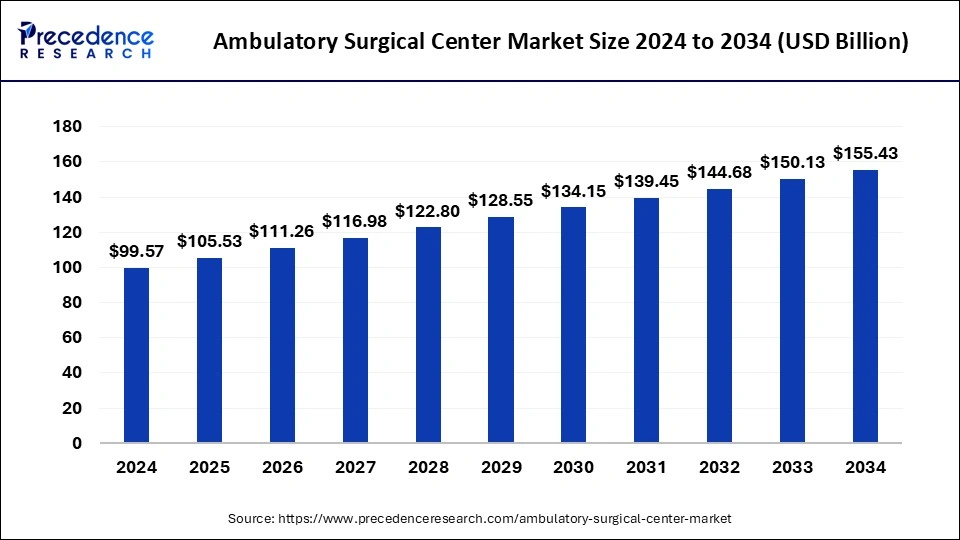

The global ambulatory surgical center market size is evaluated at USD 105.53 billion in 2025 and is forecasted to hit around USD 155.43 billion by 2034, growing at a CAGR of 4.55% from 2025 to 2034. The North America market size was accounted at USD 43.13 billion in 2024 and is expanding at a CAGR of 4.57% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global ambulatory surgical center market size was calculated at USD 99.57 billion in 2024 and is predicted to increase from USD 105.53 billion in 2025 to approximately USD 155.43 billion by 2034, expanding at a CAGR of 4.55% from 2025 to 2034.

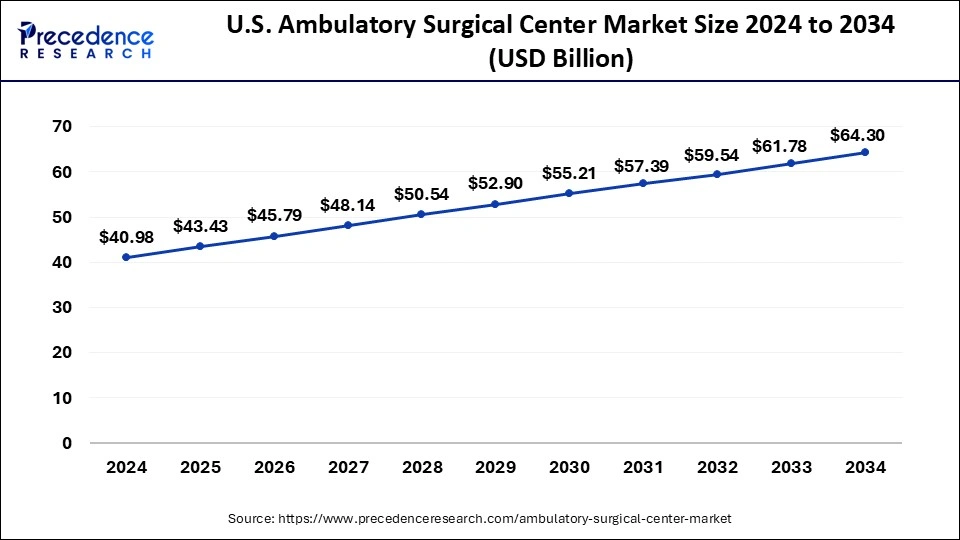

The U.S ambulatory surgical center market size was exhibited at USD 40.98 billion in 2024 and is projected to be worth around USD 64.30 billion by 2034, growing at a CAGR of 4.61% from 2025 to 2034.

