What is the Anti-Biofilm Wound Dressing Market Size?

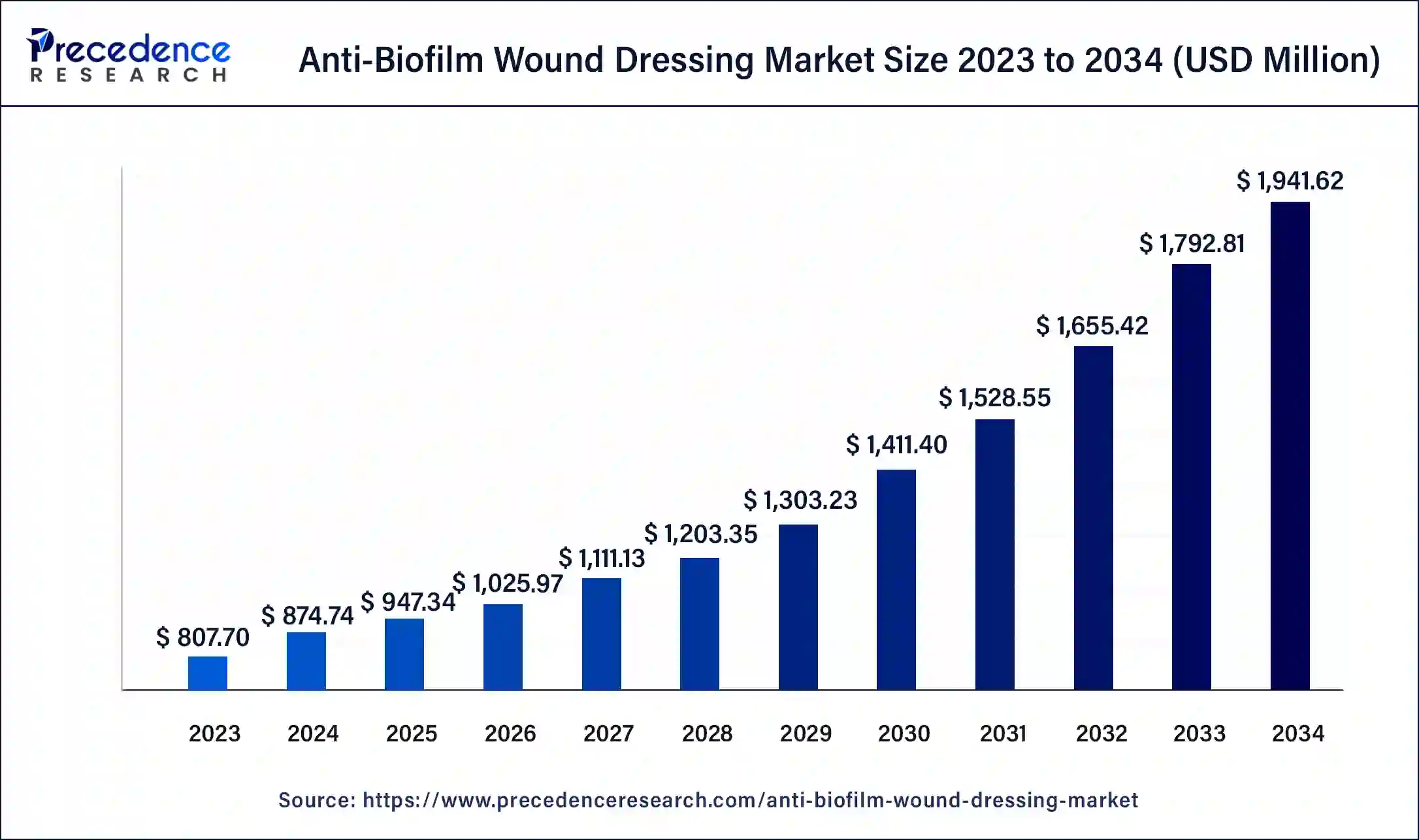

The global anti-biofilm wound dressing market size is valued at USD 947.34 million in 2025 and is predicted to increase from USD 1,025.97 million in 2026 to approximately USD 2,090.43 million by 2035, expanding at a CAGR of 8.3% from 2026 to 2035.The rising incidence of burns and trauma is driving demands for the anti-biofilm wound dressings. Increased prevalence of chronic wounds among aging patients is contributing to the market growth.

Anti-Biofilm Wound Dressing Market Key Takeaways

- North America dominated the global market with largest revenue in 2025.

