January 2025

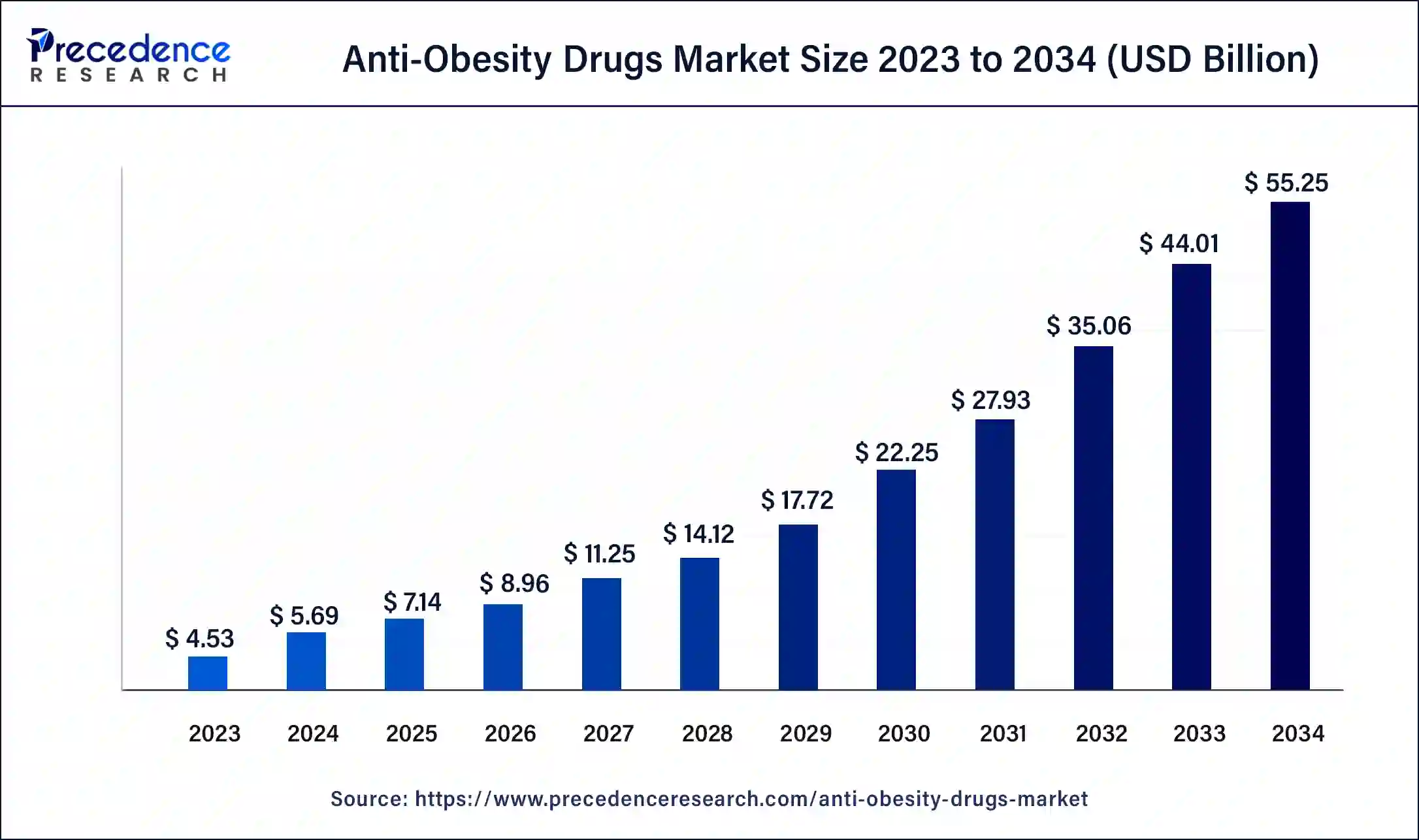

The global anti-obesity drugs market size surpassed USD 4.53 billion in 2023 and is estimated to increase from USD 5.69 billion in 2024 to approximately USD 55.25 billion by 2034. It is projected to grow at a CAGR of 5.53% from 2024 to 2034.

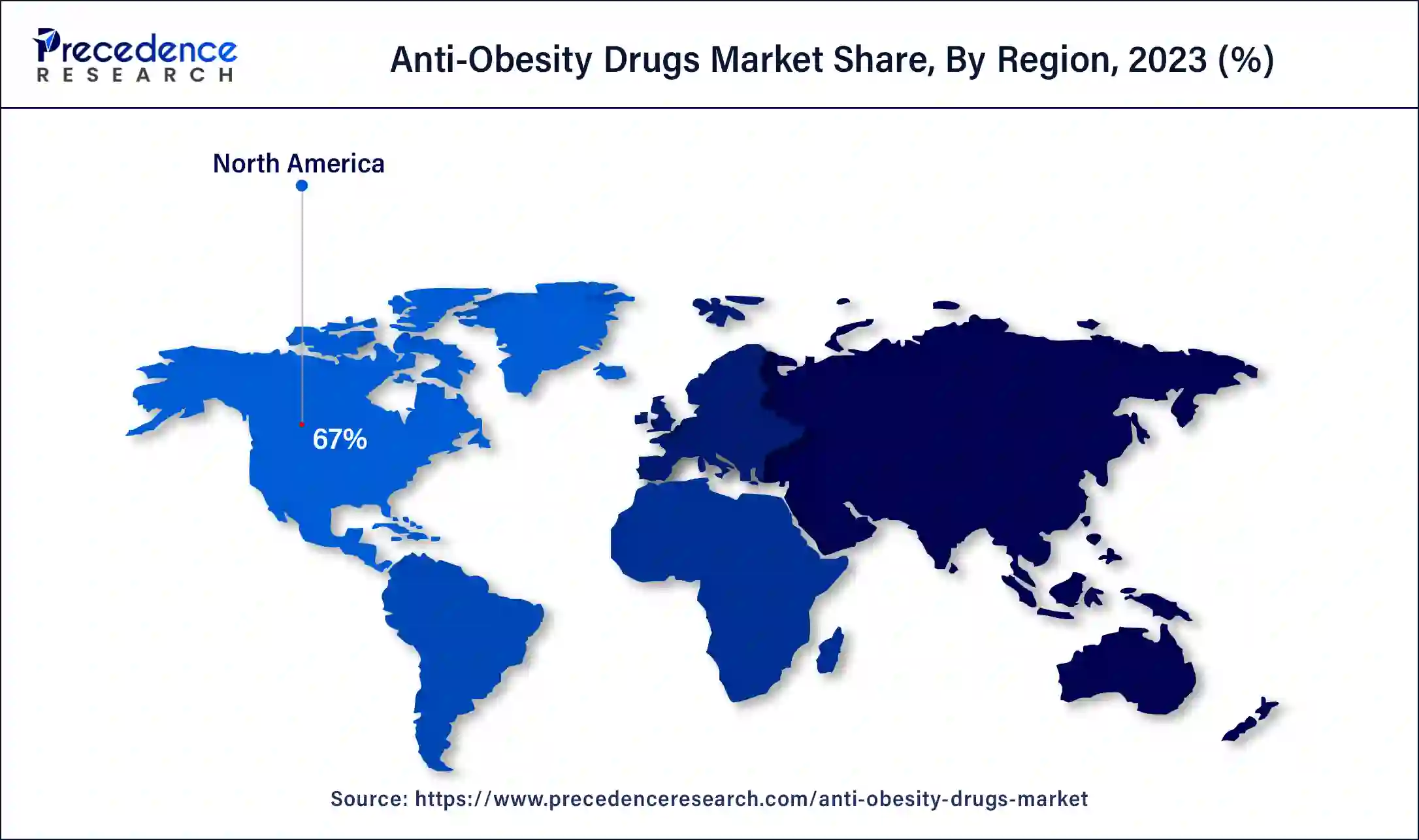

The global anti-obesity drugs market size is projected to be worth around USD 55.25 billion by 2034 from USD 5.69 billion in 2024, at a CAGR of 5.53% from 2024 to 2034. The North America anti-obesity drugs market size reached USD 3.04 billion in 2023. The increase in the incidence of obesity has led to a large patient population suffering from debilitating problems, which is the key factor driving the anti-obesity drugs market growth.