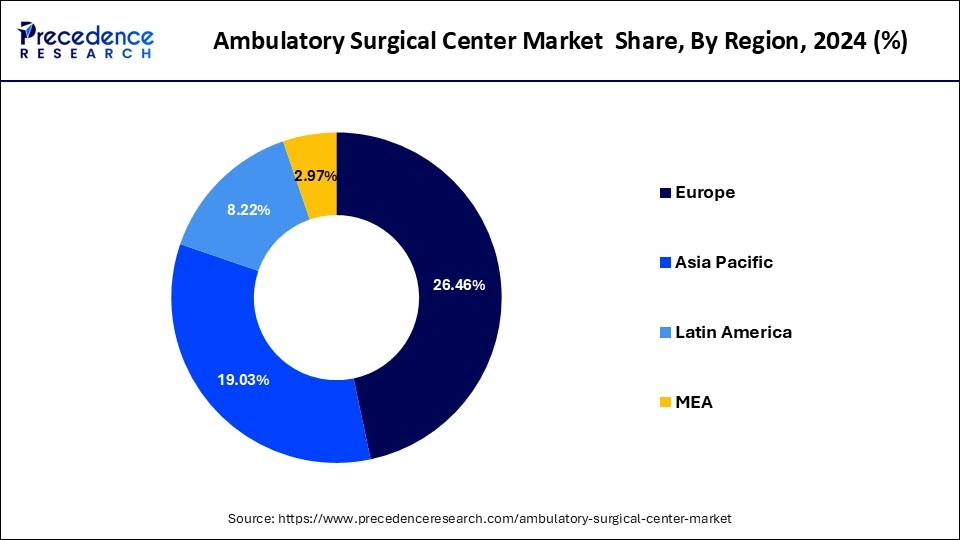

North America dominated the ambulatory surgical center market with revenue share of over 43.32% in 2024. Increased government support for primary care services and expanding outpatient coverage are major elements driving the ambulatory surgical center market’s expansion in the North America region.

Asia-Pacific, on the other hand, is expected to develop at the fastest rate during the forecast period. The expansion of outpatient facilities has resulted from rising healthcare expenditures due to the rise in prevalence of chronic diseases, the ageing population, high healthcare expenditure, and growing hospitalizations rates. All these aforementioned factors are driving the growth of the ambulatory surgical center market in the region.

Ambulatory surgical centers are modern outpatient surgery centers that specialize in same day surgical procedures such as diagnostic and preventative procedures. These centers generally serve individuals who do not require hospitalization. The therapy can be performed outside of the hospital, and the patient can be released as soon as the medical procedure is completed. Ambulatory surgical centers are an excellent choice for people who cannot afford significant medical bills. For the convenience of patients, ambulatory surgical facilities offer mobile surgical procedures. For on-site surgical operations, ambulatory surgical facilities are fully equipped with an operating room. Ambulatory surgical centers are best for non-invasive and minor operations.

The sustained growth of the ambulatory surgical center market is expected to be fueled by the exponential rise in healthcare expenses over the last decade, which has resulted in changing healthcare practices. In addition, the increased frequency of chronic disorders that necessitate regular minor procedures that may be performed in ambulatory settings is a major driver of the ambulatory surgical center market. A major driver of the ambulatory surgical center market is the growing burden of surgical procedures on hospitals and healthcare organizations. The need to reduce inpatient surgeries, particularly for simple procedures as well as growing acceptance of ambulatory surgical centers, are driving the market for ambulatory surgical centers to rise.

| Report Coverage | Details |

| Market Size by 2034 | USD 155.43 Billion |

| Market Size by 2025 | USD 105.53 Billion |

| Growth Rate | CAGR of 4.55% from 2025 to 2034 |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Type, Process, Type, Therapeutic Area, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

A rise in the number of surgeries, the surge in the older population, and a rise in the frequency of chronic disorders are all driving the ambulatory surgical center market during the forecast period. The surge in outpatient hospitalizations could also be attributed to the use of technologically advanced treatments in outpatient clinics, which makes treatment more cost-effective and speedier. The advanced surgical methods allow tests and surgeries to be carried out without the requirement for a hospital admission rates in such situations. In addition, technological advancements, the growth of outpatient services, and increased desire for less invasive surgeries all contribute to the ambulatory surgical center market’s expansion.

A growth in the demand for ambulatory surgical centers in developing countries is likely to create new lucrative opportunities during the forecast period. Due to advancements in medical technology and the affordability of facilities, the ambulatory surgical center market is rising. The convenient locations, cost savings, technical developments, and patient happiness by ambulatory surgical centers all influence the growth of the ambulatory surgical center industry. Ambulatory surgical centers offer low-cost treatments and amenities as well as the convenience of day surgery for patients. The evolution of less invasive surgical approaches has resulted in an increase in the number of procedures that can be performed in ambulatory surgical centers.

Another significant element driving the ambulatory surgical center market is favorable reimbursement possibilities for services supplied by ambulatory surgical centers. Medical coverage through state run and private healthcare insurance makes ambulatory surgery clinics appealing for surgical operations, particularly minor ones, in emerging nations. Most ambulatory surgical centers do not require a hospital stay and are costly than hospital surgeries.

Due to the rise in chronic disorders prevalence, the worldwide outpatient surgical center market is expected to expand over the projection period. The ambulatory surgical center sector is also expected to benefit from the growing number of collaborations and acquisitions around the globe. The ambulatory surgical center industry is growing as a result of rising demand for minimally invasive treatments, surgeon tools and equipment, technological developments in surgical tools and equipment, and physician control over equipment selection. The rise in global demand for ambulatory surgical facilities is expected to be stymied by a low health care professional rate.

Thus, rising healthcare costs are a major cause of concern for the company, as they result in many individuals being unable to afford treatment, especially surgical procedures. As a result, healthcare professionals have been working to devise innovative tactics and strategies to reduce the cost of therapies while maintaining high quality of surgeries which will benefit patients on large scale. The ambulatory surgical centers have shown to be viable alternative in this case.

High-Quality Care

To make sure they adhere to strict standards of care, ASCs frequently apply for accreditation from institutions like the Joint Commission or the Accreditation Association for Ambulatory Health Care (AAAHC). Ensuring the exceptional qualifications and continual education of all medical personnel, including nurses, anesthesiologists, and surgeons. Placing a strong emphasis on patient education, communication, and participation in decision-making. Purchasing cutting-edge surgical instruments and upholding strict maintenance and sterilization guidelines for those instruments. Expansion in the range of operations that can be carried out as an outpatient as a result of improvements in minimally invasive surgical methods. The transition from inpatient to outpatient surgical settings is being driven by patient choice for shorter hospital stays and economic pressures.

Competition from Emerging Technologies

In ASCs, robotically assisted surgery is becoming more and more common. During operations, these devices give surgeons more control, flexibility, and precision. Patients may find ASCs to be a desirable alternative because of the less invasive nature of robotic surgery, which can also result in shorter recovery periods, less discomfort following surgery, and a decreased risk of infection. Better preoperative and postoperative treatment is made possible by advances in telemedicine and remote monitoring technologies. Telehealth systems allow patients to have follow-up visits and consultations, which eliminates the need for in-person appointments. Remote monitoring tools can keep tabs on a patient's vital signs and progress, guaranteeing prompt actions if problems develop. Patients are receiving constant health monitoring because of wearable technology and Internet of Things (IoT) advancements.

Patient-Centered Care Models

In the ambulatory surgical center market, patient-centered care (PCC) models emphasize giving healthcare that is considerate of and sensitive to patients' preferences, requirements, and values. By ensuring that patient values inform all clinical decisions, these models seek to improve patient happiness and care quality. In the ambulatory surgical center (ASC) market, patient-centered care (PCC) models emphasize giving healthcare that is considerate of and sensitive to patients' preferences, requirements, and values. By ensuring that patient values inform all clinical decisions, these models seek to improve patient happiness and care quality. establishing a relaxing and friendly atmosphere at the ASC in order to lessen anxiety and enhance the general patient's experience.

The single-specialty segment held the largest share in the ambulatory surgical center market. In the Ambulatory Surgical Center (ASC) sector, ASCs that concentrate on a particular field of medicine or surgery are referred to as single-specialty ASCs. These facilities specialize in offering specialist care in a specific area, such as pain treatment, orthopedics, gastroenterology, or ophthalmology. More focused and effective care can be provided using the single-specialty model, which frequently results in improved outcomes and increased patient satisfaction. The aging population's need for specialized surgical treatments and the rising incidence of chronic diseases are driving up demand for single-specialty ASCs. Single-specialty ASCs are appealing to consumers and insurers alike since they frequently have lower prices than hospital-based outpatient departments.

The multi-specialty segment is expected to be the fastest-growing market. Within the Ambulatory Surgical Center (ASC) business, the multi-specialty category is a significant and expanding industry. Ambulatory Surgical Centers are medical establishments that provide patients with the option to have surgical operations performed outside of a conventional hospital. These facilities offer same-day surgical care, including diagnostic and prophylactic procedures, and have gained popularity as an alternative to hospitals because of their effectiveness, affordability, and quicker recovery periods. Due to decreased overhead, procedures carried out at ASCs typically cost less than those conducted in hospitals. Both patients and insurance companies may experience large cost savings as a result of this.

The physician only segment held the largest share in the ambulatory surgical center market. Within the Ambulatory Surgical Center (ASC) market, the physician-owned segment represents a sizable and expanding portion of the healthcare sector. Facilities with physician ownership stakes are known as physician-owned ASCs, and they frequently provide better treatment and more efficient operations. The growing demand for outpatient operations and procedures has resulted in significant development in the physician-owned ASC market. With the development of minimally invasive surgical techniques and medical technology, increasingly difficult treatments can now be carried out in ASCs. Since physicians directly participate in both clinical and administrative decisions, physician ownership frequently results into a higher standard of care.

The hospital only segment is expected to be the fastest growing market. A growing and substantial share of the ambulatory surgical center (ASC) market is made up of hospital-owned facilities. Ambulatory Surgical Centers are medical establishments that focus on offering outpatient surgical procedures, allowing patients to return home the same day of the procedure. Hospitals are using ASCs to broaden their services, improve patient care, and maximize operational efficiencies, which makes this market segment crucial. Surgery can be performed in hospital-owned ASCs for less money than in conventional hospital settings. Both patients and payers, such as Medicare and insurance companies, find this cost efficiency appealing.

The demand in the ambulatory surgical center market is being fueled by an increase in research on service portfolios in mobile operative systems, which is being fueled by the rise of the healthcare sector. The key market players in the healthcare industry are investing in research and development in order to build mobile surgery centers. The acquisitions, mergers, collaborations, and product portfolio enhancement through substantial research and development are the main techniques used by businesses to increase revenue. The major market players are employing a variety of inorganic and organic growth tactics to acquire a significant market position and maintain industry rivalry in the ambulatory surgical center industry.

By Ownership

By Surgery Type

By Speciality Type

By Service

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2023

September 2024

November 2024

February 2025