November 2024

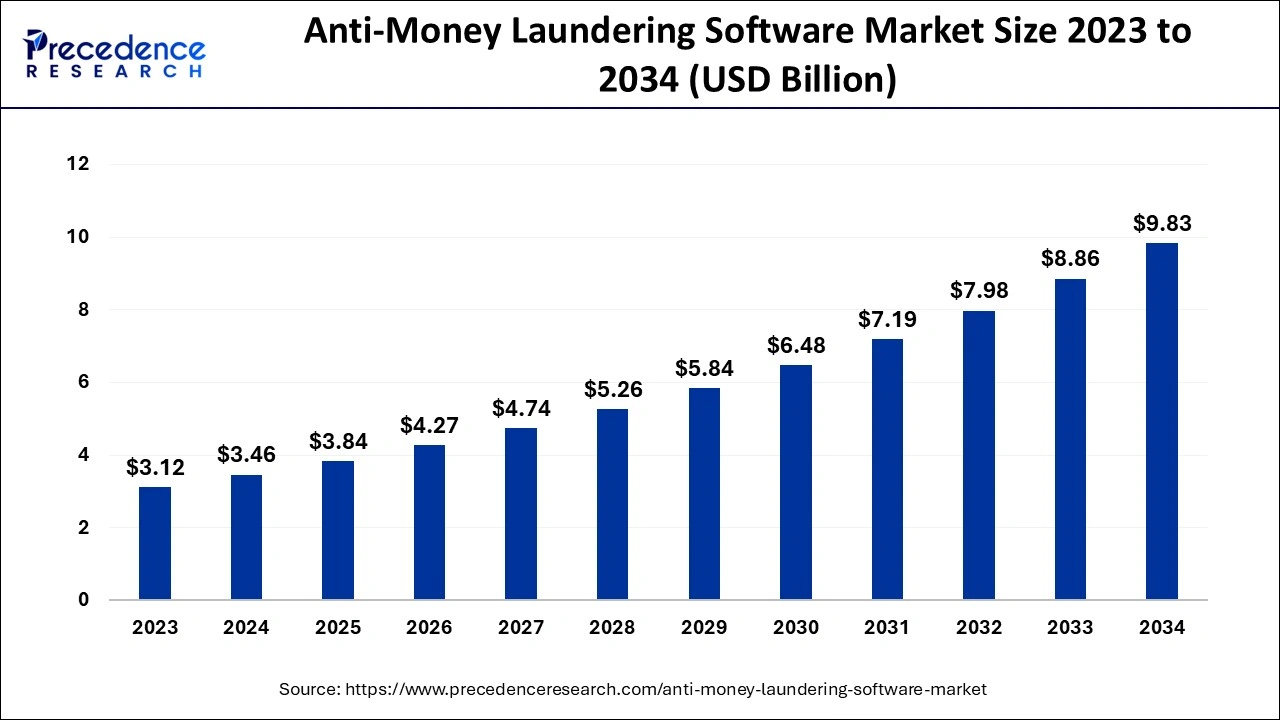

The global anti-money laundering software market size accounted for USD 3.46 billion in 2024, grew to USD 3.84 billion in 2025 and is predicted to surpass around USD 9.83 billion by 2034, representing a healthy CAGR of 11% between 2024 and 2034. The North America anti-money laundering software market size is calculated at USD 1.14 billion in 2024 and is expected to grow at a fastest CAGR of 11.14% during the forecast year.

The global anti-money laundering software market size is estimated at USD 3.46 billion in 2024 and is anticipated to reach around USD 9.83 billion by 2034, expanding at a CAGR of 11% from 2024 to 2034.

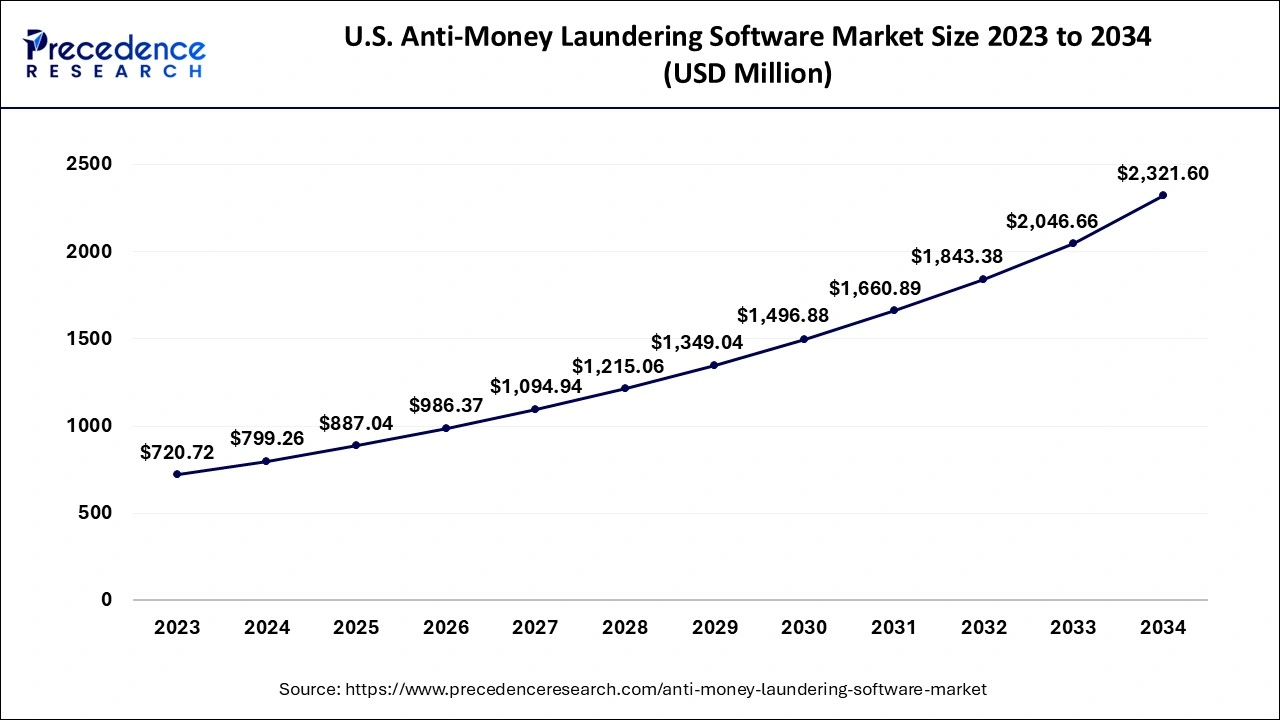

The U.S. anti-money laundering software market size is evaluated at USD 799.26 million in 2024 and is predicted to be worth around USD 2321.60 million by 2034, rising at a CAGR of 11.22% from 2024 to 2034.