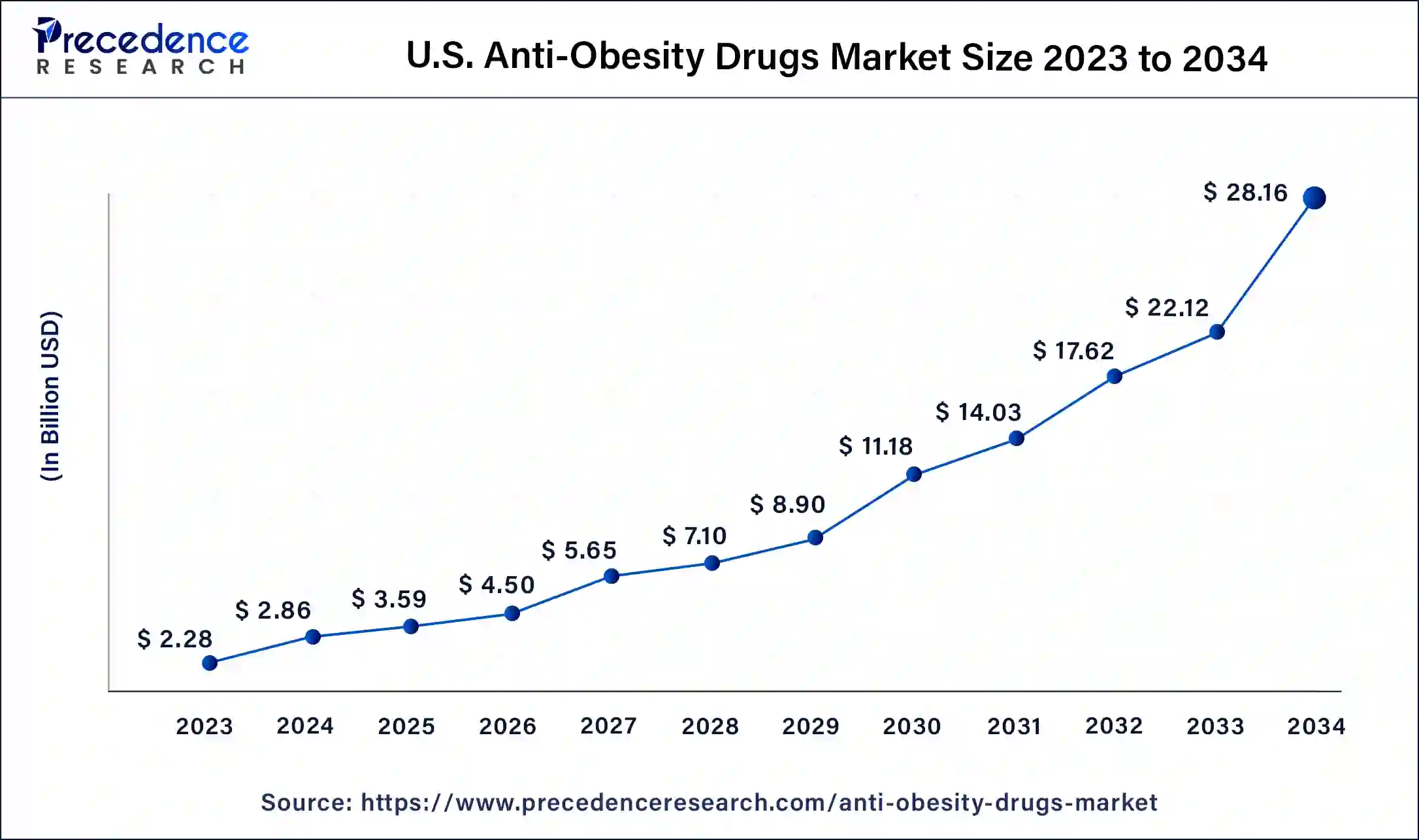

U.S. Anti-Obesity Drugs Market Size and Growth 2024 to 2034

The U.S. anti-obesity drugs market size was exhibited at USD 2.28 billion in 2023 and is projected to be worth around USD 28.16 billion by 2034, poised to grow at a CAGR of 25.67% from 2024 to 2034.

North America dominated the global anti-obesity drugs market in 2023. The growth of the anti-obesity drugs market in the region is driven by several factors, including the rising rates of obesity, advancements in drug development technologies, and the approval of numerous new medications by the U.S. FDA. In North America, the market is projected to experience moderate growth due to the increasing prevalence of obesity.

As of 2023, the United States holds the largest market share in the region, a position it is likely to maintain due to its significant obese population. The U.S. is expected to remain the leader in both the North American and global anti-obesity drugs market, thanks to the availability of FDA-approved drugs and the high rates of both adult and childhood obesity.

Asia Pacific is set to host the fastest-growing anti-obesity drugs market over the forecast period. This is due to the increasing prevalence of obesity, driven by sedentary lifestyles and unhealthy eating habits. Additionally, growing awareness of obesity-related health risks, such as heart disease, diabetes, and cancer, is contributing to this growth. The demand for anti-obesity medications is rising, particularly in developing countries like India, China, Japan, and South Korea. This growth is further supported by an upsurge in clinical research focused on obesity management and the escalating prevalence of obesity-related conditions such as diabetes and cardiovascular diseases in the region.

