October 2024

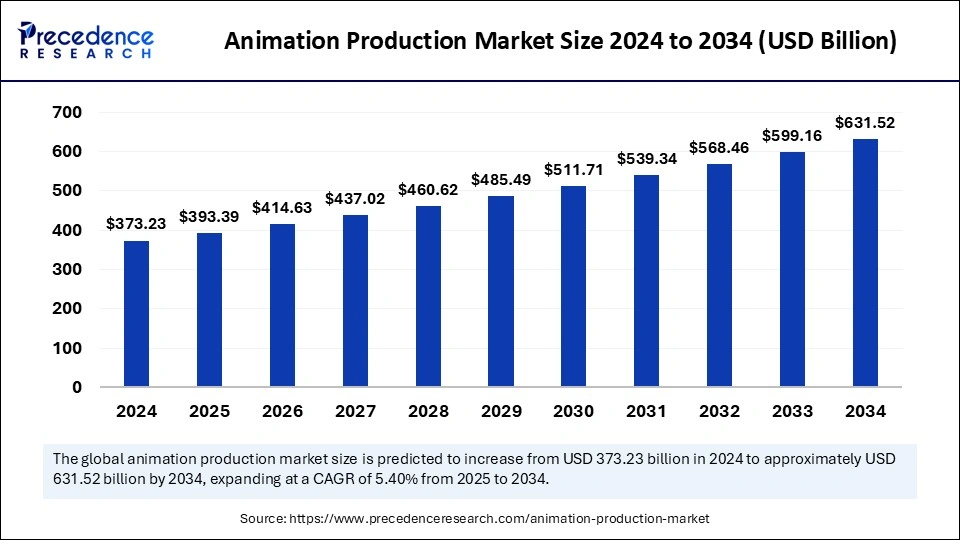

The global animation production market size is calculated at USD 393.39 billion in 2025 and is forecasted to reach around USD 631.52 billion by 2034, accelerating at a CAGR of 5.40% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global animation production market size accounted for USD 373.23 billion in 2024 and is predicted to increase from USD 393.39 billion in 2025 to approximately USD 631.52 billion by 2034, expanding at a CAGR of 5.40% from 2025 to 2034. Growing due to increasing demand for animated content in films, gaming, advertising, and streaming platforms.

By improving creativity, automating repetitive tasks, and optimizing workflows, artificial intelligence is revolutionizing the animation production market . Runway Machine learning and Adobe Sensei are two examples of tools that greatly cut production time and expenses by speeding up tasks like lip-syncing background generation and in-betweening. Smaller studios and independent artists can now more easily access high-quality animation. The efficiency of motion capture has increased the need for costly rigs and enhanced character realism.

Real-time animation improves interactive media, gaming, and virtual influencers, while automated storyboarding and character design free artists to concentrate on storytelling. Further improvements in visual quality are brought about by developments in frame interpolation upscaling and realistic lighting. While predictive analytics assist studios in understanding audience preferences and optimizing narratives for maximum engagement, multilingual dubbing with accurate lip-syncing streamlines the distribution of content globally.

The animation production market is expanding rapidly, driven by increasing demand for animated content in entertainment, gaming, advertising, and education. While developments in AI motion capture and real-time rendering are increasing production efficiency, streaming services like Netflix and Disney+ are making significant investments in animations. There is also an increase in global outsourcing to more affordable places like the Philippines and India.

Animation is becoming more popular in corporate training, and Virtual Reality and Augmented Reality are marketing in addition to entertainment. Even though 3D animation is the most popular 2D animation, it is returning nostalgically. Problems like high production costs and a lack of talent still exist despite rapid growth.

| Report Coverage | Details |

| Market Size by 2034 | USD 631.52 Billion |

| Market Size in 2025 | USD 393.39 Billion |

| Market Size in 2024 | USD 373.23 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.40% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Booming demand for streaming content

With platforms like Netflix, Disney+, and Amazon Prime heavily interested in animated films and series, the need for high-quality animation is at an all-time high. Animation is now a vital component of global entertainment due to the increase in on-demand content consumption. All age groups find animated television programs and films appealing, which guarantees steady audience participation. Animation is a popular option for streaming platforms because of its versatility, which also enables creators to experiment with storytelling. Demand is rising as a result of localization efforts that are bringing animated content to audiences around the world. For many years to come, the industry is anticipated to be driven by this trend.

Cost-effective global outsourcing

Countries like India, the Philippines, and South Korea are becoming animation hubs offering world-class production at high-class rates. Because these areas offer lower costs without sacrificing production quality, international studios are increasingly outsourcing their animation work to these areas. Outsourcing enables big studios to meet strict production deadlines and scale their operations. These nations have become popular outsourcing locations due to their advanced infrastructure and availability of talented animators. Offshore studios provide production support for a large number of international animated blockbusters and television serials. This trend is propelling the growth of the animation industry and fortifying the global supply chain.

Piracy is a silent profit killer

Animated movies, serials, and games are among the most pirated content online. Illegal downloads, unauthorized streaming, and counterfeit merchandise cost the industry billions. Due to the lack of legal resources, independent studios incur significant losses when intellectual property is stolen. It's more difficult than ever to protect original animations since digital content is getting easier to distribute and copy. Disney's animated films and other blockbusters continue to make money despite privacy, but smaller studios frequently find it difficult to recoup their production expenses.

