April 2025

The global analytical standards market size accounted for USD 1.46 billion in 2024, grew to USD 1.56 billion in 2025 and is projected to surpass around USD 2.77 billion by 2034, representing a CAGR of 6.60% between 2024 and 2034. The North America analytical standards market size is estimated at USD 690 million in 2024 and is expected to grow at a CAGR of 6.65% during the forecast year.

The global analytical standards market size is calculated at USD 1.46 billion in 2024 and is predicted to reach around USD 2.77 billion by 2034, expanding at a CAGR of 6.60% from 2024 to 2034. Rising demand for testing in, environmental monitoring and pharmaceuticals is the key factor driving the growth of the market. Also, stringent regulations imposed by the government across the globe coupled with technological advancements can fuel market growth further.

The integration of artificial intelligence is transforming the market by changing product testing and quality control-driven algorithms can substantially improve chromatography techniques, by enhancing the precision and accuracy of detection of contaminants in pharmaceuticals and food products. Furthermore, AI’s capability to monitor large amounts of data also optimizes the testing of pathogens, allergens, and contaminants in the food offering real-time insights to companies for safety and quality of the product.

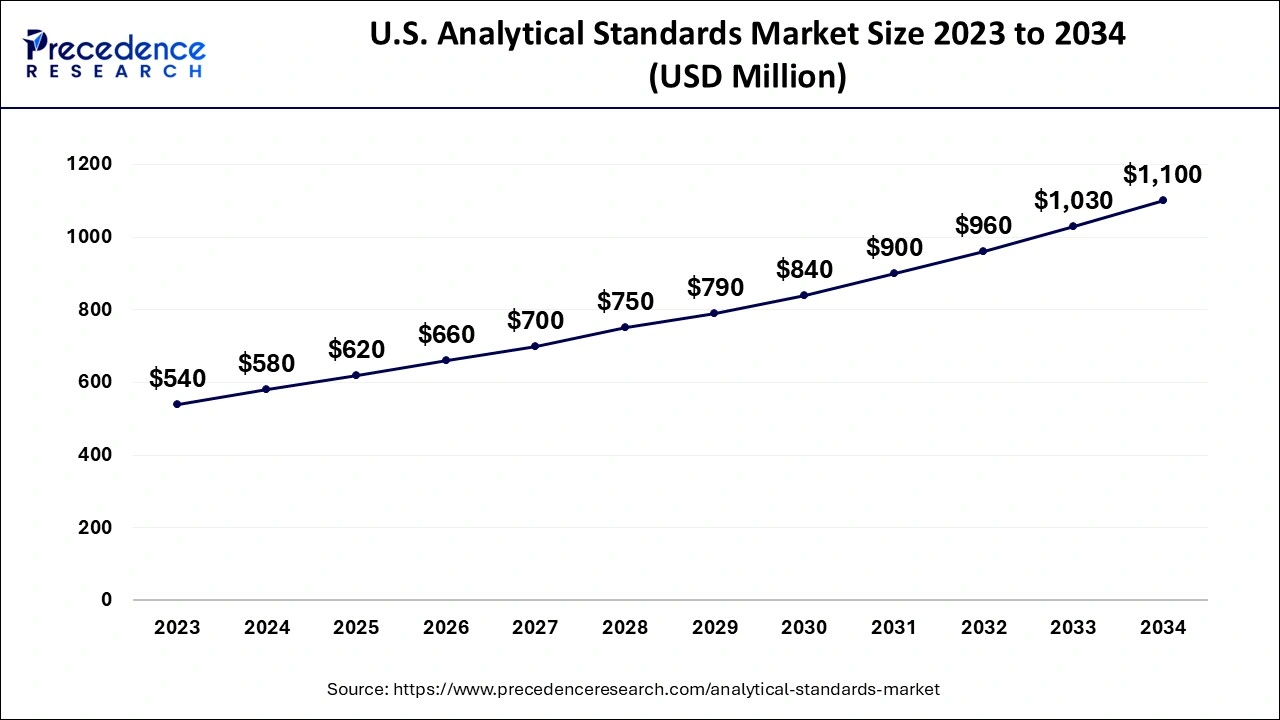

The U.S. analytical standards market size is exhibited at USD 580 million in 2024 and is expected to be worth around USD 1,110 million by 2034, growing at a CAGR of 6.68% from 2024 to 2034.

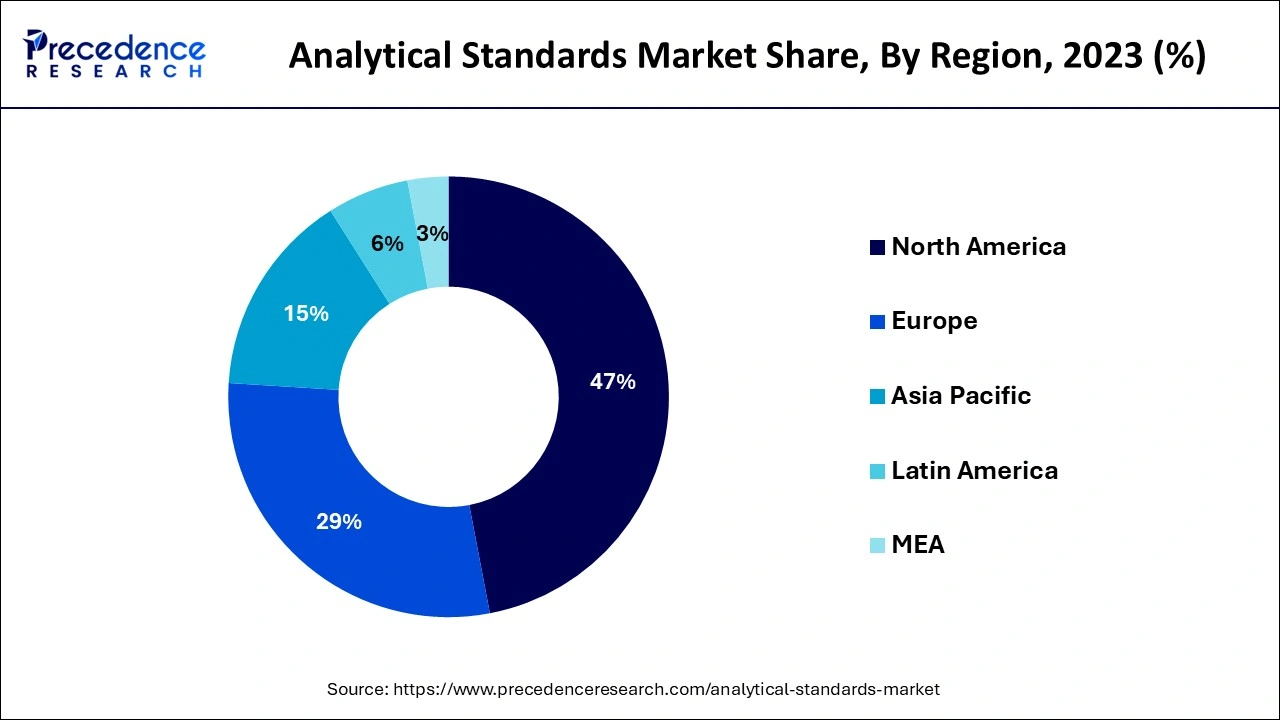

North America led the analytical standards market in 2023. The dominance of the region can be attributed to the latest technological advancements, strict regulatory requirements, and the strong presence of major market players in the region. North America also has a wide and escalating biotechnology and pharmaceutical sector. Which is the prime end-user of analytical standards. Furthermore, the increasing adoption of innovative analytical techniques with the growing need for food safety testing can boost market growth shortly.

Asia Pacific region is anticipated to grow at the fastest rate over the projected period. The growth of the region can be credited to the expanding biotechnology and pharmaceutical industries, rapid industrialization, and the rising emphasis on food safety standards, particularly in developing economies like India and China. Moreover, to presence of strong healthcare infrastructure in developed countries such as Japan can propel the market growth in the region soon.

Analytical standards market is the market for compounds with high purity and known concentration that are utilized as a calibration reference for experiments. This analytical standard can be used in many industries such as life science, and pharmaceuticals. Veterinary drug, environmental testing, and forensics. This industry involves critical analysis of the sample products. Analytical standards also ensure the accuracy and reliance of the analytical results.

Top 10 Food Companies in the World by Market Capitalization (2022)

| Company | Market Capitalization in USD Million |

| Nestle SA | 298,409 |

| Mondelez International Inc | 75,148 |

| General Mills Inc | 45,471 |

| The Hershey Co | 45,193 |

| The Kraft Heinz Co | 40,868 |

| Danone SA | 32,166 |

| Inner Mongolia Yili Industrial Group Co Ltd | 29,669 |

| Kellogg Co | 23,692 |

| McCormick & Co Inc | 19,15 |

| Wilmar International Ltd | 17,138 |

| Report Coverage | Details |

| Market Size by 2034 | USD 2.77 Billion |

| Market Size in 2024 | USD 1.46 Billion |

| Market Size in 2025 | USD 1.56 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.60% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Category, Technique, Application, Methodology, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Increasing focus on environmental testing

The growing emphasis on environmental monitoring is creating demand for analytical standards to monitor pollutants in soil, air, and water. Because regulatory organizations are enforcing strict regulations for environmental safety, hence, to meet these standard industries must implement analytical standards. In addition, there is an increasing demand for analytical standards from the pharmaceutical industry due to the rising complexity of medicinal compounds.

Shortage of specialized standards

There is an increasing need to regularly monitor developing toxins in the environment including personal care products, pharmaceuticals, and microplastics in the air. Microplastics in air samples must be analyzed by using reference materials having specific particle sizes and polymer compositions. However, reference CRMs for analysis of microplastic are under development conditions, which reduces the precision of measurements.

The growing importance of quality control

In the analytical standard market, vendors in custom synthesis offer an extensive range of options from mg to kg. They also used innovative approaches for reagent synthesis and managed stocks for quick backorders. FDA-compliant entities must keep the specialized standards as they are critical for ensuring consistency and accuracy in analytical testing. Furthermore, the need for accurate and reliable analytical standards will likely grow continuously because industries are increasingly focusing on quality control of products.

The spectroscopy segment dominated the analytical standards market in 2023 and is anticipated to grow at the fastest rate over the forecast period. The dominance of the segment can be attributed to the rising adoption of innovative spectroscopic techniques in markets such as environmental testing, environmental testing, and pharmaceuticals. Moreover, the surge in the food and beverage industry along with the strict regulations regarding food safety standards can propel the segment's growth shortly.

