February 2025

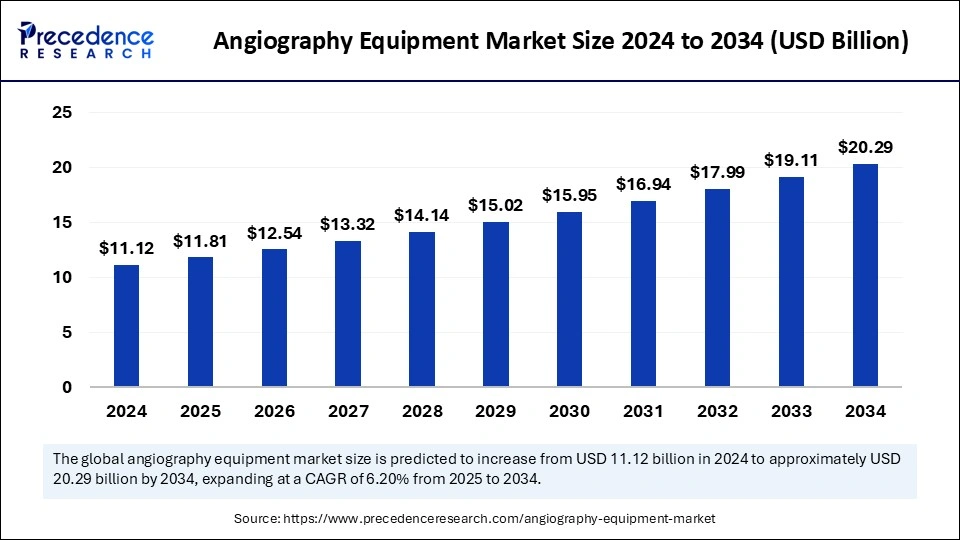

The global angiography equipment market size is calculated at USD 11.81 billion in 2025 and is forecasted to reach around USD 20.29 billion by 2034, accelerating at a CAGR of 6.20% from 2025 to 2034. The North America market size surpassed USD 3.90 billion in 2024 and is expanding at a CAGR of 6.36% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global angiography equipment market size was estimated at USD 11.12 billion in 2024 and is predicted to increase from USD 11.81 billion in 2025 to approximately USD 20.29 billion by 2034, expanding at a CAGR of 6.20% from 2025 to 2034. The growing application scope of angiography equipment is the key factor driving the market growth. Also, technological advancements coupled with the rising geriatric population are expected to fuel market growth shortly.

The use of Artificial Intelligence in cardiovascular imaging fills the gap between big data, new technology, and the clinical provider. Machine learning (ML) algorithms can analyze a large amount of data sets via different approaches in the angiography equipment market. Furthermore, ML can automate some measurements in many imaging modalities. The surging use of AI in the market will optimize the development of precision medicine.

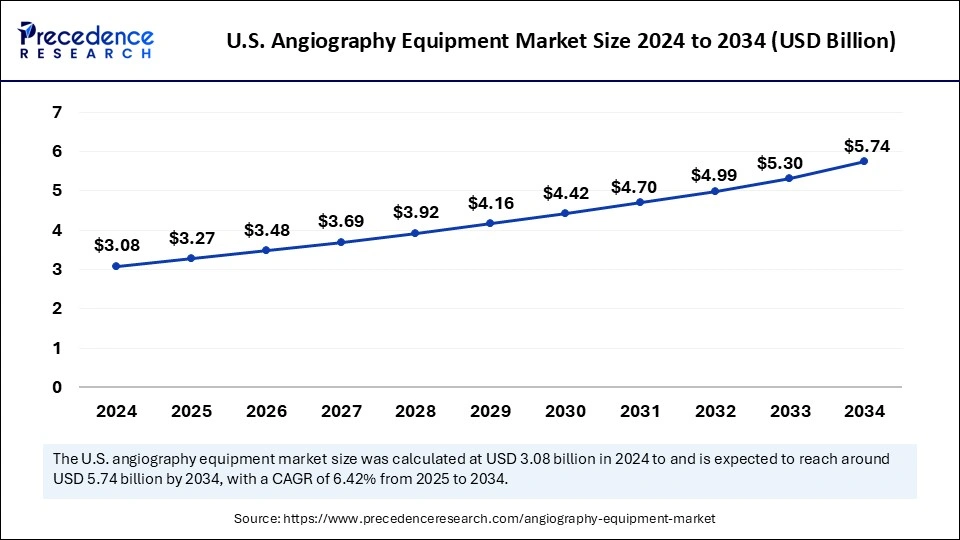

The U.S. angiography equipment market size was exhibited at USD 3.08 billion in 2024 and is projected to be worth around USD 5.74 billion by 2034, growing at a CAGR of 6.42% from 2025 to 2034.

