January 2025

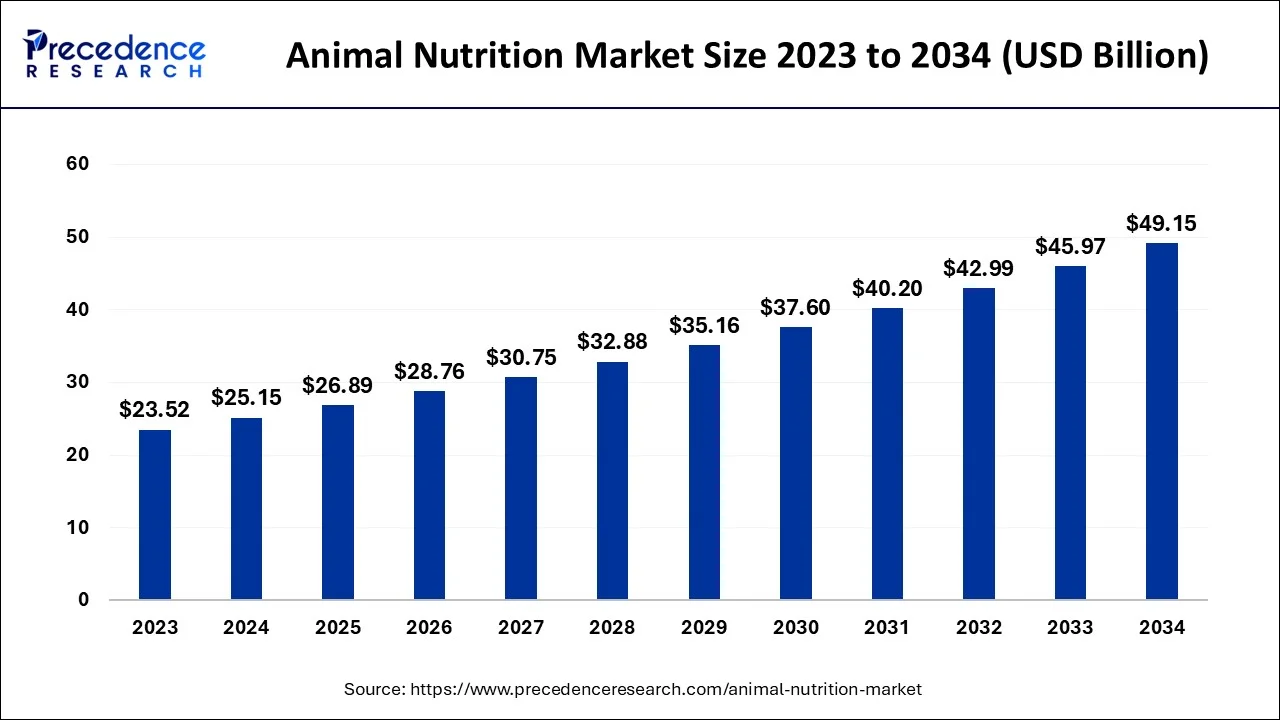

The global animal nutrition market size accounted for USD 25.15 billion in 2024, grew to USD 26.89 billion in 2025 and is projected to surpass around USD 49.15 billion by 2034, representing a healthy CAGR of 6.93% between 2024 and 2034.

The global animal nutrition market size is estimated at USD 25.15 billion in 2024 and is anticipated to reach around USD 49.15 billion by 2034, expanding at a CAGR of 6.93% between 2024 and 2034. The market is driven by the rising demand for protein-rich food, increasing pet ownership, and growing concerns about animal health.