- Asia Pacific is considered the fastest-growing region between 2025 and 2035.

- By mode of mechanism, the chemical segment dominated the market with the largest share in 2025.

- By mode of mechanism, the biological segment is considered to boost at a remarkable CAGR from 2026 to 2035.

- By wound type, the chronic segment held the largest share of the market in 2025.

- By wound type, the acute segment is seen to grow at a notable rate during the predicted timeframe.

- By end-users, the hospital segment led the anti-biofilm wound dressing market in 2025.

- By end-users, the home healthcare segment is expected to grow at the fastest rate in the market during the forecast period.

Strategic Overview of the Global Anti-Biofilm Wound Dressing Industry

The anti-biofilm wound dressing is an antimicrobial type of dressing used for patients with prolonged wounds comprised by the biofilm. A biofilm is a tough layer in an organic polymer matrix. Basically, a biofilm consists of microorganisms such as protozoa, bacteria and yeast. Biofilms produce destructive enzymes that adversely affect the pace of wound healing.

The impaired healing of chronic or acute wounds is reformed or improved with the help of anti-biofilm agents. Poly hexamethylene biguanide, Cadexomor iodine, Poloxamer-based surfactant, wound gel and honey are a few significant anti-biofilm agents utilized to prevent the growth of biofilms and to clean the surface of wounds.

The elimination of biofilms to boost the speed of wound healing was initially complex. The deployment of anti-biofilm agents in wound care management has helped the medicinal sector immensely. Anti-biofilms for wound dressing have the capacity to attack the biofilms without harming human tissues or cells. Companies involved in the global anti-biofilm wound dressing market are focused on developing an advanced anti-biofilm matrix, inventing effective cures for chronic wounds to enhance the survivability of patients and developing therapies for wound healing.

Anti-Biofilm Wound Dressing Market Growth Factors

Rising cases of sports injury, road accidents, diabetes and cancer patients across the globe are considered to boost the growth of the anti-biofilm wound dressing market.

Along with this, rising government spending on the healthcare sector is projected to develop the market for anti-biofilm wound dressing. The rising development in the healthcare infrastructure in developing countries drives the growth of the anti-biofilm wound dressing market.

- The technological advancement for the development of an anti-biofilm matrix is another factor to propel the growth of the global anti-biofilm wound dressing market.

- The rising number of research and development (R&D) activities, along with the increasing investments in product development, are fueling the growth of the anti-biofilm wound dressing market.

- Moreover, factors such as the rising geriatric population and traumatic incidents are surging the demand for wound dressing services; this is projected to boost the development of the anti-biofilm wound dressing market.

Artificial Intelligence: The Next Growth Catalyst in Anti-Biofilm Wound Dressing

AI technology has made it much easier to develop the innovative healthcare technologies, services, and facilities. However, AI isn't only advancing the manufacturing sector but also playing a crucial role in treatment and services delivery and monitoring. For instance, the tailored technology approach to 3D printing ink improves the personalized wound dressing. Similarly, the adoption of such cutting-edge technologies, including 3D biocompatible printing ink with preserved rheological characteristics, is helping with the development of personalized wound dressings according to the demand of custom-designed, syringe-based 3D printers. The rising prevalence of chronic wounds in various sectors is seeking the production of innovative and more effective wound care; the pressure of manufacturing and quality control is being slowly vanished thanks to the AI integration. The development of improved antibiotic dressings, using AI predictive models, is likely to become a new trend in the emerging market.

Market Outlook

- Market Growth Overview: The anti-biofilm wound dressing market is expected to grow significantly between 2025 and 2034, driven by the rising incidence of chronic wounds, increasing awareness & diagnostics, and a supportive regulatory environment.

- Sustainability Trends: Sustainability trends involve eco-friendly antimicrobial delivery, biodegradable and bio-based matrices, and right-sizing and packaging optimization.

- Major Investors: Major investors in the market include Smith & Nephew, ConvaTec, 3M, Coloplast, and Mölnlycke Health Care.