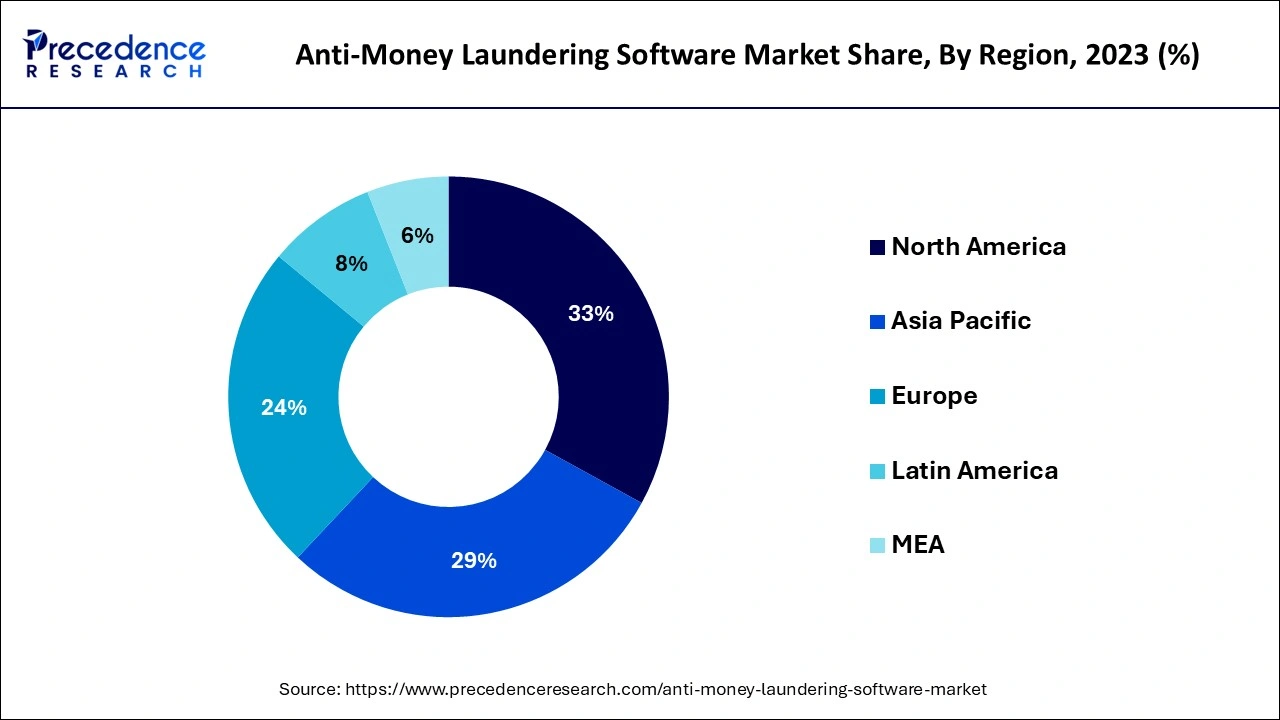

North America led the global AML software market in 2023. The growth is attributed to the robust presence of several leading AML software provider companies such as SAS Institute, Oracle Corporation, Fidelity National Information Services, and Fiserv, Inc. in North America. The rising adoption of the eBanking and mobile banking for transferring money has fueled the risks of criminal activities, which has significantly boosted the demand for the AML software among the financial institutions in North America. Moreover, the presence of several leading financial institutions in the regions along with the strict government regulations pertaining to the anti-money laundering activities has fostered the growth of the North America AML software market.

Europe is anticipated to be the most opportunistic market during the forecast period. The stringent government regulations and higher demand for the latest technologies in the field of finance is boosting the demand for the AML software among the various financial institutions in Europe. The various regulatory developments such as General Data Protection Regulation, Anti-Money Laundering Directive 5, and Payment Card Industry Data Security Standard is boosting the market growth. Moreover, the various factors like trade-based money laundering, virtual currencies, shift towards non-banking financial institutions, and non-financial professionals are some of the factors that are driving the growth of the Europe AML software market.

The rising incidences of financial crimes, growing focus of the financial institutions on the digital payments, rising strict regulations and compliances for anti-money laundering are the major factors that are boosting the growth of the global AML software market. The growing adoption of analytics in anti-money laundering and rising focus on the integration of novel technologies such as artificial intelligence, machine learning, and big data in the development of AML software is expected to foster the demand for the AML software during the forecast period.

The strict government regulations pertaining to the non-compliance with the AML regulations may result into sanctions, monetary penalties, and reputational losses is a prominent factor that significantly drives the adoption of the AML software among the financial institutions across the globe. The Financial Industry Regulatory Authority (FINRA), Australian Transaction Reports and Analysis Centre (AUSTRAC), and China's Banking and Insurance Regulatory Commission (CBIRC) are the examples of the regulations to control the money laundering and financial crime activities. With the rising number of financial frauds, the various regulations have been implemented and amended across various nations in the globe. These regulations covers even the smallest cases of money laundering that makes the regulations complicated.

The rising adoption of the AML solutions such as KYC and CDD to ensure their customers are not involved in the any money laundering activities has boosted the demand for the AML software. As per the Comply advantage, the total AML penalties were around US$7.7 billion across the globe from January to April 2019. In the same time frame, US imposed fine of around US$947 million against Standard Chartered. The increasing monetary penalties owing to the non-compliances is bolstering the adoption of the AML software across the globe.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.46 Billion |

| Market Size by 2034 | USD 9.83 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 11% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Deployment, Application, Solution, End User, and Geography |

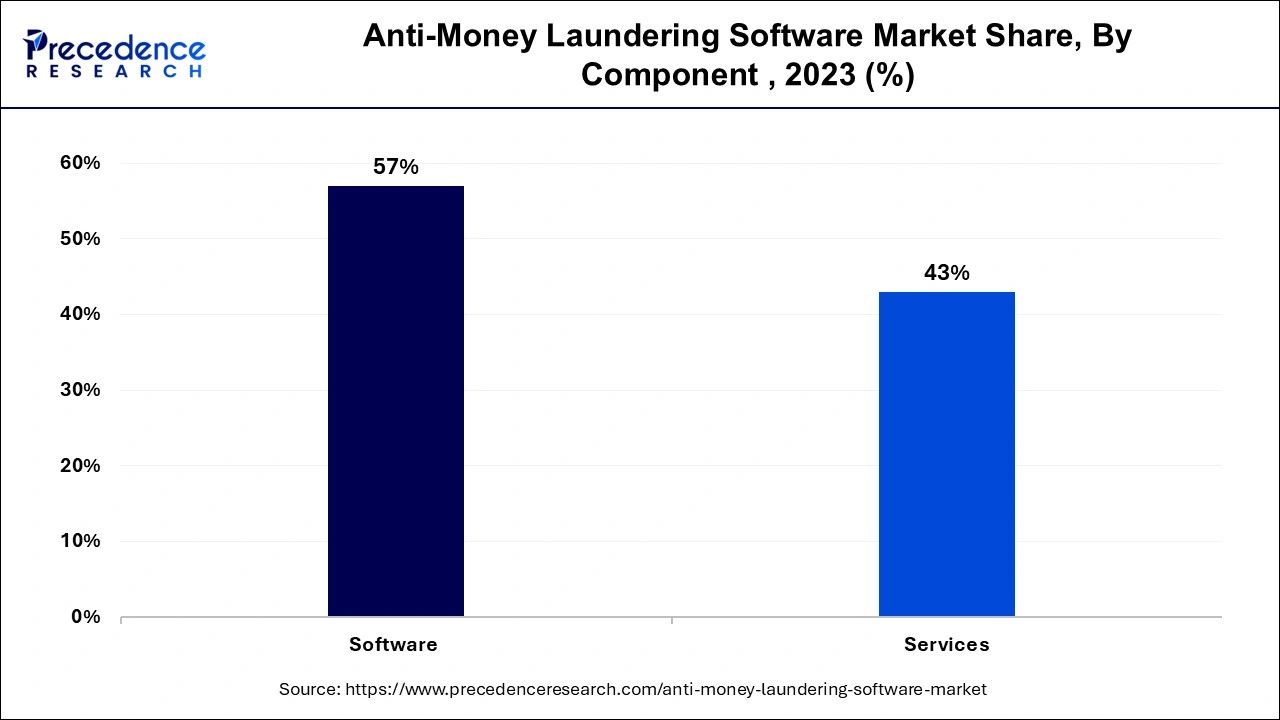

Based on components, the global AML software market was dominated by the software segment in 2023. This growth is majorly attributed to the presence of numerous domestic and international financial institutions across the globe and increased demand for the AML software among them to meet the regulatory requirements of the government authorities. The software plays a crucial role in identifying the customers and transactions and allows the regulators to take necessary actions against any fraud. The easy availability of the AML software from various top providers has boosted the market growth. The AML software are designed to monitor transactions, manages customer identity, compliance management, and reports currency transactions that allows the financial institutions to track the money transfers and identify any financial frauds. The rising regulatory compliances and financial frauds across the globe are boosting the growth of the software segment in the global AML software market.

Services is estimated to be the most opportunistic segment during the forecast period. The lack of skilled AML software operators has boosted the demand for the third party-service providers. Moreover, the integration of AI, ML, and big data analytics has made the software operations more complex and specialized knowledge is required to smoothly operate that software. Therefore, the demand for the services is expected to rise significantly in the forthcoming future along with the rising demands for the AML software across the globe.

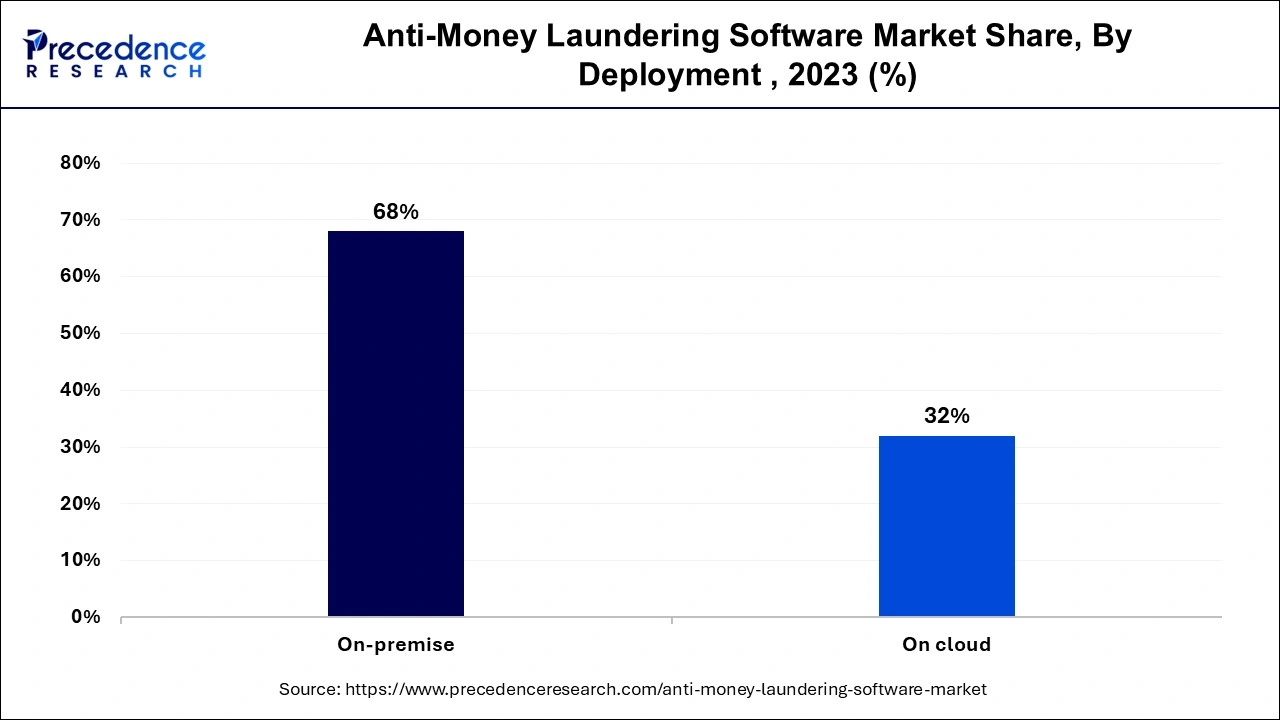

Based on the deployments, the on-premise segment dominated the global AML software market in 2023. The increased demand for the safer deployment mode among the financial institutions has led to the adoption of the on-premise deployment. Moreover, the rising need to improve the control over the financial data of the customers has led to the growth of this segment. The higher security on the on-premise deployment over the on-cloud deployment is the most prominent factor that has boosted the growth of the on-premise segment across the globe.

On the other hand, the on cloud is expected to be the fastest-growing segment during the forecast period. The rising need for reducing the costs associated with the setting up of servers and saving time is fueling the demand for the on-cloud deployment. Higher scalability, high flexibility, and increased efficiency are the major factors that are boosting the demand for the on-cloud deployment. However, the risks of cyberattacks and data breach associated with the on-cloud deployment is a major restraining factor.

On the basis of application, the transaction monitoring segment dominated the global AML software market in 2023. The increased need for regular monitoring the customer’s financial activities in real-time has led to the dominance of this segment. Transaction monitoring helps to identify any situation that violates the rules and regulations and that goes against the profile of the customers thereby reporting to the Counterfeiting the Financing of Terrorism and AML regime. The rapid adoption of the digital payment systems across the globe has boosted the demand for the transaction monitoring that helps the financial institutions to track large volumes of electronic payments. Moreover, the rising need to monitor payments, money orders, currency exchanges, withdrawals, bank transfer, and bank deposits are expected to further boost the growth of this segment during the forecast period.

By Component

By Deployment

By Application

By Solution

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

January 2025

January 2025

October 2024