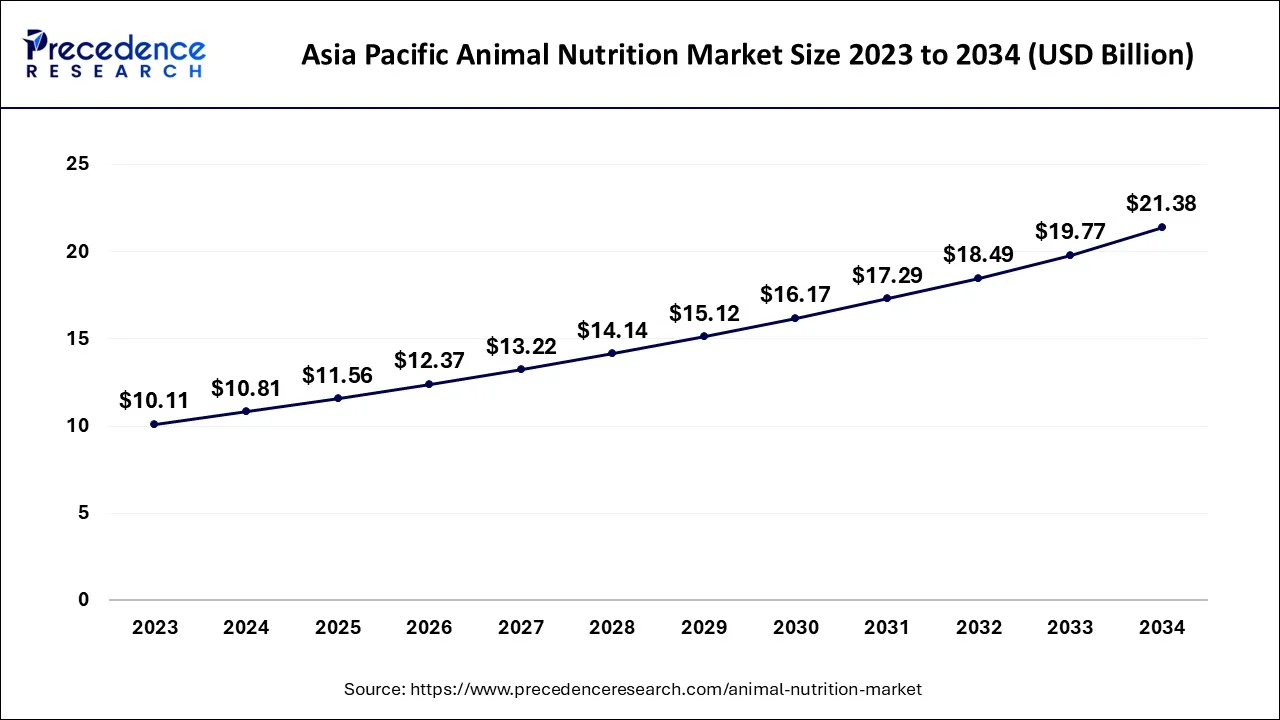

The Asia Pacific animal nutrition market size reached USD 10.81 billion in 2024 and is expected to be worth around USD 21.38 billion by 2034, expanding at a CAGR of 7.05% between 2024 and 2034.