Anti-obesity medications are prescribed to help individuals who are overweight or obese achieve weight loss. These drugs work through various mechanisms, such as curbing appetite, boosting metabolism, or preventing the absorption of dietary fat. They are generally categorized into three main types based on their mode of action: those that inhibit fat absorption in the intestines, those that suppress food intake, and those that increase energy expenditure.

The anti-obesity drugs market encompasses a range of pharmaceutical solutions designed to aid weight loss and mitigate associated health risks. The medications function in diverse ways, including reducing hunger, interfering with nutrient absorption, or modifying neurotransmitter levels that affect metabolism and feelings of fullness. Hence, these prescriptions are typically accompanied by recommendations for lifestyle changes to maximize effectiveness.

How Artificial Intelligence is Transforming the Weight Loss Market

Artificial intelligence is having a significant impact on the anti-obesity drugs market by enabling researchers and healthcare professionals to predict the health status of obese patients, suggest the best treatment plans, and offer regular monitoring of applied drugs to assess their functioning inside the patients’ bodies. Patients can get access to advanced solutions such as precision medicine and the real-time data generated can be used to study the performance efficacy of those drugs through patients’ response to them.

Machine learning and deep learning are enhancing disease prediction accuracy through accurate medical imaging and storing of patients’ personal health information both securely and reliably. AI-based learning helps to identify behavioral, and diet patterns, and some other AI-assisted applications include remote monitoring, providing personal weight loss management assistance with standardized treatment outcomes.

| Report Coverage | Details |

| Market Size by 2034 | USD 55.25 Billion |

| Market Size in 2023 | USD 4.53 Billion |

| Market Size in 2024 | USD 5.69 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.53% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Combination therapies

Combining different anti-obesity drugs with various mechanisms is recognized as an effective approach for managing weight. Unlike single-drug treatments, combination therapies offer several advantages, including potential synergistic effects, reduced side effects, and broader coverage of the underlying factors contributing to obesity. Pharmaceutical companies are actively exploring diverse drug combinations to develop more comprehensive and effective treatment options. Moreover, regulatory bodies such as the FDA and EMA are focusing m on assessing the efficacy and safety of these anti-obesity medications, which could further propel the anti-obesity drugs market.

Lack of education

Despite the growing global prevalence of obesity, treatment rates remain low due to insufficient education on weight management and widespread misconceptions. Research indicates that only 2% of the entire obese population receives treatment with prescription medications. This limited uptake is a key factor hindering the anti-obesity drugs market growth. Additionally, the market's expansion is constrained by the presence of only a few major players focused on developing obesity treatments and the side effects associated with these medications.

Rising prevalence of morbid obesity

A significant trend in the anti-obesity drugs market is the rising incidence of childhood and morbid obesity. The growing prevalence of morbid obesity is often associated with increased demands on healthcare resources, such as challenges in transporting, transferring, and examining patients. Furthermore, Routine procedures, including blood draws, X-rays, computed tomography (CT) scans, and emergency bedside ultrasounds, become more time-consuming for individuals with morbid obesity. Therefore, the escalating rates of both childhood and morbid obesity are expected to drive demand by fueling market growth throughout the forecast period.

Global Obesity Statistics (2022)

| Category | Statistics (2022) |

| Global Prevalence of Obesity | 1 in 8 People Worldwide |

| Adults Overweight | 2.5 Billion Adults (18 years and Older) |

| Adults Living with Obesity | 890 Million |

| Adults Aged 18+ Overweight | 43% |

| Adults Aged 18+ Living with Obesity | 16% |

| Children Under 5 Overweight | 37 Million |

| Children & Adolescents Aged 5–19 Overweight | Over 390 Million |

| Children & Adolescents Aged 5–19 Living with Obesity | 160 Million |

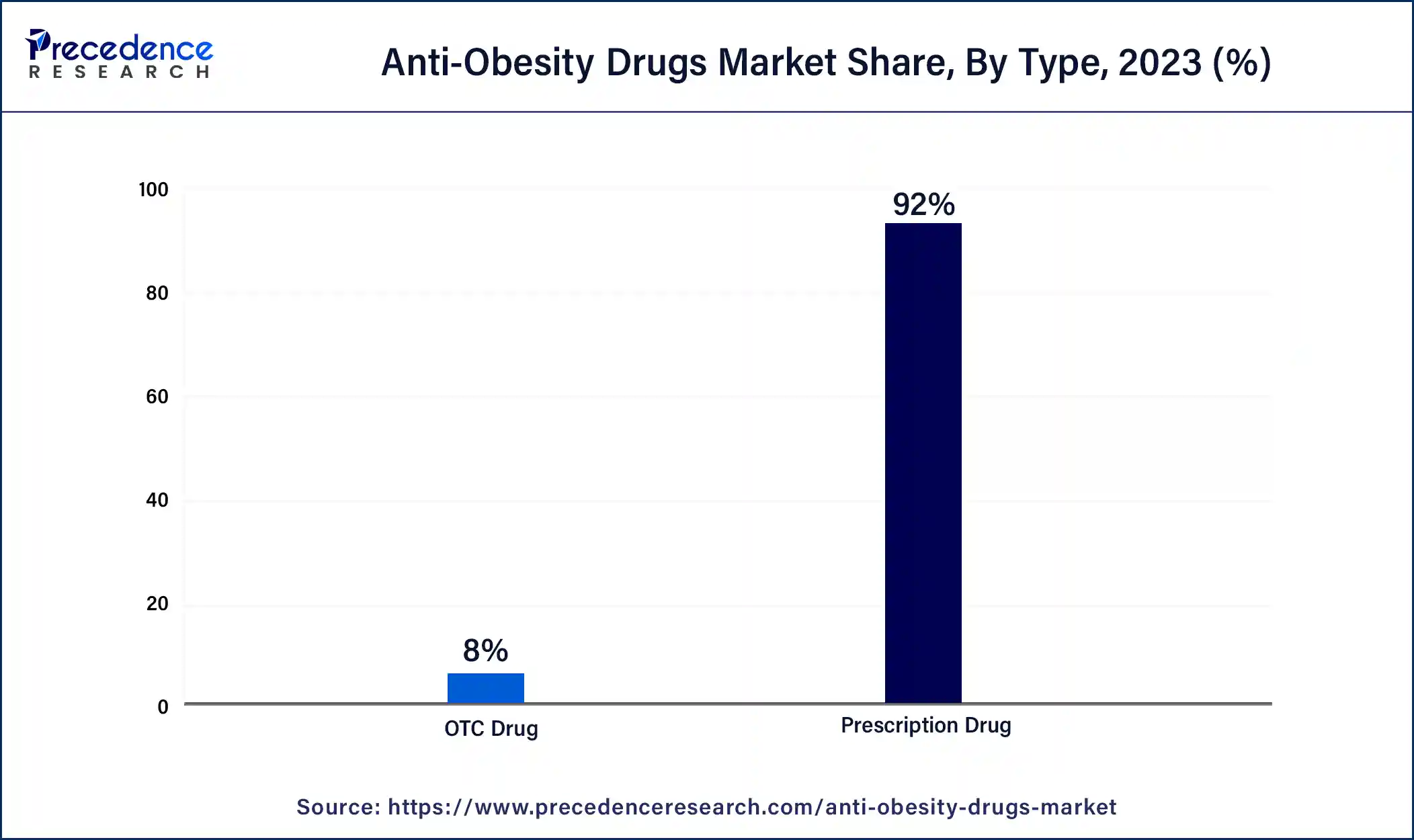

The prescription drug segment dominated the anti-obesity drugs market in 2023. The dominance of this segment can largely be attributed to the availability of therapeutically effective weight management medications, regardless of whether their action is central or peripheral. The increasing prevalence of obesity, driven by factors such as high alcohol consumption, fast food intake, and sedentary lifestyles, also contributes to the growing demand for these products.

The over the counter drug segment is observed to grow at a notable rate in the anti-obesity drugs market over the forecast period. The increase in e-commerce has significantly enhanced the accessibility and convenience of purchasing OTC anti-obesity medications online. This has made it easier for consumers to obtain these products. The over-the-counter pharmaceuticals sector covers a range of non-prescription medications, treatments, and healthcare items that consumers can buy directly without the need for a prescription from a licensed healthcare provider.

The retail & online pharmacy segment led the anti-obesity drugs market in 2023. This can be attributed to the rise in the use of e-pharmacy platforms and the availability of anti-obesity medications through these channels, which has simplified the drug procurement process and contributed to the increased prevalence of obesity and related chronic conditions globally. Moreover, factors driving the growing demand for online pharmacies include enhanced patient convenience, substantial cost savings, timely accessibility, drug shortages in retail stores, and the expansion of e-commerce.

The hospital pharmacy segment is observed to grow at a notable growth rate in the anti-obesity drugs market over the projected period. The growing prevalence of obesity and the increased demand for prescription-based anti-obesity medications are driving factors in this trend. The availability of affordable medications has led to a strong preference for frequent purchases at local pharmacies, contributing to the retail pharmacy sector's growth. Furthermore, the advancement of online platforms for delivering both prescription and over-the-counter medications to patients is expected to significantly boost the expansion of the online pharmacy market.

Segments Covered in the Report

By Type

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

March 2025

March 2025