- Startup Economy: The startup economy is focused on developing innovative solutions, often utilizing advanced technologies like nanotechnology, enzymes, and specialized biomaterials to target and disrupt bacterial biofilms.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 947.34 Million |

| Market Size in 2026 | USD 1,025.97 Million |

| Market Size by 2035 | USD 2,090.43 Million |

| Growth Rate from 2026 to 2035 | CAGR of 8.3% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Mode of Mechanism, By Wound Type and By End-Users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Rising sports injuries across the globe

Children are particularly at the edge of getting sports injuries. Stanford Children's Health stated that approximately 3.5 million children are injured yearly during physical activity. Sports injuries often cause wounds on the lower body parts. However, such wounds can be easily treated with home care, but the risk of infection on the wound, such as discharge, swelling and pain, may lead to hospitalization.

Wounds caused by sports injuries are considered in the acute wound category that heals within 2-3 weeks with a proper anti-biofilm wound dressing. With a rising number of sports activities, the probability of sports injuries increases.

Restraint

Risks associated with the wound care treatment

The overall cost of wound care treatment has become high due to the increased prices of wound care materials. The fluctuation in prices of synthetic anti-biofilm agents in the market has impacted the prices of wound care products. Furthermore, the risks associated with wound care treatment limit the public acceptance of anti-biofilm wound dressing.

An improper dressing or utilization of the wrong dressing product may lead to infection complications. In some cases, the lack of healing of wounds is directly associated with inappropriate wound dressing or wound care plans. Such risks associated with wound care treatment hinder the market's growth.

Opportunity

Increasing volume of surgeries

In order to manage multiple health conditions, surgical procedures are increasing across the globe. Along with this, the availability of established healthcare infrastructure with advanced healthcare services has boosted the volume of surgeries. The rising number of surgeries offers a plethora of opportunities for the global anti-biofilm wound dressing market to grow.

Every surgical procedure requires an incision to get access to the body tissue or organ, and such small or long incisions can cause surgical wounds. Thus, post-surgical wound care plays a vital role in the entire healthcare industry.

Rising surgical activities offer lucrative opportunities for anti-biofilm wound dressing services, including wound protection, skin infection reduction, dressing for fluid loss, and covering surgical stitches. Along with the in-hospital wound care services, the growing number of post-acute care in the healthcare sector is offering opportunities for home-based wound care services globally.

Mode of Mechanism Insights

The chemical mode of mechanism segment holds largest share of the global market, due to increased number of surgeries.

On the other hand, the biological segment is considered to boost at a significant rate during the forecast period. The biological segment is further segmented into dispersion B, lactoferrin, bacteriophage, and others. The bacteriophage segment has become a renewed interest for research in the global anti-biofilm wound dressing market.

The growth of the segment is anticipated due to the adoption of advanced biotechnology leading to the development of biologic wound care products like bioengineered skin alternatives. Biological wound dressing improves the wound healing by providing tissue regeneration and reducing the inflammation. The rising demand for biologic wound dressing for diabetes ulcers and pressure ulcers is significantly contributing to the segment expansion.

Wound Type Insights

The chronic segment holds approximately 60% of the market share in the global anti-biofilm wound dressing market. The chronic segment is further segmented into applications for diabetic foot ulcers, pressure ulcers and venous leg ulcers. Chronic diseases such as diabetes often cause ulcers that are open and deep wounds, commonly on the bottom of the feet. The healing of such chronic wounds takes extended periods, or even a few won't heal for a lifetime. For instance, approximately two million people in the United States suffer from diabetic foot ulcers. The rising cases of diabetes across the globe are considered to boost the growth of the chronic segment.

At the same time, the acute segment of wound type is projected to grow at a significant rate during the forecast period. The acute segment is further segmented into surgical wounds and burn wounds. A wide range of medical conditions require surgeries, surgical wounds are caused during surgical procedures while making incisions, and such wounds are healed quickly within 3-4 weeks without a complex dressing procedure. According to the World Health Organization (WHO), India registers approximately 1,00,000 cases of burns each year; this rising number will promote the acute segment in the global anti-biofilm wound dressing market.

End-User Insights

The hospital segment holds the largest revenue share of approximately 45.50% in the global anti-biofilm wound dressing market. The rising number of hospital admissions for surgery is a significant factor in boosting the growth of the hospital segment in the global anti-biofilm wound dressing market. The availability of advanced wound treatment procedures and long-term care options for wound healing have fueled the segment's growth. Moreover, sports injuries in kids are the most common factor for hospital admissions, the rising number of sports injuries is considered to boost the growth of hospital segment.