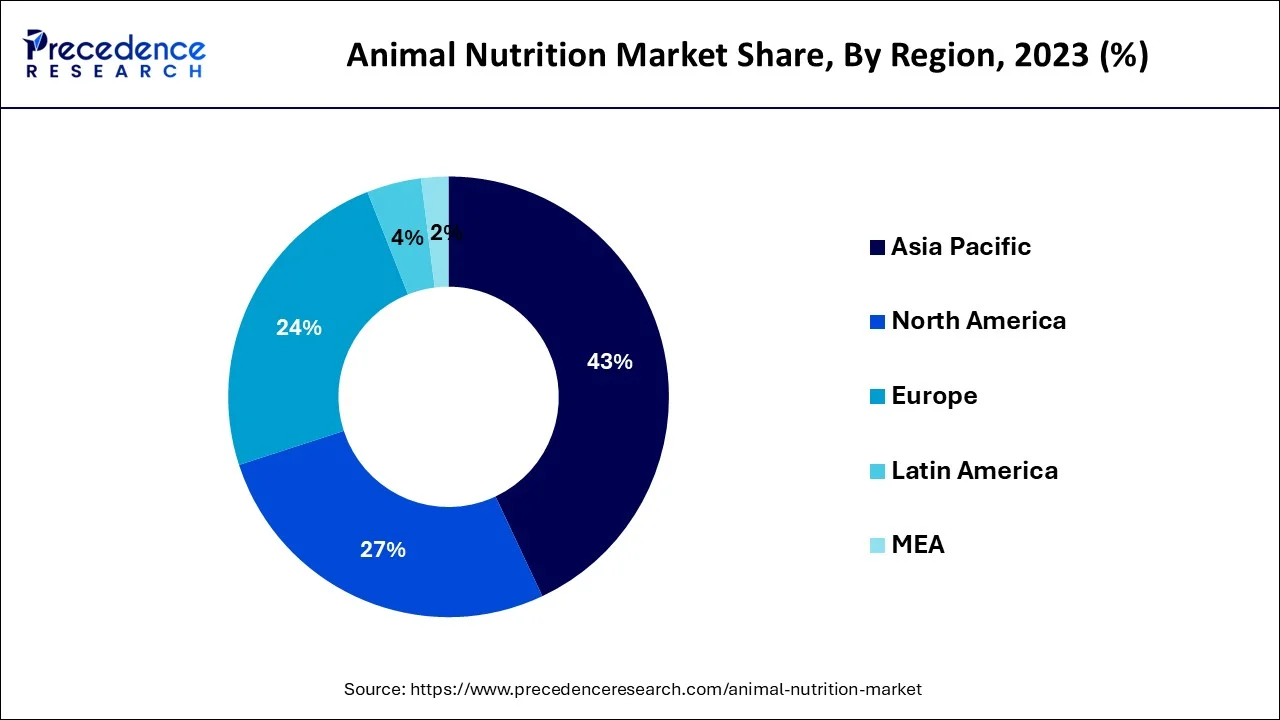

Asia Pacific dominated the global animal nutrition market with the largest share in 2023. This is mainly due to significant growth in animal husbandry practices. The region is the largest producer of animal feed across the globe, reaching 458.1 million tons in 2021, with a record increase of 5.7%. China and India held the maximum market share. As per the Alltech survey, China increased its tonnage of feed production by 8.9% to 261.42 million tons in 2021. Moreover, India ranks first in ownership of livestock. Increased production of livestock and pet ownership further supported the region’s dominance.

North America is expected to capture the second-largest position in the animal nutrition market over the forecast period. The growth in the region is attributed to the presence of major players such as Cargill Inc., Alltech, ADM, Tyson Foods and others. The continuous innovative product launch by these key players is one of the most prominent reasons that propel the industry growth during the study timeframe. For instance, in November 2022, ADM announced the launch of two new sweetening feed options for piglets i.e. SUCRAM M’1 Sweet and SUCRAM Specifeek. These products are made to increase the palatability of feed for young animals, particularly weanling pigs. The use of palatants and sweeteners in nutrition is a beneficial way to boost animal health and welfare while also increasing feed intake and producer efficiency. Thus, the increasing product launch by the key players in the region is expected to offer potential opportunities for industry growth.

Europe is expected to grow at a significant rate over the forecast period. The growth in the region is attributed to the highest consumption of meat, fish, eggs and dairy products. For instance, according to secondary analysis, in 2019, the per capita consumption of meat in European countries was around 77.1 kg. Thus, the increasing consumption of meat will drive the growth of the animal nutrition market across the regions.

To improve the nutritional value of feed and have a good effect on animal healthcare, animal nutrition other than materials like grains, crops, silage, and residue is added to feed. Livestock breeders are under a lot of pressure because of the always-increasing demand for meat from animals and products, which forces them to make sure that the productivity of their livestock increases. The consumer demand for meat and products related, and consumer knowledge of animal health issues is growing as well. Additionally, consumers' increased disposable money and the increasing nutritional needs of current animals are driving up the consumption of animal-based products. While the high cost of animal nutrition products and the environmental issues affecting livestock agriculture are anticipated to limit market expansion. On the other hand, growing market prospects will be brought about by manufacturers' increased investment in the feed sector during the anticipated time frame.

According to the United Nations, the population of the globe has increased by more than three times since the middle of the 20th century. In mid-November 2022, there were 8.0 billion people on the planet, up from 2.5 billion in 1950, 1 billion since 2010, and 2 billion since 1998. The population of the world is projected to rise by almost 2 billion people over the next 30 years, from the present 8 billion to 9.7 billion in 2050, with a potential peak of roughly 10.4 billion in the middle of the 1980s.

| Report Coverage | Details |

| Market Size in 2024 | USD 25.15 Billion |

| Market Size by 2034 | USD 49.15 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.93% |

| Largest Market | Asia Pacific |

| Second Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Nutrient Type, By Species, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising Awareness of Animal Health and Wellness

With the growing awareness about animal health and wellness, the demand for animal nutrition is rising worldwide. Animal nutrition promotes animal growth and development by improving the immune system and digestive health. Poor nutrition can cause various health issues, which may threaten their life. Moreover, the increasing livestock population and rising prevalence of various diseases are expected to boost the market growth in the coming years.

For instance, according to HealthforAnimals, a global animal health association, disease is the most common threat to animal wellbeing. About one in five farm animals are lost due to diseases each year.

Increasing Pet Ownership

The rising pet ownership worldwide is a major factor driving the market growth. According to the Pet Ownership Statistics 2024, there are 900 million pet dogs and about 370 million cats kept as pets across the globe. With the rising pet ownership, many pet owners are becoming more aware of the importance of pet health, boosting the demand for animal nutrition. Including functional ingredients like probiotics and omega-3 in animal foods improves their overall health outcomes. Functional food can improve fertility rates and reproductive effects.

Moreover, rising preference for sustainable, healthy, and high-quality animal food, the concern about animal health and wellness has increased.

Regulatory Frameworks

Regulatory frameworks may restrain the growth of the animal nutrition market. Stringent regulations about food safety, labeling, and sourcing ensure that high-quality food products are available to animals. Granting approval from regulatory bodies for new products is a time-consuming process, which may deter manufacturers from inventing new products. Moreover, fluctuations in the price of raw materials significantly impact on production costs, further hampering the market.

in October 2024, the U.S. Food and Drug Administration (FDA) published final guidelines that allow animal feed manufacturers to continue using ingredients, which were already reviewed for safety and published in the 2024 Association of American Feed Control Officials (AAFCO) Official Publication.

Technological Advancements

Technological advancements create immense opportunities in the animal nutrition market. Innovations in feed formulations and processing technologies enhance the quality of animal feed, improving the overall well-being of animals. Integrating AI and ML technologies in feed processing optimizes feed formulations based on animal species, weight, and age. Genomic and metabolic profiling helps in understanding the dietary patterns of animals. Nutrigenomics is a tool for testing personalized animal nutrition. These advanced technologies improve efficiency and nutritional accuracy and reduce feed waste. Moreover, the demand for sustainable feed options is rising with the growing emphasis on sustainable farming practices. Thus, market players are developing sustainable animal feed to gain a competitive edge.

Based on the nutrient type, the global animal nutrition market is segmented into antioxidants, EU biotics, carotenoids, fiber, amino acids, enzymes, medicated feed additives, fatty acids, lipids, minerals, vitamins and others. The amino acids segment is expected to dominate the market during the forecast period. The primary constituent of an animal’s muscles and tissues, amino acids are the building blocks of proteins and polypeptides. In some fluids, like milk, amino acids play a significant role. Amino acids are essential for many crucial biochemical and metabolic processes in animal cells in addition to serving as the building blocks of body proteins. Therefore, amino acids play a key role in the productivity of farm animals and can considerably increase the profitability of a farm from growth through production and reproduction.

On the other hand, the enzymes segment is expected to grow at the highest CAGR over the projected period. Enzymes are used in the range of feedstuffs that can enhance flexibility in feed formulation by lowering or abolishing the restriction on the maximum amount of substances that can be included after incomplete digestion. Moreover, it decreased the variance in nutritional content across batches of components. Supplemental enzymes increase the value of poor samples and reduce the difference between samples of specific ingredients quality that are of good and poor quality. Therefore, the characteristics of these nutrient types are expected to fuel the segment growth over the projected period.

Based on the species, the global animal nutrition market is divided into poultry, ruminant, aquaculture, swine, and others. The poultry segment is expected to capture the largest market share over the forecast period. The segment growth is owing to the necessity of healthy food products and strict rules and regulations for the diet habits of poultry animals. Moreover, the growing consumption of broiler chickens across the globe will provide enormous opportunities for market growth. For instance, as per American Feed Industry Association, about 60.8 million tons of broiler chickens were consumed in the United States in 2019. Thereby, driving segmental growth.

Based on the application, the global animal nutrition market is divided into veterinarians, animal feed manufacturers, households, farms and others. The farms segment is expected to capture the largest market share over the forecast period. Animal nutrition is increasingly being used in farming, which is what is driving this segment's growth. Farm animals mostly need nutrition in numerous categories such as carbs, fiber, protein and more. The expansion of the market is being further fueled by the compounding advantages of animal nutrition in farms, such as improving animal temperament, simple breeding, and agriculture advantages.

By Nutrient Type

By Species

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

July 2024

January 2025

January 2025