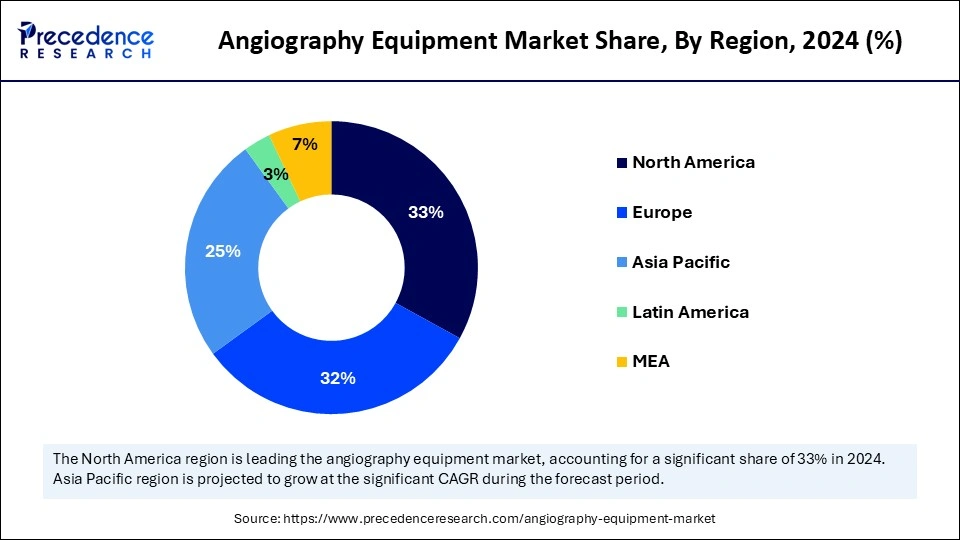

North America dominated the angiography equipment market in 2023. The dominance of the region can be attributed to the high healthcare expenditures, innovative healthcare infrastructure, and established presence of top pharmaceutical companies and manufacturers of medical devices. Moreover, the region has an escalating geriatric population that is prone to various chronic disorders, including cardiovascular diseases (CVDs), which can drive the demand for advanced diagnostic and monitoring systems.

Caristo aims to use the funds to develop its CaRi-Heart technology. Asia Pacific is expected to grow at the fastest rate over the projected period. The growth of the region can be credited to the rapid growth of the region in the healthcare sector fuelled by advanced healthcare infrastructure, a large population pool, and rising healthcare expenditure. The surge in the incidence of chronic diseases, along with the increasing middle-class population, particularly in emerging economies such as China, Japan, and India, can propel angiography equipment market growth further.

Angiography equipment is an essential component in advanced diagnostic imaging because it enables physicians to look inside the organs and blood arteries to diagnose and manage various medical disorders. This device utilizes imaging techniques like magnetic resonance imaging (MRI), X-rays, and computed tomography (CT) to craft keen images of the heart, blood arteries, and other internal organs. These imaging methods are important for identifying and treating cardiovascular diseases like aneurysms, coronary artery disease (CAD), and peripheral artery disease (PAD).

Top 5 Medical Device Companies with Revenue Share (2023)

| Company | Revenue (USD billion) |

| Medtronic plc | 31.56 |

| Abbott Laboratories | 31.27 |

| Danaher Corporation | 29.57 |

| Siemens Healthineers AG | 23.43 |

| Report Coverage | Details |

| Market Size by 2034 | USD 20.29 Billion |

| Market Size in 2025 | USD 11.81 Billion |

| Market Size in 2024 | USD 11.12 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.20% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Technology, Procedure, Application, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Increasing demand for interventional angiography systems

Minimal-invasive surgeries are cost-effective and rapid as compared to traditional surgery. The minimally invasive surgical processes raise the patient's safety, ensuring faster recovery by decreasing hospital stays, which fuels the market growth. In addition, in the current scenario, medical operators are increasingly adopting invasive surgical procedures over traditional open procedures because of their clinical benefits and cheapness.

Technological complexities

The innovative nature of today's angiography technology complicates maintenance and operation. End-use systems use cutting-edge imaging technologies, including real-time image processing and 3D imaging, which necessitates specialized abilities and knowledge to perform well. However, due to technological complexity, healthcare professionals, particularly technicians, and radiologists, should receive proper training to ensure précised imaging.

Minimization of radiation exposures

There is an increasing emphasis on complying with Federal regulations for radiation exposure by market players. Players in the angiography equipment market are creating a system that reduces ionizing radiation by improving image quality. This is done through the application of innovative dose modulation techniques and image processing algorithms. Furthermore, interventional cardiologists depend highly on this equipment to offer precise diagnoses and advanced treatments for the elderly population.