The home care segment is predicted to witness a significant increase during the forecast period. Additionally, the growing prevalence of chronic wounds in the aging population is seeking the convenient and comfortable care facilities like home care services. The cost-effectiveness of home care services and patient-centered comfort is helping to improve the patient outcomes. The availability of advanced wound care technologies is allowing patients to take the treatment or care on a home basis. Moreover, with the integration of advanced technologies like automation and robotics, the home care services are becoming more advanced and easier to adopt.

Regional Insights

U.S. Anti-Biofilm Wound Dressing Market Trend

The United States led the regional market with increased awareness of wound care management. The availability of advanced healthcare technologies is another key reason behind this growth. The prevalence of pressure ulcers has increased among the aging population in the United States. The well-established healthcare companies in the US are allowing the adoption of advanced wound care products as well as novel innovative technologies. The government focus on sport wound care and military healthcare further fuels the country's market. The growing partnership between government and non-government organizations and pharmaceutical companies and the military is expected to open novel ways for the market to grow in the United States.

- For instance, In November 2024, SOLASCURE Ltd. ("SolasCure"), a biotechnology company developing a novel treatment to transform chronic wound care, collaborated with the U.S. Army Institute of Surgical Research ("USAISR") to develop SolasCure's investigational product, called Aurase Wound Gel, designed for managing combat wounds. This gel is a hydrogel releasing tarumase, a recombinant enzyme derived from medical maggots.

Asia Pacific is considered the fastest-growing region in the global anti-biofilm wound dressing market due expanding healthcare expenditure and growing government initiatives in research & development firms.

China Anti-Biofilm Wound Dressing Market Trend

China led the regional market due to countries rapidly expanding healthcare expenditure and adoption of innovative technologies. Additionally, Chinese government initiatives and policies are empowering the country's healthcare facilities. On the other hand, India is the second-largest nation leading the regional market. The growth is anticipated due to increased prevalence of chronic wounds, expanding urbanizations, and aging populations in India. Government and non-government organizations are investing in countries R&D and pharmaceutical institutes for the development of affordable and effective healthcare facilities and treatments, leading to fueling the market growth in the country. Additionally, growing accessibility of healthcare sectors in developing and rural areas is projected to witness marvellous growth of the market in India in the upcoming years.

- In February 2024, the eco-friendly wound dressing material made from transformed banana pseudo stems, which are often considered agricultural waste, was introduced by the scientists at the Institute of Advanced Study in Science and Technology (IASST), an autonomous institute under the Department of Science and Technology.

How did Europe Experience Notable Growth in the Anti-Biofilm Wound Dressing Market?

Europe's a high incidence of chronic wounds and a significant aging population. This substantial patient pool drives sustained demand for specialized, anti-biofilm solutions. The region's market expansion is further propelled by a robust healthcare infrastructure, substantial R&D investment, and proactive marketing strategies from major industry players like Mölnlycke AB and Smith+Nephew. Concurrently, supportive policies focusing on infection control and an increase in outpatient procedures are accelerating the adoption of these advanced dressings.

Germany Anti-Biofilm Wound Dressing Market Trend

Germany's strong preference for high-efficacy, silver-based, and innovative antimicrobial technologies is supported by a robust domestic R&D ecosystem. Germany's statutory health insurance provides comprehensive reimbursement, facilitating the widespread adoption of advanced dressings in both hospital and outpatient settings.

Leaders' Announcements

- In November 2024, Lee Harle, Chief Executive Officer of SolasCure, talked about collaboration with the U.S. Army Institute of Surgical Research ("USAISR");

“It is an honor for SolasCure that the US military, one of the most prestigious and impressive institutions globally, has collaborated with the company and identified the company's technology and decided to empower its ongoing innovations. Companies are looking forward to the result of the project to assess the suitability of Aurase Wound Gel for managing biofilm and bioburden in prolonged combat situations.”

- In October 2024, James Harding, CEO of Transdiagen, talked about the company's partnership with Mölnlycke Health Care;

“Company is excited to work with Mölnlycke. This partnership will enable us to provide access for Mölnlycke to TDG's novel models to create functional insights regarding the mode of action of innovative and biological wound treatment solutions. The company is confident that this collaboration and R&D program will lead to an open novel chapter in the approach to data-driven, evidence-based product development for the treatment of complex wounds.”

Value Chain Analysis of the Anti-Biofilm Wound Dressing Market

- Research & Raw Material Sourcing: This foundational stage involves the development and procurement of high-purity specialized polymers, silver nanoparticles, honey-based compounds, and iodine complexes.