The popularity of animated content on torrent websites and unapproved streaming services has an impact on both digital and box office revenue. Because of the overabundance of fake goods on the market animated franchise's main source of income, merchandise, suffers as well. It is imperative to strengthen copyright laws and put advanced digital rights management (DRM) systems in place, but enforcement is still difficult in many nations.

High production costs

Creating high-quality animation isn’t cheap. From cutting-edge software to skilled animators and massive rendering power, studios must invest heavily. Even though technology has increased productivity, creating intricate animations, motion capture, and special effects is still very expensive, particularly for smaller studios that are finding it difficult to compete with the big players in the market. While independent studios frequently struggle financially to finish projects, big-budget productions like Pixar and Disney can afford to invest heavily in resources. Managing lengthy rendering times, keeping a skilled staff, and the high expenses of licensing animation software make budgeting extremely difficult. Furthermore, unforeseen delays may cause expenses to rise even more, placing pressure on studios to produce top-notch work within strict budgetary limits.

Massive boom in the gaming industry

Gaming is no longer just entertainment; it's a multibillion-dollar industry that thrives on high-quality animation. Animators are becoming increasingly important in producing incredibly lifelike characters and breathtaking open-world settings thanks to developments in real-time rendering engines like Unreal and Unity. There is an unending need for animated assets, cinematics, and in-game storytelling due to the unprecedented growth of esports, mobile gaming, and cloud gaming. Studios can now create incredibly detailed game animations more quickly and effectively than ever before, thanks to advancements in AI-powered animation tools.

Expansion use of Animation in education and healthcare

Animation is transforming learning and medical fields by making complex concepts easier to understand. For students of all ages, educational institutions and e-learning platforms are using animated videos to make subjects more interactive and engaging. Doctors use medical staff to explain procedures and even produce therapeutic content for patients. High-quality medical and educational animations will become more and more necessary as virtual reality training programs become more popular, providing animation studios with a steady and profitable market.

The full-service animation studios segment dominated the market with the largest share, offering end-to-end animation solutions, including production services. These studios cater to major film studios, gaming companies, and advertising agencies, making them a crucial component of the industry. Their proficiency in visual effects, character development, and storytelling guarantees top-notch results, preventing their market leadership. Full studio efficiency is being further increased by the incorporation of virtual production techniques and real-time rendering technology. Their dominance in the market is also being strengthened by collaborations between tech companies and animation studios that are advancing motion capture and AI-driven animations.

The production houses segment is expected to grow at the fastest rate in the market during the forecast period. The increasing demand for specialized animation services such as 2D/3D animation and motion graphics has led to a surge in independent production houses. This expansion has been further stimulated by the availability of animation software and outsourcing opportunities, which have allowed smaller studios to flourish and spur industry innovation. Production companies are discovering new sources of income outside of traditional film and television with the growth of independent animation content and web-based series. Additionally, smaller production companies have been able to collaborate on international projects thanks to the shift towards remote work and cloud-based animated pipelines, which have accelerated their growth.

The film segment dominated the animation production market with the largest share, driven by the growing demand for high-quality animated movies and the expansion of streaming platforms. The position of this segment has been further reinforced by large studio investments and CGI technology advancements. Due to the growing popularity of animated films among different audiences, the film industry remains a major source of income for the market for animation production. This segment's global reach has also increased due to the growth of international partnerships and the localization of animated content. To maintain their market dominance, streaming behemoths like Netflix and Disney+ continuously invest in original animated films.

The advertising segment is expected to grow at the fastest rate in the forecast period. The increasing use of animation in digital marketing, social media campaigns, and brand promotion is fueling this growth. Animation is becoming an indispensable tool for contemporary marketing strategies as businesses use it to produce captivating ads and explainer videos. This segment is growing at an even faster rate due to the popularity of short-form video content on websites like YouTube and Instagram. Additionally, brands are finding it easier to create high-quality animated advertisements at reduced costs. AI-driven animation tools are increasing adoption. Animated content continues to lead to digital engagement as companies move forward with immersive advertising experiences.

North America dominated the animation production market with the largest share, primarily driven by the presence of major animation studios, advanced production technologies, and high consumer demand for animated content. Disney Pixar and DreamWorks, three industry titans that regularly create popular animated films and television shows, are based in the area. Furthermore, the extensive use of animation in digital platforms, gaming, and advertising has been reinforced. North American supremacy. A robust market for streaming services, which continue to make significant investments in original animated content, a well-established infrastructure, and government support for creative industries are additional advantages for the area.

Asia Pacific is expected to grow at the fastest rate in the animation production market during the forecast period. The rapid expansion of the animation industry in countries like China and Japan is fueling the growth. The market is also expanding due to the rising expenditure on animation education outsourcing possibilities and government programs encouraging the production of local content. Asia-Pacific is becoming a major force in the anime industry due to the growing demand for reasonably priced, high-quality animation services and the growing popularity of anime worldwide. Streaming services and digital content producers are also actively working with local studios, which are increasing the production and global distribution of animated content.

Europe is currently experiencing the most rapid growth in the animation production market due to its strong creative heritage and government support for the animation sector. Europe has an established network of animation schools and institutions that consistently develop new talent and support the expansion of the industry. Coproduction between European nations and international studios has also produced a wide variety of animated content, extending its appeal beyond local markets. Europe is positioned as a significant player in the global animation industry due to the growing demand for animation in gaming advertising and streaming platforms.

By Product

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

September 2024

February 2025

July 2024