January 2025

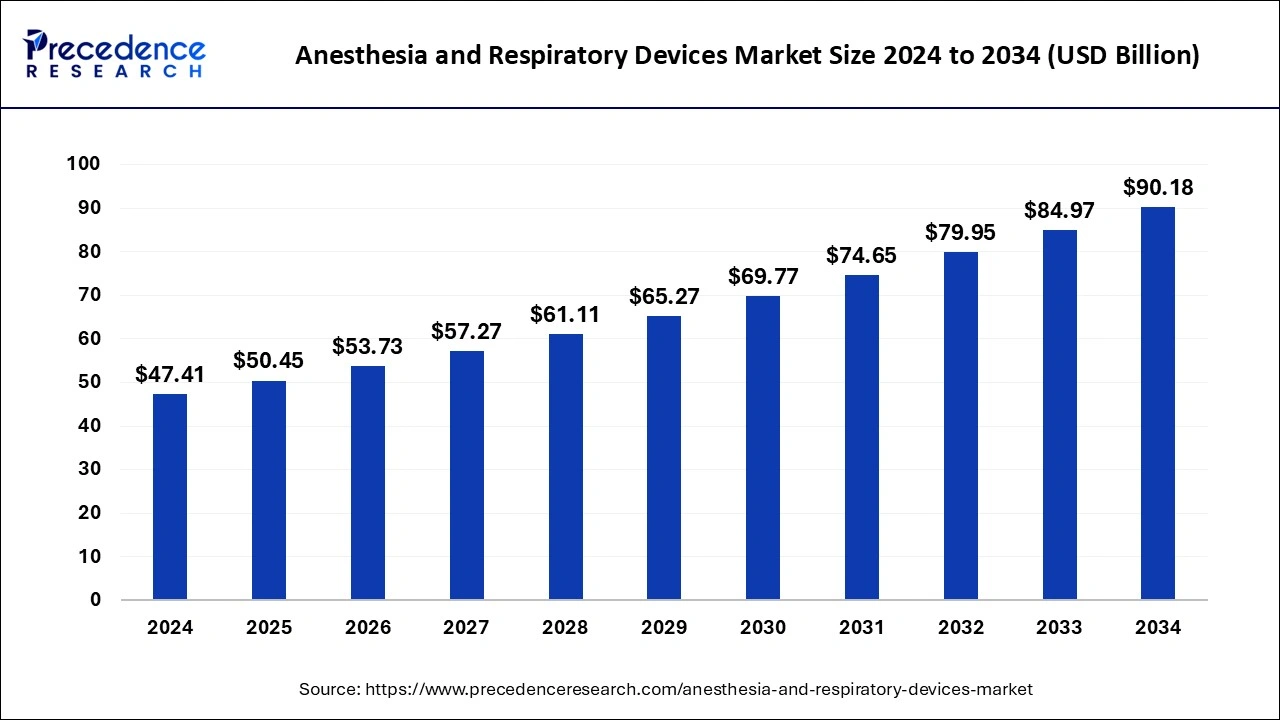

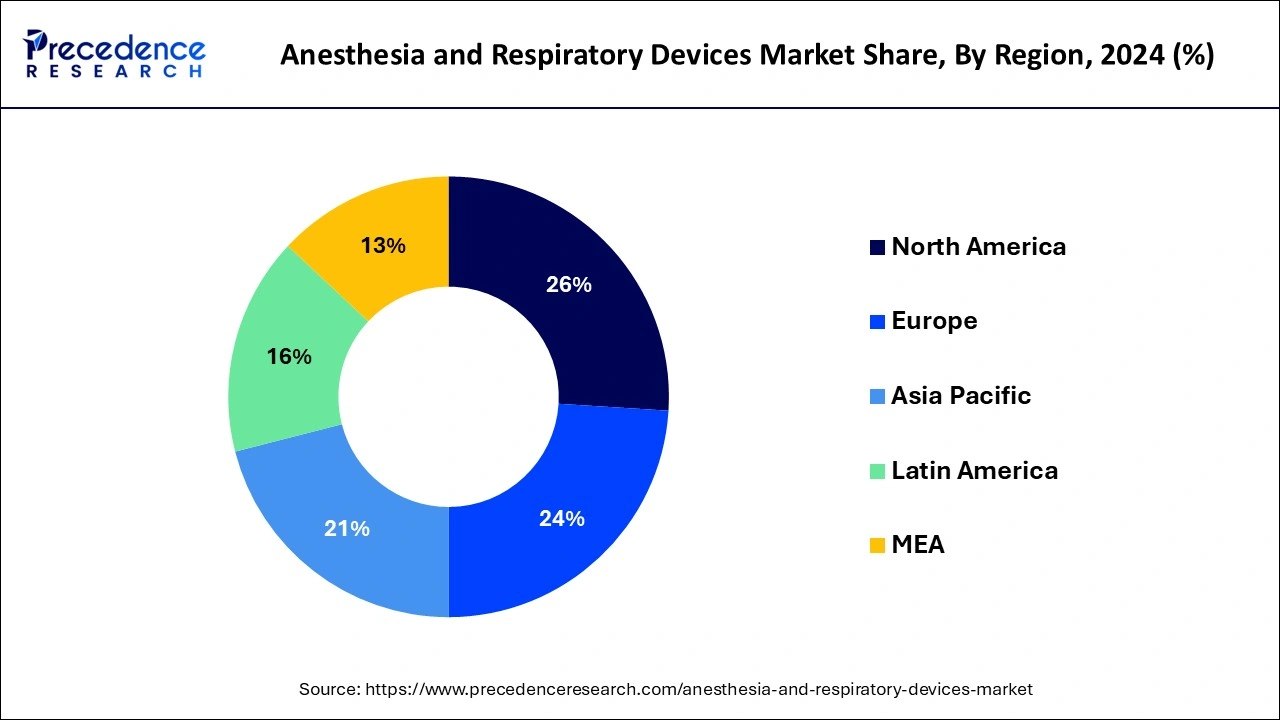

The global anesthesia and respiratory devices market size is accounted at USD 50.45 billion in 2025 and is forecasted to hit around USD 90.18 billion by 2034, representing a CAGR of 6.64% from 2025 to 2034. The North America anesthesia and respiratory devices market size was estimated at USD 12.33 billion in 2024 and is expanding at a CAGR of 6.84% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global anesthesia and respiratory devices market size was estimated at USD 47.41 billion in 2024 and is predicted to reach around USD 90.18 billion by 2034, registering a CAGR of 6.64% from 2025 to 2034. The growth of the anesthesia and respiratory devices market is expected to expand rapidly in the coming years due to the increasing surgical procedures and rising cases of respiratory disorders. Anesthesia and respiratory devices provide better care to patients with serious and chronic respiratory diseases. These devices are designed to deliver adequate amounts of anesthetic gases to keep patients unconscious during surgery.

AI has tremendous potential to improve health, increase productivity, and aid in education and training. This transformative technology will greatly benefit the anesthesia and respiratory devices market. AI can improve the design and efficiency of these devices by automating their functions. Integrating AI algorithms in these devices offers a range of benefits, including monitoring vital signs, predicting adverse events, adjusting drug dosages, and storing patient data. From the most advanced AI tools to modern AI tools, AI innovations revolutionize healthcare delivery. AI algorithms can predict anesthesia outcomes and monitor the vital signs of patients in real-time during surgery, reducing adverse effects. This further helps anesthesiologists make more informed decisions, improving patient outcomes and reducing costs. In addition, AI analyzes patient health data, which helps anesthesiologists tailor anesthesia plans based on individual patient characteristics. This personalization further minimizes side effects associated with anesthesia and improves the efficiency of the treatment.

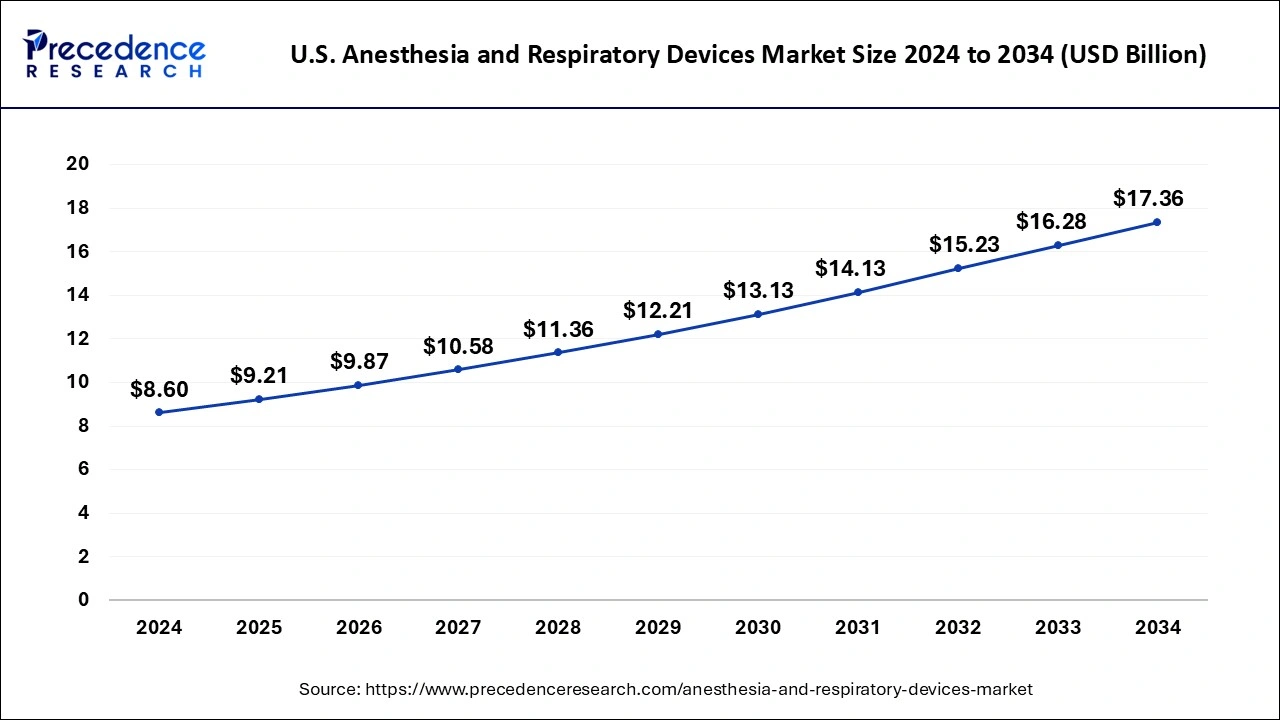

The U.S. anesthesia and respiratory devices market size was valued at USD 8.60 billion in 2024 and is estimated to reach around USD 17.36 billion by 2034, growing at a CAGR of 7.27% from 2025 to 2034.

In 2024, North America dominated the global anesthesia & respiratory devices market and is expected to reflect this trend throughout forecast period. The anesthesia and respiratory devices market in the U.S.is predicted to grow, as the number of patients undergoing from COPD is mounting quickly. It is expected that nearby 12 million people are suffering from COPD in the U.S. Growing senior population, more number of casualty surgeries accomplished and accessibility of reimbursement for respiratory and anesthesia devices are the reasons that are positively impacting market growth in the U.S.

Asia Pacific, Japan accounted for the major share of the market on account of substantial rise in the elderly population. Emerging nations such as China and India are also projected to observe a noteworthy population suffering from pulmonary diseases. As per the data released by World Health Organization (WHO), nearby 90% of the deaths credited to COPD occur in middle-income and low nations. Likewise, as per the study circulated in the International Journal of Pulmonary and Respiratory Sciences, in India, COPD was the second biggest reason of death in 2016. Thus, rising cases of respiratory diseases across emerging countries is anticipated to further propel the growth of anesthesia & respiratory devices market in the Asia Pacific.

| Report Highlights | Details |

| Market Size in 2025 | USD 50.45 Billion |

| Market Size by 2034 | USD 90.18 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.64% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing Number of Surgical Procedures Among Geriatric People

The increasing number of surgical procedures in elderly patients, who are at higher risk of perioperative morbidity and mortality due to age-related physiological and pathological changes, is driving the growth of the anesthesia and respiratory devices market. As older adults are more sensitive to anesthesia and require long-term physical and respiratory support, they require adequate amounts of anesthetic drugs to reduce overdosing and associated side effects. However, anesthesia devices play a crucial role during surgery to administer adequate amounts of anesthetic drugs, further improving the outcomes of elderly patients. Elderly patients receiving anesthesia, especially after endotracheal intubation, face a high risk of lower respiratory tract infections, boosting the need for anesthesia and respiratory devices.

Complexity of Modern Anesthesia Machines

The complexity of modern anesthesia machines has limited the adoption of anesthesia and respiratory devices. Significant investments need to be made in research and development as these systems evolve from simple devices used to anesthetize and oxygenate patients to sophisticated systems that include complex ventilators, end-tidal carbon dioxide monitors, anesthetic concentration monitors, and vital sign monitoring. In addition, the high level of complexity can increase manufacturing costs and potentially limit their affordability and accessibility, especially in medical facilities in low-income countries. The need for specialized training to operate these devices also limits their widespread use, further hindering market growth.

Advancements in Integrated Anesthesia Workstation

The emergence of modern anesthesia clinics presents a great opportunity for the growth of the anesthesia and respiratory devices market. These cutting-edge systems combine high-pressure heating, gas delivery, drug vaporization, and patient care in a single, cohesive platform, providing greater precision and control during anesthesia. The integration of precise high-precision sensors, electronically controlled flow valves, and advanced software enables high-quality gas delivery and optimized inhalant use, leading to cost-effective processes. Furthermore, integrating low-level and closed-circuit anesthesia systems with anesthesia information provides significant benefits in patient safety and management. This technological advancement not only improves the quality of anesthesia care but also creates lucrative growth opportunities for companies competing in the market.

Over the past few years, foremost improvements in anesthesia equipment have been ventilation modes that were earlier only employed in ICUs. These comprise synchronized intermittent mandatory ventilation (SMMV), pressure support ventilation (PSV), and synchronized mandatory minute ventilation (SMMV) and numerous derivatives of every mode. The ventilator has ICU quality ventilation throughout all patient classes and has less flow and nominal flow anesthesia modes to recover anesthetic conveyance and decrease financial influence. Current models have incorporated novel ventilation modes and most producers are striving to upsurge the resemblances among their anesthesia and ventilator monitor interfaces.

Anesthesia devices are generally classified into disposables and machines. Anesthesia disposables comprise accessories and masks. The machine segment comprises delivery machines, workstations, ventilators and monitors. The increasing number of surgical procedures is anticipated to upsurge the practice of anesthesia, thus pushing the demand for anesthesia devices.

Respiratory equipment is categorized into oxygen concentrators, nebulizers, humidifiers, ventilators, and positive airway pressure devices, respiratory inhalers. In 2023, positive airway pressure devices conquered the whole anesthesia and respiratory devices market and are also predicted to observe noteworthy growth during years to come due to escalating occurrence of respiratory disorders including asthma, cystic fibrosis, and tuberculosis.

By Product

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

November 2024

January 2025