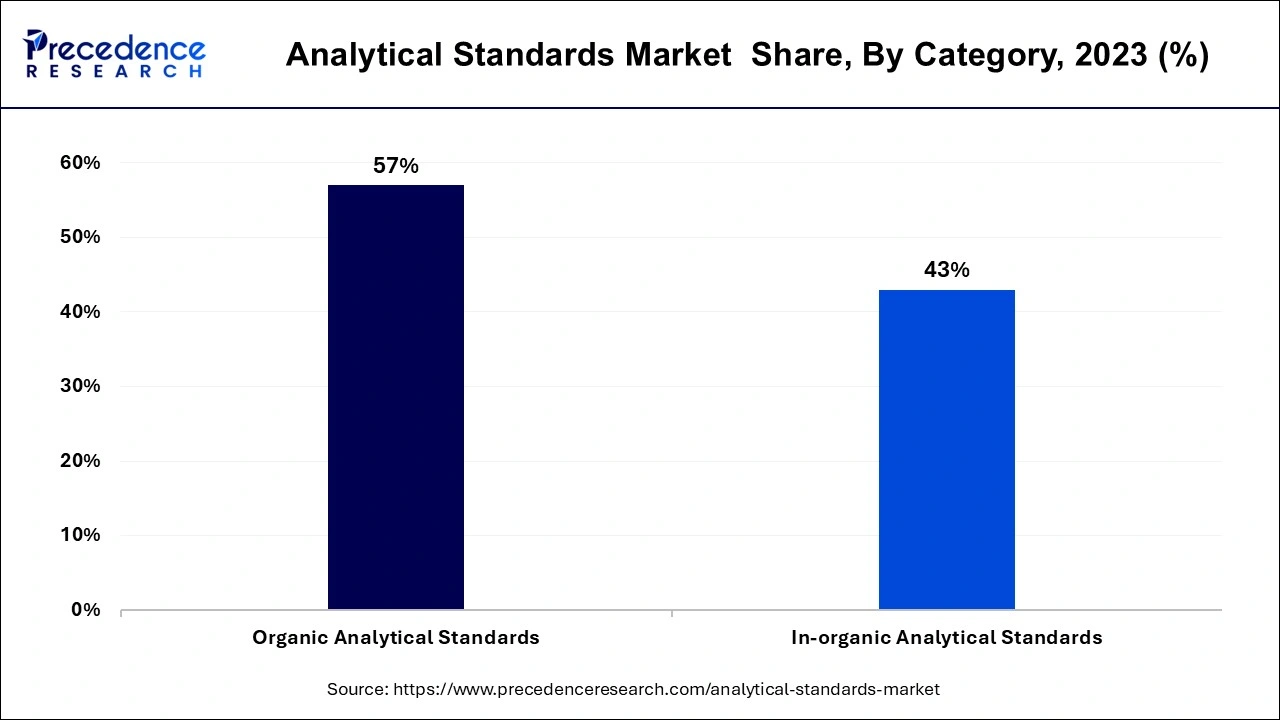

The organic analytical standards segment dominated the analytical standards market in 2023. The dominance of the segment can be linked to the rising complexity of organic compounds utilized in environmental testing, pharmaceuticals, and food and beverage. Also, increasing emphasis on environmental protection has led to the surging need for organic analytical standards for the assessment of contaminants and pollutants in air, water, and soil.

The inorganic analytical standards segment is expected to grow at a steady rate over the forecast period. The growth of the segment can be linked to the growing use of inorganic standards to analyse biological tissues and fluids like urine, blood, and bone. Additionally, the increasing focus on quality assurance in the pharmaceutical and food and beverage industries is a crucial factor boosting the growth of the segment in the market.

The pharmaceutical and life science segment dominated the analytical standards market in 2023. The dominance of the segment is driven by ongoing technological advancements, rising regulatory requirements, and the increasing demand for high-quality analytical data. Analytical standards play an essential role in the life science and pharmaceutical industry. They are important for ensuring the reliability and precision of the measurements leading to segment growth further.

The food and beverage analysis segment is expected to show fastest growth over the projected period. The growth of the segment is due to the growing complications in global food supply chains and the growing requirement for rigorous quality control methods, which has fuelled a demand for analytical standards in this industry. Furthermore, precise measurement of contaminants, ingredients, and nutritional content are important to fix the compliance with regulatory standards.

In 2023, the bioanalytical testing segment led the analytical standards market by holding the largest market share. The dominance of the segment can be credited to the increasing use of bioanalytical testing in pharmacokinetic research and drug development that depends substantially on the analytical standards to create consistent and precise data. In addition, the reproducible measurements in analytics can ensure the efficacy and safety of drugs.

The stability testing segment is estimated to witness the fastest growth over the forecast period. The growth of the segment can be linked to the increasing demand to ensure product quality coupled with the rising regulatory needs and drug development initiatives. Moreover, in this segment analytical standards are utilized to monitor the deterioration of the drugs over time. This process includes the exposing of samples to many harsh conditions and processing them using spectroscopy.

By Category

By Technique

By Application

By Methodology

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

November 2024

February 2025

August 2024