The angiography systems segment dominated the angiography equipment market in 2024. The dominance of the segment can be attributed to technological advancements, frequent investments, and increasing scope of applications. Basically, there are four types of angiography systems: coronary angiography, cerebral angiography, pulmonary angiography, and renal angiography. These systems advance from catheter-based procedures to digitalized procedures.

The contrast media segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be linked to the increasing utilization of these products in enhancing the visibility of blood vessels in various imaging techniques such as MRA, CT angiography, and X-ray. Additionally, they are also used in protectional fluoroscopy and radiography. The radiocontrast agents are barium sulfate,iodine and gadolinium.

The X-ray segment led the global angiography equipment market in 2024. The dominance of the segment can be driven by high image resolution, efficient diagnosis process, and long-established use. X-ray angiography. This technology is extensively adopted as it offers detailed imaging which is necessary for precise intervention and diagnosis in surgeries such as stent placement and coronary angioplasty. Also, MRA, X-ray, and CT. market players are heavily investing in creating advanced technologies.

The MRA segment is estimated to grow at the fastest rate during the forecast period. The growth of the segment is due to the benefits of minimal exposure to harmful radiation when diagnosing heart disease.MRA gives 3D capabilities to get images of any anatomical part with exceptional soft tissue contrast. Moreover, the launch of 3.0T MR imaging has substantially improved the diagnosis of CVD disorders.

In 2024, the coronary segment held the largest angiography equipment market share. The dominance and growth of the segment are because of the rising prevalence of coronary artery disease (CAD) in developing nations such as China and India. Coronary angiography is important for diagnosing and assessing coronary artery disorders and treatment strategies, including bypass surgery or stenting. Developments in imaging methods, like the shift from single slice to multislice Computed Tomography, have substantially enhanced the diagnostic capabilities.

The endovascular segment is projected to grow at the fastest rate over the forecast period. Endovascular procedures, such as stent placements, angioplasties, and embolization techniques, are increasingly used to treat vascular conditions like aneurysms, peripheral artery disease, and deep vein thrombosis. Also, increasing preference for minimally invasive procedures that offer reduced recovery times, lower risk of complications, and improved patient outcomes.

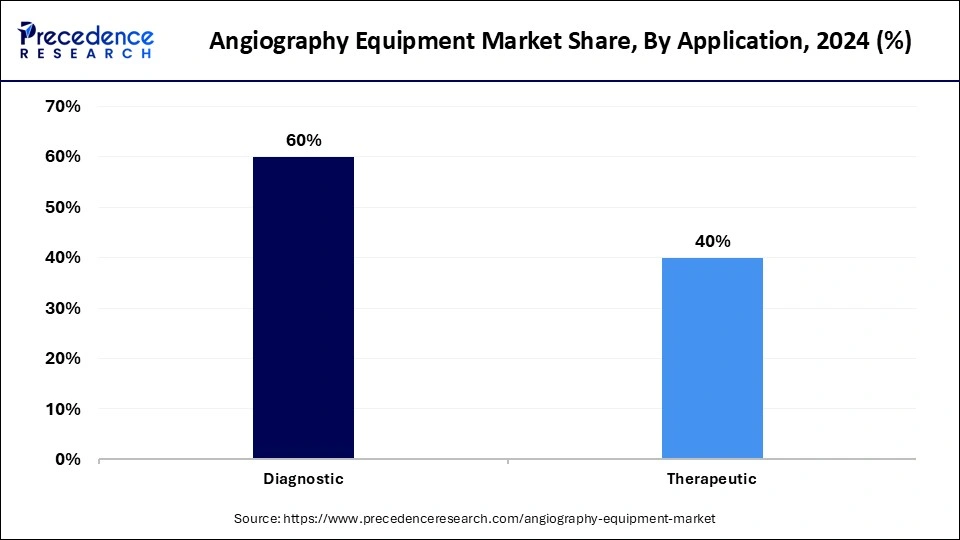

The diagnostic segment dominated the angiography equipment market in 2024. The dominance and growth of the segment can be credited to the ongoing developments in MRA and CTA to offer appropriate data in neurology and cardiology, such as brain arteriovenous malformation, cerebral aneurysms, dural arteriovenous fistula, and occlusive diseases. Furthermore, the increasing awareness of (CVDs) and the risk factors associated with them is anticipated to propel market growth. Diagnostic angiography is essential for early detection of disease and treatment planning that, raises its need across diagnostic centers and hospitals.

The therapeutic segment is expected to grow at the fastest pace during the projected period. This segment includes targeted therapies for cancer, cardiovascular disorders, and neurological diseases. Its growth can be attributed to the growing demand for advanced treatments across various medical conditions. Additionally, the increase in chronic conditions, aging populations, and the demand for personalized treatments have driven the growth of this segment, making it a primary focus for medical advancements and investments.

By Product

By Technology

By Procedure

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

September 2024

January 2025

January 2025