January 2025

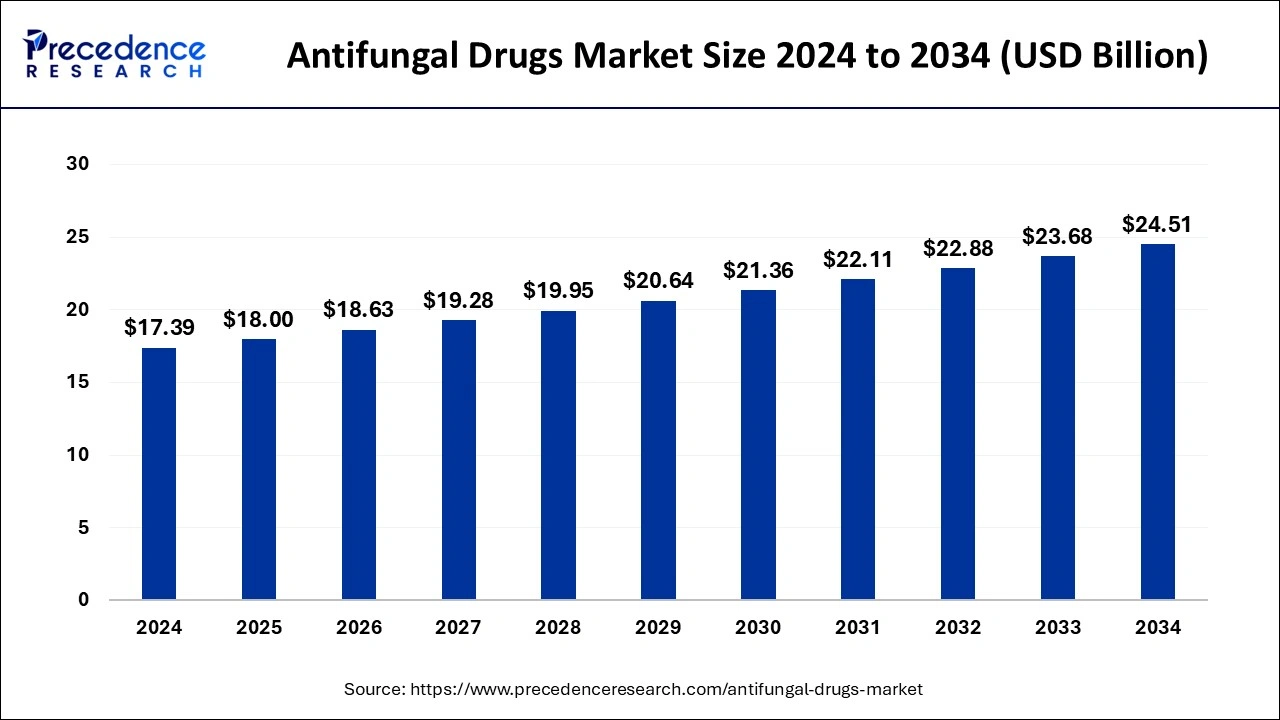

The global antifungal drugs market size was accounted for USD 17.39 billion in 2024, grew to USD 18 billion in 2025 and is expected to be worth around USD 24.51 billion by 2034, registering a CAGR of 3.49% between 2025 and 2034. The North America antifungal drugs market size was calculated at USD 7.30 billion in 2024 and is estimated to grow at a CAGR of 3.49% during the forecast period.

The global antifungal drugs market size was calculated at USD 17.39 billion in 2024 and is projected to surpass around USD 24.51 billion by 2034, growing at a CAGR of 3.49% from 2025 to 2034.

The rising prevalence of fungal infections like candidiasis and aspergillosis is the key factor driving the market growth. Also, developments in innovative products coupled with the growing awareness regarding fungal diseases can fuel market growth further.

AI is playing a significant role in the market by improving R&D efficiency and optimizing processes of drug discovery. By leveraging ML algorithms, researchers can process large datasets to detect potential antifungal compounds precisely and rapidly. Furthermore, the implementation of AI-powered predictive analytics is also enhancing the patient outcomes by streamlining individualised treatment plans.

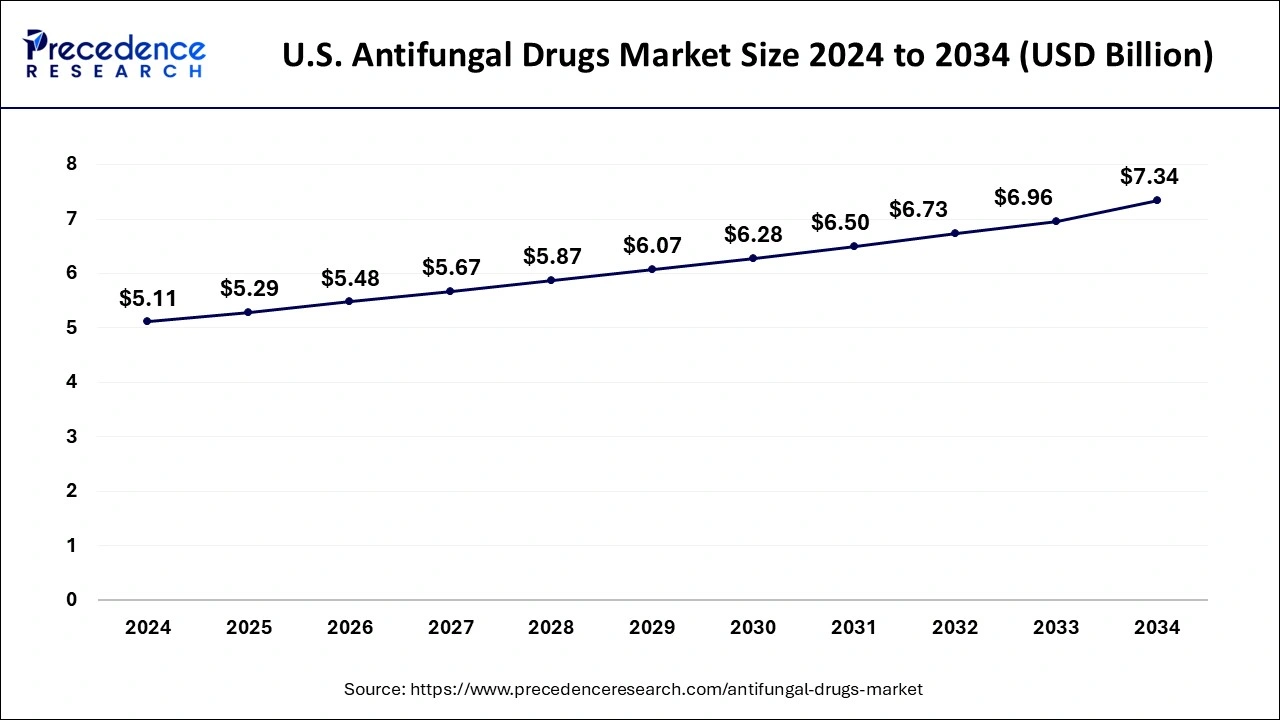

The U.S. antifungal drugs market size was exhibited at USD 5.11 billion in 2024 and is projected to be worth around USD 7.34 billion by 2034, growing at a CAGR of 3.57% from 2025 to 2034.

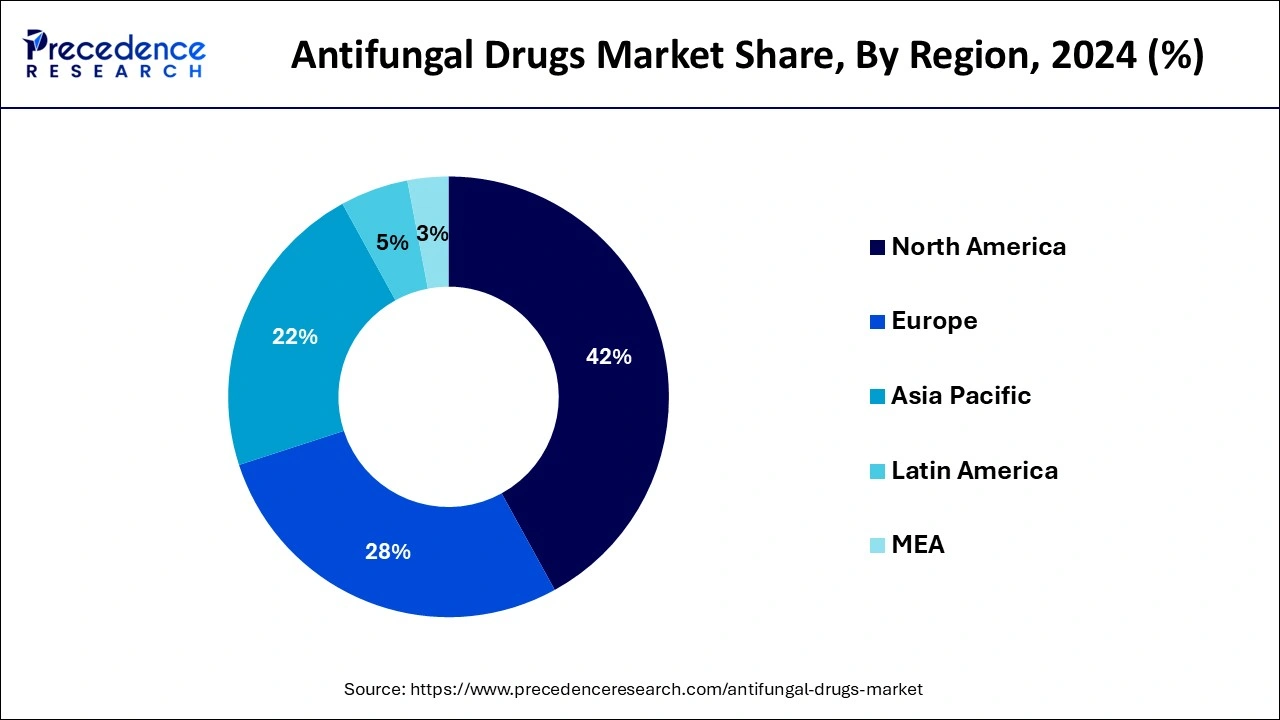

North America dominated the antifungal medication market with a 42% share in 2024. The rising prevalence of infectious diseases can be linked to the region's expansion. Increased incidence has increased clinical urgency to use these medications more frequently and accelerated the development of novel treatments with expedited FDA clearance. Additionally, it is projected that the presence of well-established pharmaceutical businesses, who continually work to expand the commercialization of their products and expand their geographic reach, would play a significant role in accelerating regional market expansion.

The market for antifungal medications will likely grow at the highest CAGR in Asia Pacific during the forecast period. A sizable base of potential customers, rising disposable income, increased drug availability, and significant unmet clinical requirements are all fostering the expansion of the local market. Global firms are thus concentrating on making significant R&D investments and selling branded medications at a relatively cheaper cost in the region. In 2023, Japan had a sizable market share in the APAC region due to rising healthcare costs and expanded insurance coverage.

A pharmaceutical fungicide or fungistatic known as antifungal medication also referred to as antimycotic medication, is used to treat and prevent mycosis, including ringworm, candidiasis, and cryptococcal meningitis, among others. To treat fungal infections, a variety of antifungal medications are available. Different antifungal medications exist, and they are administered orally, topically, or intravenously.

As they can affect everyone, fungi illnesses are a public health issue. Fungal infections pose a serious hazard to those with weakened immune systems, such as AIDS patients, and opportunistic fungal infections are more likely to develop in these people. Cryptococcal meningitis, a brain infection that has caused 181,000 annual deaths worldwide, affects about 220,000 new people each year, according to information released by the Centers for Disease Control and Prevention in 2016. Due to the higher incidence of HIV/AIDS in these nations, sub-Saharan Africa is where most reported deaths occur.

One of the main drivers of the market is the rising occurrence of fungal illnesses, including aspergillosis and candidiasis. Systemic and superficial infections, such as skin, eyes, mouth, and vagina, can all be caused by fungi. Ringworm, athlete's foot, and fungal meningitis are just a few of the disorders typically treated using antifungal medicines with fungicidal activity. Additionally, increasing numbers of patients with nosocomial infections, hospital-acquired infections, and infectious disorders will likely fuel the market's expansion throughout the forecast year.

The increase in nosocomial and fungal infections is a major factor in the growth of the worldwide antifungal industry. The market for antifungal medications will likely grow due to an increase in initiatives by private and public groups to raise awareness about various fungal illnesses. Aspergillosis and candidiasis are two other common fungal infections that are becoming more common, and this is one of the main causes driving the expansion of the antifungal market. Skin, eye, and mouth infections caused by fungi include both systemic and superficial infections. Antifungal medications having fungicidal action are typically used to treat various illnesses, including ringworm and fungal meningitis. Therefore, the rise in nosocomial infections and infectious disorders fuels the demand for antifungal medications. Invasive candidiasis is a common bloodstream infection in the United States, and there are approximately 46,000 new cases reported each year, according to the Centers for Disease Control and Prevention.

Additionally, according to a 2019 article from the National Center for Biotechnology Information, there are thought to be 1 million cases of cryptococcosis recorded annually, resulting in 625,000 fatalities around the world. Thus, the market is growing as the number of infectious disease patients rises. Additionally, during the projection period, the rising number of drug approvals offers profitable potential for the growth of the worldwide antifungal medicine market.

| Report Coverage | Details |

| Market Size in 2024 | USD 17.39 Billion |

| Market Size in 2025 | USD 18 Billion |

| Market Size by 2034 | USD 24.51 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 3.49% |

| Fastest Growing Market | Asia-Pacific |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Drug Class, By Indication, By Dosage Form, By Distribution Channel and By Infection Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising investment in healthcare infrastructure

Developed healthcare infrastructure leads to superior diagnostic facilities. Enhanced diagnostic abilities can result in timely and precise identification of fungal diseases, enabling specific and prompt treatment with these drugs. In addition, the large availability of innovative medical infrastructure can help individuals to seek proper medical treatment for fungal infections.

Underdiagnosis fungal infections

Due to limited awareness among medical professionals and the majority of the population, fungal infections often remain underdiagnosed. This can in turn result in inadequate or delayed treatment procedures. Moreover, a lack of awareness regarding the adverse effects of fungal infections can lead to insufficient diagnosis and treatment plans.

Innovations in antifungal drug development

Current research in the sector of antifungal drugs creates lucrative market opportunities for the launches of more potent and effective medications. Advancements in drug formulations, therapeutic targets, and delivery mechanisms can enhance overall patient compliance. Furthermore, ongoing breakthroughs in drug development, such as the discovery of new formulations with enhanced safety profiles, can impact market growth positively.

In 2024, the Azoles medicine class segment, which includes popular therapeutics like Noxafil, Diflucan, Vfend, and Cresemba, led the market for antifungal medications with a 48% revenue share. The market's dominance can be traced to Azoles's wide-ranging activity. By preventing fungal enzymes from working, these substances support fungistatic actions. Azoles are prescribed to treat ocular fungal infections, systemic candidiasis, blastomycosis, and candidemia. Triazoles and imidazoles, two types of azoles, are also used to treat systemic fungal infections. They provide a wide range of activities and higher levels of safety. Triazoles have better absorption and distribution qualities, fewer side effects, and fewer harmful medication interactions.

The market for antifungal medications will likely develop slowly due to rising drug resistance among Candida and Aspergillus species, particularly to azoles. Synthetic fungicidal compounds called allylamines will likely grow at a CAGR of over 2.2% throughout the projected period. These medications are recommended for ringworm, athlete's foot, jock itch, and nail infections. Following fluconazole, Lamisil is the topical antifungal drug dermatologists most frequently recommend for treating systematic antifungals. As a result, the segment's growth is projected to be further boosted by the increasing prevalence of dermatological illnesses.

The most frequent systemic fungal illness, candidiasis, is anticipated to have the quickest CAGR during the prediction period. It is a yeast infection brought on by the Candida genus, and how it is treated has changed over time. Echinocandins and broad-spectrum azoles should be used appropriately to treat mucosal candidiasis, candidemia, and invasive candidiasis, among other alterations. A major driver for the market is the rising number of individuals more prone to fungal infections. Additionally, a rise in patient and healthcare professional awareness will likely fuel the market for antifungal medications.

Due to the increased prevalence of skin illnesses in children, the dermatophytosis category will likely have a sizable proportion of the market throughout the forecast period. Due to an unhealthy lifestyle, the prevalence of this infection has significantly increased over the past ten years. Due to their susceptibility to severe lesions and unusual signs brought on by a fungus, immunocompromised patients have reason to be concerned about this.

Other indications include endocarditis, rhino cerebral mucormycosis, and invasive pulmonary aspergillosis. One of the main issues that physicians must deal with is that fewer treatments are available to treat invasive fungal infections than bacterial infections. Over the past 30 years, only a few therapeutic molecule classes have been created. Developing efficient therapeutic medicines for managing systemic fungal infections in immunocompromised patients is a key area of interest for players. It is anticipated that different public-private partnership arrangements for discovering innovative therapies would offer the industry fantastic growth potential.

The aspergillosis segment is expected to grow at a significant rate over the forecast period. The growth of the segment can be attributed to the increasing prevalence of these conditions among children and the elderly population. Also, it affects individuals with lung disorders like asthma, tuberculosis, and chronic obstructive pulmonary disease. Moreover, Antifungal drugs including amphotericin B and voriconazole (Vfend) are more effective in the treatment of this condition.

An increase in aspergillosis cases and the production of intravenous and oral medications like voriconazole, which can cure the segment for systemic antifungal infections, drive the invasive type of aspergillosis, the market's growth. However, due to an increase in candidiasis, a yeast-caused fungal infection, the superficial antifungal infection sector is anticipated to experience significant expansion over the projection period.

The oral drugs dosage form segment dominated the market in 2024. The dominance of the segment can be linked to the rising initiatives launched by key market players to increase awareness of antifungal drugs. Additionally, some antifungal medications are created for oral intake for proper digestion of the medicines, ensuring their precise bioavailability. However, oral antifungal drugs have more risks as compared to other forms.

The ointment segment is anticipated to grow at the fastest rate during the projected period. The growth of the segment can be driven by the convenience provided by this ointment to treat normal fungal infections. Ointments like Lamisil, Nystatin, Lotrisone, and Lotrimin AF provide lower side effects and are much easier to apply on the affected area.

In 2024, the hospital pharmacies segment led the market by holding the largest market share. The dominance of the segment can be credited to features such as cost-effectiveness, high accessibility, and the rise in prescription rates given by hospitals. Moreover, hospital pharmacies play a crucial role in providing immediate access to important drugs. They serve both OPD and IPD services optimising the whole treatment experience of the patient.

The retail pharmacy segment is expected to grow at a significant rate over the studied period. The growth of the segment is due to the increase in fungal infections and the growing need for early treatment propels elf-medication. Furthermore, retail pharmacies are consistently forming chains and experiencing consolidation trends driving segment growth soon.

By Drug Class

By Indication

By Dosage Form

By Distribution Channel

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

March 2025

March 2025