Key Players: BASF SE, DuPont, 3M Health Care, and Evonik Industries. - Product Development & Manufacturing: Manufacturers convert raw materials into finished dressings such as hydrogels, alginates, and foams infused with anti-biofilm agents.

Key Players: Smith+Nephew, Mölnlycke Health Care AB, ConvaTec Group PLC, and Coloplast A/S. - Clinical Testing & Regulatory Approval: Before commercialization, products must undergo rigorous clinical trials to prove their ability to disrupt existing biofilms and prevent new formation.

Key Players: B. Braun Melsungen AG, Urgo Medical, and Next Science. - Marketing & Distribution: Finished products are distributed through specialized medical supply chains to hospitals, specialized wound care centers, and pharmacies.

Key Players: Cardinal Health, Medline Industries, McKesson Corporation, and Henry Schein. - End-User Application & Post-Market Surveillance: The final stage involves the application of the dressing by healthcare professionals or patients in outpatient settings.

Key Players: Hollister Incorporated, Hartmann Group, and Acelity (3M).

Top Companies in the Anti-Biofilm Wound Dressing Market & Their Offerings:

- ConvaTec: The company provides the widely-used AQUACEL™ Ag+ Extra™ dressing, which utilizes "More Than Silver" technology to specifically disrupt, biofilm and prevent its reformation in chronic wounds.

- Smith & Nephew Plc: This leader offers a comprehensive portfolio including the IODOSORB™ and ACTICOAT™ ranges, which leverage cadexomer iodine and nanocrystalline silver to penetrate and eradicate complex biofilm structures.

- Coloplast: Coloplast contributes through its Biatain Silicone Ag foam dressings, which provide a sustained release of silver to manage infected wounds while maintaining a localized anti-biofilm effect. Their focus is on high-absorption dressings that offer superior comfort and effective infection control for patients with high-exudate wounds.

- 3M: Following its acquisition of Acelity, 3M provides advanced solutions like the V.A.C. VERAFLO™ Therapy and Promogran Prisma™, which help manage the wound microenvironment and inhibit biofilm growth.

- Urgo Medical: Urgo contributes through its UrgoClean Ag dressings, which utilize a poly-absorbent fiber matrix and silver to trap slough and disrupt biofilms effectively. The company focuses on clinical-led innovation, providing evidence-based dressings that address the "bioburden" challenges prevalent in diabetic foot and venous leg ulcers.

- Imbed Biosciences: This innovative biotech firm offers Microlyte Ag, a synthetic "skin-mimicking" matrix that uses ultra-low levels of silver to kill bacteria and disrupt biofilms upon contact. Its contribution lies in providing a unique, ultra-thin dressing that adheres closely to the wound bed, ensuring maximum antimicrobial exposure with minimal toxicity.

- Lohmann & Rauscher: L&R provides the Suprasorb range, featuring antimicrobial and debridement options that physically remove biofilm and infected tissue to prepare the wound bed for healing.

Anti-Biofilm Wound Dressing Market Companies

- Conva-Tec

- Smith & Nephew Plc

- Coloplast

- 3M

- Urgo Medical

- Imbed Biosciences

- Lohmann & Rauscher

Recent Developments

- In October 2024, Mölnlycke Health Care, a world-leading MedTech company specializing in wound care and wound management, collaborated with Transdiagen (TDG), a precision medicine company developing drugs and diagnostics for chronic wound healing and tissue regeneration. This partnership has signed to use TDG's novel wound gene signatures to further explore Mölnlycke products.

- In September 2024, HCAH, a provider of out-of-hospital healthcare solutions in India, launched the “WOW (Warriors of Woundcare) Nurses” program through collaboration with Aroa Biosurgery, a New Zealand-based company known for developing medical and surgical products for soft tissue regeneration and complex wound healing. The program shows the focus of HCAH on the prevention and treatment of bedsores, also known as pressure ulcers, which are a common complication for patients with limited mobility.

- In March 2025, Urgo Medical launched an enhanced version of UrgoClean Ag. This features a higher-density poly-absorbent fiber matrix designed specifically to "trap and strip" stubborn biofilm layers from venous leg ulcers. (https://www.urgomedical.co.uk)

Segments Covered in the Report

By Mode of Mechanism

- Physical

- Chemical

- Biological

By Wound Type

- Acute wounds

- Chronic wounds

By End-Users

- Hospitals

- Specialty clinics

- Home healthcare

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa